Category: aerospace and defence

Air Charter Services Market Drivers, Restraints, Challenges and Opportunities, 2024–2032

By Rishika19, 2025-09-24

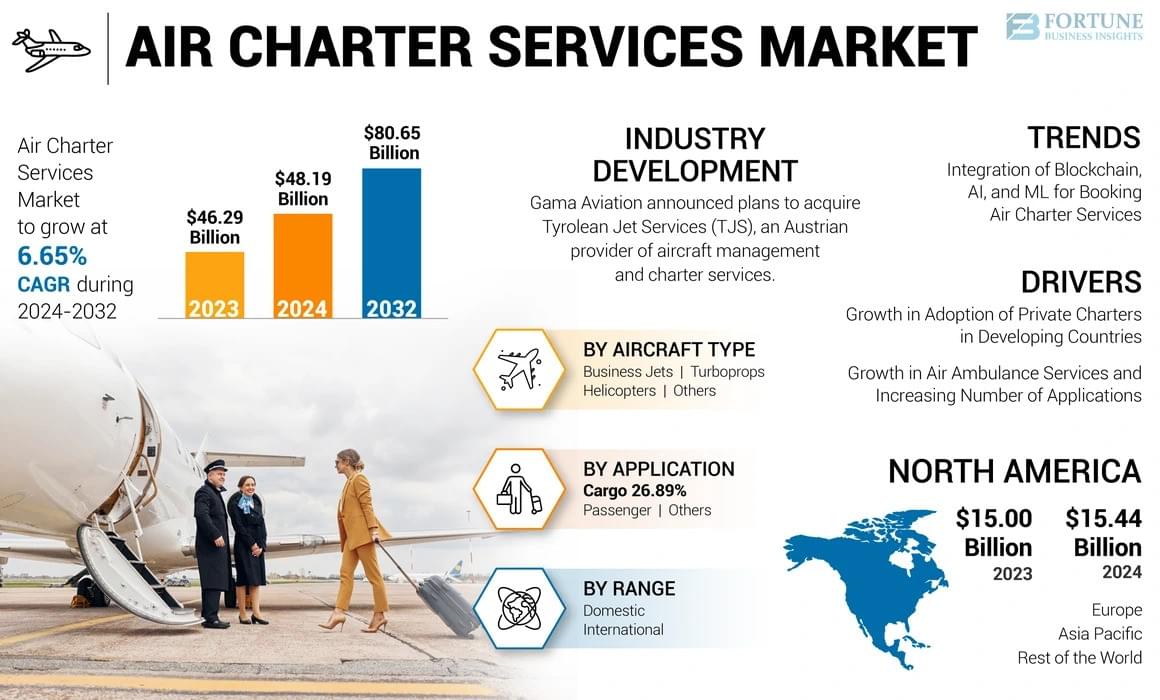

The global air charter services market is soaring, driven by growing demand for luxury travel, corporate mobility, and air ambulance operations. Valued at USD 46.29 billion in 2023, the sector is projected to expand from USD 48.19 billion in 2024 to an impressive USD 80.65 billion by 2032, at a steady CAGR of 6.65% (2025–2032).

North America continues to dominate with 33.35% market share in 2023, backed by a strong presence of major players and increasing adoption of private charters for both business and leisure travel.

Global Market Highlights

2024 Market Size : USD 48.19 billion

2025 Market Size : USD 51.39 billion

2032 Forecast Size : USD 80.65 billion

CAGR : 6.65% (2025–2032)

What’s Driving Growth?

Rise of High-Net-Worth Individuals (HNWIs): Customized, luxury travel experiences continue to fuel private charter demand.

Air Ambulances on the Rise: Growing medical emergencies and disaster relief operations are boosting demand for critical air transport.

Tech-Driven Travel: Integration of AI, ML, and blockchain in booking systems enhances efficiency, personalization, and payment security.

Corporate Mobility & Events: From site visits to destination weddings, air charters are becoming the go-to choice for convenience and speed.

Information Source:

https://www.fortunebusinessinsights.com/air-charter-service-market-108388

Market Segmentation Insights

By Aircraft Type

Business Jets: This segment holds the largest market share, driven by strong demand for MRO services, cabin refurbishments, and premium in-flight experiences. Business jets remain the preferred choice for corporate executives and high-net-worth individuals due to their speed, comfort, and flexibility.

Helicopters: Widely utilized across industries such as oil & gas, pilgrimage, and emergency rescue services, helicopters are gaining traction for their ability to operate in remote and hard-to-reach areas. Their role in medical evacuations and short-distance travel is fueling growth.

Turboprops & Others: Known for their fuel efficiency and lower operating costs, turboprops and other small aircraft are increasingly adopted for regional routes and cost-effective operations. These aircraft are particularly valuable for short-haul flights and underserved destinations.

By Application

Passenger Services: This is the leading application segment, supported by rising demand for corporate and luxury travel. Growing per capita income and the need for flexible mobility solutions have strengthened passenger charter adoption globally.

Others (Air Ambulance, Air Taxi): This segment is the fastest-growing, as governments and private operators expand medical transport and on-demand air mobility services. The rising importance of air ambulances during emergencies is a key growth driver.

Cargo: Playing a vital role in logistics, the cargo charter segment supports time-critical and specialized transport needs. From high-value goods to urgent deliveries, cargo charters provide unmatched flexibility and reliability.

Regional Outlook

North America – USD 15.44 billion market size (2023); led by U.S. private jet adoption and corporate mobility.

Europe – Driven by luxury tourism, destination weddings, and new eco-efficient aircraft designs.

Asia Pacific – Fastest growth; rising disposable income in China & India, government support for air ambulances.

Middle East & Africa – Oil & gas, remote connectivity, and luxury tourism fueling expansion.

Key Players Reshaping the Market

NetJets (U.S.)

Air Charter Service Pvt. Ltd. (U.K.)

Gama Aviation (U.K.)

Air Partner (U.K.)

Delta Private Jets (U.S.)

Flexjet LLC (U.S.)

Jet Aviation AG (Switzerland)

GlobeAir AG (Austria)

Recent Developments:

Aug 2024 : Air Charter Service opened a new Dublin office, expanding its global footprint.

Feb 2024 : NetJets announced takeover of Signature Aviation South FBO terminal to better serve fractional aircraft owners.

The global aircraft leasing market was valued at USD 172.88 billion in 2023 and is projected to grow from USD 183.23 billion in 2024 to USD 401.67 billion by 2032, exhibiting a CAGR of 11.1% during the forecast period. Europe led the market in 2023 with a 50.32% share, driven by the dominance of leasing companies in Ireland and the rising adoption of leasing models by low-cost carriers (LCCs).

Aircraft leasing offers airlines the flexibility to operate without the financial burden of purchasing aircraft. Lessors purchase aircraft and lease them to operators in return for periodic payments, providing airlines with liquidity, fleet consistency, and capacity flexibility. Leasing is typically short-term (not exceeding 10 years), after which the aircraft is returned to the lessor.

