The global aircraft gearbox market size was valued at USD 3,381.5 million in 2024 and is projected to expand from USD 3,653.7 million in 2025 to USD 6,094.1 million by 2032, reflecting a CAGR of 7.58% during the forecast period. North America led the market in 2024 with a 45.71% share, supported by a well-established aerospace industry and the presence of major aircraft OEMs.

Aircraft gearboxes are essential mechanical systems that transfer engine power to propellers or rotors by regulating rotational speed and enhancing torque, enabling efficient propulsion. These components are typically manufactured from high-strength materials such as steel and titanium, with lightweight housings made from aluminum or magnesium, designed to withstand extreme loads, vibrations, and temperatures.

The market encompasses several key gearbox types, including reduction gearboxes for propellers, accessory gearboxes for auxiliary systems, actuation gearboxes for control surfaces, and tail rotor gearboxes for helicopters. Ongoing innovations in design and precision manufacturing are driving improvements in gearbox performance, durability, and reliability.

These findings are detailed in the report titled “Aircraft Gearbox Market Size, Share, and Forecast 2025–2032.”

Information Source:

https://www.fortunebusinessinsights.com/aircraft-gearbox-market-105541

List of Key Players Mentioned in the Report:

- Safran (France)

- Liebherr (Switzerland)

- United Technologies Corporation (UTC) (U.S.)

- Rexnord Aerospace (U.S.)

- Triumph Group (U.S.)

- Aero Gear (U.S.)

- CEF Industries Inc. (U.S.)

- The Timken Company (U.S.)

- AAR Corp (U.S.)

- Rolls-Royce plc (U.K.)

- Regal Rexnord (U.S.)

Segmentation:

The aircraft gearbox market is segmented by component into gears, housings, bearings, and others; by platform into commercial, civil, and military aircraft; and by gearbox type into accessory gearboxes, reduction gearboxes, actuation gearboxes, tail rotor gearboxes, auxiliary power unit (APU) gearboxes, and others. By end-user, the market is classified into OEM, MRO, and others. Regionally, it is categorized into North America (U.S. and Canada), Europe (U.K., Germany, France, Russia, and Rest of Europe), Asia Pacific (China, Japan, India, South Korea, and Rest of Asia Pacific), and the Rest of the World (Latin America, Middle East & Africa), with each region further analyzed by component, platform, gearbox type, and end-user.

Drivers and Restraints: Aircraft Gearbox Market Size

Rising Demand for Lightweight Aircraft Components to Boost Market Growth

With airlines and aircraft manufacturers focusing on efficiency, the demand for lightweight components, including gearboxes, is increasing. Lighter components not only enhance fuel efficiency but also improve performance, reduce emissions, and extend component lifespan. Manufacturers are leveraging advanced materials and design techniques to create high-performance, lightweight gear systems.

Stringent Regulations Pose Challenges to Market Expansion

However, the aircraft gearbox market faces challenges from stringent aerospace regulations. The high costs associated with design, development, and certification of gearboxes can hinder new entrants and slow innovation. Regulatory compliance and safety testing add to the complexity and cost of market participation, acting as a restraint on growth.

Regional Insights:

North America to Maintain Dominance Owing to Aerospace Leadership and Military Investment

North America led the global aircraft gearbox market in 2024, with a market value of USD 1,545.82 million. The region benefits from the presence of key players such as Boeing and GE, as well as strong R&D capabilities and government defense programs. The U.S. Department of the Air Force’s FY2025 budget of USD 217.5 billion—featuring USD 29 billion for procurement and USD 37.7 billion for R&D—underscores the scale of investment supporting the gearbox market.

Europe Benefiting from Technological Advancements and Green Aviation Initiatives

Europe holds a significant market share, supported by investments from leading aerospace firms focused on reducing emissions and improving aircraft efficiency. Collaborations between governments and industry players have been key to driving innovation in the region.

Asia Pacific Set to Grow at Fastest Pace Due to Civil Aviation Boom

The Asia Pacific region is projected to witness the highest CAGR due to increasing demand for civil aviation and regional fleet expansions in countries like China and India. Infrastructure development and rising disposable incomes are contributing to a flourishing aviation market and growing demand for reliable gearboxes.

Other Regions See Gradual Growth

The Middle East & Africa are experiencing modest growth through fleet expansion and investments in aviation infrastructure. Latin America, led by Brazil and Mexico, is seeing steady market recovery through a focus on MRO capabilities and aviation development.

Competitive Landscape:

Key Players Focus on Innovation, Contracts, and Partnerships to Strengthen Market Position

The aircraft gearbox market is competitive, with leading players investing heavily in R&D and strategic partnerships to meet evolving industry needs. Companies are also expanding product lines and entering long-term agreements to maintain market leadership.

Key Industry Developments:

-

February 2025 – Bell Boeing received a USD 46 million contract for the integration and supply of V-22 Gearbox Vibration Monitoring/Osprey Drive System Safety and Health Information (ODSSHI) kits.

-

August 2023 – Leonardo announced partnerships to support its AW09 helicopter at Heli-Expo 2023.

