Category: aerospace and defence

Airborne Optronics Industry Analysis, Forecast, Share and Trends, 2024–2032

By Rishika19, 2025-08-29

According to Fortune Business Insights™, the global airborne optronics industry size was valued at USD 2.03 billion in 2023 and is projected to grow from USD 2.53 billion in 2024 to USD 4.96 billion by 2032, registering a CAGR of 8.8% during the forecast period.

Growth is fueled by rising defense investments, increasing adoption of UAVs (unmanned aerial vehicles), and growing emphasis on ISR (intelligence, surveillance, and reconnaissance) missions. In 2023, North America led the market with a 34.98% share, supported by high military spending and the presence of major aerospace and defense companies.

What is Airborne Optronics?

Airborne optronics refers to the integration of optical and electronic technologies into aerial platforms—both manned and unmanned—for missions such as surveillance, targeting, navigation, and reconnaissance.

These systems employ infrared sensors, electro-optical modules, laser rangefinders, and AI-enabled processors to deliver high-resolution, real-time data. The result is improved situational awareness, mission accuracy, and platform survivability, making airborne optronics critical for both military modernization and commercial aviation safety.

Market Dynamics

Growth Drivers

1. Rising Adoption of UAVs

The proliferation of drones in both commercial and defense sectors is a major driver of market growth. UAVs require advanced optronics—such as infrared cameras, electro-optical targeting systems, and laser rangefinders—to conduct missions involving surveillance, target acquisition, and reconnaissance.

2. Increasing Focus on ISR Operations

The growing demand for intelligence, surveillance, and reconnaissance is reshaping defense strategies worldwide. Optronic systems equipped with EO/IR sensors and real-time data processing are essential for counterterrorism, homeland security, and border surveillance.

Restraints

Complex Installation and Maintenance

Integrating airborne optronics into platforms such as UAVs, fighter jets, and satellites is technically demanding, requiring custom designs, advanced testing, and specialized expertise. Moreover, these systems must endure harsh conditions like electromagnetic interference, extreme temperatures, and vibrations, which drive up maintenance costs.

Regular software upgrades, calibration, and spare parts replacement further escalate lifecycle expenses, presenting a key challenge for both manufacturers and end-users.

Market Trends

Integration of AI and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are transforming airborne optronics by enhancing object detection, automatic target classification, and decision-making speed.

AI-enhanced systems are also being applied to targeting and guidance, enabling faster and more precise engagements in combat scenarios.

Information Source:

https://www.fortunebusinessinsights.com/airborne-optronics-market-108108

Market Segmentation

By Aircraft Type

Fixed-wing aircraft dominated the market in 2023, accounting for nearly 44% of the share, owing to their extensive use in surveillance, targeting, and intelligence collection missions. Rotary-wing platforms are expected to record the fastest growth between 2024 and 2032, supported by their rising adoption in reconnaissance, search-and-rescue, and military operations. Unmanned Aerial Vehicles (UAVs) are also expanding rapidly, driven by the growing global adoption of drones across defense and commercial applications. Meanwhile, Urban Air Mobility (UAM) represents an emerging segment, benefiting from increasing investments in smart mobility and advanced aerial platforms.

By Application

The military sector remained the largest application segment in 2023, bolstered by modernization programs, intelligence, surveillance, and reconnaissance (ISR) missions, as well as border security initiatives. The commercial sector, however, is projected to grow at the fastest pace during the forecast period, fueled by rising demand for urban air mobility solutions, aviation safety systems, and monitoring applications. Space-based applications are also gaining traction, as satellites increasingly integrate advanced imaging technologies for ISR and Earth observation purposes.

By Technology

Multispectral technology held the largest share in 2023, valued for its broad spectral coverage, ability to support data fusion, and cost-effectiveness. Hyperspectral technology is anticipated to register the fastest growth through 2032, as it enables highly detailed spectral imaging that is critical for advanced reconnaissance, surveillance, and precise target identification.

By System

Reconnaissance systems accounted for the largest share and are expected to grow at the fastest pace, driven by the rising demand for ISR operations worldwide. Other key system categories include targeting systems, search & track systems, surveillance systems, warning & detection systems, countermeasure systems, navigation & guidance systems, and special mission systems, each supporting specialized defense and commercial applications.

By End-User

Original Equipment Manufacturers (OEMs) represented the largest end-user segment in 2023, as new aircraft production continues to incorporate advanced optronics solutions. The aftermarket segment is also witnessing robust growth, propelled by increasing requirements for maintenance, system upgrades, and retrofitting of existing platforms to enhance operational capabilities.

Regional Insights

North America – Largest market, valued at USD 0.71 billion in 2023, driven by U.S. defense spending and aerospace giants like Lockheed Martin, Northrop Grumman, and L3Harris.

Europe – Strong market presence with companies such as Thales, Safran, and Leonardo advancing ISR and defense modernization.

Asia Pacific – Fastest-growing, with China and India boosting defense budgets and focusing on indigenous UAV and ISR programs.

Middle East & Africa – Growth led by military modernization in Saudi Arabia, Israel, and UAE.

Latin America – Emerging demand in Brazil and Mexico for border surveillance and counter-narcotics operations.

Key Industry Players

Major companies shaping the airborne optronics industry include:

L3Harris Technologies (U.S.)

Safran (France)

Elbit Systems (Israel)

Hensoldt AG (Germany)

Northrop Grumman (U.S.)

Lockheed Martin (U.S.)

Collins Aerospace (U.S.)

FLIR Systems (U.S.)

Thales (France)

Leonardo S.p.A. (Italy)

These players are investing in AI integration, multispectral/hyperspectral imaging, lightweight designs, and strategic collaborations to expand their portfolios.

Recent Developments

May 2024 – The U.S. Air Force awarded SNC a multibillion-dollar contract to modernize the E-4B “Nightwatch” aircraft, also known as the "Doomsday Plane," enhancing command-and-control capabilities for national security leadership.

