The global gallium nitride device market was valued at USD 20.56 billion in 2019 and is expected to grow from USD 21.18 billion in 2020 to USD 39.74 billion by 2032, registering a CAGR of 5.20% during the 2020–2032 period.

This growth is driven by the increasing demand for high-efficiency, high-performance electronic devices across sectors such as telecommunications, automotive, aerospace, and consumer electronics. Gallium nitride devices offer advantages such as higher power density, faster switching speeds, and improved thermal performance compared to traditional silicon-based devices. In 2019, North America held the largest market share at 35.89%, supported by strong R&D activities and early adoption of advanced semiconductor technologies.

A list of all the prominent Gallium Nitride Device Market Key Players:

- Infineon Technologies AG (Germany)

- Efficient Power Conversion Corporation. (The U.S.)

- EPISTAR Corporation (Taiwan)

- GaN Systems (Canada)

- MACOM (The U.S.)

- Microsemi (The U.S.)

- Mitsubishi Electric Corporation (Japan)

- NICHIA CORPORATION (Japan)

- Northrop Grumman Corporation (The U.S.)

- NXP Semiconductors. (Netherland)

- Qorvo, Inc (The U.S.)

- Texas Instruments Incorporated. (The U.S.)

- Toshiba Corporation (Japan)

Information Source:

https://www.fortunebusinessinsights.com/gallium-nitride-gan-devices-market-103367

Drivers & Restraints

Expansion of the Telecommunications Sector to Boost Growth

The increasing demand for energy-efficient gallium nitride (GaN) devices is being driven by the rapid expansion of the telecommunications sector. Many internet service providers are now prioritizing lower latency through optical fiber connections, along with enhancing connectivity and network capacity. Additionally, the growing adoption of GaN devices in 5G infrastructure is expected to further accelerate gallium nitride device market growth in the coming years. However, the high costs associated with the maintenance and development of gallium nitride devices may pose a challenge to this growth.

Segmentation- Gallium Nitride Device Market

Opto-semiconductor Device Segment to Grow Rapidly Backed by Increasing Usage in Lasers

Based on device type, the opto-semiconductor device segment procured the highest gallium nitride device market share in 2019. This growth is attributable to their increasing usage in various aerospace applications, such as Light Detection and Ranging (LiDAR) and pulsed lasers. Besides, they are used in optoelectronics, LEDs, lasers, photodiodes, and solar cells.

Regional Insights- Gallium Nitride Device Market

High Demand for Wireless Devices to Favor Growth in Europe

Geographically, North America generated USD 7.38 billion in 2019 because of the presence of numerous prominent manufacturers, such as MACOM, Cree, Inc., Northrop Grumman Corporation, Efficient Power Conversion Corporation, Microsemi, and others in this region.

Europe, on the other hand, is anticipated to grow significantly on account of the rising demand for wireless devices in Germany, France, and the U.K. In Asia Pacific, the rising demand for gallium nitride devices from emerging nations, such as India and China would aid growth.

Key Industry Developments:

January 2025 - Wolfspeed launched its Gen 4 MOSFET technology platform, delivering breakthrough performance for high-power applications, enhancing efficiency and reliability in real-world conditions.

November 2024 - Infineon introduced the world's first 300mm power gallium nitride (GaN) wafer technology at electronica 2024, marking a significant advancement in power electronics manufacturing.

The global gallium nitride device market was valued at USD 20.56 billion in 2019 and is expected to grow from USD 21.18 billion in 2020 to USD 39.74 billion by 2032, registering a CAGR of 5.20% during the 2020–2032 period.

This growth is driven by the increasing demand for high-efficiency, high-performance electronic devices across sectors such as telecommunications, automotive, aerospace, and consumer electronics. Gallium nitride devices offer advantages such as higher power density, faster switching speeds, and improved thermal performance compared to traditional silicon-based devices. In 2019, North America held the largest market share at 35.89%, supported by strong R&D activities and early adoption of advanced semiconductor technologies.

A list of all the prominent Gallium Nitride Device Market Key Players:

- Infineon Technologies AG (Germany)

- Efficient Power Conversion Corporation. (The U.S.)

- EPISTAR Corporation (Taiwan)

- GaN Systems (Canada)

- MACOM (The U.S.)

- Microsemi (The U.S.)

- Mitsubishi Electric Corporation (Japan)

- NICHIA CORPORATION (Japan)

- Northrop Grumman Corporation (The U.S.)

- NXP Semiconductors. (Netherland)

- Qorvo, Inc (The U.S.)

- Texas Instruments Incorporated. (The U.S.)