Key Market Insights

- 2023 Market Size : USD 172.88 billion

- 2024 Market Size : USD 183.23 billion

- 2032 Forecast Market Size : USD 401.67 billion

- CAGR (2024–2032) : 11.1%

- Leading Region (2023) : Europe (50.32% share)

Growth Drivers

1. Expansion of Low-Cost Carriers (LCCs)

The rapid expansion of low-cost carriers is a key driver. LCCs typically lease most of their fleets to minimize operational costs and increase route coverage. With rising domestic air travel, budget airlines are connecting regional and rural markets, significantly boosting leasing demand.

2. Rising Passenger Air Traffic

Global passenger traffic reached 6.8 billion in 2022, with approximately 400 commercial departures per hour worldwide. This surge in air travel has encouraged both new and established airlines to lease aircraft for efficient fleet management and cash flow optimization.

3. Financial Liquidity and Cash Flow Agility

Leasing enables airlines to reduce debt and maintain liquidity. The sale-and-leaseback model, where lessors purchase aircraft ordered by airlines and lease them back, has gained momentum and strengthens airline balance sheets.

Restraining Factors

- Lack of Modern Airport Infrastructure : Many developing regions face challenges in providing sufficient storage, parking, and maintenance facilities for leased aircraft.

- Regional Imbalances : Market dominance remains concentrated in Europe and North America due to favorable tax policies and established lessors, while emerging economies face expansion limitations.

Market Trends

- Fleet Modernization & Green Aviation : Leasing companies and airlines are investing in next-generation, fuel-efficient aircraft and adopting Sustainable Aviation Fuel (SAF). IATA reported SAF production of 300 million liters in 2022, triple the 2021 levels.

- Government Initiatives : Governments are supporting leasing hubs to strengthen the aviation sector. For example, India introduced IFSC tax exemptions in 2023 to encourage domestic aircraft leasing.

- Post-COVID Resilience : Lessors provided cash flow relief to airlines during the pandemic, reducing airline failures and reinforcing the role of leasing in aviation stability.

Information Source:

https://www.fortunebusinessinsights.com/aircraft-leasing-market-107476

Segmentation Analysis

By Aircraft Type Analysis

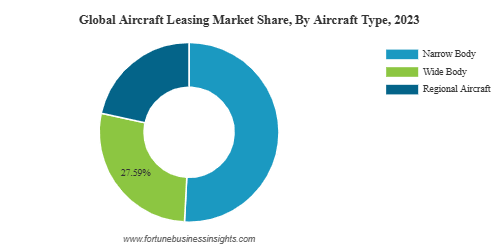

Narrow Body Segment – Market Dominance by Budget Airlines

The narrow body segment is estimated to be the largest in 2023, driven by strong demand from budget airlines and low-cost carriers (LCCs). Full-service airlines are also expanding their narrow-body fleets as next-generation aircraft can now cover longer routes. Despite pandemic impacts, airlines continue to place bulk orders, highlighting resilient demand.

Example : In February 2024, Airbus SE awarded an Indian company a manufacturing contract for its A220 narrow-body aircraft doors under the “Make in India” program, announced by India’s Civil Aviation Minister.

Wide Body Segment – Growth from International Air Traffic

The wide body segment is expected to witness significant growth due to increasing international passenger traffic. Modern wide-body aircraft can now fly over 15 hours continuously with improved fuel efficiency. Given the high cost of purchasing such aircraft, airlines prefer leasing to maintain cash flow and reduce operating costs.

Example : Lease rentals for a Boeing 777-300 ER or Boeing 777-200 LR stand at about USD 1.2 million per month, compared to a purchase price of USD 279 million. Over a 10-year lease, airlines pay nearly half the purchase cost, making leasing highly economical. The segment is expected to account for 27.59% market share in 2023.

By Lease Type Analysis

Dry Lease Segment – Substantial Growth from Cost Advantages

The dry lease segment is projected to witness substantial growth as it offers low maintenance and operational costs. In this model, the lessor provides only the aircraft, while the lessee handles crew, insurance, and maintenance, giving airlines complete cost control. Widely adopted by LCCs, dry leasing is increasingly being embraced by larger airlines as well. This growing trend has also created new job opportunities in the aviation sector.

Wet Lease Segment – Moderate Growth from Seasonal Demand

The wet lease segment is anticipated to grow moderately due to limited adoption. Here, the leasing company provides not only the aircraft but also the crew, insurance, and maintenance. Airlines opt for wet leasing during peak passenger traffic seasons when they lack resources to rapidly expand operations. Although it offers quick scalability, the lack of full operational control makes it less preferred than dry leasing.

Regional Insights

- Europe : Dominated the market in 2023 (USD 87.0 billion), supported by Ireland’s favorable tax regime and the presence of leading lessors such as AerCap and Avolon.

- North America : Moderate growth expected; Boeing Capital Corporation drives regional leasing activity.

- Asia Pacific : Fastest-growing region, led by China and India, supported by rapid aviation expansion and government-backed leasing initiatives.

- Middle East & Rest of World : Strong leasing demand from carriers like Emirates and Qatar Airways for long-haul wide-body aircraft.

Competitive Landscape

The market is moderately consolidated, with Ireland dominating global leasing activity. Key players focus on fleet expansion, strategic acquisitions, and next-gen aircraft procurement.

Key Companies:

- AerCap (Ireland)

- Avolon (Ireland)

- SMBC Aviation Capital (Ireland)

- BBAM (U.S.)

- Nordic Aviation Capital (Ireland)

- BOC Aviation (Singapore)

- Air Lease Corporation (U.S.)

- ICBC Leasing (China)

- DAE Capital (UAE)

- Boeing Capital Corporation (U.S.)

Key Industry Developments

- Apr 2022 – Air Lease Corp. ordered 32 additional Boeing 737 MAX aircraft to expand its portfolio.

- Jul 2022 – AerCap ordered 5 additional Boeing 787-9 Dreamliners, strengthening its wide-body fleet.

According to Fortune Business Insights™, the global military radar market was valued at USD 35.58 billion in 2023 and is projected to rise from USD 46.07 billion in 2024 to USD 211.12 billion by 2032, exhibiting a CAGR of 20.96% during the forecast period. North America led the market with a 38.28% share in 2023, with the U.S. emerging as the largest contributor, expected to reach USD 63.69 billion by 2032.

Radar systems remain a cornerstone of modern defense platforms, supporting applications such as surveillance, target tracking, air traffic monitoring, weapon guidance, and border protection. Technological advancements including AESA (Active Electronically Scanned Array), over-the-horizon radars, and AI-enabled threat detection are driving market growth.

Russia-Ukraine War Impact

The Russia-Ukraine conflict has significantly accelerated global demand for advanced radar systems. Both nations, along with regional allies, have increased defense spending to enhance situational awareness and air defense capabilities. For example, in 2023, Thales and the French Ministry of Defense delivered a Ground Master 200 radar to Ukraine, strengthening short-range air defense.