- May 2023 – Triumph Group’s Geared Solutions unit secured a long-term contract with GE for LEAP program Inlet Gearboxes.

- February 2023 – Airbus Helicopters launched the upgraded eMGB for its H225, doubling the Time Before Overhaul (TBO) from 1,000 to 2,000 hours.

- November 2022 – GE Aerospace and Tata Advanced Systems Ltd extended their USD 1 billion agreement for engine components manufacturing.

Report Coverage:

The aircraft gearbox market report offers a comprehensive analysis of global trends, market size, and forecast through 2032. It provides detailed segmentation by component, gearbox type, platform, and end-user. The report highlights key players, competitive dynamics, pricing strategies, regional performance, and recent industry developments. Additionally, it explores market drivers, restraints, and the strategic initiatives shaping the future of aircraft gearbox technologies.

The global microwave devices market size was valued at USD 5.85 billion in 2021 and is projected to grow from USD 6.09 billion in 2022 to USD 9.88 billion by 2029, reflecting a CAGR of 7.15% during the forecast period. In 2021, North America led the market with a 33.33% share, driven by strong demand in defense, aerospace, and telecommunications sectors.

By type, the active devices segment dominated the market owing to the widespread use of transistors, amplifiers, diodes, and ICs across telecom and military applications. In terms of frequency, the L-band accounted for the largest share due to its extensive application in radar, GPS, and air traffic control systems. Meanwhile, the Ku-band is expected to record the fastest growth fueled by rising adoption in satellite communications and defense operations.

Key Country Highlights

- United States : Leads the market through military modernization programs and space initiatives.

- China : Witnessing rapid growth with increased defense spending and strong telecom sector expansion.

- India : High potential driven by defense modernization and electronic warfare adoption.

- Japan : Growth supported by healthcare, automotive radar, and telecom applications.

- Germany : Strong demand in automotive, industrial, and healthcare systems.

- UAE & Saudi Arabia : Growth driven by defense procurement and smart city initiatives.

- Brazil : Expanding market due to aerospace sector growth and mobile connectivity demand.

- U.K. & France : Stable growth supported by military radar and space system upgrades.

Information Source:

https://www.fortunebusinessinsights.com/microwave-devices-market-103542

List of Key Players Profiled

- Analog Devices Inc. (U.S.)

- Communications & Power Industries LLC (U.S.)

- General Dynamics Corporation (U.S.)

- Kratos Defense & Security Solutions, Inc. (U.S.)

- L3Harris Technologies, Inc. (U.S.)

- MACOM Technology Solutions Inc. (U.S.)

- Microsemi Corporation (U.S.)

- Microwave Technology, Inc. (U.K.)

- Qorvo Inc. (U.S.)

- Richardson Electronics, Ltd. (U.S.)

- Teledyne Technologies Incorporated (U.S.)

- Thales Group (France)

- TMD Technologies Ltd (U.K.)

- Toshiba Corporation (Japan)

- Cytec Corporation (U.S.)

Segmentation Insights

- By Type :

The market is segmented into active and passive devices. The active segment dominates due to increasing demand from networking and telecom services . - By Frequency :

Divided into Ku-Band, Ka-Band, S-Band, C-Band, X-Band, L-Band, and others . The Ku-band segment is expected to expand rapidly with growing adoption in space and defense communications . - By End-use Industry :

Segments include telecommunication, space, defense, industrial, healthcare, and others . The telecommunication sector is projected to lead growth due to rising demand for connectivity and 5G services. - By Region :

North America, Europe, Asia Pacific, and Rest of the World.

Report Coverage

The report provides in-depth insights into microwave devices market size , key trends, COVID-19 pandemic effects, and the Russia-Ukraine war impact . It highlights growth drivers, restraints, segmentation trends, and regional dynamics , along with a competitive landscape overview.

Drivers & Restraints

- Drivers :

- Increasing adoption of 5G network services across industries.

- Rising demand for medical equipment integrated with microwave devices.

- Growing need for enhanced communication services globally.

- Restraint :

- High risk of communication jamming poses a challenge to market growth.

Regional Insights

- North America : Dominated the global microwave devices market size in 2021, valued at USD 1.95 billion , driven by adoption in aviation, defense, and industrial communication systems.

- Europe : Expected to witness strong growth due to rising semiconductor production and applications in healthcare, automotive, and manufacturing .

- Asia Pacific : Driven by China, India, and Japan , with rapid telecom, defense, and healthcare adoption.

- Rest of the World : Growth supported by Middle East defense investments and Latin America’s aerospace expansion.

Competitive Landscape

Market leaders are focusing on product innovations, strategic alliances, and partnerships to strengthen their presence. New product launches remain a key growth strategy, enhancing technological competitiveness and brand value.

Key Industry Development

- February 2025 – L3Harris launched the RF-9850W HCLOS Microwave Radio System , a high-capacity line-of-sight solution designed for tactical communications in defense operations.

