Category: Business

The global helicopter market was valued at USD 67.46 billion in 2023 and is projected to grow to USD 97.13 billion by 2032, rising from USD 74.52 billion in 2024, at a CAGR of 3.4% during the forecast period. In 2023, North America dominated the market with a substantial 55.34% share, driven by consistent procurement and fleet modernization efforts. Notably, the U.S. helicopter market is expected to reach a valuation of USD 45.26 billion by 2032, reflecting strong growth across both military and civil segments.

The global market is expanding steadily, supported by growing demand for helicopters in military, civil, and commercial applications. Key drivers include increasing investments in defense modernization programs, the expansion of emergency medical services (EMS), and rising use of helicopters in transport, tourism, and offshore operations. Furthermore, technological advancements—such as improved fuel efficiency, advanced avionics systems, and the development of electric and hybrid helicopters—are contributing to the market’s evolution. With continued demand from regions like North America, supported by recurring orders and upgrades, the helicopter market is expected to maintain a positive growth trajectory through 2032.

List of Key Players Profiled in the Report

- Airbus S.A.S (Netherlands)

- Textron Inc. (U.S.)

- Leonardo S.p.A. (Italy)

- Lockheed Martin Corporation (U.S.)

- The Boeing Company (U.S.)

- Rostec (Russia)

- The Robinson Helicopter Company (U.S.)

- Kawasaki Heavy Industries Ltd. (Japan)

- Hindustan Aeronautics Limited. (India)

- Kaman Corporation (U.S.)

Information Source:

https://www.fortunebusinessinsights.com/industry-reports/helicopter-market-101685

Segmentation:

The global helicopter market is segmented based on type, number of engines, maximum take-off weight (MTOW), application, point of sale, and geography. By type, the market is categorized into civil & commercial and military helicopters. Based on the number of engines, it is divided into single-engine and twin-engine helicopters. In terms of MTOW, the market is segmented into less than 3,000 kg, 3,000 kg to 9,000 kg, and greater than 9,000 kg. By application, the segments include emergency medical service, corporate service, search and rescue operations, oil & gas, defense, homeland security, and others. Based on the point of sale, the market is classified into new and pre-owned helicopters. Geographically, the market is studied across North America, Europe, Asia Pacific, South America, and the Middle East & Africa—each region further segmented by type, number of engines, MTOW, application, point of sale, and key countries such as the U.S., Canada, U.K., Germany, France, China, India, Brazil, and the U.A.E.

Light t o Lead Due to Demand for Civil and Commercial Helicopters

According to weight, the helicopter market is divided into light, medium, and heavy. Light segment dominated in 2022 due to growing demand for civil and commercial helicopters in sightseeing, aerial photography, and transportation of small groups and cargo.

EMS to Lead Due to Increasing Applications in Healthcare

Based on application, the market is divided into Emergency Medical Service (EMS), corporate service search and rescue operation, oil & gas, defense, homeland security, and others. The Emergency Medical Service (EMS) segment is set to dominate due to increasing applications in healthcare. The search and rescue operation segment has the second largest share owing to its applications in disaster management, aerial firefighting activities, and others.

Pre-Owned to Lead the Segment Due to Various Benefits

Based on point of sale, the market is divided into new and pre-owned. Pre-owned segment is set to dominate due to cost-effectiveness of pre-owned and increased backlog deliveries by OEMs.

In terms of geography, the market is studied across North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Report Coverage

The report provides a detailed analysis of the top segments and the latest trends in the helicopter market. It comprehensively discusses the driving and restraining factors and the impact of COVID-19 on the market. Additionally, it examines the regional developments and the strategies undertaken by the market's key players.

Get A Free Sample PDF:

https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/helicopter-market-101685

Drivers and Restraints

Demand for Air Ambulance Services to Propel Market Growth

Demand for air ambulance services is projected to drive the helicopter market growth. The demand for air ambulance services has been increasing as they are one of the fastest means of transportation due to their quickness to offer transportation to critical patients. Their ability to reach remote and inaccessible areas makes them an ideal option for transporting patients to medical facilities with speed and efficiency. The demand for ambulance services is set by the growing elderly population, rise in chronic diseases, and the requirement for prompt medical attention during emergencies.

However, delivery backlogs, high operational, and maintenance costs to impede the market expansion.

Regional Insights

North America to Dictate Market Share Due to Modernization and Expansion of Military

North America held the dominating helicopter market share in 2022 due to modernization and expansion of the military fleet. In June 2022, Lockheed Martin Corp received a five-year contract for USD 2.3 billion to manufacture a minimum of 120 H-60M Black Hawks as the U.S. military seeks a successor to its existing fleet. The five-year contract includes an option for 135 additional aircraft worth USD 4.4 billion, available to the Army, U.S. agencies, and allies.

Europe has held the second-largest share as helicopters are used for the transportation of offshore wind farms and maintenance of wind turbines.

Asia Pacific is the fastest-growing region in the market due to defense spending by emerging countries and increasing demand for lightweight helicopters.

Competitive Landscape

New Product Launches by the Key Market Players to Boost Market Progress

The helicopter market has key players such as Airbus S.A.S, Textron Inc., Leonardo S.p.A., Lockheed Martin Corporation, The Boeing Company, and others. The key players have been adopting strategies such as mergers, acquisitions, product launches, collaborations, and partnerships. In December 2022, Airbus SAS launched DisruptiveLab for the improvement of rotorcraft performance. DisruptiveLab is a flying laboratory that is designed to test technologies that can enhance the performance of aircraft and reduce CO2 emissions.

Key Industry Development

In August 2023 , Airbus Helicopters and Korea Aerospace Industries (KAI) signed an agreement to initiate the serial production phase of the Light Armed Helicopters (LAH) program. This partnership marks a significant milestone, transitioning the project into large-scale manufacturing at KAI’s facility in Sacheon, South Korea.

In June 2023 , Safran Helicopter Engines and MTU Aero Engines signed a Memorandum of Understanding (MoU) to form a 50/50 joint venture focused on developing a new engine for the European Next Generation Rotorcraft Technologies (ENGRT) program. Backed by the European Defense Fund, ENGRT aims to drive innovation and lay the technological foundation for Europe’s next generation of military rotorcraft.

The global drone simulator market is experiencing rapid expansion, fueled by the growing integration of drones into a wide range of industries and the increasing necessity for trained, certified drone operators. These simulators offer a virtual environment that mimics real-world flight scenarios, enabling both novice and experienced pilots to develop skills without risking damage to expensive hardware.