- Toshiba Corporation (Japan)

Information Source:

https://www.fortunebusinessinsights.com/gallium-nitride-gan-devices-market-103367

Drivers & Restraints

Expansion of the Telecommunications Sector to Boost Growth

The increasing demand for energy-efficient gallium nitride (GaN) devices is being driven by the rapid expansion of the telecommunications sector. Many internet service providers are now prioritizing lower latency through optical fiber connections, along with enhancing connectivity and network capacity. Additionally, the growing adoption of GaN devices in 5G infrastructure is expected to further accelerate gallium nitride device market growth in the coming years. However, the high costs associated with the maintenance and development of gallium nitride devices may pose a challenge to this growth.

Segmentation- Gallium Nitride Device Market

Opto-semiconductor Device Segment to Grow Rapidly Backed by Increasing Usage in Lasers

Based on device type, the opto-semiconductor device segment procured the highest gallium nitride device market share in 2019. This growth is attributable to their increasing usage in various aerospace applications, such as Light Detection and Ranging (LiDAR) and pulsed lasers. Besides, they are used in optoelectronics, LEDs, lasers, photodiodes, and solar cells.

Regional Insights- Gallium Nitride Device Market

High Demand for Wireless Devices to Favor Growth in Europe

Geographically, North America generated USD 7.38 billion in 2019 because of the presence of numerous prominent manufacturers, such as MACOM, Cree, Inc., Northrop Grumman Corporation, Efficient Power Conversion Corporation, Microsemi, and others in this region.

Europe, on the other hand, is anticipated to grow significantly on account of the rising demand for wireless devices in Germany, France, and the U.K. In Asia Pacific, the rising demand for gallium nitride devices from emerging nations, such as India and China would aid growth.

Key Industry Developments:

January 2025 - Wolfspeed launched its Gen 4 MOSFET technology platform, delivering breakthrough performance for high-power applications, enhancing efficiency and reliability in real-world conditions.

November 2024 - Infineon introduced the world's first 300mm power gallium nitride (GaN) wafer technology at electronica 2024, marking a significant advancement in power electronics manufacturing.

The global X Band Radar market size was valued at USD 9.57 billion in 2024 and is projected to grow from USD 11.98 billion in 2025 to USD 46.20 billion by 2032, exhibiting a strong CAGR of 21.26% during the forecast period.

This significant growth is primarily driven by the rising demand for advanced radar systems capable of delivering high-resolution imaging and real-time tracking across defense and commercial applications. X band radars, with their shorter wavelength and higher resolution capabilities, are increasingly adopted for precision surveillance, missile guidance, weather monitoring, and airborne target detection.

Browse In-depth Summary of This Research Insight:

https://www.fortunebusinessinsights.com/x-band-radar-market-113321

LIST OF KEY X BAND RADAR COMPANIES PROFILED

- BAE Systems plc. (U.K.)

- Hanwha Systems Co. Ltd. (South Korea)

- Hensoldt AG (Germany)

- Honeywell International Inc. (U.S.)

- Israel Aerospace Industries Ltd. (Israel)

- L3Harris Technologies, Inc. (U.S.)

- Leonardo S.p.A (Italy)

- Lockheed Martin Corporation (U.S.)

- Northrop Grumman Corporation (U.S.)

- Raytheon Technologies Corporation (U.S.)

- Saab AB (Sweden)

Segmentation: X Band Radar Market

By Component

The market is segmented into Transmitter, Antenna, Receiver, Duplexer, and Others . Among these, transmitters and antennas hold a substantial share due to their vital role in high-frequency signal transmission and reception in modern radar systems.

By Range

Based on range, the market is categorized into Long, Medium, Short, and Very Short . The long-range segment is anticipated to dominate the market due to growing demand for radar systems with extended detection capabilities in military and homeland security applications.

By Platform

The X band radar market is classified by platform into Airborne Radar, Land Radar, and Naval Radar . The airborne radar segment is expected to show significant growth due to increasing investment in UAVs, fighter jets, and surveillance aircraft by both commercial and defense sectors.

By Region

The market covers regions such as North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa .

- North America (By Component, Range, Platform, and Country)

- U.S. (By Platform)

- Canada (By Platform)

- Europe (By Component, Range, Platform, and Country)

- Germany, U.K., France, Italy, Russia, Rest of Europe (By Platform)

- Asia Pacific (By Component, Range, Platform, and Country)

- China, Japan, India, Australia, Rest of Asia Pacific (By Platform)

- Rest of the World (By Component, Range, Platform, and sub-region)

- Latin America (By Platform)

- Middle East & Africa (By Platform)

Report Coverage:

This comprehensive report delves into multiple aspects of the market including component innovations, strategic deployments of radar systems, the evolution of radar-based threat detection technologies, and emerging regional opportunities. It also includes detailed analyses of supply chains, R&D advancements, and competitor benchmarking to provide an all-around view of the market landscape.

