Category: aerospace and defence

Airborne Radar Market Size, Analysis, Share, Trends and Forecast, 2025–2034

By Rishika19, 2025-08-22

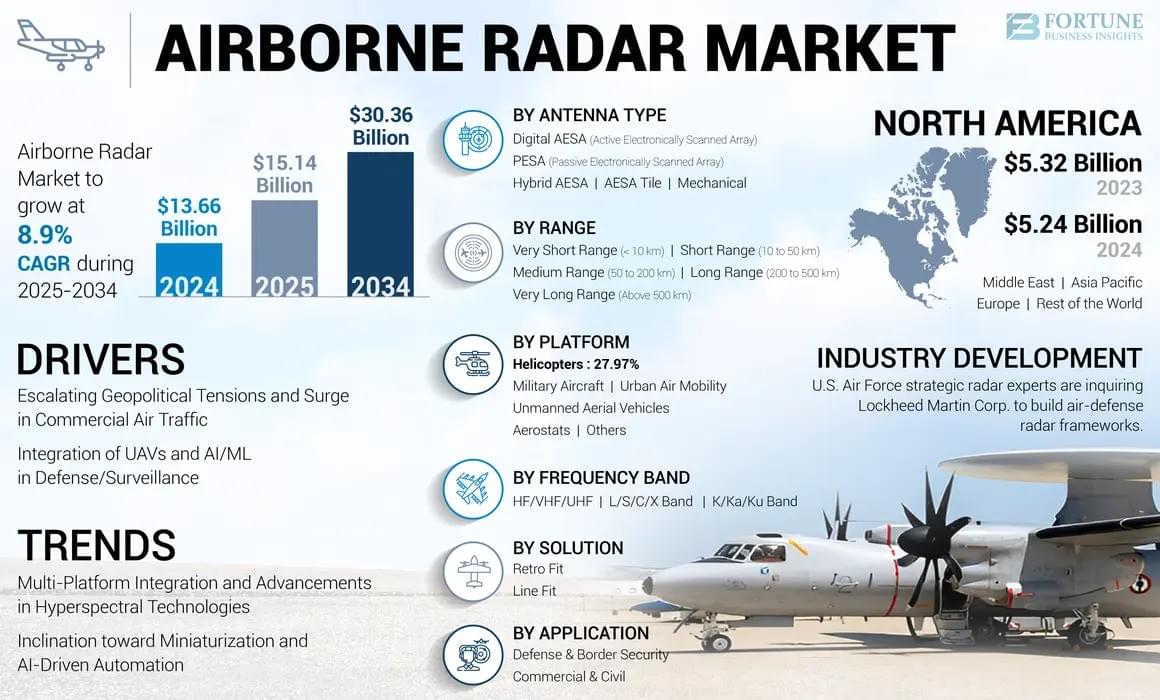

According to Fortune Business Insights™, the global airborne radar market size was valued at USD 13.66 billion in 2024. The market is projected to grow from USD 15.14 billion in 2025 to USD 30.36 billion by 2034, exhibiting a robust CAGR of 8.9% during the forecast period. North America led the global market in 2024 with a share of 38.36%, driven by substantial investments in next-generation air dominance programs and radar modernization initiatives.

Market Overview

The global airborne radar market is witnessing accelerated growth, fueled by rising geopolitical tensions, large-scale defense modernization programs, and the growing importance of air superiority. Advanced radar systems are becoming integral to platforms such as fighter jets, bombers, AWACS, UCAVs, helicopters, and maritime patrol aircraft.

Growing emphasis on ISR (Intelligence, Surveillance, and Reconnaissance) integration, alongside the development of sixth-generation combat aircraft, is further propelling demand. Modern airborne radars are vital for detecting stealth platforms, neutralizing UAV threats, enhancing missile defense systems, and ensuring dominance across multiple domains.

Key Companies Profiled

- Lockheed Martin Corporation (U.S.)

- Raytheon Technologies Corporation (U.S.)

- Northrop Grumman Corporation (U.S.)

- Thales Group (France)

- Saab AB (Sweden)

- Leonardo S.p.A. (Italy)

- Israel Aerospace Industries Ltd. (Israel)

- Indra Sistemas S.A. (Spain)

- Honeywell International Inc. (U.S.)

- Hensoldt AG (Germany)

- BAE Systems plc (U.K.)

These companies are focusing on AESA integration, GaN-based systems, and quantum radar technologies to gain a competitive edge.

Information source:

https://www.fortunebusinessinsights.com/airborne-radar-market-113126

Market Segmentation

By Platform

The airborne radar market is segmented into military aircraft, helicopters, UAVs, UAM, aerostats, and others. Military aircraft dominated the market in 2024, driven by fleet modernization, geopolitical conflicts, and technological upgrades. For example, in March 2024, Northrop Grumman secured a USD 1.2 billion contract to supply AN/APG-83 AESA radars for NATO’s F-16 upgrades. Helicopters accounted for 27.97% of the market share in 2024, supported by enhanced mission-specific radar integration. UAVs are expected to be the fastest-growing segment, propelled by miniaturized radars and asymmetric warfare needs. In April 2024, General Atomics launched the Lynx Multi-Domain Radar for MQ-9B drones, expanding maritime and land surveillance capabilities.

By Application

The market is divided into commercial & civil and defense & border security applications. The commercial & civil segment led in 2024, fueled by demand for weather monitoring, air traffic control, and infrastructure development. For instance, in May 2025, Thales introduced the Trac Sigma radar, designed for multi-mission air traffic control. The defense & border security segment is projected to grow at the fastest CAGR as nations enhance border surveillance and hypersonic missile detection. In August 2024, Raytheon secured a USD 2 billion U.S. Army contract for LTAMDS radars, including a Foreign Military Sale to Poland.

By Range

Medium-range radars (50–200 km) dominated in 2024, widely used for aviation safety, SAR operations, and coastal monitoring. Very long-range radars (above 500 km) are anticipated to witness the highest CAGR, driven by applications in ICBM tracking, orbital coordination, and stealth detection. DARPA’s 2023 quantum radar trials demonstrated the capability to detect stealth drones, highlighting future growth potential.

By Frequency Band

L/S/C/X band radars led the market in 2024, supported by storm tracking, fire control systems, and Earth observation. For example, in December 2024, ICEYE launched two SAR satellites with SpaceX to expand Earth monitoring capabilities. K/Ka/Ku band radars are expected to grow at the fastest CAGR, driven by missile guidance, SATCOM links, and hyperspectral analysis. In August 2023, the USAF upgraded F-22 Raptors with Ku-band radar and infrared defensive systems to enhance targeting and survivability.

By Antenna Type

Digital AESA radars held the largest share in 2024 and are projected to grow the fastest, supported by AI-driven smart targeting, dynamic beam steering, and stealth compatibility. PESA radars continue to see strong demand due to cost-effectiveness and proven reliability. For instance, in 2024, India awarded USD 80 million in contracts for MiG-29 radar upgrades.

By Solution

Line-fit radars dominated in 2024, driven by integration into next-generation aircraft such as Boeing’s T-7A with Raytheon AESA radars. Retrofit solutions are expected to grow at the fastest rate, supported by fleet modernization programs. In November 2023, South Korea announced a USD 450 million F-15K radar retrofit project, highlighting the increasing demand for upgraded airborne radar capabilities.

Market Dynamics

Drivers

Geopolitical Tensions: Conflicts in Ukraine, Indo-Pacific, and the Middle East are accelerating radar upgrades. Programs like NATO’s Allied Future Surveillance highlight radar modernization urgency.

Commercial Air Traffic Surge: Growing demand for collision-avoidance systems, weather radars, and airspace management is boosting commercial adoption.

Restraints

AESA Power Limitations in UAVs: High energy consumption reduces UAV endurance. For instance, AN/APY-8 integration cut MQ-1C endurance by 25%, raising cost and operational challenges.

Opportunities

Quantum Radar Development: Capable of detecting stealth aircraft and hypersonic threats, quantum radar is emerging as a game-changer. Programs by DARPA, Lockheed Martin, and Xanadu are expected to deliver deployable solutions by 2026.