Military Communication Industry Growth, Dynamics, Forecast and Analysis, 2024–2032

By Rishika19, 2025-08-29

According to Fortune Business Insights™, the global military communication industry size was valued at USD 33.12 billion in 2023 and is projected to grow from USD 34.74 billion in 2024 to USD 60.40 billion by 2032, exhibiting a CAGR of 7.2% during the forecast period.

Market growth is driven by the rising demand for secure, real-time, and multi-domain communication systems, the integration of wireless tactical networks, and the growing adoption of SATCOM (Satellite Communication) to enhance battlefield situational awareness.

North America Leads with 31.49% Market Share

In 2023, North America accounted for 31.49% of the global share, supported by high defense budgets, advanced technological infrastructure, and the presence of leading contractors such as Lockheed Martin, Northrop Grumman, and L3Harris Technologies.

The U.S. military continues to prioritize SATCOM-based systems, encrypted tactical radios, and secure communication protocols to ensure seamless coordination between commanders, deployed forces, and allied partners. Furthermore, programs like Joint All-Domain Command and Control (JADC2) and Warfighter Information Network-Tactical (WIN-T) are reinforcing wireless, real-time communication capabilities across all domains.

Market Dynamics

Growth Factors

1. Increasing Procurement of Advanced Communication Systems

The defense sector places a premium on confidential and accurate communication, critical for surveillance, command, and control. Rising geopolitical disputes are driving defense investments in advanced communication systems with enhanced security and privacy features to safeguard sensitive information.

2. Adoption of Wireless Communication Technologies

Evolving wireless technologies such as SATCOM, VHF/UHF communication, and 5G-enabled networks are replacing traditional wired systems. The U.S. military’s JADC2 program, which unifies sensors across the Army, Navy, Air Force, Marine Corps, and Space Force, highlights the growing adoption of next-generation wireless tactical communication.

3. IoT and Next-Gen Technologies

The integration of IoT-based communication, Ka-band technology, and 5G is enhancing interoperability, situational awareness, and network resilience, creating multiple growth opportunities for the market.

Restraining Factor

High Development and Infrastructure Costs

Developing advanced communication satellites requires investments of around USD 1 billion, while launch costs range from USD 55 million to USD 90 million per satellite. The high cost of infrastructure, installation, and maintenance remains a key challenge for market expansion.

Market Trends

Growing Adoption of SATCOM Systems

As modern battlefields become increasingly network-centric, military satellite communication systems (Military SATCOM) are emerging as a cornerstone of defense infrastructure. These systems provide secure, global, and high-bandwidth connectivity, ensuring reliable information sharing across air, ground, naval, and space domains.

Naval forces, in particular, rely heavily on SATCOM for network-centric warfare, enabling seamless connectivity between sensors, platforms, and weapons systems.

Information Source:

https://www.fortunebusinessinsights.com/military-communications-market-102696

Segmentation Overview

By Component

Hardware – Dominated the market in 2023 and is expected to grow fastest, driven by rising adoption of tactical radios, handheld and man-portable systems, antennas, and transceivers.

Software – Expected to witness significant growth due to rising adoption of software-defined radios (SDRs).

By Hardware

Antennas – Accounted for the largest share in 2023, fueled by applications in surveillance, SATCOM, electronic warfare, and navigation.

Receivers – Ranked second, supported by next-gen upgrades such as advanced multiband GPS-enabled radios supplied under contracts by L3Harris and others.

By Technology

SATCOM – Dominated the market in 2023 due to its role in ISR and combat operations.

VHF/UHF/L-Band – Accounted for 26.08% share in 2023.

Data Link – Expected to expand significantly, supported by programs like Link 16 for real-time tactical data exchange.

By Platform

Ground – Held the largest share in 2023 due to extensive use of ground antennas and secure communication systems.

Airborne – Expected to record notable growth with next-generation avionics integration in fighter aircraft, including SATCOM systems by Viasat.

Naval and Space – Anticipated to witness steady demand, supported by network-centric warfare applications.

Regional Insights

North America – Largest market in 2023, supported by U.S. defense spending and leading OEMs.

Europe – Fastest-growing region, driven by increased defense modernization amid the Russia-Ukraine conflict.

Asia Pacific – Second-largest market, led by rising military budgets in China and India.

Middle East & Africa – Moderate growth fueled by defense investments in Saudi Arabia, Israel, and the UAE.

Latin America – Gradual growth driven by Brazil and Mexico’s defense upgrades.

Competitive Landscape

The market is highly competitive, with leading players focusing on R&D investments, strategic acquisitions, and long-term defense contracts to expand their portfolios.

Top Companies in the Military Communication Market:

ASELSAN A.S. (Turkiye)

General Dynamics Corporation (U.S.)

L3Harris Technologies, Inc. (U.S.)

Viasat Inc. (U.S.)

Cobham PLC (U.K.)

BAE Systems PLC (U.K.)

Elbit Systems Ltd. (Israel)

Lockheed Martin Corporation (U.S.)

Northrop Grumman Corporation (U.S.)

RTX Corporation (U.S.)

Recent Developments

March 2024 – The U.S. Space Force awarded Boeing a USD 439.6 million contract to develop the WGS-12 military communications satellite, part of the Wideband Global SATCOM constellation.

Aircraft Communication System Industry Analysis, Forecast and Share, 2024–2032

By Rishika19, 2025-08-28

According to Fortune Business Insights™, the global aircraft communication system industry was valued at USD 17.12 billion in 2024 and is projected to reach USD 33.52 billion by 2032, registering a CAGR of 8.8% during the forecast period. The market growth is primarily driven by the increasing need for secure, efficient, and real-time communication between aircraft and ground control, along with rapid advancements in satellite-based communication, software-defined radios (SDR), and high-speed data link technologies.

Market Overview

Aircraft communication systems (ACARS) integrate audio systems, communication radios, tuning units, cockpit voice recorders (CVRs), antennas, and static dischargers to facilitate seamless air-to-ground and in-flight communication. The growing air traffic, stringent safety requirements, and rising adoption of satellite-based navigation and wireless communication systems are boosting demand across both commercial and defense aviation.