Drivers and Restraints:

Rising Defense Expenditures and Maritime Security Concerns to Drive Market Growth

With global defense budgets increasing and maritime security becoming a top priority, governments and naval forces are heavily investing in advanced radar systems. X band radars are preferred for their precision in hostile environments and their ability to operate in various weather conditions.

However, high operational costs and technological complexity may hinder adoption in developing regions. Budget constraints and limited technical infrastructure can pose challenges for broader market expansion.

Regional Insights:

North America dominated the global X band radar market share in 2024 , driven by the presence of major defense contractors and high military spending by the U.S. government. Continuous upgrades to missile defense systems and fleet modernization initiatives are further fueling demand.

Asia Pacific is projected to witness the fastest CAGR during the forecast period, supported by rising geopolitical tensions, increasing aircraft and naval platform procurements, and substantial investments in indigenous radar technologies by countries such as China, India, and Japan.

Competitive Landscape:

Leading Companies Focus on Defense Contracts and Advanced Technology Integration

The X band radar market is highly competitive with global players focusing on R&D and contract acquisition to gain a strategic edge. Companies are prioritizing product innovation, software-defined radar systems, and multi-platform integration to meet evolving defense requirements.

Notable Industry Development:

December 2024 – Saab AB was awarded a USD 41.6 million contract by the Swedish Defence Materiel Administration (FMV) to supply the Sea Giraffe 1X X-Band radar systems for the Swedish Naval Forces. The contract includes deliveries of radar units in various configurations for training and naval installation, with deliveries scheduled between 2024 and 2026.

The global aircraft interface device market was valued at USD 149.1 million in 2024 and is expected to grow from USD 160.5 million in 2025 to USD 259.5 million by 2032, registering a CAGR of 7.1% during the forecast period. In 2024, North America led the market, accounting for a dominant share of 38.73%.

This growth is driven by the rising need for streamlined and efficient communication between various aircraft systems to improve operational performance and flight safety. AIDs play a crucial role by enabling Electronic Flight Bags (EFBs) to interact with aircraft data buses, providing essential real-time information such as aircraft position and speed. The market is also being fueled by increasing global air travel demand and the steady expansion of commercial and military aircraft fleets.

Browse In-depth Summary of This Research Insight:

https://www.fortunebusinessinsights.com/aircraft-interface-device-market-108478

LIST OF KEY COMPANIES PROFILED IN THE REPORT

- Astronics Corporation (U.S.)

- Collins Aerospace (U.S.)

- SCI Technology Inc. (U.S.)

- Skytrac System LLC. (Canada)

- Teledyne Controls LLC (U.S.)

- Thales SA (France)

- The Boeing Company (U.S.)

- Elbit System (Israel)

- DAC International Inc. (U.S.)

- CMC Electronics Inc. (Canada)

- Honeywell International Inc. (U.S.)

Segmentation: Aircraft Interface Device Market

Aircraft Conditioning Monitoring System to be Widely Used Due to Increasing Demand for Predictive Maintenance

By application, the market is divided into flight tracking, quick access recording, Aircraft Condition Monitoring System (ACMS), DVR & video streaming, and others. The Aircraft Condition Monitoring System (ACMS) segment is predicted to be the fastest-growing segment during the forecast period as the demand for predictive aircraft maintenance activities is rising at a robust pace.

Increase in the Number of Aircraft Fleet to Boost Use of Fixed Wing Aircraft

Based on aircraft type, the market is segmented into fixed wing and rotary wing. The fixed wing segment might emerge as the fastest growing segment due to the notable expansion of aircraft fleets by airlines.

Demand for Wireless Connectivity to Rise Due to Growing Demand for Futuristic Connectivity Systems

By connectivity, the market is bifurcated into wired and wireless. The wireless segment held a dominant position in the market in 2022 as there was a notable spike in the demand for cutting-edge connectivity systems that use a higher radio frequency to transfer data.

Concerning region, the market covers North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Report Coverage:

The report analyzes the market in detail and covers several crucial areas, such as supply chain management, opportunities for AIDs to grow in demand, R&D capabilities, and competitive landscape. It also provides valuable insights about the leading industry developments and the top market trends. Besides the abovementioned factors, the report covers several factors that have boosted the market growth in recent years.

Drivers and Restraints:

Growth in In-Flight Connectivity in Aircraft to Accelerate Market Progress

Passengers and airlines across the world are looking for reliable internet access during flights to facilitate in-flight connectivity, which can help them use their devices for entertainment or business purposes. This scenario has boosted the demand for Aircraft Interface Devices (AIDs) to make in-flight connectivity easier. With the help of AIDs, users can get access to in-flight entertainment, such as live TV and streaming services, which will fuel the market development.