Rising Demand Across Industries

The growing deployment of drones across sectors such as agriculture, logistics, construction, mining, insurance, and public safety has created a parallel demand for high-quality pilot training. Drone simulators serve as essential tools in this regard, offering scalable and cost-effective solutions that reduce operational risk while enhancing operator proficiency.

Meanwhile, military and defense organizations continue to lead in drone simulator adoption. Drones are now critical to modern warfare—used for intelligence gathering, reconnaissance, combat, and disaster response missions. Simulators provide defense personnel with hands-on training in high-stakes scenarios, enabling rapid decision-making and reducing the learning curve for complex unmanned aerial vehicle (UAV) operations.

Information Source:

https://www.fortunebusinessinsights.com/drone-simulator-market-108155

Technological Advancements Fuel Market Growth

Breakthroughs in augmented reality (AR) and virtual reality (VR) have transformed simulation technology, allowing immersive training experiences that replicate real-time flight dynamics. These advancements not only enhance learning outcomes but also reduce costs associated with live flight training programs.

The integration of mixed reality (MR) and AI-based analytics into simulation platforms is further boosting the effectiveness of these tools. In addition, the development of portable simulator systems is making training more accessible in field and remote environments.

Key Players in the Global Drone Simulator Market

- Garmin Ltd.

- Northrop Grumman Corporation

- BAE Systems

- Qualcomm Technologies

- Hexagon AB

- Novatel

- Raytheon Technologies

- WR Systems

- Saab

- Telespazio

- Thales Group

- Orolia Holding SAS

- Booz Allen Hamilton

- Safran

COVID-19 Accelerates Adoption

The COVID-19 pandemic served as a catalyst for the drone industry. Drones were used extensively for medical supply delivery, public surveillance, disinfection spraying, and remote monitoring during lockdowns. This unprecedented demand accelerated the need for certified operators and, consequently, for drone simulators. As a result, the simulator market witnessed a surge in interest from both public and private sectors during and post-pandemic.

Regional Outlook

North America is expected to maintain a leading position in the global drone simulator market through 2032. This growth is supported by substantial R&D investments and the presence of key players such as Raytheon Technologies , Northrop Grumman , and Garmin Ltd.

Asia Pacific , particularly India , China , and Japan , is poised for significant growth. Increased government spending on drone-based services in agriculture, defense, and transport is pushing demand for simulation-based training programs.

Key Industry Developments

-

In October 2022 , Israel-based Xtend secured a USD 9 million contract from the U.S. Pentagon to develop multi-payload drones integrated with autonomous features and simulator support.

-

In December 2022 , a USD 47.8 million deal between the U.S. and Lithuania was signed to supply Switchblade 600 drones, which includes simulator-based training.

- In May 2022 , Maryland-based ANRA Technologies partnered with Raytheon Intelligence and Space to provide SmartSkies simulation solutions for live drone flight operations.

Market Segmentation

The drone simulator market is segmented by:

- Component : Hardware, Software

- Technology : Augmented Reality (AR), Virtual Reality (VR)

- Drone Type : Fixed-Wing, Rotary Wing, Others

- System Type : Fixed, Portable

- Application : Commercial, Military

Outlook

Despite challenges such as high initial costs and complex regulatory landscapes , the drone simulator market is poised for robust growth between 2025 and 2032. As the global drone fleet continues to expand and industries increasingly adopt unmanned aerial technologies, simulation platforms will play an indispensable role in ensuring operational safety, regulatory compliance, and workforce readiness.

With advancements in immersive tech and growing investments across defense and commercial applications, drone simulators are set to become a cornerstone of UAV training ecosystems worldwide.

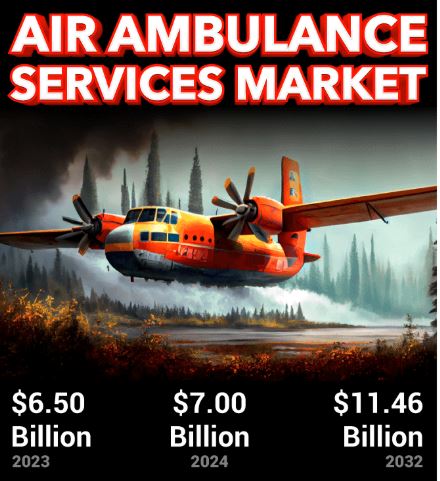

The global air ambulance services market was valued at USD 6.50 billion in 2023 and is expected to grow from USD 7.00 billion in 2024 to USD 11.46 billion by 2032, reflecting a CAGR of 6.4% during the forecast period. North America led the market in 2023, accounting for a dominant 44.62% share, supported by robust healthcare infrastructure and high demand for emergency medical transport.

In particular, the U.S. market is poised for substantial growth, with the air ambulance services market size projected to reach approximately USD 3,957.3 million by 2032. This growth is primarily driven by the increasing need for patient airlift services, particularly in rural and remote areas, along with a surge in long-term service contracts with hospitals and insurance providers.

These trends highlight the expanding role of air ambulance services in critical care and emergency response across global healthcare systems.

List of the Companies Profiled in the Global Market for Air Ambulance Services:

- Air Methods Corporation (The U.S.)

- Global Medical Response Inc. (The U.S.)

- Acadian Companies (The U.S.)

- PHI Inc. (The U.S.)

- REVA Inc. (The U.S.)

- Express Aviation Services (The U.S.)

- European Air Ambulance (Luxembourg)

- Babcock Scandinavian Air Ambulance (Sweden)

- Air Charter Services Pvt. Ltd. (India)

- Gulf Helicopters (Qatar)

Information Source:

https://www.fortunebusinessinsights.com/air-ambulance-services-market-102577

What does the Report Include?

The market report includes qualitative and quantitative analysis of several factors such as the key drivers and restraints that will impact growth. Additionally, the report provides insights into the regional analysis that covers different regions, which are contributing to the growth of the market. It includes the competitive landscape that involves the leading companies and the adoption of strategies by them to announce partnerships, introduce new products, and collaboration that will further contribute to the growth of the market between 2020 and 2027. Moreover, the research analyst has adopted several research methodologies such as SWOT and PESTEL analysis to extract information about the current trends and industry developments that will drive the market growth during the forecast period.

DRIVING FACTORS

Rising Geriatric Population Globally to Augment Growth

According to a report by the United Nations publication, there were about 703 million people over the age of 65 years in 2019, and it is estimated that the number will rise to over 1.5 billion by 2050. The rising geriatric population presents a lucrative opportunity for the high adoption of air ambulance services to provide medical care to the elderly. Additionally, the growing prevalence of chronic disease demands an agile medical services response from the healthcare industry to treat the patients across remote areas. This is likely to boost the global air ambulance services market growth in the forthcoming years.

