Magnesium Oxide Nanoparticles Market Share, Key Drivers & Competitive Landscape, 2025-2032

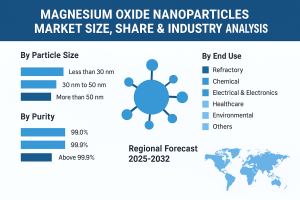

According to Fortune Business Insights, The global magnesium oxide nanoparticles market size was valued at USD 1.52 billion in 2024. The market is projected to grow from USD 1.60 billion in 2025 to USD 2.45 billion by 2032, exhibiting a CAGR of 6.3% during the forecast period. Asia Pacific dominated the magnesium oxide nanoparticles market with a market share of 45.39% in 2024.

Magnesium oxide nanoparticles (typically 10–100 nm) provide exceptional thermal stability, basicity, electrical insulation, and antimicrobial properties . Compared with bulk MgO, their nanoscale morphology delivers a much larger specific surface area, enabling faster reaction kinetics, stronger interfacial bonding in composites, and lower additive loadings to hit performance targets.

What’s driving adoption?

Fire safety & lightweighting: Stricter flame-retardancy standards in cables, connectors, EV components, and consumer devices favor MgO nano-additives in halogen-free systems.

Thermal management in electronics: High thermal conductivity with strong electrical insulation makes MgO a go-to filler for TIMs, potting compounds, and encapsulants.

Advanced ceramics & refractories: As a nanofiller and sintering aid , MgO enhances densification, grain boundary control, and high-temperature performance.

Antimicrobial surfaces & packaging: Intrinsic antimicrobial action enables coatings, filters, and food-contact applications , complementing silver- and zinc-based systems.

Request a FREE Sample Copy: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/magnesium-oxide-nanoparticles-market-113586

LIST OF KEY MAGNESIUM OXIDE NANOPARTICLE COMPANIES PROFILED

- AdNano Technologies Pvt Ltd. (India)

- American Elements (U.S.)

- Anhui Fitech Materials Co., Ltd. (China)

- Inframat Advanced Materials LLC (U.S.)

- Merck KGaA (Germany)

- MTI Korea (South Korea)

- Nanografi Advanced Materials (Germany)

- Nanoshel (U.K.)

- SAT NANO (China)

- SkySpring Nanomaterials, Inc. (U.S.)

Market Segmentation

By Product Type

Uncoated MgO nanoparticles (high-surface-area): For catalysis, remediation, ceramic mixes.

Surface-modified/functionalized MgO: Silane, stearic, or polymer-grafted surfaces to improve dispersion in resins and elastomers .

High-purity electronics grade: Tight particle size distribution for TIMs and potting compounds .

Agglomerate-controlled/monodisperse grades: For optical and biomedical uses.

By Synthesis Route

Sol-gel & precipitation: Scalable, cost-effective; tunable size.

Hydrothermal & solvothermal: Narrower size distributions, high crystallinity.

Flame spray pyrolysis & vapor-phase: Continuous processes for industrial volumes .

Green/biogenic approaches: Lower carbon footprint; increasing interest for sustainable sourcing .

By Application

Polymers & Composites: Flame retardants, thermal interface materials , EMI shielding matrices, cable compounds.

Ceramics & Refractories: Sintering aid, grain growth control, thermal shock resistance.

Catalysts & Catalyst Supports: Base catalysis, biodiesel production, fine-chemical synthesis.

Environmental: Wastewater treatment , adsorbents for heavy metals and dyes, air-purification media.

Healthcare & Hygiene: Antimicrobial coatings, wound dressings (R&D/regulated).

Energy: Solid oxide fuel cell components, battery separators (niche).

By End-Use Industry

Electronics & electricals, building & construction, automotive & e-mobility, chemicals, water & wastewater, healthcare, packaging, energy.

Key Trends to Watch

Halogen-free flame retardancy: MgO nanoparticles combined with metal hydroxides and phosphorus systems to meet UL-94 and IEC standards at lower loadings.