However, concerns regarding data safety and security associated with AIDs can impede the market growth.

Regional Insights:

North America Led the Market Share Due to Presence of Large Aircraft Fleets and Top Airlines

North America dominated the global aircraft interface device market share as region witnessed the expansion of its aircraft fleet and has a vast presence of leading airlines. Some of the popular airlines present in North America include Delta Airlines, American Airlines, and Southwest Airlines.

Asia Pacific is predicted to record the highest CAGR during the forecast period as there has been a notable increase in the number of air travelers in the region in recent years.

Competitive Landscape:

Key Market Players to Launch New Products to Maintain Their Market Dominance

The market landscape is highly competitive due to the presence of top firms, such as Astronics Corporation, Collins Aerospace, SCI Technology Inc., Skytrac System LLC., and Teledyne Controls LLC, and others. These companies are launching new products and taking various initiatives to upgrade their current software and systems to fulfill the growing product demand from different airlines and expand their market presence.

Notable Industry Development:

In December 2024, FLYHT Aerospace Solutions Ltd. announced the renewal of a multi-year software services contract with a military client in the Middle East. The renewed agreement is intended to support the client in improving flight operations and maximizing operational efficiency.

The global microwave devices market was valued at USD 5.85 billion in 2021 and is projected to grow from USD 6.09 billion in 2022 to USD 9.88 billion by 2029, exhibiting a CAGR of 7.15% during the forecast period. In 2021, North America dominated the market with a 33.33% share.

This market is witnessing steady growth, fueled by ongoing technological advancements and rising demand across diverse industries such as telecommunications, healthcare, and defense. As microwave applications broaden, the market continues to attract significant investment. North America's leadership is underpinned by its robust infrastructure and strong focus on innovation. With expanding use cases and favorable industry trends, the microwave devices market is poised for sustained and healthy growth in the years ahead.

List of Key Players Profiled in the Microwave Devices Market Report:

- Analog Devices Inc. (U.S.)

- Communications & Power Industries LLC (U.S.)

- General Dynamics Corporation (U.S.)

- Kratos Defense & Security Solutions, Inc. (U.S.)

- L3Harris Technologies, Inc. (U.S.)

- MACOM Technology Solutions Inc. (U.S.)

- Microsemi Corporation (U.S)

- Microwave Technology, Inc. (U.K.)

- Qorvo Inc. (U.S.)

- Richardson Electronics, Ltd. (U.S.)

- Teledyne Technologies Incorporated (U.S.)

- Thales Group (France)

- TMD Technologies Ltd (U.K.)

- Toshiba Corporation (Japan)

- Cytec Corporation (U.S.)

Russia-Ukraine War Impact:

The Russia-Ukraine war crisis-affected the avionics and electronic industry globally. The closure of national borders affected the supply of essential electronic and semiconductor devices required by the aviation sector. Also, Ukraine is the largest provider of noble gas neon and semiconductor-grade neon tube. The war crisis affected the supply chain of these gases from Ukraine to other countries.

Browse In-depth Summary of This Research Insight:

https://www.fortunebusinessinsights.com/microwave-devices-market-103542

Segmentation:

Active Segment to Lead the Market Due to Rising Demand from Networking & Telecom Services

By type, the microwave devices market is bifurcated into active and passive. The active segment is expected to hold a dominant share in the global market due to increasing demand for these devices in telecom and networking services.

Increasing Adoption of Ku-Band to Drive the Segment Growth

Based on frequency, the market is divided into Ku-Band, Ka-Band, S-Band, C-Band, X-Band, L-Band, and others. The Ku-Band segment leads the market share due to its rising space and defense application adoption during the forecast period.

Rising Demand for Telecommunication Services to Bolster Segmental Growth

On the basis of end-use industry, the market is segmented into telecommunication, space, defense, industrial, healthcare, and others. The increasing demand for telecommunication services is expected to fuel the segmental growth.

Finally, by geography, the market is categorized into North America, Europe, Asia Pacific, and the Rest of the World.

Report Coverage:

The report provides completely analyzed data regarding recent developments and trends in the microwave devices market, including the impact of COVID-19 pandemic. Also, the ongoing Russia-Ukraine ware crisis is discussed further in this report. Drivers and restraints affecting the global market growth during the forecast period are highlighted further along with the regional insights on segmented market areas. A list of key market players is mentioned further in this report.