Regional Insights

North America led the market in 2024 at USD 5.24 billion, fueled by the NGAD program, hypersonic missile defense, and UAV radar integration. The U.S. Air Force’s transition from AWACS to Boeing E-7A AEW&C platforms is a key driver.

Asia Pacific ranked second, supported by India, Japan, and Australia’s defense spending and initiatives such as Tejas MK-1A and KF-21 Boramae radar integration.

Europe will be the fastest-growing region, propelled by 6th-gen fighter programs (FCAS and Tempest) and Eurofighter Typhoon radar upgrades.

Middle East shows steady growth, driven by UAE and Saudi Arabia’s radar modernization and pipeline security UAV deployment.

Rest of the World will see notable adoption, particularly in Latin America and Africa for anti-trafficking surveillance, anti-poaching, and agricultural monitoring.

Competitive Landscape

The airborne radar market is moderately fragmented, with top players including Lockheed Martin, Raytheon, Northrop Grumman, Thales, and Saab AB. Companies are focusing on AESA advancements, quantum radar R&D, and multi-mission ISR solutions.

Recent highlights:

In April 2025 , Sweden entered into a contract with Thales valued at USD 93 million to acquire the Ground Master 200 Multi-Mission Compact radar (GM200 MM/C). The initial deliveries are scheduled for 2026. This medium-range radar will enhance the Swedish Armed Forces’ air and surface surveillance capabilities, replacing the outdated PS-871 radar system.

The global anti-drone market size was valued at USD 2.45 billion in 2024 and is projected to grow from USD 3.10 billion in 2025 to USD 12.24 billion by 2032, exhibiting a robust CAGR of 21.62% during the forecast period. North America accounted for the largest share of the market in 2024, holding 31.43% of the total revenue.

Anti-drone technology—also referred to as counter-UAS (Unmanned Aircraft Systems) or counter-UAV systems—includes detection, tracking, and neutralization solutions aimed at mitigating threats from unauthorized drones. These systems are increasingly deployed to safeguard critical infrastructure, military bases, airports, public venues, and national borders against drone-based threats such as surveillance, smuggling, and armed attacks.

Market Dynamics

Market Drivers

Technological Advancements in Counter-Drone Systems

Modern militaries and defense agencies are increasingly adopting advanced technologies such as laser weapons, radar systems, AI-driven detection platforms, and electronic jammers. These systems improve accuracy, reduce response times, and provide scalable solutions to counter evolving drone threats effectively.

Rising Defense Spending and Security Concerns

Governments are allocating significant budgets toward drone defense. For instance, the U.S. Department of Defense plans to invest over USD 668 million in drone defense research by 2026, while India’s military has placed new orders worth USD 1.5 billion, including naval anti-drone systems, to strengthen its defense capabilities.

Market Opportunities

Private Investments and Startups

Startups such as Dedrone and Blighter Surveillance Systems are attracting venture capital funding by offering AI-powered and IoT-enabled counter-drone solutions. These innovations are expanding the commercial applications of anti-drone systems, creating a dynamic investment ecosystem that supports both defense and civilian sectors.

Market Restraints

High Procurement Costs and Regulatory Challenges

Counter-drone systems are often expensive and subject to stringent government approval processes, which limits rapid adoption. Moreover, the absence of global standardization complicates deployments, especially as RF-based systems risk interfering with air traffic control and communication networks, restricting usage in airports and civilian airspace.

Market Challenges

Evolving Drone Threats

The increasing use of low-cost commercial drones, such as the DJI Mavic 3, in conflict zones like the Russia-Ukraine war, highlights how easily accessible drones can be weaponized for attacks and surveillance. These developments present serious challenges to national security, underscoring the need for continuous innovation and scalable counter-drone solutions.

Information Source:

https://www.fortunebusinessinsights.com/anti-drone-market-102593

Key Market Trends

Rising drone threats to civilian and military infrastructure are accelerating investments in counter-drone systems.

Proliferation of low-cost consumer drones for illicit purposes has increased demand for portable anti-drone devices.

Use of drones in warfare and terrorism is expanding—highlighted by attacks such as the 2021 Jammu airport incident in India, where drones dropped explosives on a defense establishment.

Integration of multi-sensor fusion systems (radar, RF, optical, acoustic) and AI-driven analytics is a major trend shaping the next generation of counter-drone solutions.

Segmentation Analysis

By Method

The detection segment accounted for the largest share in 2024, supported by rising global military spending and demand from emerging economies. The interdiction segment, however, is projected to register the fastest growth, primarily driven by the increasing use of RF jamming technologies that disrupt communication links between drones and their operators.

By Technology

RF jammers dominated the market in 2024 due to their reliability and widespread adoption for disabling drones effectively. High energy lasers are expected to witness the fastest growth, as they offer automated tracking and instant neutralization capabilities. Meanwhile, other technologies such as acoustic sensors, GPS spoofers, radars, nets, and high-power microwave devices are gaining significant traction, especially in Asia and the Middle East.

By Platform

Ground-based systems held the largest and fastest-growing share in 2024, accounting for 66.84% of the market, as they are extensively deployed by military forces and law enforcement agencies. Handheld systems, including portable drone guns and nets, are increasingly being used at borders and other security-sensitive locations. UAV-based systems are expected to record moderate growth, supported by the adoption of combat drones designed for counter-drone missions.

By End-Use

The government and defense segment represented both the largest share and the fastest growth in 2024, fueled by modernization programs and ongoing conflicts such as the Russia-Ukraine war. Airports are also projected to see strong growth due to rising drone incursions near runways, while the commercial and other segment is gaining momentum as protection requirements expand across public events, critical civil infrastructure, and VIP gatherings.

Regional Insights

North America (USD 0.77 Billion in 2024)

Dominated by major defense contractors such as Raytheon Technologies, Lockheed Martin, and Liteye Systems. Strong defense budgets and R&D drive growth.

Asia Pacific (fastest-growing region)

Driven by rising military budgets in India, China, and Japan, coupled with increasing demand for airport security and border protection systems.

Europe

Growth supported by defense modernization and cross-border cooperation. NATO and European nations are investing heavily in counter-drone systems, especially in response to the Ukraine war.

Rest of the World

Middle Eastern countries such as Saudi Arabia, Turkey, and Israel are investing heavily in counter-drone systems to protect critical infrastructure from drone-based attacks.

Report Coverage

The report offers comprehensive insights into the anti-drone market trends, growth drivers, restraints, regional outlook, competitive dynamics, and technological advancements. It highlights the increasing demand for counter-drone solutions amid the proliferation of UAV threats in military, defense, commercial, and civilian applications.

Competitive Landscape

The anti-drone market is highly competitive, with established defense contractors and emerging technology firms shaping the landscape. Companies are focusing on strategic collaborations, government contracts, and AI-powered innovations to strengthen their portfolios.

Key Players

- Raytheon Technology Corporation (U.S.)

- Lockheed Martin Corporation (U.S.)

- Israel Aerospace Industries (U.S.)

- DroneShield (Australia)

- Detect Inc (U.S.)

- Dedrone Holdings Inc. (U.S.)

- Liteye Systems Inc. (U.S.)

- Elbit Systems Ltd. (Israel)

- SaaB AB (Sweden)

- Thales Group (France)

Key Industry Developments

January 2025 – Elbit Systems secured a USD 60 million contract to supply its ReDrone™ Counter-UAS system to a European NATO member. The project will be executed over three years, reinforcing Elbit’s position in the European defense market.

According to Fortune Business Insights™, the global aircraft refurbishing market was valued at USD 5.86 billion in 2024 and is projected to expand from USD 5.88 billion in 2025 to USD 7.81 billion by 2032, reflecting a CAGR of 4.13% during the forecast period. North America dominated the market with a 31.74% share in 2024, supported by strong airline operations, high passenger volumes, and growing adoption of advanced refurbishment solutions.

What is Aircraft Refurbishing?