This geopolitical crisis has pushed NATO and European states to fast-track procurement of 3D radars, integrated air defense solutions, and joint radar modernization programs.

Key Market Insights

2023 Market Size: USD 35.58 billion

2024 Market Size: USD 46.07 billion

2032 Forecast: USD 211.12 billion

CAGR (2024–2032): 20.96%

Regional Leader: North America with 38.28% market share in 2023

Market Dynamics

Growth Drivers

Rising Defense Expenditure Globally – Nations such as the U.S., China, and India are prioritizing radar system procurement to strengthen national security.

Next-Generation Radar Technologies – Development of over-the-horizon radars, phased array radars, and long-range detection systems is boosting adoption.

Modernization of Existing Platforms – Military programs worldwide are upgrading naval, airborne, and land-based radar capabilities to counter evolving threats.

Restraining Factors

Stealth Technology Advancements : Aircraft like the U.S. B-21 Raider and radar-absorbing materials reduce detection capability.

Radar Jamming and Electronic Warfare : Systems like Hensoldt’s Kalaetron Attack disrupt enemy radar efficiency, posing challenges to radar operators.

Information Source:

https://www.fortunebusinessinsights.com/industry-reports/military-radar-market-101777

Segmentation Analysis

By Component

Antenna dominated in 2023 and is projected to be the fastest-growing segment, driven by demand for accurate detection.

Transmitter expected to expand steadily due to its role in extending radar lifespan and efficiency.

By Frequency

UHF/VHF segment to grow fastest owing to adoption in ground-based surveillance.

S-Band radars held the largest share in 2023 due to high accuracy in military applications.

By Range

Long-range radars projected to witness highest CAGR, supported by large-scale defense procurements (e.g., Indonesia’s 13 GM400 Alpha radars).

Short-range radars dominated in 2023 with widespread adoption in battlefield surveillance.

By Platform

Airborne radars forecasted to grow fastest due to rising demand for air defense and UAV detection.

Land radars held the largest share in 2023, with increasing adoption in territorial surveillance.

By Application

Airspace monitoring & traffic management to witness fastest growth with heavy investments in air defense networks.

Ground surveillance & intruder detection dominated in 2023 due to expanding border security operations.

Regional Insights

North America: Largest market at USD 13.62 billion in 2023, supported by U.S. defense budgets and procurement of advanced radars like AN/SPY-6.

Asia Pacific: Fastest-growing region with major investments from China, India, and South Korea in naval and airborne radar programs.

Europe: Rising demand driven by NATO-led radar modernization and the Russia-Ukraine war.

Rest of the World: Growth fueled by defense investments in Latin America and the Middle East for surveillance and missile defense.

Competitive Landscape

The market is moderately consolidated with global leaders investing in R&D, acquisitions, and collaborations. Players are expanding portfolios with next-generation radar technologies to enhance long-range detection, counter-UAS capabilities, and integrated defense solutions.

Key Companies:

Raytheon Technologies Corporation (U.S.)

Lockheed Martin Corporation (U.S.)

Northrop Grumman Corporation (U.S.)

BAE Systems plc (U.K.)

Thales Group (France)

Saab AB (Sweden)

Israel Aerospace Industries Ltd. (Israel)

Hensoldt AG (Germany)

Leonardo S.p.A (Italy)

Hanwha Systems Co. Ltd. (South Korea)

L3Harris Technologies, Inc. (U.S.)

Honeywell International Inc. (U.S.)

Recent Industry Developments

July 2023 – BAE Systems & Leonardo awarded a USD 958.9 million contract to upgrade RAF Typhoon fighter jet radars with ECRS Mk2.

May 2023 – Lockheed Martin received a USD 2.3 billion contract to enhance PATRIOT radar systems.

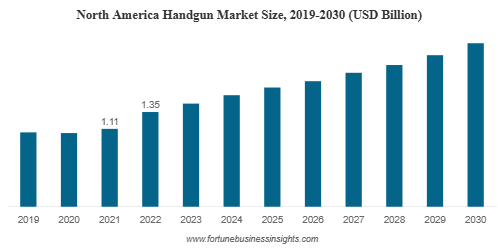

The global handgun market was valued at USD 3.12 billion in 2022 and is projected to grow from USD 3.41 billion in 2023 to USD 5.35 billion by 2030, at a CAGR of 6.6% during the forecast period. North America held the dominant share of 43.27% in 2022, supported by high civilian firearm ownership, strong defense procurement programs, and the presence of key manufacturers such as SIG SAUER, Smith & Wesson, and Glock GmbH.

Handguns, defined as compact firearms designed to be fired with one hand, are widely used for self-defense, law enforcement, sports shooting, hunting, and defense applications. The two most common types are revolvers and semi-automatic pistols, while single-shot handguns and machine pistols remain less prevalent.

Russia–Ukraine War Impact

The Russia–Ukraine war has significantly accelerated market growth, particularly in Europe, where firearm procurement and defense modernization programs have intensified. NATO members have increased firearm acquisitions for border security and combat readiness. Notably, the EU’s historic decision to procure and supply weapons to Ukraine has further boosted global demand.

According to SIPRI, the U.S. accounted for 40% of global arms exports between 2018–2022, compared with 33% during 2013–2017. Meanwhile, European arms imports surged by 47% over the same period. In May 2022, the U.S. Department of Defense awarded USD 136.8 million in contracts for weapons and equipment in support of Ukraine.

Key Market Highlights

2022 Market Size: USD 3.12 billion

2023 Market Size: USD 3.41 billion

2030 Forecast Size: USD 5.35 billion

CAGR (2023–2030): 6.6%

Regional Leader (2022): North America (43.27% share)

By type, semi-automatic pistols are expected to maintain the largest share due to their popularity in law enforcement, security, and sports.

Market Trends

Development of Polymer-based Handguns

The rise of polymer-frame handguns is one of the most notable trends. Lighter than traditional metal weapons, polymer models offer durability, corrosion resistance, and easier maneuverability. Leading examples include the Glock-19, Smith & Wesson M&P Shield, Sig Sauer P320, and HK VP9.

For instance, in January 2020, the U.S. Marine Corps awarded a USD 10 million contract to MAC LLC for lightweight polymer-based ammunition, highlighting the military’s shift toward weight-reduction technologies.

Growth Drivers

Technological Advancements in Firearms

Development of high-tech weapons such as automatic and sub-machine guns.

U.S. arms makers like Textron Systems, General Dynamics, and SIG SAUER are innovating advanced 6.8 mm firearms to replace traditional 5.56 mm NATO rifles.

Civilian Demand

Rising interest in personal protection, hunting, and sports shooting is fueling growth.

Over 1 billion firearms are owned globally, with 85% held by civilians (2017 survey).

Gun purchases surged in the U.S. during the COVID-19 pandemic due to heightened safety concerns.

Restraining Factors

Stringent Regulations: Political, legal, and economic restrictions on firearms sales and imports affect market growth.