The global small arms market was valued at USD 9.07 billion in 2023 and is expected to rise from USD 9.46 billion in 2024 to USD 12.32 billion by 2032, reflecting a steady CAGR of 3.35% during the forecast period. In 2023, North America led the market with a 43.33% share, driven by strong defense spending, civilian firearm ownership, and the presence of leading manufacturers.

In 2023, North America dominated the small arms market with a 43.33% share, supported by high civilian firearm ownership, significant defense spending, and strong procurement from law enforcement and homeland security agencies. By type, handguns accounted for the largest share, driven by rising demand for personal protection, sports shooting, and concealed carry across the U.S., Canada, and Germany. The United States led globally, with over 400 million privately held firearms, robust defense modernization programs, and major contracts awarded to FN America and Heckler & Koch. Canada advanced with Colt Canada’s C20 rifle contract for the Department of National Defence, while Germany, home to Heckler & Koch, strengthened its position through NATO-aligned investments. France benefited from the contributions of Thales and Beretta in defense programs and exports, whereas India boosted domestic manufacturing and exports through procurement of 7.62mm rifles and joint ventures like PLR Systems. In China, more than 49 million civilian-owned firearms and state-backed modernization efforts bolstered growth, while Russia, led by Kalashnikov Group, continued exports to Africa, Asia, and Latin America despite sanctions.

Information Source:

https://www.fortunebusinessinsights.com/small-arms-market-103173

List of companies profiled in the report:

- American Outdoor Brands Corporation (The U.S.)

- Fabbrica d'Armi Pietro Beretta S.p.A. (Italy)

- FN HERSTAL (Belgium)

- General Dynamics Corporation (The U.S.)

- Heckler & Koch GmbH (Germany)

- Lockheed Martin Corporation (The U.S.)

- Northrop Grumman Corporation (The U.S.)

- Sturm, Ruger & Co., Inc. (The U.S.)

- Taurus International Manufacturing, Inc. (Brazil)

- Thales Group (France)

Increasing Number of Company Mergers will Bode Well for Market Growth

The report encompasses several factors that have contributed to the growth of the overall market in recent years. Among all factors, the increasing number of company mergers and acquisitions has made the highest impact on market growth. Due to constant demand for small arms, companies are tying-up with manufacturers for supply of these products for a long duration. In January 2019, the United States Army announced that it has signed a contract with Sig Sauer for long-term supply and development of the company’s popular P320 handgun. The contract is said to worth USD 580 million and will last for 8 years. This will be a significant step in the progress and expansion of the company. The collaboration

with US Army will also make it more popular in the global market. Sig Sauer’s collaboration with the United States Army will not just help the company grow, but will play a huge part in the growth of the overall small arms market in the foreseeable future.

North America Holds the Highest Market Share; High Defense Budget is a Primary Factor Behind Market Growth

The report analyses the latest market trends across five major regions, including North America, Rest of the Word, Europe, Asia Pacific, and the Middle East and Africa. Among all regions, the market in North America is expected to emerge dominant in the coming years. The high defense budgets in countries such as the United States has not just led to a wider product adoption, but has also yielded technologically advanced products. The increasing terror attacks and tense cross-border relations have also contributed to the growth of the small arms market in this region. As of 2019, the market in North America was worth USD 1.56 billion and this value is projected to increase at a considerable pace in the coming years.

Industry Developments:

- November 2023 – Belgium approved a long-term strategic partnership between Belgian Defence and FN Herstal to ensure small-caliber ammunition supply and maintain the army’s small arms fleet for 20 years. The initiative, part of EU and NATO strategic autonomy goals, is also open to other European nations.

- May 2023 – Israel Weapon Industries (IWI) signed a technology transfer agreement with FAME to set up an ARAD assault rifle production line in Peru, covering assembly, quality assurance, and maintenance, with potential expansion to other weapons and optical sights.

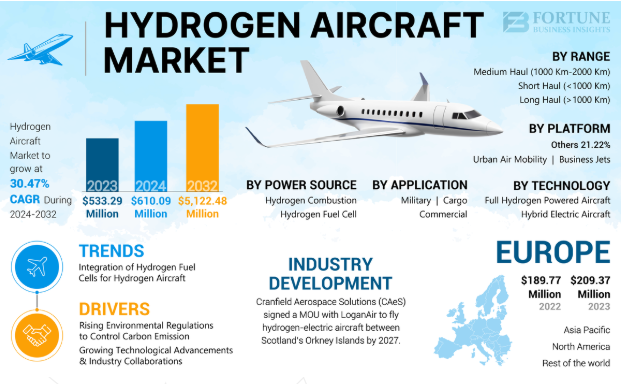

Hydrogen Aircraft Market Size, Top Key Players and Competitive Landscape 2024-2032

By Miyasingh, 2025-08-29

The global hydrogen aircraft market size was valued at USD 533.29 million in 2023 and is expected to expand from USD 610.09 million in 2024 to USD 5,122.48 million by 2032, registering a remarkable CAGR of 30.47% during the forecast period. In 2023, Europe led the market with a 39.26% share, driven by strong government support, R&D investments, and initiatives to accelerate sustainable aviation technologies.