Aircraft refurbishing involves the overhaul, renovation, and modernization of both interiors and exteriors to improve aircraft performance, extend service life, ensure regulatory compliance, and enhance passenger comfort. It covers a wide spectrum of processes, including:

Cabin upgrades (seating, LED lighting, in-flight entertainment systems)

Engine and component modernization

Avionics enhancement (navigation, predictive maintenance systems, digital controls)

Structural modifications and repainting

VIP jet refurbishments with luxury interiors

This process not only improves aesthetics and passenger experience but also helps airlines boost fuel efficiency, meet sustainability targets, and increase resale value.

Market Dynamics

Drivers:

The market is strongly driven by the rising demand for customized interiors and premium passenger experiences. Airlines are increasingly opting for refurbishment instead of new aircraft purchases to reduce costs while meeting operational requirements. At the same time, the focus on fuel efficiency and compliance with safety standards is accelerating adoption. Additionally, the integration of smart cabin technologies, IoT-enabled maintenance systems, and the use of eco-friendly materials are shaping refurbishment strategies across the sector.

Restraints:

Supply chain disruptions remain a major restraint, impacting the availability of spare parts and delaying projects. Rising material and labor costs, combined with an ongoing shortage of skilled MRO (Maintenance, Repair, and Overhaul) technicians, are further adding to the challenges faced by airlines and service providers.

Opportunities:

Growing passenger traffic worldwide, particularly in Asia Pacific and emerging economies, is fueling the demand for regular upgrades and refurbishments. Increasing emphasis on sustainability and green aviation initiatives is creating opportunities for eco-friendly solutions. Furthermore, the rising demand for luxury refurbishments in business and VIP jets is opening new revenue streams for refurbishment providers.

Challenges:

High capital costs continue to be a barrier for airlines considering refurbishment projects. In addition, labor shortages are contributing to longer turnaround times and increased downtime for aircraft, which can affect airline profitability and scheduling efficiency.

Information Source:

https://www.fortunebusinessinsights.com/aircraft-refurbishing-market-109645

Market Trends

Digitalization and connectivity are reshaping aircraft refurbishment, with digital twin simulations, IoT-driven predictive maintenance, and RFID-based management solutions gaining momentum.

Virtual reality (VR) and augmented reality (AR) are being deployed for technician training and maintenance simulations.

Sustainability initiatives are driving retrofits with lighter materials, efficient engines, and eco-friendly interiors.

Regional Insights

North America (USD 1.87 billion, 2024): Leads the market with established MRO facilities, strong airline presence, and focus on sustainable retrofits. U.S. carriers are heavily investing in fuel-efficient upgrades and premium cabin refurbishments.

Europe: Strong regulatory compliance and emphasis on sustainability drive demand. Airlines in Germany, France, and the U.K. are upgrading fleets with premium cabins and energy-efficient systems.

Asia Pacific: Expected to register the fastest growth due to booming air traffic in China and India. Airlines are refurbishing aging fleets to reduce costs and meet rising demand. Middle-class growth and government investments in aviation infrastructure also support expansion.

Rest of the World:

Latin America: Emerging aviation hubs in Brazil and Mexico offer refurbishment opportunities.

Middle East: High demand for luxury cabin refurbishments, with the region serving as a global aviation hub.

Africa: Airlines focus on cost-effective refurbishment of older fleets to meet growing passenger demand.

Key Players in the Market

Prominent companies operating in the global aircraft refurbishing market include:

- AAR Corporation (U.S.)

- Air France Industries KLM Engineering & Maintenance (France)

- Airbus SAS (Netherlands)

- Boeing Company (U.S.)

- Bombardier Inc. (Canada)

- Delta TechOps (U.S.)

- Embraer S.A. (Brazil)

- GE Aviation (U.S.)

- General Dynamics Corp. (U.S.)

- Honeywell Aerospace (U.S.)

- Hong Kong Aircraft Engineering Company (HAECO) Ltd (Hong Kong)

- Lufthansa Technik AG (Germany)

- MTU Aero Engines AG (Germany)

- Rolls-Royce plc (U.K.)

- Safran SA (France)

- SIA Engineering Company Ltd. (Singapore)

- Spirit AeroSystems Inc. (U.S.)

- Textron, Inc. (U.S.)

- Turkish Technic (Turkey)

- United Technologies Corporation (U.S.)

These companies focus on strategic partnerships, fleet modernization projects, sustainability-driven refurbishments, and digital MRO solutions to strengthen their global footprint.

Report Coverage

This report provides an in-depth analysis of the global aircraft refurbishing market (2025–2032), offering insights into key players, market drivers, restraints, opportunities, and challenges. It covers regional performance, emerging trends, industry developments, and future projections, helping stakeholders understand the competitive landscape and growth opportunities in the sector.

Recent Industry Development

October 2024 – Qantas Airways announced a retrofit program for 10 Airbus A330-200 aircraft, with upgrades including modern cabin interiors and enhanced comfort features. These aircraft will operate on major international routes to Hong Kong, Singapore, and Tokyo. The initiative reflects Qantas’ commitment to extending fleet life, improving passenger satisfaction, and integrating advanced technologies through refurbishment.

The global drone motor market was valued at USD 6.34 billion in 2024 and is projected to reach USD 13.39 billion by 2032, exhibiting a CAGR of 10.33% during the forecast period. Growth is fueled by the rising adoption of unmanned aerial vehicles (UAVs) across commercial, defense, and industrial sectors, alongside continuous technological advancements in motor efficiency and performance.

Drone motors play a critical role in UAV operations by converting electrical energy into mechanical thrust, enabling drones to take off, hover, maneuver, and land. Typically mounted on the drone’s frame arms and connected to propellers, motors control flight dynamics by adjusting rotational speeds.

Motor Types and Functionality

Two primary motor types dominate the UAV landscape:

Brushed Motors – Cost-effective, simple in design, and widely used in toy and entry-level drones.

Brushless Motors (BLDC) – Highly preferred for advanced drones due to their efficiency, durability, and reliability. These motors provide higher power-to-weight ratios, smoother operation, and better energy conversion.

A BLDC motor comprises:

Stator – Wire coils generating a magnetic field.

Rotor – Permanent magnets that rotate with the field.

Bearings – Minimizing friction for smooth movement.

Controller – Regulating motor speed and direction.

Market Segmentation

By Motor Type

The drone motor market is segmented into brushless and brushed motors. Brushless motors dominated the market in 2024, driven by their superior efficiency, reliability, and capability to support extended flight times with heavy payloads while consuming less battery power. These factors position brushless motors as the fastest-growing segment through 2032. In contrast, brushed motors are expected to maintain steady demand, primarily in low-cost UAV applications such as educational projects, entry-level drones, and recreational models, where affordability and simple design remain key advantages.

By Drone Type

Based on drone type, the market is classified into fixed wing, rotary wing, and hybrid drones. The fixed wing segment held the largest market share in 2024, supported by its effectiveness in long-distance surveying, mapping, and surveillance operations. Rotary wing drones are witnessing strong growth due to their stability and maneuverability, making them particularly useful in construction, utilities, and telecommunications for close-range inspections and asset monitoring. Hybrid drones, which combine the endurance of fixed wings with the versatility of rotary wings, are emerging as a promising segment for multi-functional applications.

By Power Capacity

In terms of power capacity, the 51–100 W segment led the market in 2024, offering an ideal balance between lightweight design and operational efficiency. These motors are widely deployed in commercial drones for agriculture, inspection, and logistics due to their extended flight capability. The below 50 W category is primarily used in smaller drones, such as hobbyist or consumer models. Meanwhile, the above 100 W segment is expected to grow steadily, fueled by rising demand for heavy-lift UAVs designed to carry larger payloads and perform demanding missions in logistics and defense sectors.

By Application

By application, the market is segmented into aerial photography, agriculture, construction & infrastructure, and military & defense. Aerial photography dominated the market in 2024, with widespread use in real estate, tourism, entertainment, and construction, where drones provide enhanced project planning and monitoring capabilities. The agriculture segment is projected to be the fastest-growing during the forecast period, as drones equipped with sensors and high-resolution cameras support precision farming, crop health monitoring, irrigation management, and yield optimization. Construction and infrastructure applications are also rising, driven by the need for efficient surveying, site monitoring, and inspection. Meanwhile, military and defense continue to represent a critical application area, with strong adoption in surveillance, intelligence gathering, and tactical missions.