Drivers & Restraints:

Increasing Demand for Improved Communication Services to Bolster Market Growth

The microwave devices market is expected to witness rapid growth during the projected period due to increasing demand for 5G network services in various industries. Also, the rising demand for medical instruments equipped with microwave devices is expected to fuel the market growth in the coming years. Furthermore, the increasing need for enhanced communication services is anticipated to drive the global market.

However, the high risk of communication jamming may hamper the market growth in the coming years.

Regional Insights:

North America Dominates Global Market Share Due to Rising Adoption of Advanced Communication Services

North America dominated the global microwave devices market share in 2021. The regional market stood at USD 1.95 billion in 2021. This is attributed to the increasing adoption of advanced communication systems in aviation, defense, commercial, and industrial sectors.

Europe is expected to grow at a substantial CAGR during the forecast period due to increasing semiconductor production and its utilization in healthcare, automotive, and manufacturing industries in the U.K., Germany, and France.

Competitive Landscape:

New Product Launch Allow Companies to Propel Growth

The key players focus on implementing several strategies to improve their business performance. These strategies include forming strategic alliances, collaborations, and partnerships. Also, introducing new products and getting recognized for these launches allow key players to enhance their brand value globally.

Key Industry Development:

In June 2024 , Communications & Power Industries (CPI) announced the spin-off of its Electron Device Business, which is now functioning as an independent entity. This division specializes in the development and manufacturing of a wide range of RF and microwave products for essential defense and commercial applications.

In February 2025 , Kratos Defense reported a rise in revenues within its Microwave Products division, driven by organic growth in its Turbine Technologies, C5ISR, and Defense Rocket Support sectors. This growth highlights the company's expanding involvement in microwave technologies for defense applications.

The global space launch services market was valued at USD 4.28 billion in 2023 and is expected to grow from USD 4.91 billion in 2024 to USD 10.98 billion by 2032, exhibiting a CAGR of 10.6% during the forecast period. In 2023, North America led the market with a 42.06% share, driven largely by U.S. activity. The U.S. market alone is projected to reach approximately USD 7,480.1 million by 2030, supported by favorable government regulations encouraging the development and deployment of launch services.

The market encompasses both commercial and governmental launch activities, involving the transportation of satellites, cargo, and crew into space. Growth is fueled by rising demand for satellite-based services, renewed interest in space exploration, and robust public-private investment. Technological advancements—such as reusable launch vehicles and miniaturized satellite systems—are reshaping the landscape, reducing costs, and expanding access to space.

These insights are detailed in the latest report by Fortune Business Insights™, titled "Space Launch Services Market Size, Share, and Forecast 2024–2032."

Information Source:

https://www.fortunebusinessinsights.com/industry-reports/space-launch-services-market-101931

List of Key Players Mentioned in the Space Launch Services Market Report:

- Antrix Corporation Limited (India)

- ArianeGroup SAS (France)

- Rocket Lab (U.S.)

- United Launch Alliance (U.S.)

- Space Exploration Technologies Corp. (SpaceX) (U.S.)

- Mitsubishi Heavy Industries, LTD. (Japan)

- Northrop Grumman Systems Corporation (U.S.)

- Roscosmos (Russia)

- NASA (U.S.)

- Jaxa (Japan)

- CNSA (China)

- China Aerospace Science and Technology Corporation (China)

Segmentation:

LEO Segment Accounted for Prominent Share Due to Increasing Launch of Satellites

On the basis of orbit type, the market for space launch services is subdivided into GEO, LEO, and others. The LEO segment registered a dominating share in the market. This is driven by the growing initiatives focused on the launch of satellites in this orbit.

Heavy Lift Launch Vehicle Segment Garnered Key Share Owing to Soaring Number of Rideshare Missions

Based on launch vehicle, the market is segmented into medium lift launch vehicle, small lift launch vehicle, and heavy lift launch vehicle. The heavy lift launch vehicle segment captured a leading share in the global market. An escalation in the number of ride share missions at the global level is anticipated to drive the dominance of the segment.

Commercial Segment to Expand at the Fastest Pace Impelled by Increasing Launch of Commercial Offerings

Based on end user, the market for space launch services is bifurcated into civil & military and commercial. The commercial segment is set to emerge as the fastest growing segment. Private organizations are directing their efforts toward the launch of commercial space-based services, which is one of the vital factors driving the segmental growth.

Human Spacecraft Segment to Surge at the Fastest Rate Due to Rise in Space Tourism

By payload, the market is segmented into human spacecraft, cargo, satellite, and testing probes. The human spacecraft segment is slated to grow at the fastest rate over the study period. This can be attributed to an escalation in space tourism and a rise in the number of manned space missions.

Based on geography, the market for space launch services has been studied across Asia Pacific, Europe, North America, Latin America, and the Middle East & Africa.