At the country level, France stands out with Airbus spearheading hydrogen aircraft development under the ZEROe program and EU-backed sustainability projects. Germany benefits from robust public-private partnerships and institutional research support from DLR, whereas the UK is advancing hydrogen propulsion and storage through investments from GKN Aerospace and Rolls-Royce. In the United States, initiatives from NASA and the FAA, coupled with efforts by Boeing and ZeroAvia, accelerate hydrogen’s commercial adoption. Meanwhile, Japan fosters hydrogen integration through JAXA-led projects and private sector investment, China channels significant funding into hydrogen infrastructure to support aviation adoption, and the UAE positions itself as an emerging hub through hydrogen-focused diversification strategies.

Major Players Profiled in the Hydrogen Aircraft Market:

- Rolls Royce (U.K.)

- Safran SA (France)

- PIPISTREL (Slovenia)

- Hydrogen Energy Systems LLC (U.S.)

- GKN Aerospace (U.K.)

- Airbus (Netherlands)

- Boeing (U.S.)

- Urban Aeronautics Ltd. (Israel)

- Embraer (Brazil)

- Honeywell International Inc. (U.S.)

- Bell Textron Inc. (U.S.)

- ZeroAvia, Inc. (U.S.)

Get a Free Sample Research PDF:

https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/hydrogen-aircraft-market-108161

Segmentation:

- By platform, the hydrogen aircraft market is classified into air taxis, business jets, unmanned aerial vehicles, and others.

- On the basis of power source, the market is divided into hydrogen combustion and hydrogen fuel cell.

- Based on the passenger capacity, the market is segregated into less than 100, 100-200, and above 200.

- By range, the market is segregated into short haul (less than 1000km), medium haul (1000km - 2000km), and long haul (above 2000km).

- From the regional ground, the market is segmented into North America, Europe, Asia Pacific, and Rest of the World.

Report Coverage

The comprehensive hydrogen aircraft market research report delves into crucial elements, including the competitive landscape, material, product type, and application. The document provides valuable insights into prevailing market trends and significant industry advancements. It also encompasses a wide range of variables that have contributed to the recent expansion of the market. With a thorough examination of these factors, the report offers a holistic view of the market's current state and future potential.

Drivers & Restraints: Hydrogen Aircraft Market

Governments Globally Are Implementing Policies for the Promotion Of Sustainable Solutions To Offer Market Development Scope

Governments globally are implementing policies for the promotion of sustainable solutions in the aviation which is driving the hydrogen aircraft market growth. Hydrogen is considered to be one of the alternatives to the traditional fossil fuels in the aviation industry. Incentives, subsidies, and tax benefits for the development and employment of hydrogen aircrafts. These aircrafts provide sustainable solutions as they produce zero emissions at the time of operations, resulting in clean air.

One of the major restraints in the hydrogen aircraft market growth is issues with long-haul flights which require new designs of aircrafts. Integration of hydrogen fuel cell can get challenging and it gets heater repeatedly which requires cooling effect leading to more weight on the aircraft.

Information Source:

https://www.fortunebusinessinsights.com/hydrogen-aircraft-market-108161

Regional Insights

North America Leads the Market Share Due Presence Of Key Market Players

North America holds the largest part in global hydrogen aircraft market share as the region owing to high rate of innovation and technological advancements. Presence of key market players in the market for the production is also one of the reasons for the market growth.

Competitive Landscape

Various Business Initiatives Adopted By The Key Market Players To Drive Market Competition

The hydrogen aircraft market size has various key market players engaging into partnerships, collaborations, and getting certification for their new products. These strategies are set to enhance the market positions of the key market players.

Key Industry Development

- March 2023: Worcester Polytechnic Institute (WPI) and Honeywell Aerospace partnered for the examination of hydrogen cells which can help in the powering of new generation of aircrafts.

The global aircraft gearbox market size was valued at USD 3,381.5 million in 2024 and is anticipated to expand from USD 3,653.7 million in 2025 to USD 6,094.1 million by 2032, registering a CAGR of 7.58% during the forecast period. In 2024, North America led the market, accounting for 45.71% of the global share.

North America led the market with a 45.71% share in 2024, supported by the presence of major OEMs such as Boeing, GE, and Pratt & Whitney, along with strong defense spending and R&D investments. By component, the gear segment dominated due to its essential role in power transmission, torque control, and engine efficiency, while by platform, commercial aviation held the largest share, fueled by rising passenger traffic and global fleet expansion. In terms of gearbox type, accessory gearboxes led the market on account of increasing fleet size and demand for auxiliary system support, whereas OEMs accounted for the highest end-user share due to advanced technology integration and long-term supply chain partnerships with aircraft manufacturers. Regionally, the United States market is driven by military modernization and a large commercial fleet, with the Department of the Air Force requesting USD 217.5 billion for FY2025, including USD 66.7 billion for procurement and R&D. Canada benefits from a strong MRO ecosystem and suppliers like Safran and Liebherr, while Germany advances through aerospace investments and gearbox innovation led by Liebherr-Aerospace. The UK, with Rolls-Royce, continues to develop high-performance gearboxes, whereas France’s Safran focuses on lightweight, efficient designs for geared turbofans. In Asia, China and India drive growth with rapid fleet expansion, indigenous programs such as COMAC C919 and HAL Tejas, and growing MRO demand. The Middle East market expands with aircraft deliveries, airport development, and rising MRO needs in the UAE and Saudi Arabia, while Brazil and Mexico see steady growth through civil aviation recovery and MRO investments across Latin America.