Information Source:

https://www.fortunebusinessinsights.com/drone-motor-market-110736

Market Dynamics

Market Drivers

The growth of the drone motor market is primarily driven by strong government and private investments aimed at expanding UAV capabilities and domestic manufacturing. For instance, India has introduced a Production-Linked Incentive (PLI) scheme to attract multi-billion-dollar investments, reduce dependency on imports, and boost local UAV production. In addition, the rising adoption of drones across multiple sectors—including commercial delivery services, defense surveillance, agriculture, and construction—is significantly fueling the demand for efficient and reliable drone motors.

Market Restraints

Despite this robust growth, the market faces challenges related to thermal management. High-performance drone motors, particularly those with high KV ratings, often generate substantial heat during operation. Without adequate cooling systems, this heat can negatively affect motor efficiency, reduce overall reliability, and increase maintenance costs. These limitations pose a barrier to long-term performance and scalability in demanding applications.

Regional Insights

North America (USD 2.89 billion, 2024 – Market Leader)

Strong demand from defense, surveillance, and construction sectors .

U.S. government investments in R&D and UAV programs driving innovation.

Example: In January 2025, the U.S. Air Force awarded Firestorm Labs a USD 100 million contract for advanced UAV development.

Europe

Significant adoption in urban logistics and sustainable delivery solutions .

Strong government R&D support for motor efficiency and long-range capabilities .

Asia Pacific (Fastest-Growing Region)

Expanding UAV adoption across agriculture, logistics, and filmmaking .

Japan increasing drone exports through Official Security Assistance (OSA) , with funding rising to USD 53 million in 2025.

Rest of the World (Latin America, Middle East & Africa)

Growing UAV use in agriculture and defense applications .

February 2025: Sentrycs secured a multi-million-dollar Latin American contract for counter-drone systems enhancing airspace security.

Competitive Landscape

The market is moderately fragmented, with leading players investing heavily in R&D to improve motor efficiency, durability, and payload capacity .

Key Players

- DJI (China)

- Hacker Motor GmBH(Germany)

- KDE Direct (U.S.)

- Parrot Drone SAS (France)

- T-motor (China)

- Nidec Corporation (Japan)

- Neumotors (U.S.)

- Faulhaber Group (Germany)

- Sunnysky Motors (China)

- Mad Motor Components Co., Ltd. (China)

Recent Developments

January 2025 – Red Cat Holdings, Inc. , a leading provider of drone technology integrating robotic hardware and software for military, government, and commercial applications, announced that it secured USD 518,000 in new orders for its Edge 130 drone. The contracts were placed by the U.S. Army National Guard and another U.S. Government Agency (OGA), strengthening the company’s position in the defense and government drone market.

Very Small Aperture Terminal (VSAT) Market Insights, Share, Growth, Trends, Forecast, 2025–2032

By Rishika19, 2025-08-20

According to Fortune Business Insights, the global Very Small Aperture Terminal (VSAT) Market was valued at USD 10.20 billion in 2024 and is expected to grow from USD 11.86 billion in 2025 to USD 29.42 billion by 2032, reflecting a robust CAGR of 13.9% during the forecast period. In 2024, North America dominated the market, holding a 30.88% share, owing to widespread satellite adoption across commercial, government, and defense sectors.

VSAT technology leverages compact satellite antennas, typically under 3 meters in diameter, to establish two-way communication with geostationary satellites. It plays a critical role in enabling broadband connectivity for remote and underserved regions, where terrestrial infrastructure is limited or unavailable. Applications range from telemedicine and rural education to emergency communications and defense networks, making VSAT systems a cornerstone of modern connectivity.

Market Dynamics

Market Drivers

1. Rising Demand for High-Speed Connectivity

The accelerating need for reliable and high-speed internet is a primary driver of VSAT market growth. From digital banking to online education and telehealth, connectivity is now essential for socio-economic development. Governments and enterprises are deploying VSAT systems to ensure fast, resilient, and easily deployable communication networks, particularly in rural and disaster-prone areas.

2. Surge in Commercial Satellite Launches

The proliferation of commercial satellite launches—including High-Throughput Satellites (HTS)—is unlocking new opportunities for VSAT providers. HTS offers higher bandwidth capacity and improved data throughput, enabling seamless streaming, cloud applications, and enterprise networking. Enhanced satellite coverage also lowers service costs, expanding VSAT adoption across maritime, oil & gas, aviation, and emergency response sectors.

3. Integration of High-Throughput Satellites (HTS)

The integration of HTS into VSAT networks acts as a catalyst for growth, boosting performance and efficiency. With industries demanding real-time data transfer and high-capacity communications, HTS-powered VSAT systems provide unmatched scalability and speed, making them indispensable for next-generation satellite connectivity.

Market Restraints

High Initial Deployment Costs

Despite strong demand, high capital expenditure (CAPEX) remains a restraint. The cost of satellite dishes, modems, RF equipment, and installation presents a barrier, particularly for SMEs and organizations in developing regions. Moreover, in urban areas where fiber optics or DSL are more cost-effective, VSAT adoption may remain limited. The longer return on investment (ROI) timeline further impacts adoption among cost-sensitive industries.

Information Source:

https://www.fortunebusinessinsights.com/v-sat-market-110136

Key Market Trends

1. IoT and M2M Connectivity Expansion

As industries embrace IoT and machine-to-machine (M2M) communication, VSAT systems are increasingly vital for remote monitoring and automation. Sectors such as energy, agriculture, transportation, and utilities rely on VSAT for connecting dispersed sensors and devices, reinforcing its role in the digital ecosystem.

2. Global Expansion Strategies

Leading VSAT providers are expanding into emerging markets across Africa, Asia-Pacific, and Latin America. By forging strategic partnerships and acquisitions, players aim to capture underserved regions where demand for satellite broadband is surging.

3. Advancements in Ground Equipment

The satellite ground equipment sector is evolving with next-gen network operations centers (NOCs), gateways, and VSAT terminals. These innovations enhance operational efficiency and reliability, while HTS-enabled equipment boosts throughput and optimizes spectrum use.

Market Segmentation

By Platform

Land VSAT : Largest share in 2024, driven by demand for rural connectivity.

Maritime VSAT : Fastest-growing, fueled by vessel digitization and crew welfare connectivity.

Airborne VSAT : Increasing adoption in aviation for in-flight internet and operational data transfer.

By Frequency Band

Ku-Band : Dominant segment, valued for reliability across maritime, aviation, and enterprise use.

Ka-Band : Expected to grow significantly, offering high bandwidth and faster transmission.

C-Band, X-Band, Others : Supporting critical applications in defense and remote operations.

By Network Architecture

Mesh Topology : Largest segment, preferred for military and emergency applications requiring real-time communication.

Star Topology : Fastest-growing, popular in retail, banking, and enterprise networks due to centralized control and scalability.

By Application

Data Transfer : Dominant use case, driven by demand for seamless global business communication.

Voice Communication : Growing rapidly for private networks and secure enterprise communications.

Video Broadcasting & Others : Expanding adoption in media, government, and education.

Regional Insights

North America:

North America dominates the space power supply market with the largest share, fueled by strong defense investments and the presence of advanced satellite infrastructure.

Europe:

The European market is witnessing growth led by the maritime sector, alongside strict regulatory requirements for vessel communication that drive demand.

Asia-Pacific:

Asia-Pacific is expected to record significant expansion, driven by large-scale satellite investments in China and India, coupled with rising rural connectivity needs across the region.

Middle East & Africa:

In the Middle East & Africa, adoption is increasing for enterprise and government applications, particularly in underserved regions where satellite solutions are crucial.

Latin America:

Latin America represents an emerging market, with demand rising for broadband and corporate satellite services, creating new opportunities for growth.

Key Industry Players

Hughes Network Systems, LLC

Viasat Inc.

Gilat Satellite Networks Ltd.

Cobham Limited

Marlink

ST Engineering

L3Harris Technologies, Inc.

Intelsat

Orbit Communications Systems Ltd.