SEGMENTATION

Independent Segment to Hold Largest Market Share

The independent segment, based on the service operator, is expected to hold the largest share of the global market for air ambulance services backed by the increasing partnerships between community health organizations and private players.

REGIONAL INSIGHTS

North America to Remain at Forefront; Availability of Advanced Medical Services to Promote Growth

Among all the regions, North America is expected to remain dominant and hold the highest position in the global emergency services market during the forecast period. This is attributable to the availability of advanced medical services, along with the presence of established air ambulance services providers in the region. North America stood at USD 2,142.8 in 2019.

The market in Asia-Pacific is expected to gain momentum owing to the increasing investment in healthcare programs by the government in countries such as India and China that is likely to boost the adoption of advanced air ambulance services in the region between 2020 and 2027.

COMPETITIVE LANDSCAPE

Prominent Companies Focus on Contract Signing to Amplify Their Market Positions

The global air ambulance services market is consolidated by the presence of several multinational companies that are focusing on securing lucrative government contracts to boost their positions and expand their air ambulance services. Furthermore, other key players are adopting strategies such as facility expansion, collaboration, and merger and acquisition to maintain their strongholds in the global marketplace.

Industry Development:

- July 2020 - GAMA Aviation secures a five-year contract by the Government of Jersey and the Government of Guernsey. As per the contract, GAMA will provide its advanced and efficient air ambulance services between Channel Island and the U.K. mainland.

The global dynamic positioning system market was valued at USD 8.49 billion in 2023 and is projected to grow from USD 9.33 billion in 2024 to USD 17.48 billion by 2032, registering a CAGR of 8.2% during the forecast period. In 2023, Asia Pacific led the market, capturing a dominant 37.34% share, driven by strong demand across offshore and marine applications.

The market is witnessing steady growth, fueled by increasing adoption in the offshore, marine, and energy sectors. Dynamic positioning systems are essential for maintaining vessel position and heading through advanced computer controls and integrated sensor technologies. Key growth factors include rising offshore exploration activities, rapid technological advancements, and expanding investments in maritime automation. With supportive market conditions and increasing regional adoption, the dynamic positioning system industry is poised for significant expansion over the coming years.

These insights are detailed in the report titled “Dynamic Positioning System Market Size, Share, 2024–2032” by Fortune Business Insights.

Browse In-depth Summary of This Research Insight:

https://www.fortunebusinessinsights.com/dynamic-positioning-system-market-103535

List of Key Players Profiled in the Dynamic Positioning System Market Report

- Kongsberg Gruppen (Norway)

- Wartsila (Finland)

- ABB Group (Switzerland)

- Elcome International LLC (Dubai)

- B. Volvo (Sweden)

- Rolls Royce PLC (U.K.)

- Navis Engineering (Finland)

- Praxis Automation Technology B.V. (Netherlands)

- Thrustmaster of Texas (U.S.)

- Royal IHC (Netherlands)

Segmentation

DP Control Systems Led the Market with Their Increased Adoption in New Builds and Retro Fits for Vessels

By sub-system, the dynamic positioning system market is segregated into power system, thruster system, and DP control system. DP control system led the market as it comprises a series of hardware, software, and systems that keep a vessel in position. Rising demand for DP control systems in new builds and retro fits for vessels boosting segment growth.

Position Reference Sensors Commanded the Market Owing to Their Precision in Monitoring a Ship’s Horizontal Movements

On the basis of sensors, the market is categorized into position reference sensors, wind sensors, motion sensors, and gyro compass. Position reference sensors commanded the global market, owing to their precision in monitoring a ship’s movements on the horizontal plane and location. Integrated into DP systems, they enable automated control over the ship’s surge and sway, enhancing stability and maneuverability.

Growing Focus on Preventing a Single Fault in an Active System Boosted the Demand for Class 2 Equipment

In terms of equipment type, the market is classified into class 1, class 2, and class 3. The class 2 segment dominated the global market, driven by advancements in equipment and improved redundancy systems that safeguard against single-point failures, ensuring continuous position and heading control. With ongoing system upgrades, this segment is poised for further growth.

New Builds Dominated the Market Due to Rising Production of New Ships by OEMs Across Commercial and Defense Sectors

On the basis of solution, the dynamic positioning system market is bifurcated into new builds and retro fits. The new builds segment took the lead in the global market, driven by the rising production of new ships by OEMs across commercial and defense sectors, unlocking profitable prospects. In September 2022, Kongsberg Digital delivered DP simulators to MOL Marine & Engineering, enabling MOL’s Tokyo-based training center to become Japan’s first NI-accredited facility for dynamic positioning courses.

Rising Emphasis on Maintaining Precise Positioning in Marine Environments Boosted DPS Adoption in Commercial Vessels

In terms of application, the market is divided into commercial and military. The commercial segment captured the highest dynamic positioning system market share as DP systems play a key role in offshore vessels, pipelay, cable lay, trenching, and dredging, ensuring operational stability by maintaining precise positioning in marine environments.

From the regional ground, the market is classified into North America, Europe, Asia Pacific, and Rest of the World.

Report Coverage

The dynamic positioning system market research report presents a complete market examination, highlighting essential elements, including the competitive environment and noticeable product categories. Furthermore, the report provides valuable insights on market trends and significant industry developments. Apart from the factors above, the report includes several aspects that have fostered market expansion in recent times.

Drivers and Restraints

Rapid Innovations are Shaping the Future of Dynamic Positioning Systems

Dynamic positioning systems are advancing rapidly, driven by breakthroughs in technology and sustainability initiatives. As digitalization and automation become central to maritime and offshore sectors, these innovations promise safer, more efficient, and eco-friendly operations, including:

Sensor Fusion Technique : By combining inputs from various sensors, this method delivers a clearer environment picture, ensuring accurate and stable control.

Energy-Efficient Propulsion Systems: Cutting-edge electric and hybrid propulsion solutions offer greater agility, reduce emissions, and bolster operational redundancy, making them essential to the future of DPS.

On the other hand, substantial initial capital investments are impeding the dynamic positioning system market growth.

Regional Insights

Rapid Growth of Seaborne Trade Augmented Market Growth in Asia Pacific

The dynamic positioning system market in Asia Pacific is valued at USD 3.17 billion in 2023 due to increased DPS adoption in several sectors and rapid growth of seaborne trade. Increasing investments in the offshore shipping sector, mainly in China, India, and Japan, are also fueling market expansion in the region.

The market in Europe is witnessing significant growth as a result of technological innovations, rise in maritime activities, and surge in defense expenditures. Furthermore, strict rules about safety and environmental standards are pushing operators to invest in markets.