Information Source:

https://www.fortunebusinessinsights.com/aircraft-gearbox-market-105541

List of Key Players Mentioned in the Report:

- Safran (France)

- Liebherr (Switzerland)

- United Technologies Corporation (UTC) (U.S.)

- Rexnord Aerospace (U.S.)

- Triumph Group (U.S.)

- Aero Gear (U.S.)

- CEF Industries Inc. (U.S.)

- The Timken Company (U.S.)

- AAR Corp (U.S.)

- Rolls-Royce plc (U.K.)

- Regal Rexnord (U.S.)

Segmentation:

Gear Segment Dominated Owing to its Crucial Role in Power Transmission and Engine Optimization

By component, the market is segmented into gear, housing, bearing, and others. The gear segment dominated the market in 2024 due to its essential function in transmitting power from the engine to various aircraft systems. Lightweight, high-precision gears support improved fuel efficiency and engine performance.

The housing segment is also anticipated to witness notable growth, driven by advances in lightweight materials that contribute to overall aircraft weight reduction and increased component durability.

Commercial Segment Led the Market Amid Rising Air Travel Demand

Based on platform, the market is segmented into commercial, civil, and military. The commercial segment held the dominant share in 2024, fueled by increasing airline fleet sizes and global passenger traffic. With 850 million passengers in the U.S. alone in 2023, demand for commercial aircraft—and their gearboxes—continues to rise.

Meanwhile, the military segment is expected to grow significantly, as heightened geopolitical tensions spur defense modernization efforts and procurement of advanced aircraft with robust gearbox requirements.

Accessory Gearbox Segment Dominated Due to Fleet Expansion

By gearbox type, the market is categorized into accessory gearboxes, reduction gearboxes, actuation gearboxes, tail rotor gearboxes, APU gearboxes, and others. The accessory gearbox segment led the market in 2024 due to expanding airline fleets and growing demand for more efficient aircraft systems.

The reduction gearbox segment is expected to grow steadily as it enables efficient engine-propeller coordination, supported by innovations in materials and designs that enhance reliability and longevity.

OEM Segment Led Market Due to Advanced Integration Capabilities

By end-user, the market is segmented into OEM, MRO, and others. The OEM segment dominated in 2024, owing to established supply chain networks and technical integration capabilities. OEMs play a vital role in incorporating new gearbox technologies into next-generation aircraft.

The MRO segment is projected to expand rapidly during the forecast period, driven by the aging global fleet and rising demand for maintenance, repair, and overhaul services.

Drivers and Restraints: Aircraft Gearbox Market

Rising Demand for Lightweight Aircraft Components to Boost Market Growth

With airlines and aircraft manufacturers focusing on efficiency, the demand for lightweight components, including gearboxes, is increasing. Lighter components not only enhance fuel efficiency but also improve performance, reduce emissions, and extend component lifespan. Manufacturers are leveraging advanced materials and design techniques to create high-performance, lightweight gear systems.

Stringent Regulations Pose Challenges to Market Expansion

However, the aircraft gearbox market faces challenges from stringent aerospace regulations. The high costs associated with design, development, and certification of gearboxes can hinder new entrants and slow innovation. Regulatory compliance and safety testing add to the complexity and cost of market participation, acting as a restraint on growth.

Regional Insights:

North America to Maintain Dominance Owing to Aerospace Leadership and Military Investment

North America led the global aircraft gearbox market in 2024, with a market value of USD 1,545.82 million. The region benefits from the presence of key players such as Boeing and GE, as well as strong R&D capabilities and government defense programs. The U.S. Department of the Air Force’s FY2025 budget of USD 217.5 billion—featuring USD 29 billion for procurement and USD 37.7 billion for R&D—underscores the scale of investment supporting the gearbox market.

Europe Benefiting from Technological Advancements and Green Aviation Initiatives

Europe holds a significant market share, supported by investments from leading aerospace firms focused on reducing emissions and improving aircraft efficiency. Collaborations between governments and industry players have been key to driving innovation in the region.

Asia Pacific Set to Grow at Fastest Pace Due to Civil Aviation Boom

The Asia Pacific region is projected to witness the highest CAGR due to increasing demand for civil aviation and regional fleet expansions in countries like China and India. Infrastructure development and rising disposable incomes are contributing to a flourishing aviation market and growing demand for reliable gearboxes.

Other Regions See Gradual Growth

The Middle East & Africa are experiencing modest growth through fleet expansion and investments in aviation infrastructure. Latin America, led by Brazil and Mexico, is seeing steady market recovery through a focus on MRO capabilities and aviation development.