Speedcast

These companies focus on dual-band VSAT solutions, scalable architectures, and global service expansions to strengthen their competitive positioning.

Recent Developments

September 2024 : Gilat Satellite Networks secured over USD 12 billion in orders from a major satellite operator to enhance global SATCOM networks with its SkyEdge IV and SkyEdge II-c platforms.

October 2024 : Gilat’s U.S. subsidiary DataPath won a USD 4 million contract from the U.S. Department of Defense to supply DKET 3421 portable SATCOM terminals for rapid deployment.

May 2024 : Eutelsat expanded its partnership with InterSAT to boost satellite services across Africa using the EUTELSAT 70B satellite.

Space Power Supply Market Growth, Size, Share, Trends, Insights and Forecast, 2025–2032

By Rishika19, 2025-08-20

According to Fortune Business Insights™, the global space power supply market size was valued at USD 3.19 billion in 2024 and is projected to grow from USD 3.46 billion in 2025 to USD 5.72 billion by 2032, exhibiting a CAGR of 7.4% during the forecast period. North America dominated the market in 2024 with a share of 47.02%, supported by strong investments from NASA, the U.S. Department of Defense, and leading aerospace companies.

Space power supplies are essential components of spacecraft and satellite systems, ensuring reliable and efficient energy distribution for mission-critical operations. The rising adoption of satellite-based services—such as telecommunications, remote sensing, navigation, and weather forecasting—is driving the expansion of this market.

MARKET DYNAMICS

Market Drivers

1. Surge in Satellite Constellations Boosts Market Growth

The growing deployment of satellite constellations for Earth observation, communication, navigation, and space exploration is fueling demand for high-performance space-grade power supplies. For instance, SpaceX expanded its Starlink satellite network in May 2025 by launching 28 new satellites, bringing its total to over 7,200 in low Earth orbit (LEO). This development highlights the increasing need for reliable power systems to support large-scale connectivity solutions.

2. Rising Demand for Small Satellites

The global shift toward small satellites (smallsats) is a major growth driver. Lightweight, cost-effective, and efficient, smallsats are increasingly used for communication, navigation, Earth observation, and defense missions. Between 2024 and 2032, nearly 18,500 small satellites are expected to be launched, underscoring the market potential for compact and efficient power systems.

Market Restraints

High Costs and Supply Chain Disruptions

The market faces challenges such as raw material shortages, regulatory complexities, and high costs of designing space-grade electronics. Stringent quality and safety certifications add to manufacturing expenses, while geopolitical tensions contribute to supply chain disruptions, affecting production timelines.

Market Opportunities

Deep Space Exploration and Commercial Space Missions

Rising investments in lunar and Mars missions, coupled with In-Situ Resource Utilization (ISRU), present significant opportunities. Governments and private players are investing in sustainable space missions, with projects such as NASA’s Fission Surface Power Project and India’s upcoming 52 satellite launches strengthening market potential.

Market Trends

Adoption of Lithium-Ion Batteries : High energy density, long cycle life, and compact size are making lithium-ion the preferred choice for space power. In October 2024, EnerSys launched its ABSL™ lithium-ion space battery onboard NASA’s Europa Clipper mission.

Advancements in Nuclear Power : The development of Radioisotope Thermoelectric Generators (RTGs) and Nuclear Fission Reactors is accelerating. For instance, NASA and DOE are collaborating on a 40-kilowatt fission power system for lunar operations in the 2030s.

Information Source:

https://www.fortunebusinessinsights.com/space-power-supply-market-108383

SEGMENTATION ANALYSIS

By Power Source: Solar Power, Nuclear Power, Battery Power/Storage

Battery Power held the largest market share in 2024, driven by demand for satellite-based communication and navigation.

Solar Power is projected to grow at a significant CAGR, with advancements in space-based solar energy transmission.

By Battery Shape: Cylindrical, Prismatic, Pouch-Type

Cylindrical Batteries dominated in 2024 due to space efficiency, safety, and reliability.

By Battery Capacity: Low (<100 Wh), Medium (100–500 Wh), High (>500 Wh)

Medium Capacity Batteries (100–500 Wh) are expected to record the highest growth, supported by rising deployment of small and medium satellites for defense and research.

By Product Type: Solar Panels, Power Management Devices, Power Converters, Energy Storage, Others

Solar Panels dominated in 2024 due to their cost-effectiveness and environmental benefits.

Power Management Devices are projected to grow at the highest CAGR, holding nearly 29% market share in 2024 .

By Application: Communication Satellites, Navigation Satellites, Earth Observation Satellites, Space Stations, Space Probes & Rovers, Launch Vehicles & Rockets

Communication Satellites held the largest share in 2024 and are projected to grow fastest, driven by demand for global connectivity.

By End-User: Government & Military, Commercial Operators, Research Institutions

Government & Military dominated in 2024 due to regulatory oversight and national defense projects.

Commercial Operators are anticipated to grow rapidly, fueled by private investments in satellite internet and Earth observation services.

REGIONAL INSIGHTS

North America : Valued at USD 1.50 billion in 2024 , the region dominates due to the presence of NASA, CSA, and major OEMs.

Asia Pacific : Expected to grow at the highest CAGR, driven by ISRO, China’s space expansion, and private investments in smallsat launches.

Europe : Growth supported by technological advancements and investments in renewable and nuclear space power systems.

Middle East & Rest of the World : Growth driven by increasing participation in space-based services and international collaborations.

COMPETITIVE LANDSCAPE

The market is consolidated with leading companies focusing on advanced battery technologies, power management systems, and global expansion strategies.

List of Key Companies:

AAC Clyde Space (U.K.)

Airbus S.A.S (Netherlands)

AZUR SPACE Solar Power GmbH (Germany)

DHV Technology (Spain)

EaglePitcher Technologies (U.S.)

GS Yuasa International Ltd. (Japan)

Northrop Grumman Corporation (U.S.)

Rocket Lab USA, Inc. (U.S.)

Saft Groupe SA (France)

Teledyne Technologies Inc. (U.S.)

Recent Developments:

March 2025 : Teledyne Micropac introduced a patent-pending 3U VPX power supply card for LEO satellites, delivering up to 600W output and enabling flexible satellite power management.

September 2024 : Airbus received a contract from MDA Space Ltd. to supply solar arrays for its AURORA™ satellite line, enhancing Airbus’s presence in the commercial satellite segment.

Satellite Launch Vehicle Market Insights, Growth, Trends, Share, Forecast 2025–2032