The increasing commercialization of Unmanned Aerial Vehicles (UAVs) presents additional opportunities. For instance, in April 2019, Honeywell International Inc. extended a contract with OJets to provide in-flight connectivity services for business aircraft, highlighting the rising demand in the UAV segment.

Impact of Geopolitical Tensions

The Russia-Ukraine war has notably influenced the aircraft communication system industry, increasing the emphasis on secure and resilient communication technologies. The conflict disrupted global supply chains, causing delays and higher costs for aviation components, including communication systems. Heightened security requirements have spurred demand for tamper-proof and reliable communication solutions, while restricted airspaces and altered flight routes have necessitated more robust and adaptable infrastructures.

Key Growth Drivers

Increase in Aircraft Deliveries

The rising number of aircraft deliveries is fueling market growth. For example, Airbus planned to deliver 863 commercial jets by 2019, driving procurement of audio integrating systems, antennas, cockpit voice recorders, and static dischargers. In commercial aircraft such as the Airbus A320 and Boeing 767, multiple antennas are deployed for in-flight broadband communication, enabling reliable connectivity at altitudes up to 50,000 ft.

The growing demand for military helicopters, commercial aviation, and regional jets is also expected to propel the military aircraft communication system market during the forecast period.

Software Defined Radio (SDR) Adoption

SDR technology is transforming aircraft communication systems by providing a software-enabled digital infrastructure. SDR decodes incoming radio signals and enhances the accuracy and efficiency of radio communication, helping pilots receive real-time operational data. The increasing adoption of SDR across commercial and military aviation is a key factor driving market growth.

Restraining Factors

The high development cost of aircraft communication systems is a major challenge. Advanced systems include expensive antennas, communication radios, and audio integration components. Rapid technological changes in aircraft antennas and limited availability of radio spectrum from regulatory authorities may also constrain market growth.

Information Source:

https://www.fortunebusinessinsights.com/aircraft-communication-system-market-102541

Market Segmentation

By Component: The antennas segment dominates the aircraft communication system market, driven by the rising need for reliable wireless communication systems in both commercial and defense aviation. Modern antennas, such as the AV-17 RAMI and AV-529 RAMI, support air-to-ground communication as well as in-flight broadband connectivity, enabling seamless data transmission for navigation, weather monitoring, and passenger connectivity. These antennas are designed to withstand high-altitude and high-speed conditions, ensuring uninterrupted communication across long distances. The transponder segment is also expected to grow significantly, particularly ADS-B-enabled transponders, which provide real-time aircraft position data, enhancing safety and air traffic management. Products like uAvionix’s tailBeaconX integrate with EFIS (Electronic Flight Instrument Systems) to deliver enhanced situational awareness and ensure compliance with global aviation regulations. Other components, including receivers, transmitters, SDR units, and radio tuning systems, complement the core communication infrastructure, further supporting growth in this segment.

By System: The radio communication system holds the largest market share, accounting for 29.5% in 2023, driven by its widespread adoption across commercial, military, and business aircraft. Radio communication systems, encompassing VHF, HF, and UHF transceivers, facilitate long-range voice communication, essential for air traffic coordination and operational safety. The cockpit voice recorder (CVR) segment is projected to grow rapidly, driven by regulatory mandates from authorities such as the FAA and ICAO. The FAA, for instance, proposed extending CVR recording duration to 25 hours for newly manufactured aircraft, necessitating upgrades to existing systems and boosting market demand for advanced CVRs with longer recording capacity and improved durability.

By Connectivity: Satellite communication (SATCOM) is anticipated to witness the fastest growth, fueled by increasing adoption of satellite-based voice and data services in both commercial and military aviation. SATCOM enables aircraft to maintain continuous global connectivity, even over remote or oceanic regions where conventional radio communication is limited. Additionally, VHF, UHF, and L-Band antennas are projected to see strong adoption, supporting in-flight entertainment, data streaming, and line-of-sight communication applications. The integration of Software Defined Radio (SDR) further enhances connectivity by allowing flexible frequency management, modulation, and data rate adjustment in real time.

By Fit Type: The line fit segment dominates due to increasing incorporation of advanced communication systems in newly delivered UAVs, commercial jets, and military aircraft. Line fit installations offer optimal system integration, ensuring maximum performance, reliability, and compliance with aircraft certification standards. The retrofit segment is also witnessing significant growth as airlines and defense operators upgrade legacy systems to next-generation antennas, including 5G-ready and SATCOM-enabled solutions, to meet evolving operational requirements and passenger expectations.

By Platform: Within aircraft platforms, the fixed-wing segment is expected to witness the fastest growth, supported by the rising number of commercial aircraft deliveries globally, including aircraft like the Boeing 787, Airbus A320, and Airbus A380, which employ multiple antennas and radio communication systems for both passenger and operational connectivity. The rotary-wing segment, including military and commercial helicopters, is also expected to grow due to increased deployment of GPS, HF, and VHF antennas for surveillance, reconnaissance, navigation, and communication applications. Enhanced communication capabilities are particularly critical for mission-critical operations in military, search and rescue (SAR), and oil & gas sectors, driving demand for robust, high-performance communication systems.

Regional Insights

North America is expected to hold the largest market share, driven by high air passenger traffic, UAV adoption, and the presence of key industry players such as Lockheed Martin and Northrop Grumman.

Asia Pacific is projected to see significant growth due to the rising utilization of UAVs and 3D-printed aircraft antennas, particularly in China. Airbus forecasts over 7,000 passenger aircraft will be required in the region by 2037.

Europe is estimated to grow rapidly due to increased investments in military UAVs and GPS-enabled helicopters for search and rescue operations.

Middle East & Africa and Latin America are also expected to register steady growth, driven by helicopter usage for oil, gas, and commercial applications.

Key Players

Leading companies in the aircraft communication system market include:

- Cobham Plc (U.K.)

- General Dynamics Corporation (U.S.)

- Thales Group (France)

- Harris Corporation (U.S.)