Compliance Challenges: Companies face barriers such as export controls, anti-corruption laws, and technology transfer regulations that vary by country.

Information Source:

https://www.fortunebusinessinsights.com/handgun-market-108876

Segmentation Insights

By Type

Single-Shot Handguns (Muzzleloaders)

Revolvers

Semi-Automatic Pistols (largest and fastest-growing segment)

By Operation

Automatic (dominant segment, driven by defense procurement)

Semi-Automatic

Manual

By End-user

Defense & Homeland Security (largest share in 2022)

Self-Defense

Sports

Hunting

Law Enforcement

Regional Outlook

North America: Largest market (USD 1.35 billion in 2022) driven by defense budgets, civilian firearm ownership, and military modernization.

Europe: Second-largest market; growth accelerated by the Russia–Ukraine conflict and rising NATO procurement.

Asia Pacific: Strong growth expected from India, China, South Korea, and Australia, supported by modernization programs and cross-border tensions.

Middle East & Africa / Latin America: Moderate but rising demand due to increased defense spending and international collaborations.

For example, in July 2023, Brazil’s Taurus signed a deal with Saudi Arabia to supply military and police firearms.

Competitive Landscape

The market is moderately consolidated, with leading players focusing on innovation, partnerships, and defense contracts. Lack of stringent entry barriers is expected to encourage new domestic entrants.

Key Players:

Glock GmbH (Austria)

SIG SAUER (U.S.)

Sturm, Ruger & Co., Inc. (U.S.)

FN Herstal (Belgium)

Beretta (Italy)

Smith & Wesson (U.S.)

Ceska zbrojovka a.s. (Czech Republic)

Colt’s Manufacturing (U.S.)

Israel Weapon Industries (Israel)

Kalashnikov Group (Russia)

Key Industry Developments

Aug 2023: AWEIL (India) launched Prabal , a long-range revolver with 50m firing reach.

Oct 2022: Jindal Defense and Taurus Armas announced a joint venture to manufacture small arms in India.

Cargo Vessel Market Outlook, Trends, Growth, Share, Analysis, Insights and Opportunities, 2030

By Rishika19, 2025-09-22

According to Fortune Business Insights™, the global cargo vessel market is undergoing significant transformation as maritime trade continues to drive global commerce. According to Fortune Business Insights™, the market was valued at USD 37.07 billion in 2022 and is expected to expand from USD 49.22 billion in 2023 to USD 61.77 billion by 2030, growing at a CAGR of 3.3% during the forecast period.

Why Cargo Vessels Matter

Cargo vessels form the backbone of international trade, transporting goods, raw materials, and industrial supplies across continents. With increasing globalization, shipping remains the most cost-effective mode of transport, supporting industries such as automotive, oil & gas, food & beverages, and consumer goods.

Key Market Insights

Asia Pacific dominance : The region held a commanding 60.53% market share in 2022, led by China, Japan, and South Korea, the world’s shipbuilding giants.

Tanker vessels lead : Tankers accounted for the largest share, fueled by strong demand for oil and chemical transport.

Fuel shift underway : Diesel and gasoline remain dominant, but LNG and hybrid-powered ships are gaining traction as decarbonization becomes a top priority.

Market Trends to Watch

Green Shipping Fuels

With shipping responsible for nearly 13% of global SOx and 15% of global NOx emissions, companies are rapidly adopting LNG, methanol, hydrogen, and LPG as cleaner alternatives. Industry leaders like MOL Group are investing heavily in LNG-powered vessels as part of their 2050 zero-emissions vision.

Air Lubrication Technology

Innovative energy efficiency solutions, such as air lubrication systems, are reducing resistance between hulls and seawater. Companies like Alfa Laval, Mitsubishi Heavy Industries, and Wärtsilä are actively deploying these systems, helping shipping lines cut fuel costs and carbon emissions.

Information Source:

https://www.fortunebusinessinsights.com/cargo-vessel-market-108601

Market Segmentation

By Ship Type

Tanker : Largest share in 2022, driven by oil and chemical transport demand.

Bulk Carriers : Fastest-growing segment; used for transporting coal, grains, cement, and ore.

Container Ships, General Cargo, Roll-on/Roll-off, Others : Growing demand across industries.

By Fuel Type

Diesel & Gasoline : Largest share in 2022, driven by decarbonization initiatives.

LNG : Fastest-growing segment, supporting emission reduction and regulatory compliance.

Hybrid & Other fuels : Gradual adoption to reduce environmental impact.

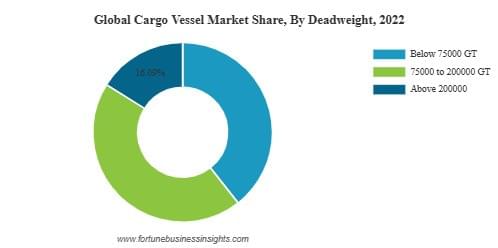

By Gross Tonnage

Below 50,000 GT : Largest segment due to widespread industrial demand.

50,000 – 120,000 GT : Fastest-growing segment for medium-scale cargo transport.

Above 120,000 GT : Niche segment with a 16.09% market share in 2022.

By Deadweight

75,000 – 200,000 DWT : Largest and fastest-growing segment; includes medium and large container ships, tankers, and bulk carriers.

Below 75,000 DWT : Second fastest-growing; includes smaller cargo vessels for niche requirements.

Above 200,000 DWT : Specialized large vessels, limited market share.

Regional Outlook

Asia Pacific : Expected to remain the largest and fastest-growing market due to high maritime trade volumes and advanced shipbuilding infrastructure.

Europe : Strong focus on fuel-efficient and eco-friendly vessels, with innovation from companies like Damen Shipyards.

North America : Growth driven by fleet modernization and U.S. government investments in maritime infrastructure.

Middle East & Africa : Steady growth as trade routes expand and global shipping demand rises.

Latin America : Increasing role in supply chain logistics, particularly for food and medical supplies.

Key Players

Prominent companies include:

Hyundai Heavy Industries Co. Ltd. (South Korea)

Samsung Heavy Industries (South Korea)

Daewoo Shipbuilding & Marine Engineering (South Korea)

China State Shipbuilding Corporation (China)

Mitsubishi Heavy Industries (Japan)

General Dynamics NASSCO (U.S.)

Damen Shipyards (Netherlands)

Industry Developments

June 2023 – Tersan Shipyard secured contracts for construction service vessels for Acta Marine.

June 2023 – Udupi Cochin Shipyard bagged a USD 72 million order for six next-generation cargo vessels for Wilson Shipowning AS.

Outlook & Opportunities

Despite cyclical challenges and cost pressures in shipbuilding, the push for decarbonization, digitalization, and green fuel adoption positions the cargo vessel market for steady long-term growth. Rising maritime trade volumes, technological upgrades, and sustainability mandates are expected to reshape the industry landscape by 2030.