Competitive Landscape

Top Players Focus on Strategic Partnerships to Strengthen Their Market Presence

Leading players focus on strategic partnerships and collaborations to share resources, reduce risks, and improve technological capacities. Recent contract awards to companies, including Praxis Automation, highlight a growing industry-wide push toward enhancing maritime safety and seamless technology integration. This trend reflects the increasing pressure on operations driven by current geopolitical challenges.

Key Industry Development

-

September 2023 : Praxis Automation secured a long-term collaboration with Rawabi Vallianz Offshore Service (RVOS), a major Saudi offshore support provider. Under the agreement, Praxis will equip both existing and new vessels in the RVOS fleet with dynamic positioning systems and customized digital solutions. The fleet’s transformation will be executed in approved phases, making a pivotal step forward in advancing maritime innovation and safety across the Gulf region.

According to Fortune Business Insights, the global gallium nitride device market was valued at USD 20.56 billion in 2019 and is projected to grow from USD 21.18 billion in 2020 to USD 39.74 billion by 2032, reflecting a compound annual growth rate (CAGR) of 5.20% from 2020 to 2032. In 2019, North America led the market with a dominant 35.89% share, driven by early adoption and robust semiconductor infrastructure.

The gallium nitride device market is experiencing substantial growth, fueled by increasing demand for high-performance, energy-efficient semiconductor solutions. GaN technology offers several advantages, including high power density, superior thermal efficiency, and fast switching speeds, making it ideal for emerging applications such as 5G networks, electric vehicles, renewable energy systems, and aerospace electronics.

Widespread adoption of GaN in both power electronics and radio frequency (RF) devices is accelerating market expansion. Innovations in GaN-on-Silicon (GaN-on-Si) manufacturing and advanced packaging technologies are helping reduce production costs and expand GaN accessibility across industries. Furthermore, supportive government initiatives promoting energy efficiency and the increasing integration of GaN in consumer electronics are also propelling the market forward.

A list of all the prominent key players of Gallium Nitride Device Market :

- Cree, Inc. (The U.S.)

- Infineon Technologies AG (Germany)

- Efficient Power Conversion Corporation. (The U.S.)

- EPISTAR Corporation (Taiwan)

- GaN Systems (Canada)

- MACOM (The U.S.)

- Microsemi (The U.S.)

- Mitsubishi Electric Corporation (Japan)

- NICHIA CORPORATION (Japan)

- Northrop Grumman Corporation (The U.S.)

- NXP Semiconductors. (Netherland)

- Qorvo, Inc (The U.S.)

- Texas Instruments Incorporated. (The U.S.)

- Toshiba Corporation (Japan)

Information Source:

https://www.fortunebusinessinsights.com/gallium-nitride-gan-devices-market-103367

Drivers & Restraints-

Expansion of Telecommunications Domain to Accelerate Growth

The demand for energy efficient GaN devices is surging rapidly owing to the expansion of the telecommunications domain. Most of the internet service providers are nowadays focusing on providing lower latency with optical cable wires, ubiquitous connectivity, and network with higher capacity. Apart from that, the rising utilization of GaN devices in the 5G infrastructure is likely to propel the gallium nitride device market growth in the near future. However, the high cost associated with the maintenance and development of gallium nitride devices may hinder growth.

Segmentation:

Opto-semiconductor Device Segment to Grow Rapidly Backed by Increasing Usage in Lasers

Based on device type, the opto-semiconductor device segment procured the highest gallium nitride market share in 2019. This growth is attributable to their increasing usage in various aerospace applications, such as Light Detection and Ranging (LiDAR) and pulsed lasers. Besides, they are used in optoelectronics, LEDs, lasers, photodiodes, and solar cells.

Regional Insights-

High Demand for Wireless Devices to Favor Growth in Europe

Geographically, North America generated USD 7.38 billion in 2019 because of the presence of numerous prominent manufacturers, such as MACOM, Cree, Inc., Northrop Grumman Corporation, Efficient Power Conversion Corporation, Microsemi, and others in this region.

Europe, on the other hand, is anticipated to grow significantly on account of the rising demand for wireless devices in Germany, France, and the U.K. In Asia Pacific, the rising demand for gallium nitride devices from emerging nations, such as India and China would aid growth.

Competitive Landscape-

Key Companies Focus on Winning New Contracts to Intensify Competition

The global gallium nitride device market is highly fragmented with the presence of numerous reputed manufacturers. Most of them are focusing on achieving new contracts from significant governments, as well as private agencies to deliver their in-house products. Below are the two latest industry developments:

- In May 2021 , Raytheon Technologies Corporation entered into partnership with GlobalFoundries to develop and commercialize a gallium nitride (GaN) on silicon process for 5G and 6G RF. The GaN process technology improves RF performance. It maintains operational and production costs and enables levels of power and power efficiency for 5G and 6G RF millimeter-wave operating frequency standards.

- In January 2021 , Yaskawa Electric Corporation, a Japanese power electronics firm, entered into a partnership with Transphorm, a GaN-based power conversion product provider in California. Under the agreement, Yaskawa will use Transphorm’s GaN power devices for industrial power conversion applications that include variable frequency drives and servo motors.

The global aircraft gearbox market was valued at USD 3,381.5 million in 2024 and is projected to rise from USD 3,653.7 million in 2025 to USD 6,094.1 million by 2032 , registering a CAGR of 7.58% during the forecast period. North America dominated the market in 2024, capturing approximately 45.71% of the global share, fueled by a robust aerospace infrastructure and the presence of leading aircraft manufacturers.

Aircraft gearboxes are essential mechanical components responsible for transmitting engine power to the propeller or rotor. They regulate rotational speed and boost torque, enabling efficient propulsion. Constructed using durable materials like steel and titanium , and often encased in lightweight aluminum or magnesium housings , these systems are designed to withstand extreme loads, high temperatures, and vibrations.

There are several key types of aircraft gearboxes:

- Reduction gearboxes – used to adjust engine speed for propeller-driven aircraft.

- Accessory gearboxes – support auxiliary systems such as hydraulic pumps and generators.

- Actuation gearboxes – control surface movement on aircraft.

- Tail rotor gearboxes – specific to helicopters for tail rotor drive.

Ongoing advancements in design, materials, and precision manufacturing have significantly improved gearbox reliability, performance, and weight efficiency. However, the market faced a downturn during the COVID-19 pandemic, as lockdowns, travel restrictions, and supply chain disruptions led to a decline in aircraft production and demand.

These developments are thoroughly analysed in the report titled “Aircraft Gearbox Market Size, Share, Forecast, and 2025–2032.”