Competitive Landscape:

Key Players Focus on Innovation, Contracts, and Partnerships to Strengthen Market Position

The aircraft gearbox market is competitive, with leading players investing heavily in R&D and strategic partnerships to meet evolving industry needs. Companies are also expanding product lines and entering long-term agreements to maintain market leadership.

Key Industry Developments:

- February 2025 – Bell Boeing received a USD 46 million contract for the integration and supply of V-22 Gearbox Vibration Monitoring/Osprey Drive System Safety and Health Information (ODSSHI) kits.

- August 2023 – Leonardo announced partnerships to support its AW09 helicopter at Heli-Expo 2023.

Sustainable Aviation Fuel Market Size, Growth Drivers and Opportunities 2025–2032

By Miyasingh, 2025-08-28

The global sustainable aviation fuel market size was valued at USD 1,845.2 million in 2024 and is projected to expand from USD 2,723.8 million in 2025 to USD 28,636.36 million by 2032, registering an impressive CAGR of 39.9% during the forecast period. North America led the market in 2024 with a 46% share, driven by strong policy support, airline commitments to net-zero targets, and significant investments in SAF production capacity.

Key Players:

- Neste (Finland)

- World Energy (U.S.)

- Gevo, Inc. (U.S.)

- Alder Fuels (U.S.)

- SkyNRG (Netherlands)

- Air BP (U.K.)

- Shell Aviation (Netherlands)

- TotalEnergies (France)

- Vitol Aviation (Switzerland)

- LanzaTech (U.S.)

- Fulcrum Bioenergy (U.S.)

Information Source:

https://www.fortunebusinessinsights.com/sustainable-aviation-fuel-saf-market-111563

Segmentation: Sustainable Aviation Fuel Market

The sustainable aviation fuel market is segmented by type, technology, blending capacity, end use, application, and region. By type, the market is classified into biofuel and synthetic fuel. Based on technology, it includes HEFA-SPK (Hydroprocessed Esters and Fatty Acids Synthetic Paraffinic Kerosene), FT-SPK (Fischer-Tropsch Synthetic Paraffinic Kerosene), ATJ-SPK (Alcohol-to-Jet Synthetic Paraffinic Kerosene), and others. By blending capacity, the market is divided into 5–30%, 30–50%, and above 50%. In terms of end use, SAF is applied in commercial aviation, military aviation, and others, while by application it is used in fixed-wing and rotary-wing aircraft. Regionally, the market is segmented into North America (U.S. and Canada), Europe (UK, Germany, France, Russia, and Rest of Europe), Asia Pacific (China, Japan, India, South Korea, and Rest of Asia Pacific), and Rest of the World, which further includes Latin America and the Middle East & Africa.

Global Sustainable Aviation Fuel Market Key Takeaways:

- Market Size & Forecast

The global sustainable aviation fuel (SAF) market was valued at USD 1,845.2 million in 2024 and is projected to grow from USD 2,723.8 million in 2025 to USD 28,636.36 million by 2032 , at a robust CAGR of 9% during 2025–2032. - Market Share

In 2024, North America dominated the market with a 46% share , supported by strong policy frameworks, tax incentives, and initiatives such as the U.S. SAF Grand Challenge. By type, biofuel led the market due to its compatibility with current aircraft engines and fueling infrastructure. By technology, HEFA-SPK remained the leading pathway thanks to its maturity and flexibility in feedstock usage. By blending capacity, the 30–50% blend segment led in 2024 as airlines moved toward higher SAF utilization to meet sustainability targets. By end use, commercial aviation accounted for the largest share , driven by airline commitments to net-zero emissions. By application, fixed-wing aircraft dominated , supported by OEM adoption initiatives and favorable government subsidies. - Key Country Highlights

United States: Expansion supported by tax credits, ethanol-based SAF subsidies, and the SAF Grand Challenge targeting 3 billion gallons annually by 2030.

Canada: Air Canada signed a 60,000-ton SAF supply deal with Neste in 2024 to meet its 1% SAF blending goal by 2025.

United Kingdom: Announced a 2% SAF blending mandate from 2025 under its decarbonization roadmap.

Germany: Deutsche Aircraft successfully tested a 100% Fischer-Tropsch synthetic fuel flight , advancing certification efforts.

France: TotalEnergies secured a 5 million ton SAF supply agreement with Air France-KLM through 2035.

China: Completed its first 40% SAF blend helicopter flight in 2023 , underscoring Asia’s growing adoption.

Brazil: Enacted the “Fuel of the Future” law in 2024 to promote SAF use and strengthen its role in aviation decarbonization.

South Africa: IATA identified potential production capacity of 3.2–4.5 billion liters annually from biomass and sugarcane residues.

Report Coverage:

The report has conducted a detailed study of the market and highlighted several critical areas, such as leading types, technologies, applications, and prominent market players. It has also focused on the latest market trends and the key industry developments. Apart from the aforementioned factors, the report has given information on many other factors that have helped the market grow.