- United Technologies Company (U.S.)

- Honeywell International Inc. (U.S.)

- Iridium Communications Inc. (U.S.)

- l3harris technologies (U.S.)

- Lockheed Martin Corporation (U.S.)

- Northrop Grumman Systems Corporation (U.S.)

- Raytheon Company (U.S.)

- Rohde & Schwarz GmbH & Co KG (Germany)

- Viasat, Inc. (U.S.)

Cobham Plc, for example, offers a broad portfolio of SATCOM, VHF, and datalink antennas to support reliable communication across helicopters, regional jets, business jets, and wide-body aircraft.

Recent Industry Developments

April 2024: BAE Systems secured a USD 459 million contract from the U.S. Department of Defense for the supply of hardware, repair services, and technical support for the AN/ARC-231/A Multi-mode Aviation Radio Suite, highlighting ongoing demand for advanced communication solutions in defense aviation.

According to Fortune Business Insights™, the global smart weapons industry was valued at USD 18.99 billion in 2023 and is projected to expand from USD 20.20 billion in 2024 to USD 45.24 billion by 2032, registering a CAGR of 10.61% during the forecast period. Growth is driven by rising global defense budgets, increasing military modernization programs, and the growing demand for precision strike capabilities in modern combat environments.

Market Overview

The global defense landscape is rapidly evolving, shaped by geopolitical tensions, cross-border disputes, and asymmetric warfare. Militaries are prioritizing precision, flexibility, and reduced collateral damage, which has accelerated the adoption of smart weapons systems worldwide.

Smart weapons—including guided bombs, cruise missiles, directed-energy weapons, and satellite/laser-guided systems—provide superior accuracy, extended operational range, and improved mission success rates compared to conventional arms.

In 2023, North America led the market with a 33.86% share, supported by high U.S. defense spending and the presence of leading contractors such as Lockheed Martin, Northrop Grumman, and Raytheon Technologies.

Growth Factors

Increasing Need for Precision Weapons

Rising warfare activities and cross-border disputes are boosting the demand for highly accurate and cost-effective weapons. Precision-guided systems offer enhanced range, minimal training requirements, and higher mission efficiency.

Surging Defense Budgets

Defense spending continues to rise globally. For example, the U.S. allocated USD 732 billion in 2020, while China, India, Russia, and Saudi Arabia collectively invested hundreds of billions more. These budgets directly support procurement of advanced smart weapons.

Modernization Programs

Ongoing replenishment and modernization initiatives are driving contracts for advanced systems. In March 2020, Raytheon Technologies signed a USD 110 million contract with the U.S. Navy to upgrade radar-guided gun systems.

Information Source:

https://www.fortunebusinessinsights.com/smart-weapons-market-104058

Restraining Factors

Stringent Regulations

Strict firearm and weapons regulations in countries such as India, New Zealand, Australia, and the U.K. hinder market growth. For instance, New Zealand banned semi-automatic weapons in 2019 after the Christchurch attacks.

Market Segmentation

By Product:

The missiles segment is projected to dominate the guided weapons market, driven by increasing defense budgets and the strategic need for advanced long-range precision strike capabilities. These systems are crucial for modern military operations, providing accuracy, speed, and lethality. Munitions are expected to record the highest growth rate, as militaries worldwide increasingly adopt precision-guided bombs and artillery shells to minimize collateral damage during counter-terrorism operations and cross-border conflicts. Additionally, segments such as guided projectiles, guided rockets, and directed energy weapons are experiencing steady adoption due to technological advancements, operational versatility, and integration into modern combat platforms.

By Platform:

The land segment is anticipated to be the fastest-growing, fueled by growing army procurements and modernization programs. Ground forces are investing in next-generation guided missiles, rockets, and munitions to enhance battlefield effectiveness and mobility. Air platforms are also experiencing significant growth, supported by air force modernization initiatives and the deployment of precision air-to-ground weapons that improve strike accuracy and operational efficiency. The naval segment, while holding a moderate share of 23.33% in 2023, is seeing rising interest in directed energy weapons and missile systems to enhance maritime defense capabilities against modern threats, including unmanned surface vessels and incoming missile attacks.

By Technology:

Laser guidance technology is forecasted to witness the highest growth due to its ability to provide highly accurate targeting in real-time, even against moving targets. Satellite guidance systems are also expected to see strong demand as GPS-based technologies enable precision strikes in all weather conditions and challenging terrains, enhancing operational reliability. Infrared and radar guidance continue to be widely adopted, offering versatile tracking and targeting solutions across multiple platforms. These technologies allow military forces to engage targets effectively in diverse scenarios, from close-range skirmishes to long-range strategic operations.

Regional Insights

North America (USD 6.43 billion, 2023)

The largest market, benefiting from high defense budgets and advanced modernization programs. U.S. procurement of over 6,000 munitions in 2019 highlights strong demand.

Asia-Pacific

Expected to showcase the fastest growth, driven by defense investments in China, India, Japan, and South Korea amid rising regional conflicts and terrorism.

Europe

Significant growth projected due to defense expansions in the U.K., France, and Russia, alongside contributions from players such as BAE Systems, Thales Group, and Rheinmetall AG.

Rest of the World

Middle Eastern countries like the UAE and Saudi Arabia are investing heavily in precision weapons. In 2019, EDGE (UAE) signed a USD 1 billion contract to deliver Desert Sting-16 precision weapons.

Key Players

- BAE Systems (The U.K)

- Boeing (The U.S.)

- General Dynamics Corporation (The U.S.)

- Lockheed Martin Corporation (The U.S.)

- MBDA (France)

- Northrop Grumman Corporation (The U.S.)

- Raytheon Company, a Raytheon Technologies company (The U.S.)

- Rheinmetall AG (Germany)

- Textron Inc. (The U.S.)

- Thales Group (France)

Leading players focus on business expansion, contracts, and acquisitions. For example, in February 2021, Lockheed Martin secured a USD 414 million contract with the U.S. Navy and Air Force for LRASM (Long-Range Anti-Ship Missile) systems.