Information Source:

https://www.fortunebusinessinsights.com/aircraft-gearbox-market-105541

List of Key Players Mentioned in the Report:

- Safran (France)

- Liebherr (Switzerland)

- United Technologies Corporation (UTC) (U.S.)

- Rexnord Aerospace (U.S.)

- Triumph Group (U.S.)

- Aero Gear (U.S.)

- CEF Industries Inc. (U.S.)

- The Timken Company (U.S.)

- AAR Corp (U.S.)

- Rolls-Royce plc (U.K.)

- Regal Rexnord (U.S.)

Segmentation:

Gear Segment Dominated Owing to its Crucial Role in Power Transmission and Engine Optimization

By component, the market is segmented into gear, housing, bearing, and others. The gear segment dominated the market in 2024 due to its essential function in transmitting power from the engine to various aircraft systems. Lightweight, high-precision gears support improved fuel efficiency and engine performance.

The housing segment is also anticipated to witness notable growth, driven by advances in lightweight materials that contribute to overall aircraft weight reduction and increased component durability.

Commercial Segment Led the Market Amid Rising Air Travel Demand

Based on platform, the market is segmented into commercial, civil, and military. The commercial segment held the dominant share in 2024, fueled by increasing airline fleet sizes and global passenger traffic. With 850 million passengers in the U.S. alone in 2023, demand for commercial aircraft—and their gearboxes—continues to rise.

Meanwhile, the military segment is expected to grow significantly, as heightened geopolitical tensions spur defense modernization efforts and procurement of advanced aircraft with robust gearbox requirements.

Accessory Gearbox Segment Dominated Due to Fleet Expansion

By gearbox type, the market is categorized into accessory gearboxes, reduction gearboxes, actuation gearboxes, tail rotor gearboxes, APU gearboxes, and others. The accessory gearbox segment led the market in 2024 due to expanding airline fleets and growing demand for more efficient aircraft systems.

The reduction gearbox segment is expected to grow steadily as it enables efficient engine-propeller coordination, supported by innovations in materials and designs that enhance reliability and longevity.

OEM Segment Led Market Due to Advanced Integration Capabilities

By end-user, the market is segmented into OEM, MRO, and others. The OEM segment dominated in 2024, owing to established supply chain networks and technical integration capabilities. OEMs play a vital role in incorporating new gearbox technologies into next-generation aircraft.

The MRO segment is projected to expand rapidly during the forecast period, driven by the aging global fleet and rising demand for maintenance, repair, and overhaul services.

Drivers and Restraints: Aircraft Gearbox Market

Rising Demand for Lightweight Aircraft Components to Boost Market Growth

With airlines and aircraft manufacturers focusing on efficiency, the demand for lightweight components, including gearboxes, is increasing. Lighter components not only enhance fuel efficiency but also improve performance, reduce emissions, and extend component lifespan. Manufacturers are leveraging advanced materials and design techniques to create high-performance, lightweight gear systems.

Stringent Regulations Pose Challenges to Market Expansion

However, the aircraft gearbox market faces challenges from stringent aerospace regulations. The high costs associated with design, development, and certification of gearboxes can hinder new entrants and slow innovation. Regulatory compliance and safety testing add to the complexity and cost of market participation, acting as a restraint on growth.

Regional Insights:

North America to Maintain Dominance Owing to Aerospace Leadership and Military Investment

North America led the global aircraft gearbox market in 2024, with a market value of USD 1,545.82 million. The region benefits from the presence of key players such as Boeing and GE, as well as strong R&D capabilities and government defense programs. The U.S. Department of the Air Force’s FY2025 budget of USD 217.5 billion—featuring USD 29 billion for procurement and USD 37.7 billion for R&D—underscores the scale of investment supporting the gearbox market.

Europe Benefiting from Technological Advancements and Green Aviation Initiatives

Europe holds a significant market share, supported by investments from leading aerospace firms focused on reducing emissions and improving aircraft efficiency. Collaborations between governments and industry players have been key to driving innovation in the region.

Asia Pacific Set to Grow at Fastest Pace Due to Civil Aviation Boom

The Asia Pacific region is projected to witness the highest CAGR due to increasing demand for civil aviation and regional fleet expansions in countries like China and India. Infrastructure development and rising disposable incomes are contributing to a flourishing aviation market and growing demand for reliable gearboxes.

Other Regions See Gradual Growth

The Middle East & Africa are experiencing modest growth through fleet expansion and investments in aviation infrastructure. Latin America, led by Brazil and Mexico, is seeing steady market recovery through a focus on MRO capabilities and aviation development.

Competitive Landscape:

Key Players Focus on Innovation, Contracts, and Partnerships to Strengthen Market Position

The aircraft gearbox market is competitive, with leading players investing heavily in R&D and strategic partnerships to meet evolving industry needs. Companies are also expanding product lines and entering long-term agreements to maintain market leadership.

Key Industry Developments:

-

February 2025 – Bell Boeing received a USD 46 million contract for the integration and supply of V-22 Gearbox Vibration Monitoring/Osprey Drive System Safety and Health Information (ODSSHI) kits.

-

August 2023 – Leonardo announced partnerships to support its AW09 helicopter at Heli-Expo 2023.

The global AI in aviation market was valued at USD 6,200.0 million in 2024 and is projected to grow from USD 7,449.3 million in 2025 to USD 26,997.6 million by 2032, registering a robust CAGR of 20.20% during the forecast period. In 2024, North America led the market, accounting for a dominant share of 46.19%, driven by strong adoption of AI technologies across commercial and defense aviation sectors.

Artificial intelligence is revolutionizing aviation by improving operational efficiency, safety, and passenger experiences. AI is widely used in check-ins, security, baggage handling, ticket pricing, flight optimization, and predictive maintenance. Machine learning helps analyze aircraft data to reduce downtime, optimize fuel use, and enhance customer service with chatbots and recommendations.

Key players advancing AI adoption in aviation include tech giants like Intel, NVIDIA, IBM, Microsoft, and Amazon, alongside aerospace leaders such as Airbus, Boeing, GE, Thales, and Lockheed Martin. Specialized firms like SynapseMX, Jeppesen, Skywise, and TAV Technologies are also innovating in areas like flight delay prediction and AI-based maintenance.

List of Key Players Mentioned in the Report:

- Intel Corporation (U.S.)

- IBM Corporation (U.S.)

- Airbus S.A.S. (Netherlands)

- Thales Group (France)

- Lockheed Martin Corporation (U.S.)

- General Electric Company (U.S.)

- The Boeing Company (U.S.)

- Garmin Ltd. (U.S.)