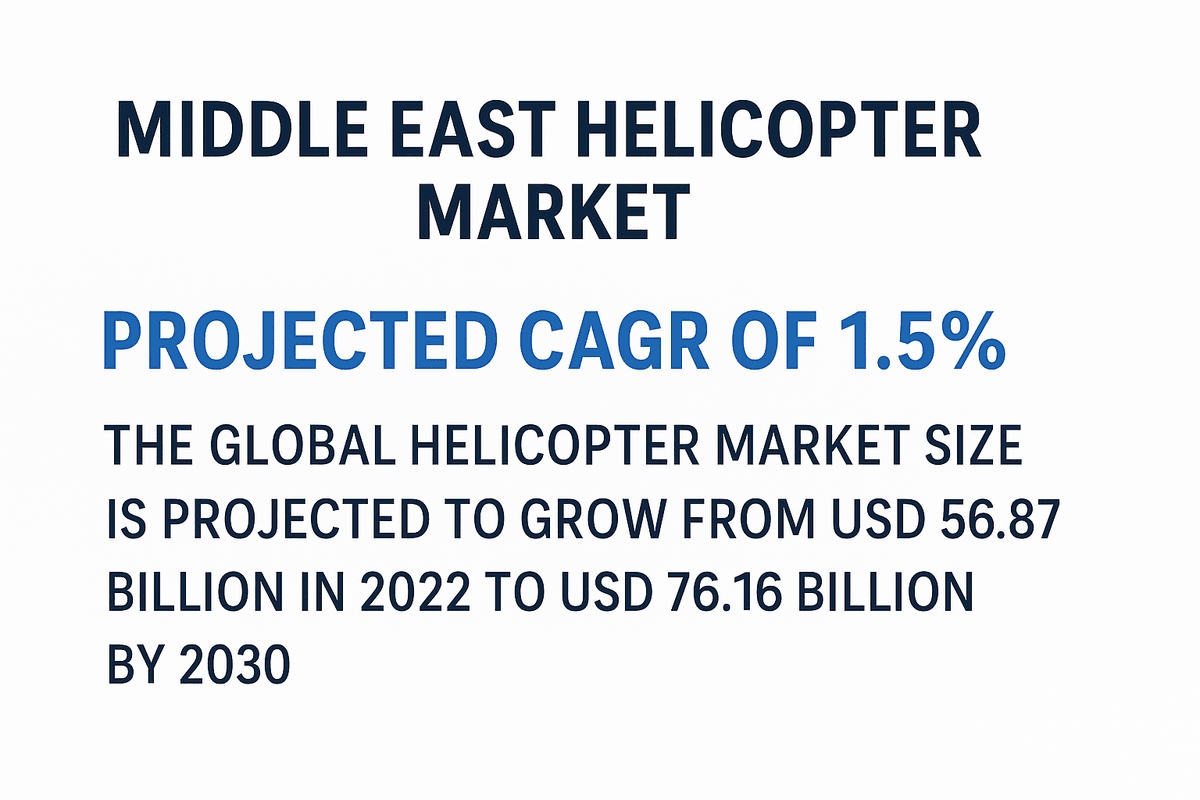

According to Fortune Business Insights™, the Middle East helicopter market is entering a steady growth phase, driven by rising demand in oil & gas, emergency medical services, defense, and tourism sectors. The global helicopter market was valued at USD 56.87 billion in 2022 and is projected to reach USD 76.16 billion by 2030, expanding at a CAGR of 1.5% during the forecast period.

Market Overview

The Middle East represents a strategic and fast-evolving market for helicopters. Regional growth is supported by expanding offshore oil & gas operations, a booming tourism sector, and rising demand for specialized applications such as VIP transport, corporate services, and search & rescue.

The market is analyzed by:

Type: Civil & Commercial, Military

Weight: Light, Medium, Heavy

Application: Emergency Medical Service, Corporate, Search & Rescue, Oil & Gas, Defense, Homeland Security, Others

Point of Sale: New, Pre-Owned

Countries Covered: Saudi Arabia, UAE, Israel, and the Rest of the Middle East

Key Market Drivers

Offshore Oil & Gas Activities:

The Middle East’s vast oil reserves make helicopters essential for transporting personnel and equipment to offshore platforms. New exploration projects are fueling fresh demand for rotorcraft in the region.

Tourism and VIP Transport:

With international arrivals recovering strongly post-pandemic, the region—especially the UAE and Saudi Arabia—is witnessing a surge in demand for VIP air travel, corporate services, and tourism-related helicopter operations.

Air Taxi and Charter Services:

The growing number of high-net-worth individuals (HNWIs) in the Middle East is boosting demand for private air mobility solutions, including charter flights and air taxis.

Market Challenges

Despite growth opportunities, political instability, terrorism, and regional conflicts remain barriers to market expansion. Ongoing unrest in countries such as Syria and Yemen has disrupted the aviation ecosystem, impacting both new sales and maintenance services.

Information Source:

https://www.fortunebusinessinsights.com/middle-east-helicopter-market-107406

Emerging Trends

Rise of Air Mobility Solutions: Increasing adoption of air taxis and charter helicopters for personalized travel experiences.

Defense Modernization Programs: Investments in advanced military helicopters to strengthen national security.

Sustainability Focus: Growing interest in fuel-efficient and hybrid-electric helicopters.

Key Players

Major companies shaping the competitive landscape include:

Airbus SE

Textron Inc.

Leonardo S.p.A.

Lockheed Martin Corporation

The Boeing Company

Rostec

Turkish Aerospace Industries

Robinson Helicopter Company

Kaman Corporation

MD Helicopters Inc.

These players are investing heavily in R&D, partnerships, and regional collaborations to strengthen their footprint in the Middle East.

Recent Industry Developments

July 2022: Falcon Aviation Services (UAE) ordered five Airbus H130 helicopters, adding to its fleet of H125 and H145 models for EMS and aerial work.

Aircraft Fairing Market Projection, Landscape, Challenges and Insights, 2028

By Rishika19, 2025-09-19

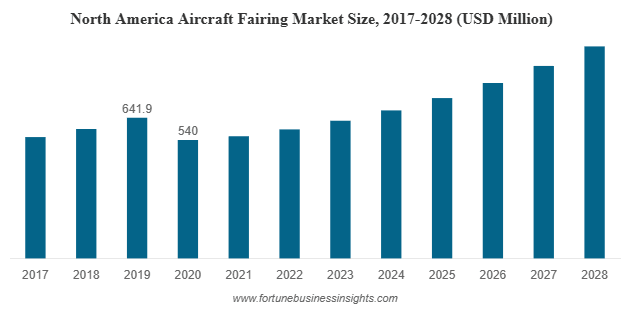

According to Fortune Business Insights™, the global aircraft fairings market was valued at USD 1.41 billion in 2020 and is expected to grow from USD 1.46 billion in 2021 to USD 2.60 billion by 2028, registering a strong CAGR of 8.59%. This growth is powered by the aviation industry’s push for lightweight, aerodynamic components that boost fuel efficiency, reduce drag, and improve performance and aesthetics.