Key Industry Developments

February 2021 – Lockheed Martin signed a USD 414 million contract with the U.S. Navy and Air Force for LRASM delivery.

January 2021 – India’s DRDO successfully tested the Smart Anti-Airfield Weapon (SAAW) on HAL’s Hawk-I jet.

2019–2020 – Multiple modernization contracts signed, including Elbit Systems’ USD 30 million supply of precision-guided mortar munitions to an Asia-Pacific nation.

According to Fortune Business Insights™, the global aircraft fairing industry was valued at USD 1.41 billion in 2020 and is projected to grow from USD 1.46 billion in 2021 to USD 2.60 billion by 2028, registering a CAGR of 8.59% during the forecast period. The steady expansion of this market is primarily fueled by the rising demand for lightweight, aerodynamic components that enhance fuel efficiency, reduce drag, and improve overall aircraft performance and aesthetics.

Market Overview

Aircraft fairings are essential aerodynamic structures designed to smoothen an aircraft’s profile by covering gaps, joints, and structural components. Their role is critical in reducing drag, delaying boundary layer separation, and enhancing both fuel efficiency and overall performance. Additionally, fairings contribute significantly to an aircraft’s aesthetics, making them an indispensable part of modern aerospace engineering.

A widely recognized example is the flap track fairing, a pod-like structure located under an aircraft’s wings. While Boeing and Airbus aircraft use fairings of similar configurations, McDonnell Douglas designs feature distinctive vertical fairings that also house hydraulic actuators. Depending on the application, fairings are manufactured using aluminum or advanced composite materials, with composites increasingly favored due to their lightweight and high-strength properties.

The design and manufacturing of aircraft fairings form a crucial stage in aircraft production, requiring careful consideration of aerodynamic efficiency, weight reduction, and component integration. With global passenger air traffic steadily increasing, demand for new aircraft deliveries and fleet modernization is rising, further driving the need for advanced fairing systems that reduce operational costs and improve performance.

Market Dynamics

Growth Drivers

1. Rising Demand for Composite Aerostructures

Lightweight composite materials are becoming a standard in modern aircraft design. Engineers prioritize high strength-to-weight ratios to improve payload capacity and fuel efficiency. The growing adoption of composite aerostructures—such as fairings, doors, and control surfaces—is a significant factor accelerating market growth.

2. Procurement of Lightweight Aircraft

With the aviation industry focusing on fuel efficiency and sustainability, airlines and defense organizations are increasingly procuring lightweight aircraft. The rise of low-cost carriers (LCCs) and expanding military aircraft acquisitions—such as trainers and multi-role fighter jets—are expected to further boost demand for aircraft fairings.

Restraining Factors

Backlogs in Aircraft Orders

Order accumulation and delivery delays remain significant challenges for aircraft manufacturers, hindering timely adoption of new components such as fairings. The COVID-19 pandemic further amplified this issue, with commercial aircraft deliveries falling sharply to 723 units in 2020, down 42% from 2019. This marked the second consecutive year of declining deliveries, creating bottlenecks in market growth.

Information Source:

https://www.fortunebusinessinsights.com/aircraft-fairings-market-105857

Key Market Trends

Embracing 3D Printing for Aircraft Components

Additive manufacturing is rapidly transforming the aerospace supply chain by enabling on-demand production of complex composite and metal parts. From maintenance, repair, and overhaul (MRO) services to Urban Air Mobility innovations, 3D printing is driving efficiency across the industry.

For example, in November 2021, Materialise and Proponent announced a partnership to expand 3D printing applications in aerospace aftermarket supply chains. Proponent already delivers 54 million parts annually to nearly 6,000 clients worldwide, and the integration of 3D printing is set to further strengthen aftermarket support for engines, airframes, and interiors.

Segmentation Analysis

By Platform

Commercial Aircraft : Dominated the market in 2020 and is projected to retain leadership due to rising global air traffic and fleet modernization programs.

Military Aircraft : Expected to record the fastest growth, driven by increasing defense budgets and demand for multi-role combat and transport aircraft.

Regional & General Aviation : Will contribute steadily, supported by increasing private and business jet adoption.

By Application

Fuselage : Held the largest share in 2020 due to advancements in structural design aimed at reducing weight and improving durability.

Landing Gear : Emerging as a high-growth segment as manufacturers develop lighter yet more robust systems.

Engine, Control Surfaces, Radars & Antennas : Continue to see steady adoption with performance-focused design innovations.

By Material

Composites : Dominated the market in 2020 and will continue leading due to their superior strength-to-weight ratio and fuel-saving properties.

Aluminum : Expected to decline gradually owing to high operating and maintenance costs compared to composites.

Alloys : Will maintain a niche share across specific applications.

Regional Insights

North America : Valued at USD 540 million in 2020, the region remains the largest market due to strong presence of major OEMs like Boeing and a high volume of commercial and cargo operations led by airlines such as Delta, FedEx, and UPS.

Europe : Expected to witness moderate growth, supported by aerospace giants such as Airbus, Leonardo Spa, and Saab AB.

Asia Pacific : Forecast to record the fastest growth, driven by increasing air passenger traffic in China, India, and Japan. The Indian aviation sector, in particular, is witnessing rapid expansion in commercial aircraft deliveries.

Middle East & Africa : Growth will be propelled by rising tourism and general aviation demand, with Strata Manufacturing (UAE) playing a central role in boosting regional production capabilities.

Competitive Landscape

The aircraft fairing market is moderately consolidated, with major players focusing on lightweight, fuel-efficient designs. Key companies are expanding production capacity, entering partnerships, and adopting new materials to strengthen their global footprint.

Top Market Players:

Airbus (France)

Boeing (U.S.)

Strata Manufacturing (UAE)

SAAB AB (Sweden)

Lockheed Martin (U.S.)

FACC AG (Austria)

Daher (France)

Malibu Aerospace (U.S.)

Avcorp (Canada)

Barnes Group (U.S.)

Royal Engineered Composites (U.S.)