By Rishika19, 2025-08-20

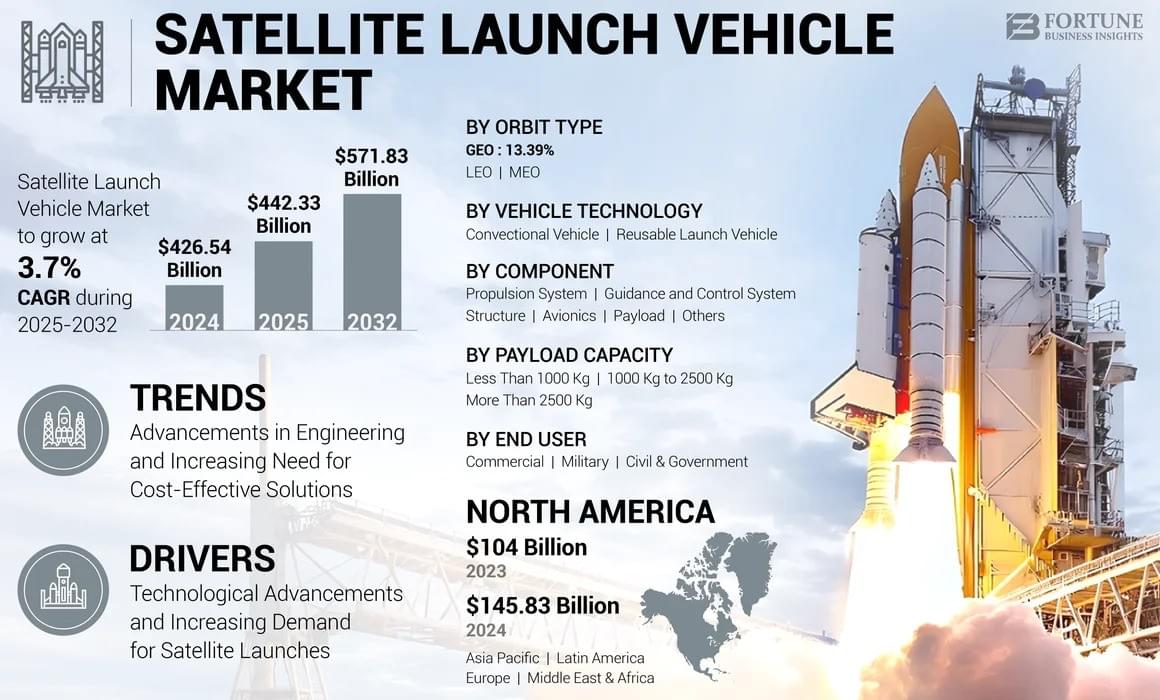

According to Fortune Business Insights™, the global satellite launch vehicle market was valued at USD 426.54 billion in 2024 and is projected to grow from USD 442.33 billion in 2025 to USD 571.83 billion by 2032, exhibiting a CAGR of 3.7% during the forecast period. The market expansion is fueled by the rising demand for satellite deployments in commercial, military, and civil applications, alongside advancements in reusable launch technologies, miniaturized satellite designs, and AI integration.

The demand for satellite launch vehicles is accelerating due to the increasing role of satellites in communication, navigation, Earth observation, weather forecasting, and defense. Modernization of platforms, digital transformation, and ongoing innovations are reshaping the market landscape. For instance, in November 2024, Boeing delivered two additional O3b mPOWER satellites for SES, showcasing advanced software-controlled payload technology for flexible bandwidth allocation.

Key Companies Profiled

- Airbus S.A.S (Netherlands)

- Arianespace (France)

- The Boeing Company (U.S.)

- Rocket Lab (U.S.)

- Mitsubishi Heavy Industries, Ltd. (Japan)

- Northrop Grumman (U.S.)

- Lockheed Martin Corporation (U.S.)

- Blue Origin Enterprises, L.P. (U.S.)

- SpaceX (U.S.)

- ISRO (India)

Major players such as SpaceX, United Launch Alliance, ISRO, NASA, and CASC are contributing significantly to market growth through technological advancements and increasing satellite launch frequency.

Information Source:

https://www.fortunebusinessinsights.com/satellite-launch-vehicle-market-111955

Market Segmentation

By Vehicle Technology

-

Conventional Vehicle : Accounted for the largest market share in 2024, supported by technological upgrades and government investments.

-

Reusable Launch Vehicle (RLV) : Expected to be the fastest-growing segment (2025–2032). Reusable launch technologies reduce costs and enhance mission flexibility. For instance, in September 2024, ISRO approved the development of its Next Generation Launch Vehicle (NGLV), designed for reusability and heavier payloads.

By Orbit Type

-

Low Earth Orbit (LEO) : Fastest-growing segment, driven by demand for low-latency and cost-effective communications. For example, Geespace launched 10 LEO satellites in September 2024 to expand its mega-constellation.

-

Geostationary Orbit (GEO) : Second-fastest growing segment, driven by communication services and government initiatives.

-

Medium Earth Orbit (MEO) : Stable demand for navigation and positioning services.

By Payload Capacity

-

Less than 1000 kg : Fastest-growing segment due to rising adoption of CubeSats and small satellites for military, communication, and research. In April 2024, SAIC and GomSpace collaborated to develop an AI-powered small satellite.

-

1000 kg to 2500 kg : Second fastest-growing, fueled by medium-size satellite launches.

-

More than 2500 kg : Stable demand for large payload launches.

By Component

-

Propulsion System : Fastest-growing segment, with innovations in green propulsion and electric systems. For example, in September 2024, Benchmark Space Systems received USD 4.9 million to develop ASCENT monopropellant propulsion systems.

-

Avionics : Second fastest-growing segment, as advanced GPS and navigation systems enhance mission reliability.

-

Other components include structure, payload, and guidance systems.

By End User

-

Military : Fastest-growing segment, driven by satellite investments for defense, surveillance, and secure communication. India announced USD 3 billion investment in space defense programs in March 2024.

-

Commercial : Largest share in 2024, supported by growing satellite services for communication and broadband.

-

Civil & Government : Ongoing investments in space exploration and scientific research.

Market Dynamics

Drivers

The satellite launch vehicle market is primarily driven by the rising demand for communication, Earth observation, and scientific satellites, which continues to fuel the need for reliable launch services. The rapid growth of small satellite and CubeSat missions is further accelerating this demand, as these platforms require cost-effective and flexible launch solutions. Increasing private sector participation, led by companies such as SpaceX and Rocket Lab, is transforming the industry with innovative reusable rocket technologies and reduced launch costs. Additionally, government space initiatives and higher defense spending are strengthening the global market, with national space agencies focusing on independent launch capabilities and strategic space programs.

Restraints

Despite strong growth prospects, the market faces several restraints. High research and development costs represent a significant challenge, particularly for smaller players attempting to compete with established providers. Engineering and refurbishment issues linked to reusable launch vehicles add further complexity and raise operational risks. Moreover, the risk of launch failures poses both financial and reputational setbacks for companies. Another restraint is the supply-demand imbalance caused by overcapacity in certain regions, which can limit profitability and disrupt launch schedules.

Opportunities

On the other hand, the industry is witnessing emerging opportunities that could redefine its trajectory. The integration of artificial intelligence in mission planning and space debris management has the potential to enhance safety, efficiency, and operational reliability. Advancements in additive manufacturing, particularly 3D printing, are enabling cost-efficient and rapid production of components, reducing overall development cycles. The growing adoption of sustainable practices such as green propulsion systems and recyclable materials reflects the industry’s commitment to environmentally responsible operations. Furthermore, the expansion of the small satellite and CubeSat markets offers consistent opportunities for dedicated and rideshare launches.

Challenges

Nevertheless, the market continues to grapple with several challenges. Limited payload capacities restrict the competitiveness of some systems compared to next-generation heavy-lift vehicles. While reusability has become a major focus, the high costs and technical difficulties associated with it remain barriers to widespread adoption. Demand forecasting also poses a challenge due to longer satellite lifespans and changing mission requirements. Additionally, overcapacity issues, particularly evident in regions such as India with ISRO’s current infrastructure, can lead to inefficiencies and delays, further complicating market growth.

Market Trends

-

Advanced Propulsion Technologies : Increasing shift toward eco-friendly fuels such as green propellants. For example, Bellatrix Aerospace tested its non-toxic Rudra propulsion system in January 2024.

-

AI and Automation : Enhancing efficiency in launch planning, trajectory optimization, and payload integration. In September 2024, Proteus Space announced plans to launch the first AI-designed ESPA-class satellite in 2025.

Regional Insights

North America : Largest market share (USD 145.83 billion in 2024). Driven by U.S. defense spending, NASA investments, and strong private sector involvement.

Asia Pacific : Fastest-growing region. Countries like China, India, and Japan are advancing national security initiatives and fostering private space startups. For example, India launched RHUMI 1, a reusable hybrid rocket, in August 2024.

Europe : Second-fastest growing region. ESA expanding investment in commercial-led launch services.

Middle East & Africa : Moderate growth with new programs from UAE, Saudi Arabia, and Israel. Yahsat selected SpaceX for satellite launches in July 2024.

Latin America : Growth led by Brazil, Argentina, and Colombia through new partnerships, such as Brazil’s 2024 agreement with China’s National Data Administration and SpaceSail.

Recent Developments

-

November 2024 : Rocket Lab USA signed a multi-launch contract for its Neutron medium-lift rocket with a commercial satellite operator.

-

November 2024 : ESA and ArianeGroup signed contract addendums worth USD 232.47 million to advance Prometheus engine testing and reusable rocket demonstrator Themis.