Report Coverage:

The report presents an account of the pivotal initiatives undertaken by major industry participants to gain a strong space launch services market footing. An account of the market scenario based on various segments has also been provided in the report. The industry has been analyzed on the basis of orbit type, launch vehicle, end user, payload, and geography.

Drivers and Restraints:

Industry Value to Rise with Increased Emergence of Private Players

Several startups have emerged in the space industry which are keen to provide low cost and advanced technologies for facilitating a range of space services. These startups are operational in the areas of remote sensing, navigation, earth observation, communication, and others. This places a greater emphasis on the need for satellite constellations, which is expected to favor space launch services market growth.

However, issues pertaining to space debris could create challenges for industry expansion.

Regional Insights:

North America Emerged as Leading Region Due to Increasing Product Deployment for Commercial Purposes

The North America market accounted for a dominant position in the space launch services market. The rising deployment of services offered by private players for a range of commercial purposes is one of the key factors boosting the dominance of the segment.

The Asia Pacific space launch services market share is poised to expand at the fastest growth rate over the analysis period. The increasing demand for launch services from the surveillance, communication satellites, and telecommunication industries from China, India, Japan, and South Korea is set to drive the regional expansion.

Competitive Landscape:

Industry Players Focus on Optimizing the Cost of Offerings to Gain an Edge over Competitors

Companies are engaged in collaborations and optimizing the cost of per-kg launch. These steps are being adopted for outpacing their competitors in the space launch services sector. Some of the key market players are SpaceX and Antrix Corporation Limited.

Key Industry Development:

July 2023 – Rocket Lab USA, Inc., announced its launch of seven satellites. The satellites were launched for NASA, Spire Global, and Space Flight Laboratory from New Zealand.

The global cargo drone market was valued at USD 1.15 billion in 2024 and is projected to grow from USD 1.82 billion in 2025 to USD 33.79 billion by 2032, registering a CAGR of 51.8% during the forecast period. This exponential growth is driven by the increasing demand for rapid, cost-effective, and autonomous delivery solutions across various industries. North America accounted for the largest market share in 2024, owing to early adoption and strong defense and logistics infrastructure.

Cargo drones are transforming last-mile and long-range logistics by enabling swift delivery in hard-to-reach and high-traffic areas. Their scalability, autonomous operation, and reduced environmental footprint make them ideal for both commercial and military applications.

List of Key Companies Profiled

- DJI (China)

- Parrot SA (France)

- Natilus (U.S.)

- Dronamics (U.K.)

- Silent Arrow (U.S.)

- Sabrewing Aircraft Company (U.S.)

- Elroy Air (U.S.)

- Volocopter GmbH (Germany)

- Dufour Aerospace (Switzerland)

- H3 Dynamics (Singapore)

- Bell Textron Inc. (U.S.)

- Kaman Corporation (U.S.)

- Airbus (Netherlands)

- Elbit Systems (Israel)

- Israel Aerospace Industries (IAI) (Israel)

Information Source:

https://www.fortunebusinessinsights.com/cargo-drones-market-108151

Cargo Drones Market Drivers and Opportunities

Growth of E-Commerce and On-Demand Delivery Services

The boom in global e-commerce and expectations of faster delivery are fueling the adoption of cargo drones. Major retailers and logistics firms are exploring drone-based delivery systems to enhance operational efficiency and reduce reliance on ground transport in congested areas.

Technological Advancements and Automation

Advancements in VTOL design, battery technology, AI-powered navigation, and lightweight materials are making drones more capable and cost-efficient. Semi and fully autonomous systems are becoming viable for cargo missions over varying distances and terrains.

Regulatory Support and Infrastructure Development

Governments are increasingly supportive of drone logistics, developing regulatory frameworks, test corridors, and UAS traffic management systems. Strategic partnerships with logistics companies, tech firms, and municipal bodies are enabling pilot programs and ecosystem building.

Key Industry Developments

-

April 2025 – Piasecki Aircraft acquired Kaman Air Vehicles’ Kargo UAV to expand its portfolio and accelerate the commercialization of autonomous aerial logistics. The production-ready model is expected by 2026.

Segmentation Analysis

- By Type: Fixed-Wing, Hybrid, Rotary-Wing

- By Automation Level: Fully Autonomous, Semi-Autonomous, Remotely Controlled

- By Range: Very Short, Short, Medium, Long

- By Payload Capacity: Featherweight, Lightweight, Middleweight, Heavy-Lift

- By Component: Cameras, Sensors, Equipment, Delivery Packages

- By Application: Commercial Cargo, Military Cargo

- By End-User Industry:

- E-Commerce

- Construction

- Government & Defense Organizations

- Healthcare

- Offshore & Energy

Regional Insights

North America Leads in Innovation and Defense Logistics

North America held the largest share in 2024 due to robust government funding, integration of drones in defense logistics, and active participation from tech giants and startups. FAA’s evolving UAS integration policies and pilot programs are accelerating commercial use cases.