- Northrop Grumman Corporation (U.S.)

- Honeywell International Inc. (U.S.)

Information Source:

https://www.fortunebusinessinsights.com/ai-in-aviation-market-113289

Segmentation Highlights:

Flight Operations Segment to Lead Application Demand

Based on application, the AI in aviation market is segmented into flight operations , maintenance , air traffic management , and others . Among these, the flight operations segment is expected to dominate, driven by the increasing adoption of AI for route optimization, pilot assistance, and decision-making support systems.

Software Segment to Hold Largest Share by Offering

By offering, the market is categorized into software , hardware , and services . The software segment held the largest market share in 2024 and will likely retain its position due to the widespread use of AI platforms for analytics, automation, and intelligent decision-making across airlines and airports.

Machine Learning Segment to Dominate Technology Adoption

Under the technology segment, machine learning leads, followed by computer vision , data analytics , and others . Machine learning is widely used for predictive maintenance, demand forecasting, and personalized passenger experiences, offering valuable operational insights and automation capabilities.

Airlines Segment to Remain Leading End User

By end user, the market includes airlines , airports , OEMs , and MROs . The airlines segment continues to lead, accounting for the largest market share, owing to large-scale digital transformation initiatives aimed at improving fuel efficiency, crew management, and passenger satisfaction.

Market Dynamics:

Drivers:

Operational Efficiency and Automation to Bolster Market Growth

AI’s growing role in optimizing air traffic management and flight route planning is a key driver. AI algorithms and machine learning systems are improving decision-making and enabling real-time adjustments in response to changing weather, airspace congestion, and fuel efficiency demands.

For example, in April 2025 , Alaska Airlines reported saving 480,000 gallons of jet fuel in six months by using an AI-powered flight route optimizer, showcasing AI’s ability to enhance sustainability and operational savings.

Post-Pandemic Digital Acceleration and Passenger Experience Enhancements

Post-COVID digital transformation has fast-tracked AI implementation across passenger-facing services, including biometric boarding, baggage tracking, and chatbots for customer engagement. Airports and airlines alike are prioritizing seamless, contactless experiences that AI can deliver.

Restraints:

Data Security and Privacy Concerns May Restrict Market Expansion

The integration of AI in aviation raises concerns around data privacy, cybersecurity, and compliance with international data regulations , especially with AI systems processing sensitive operational and passenger data. These challenges may hinder adoption, particularly in regions with stringent privacy laws.

Regional Insights:

North America to Maintain Dominance

North America is expected to lead the global AI in aviation market throughout the forecast period. The region benefits from early adoption of AI technologies, the presence of leading aerospace companies, and high investments in AI-enabled aviation platforms. Strategic collaborations between AI firms and aviation authorities further bolster growth.

Asia Pacific to Register the Fastest Growth

Asia Pacific is anticipated to witness the highest CAGR over the forecast period, driven by rising air passenger traffic , rapid airport modernization , and the growing presence of budget airlines. Countries like China , India , and Singapore are at the forefront of integrating AI into smart airport operations and traffic control systems.

Competitive Landscape:

Companies Focusing on AI Innovation and Aviation-Specific Solutions

Market leaders are investing heavily in developing tailored AI solutions for aviation. Strategies include partnerships with aviation regulatory bodies, collaborations with AI startups, and deployment of cloud-based analytics platforms for predictive and prescriptive intelligence.

Key Industry Developments:

-

March 2025 – The Federal Aviation Administration (FAA) awarded an $80,000 contract titled “ Azure OpenAI CDO ” to develop AI-driven aviation solutions leveraging OpenAI’s models via Microsoft Azure , signaling growing government interest in AI adoption.

-

October 2024 – Thales Group partnered with SITA to enhance air traffic management through real-time AI analytics, focusing on flight delay reduction and improved situational awareness.

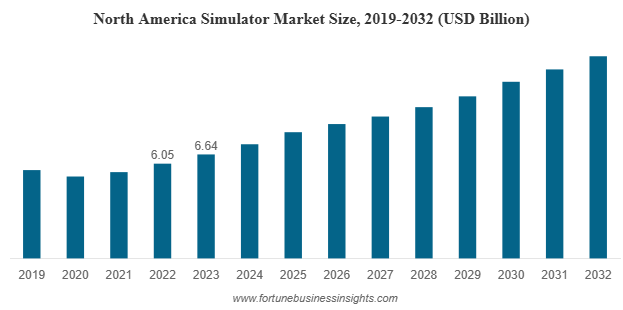

The global simulator market was valued at USD 18.07 billion in 2023 and is projected to reach USD 32.38 billion by 2032, growing at a CAGR of 6.4% from 2024 to 2032. North America held the largest market share at 36.75% in 2023, fueled by strong investments in defense training, technological innovation, and the extensive adoption of simulation systems across aviation, military, and healthcare sectors.

The Full Flight Simulation (FFS) segment is expected to lead the market in 2024, owing to its high fidelity, regulatory preference for pilot training, and growing use in aerospace, automotive, and energy applications. In the U.S., market growth is driven by military flight training modernization programs such as the USD 455 million FSTSS initiative and the demand for full-flight simulators for helicopters like the CH-47F and UH-60M. The U.K. is advancing in simulation technology with companies like BAE Systems and cre8tive rooms integrating AR/VR and immersive tech into military and commercial systems. China is witnessing rapid aviation training growth, with companies like Avion Simulation entering the market through joint ventures. In India, rising aviation training needs are being met by advanced simulators such as the Airbus A320 FFS, adopted by training firms like Gen24 Flybiz. Germany is focused on R&D in quantum simulation and virtual training, with efforts like the Rolls-Royce and Nvidia partnership on large-scale CFD quantum circuits for engineering applications.

Fortune Business Insights™ displays this information in a report titled, "Simulator Market Size, Share, Forecast, and 2024-2032."

LIST OF KEY COMPANIES PROFILED IN THE REPORT

- BAE Systems Plc (U.K.)

- The Boeing Company (U.S.)

- CAE Inc. (Canada)

- cre8tive rooms (U.K.)

- Indra Sistemas (Spain)

- Konsgberg Group (Norway)

- L3 Harris Technologic Inc. (U.S.)

- Pulseworks LLC (U.S.)

- Raytheon Technologies Corporation (U.S.)

- Unitest Marine Simulators (Poland)

Information Source:

https://www.fortunebusinessinsights.com/simulator-market-107016

Segmentation:

Simulators to be Widely Used in Aerospace & Defense Sector to Train and Test New Recruits

Based on end use industry, the market is segmented into aerospace & defense, automotive, marine & naval, and media & entertainment. The aerospace & defense segment dominated the market as these devices can be used to train new recruits, thereby improving the training safety and efficiency.