Synthetic Aperture Radar Imagery Market Insights, Trends, Growth, Size and Forecast, 2025–2032

By Rishika19, 2025-08-19

According to Fortune Business Insights™, the global Synthetic Aperture Radar (SAR) Imagery Market was valued at USD 1,455.5 million in 2024 and is projected to grow from USD 1,589.7 million in 2025 to USD 2,799.3 million by 2032, exhibiting a CAGR of 8.4% during the forecast period.

SAR is an advanced remote sensing technology that generates high-resolution images using microwave signals, enabling effective operation in all weather conditions, day or night. Widely adopted for surveillance, reconnaissance, precision targeting, and environmental monitoring, SAR technology is further strengthened by Interferometric SAR (InSAR), which provides highly accurate ground deformation detection essential for earthquake tracking, infrastructure assessment, and subsidence monitoring.

The market is witnessing significant momentum from the rising need for real-time situational awareness and the integration of AI-powered analytics, which enhance the speed and accuracy of SAR image interpretation.

Key Market Players

- ICEYE (Finland)

- Capella Space (U.S.)

- Geocento (U.K.)

- Viridien (France)

- Maxar Technologies (U.S.)

- Satim Inc. (Poland)

- KappaZeta Ltd (Estonia)

- Aloft Sensing, Inc. (U.S.)

- L3Harris Technologies, Inc. (U.S.)

- Airbus S.A.S. (Netherlands)

Information Source:

https://www.fortunebusinessinsights.com/synthetic-aperture-radar-sar-imagery-market-112463

Market Segmentation

By Service – Information Product (IP) Leads

Information Product (IP) accounted for the largest market share in 2024, supported by advances in high-resolution imaging and frequency capabilities. IP services are increasingly being used across defense, finance, insurance, and infrastructure sectors.

Insurance companies are leveraging SAR-derived IP for flood monitoring and risk assessment , boosting efficiency in disaster management.

The IP segment is expected to represent 33.89% of the market in 2024 .

Big data services are growing rapidly as new satellite constellations generate higher volumes of imagery, requiring advanced analytics integration for real-time decision-making .

By Resolution – Very High Resolution (VHR) Dominates

The VHR segment (finer than 1 meter) holds the largest market share, driven by its critical role in defense and intelligence applications .

VHR SAR systems are vital for urban planning, infrastructure monitoring, and precise defense surveillance.

For example, ICEYE’s Gen3 satellites (50 cm resolution) highlight significant progress in SAR imaging capabilities.

The High Resolution (1–5 meters) segment is expected to grow steadily, supporting agriculture, disaster management, and environmental monitoring .

By Industry – Defense & Intelligence Leads

Defense & Intelligence accounted for the largest share in 2024 due to the need for all-weather, day-and-night imaging for surveillance and reconnaissance amid growing geopolitical tensions.

Maritime applications are expected to expand rapidly as SAR technology is deployed for vessel tracking, shipping route monitoring, and illegal fishing detection.

Other sectors such as agriculture, energy & power, and urban planning are also increasing adoption, particularly for disaster management and land-use assessments .

By End-user – Military & Government Dominate

The Military & Government segment held the largest share in 2024, relying on SAR technology for geospatial intelligence, real-time situational awareness, and mission planning .

Governments are integrating SAR into national security operations and disaster monitoring strategies.

The Commercial segment is growing, with adoption in oil & gas, construction, telecommunications , and other industries. SAR data integrated with big data analytics enhances operational efficiency for commercial users.

Market Drivers and Restraints

Emergence of New Satellite Constellations

Companies such as ICEYE and Capella Space are launching advanced SAR satellites that provide higher resolution and reduced revisit times. These advancements are making SAR technology more accessible for both commercial and defense applications.

Cloud-Based Accessibility

The integration of SAR data with cloud platforms is democratizing its usage. By enabling real-time processing and seamless access, cloud-based solutions allow small businesses, NGOs, and research institutions to utilize SAR without heavy infrastructure investments.

Technological Advancements in Resolution & Frequency

Next-generation SAR systems are now capable of delivering sub-meter resolution, enabling greater precision and accuracy. These improvements are expanding applications in urban planning, environmental monitoring, and precision agriculture, creating new revenue opportunities for the market.

Regional Insights

North America – USD 475.8 Million in 2024

North America leads the global market, supported by strong investments from the U.S. Department of Defense, NASA, and private players like Capella Space and Maxar. Initiatives such as the NISAR mission highlight the region’s commitment to earth observation and disaster management.

Asia Pacific – Fastest Growing Region

Asia Pacific is witnessing rapid growth, driven by substantial investments in satellite technology from countries like China and India. Applications span urban planning, agriculture, and resource management. China’s Gaofen-7 satellite showcases the region’s advancements in SAR-enabled earth observation.

Europe – Significant Market Growth

Europe continues to expand its market presence, with strong support from the European Space Agency (ESA). The region emphasizes SAR adoption in defense, security, and environmental monitoring. The U.K. and Germany are particularly active in deploying SAR technologies for defense surveillance and climate change monitoring.

Rest of the World

Emerging markets in Latin America, Africa, and the Middle East are increasingly turning to SAR imagery for disaster response, agriculture monitoring, and environmental applications. The rising importance of big data analytics is pushing SAR usage beyond traditional defense purposes.

Key Industry Developments

September 2024 – Capella Space Corp.

Received a USD 15 million STRATFI award from the U.S. Air Force (via AFWERX Ventures) to accelerate the development and deployment of next-generation SAR sensors.

September 2024 – SATIM Partners with Capella Space

SATIM Inc., a leader in object detection and classification software, joined Capella’s Certified Analytics Partner program to leverage SAR archives and expand actionable intelligence offerings.

Aircraft Communication System Market Size, Share, Insights, Growth and Forecast, 2024–2032

By Rishika19, 2025-08-19

According to Fortune Business Insights™, the global aircraft communication system market was valued at USD 17.12 billion in 2024 and is projected to reach USD 33.52 billion by 2032, exhibiting a CAGR of 8.8% during the forecast period. Market growth is driven by the rising demand for secure, efficient, and real-time communication between aircraft and ground control, along with rapid advancements in satellite-based communication, software-defined radios (SDR), and high-speed data link technologies.

Market Overview

The aircraft communication system (ACARS) integrates audio systems, communication radios, tuning units, cockpit voice recorders (CVRs), antennas, and static dischargers to ensure seamless air-to-ground and in-flight cabin communication. Growing air traffic, strict safety requirements, and the increasing use of satellite-based navigation and wireless communication systems are boosting adoption across both commercial and defense aviation.

Additionally, the commercialization of drones (UAVs) presents lucrative opportunities. For instance, in April 2019, Honeywell International Inc. extended a contract with OJets to provide in-flight connectivity services for business aircraft, highlighting rising demand in the UAV segment.

Market Growth Drivers

1. Increasing Aviation Traffic and Safety Needs

With global aviation traffic rising, airlines and defense operators are prioritizing modern communication solutions to enhance air traffic management, situational awareness, and collision avoidance. Advanced systems play a key role in long-range voice and data transmission, ensuring safer and more efficient flight operations.

2. Technological Advancements

Companies are heavily investing in SATCOM, VHF/HF radios, SDRs, and broadband data connectivity. For example, Airborne Wireless Network (AWN) is developing an airborne wireless broadband system aimed at providing cost-effective, high-speed connectivity to aircraft in-flight.

Information Source:

https://www.fortunebusinessinsights.com/aircraft-communication-system-market-102541

Key Market Segments

By Component – Antennas Lead the Market

Antennas dominate the market owing to their critical role in wireless aviation communication.

Innovative products like the AV-17 RAMI (air-to-ground communication) and AV-529 RAMI (broadband in-flight connectivity) are driving adoption.

Transponders are also witnessing demand, particularly with ADS-B-enabled solutions such as uAvionix’s tailBeaconX, which supports modern surveillance requirements.

By System – Radio Communication Dominates

Radio communication is the largest and fastest-growing segment, supported by widespread deployment of VHF and HF transceivers in commercial and defense aircraft.

Other systems include passenger address, interphone communication, and cockpit voice recorders (CVRs).