Why Aircraft Fairings Matter

Aircraft fairings are more than just covers—they are critical aerodynamic structures that smooth out gaps and joints in an aircraft’s body. By reducing drag and delaying boundary layer separation, fairings improve fuel efficiency and overall performance, while also enhancing the aircraft’s visual appeal.

A classic example is the flap track fairing, a pod-like structure under an aircraft’s wing. While Airbus and Boeing use similar fairings, McDonnell Douglas aircraft stand out with vertical fairings housing hydraulic actuators. Fairings are typically built from aluminum or composites, with composites increasingly favored for their lightweight, high-strength properties.

As air travel demand rises and airlines modernize fleets, the need for advanced, efficient fairing systems will continue to grow.

Market Dynamics

Growth Drivers

Rising Demand for Composite Aerostructures

Modern aircraft prioritize strength-to-weight optimization, making composite aerostructures—fairings, doors, control surfaces—essential for efficiency. The growing adoption of composites is a key driver of this market.

Procurement of Lightweight Aircraft

Airlines and defense forces are increasingly acquiring fuel-efficient, lightweight aircraft. The expansion of low-cost carriers (LCCs) and the procurement of trainer and multi-role fighter jets are accelerating fairing demand.

Restraining Factor

Backlogs in Aircraft Orders

Aircraft manufacturers continue to face order backlogs and delivery delays. COVID-19 further amplified this challenge, with aircraft deliveries dropping 42% in 2020 compared to 2019. Such bottlenecks slow down the adoption of new components like fairings.

Key Trends Shaping the Market

3D Printing in Aerospace

Additive manufacturing is revolutionizing aerospace supply chains by enabling on-demand production of complex parts.

In November 2021 , Materialise partnered with Proponent to expand 3D printing in aerospace aftermarket supply chains. Proponent already supplies 54 million parts annually to 6,000 clients, and with 3D printing, the company aims to further improve aftermarket support.

From MRO services to Urban Air Mobility, 3D printing is driving the next phase of efficiency and innovation in aircraft component manufacturing.

Information Source:

https://www.fortunebusinessinsights.com/aircraft-fairings-market-105857

Segmentation Insights

By Platform

Commercial Aircraft : Largest segment in 2020, supported by global air traffic growth and fleet modernization.

Military Aircraft : Expected to grow fastest, driven by rising defense budgets and procurement of multi-role combat and transport aircraft.

Regional & General Aviation : Steady contribution from private and business jet adoption.

By Application

Fuselage : Largest segment, backed by advances in lightweight and durable structural designs.

Landing Gear : Fastest-growing, with demand for lighter yet stronger systems .

Engines, Control Surfaces, Radars & Antennas : Continue steady adoption with performance-oriented designs.

By Material

Composites : Leading segment, favored for lightweight and fuel-saving properties .

Aluminum : Gradually declining due to higher maintenance costs.

Alloys : Maintain a niche role in specialized applications.

Regional Outlook

North America : Valued at USD 540 million in 2020 , remains the leader due to OEMs like Boeing and operators like Delta, FedEx, UPS .

Europe : Moderate growth with major players including Airbus, Saab AB, Leonardo Spa .

Asia Pacific : Fastest-growing, driven by rising passenger traffic in China, India, and Japan . India’s aviation boom is a standout driver.

Middle East & Africa : Growth supported by tourism and general aviation , with Strata Manufacturing (UAE) boosting regional production.

Competitive Landscape

The aircraft fairings market is moderately consolidated, with top players focusing on lightweight, fuel-efficient designs. Companies are investing in capacity expansion, partnerships, and composite innovations.

Key Players

Airbus (France)

Boeing (U.S.)

Strata Manufacturing (UAE)

SAAB AB (Sweden)

Lockheed Martin (U.S.)

FACC AG (Austria)

Daher (France)

Avcorp (Canada)

Barnes Group (U.S.)

Royal Engineered Composites (U.S.)

Recent Developments

Dec 2021 – Airbus completed structural assembly of its first A321XLR test aircraft, including door fairings.

Feb 2021 – Boeing expanded its Tata Boeing Aerospace Limited (India) line to produce 737 MAX vertical fins.

Digital Shipyard Market Projection, Landscape, Challenges and Insights, 2028

By Rishika19, 2025-09-19

According to Fortune Business Insights™, the global digital shipyard market was valued at USD 963.6 million in 2020 and is projected to rise from USD 1,129.6 million in 2021 to USD 3,444.5 million by 2028, registering a robust CAGR of 17.27% during the forecast period. This rapid growth reflects the maritime industry’s ongoing shift toward Industry 4.0 technologies, automation, and enhanced operational efficiency across both commercial and defense shipbuilding.

What is a Digital Shipyard?

Digital shipyards represent a paradigm shift in the shipbuilding industry. Traditional processes are being replaced with IoT-enabled systems, artificial intelligence (AI), digital twins, robotics, and additive manufacturing. These advanced tools are helping shipbuilders move toward real-time decision-making, optimized life-cycle management, and improved production agility.

Key enablers such as cyber-physical systems (CPS) and robotic process automation (RPA) are streamlining manufacturing operations, reducing costs, and accelerating vessel delivery. With governments modernizing naval fleets and global trade expanding, digital shipyards are no longer an option—they’re becoming a strategic necessity.

Key Market Insights

Digital twins, IoT sensors, and 3D modeling are revolutionizing ship design, maintenance, and operations.

Leading shipbuilders are deploying predictive analytics and robotics to enhance safety and productivity.

Navantia (Spain) partnered with Siemens Digital Industries Software in 2019 to digitalize its operations, highlighting industry-wide momentum.

Market Segmentation

By Shipyard Type

Commercial Shipyards: These held the largest market share in 2020, driven by the rising demand for global seaborne trade. According to UNCTAD, nearly 80% of the world’s trade volume is transported by sea, which continues to fuel demand for digitalization in commercial shipbuilding.

Military Shipyards: This segment is growing steadily as governments worldwide adopt digital twin technologies to modernize naval programs. The integration of smart solutions helps enhance operational readiness, fleet maintenance, and long-term cost efficiency for defense vessels.

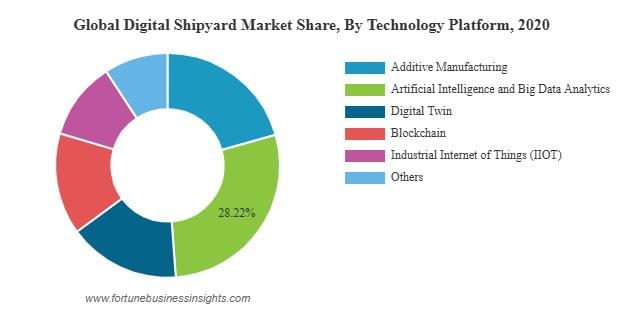

By Technology Platform

Robotic Process Automation (RPA): RPA accounted for the largest share in 2020, especially in processes such as welding, cutting, and painting. For instance, an Ulsan-based shipyard achieved USD 9.4 million in annual savings through welding automation, highlighting the cost-efficiency benefits of robotic integration.