Rising Demand for Safety and Efficiency to Boost Product Use in Training Applications

By application, the market is segmented into training, research & development, and others. The training segment held a dominant simulator market share in 2022 as these devices are useful in enhancing the efficiency and safety of training, allowing them to develop their skills in a controlled environment.

Large-scale Application in Automotive, Aerospace, and Energy Sectors to Fuel the Use of Full Flight Simulation

In terms of type, the market is segmented into full flight simulation, fixed base simulation, driving simulation, and others. The full flight simulation segment is expected to dominate the market during the forecast period as this type of device simulates the experiences of operating an aircraft, thereby giving pilots an idea of how flying a real one will feel like.

With respect to region, the market covers North America, Europe, Asia Pacific, and the Rest of the World.

Report Coverage:

The report gives in-depth analysis of the market and highlights key areas such as increased demand for simulation services and R&D capabilities. It also provides valuable insights into the latest market trends and covers top developments in the industry. Apart from the above-mentioned factors, the report focuses on several factors that have augmented the global market growth in recent years.

Drivers and Restraints: Simulator Market

Rising Demand for Training in Aviation, Military, and Navy to Spur Market Progress

Simulators have found widespread use in training new recruits in the military, naval, and aviation sectors as they can replicate some dangerous real-life scenarios to make them better prepared for different missions. One of the key advantages of using simulation technologies in these industries is that they offer operators an opportunity to create numerous scenarios in a realistic training environment. This factor is expected to drive the market share.

However, continuous upgrades in simulation systems for new aircraft models may restrict the market growth.

Regional Insights:

North America to Dominate Global Market Due to Technological Innovations in Simulation Technologies

North America dominated the market in 2022 as there was a strong rise in technological innovations in various simulation technologies to keep up with the ever-increasing and unique training requirements of different sectors.

Europe captured a major market share as there has been a robust growth in investments by key market players to improve simulation systems.

Competitive Landscape:

Advanced Technologies Adopted by Key Market Players for Higher Processing Capacity

The market is highly consolidated with the presence of leading companies such as CAE Inc., The Boeing Company, BAE Systems Plc, Indra Sistemas, and cre8tive rooms, among many others. These organizations are offering technologically advanced simulation products and solutions for different industries, such as marine, media & entertainment, and aerospace & defense.

Key Industry Development:

February 2023 – BAE Systems and FSTC declared plans to design, build, and deliver a high-quality simulation system to train Indian Defense Force pilots. The two firms are developing a twin-dome full-mission simulation system that utilizes realistic synthetic environments to enable pilots to train in virtual environments of the real world.

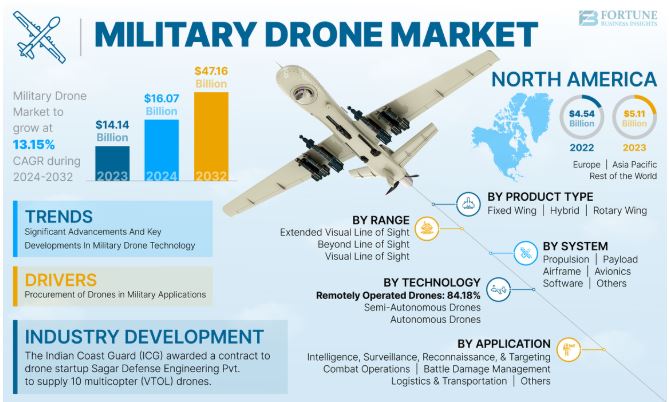

The global military drone market was valued at USD 14.14 billion in 2023 and is projected to reach USD 47.16 billion by 2032, growing at a CAGR of 13.15% from 2024 to 2032. North America led the market with a 36.1% share in 2023, driven by strong defense spending, strategic R&D investments, and the presence of key OEMs such as General Atomics and Northrop Grumman.

The U.S. market alone is expected to reach USD 10.71 billion by 2030, fueled by military modernization and widespread deployment in ISR and combat operations. Fixed-wing drones held the largest share by product type in 2023 due to their long endurance, high payload capacity, and suitability for strategic missions. Key developments include the U.S. awarding a USD 389 million contract to General Atomics for MQ-1C Gray Eagle drones; Ukraine deploying over 700 kamikaze drones like the DJI Mavic 3T and Switchblade in the Russia-Ukraine conflict; Russia using Shahed-136 (Geranium-2) drones in targeted strikes and signing a USD 12 million drone deal with China; China supplying over 48 GJ-2 drones to Pakistan, capable of carrying 12 missiles at speeds up to 380 km/h; Israel continuing to lead UAV exports through Elbit Systems and IAI; and the U.K. investing in tactical ISR drones as part of its broader defense modernization strategy.

This information is provided by Fortune Business Insights™ in its research report, titled “Military Drone Market Size, Share, Forecast and 2024-2032”.

List of Key Players Mentioned in the Report:

- General Atomics Aeronautical Systems, Inc. (U.S.)

- Northrop Grumman Corporation (U.S.)

- Elbit Systems Ltd. (Israel)

- Israel Aerospace Industries Ltd. (Israel)

- AeroVironment, Inc. (U.S.)

- Lockheed Martin Corporation (U.S.)

- Thales Group (France)

- Boeing (U.S.)

- BAE Systems (U.K.)

- SAAB Group (Sweden)

- Textron Systems (U.S.)

Information Source:

https://www.fortunebusinessinsights.com/military-drone-market-102181

Segmentation:

Fixed Wing Segment to Register Substantial Demand Impelled by Rising Use for Long Distance Operations

Based on product type, the market is segmented into hybrid wing, fixed wing, and rotary wing. Of these, the fixed wing segment is set to dominate the product type segment over the study period. The growth is on account of rising deployment of the product for long-distance missions such as mapping, surveillance, and defense.

EVLOS Segment to have Fastest CAGR Driven by Escalating Adoption in Electronic Warfare

By range, the market is subdivided into Beyond Line of Sight (BLOS), Visual Line of Sight (VLOS), and Extended Visual Line of Sight (EVLOS). The EVLOS segment is expected to register fastest CAGR over the forecast period. The rise is propelled by the soaring product adoption in long-range missions, electronic warfare, and proper battle management.

Remotely Operated UAVs Segment to Record Appreciable Expansion Driven by Surging Adoption

Based on technology, the market is subdivided into semi-autonomous drones, remotely operated drones, and autonomous drones. The remotely operated drones segment is estimated to depict an appreciable surge over the estimated period. The expansion is on account of stringent government requirements for autonomous flying over long distances.