CVRs are gaining traction due to updated ICAO and FAA regulations, including the 2023 FAA proposal mandating 25-hour cockpit recording capacity.

By Connectivity – SATCOM Shows Fastest Growth

SATCOM leads the market, driven by increasing demand for in-flight satellite voice and data services.

SDR technology is enabling flexible frequency management and efficiency improvements.

VHF/UHF/L Band connectivity continues to expand for line-of-sight operations and broadcasting.

By Fit Type – Line Fit Leads Due to UAV Deliveries

Line fit dominates due to increasing deliveries of UAVs and new-generation aircraft equipped with advanced radios and antennas.

Retrofit demand is also rising, as airlines upgrade fleets with 5G-compatible communication systems.

By Platform – Fixed-Wing Aircraft Hold Largest Share

Fixed-wing aircraft, led by Boeing and Airbus deliveries, account for the largest market share.

Rotary-wing platforms are seeing growth in defense and commercial applications, particularly for surveillance and reconnaissance missions.

UAV adoption continues to expand across defense, logistics, and security applications.

Regional Insights

North America – Valued at USD 5.26 billion in 2024, the region remains dominant, supported by advanced aerospace R&D, UAV adoption, and the presence of leading defense contractors.

Asia Pacific – Poised for strong growth, led by China’s rising demand for over 7,000 passenger aircraft by 2037 and the growing adoption of UAVs and 3D-printed antennas.

Europe – Expected to grow rapidly, driven by military UAV investments and the adoption of GPS-based antennas for SAR (Search and Rescue) operations.

Middle East & Africa / Latin America – Growth supported by helicopter use in oil & gas exploration and expanding regional commercial aviation markets.

Competitive Landscape

The market is fragmented and competitive, with leading companies focusing on strategic contracts, acquisitions, and product innovation.

Key Players Include:

- Cobham Plc (U.K.)

- General Dynamics Corporation (U.S.)

- Thales Group (France)

- Harris Corporation (U.S.)

- United Technologies Company (U.S.)

- Honeywell International Inc. (U.S.)

- Iridium Communications Inc. (U.S.)

- l3harris technologies (U.S.)

- Lockheed Martin Corporation (U.S.)

- Northrop Grumman Systems Corporation (U.S.)

- Raytheon Company (U.S.)

- Rohde & Schwarz GmbH & Co KG (Germany)

- Viasat, Inc. (U.S.)

Key Industry Developments

April 2024 – BAE Systems received a USD 459 million U.S. DoD contract for hardware components, repair services, and technical support for the AN/ARC-231/A Multi-mode Aviation Radio Suite.

April 2024 – The SAOC announced plans to deploy a modified commercial derivative aircraft with a modular open system architecture, integrating secure communication, planning features, and advanced ground support infrastructure.

According to Fortune Business Insights™, the global smart weapons market was valued at USD 18.99 billion in 2023 and is projected to expand from USD 20.20 billion in 2024 to USD 45.24 billion by 2032, at a CAGR of 10.61% during the forecast period. This robust growth is fueled by rising global defense budgets, large-scale military modernization programs, and increasing demand for precision strike capabilities in evolving combat environments.

Market Overview

The global defense industry is undergoing rapid transformation amid escalating geopolitical tensions, cross-border disputes, and asymmetric warfare challenges. To strengthen combat effectiveness while minimizing collateral damage, militaries worldwide are integrating advanced smart weapons systems into their arsenals.

Smart weapons—including sensor-fused munitions, guided bombs, cruise missiles, and satellite/laser-guided systems—offer superior precision, extended range, and greater operational flexibility compared to conventional weapons. Their deployment enhances mission success rates and supports modern doctrines emphasizing targeted, low-risk engagements.

In 2023, North America accounted for 33.86% of the global market, driven by high U.S. defense expenditure and the presence of leading defense contractors such as Lockheed Martin, Northrop Grumman, and Raytheon Technologies.

Key Market Players

Lockheed Martin Corporation (U.S.)

Raytheon Technologies (U.S.)

Northrop Grumman Corporation (U.S.)

General Dynamics Corporation (U.S.)

Boeing (U.S.)

Textron Inc. (U.S.)

BAE Systems (U.K.)

Thales Group (France)

MBDA (France)

Rheinmetall AG (Germany)

Others

Information Source:

https://www.fortunebusinessinsights.com/smart-weapons-market-104058

Market Segmentation

By Product:

Missiles & Munitions – Dominant segments owing to proven effectiveness, precision, and multi-platform deployment.

Guided Projectiles & Rockets – Gaining adoption for cost-effective accuracy in tactical missions.

Directed Energy Weapons (DEWs) – Emerging segment with potential to revolutionize warfare through speed, precision, and low-cost per shot.

By Platform:

Land Systems – Expected strong growth due to investments in border security, counter-terrorism, and modernization of ground-based defenses.

Air Systems – Increasing integration of precision weapons into fighter jets, UAVs, and helicopters.

Naval Systems – Deployment of smart torpedoes and anti-ship missiles enhancing maritime strike capabilities.

By Technology:

Laser & Satellite Guidance – Leading technologies ensuring superior targeting precision in both urban and open-terrain operations.

Infrared & Radar Guidance – Vital for low-visibility and electronic warfare conditions.

Others – Emerging solutions leveraging AI, autonomy, and advanced sensors for improved battlefield awareness.

Regional Insights

North America – Valued at USD 6.43 billion in 2023, the region maintains dominance due to high defense budgets, advanced R&D programs, and a strong presence of OEMs such as Lockheed Martin, General Dynamics, and Northrop Grumman. The U.S. Department of Defense continues to drive procurement of next-generation smart weapons, supported by partnerships with domestic suppliers and international allies. Additionally, Canada is investing in modernization programs to align with NATO commitments.

Asia-Pacific – Identified as the fastest-growing region, fueled by military modernization initiatives in China, India, South Korea, and Japan amid escalating territorial disputes in the South China Sea and along the Indo-Pak border. China continues to expand its indigenous smart weapons development, while India’s “Make in India” defense push is encouraging domestic production alongside foreign collaborations. South Korea and Japan are accelerating investments in missile defense and precision strike capabilities to counter regional threats.

Europe – Growth is underpinned by leading players such as BAE Systems, Thales, and Rheinmetall, alongside increased defense spending in the U.K., France, Germany, and Russia. The Russia-Ukraine war has significantly accelerated demand for smart munitions and modernized weapons systems across NATO states. EU defense cooperation initiatives, including the Permanent Structured Cooperation (PESCO) projects, are further supporting innovation and procurement of advanced weaponry.

Rest of the World – Middle Eastern countries, including the UAE, Saudi Arabia, and Israel, are investing heavily in smart weapons to strengthen deterrence capabilities. For example, in 2019, EDGE Group won a USD 1 billion contract to supply Desert Sting-16 guided munitions. Saudi Arabia is expanding its domestic defense manufacturing under Vision 2030, while Israel remains a global leader in smart weapons exports. In Latin America, Brazil is gradually increasing defense budgets with a focus on modernization, while African nations are beginning to adopt precision-guided systems, though at a smaller scale compared to other regions.

Market Dynamics

Growth Drivers:

Rising Demand for Precision Weapons: Essential for minimizing collateral damage and maximizing mission success.

Increasing Defense Expenditure: SIPRI reports highlight significant investments by the U.S., China, India, Russia, and Saudi Arabia.

Technological Advancements: AI integration, autonomous targeting, and advanced navigation systems improving accuracy.

Strategic Defense Contracts: Long-term deals with defense departments strengthening industry outlook.

Restraints:

Stringent Export Regulations: Policies in countries such as India, Australia, and the U.K. limiting market expansion.

Pandemic Disruptions: COVID-19 caused temporary production halts and delivery delays (e.g., Rafale production suspension in France, 2020).

Key Industry Developments

February 2021: Lockheed Martin secured a USD 414 million contract with the U.S. Navy and Air Force for Long-Range Anti-Ship Missiles (LRASM), enhancing maritime strike capabilities.

March 2020: Raytheon Technologies awarded an USD 86 million DoD contract to provide engineering services for the M982 Excalibur , a long-range precision artillery system.