ShinMaywa (Japan)

Recent Developments:

December 2021 : Airbus completed the final structural assembly of its first A321XLR test aircraft, integrating engines, landing gear, and door fairings. This milestone represents a significant step toward delivering long-range, fuel-efficient narrow-body aircraft.

February 2021 : Boeing announced a new production line at Tata Boeing Aerospace Limited (India) to manufacture advanced vertical fins for the 737 MAX family.

According to Fortune Business Insights™, the global digital shipyard industry size stood at USD 963.6 million in 2020 and is projected to surge from USD 1,129.6 million in 2021 to USD 3,444.5 million by 2028, registering a CAGR of 17.27% during the forecast period. This growth is being accelerated by the maritime sector’s transition toward Industry 4.0 technologies, automation, and operational efficiency in both commercial and defense shipbuilding.

Market Overview

Digital shipyards represent a paradigm shift in the shipbuilding industry. By leveraging IoT, artificial intelligence (AI), digital twins, robotics, and additive manufacturing, shipbuilders are replacing traditional methods with highly automated and data-driven processes. These advanced technologies enable real-time decision-making, improved life-cycle management, and greater production agility.

The integration of cyber-physical systems (CPS) and robotic process automation (RPA) is streamlining operations, lowering costs, and accelerating vessel delivery timelines. With maritime trade continuing to expand and governments modernizing naval fleets, digital shipyards are quickly becoming a strategic necessity.

Key Market Insights

Adoption of digital twins, IoT-enabled sensors, and 3D modeling is improving efficiency across design, maintenance, and operations.

Leading shipbuilders are increasingly turning to predictive analytics and automated robotics to enhance productivity and safety.

Navantia (Spain) partnered with Siemens Digital Industries Software in 2019 to fully digitalize its shipbuilding operations.

Major Industry Players

Key companies driving digital shipyard innovation include:

- IFS AB (Sweden)

- Pemamek Oy (Finland)

- Dassault Systemes (France)

- BAE Systems (U.K.)

- Altair Engineering, Inc. (U.S.)

- AVEVA Group Plc. (U.K.)

- Wartsila (Finland)

- KUKA AG (Germany)

- Damen Shipyards Group (Netherlands)

- Prostep AG (Germany)

Information Source:

https://www.fortunebusinessinsights.com/digital-shipyard-market-106561

Market Segmentation

By Shipyard Type

Commercial Shipyards : Dominated the market in 2020, fueled by increasing global seaborne trade. With UNCTAD estimating 80% of global trade volume carried by sea, demand for digitalization in commercial shipyards is soaring.

Military Shipyards : Expected to grow steadily as governments invest in digital twins and next-generation defense technologies.

By Technology Platform

Robotic Process Automation (RPA) : Held the largest market share in 2020, driven by automation in welding, cutting, and painting. For instance, a Ulsan-based shipyard reported saving USD 9.4 million annually through automated welding.

AI & Big Data Analytics : Accounted for 28.22% of the market in 2020 and projected to grow rapidly as AI-driven robotics reduce reliance on human intervention.

Additive Manufacturing, Digital Twin, Blockchain, IIoT : Emerging as transformative technologies for advanced shipbuilding.

By Digitalization Level

Semi-Digital Shipyards : Largest segment in 2020, as more companies adopt partial automation.

Fully Digital Shipyards : Forecast to record the highest CAGR, fueled by rising adoption of IIoT, AR, and digital twins in advanced shipbuilding projects.

Market Growth Drivers

Industrial Internet of Things (IIoT) Integration

Real-time data, advanced sensors, and AI-driven analytics are boosting productivity, minimizing downtime, and improving workplace safety.

Rising Use of Robotics in Shipbuilding

Industry leaders like Hyundai Heavy Industries, Samsung Heavy Industries, and DSME are increasingly deploying robots across welding, assembly, and painting lines to reduce labor costs and improve quality.

Restraining Factor

High Capital Investment is considered a major restraint because adopting advanced systems requires significant upfront spending. Shipbuilders must invest heavily in specialized hardware such as sensors, navigation systems, and communication modules, along with software solutions for data processing, monitoring, and automation. On top of that, there are expenses for system integration, which ensures all components work seamlessly, and for ongoing maintenance, which adds to long-term costs.

For large shipbuilding companies, these expenses can be managed due to bigger budgets and government contracts. However, for small and mid-sized shipbuilders, the financial burden is much heavier. This cost barrier makes it difficult for them to implement advanced technologies at scale, ultimately slowing the overall adoption rate across the industry.

Emerging Market Trends

Additive Manufacturing Surge : The rapid adoption of 3D printing is transforming the shipbuilding sector by streamlining part fabrication and repair processes. On-site production of metal components significantly reduces lead times, minimizes downtime, and lowers overall costs. This technological shift enhances operational flexibility for shipbuilders and supports faster maintenance cycles, ultimately improving fleet availability and efficiency.

AI-Powered Smart Shipyards : The integration of advanced digital technologies is reshaping modern shipyard operations. For instance, in September 2024, ST Engineering launched a next-generation smart shipyard in Singapore that leverages artificial intelligence, 5G connectivity, Internet of Things (IoT), and predictive maintenance. This development highlights how smart maritime infrastructure is driving automation, improving operational efficiency, and setting new benchmarks for future shipbuilding and repair practices.

Regional Insights

Asia Pacific : Accounted for USD 323.3 million in 2020 and will remain the largest market, supported by dominant shipbuilders in South Korea, Japan, and China, which together build over 90% of global cargo ships.

Europe : Growth driven by investments in robotics, digital platforms, and 3D visualization tools.

North America : Expansion expected due to strong R&D activity and digitalization projects in naval shipyards.

Middle East, Africa, and South America : Moderate growth expected as governments explore fleet modernization and local shipbuilding investments.

Competitive Landscape

Market leaders are pursuing strategic collaborations, R&D investments, and automation projects to strengthen their position. Companies such as SAP and Accenture are collaborating to develop cloud-based shipbuilding solutions, while others are investing heavily in AI, IoT, and AR-based robotics.