A irframe Segment to Dominate due to Increasing Adoption of UAVs by the Armed Forces

By system, the market is classified into payload, avionics, airframe, propulsion, software, and others. The airframe segment held the highest market share. The growth is impelled by the growing UAV adoption for a range of operations such as monitoring, surveillance, reconnaissance, and others.

ISRT Segment to Emerge as a Leading Segment Considering Growing Awareness for Strengthening the Defense System

Based on application, the market is segmented into logistics & transportation, Intelligence, Surveillance, Reconnaissance, and Targeting (ISRT), battle damage management, combat operations, and others. The surge is propelled by the growing role of UAVs in the defense sector.

Based on geography, the market is fragmented into Asia Pacific, Europe, North America, and the rest of the world.

Report Coverage:

The report gives a comprehensive coverage of the major trends augmenting the market share over the forecast period. It further offers an insight into the key factors boosting the global business landscape over the ensuing years. Other aspects in the market comprise an account of merger agreements, acquisitions, and additional initiatives adopted by leading industry participants for strengthening their business positions.

Drivers and Restraints:

Rising Military Expenditure to Propel Industry Expansion

One of the key factors propelling the military drone market growth is the escalation in military expenditure. The industry expansion is further propelled by the surging procurement of next-generation military drones.

However, the industry expansion could be affected by the high cost of modern systems.

Regional Insights:

North America to Emerge as Dominant Region Owing to the Presence of OEMs

The North America military drone market share is slated to dominate the global market over the forecast period. The surge is on account of the presence of several OEMs in the region.

The Europe market is poised to exhibit considerable expansion throughout the forecast period. The rise is due to the growing awareness associated with the improvement of military, navy, and air force capabilities.

Competitive Landscape:

Major Companies Ink Partnership Agreements to Strengthen Market Foothold

Leading market players are focused on adopting a series of strategic initiatives for strengthening their industry positions. These include merger agreements, collaborations, and the formation of alliances. Additional aspects comprise an increase in research activities and the development of new products.

Key Industry Development:

February 2023 – The Indian Army announced plans to procure 850 indigenous nano drones to support special military operations. These drones will be used primarily for surveillance and counter-terrorism missions.

February 2023 – The U.S. Air Force completed the development of facial recognition technology integrated into UAVs. These autonomous drones are capable of identifying and engaging targets independently. They are intended for use by special operations forces to gather intelligence and support mission-critical activities.

The global microwave devices market was valued at USD 5.85 billion in 2021 and is expected to grow from USD 6.09 billion in 2022 to USD 9.88 billion by 2029, reflecting a CAGR of 7.15% during the forecast period. North America led the market in 2021, accounting for a 33.33% share, driven by advanced infrastructure and a strong emphasis on R&D.

The market is experiencing steady growth, supported by continuous technological advancements and increasing demand across key sectors such as telecommunications, defense, and healthcare. As the adoption of microwave technologies expands into new applications, the sector is attracting substantial investments. With favorable industry dynamics and expanding end-use scenarios, the microwave devices market is well-positioned for consistent and sustained growth in the coming years.

List of Key Players Profiled in the Microwave Devices Market Report:

- Analog Devices Inc. (U.S.)

- Communications & Power Industries LLC (U.S.)

- General Dynamics Corporation (U.S.)

- Kratos Defense & Security Solutions, Inc. (U.S.)

- L3Harris Technologies, Inc. (U.S.)

- MACOM Technology Solutions Inc. (U.S.)

- Microsemi Corporation (U.S)

- Microwave Technology, Inc. (U.K.)

- Qorvo Inc. (U.S.)

- Richardson Electronics, Ltd. (U.S.)

- Teledyne Technologies Incorporated (U.S.)

- Thales Group (France)

- TMD Technologies Ltd (U.K.)

- Toshiba Corporation (Japan)

- Cytec Corporation (U.S.)

Information Source:

https://www.fortunebusinessinsights.com/microwave-devices-market-103542

Segmentation:

The microwave devices market is segmented by type, frequency, end-use industry, and geography. By type, the market is bifurcated into active and passive, with the active segment expected to lead due to growing demand in telecom and networking services. Based on frequency, the market includes Ku-Band, Ka-Band, S-Band, C-Band, X-Band, L-Band, and others, where the Ku-Band segment dominates owing to its expanding applications in space and defense. In terms of end-use industry, the market is segmented into telecommunication, space, defense, industrial, healthcare, and others, with telecommunication emerging as the leading segment driven by rising global demand for telecom services. Geographically, the market is categorized into North America, Europe, Asia Pacific, and the Rest of the World.

Report Coverage:

The report provides completely analyzed data regarding recent developments and trends in the microwave devices market, including the impact of COVID-19 pandemic. Also, the ongoing Russia-Ukraine ware crisis is discussed further in this report. Drivers and restraints affecting the global market growth during the forecast period are highlighted further along with the regional insights on segmented market areas. A list of key market players is mentioned further in this report.

Drivers & Restraints:

Increasing Demand for Improved Communication Services to Bolster Market Growth

The microwave devices market is expected to witness rapid growth during the projected period due to increasing demand for 5G network services in various industries. Also, the rising demand for medical instruments equipped with microwave devices is expected to fuel the market growth in the coming years. Furthermore, the increasing need for enhanced communication services is anticipated to drive the global market.

However, the high risk of communication jamming may hamper the market growth in the coming years.

Regional Insights:

North America Dominates Global Market Share Due to Rising Adoption of Advanced Communication Services

North America dominated the global microwave devices market share in 2021. The regional market stood at USD 1.95 billion in 2021. This is attributed to the increasing adoption of advanced communication systems in aviation, defense, commercial, and industrial sectors.

Europe is expected to grow at a substantial CAGR during the forecast period due to increasing semiconductor production and its utilization in healthcare, automotive, and manufacturing industries in the U.K., Germany, and France.

Competitive Landscape:

New Product Launch Allow Companies to Propel Growth

The key players focus on implementing several strategies to improve their business performance. These strategies include forming strategic alliances, collaborations, and partnerships. Also, introducing new products and getting recognized for these launches allow key players to enhance their brand value globally.

Key Industry Development:

In June 2024 , Communications & Power Industries (CPI) announced the spin-off of its Electron Device Business, which is now functioning as an independent entity. This division specializes in the development and manufacturing of a wide range of RF and microwave products for essential defense and commercial applications.

In February 2025 , Kratos Defense reported a rise in revenues within its Microwave Products division, driven by organic growth in its Turbine Technologies, C5ISR, and Defense Rocket Support sectors. This growth highlights the company's expanding involvement in microwave technologies for defense applications.