Europe Focused on Eco-Friendly and Humanitarian Use

European countries like France, Germany, and the U.K. are emphasizing sustainable logistics and emergency delivery services using drones. Companies like Dronamics and Airbus are pioneering medium-to-long-range heavy-lift cargo drone solutions.

Asia Pacific Gaining Momentum with Urban Logistics

Rapid urbanization, high e-commerce activity, and government-backed smart city initiatives in China, India, and Southeast Asia are catalyzing drone delivery deployments. Local startups and global players are partnering to test scalable infrastructure.

Competitive Landscape

Innovation and Strategic Alliances Drive Market Dynamics

Leading cargo drone manufacturers are prioritizing R&D, prototype testing, and regulatory approvals. Collaborations with logistics providers, technology developers, and defense agencies are enabling scalable deployments. M&A activity is on the rise as companies race to develop versatile, payload-optimized platforms.

Report Coverage

The global cargo drone market report offers a deep dive into industry dynamics, including market size, segmentation by platform type, range, payload, automation, and end-user industry. It features key trends, pricing and cost analysis, competitive benchmarking, innovation pipelines, and regulatory landscapes. Regional and country-level forecasts, as well as insights into R&D investments and emerging opportunities, are comprehensively covered.

Surface Radar Market Research Report, Segmentation, and Forecast, 2025–2032

By Miyasingh, 2025-07-09

The global surface radar market is witnessing significant growth, driven by increasing defense modernization programs, rising demand for advanced surveillance systems, and the growing threat of unmanned aerial systems (UAS). Valued at USD 17.66 billion in 2024, the market is projected to reach USD 31.18 billion by 2032, growing at a CAGR of 6.6% during the forecast period (2025–2032). This robust growth reflects the expanding applications of surface radar in defense, border surveillance, and counter-drone systems.

The surface radar market is experiencing steady growth due to increasing demand for advanced surveillance and defense systems across various regions. These radars play a vital role in monitoring ground and maritime activity, detecting threats, and supporting military operations. Technological advancements, such as electronically scanned arrays and 4D radar capabilities, are enhancing performance and expanding application areas. The market is also benefiting from rising investments in defense modernization and border security. With growing emphasis on situational awareness and threat detection, the global surface radar market is expected to witness significant expansion in the coming years.

Key Industry Players

Leading companies in the surface radar market include:

- Lockheed Martin Corporation (U.S.)

- Raytheon Technologies Corporation (U.S.)

- Thales (France)

- Leonardo S.p.A (Italy)

- Saab AB (Sweden)

- BAE Systems (U.K.)

- Northrop Grumman Corporation (U.S.)

- IAI – Israel Aerospace Industries (Israel)

- Elbit Systems (Israel)

- L3Harris Technologies, Inc. (U.S.)

These firms are heavily investing in R&D to develop compact, mobile, and multi-mission radar systems with enhanced electronic counter-countermeasures (ECCM) capabilities.

Information Source:

https://www.fortunebusinessinsights.com/surface-radar-market-113084

Regional Insights

North America held the largest market share of 35.9% in 2024 , propelled by high military expenditure, continuous upgrades of ground-based radar systems, and the presence of major players such as Lockheed Martin, Raytheon Technologies, and Northrop Grumman. Europe and Asia-Pacific are also expected to witness significant growth, driven by border security initiatives and expanding naval surveillance operations.

Market Segmentation

The surface radar market is segmented based on installation type , technology , frequency band , range , platform , application , dimension , and component :

- By Installation Type : Mobile and Fixed

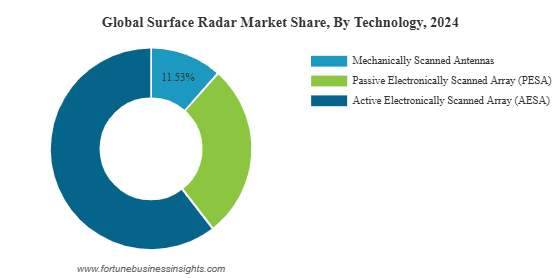

- By Technology : Mechanically Scanned Antennas, Passive Electronically Scanned Array (PESA), and Active Electronically Scanned Array (AESA)

- By Frequency Band : S Band, X Band, and L Band

- By Range : Short Range, Medium Range, and Long Range

- By Platform : Ground-Based and Naval-Based

- By Application : Surveillance, Defense, Counter-UAS (C-UAS), Weapon Detection & Tracking, and Others

- By Dimension : 2D, 3D, and 4D

- By Component : Antenna, Transmitter, Receiver, and Signal Processor

Among these, AESA technology and 4D radar systems are experiencing rapid adoption due to their superior detection capability, faster target acquisition, and resistance to electronic jamming.