Drivers and Restraints:

Increasing Demand for Alternative Fuels to Boost Product Adoption

Industries across the world, including aviation, are becoming aware of the harmful effects of using fossil fuels on the environment, such as global warming and climate change. This factor has prompted them to take various measures to reduce their greenhouse gas emissions and make their business operations eco-friendlier. This is expected to fuel the adoption of Sustainable Aviation Fuel (SAF) in the aviation sector as this fuel has the potential to decrease emissions by nearly 80%, depending on the production technique and type of feedstock used. This can make the aviation industry more sustainable in its operations.

However, high cost and limited availability of feedstock can hinder the Sustainable Aviation Fuel (SAF) market growth.

Regional Insights:

North America Dominated Global Market Owing to Implementation of Strict Environmental Regulations

North America held the biggest sustainable aviation fuel market share in 2024 and might retain its dominance during the forecast period as well as governments across the region have imposed several stringent environmental regulations to reduce their carbon emissions. They have also formulated various policies to support the adoption of cleaner fuels in various industries.

Europe is also increasing its reliance on Sustainable Aviation Fuel (SAF) owing to the strict regulations imposed by the governments to decrease the carbon emissions of its industries, including aviation.

Competitive Landscape:

Market Players to Focus On Launch of Innovative Fuels to Cater to Wider Audience

Some of the top companies driving the global Sustainable Aviation Fuel (SAF) market growth are focusing on developing and launching a wide range of eco-friendly fuels for different industries. They are increasing their investments in research & development programs to find out about the latest technologies and use them to manufacture SAF.

Notable Industry Development:

September 2024- TotalEnergies signed an agreement with Air France-KLM to help the former deliver around 1.5 million tons of Sustainable Aviation Fuel (SAF) over a period of 10 years until 2035. This deal was one of the biggest SAF purchase agreements for Air France-KLM to date. It strengthened the airline’s dominance in the use of SAF, accounting for 17% and 16% of the global SAF production in 2022 and 2023, respectively.

The global on-orbit services market was valued at USD 2,332.6 million in 2023 and is expected to grow from USD 2,547.2 million in 2024 to USD 5,897.6 million by 2032, registering a CAGR of 11.1% during the forecast period.

North America led the market in 2023 with a 45.95% share, supported by the presence of major commercial players, advanced servicing infrastructure, and strong government backing. By service type, the life extension segment accounted for the largest share in 2023, driven by rising demand for cost-effective satellite mission prolongation. Country-wise, the United States dominates with leading companies like Northrop Grumman and Orbit Fab supported by government and defense contracts, while China is advancing rapidly in satellite servicing technology with both commercial and military ambitions. Russia continues investment in satellite servicing despite sanctions, focused on defense and national security. India is expanding capabilities through ISRO’s initiatives and private sector participation, while Japan invests heavily in debris removal and refueling technologies. In Europe, France is driving collaborations under ESA to enhance life extension and de-orbiting systems, and the UK strengthens its position through investments in startups such as Astroscale for debris mitigation and satellite repair.

On-Orbit Services Market Key Players

Several companies are actively shaping the on-orbit services landscape. Leading organizations include:

- Airbus S.A.S (Netherlands)

- Thales Alenia Space (France)

- Lockheed Martin Corporation (U.S.)

- Orbit Fab (U.S.)

- Astroscale (Japan)

- ClearSpace SA (Switzerland)

- Obruta Space Solutions Corp. (Canada)

- D-Orbit SpA (Italy)

- Maxar Technologies (U.S.)

- Eta Space (U.S.)

Information Source:

https://www.fortunebusinessinsights.com/on-orbit-services-market-108399

Market Segmentation

The on-orbit services market is segmented by end-user, orbit, satellite type, service, and solution. Among end-users, the military & government segment is growing rapidly due to investments from agencies like NASA and ESA, while the commercial & civil segment dominated in 2023. By orbit, Low Earth Orbit (LEO) held the largest share owing to increased small satellite deployments, whereas Geostationary Orbit (GEO) is expected to grow at the fastest pace as aging satellites require servicing. In terms of satellite type, Earth observation satellites led the market, while the space science segment is projected to grow fastest due to the critical nature of scientific missions. By service, refueling dominated and is anticipated to continue its strong growth, supported by cost-saving benefits and extended satellite lifespan. Lastly, robotic teleoperated solutions led in 2023 due to precision handling, while robotic autonomous systems are set to expand quickly with advancements in AI and visual perception technologies.

Regional Insights

North America

North America led the on-orbit services market in 2023, holding a dominant market share of 45.95%. The presence of major space companies, robust government funding, and increasing private sector participation have propelled growth in this region.

Europe

Europe is witnessing steady growth due to advancements in satellite servicing technologies and collaborations between government agencies and private firms.

Asia-Pacific

Countries like Japan and China are investing heavily in space missions, driving demand for on-orbit services in this region.

Rest of the World

Other regions, including the Middle East and Africa, are slowly entering the market, focusing on satellite-based communication and Earth observation initiatives.