AI & Big Data Analytics: Representing 28.22% of the market in 2020, this segment is expected to expand rapidly. The use of AI-powered systems and big data enables predictive analytics, reduces manual workloads, and improves overall decision-making in ship design and production.

Additive Manufacturing, Digital Twins, Blockchain, and IIoT: These emerging technologies are transforming shipbuilding by enhancing design accuracy, supply chain transparency, and real-time operational monitoring—making them the future of smart shipyards.

By Digitalization Level

Semi-Digital Shipyards: This segment held the largest share in 2020, as many shipbuilders have adopted partial automation and digital systems while still relying on traditional methods for certain operations.

Fully Digital Shipyards: Expected to record the fastest CAGR during the forecast period, this segment is gaining momentum with the adoption of Industrial IoT (IIoT), augmented reality (AR), and digital twin integration. Fully digital shipyards are seen as the next stage in Industry 4.0-driven maritime transformation.

Information Source:

https://www.fortunebusinessinsights.com/digital-shipyard-market-106561

Market Drivers

Industrial IoT Integration: Advanced sensors and AI analytics improve productivity, reduce downtime, and enhance safety.

Robotics in Shipbuilding: Shipyard giants like Hyundai Heavy Industries, Samsung Heavy Industries, and DSME are deploying robots across welding, assembly, and painting lines to reduce labor costs and improve precision.

Market Challenges

The biggest hurdle for digital shipyards remains high capital investment . Transitioning to advanced systems requires heavy upfront costs in hardware (sensors, navigation systems), software, and system integration. While large shipbuilders can manage these costs, SMEs face financial barriers —slowing adoption rates across the industry.

Emerging Trends

Additive Manufacturing (3D Printing): Accelerates part production, reduces downtime, and enhances flexibility in maintenance.

AI-Powered Smart Shipyards: In September 2024 , ST Engineering launched a next-gen smart shipyard in Singapore, leveraging AI, 5G, IoT, and predictive maintenance —setting new benchmarks for the industry.

Regional Insights

Asia Pacific: Market size was USD 323.3 million in 2020 , the largest globally, driven by South Korea, Japan, and China—responsible for building over 90% of global cargo ships .

Europe: Growth driven by robotics, 3D visualization, and strong investments in automation.

North America: Expansion supported by naval digitalization projects and strong R&D focus.

Middle East, Africa & South America: Moderate growth expected, led by fleet modernization programs.

Competitive Landscape

The digital shipyard market is highly competitive , with companies focusing on automation, collaborations, and cloud-based solutions .

Key Players Include:

IFS AB (Sweden)

Pemamek Oy (Finland)

Dassault Systèmes (France)

BAE Systems (U.K.)

Altair Engineering (U.S.)

AVEVA Group Plc. (U.K.)

Wärtsilä (Finland)

KUKA AG (Germany)

Damen Shipyards Group (Netherlands)

Prostep AG (Germany)

Recent Developments:

June 2021: Drydocks World partnered with IFS Cloud for asset management and digital transformation.

February 2021: Damen Shipyard Group collaborated with Sea Machines Robotics to test collision avoidance AI on ships.

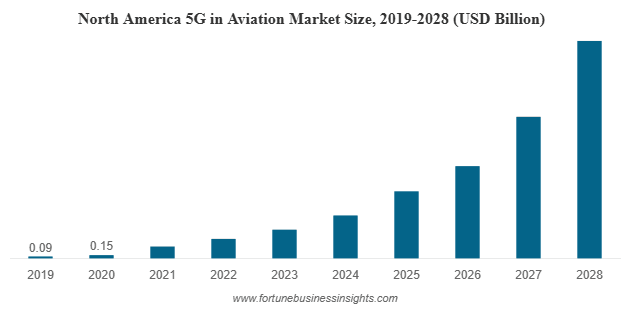

According to Fortune Business Insights™, the global 5G in aviation market was valued at USD 0.35 billion in 2020 and is projected to expand from USD 0.54 billion in 2021 to USD 9.92 billion by 2028, registering a remarkable CAGR of 47.03% during the forecast period. This explosive growth reflects the aviation industry’s increasing reliance on next-generation wireless connectivity.

5G represents more than just faster internet—it is a core enabler of digital aviation, powering real-time communication, advanced passenger services, and smart airport operations. By replacing legacy 4G LTE systems, 5G brings the aviation sector closer to a future defined by IoT, Augmented Reality (AR), Virtual Reality (VR), and seamless connectivity.

Why 5G Matters in Aviation

The aviation ecosystem is evolving rapidly, and 5G is at the center of this transformation:

Ultra-fast passenger connectivity: Travelers benefit from real-time streaming, smooth video calls, and uninterrupted internet access both at airports and onboard aircraft.

Smarter airports: From automated check-ins to baggage tracking, 5G enhances efficiency across operations.

Next-generation air traffic management: 5G supports NextGen systems, enabling safer and more reliable communication between aircraft and ground stations.

Digital aviation growth: AR/VR for pilot training, IoT-enabled aircraft monitoring, and predictive maintenance are now becoming a reality.

The Future of 5G in Aviation

The aviation industry is steadily moving toward connected, digital-first operations . From passenger comfort to safer skies, 5G is reshaping how airports, airlines, and aircraft operate. Despite infrastructure and regulatory challenges, the long-term outlook remains highly positive, with 5G becoming a cornerstone of next-generation aviation .

Key Market Drivers

Rising Demand for High-Speed Connectivity

Airlines and airports are under pressure to meet growing passenger expectations for reliable, high-speed internet. 5G’s low latency and high throughput make this possible.

Integration of IoT, AR/VR, and Smart Operations

From real-time aircraft health monitoring to advanced ground operations, 5G-enabled systems are streamlining aviation processes.

Modernization of Air Traffic Control

As global skies become more crowded, 5G ensures better coordination, secure communication, and enhanced aircraft safety.

Challenges to Growth

Despite its promise, the rollout of 5G in aviation faces certain barriers:

High Infrastructure Costs: Building small cells, RAN systems, and upgrading base stations requires massive investments.

Spectrum Allocation Issues: Regulatory hurdles often delay deployment.

Dependence on 4G Systems: Non-standalone 5G networks still rely on 4G, limiting the full benefits of 5G.

Information Source:

https://www.fortunebusinessinsights.com/industry-reports/5g-in-aviation-market-101778

Market Segmentation Highlights

By Platform:

5G Airports lead the market, driven by demand for high-speed connectivity and smart passenger services.

5G Aircraft is the fastest-growing segment, with applications in in-flight entertainment, connected cockpits, and drones.

By Technology:

Enhanced Mobile Broadband (eMBB) dominates due to its role in delivering high-speed internet.

URLLC (Ultra-Reliable Low Latency Communication) is set to grow fastest, supporting autonomous navigation and mission-critical systems.

mMTC (Massive Machine-Type Communication) drives IoT adoption for real-time tracking and monitoring.