Thermal interface evolution: Formulations balancing viscosity, pump-out resistance, and dielectric strength in EV power electronics and data-center modules.

Hybrid nano-systems: MgO with BN, AlN, or graphene to co-optimize thermal conductivity and mechanical integrity.

Surface engineering: Next-gen coatings for waterborne resins , low VOCs, and long-term dispersion stability.

Sustainability & EHS: Push toward green synthesis , waste valorization of Mg sources, and transparent safety dossiers for occupational exposure.

Growth Drivers

Electrification & 5G/AI hardware: Thermal management gap widens; demand for high-k, electrically insulating fillers grows.

Infrastructure & safety codes: Cable management, tunnel/building safety, and public transport materials adopt non-halogenated flame-retardant solutions .

Water scarcity & stricter effluent norms: Utilities and industry expand remediation media capacities.

Process innovation: Continuous vapor-phase and flame synthesis lower unit costs and improve consistency.

Challenges & Restraints

Dispersion & agglomeration: Requires surface modification, coupling agents, or masterbatches ; adds cost/complexity.

Price sensitivity vs. commodity fillers: Competes with ATH, MDH, CaCO₃; ROI must be demonstrated at lower phr .

Regulatory clarity: Compliance with REACH, OSHA/NIOSH guidance, and local nanomaterial registries ; documentation and toxicology data are essential.

Scale-up & QC: Maintaining narrow particle size distributions and low impurities at industrial scale.

Regional Insights

Asia Pacific (APAC): Largest production and consumption hub backed by electronics, polymer compounding, and ceramics ecosystems in China, Japan, South Korea, and ASEAN.

North America: Demand tied to EVs, data centers, building safety codes , and water treatment retrofits.

Europe: Strong orientation to halogen-free materials, eco-design, and circularity ; robust specialty chemical and advanced materials base.

Middle East & Africa / Latin America: Emerging adoption in infrastructure, cables, and water treatment ; localized compounding opportunities.

Competitive Landscape

The market features specialty nanomaterial producers, advanced ceramic suppliers, and polymer-compound masterbatchers . Differentiation hinges on:

Purity & PSD control (e.g., D50 and D90 tightness)

Surface modification portfolios by resin family (epoxy, silicone, PU, PP/PE)

Application-ready concentrates and masterbatches

Use-Case Snapshots

1) EV Power Electronics

Need: High thermal conductivity, dielectric strength, low outgassing

Solution: MgO-loaded silicone TIMs (pads/greases) with optimized particle morphology

Benefit: Lower junction temperatures, improved reliability

2) Halogen-Free Flame-Retardant Cables

Need: Pass stringent flame tests while maintaining flexibility

Solution: MgO nanoparticles in MDH/ATH blends with phosphorus synergists

Benefit: Reduced total filler loading, better mechanicals

3) Wastewater Phosphate & Dye Removal

Need: Efficient adsorption at low concentrations

Information Source: https://www.fortunebusinessinsights.com/magnesium-oxide-nanoparticles-market-113586

Frequently Asked Questions

Q1. How much is the global magnesium oxide nanoparticles market worth?

A: Fortune Business Insights says that the global market size was USD 1.52 billion in 2024 and is projected to reach USD 2.45 billion by 2032.

Q2. Can MgO nanoparticles replace halogenated flame retardants?

A: Often not 1:1 , but MgO nano-additives significantly enhance halogen-free systems (MDH/ATH/phosphorus), helping pass UL-94 and cable standards at reduced loadings.

Q3. How do I avoid agglomeration?

A: Use surface-modified grades , optimize mixing energy and order of addition , and consider predispersed slurries or masterbatches .

Q4. Are there safety concerns?

A: As with all nanomaterials, implement exposure controls (closed handling, LEV, PPE) and verify compliance with local nanomaterial regulations .

Q5. What purity matters for electronics?

A: Low ionic contaminants (e.g., Cl⁻) and tight PSD improve dielectric properties and long-term reliability .