Key Industry Development

-

April 2025 – Thales secured a contract from the Swedish Defence Materiel Administration to deliver the Ground Master 200 Multi-Mission Compact (GM200 MM/C) radar . This 4D AESA radar system enhances Sweden’s airspace surveillance with its high mobility, rapid deployment, and multi-target tracking features, reinforcing the country's situational awareness and defense readiness.

Helicopter Fasteners Market Research Report, with Industry Segmentation, 2025–2032

By Miyasingh, 2025-07-09

The global helicopter fasteners market was valued at USD 66.4 million in 2024 and is projected to grow from USD 75.4 million in 2025 to USD 156.5 million by 2031 , at a strong compound annual growth rate (CAGR) of 13.0% over the forecast period. This growth reflects the rising demand for lightweight, durable, and high-performance fastening solutions tailored to military and civil helicopters. As rotorcraft manufacturing expands globally, the need for advanced fasteners is becoming increasingly critical in ensuring structural safety, efficiency, and regulatory compliance.

Helicopter fasteners are key components in aerospace assemblies, playing a vital role in maintaining the mechanical integrity of helicopters across various subsystems. This article explores the market landscape, including key players, segmentation, growth drivers, and recent developments shaping the industry's future.

Key Players: Helicopter Fasteners Market

- LISI Aerospace SAS (France)

- Precision Castparts Corp. (U.S.)

- Howmet Aerospace Inc. (U.S.)

- TriMas (U.S.)

- Arconic Corporation (U.S.)

- National Aerospace Fasteners Corporation (Taiwan)

- SPS Technologies Ltd. (U.K.)

- TFI Aerospace Corporation (Canada)

- B&B Specialties, Inc. (U.S.)

These companies are focusing on technological innovation, strategic partnerships, and capacity expansion to meet the increasing demands of both civil and defense helicopter manufacturers.

Information Source:

https://www.fortunebusinessinsights.com/helicopter-fasteners-market-113409

Segmentation: Helicopter Fasteners Market

The Helicopter Fasteners Market is segmented by material, product, type, application, and geography, each contributing uniquely to the market’s growth. By material, the market includes aluminum, steel, titanium, superalloy, and others, chosen based on specific requirements for strength, weight, and resistance to corrosion and temperature. Product types such as screws, bolts, rivets, and others serve diverse structural needs across helicopter components. The market is further divided into military and civil helicopters, reflecting varying performance and regulatory demands. In terms of application, fasteners are used across the airframe, rotor system, engine & transmission, avionics and electrical systems, and other subsystems. Geographically, the market spans North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, each region exhibiting distinct demand trends driven by local aerospace activity, defense spending, and helicopter production rates.

Driving Factors: Helicopter Fasteners Market

Several key factors are propelling the growth of the helicopter fasteners market:

- Rising defense budgets and procurement of military helicopters by major economies such as the U.S., India, and China are creating a strong pull for specialized aerospace fasteners.

- Lightweight materials like titanium and superalloys are gaining traction to improve performance and fuel efficiency.

- Increased production of civil helicopters , especially for urban air mobility, medical evacuation, and commercial transport, is boosting demand across all product types.

- Strict aerospace regulations and safety standards necessitate precision-engineered fasteners with enhanced mechanical properties.

- Technological advancements , including additive manufacturing and surface treatment techniques, are improving durability and design flexibility.

Industry Developments: Helicopter Fasteners Market

Recent developments highlight the innovation and evolving dynamics within the industry:

-

April 2025 : Mahindra Aerostructures Pvt. Ltd. (MASPL) secured a significant contract from Airbus Helicopters to manufacture the main fuselage of the H130 helicopter . This marks a strategic shift for Mahindra from supplying small parts to producing complex aerostructures, emphasizing the growing importance of domestic suppliers and integrated fastening systems in global supply chains.

The Helicopter Fasteners Market is poised for remarkable growth through 2031, driven by rising helicopter production, the shift toward advanced lightweight materials, and evolving applications across military and commercial aviation. With leading aerospace manufacturers pushing for higher efficiency and reliability, fastener suppliers are expected to innovate and scale rapidly to meet global demand.

As the industry navigates through evolving safety regulations and shifting geopolitical priorities, the role of high-performance helicopter fasteners will remain crucial in securing the future of rotorcraft design and operation.