Recent Developments

June 2021 – Drydocks World launched a digital transformation project with IFS Cloud for asset management and resource planning, laying the foundation for a fully digital shipyard.

According to Fortune Business Insights™, the global LiDAR drone industry size was valued at USD 129.0 million in 2020 and is projected to grow from USD 143.0 million in 2021 to USD 455.0 million by 2028, at a CAGR of 17.98% during the forecast period.

North America led the global market in 2020 with a 39.74% share, supported by widespread adoption across infrastructure, forestry, and defense applications. However, the COVID-19 pandemic disrupted operations, causing a decline of -5.6% in 2020 compared to the average annual growth recorded between 2017–2019.

Market Overview

LiDAR drones, unmanned aerial vehicles (UAVs) equipped with Light Detection and Ranging (LiDAR) sensors, are revolutionizing 3D mapping, terrain modeling, structural inspections, and object detection. Compared to traditional surveying methods, these drones deliver faster data collection, higher accuracy, and lower costs, making them vital for industries such as construction, precision agriculture, archaeology, and forestry.

The demand for UAV LiDAR systems is largely fueled by their enhanced image resolution, rapid automated data processing, and ability to produce high-quality 3D images. A surge in the use of 3D imaging technology and the rising deployment of drones for terrain exploration, environmental monitoring, and heritage studies are accelerating market growth.

Growth Factors

Rising Adoption of Cost-Effective 3D Mapping Solutions

Advances in laser sensors and UAV platforms are expanding applications in vegetation monitoring, precision farming, archaeology, and large-scale infrastructure surveys. LiDAR-based mapping provides highly accurate georeferenced data for urban development and forestry management.

Increased Deployment in Corridor Mapping

LiDAR drones are increasingly utilized for surveying highways, railways, bridges, and shoreline infrastructure, especially in mountainous or dense landscapes. Their ability to generate high-resolution point clouds at lower operational costs makes them indispensable in modern infrastructure projects.

Information Source:

https://www.fortunebusinessinsights.com/lidar-drone-market-102602

Market Restraints

Strict Aviation Regulations governing UAV operations.

High Acquisition and Maintenance Costs compared to alternatives like photogrammetry.

Shortage of Skilled Operators capable of handling long-range UAVs.

Market Trends

Next-Generation UAV LiDAR Sensors

Manufacturers are developing compact, lightweight, and high-resolution sensors integrated with navigation and positioning systems. Key innovations include optical altimeter-based systems and MEMS (micro-electromechanical systems) laser scanners, enhancing resolution, density, and mapping precision for government, industrial, and environmental projects.

Segmentation Insights

By Product

Rotary-Wing Drones held the largest market share in 2020 and are projected to maintain dominance due to their cost-effectiveness, easy control, and widespread adoption in 3D mapping and corridor applications.

Fixed-Wing Drones are expected to register the fastest growth, driven by rising demand for long-range detection, Beyond Line of Sight (BLOS) operations, and larger payload capacities.

By LiDAR Type

Mechanical LiDAR dominated in 2020, widely adopted for 360-degree data detection across large areas.

Solid-State LiDAR is projected to grow at the highest CAGR owing to its compact chip-based design, reduced cost, and ability to deliver superior resolution in precision agriculture and corridor mapping.

By Range

Short-Range LiDAR accounted for the largest share in 2020, supported by strong adoption in low-altitude applications.

Long-Range LiDAR is anticipated to grow at the fastest pace, benefiting from advancements in laser technology that enable accurate detection from higher altitudes.

By Application

Mapping and Cartography dominated in 2020, driven by rising demand from infrastructure, agriculture, oil & gas, and energy utilities.

Other applications include environment monitoring, surveillance, exploration and detection, and precision agriculture.

Regional Insights

North America : Valued at USD 51.27 million in 2020, the region will continue to lead due to favorable drone regulations, strong R&D, and the presence of key players such as Velodyne Lidar, Phoenix LiDAR Systems, and LiDARUSA.

Europe : The second-largest market, driven by demand for 3D image mapping and environmental monitoring, supported by leading manufacturers like Leica Geosystems, Delair, and YellowScan.

Asia Pacific : Expected to witness the fastest growth owing to the strong presence of UAV and component manufacturers in China and India, alongside applications in agriculture and precision farming.

Middle East & Africa : Moderate growth fueled by infrastructure development and increasing adoption in government projects.

Rest of the World : Gradual growth supported by cost-effective drone surveys in Turkey, South Africa, and other regions.

Key Industry Players

Leading companies are investing heavily in R&D, partnerships, and acquisitions to expand their product portfolios and global presence. Major players include:

- Velodyne Lidar, Inc. (U.S.)

- Teledyne Optech Inc. (Canada)

- RIEGL Laser Measurement Systems GmbH (Austria)

- Delair SAS (France)

- Phoenix LiDAR Systems (U.S.)

- Leica Geosystems AG (Switzerland)

- Yellow Scan (France)

- LiDARUSA (U.S.)

- SZ DJI Technology Co., Ltd (China)

- Benewake (Beijing) Co., Ltd. (China)

- RoboSense (China)

- Sick AG (Germany)

- Microdrones (Germany)

Recent Developments

July 2021 – Microdrones completed a high-precision LiDAR survey in Minas Gerais, Brazil, covering a 10 km² mining complex containing three dams. The project was executed within a week, supporting risk analysis and demonstrating the efficiency of LiDAR drone technology in large-scale industrial applications.

According to Fortune Business Insights™, the global drone sensors market was valued at USD 394.7 million in 2020 and is projected to expand to USD 2,342.1 million by 2028, registering an impressive CAGR of 25.08% during the forecast period (2021–2028). This rapid growth is primarily fueled by the increasing integration of unmanned aerial systems (UAS) across both defense and commercial sectors worldwide.

Market Overview

The drone sensors market is experiencing strong momentum, driven by rising adoption of UAVs across industries such as agriculture, logistics, aerial imaging, public safety, and defense. UAVs rely heavily on advanced sensors—including image, inertial, pressure, and distance sensors—for accurate navigation, flight stability, and real-time data capture.