By Communication Infrastructure:

Small Cells lead due to their efficiency in delivering seamless coverage inside terminals and cabins.

RAN and DAS support robust signal distribution across wide areas.

By Services:

Airport Operations grow fastest, enabling smart baggage handling, security, and passenger management.

Aircraft Operations leverage predictive maintenance, flight data exchange, and in-flight connectivity.

Regional Insights

North America dominates the market with 42.86% share in 2020 , driven by strong aviation infrastructure and rapid 5G adoption.

Asia Pacific is the fastest-growing market, led by China, India, and Japan, where governments and telecom companies are investing heavily in 5G-ready airports and air-to-ground networks.

Europe benefits from strong telecom presence (Ericsson, Nokia, OneWeb) and collaborative projects focused on digital aviation.

Competitive Landscape

The market is highly competitive, with global telecom and aviation leaders investing in large-scale 5G deployments, R&D, and partnerships.

Key Companies Include:

Cisco Systems (U.S.)

Huawei Technologies (China)

Gogo LLC (U.S.)

Nokia Corporation (Finland)

OneWeb Ltd (U.K.)

Panasonic Avionics (U.S.)

Ericsson (Sweden)

SmartSky Networks (U.S.)

AeroMobile Communications (U.K.)

Intelsat (U.S.)

ANUVU Inc. (U.S.)

Strategic alliances, satellite integration, and connected aircraft initiatives are central to their growth strategies.

Recent Industry Development

May 2021: ANUVU Inc. signed an agreement with Breeze Airways to deliver wireless in-flight entertainment (W-IFE) using its IRIS and Airconnect systems on E195 and E190 aircraft.

According to Fortune Business Insights™, the global LiDAR drone market was valued at USD 129.0 million in 2020 and is projected to grow from USD 143.0 million in 2021 to USD 455.0 million by 2028, representing a CAGR of 17.98% during the forecast period. North America led the market in 2020 with a 39.74% share, driven by extensive adoption across infrastructure, forestry, and defense applications. However, the COVID-19 pandemic disrupted operations, causing a decline of -5.6% compared to the average annual growth between 2017 and 2019.

What Are LiDAR Drones?

LiDAR drones are unmanned aerial vehicles (UAVs) equipped with Light Detection and Ranging (LiDAR) sensors. These drones are transforming industries by enabling high-precision 3D mapping, terrain modeling, structural inspections, and object detection. Compared to traditional surveying methods, LiDAR drones offer:

Faster data collection

Higher accuracy

Lower operational costs

Industries benefiting from these technologies include construction, precision agriculture, forestry, archaeology, and environmental monitoring.

Market Segmentation

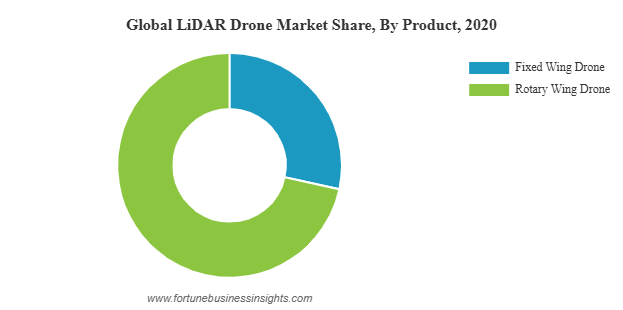

By Product:

Rotary-Wing Drones hold the largest market share due to their cost-effectiveness, easy maneuverability, and suitability for 3D mapping and corridor applications. Fixed-Wing Drones are expected to register the fastest growth, driven by requirements for long-range detection, Beyond Line of Sight (BLOS) operations, and higher payload capacities.

By LiDAR Type:

Mechanical LiDAR dominated the market in 2020, widely used for 360-degree data detection across large areas. In contrast, Solid-State LiDAR is projected to grow the fastest, owing to its compact design, lower cost, and superior resolution for precision mapping and corridor applications.

By Range:

Short-Range LiDAR held the largest share in 2020, favored for low-altitude operations due to cost efficiency and ease of use. Long-Range LiDAR is expected to expand rapidly, leveraging advanced laser technology for high-altitude and long-distance detection.

By Application:

Mapping and Cartography accounted for the largest segment in 2020, driven by infrastructure development, agriculture, oil & gas, and energy utility projects. Other applications such as environmental monitoring, surveillance, exploration, detection, and precision agriculture are also contributing significantly to market growth.

Key Growth Drivers

1. Rising Adoption of Cost-Effective 3D Mapping

LiDAR drones provide accurate georeferenced data at a fraction of the cost of traditional methods. This has expanded their applications to vegetation monitoring, precision farming, archaeology, and large-scale infrastructure surveys.

2. Increased Deployment in Corridor Mapping

Surveying highways, railways, bridges, and shoreline infrastructure has become easier and more accurate with LiDAR drones. Their ability to generate high-resolution point clouds at lower operational costs makes them essential for modern infrastructure projects.

3. Technological Advancements

The integration of next-generation UAV LiDAR sensors, such as optical altimeter-based systems and MEMS (Micro-Electromechanical Systems) laser scanners, has improved mapping precision and resolution. These innovations enhance operational efficiency for government, industrial, and environmental projects.

Market Restraints

Despite rapid adoption, the market faces some challenges:

Strict aviation regulations governing UAV operations

High acquisition and maintenance costs compared to alternatives like photogrammetry

Shortage of skilled operators capable of handling advanced UAV systems

Information Source:

https://www.fortunebusinessinsights.com/lidar-drone-market-102602

Regional Insights

North America: Valued at USD 51.27 million in 2020; continues to lead due to favorable regulations and strong R&D. Key players include Velodyne Lidar, Phoenix LiDAR Systems, and LiDARUSA.

Europe: Second-largest market, fueled by 3D mapping demand and environmental monitoring. Key manufacturers: Leica Geosystems, Delair, YellowScan.

Asia Pacific: Fastest-growing region due to domestic UAV manufacturers in China and India and expanding applications in agriculture.

Middle East & Africa: Moderate growth driven by government projects and infrastructure development.

Rest of the World: Gradual growth, supported by cost-effective drone surveys in countries such as Turkey and South Africa.

Leading Players

Key companies are focusing on R&D, innovation, strategic partnerships, and acquisitions to expand their market presence:

Velodyne Lidar, Inc. (U.S.)

Teledyne Optech Inc. (Canada)

RIEGL Laser Measurement Systems GmbH (Austria)

Delair SAS (France)

Phoenix LiDAR Systems (U.S.)

Leica Geosystems AG (Switzerland)

Yellow Scan (France)

LiDARUSA (U.S.)

SZ DJI Technology Co., Ltd (China)

Benewake (China)

RoboSense (China)

Sick AG (Germany)

Microdrones (Germany)

Recent Developments

July 2021: Microdrones completed a high-precision LiDAR survey in Minas Gerais, Brazil, covering 10 km² of a mining complex with three dams, demonstrating efficiency in large-scale industrial applications.