Industry Developments:

December 2024 – Thales Alenia Space, a joint venture between Thales and Leonardo, signed a first-phase contract valued at €25 million (USD 26.09 million) with the European Space Agency (ESA) to develop and demonstrate a complete cargo delivery service to and from space stations in low-Earth orbit (LEO) by 2028. The company will co-lead the development of this innovative LEO Cargo Return Service, marking a key step toward commercial space logistics.

December 2023 – Rogue Space Systems Corporation, a provider of space situational awareness and satellite servicing solutions, announced its upcoming mission to locate and communicate with a customer’s satellite following its deployment from SpaceX's Transporter-9 mission. The operation will involve establishing contact and initiating in-orbit servicing tasks, supporting the customer’s satellite functionality and mission objectives.

Future Outlook

The on-orbit services market is poised for rapid expansion due to technological innovations, increasing satellite deployments, and the growing need for sustainable space operations. Companies are focusing on automation, AI-powered diagnostics, and in-orbit manufacturing to revolutionize the industry. As demand for satellite servicing rises, the sector is expected to witness increased investments, partnerships, and policy developments, shaping the future of space sustainability.

The global small satellite market size was valued at USD 11.41 billion in 2024 and is expected to increase from USD 14.21 billion in 2025 to USD 19.67 billion by 2032, registering a CAGR of 4.8% during the forecast period. North America dominated the market in 2024 with a 49.17% revenue share, supported by substantial investments and the strong presence of leading industry players in the region.

North America dominated with a 49.17% share in 2024, supported by broadband initiatives, government funding, and private sector contributions from SpaceX, OneWeb, and Amazon’s Kuiper. By application, communication is expected to be the fastest-growing segment, driven by rising demand for high-speed internet in underserved areas and the rollout of large LEO constellations. The United States leads global deployment, with investments from programs like Starlink and NASA’s satellite contracts, while India is emerging as a key manufacturing and launch hub, with companies such as Azista BST ramping up production. The United Kingdom is spearheading European growth through ESA-backed initiatives like Open Cosmos, and China is expanding rapidly in communication, Earth observation, and defense applications under government-led space programs. Meanwhile, the UAE is strengthening its role with satellite investments focused on civil and defense uses in collaboration with international partners.

Leading Players Featured in the Research Report:

- Airbus S.A.S. (Netherlands)

- The Boeing Company (U.S.)

- Lockheed Martin Corporation (U.S.)

- Northrop Grumman Corporation (U.S.)

- Sierra Nevada Corporation (U.S.)

- ST Engineering (Singapore)

- Thales Group (France)

- SpaceX (U.S.)

- L3Harries Technologies (U.S.)

Information Source:

https://www.fortunebusinessinsights.com/industry-reports/small-satellite-market-101917

Segmentation:

The global small satellite market is segmented by application into communication, navigation, Earth observation, and others; by component into telemetry, tracking and command (TT&C), power systems (solar panels and battery backup), propulsion systems, command & data handling (C&DH), and others; and by type into minisatellites, microsatellites, nanosatellites, and picosatellites. Based on end-use, the market is categorized into civil, military, and commercial sectors. Regionally, the market covers North America (by component, weight, application, and end-use) with detailed analysis of the U.S. and Canada by application; Europe (by component, weight, application, and end-use) with insights on the U.K., Germany, France, Russia, and the rest of Europe by application; Asia Pacific (by component, weight, application, and end-use) including China, India, Japan, and the rest of Asia Pacific by application; and the Rest of the World (by component, weight, application, and end-use) comprising the Middle East & Africa and Latin America by application.

Report Coverage:

The report provides an analysis of the prominent trends driving the global industry landscape. It further gives an account of the key steps and initiatives undertaken by leading market participants for strengthening their industry position. Some of these steps include merger agreements, acquisitions, and the launch of new products.

Drivers and Restraints:

Rise in Market Value Owing to Surging Development of Launch Vehicles

One of the key factors propelling the small satellite market growth is the increasing development of small launch vehicles. The industry expansion is propelled by the lower cost of SLVs and shorter production time.

However, the industry expansion is likely to be hindered on account of short lifespan and the limitations of weight and size.

Regional Insights:

North America to Depict Substantial Growth Driven by Various Upcoming and Ongoing Projects

The North America small satellite market share is poised to grow at a commendable pace over the projected period. The rise is driven by an increase in the range of upcoming and ongoing projects.

The Europe market is expected to depict moderate growth throughout the study period. The surge is impelled by a range of smallsats for earth observation and military applications.

Competitive Landscape:

Leading Companies Form Joint Ventures to Secure Competitive Edge

Major small satellite industry players are formulating and implementing a range of strategic initiatives for the consolidation of their position in the market. Some of these initiatives include acquisitions, merger agreements, joint ventures, and the rollout of new products. Additional steps include an increase in research activities.

Key Industry Development:

November 2022 – The Indian Space Research Organization launched an earth observation satellite in addition to 8 nanosatellites. The purpose of these nanosatellites was technology demonstration and optical imaging.