As industries seek more autonomous and intelligent operations, the demand for advanced sensors has surged. High-quality sensor systems enable drones to conduct long-range flights, perform precise imaging, and provide enhanced surveillance, all of which are essential in modern commercial and defense applications.

Key Market Growth Drivers

Expanding Commercial Applications

Drone technology is revolutionizing industries by offering automated, efficient, and cost-effective solutions. From precision agriculture and logistics to wildlife monitoring and aerial photography, drones are increasingly equipped with advanced sensors that enable real-time imaging, navigation, and data analytics.

Military Adoption of UAVs

Defense organizations are significantly increasing investments in unmanned aerial systems for intelligence, surveillance, reconnaissance (ISR), and target acquisition. Advanced sensors—such as infrared, LiDAR, gyroscopes, and barometric systems—enhance drone efficiency in complex and hostile environments.

Information Source:

https://www.fortunebusinessinsights.com/drone-sensor-market-102596

Market Segmentation Insights

By Sensor Type

Image Sensors (thermal, infrared, multispectral) are expected to witness the fastest CAGR due to rising demand in aerial imaging for agriculture and construction.

Inertial Sensors remain crucial for navigation and motion detection, with the segment projected to reach USD 312.5 million by 2025 .

Other categories include position sensors, pressure sensors, altimeters, and speed & distance sensors .

By Platform

Vertical Take-Off and Landing (VTOL) drones dominated in 2020 and are set to grow fastest, given their suitability for urban logistics, medical supply delivery, and surveillance.

Fixed-wing drones continue to hold significant share, particularly in long-range defense and reconnaissance missions.

By Application

The navigation segment held the largest market share in 2020 and is projected to account for nearly 29% of the market by 2025 . Reliable navigation is vital for applications such as disaster response, autonomous mapping, and emergency operations .

Restraining Factors

Despite strong prospects, the market faces challenges such as:

High costs of advanced drone sensor systems, limiting adoption by SMEs.

Environmental vulnerability , as sensors may be affected by extreme weather conditions.

High maintenance needs , which can restrict adoption in developing markets.

Emerging Trends

Integration of AI, IoT, and Smart Sensors

The next wave of growth in drone sensors is driven by the adoption of AI, machine learning, and IoT technologies. Smart multi-parameter sensors capable of simultaneously tracking temperature, humidity, and pressure are gaining traction, enabling drones to perform complex operations in smart farming, urban planning, and environmental monitoring.

Key Players

Leading companies are investing heavily in smart sensor innovation and AI-driven solutions. Prominent players include:

- Trimble (US)

- Bosch Sensortec (Germany)

- TDK InvenSense (U.S.)

- Sparton NavEx (US)

- Raytheon (US)

- AMS AG (Austria)

- Flir System (U.S.)

- KVH Industries (U.S.)

- TE connectivity (Switzerland)

- Lord MicroStrain (U.S.)

- Other Players

Raytheon, Trimble, and KVH Industries currently hold dominant positions in the global market. However, with growing demand across commercial and defense sectors, competition is intensifying, leading to a highly fragmented market structure by 2028.

Regional Insights

North America : Valued at USD 143.2 million in 2020, driven by strong U.S. military adoption and agricultural applications.

Europe : Expected to grow at a 24.57% CAGR, led by demand in Germany, France, and Russia.

Asia Pacific : Projected to expand rapidly, supported by rising defense budgets in China, India, and Japan. China is forecast to grow at 25.33% CAGR, while Japan’s market is expected to hit USD 48.79 million by 2025.

Rest of the World : Growth is moderate but improving due to increasing defense modernization in Latin America, the Middle East, and Africa.

Recent Industry Developments

November 2020 – The U.S. Department of Defense awarded a USD 93.3 million contract to General Atomics for the development of advanced sensors for the MQ-9 Reaper. The initiative falls under the Joint Artificial Intelligence Center’s Smart Sensor Project, aimed at integrating artificial intelligence-driven object recognition algorithms to enhance autonomous control of aircraft sensors.

According to Fortune Business Insights™, the global push-to-talk market was valued at USD 12.00 billion in 2019 and is projected to grow to USD 46.75 billion by 2032, exhibiting a CAGR of 12.0% during the forecast period. North America accounted for the largest share of 37.42% in 2019, supported by early adoption of advanced communication technologies and the strong presence of leading telecom and technology players.

Market Growth Overview

The growth of the push-to-talk market is being driven by the rising adoption of cloud-based Push-to-Talk over Cellular (PoC) solutions among enterprises. These systems provide real-time, secure, and scalable communication platforms with advanced features such as multimedia sharing, GPS location tracking, and two-way voice services.

Large enterprises are adopting PoC for portable, cost-efficient communication, enhanced call management, and improved safety, particularly across industries like public safety, logistics, utilities, and construction.

Technological advancements in LTE and 5G infrastructure are also fueling market expansion. High-speed, low-latency networks enable mission-critical PTT applications. Fortune Business Insights™ notes that the global 5G infrastructure market, valued at USD 720.6 million in 2018, is projected to reach USD 50,640.4 million by 2026 at a remarkable CAGR of 76.29%, significantly enhancing PTT system capabilities across public safety and enterprise domains.

Emerging technologies such as IoT, AI, natural language processing (NLP), and mobile applications are expected to unlock new opportunities. Furthermore, industry players are pursuing mergers, acquisitions, and partnerships to strengthen market presence. For example, in March 2019, Motorola Solutions acquired Avtec, Inc., a U.S.-based VoIP dispatch communications provider, to expand its end-to-end PTT platform for public safety.

Growth Drivers

The growth of the push-to-talk market is strongly supported by several key factors. One of the most significant drivers is the rising adoption of wireless PTT devices across industries such as defense, enterprise, and commercial sectors, which is enhancing both productivity and operational safety. Another major factor is the increasing demand for PTT software, with smartphone-based applications enabling seamless group communication and thereby boosting overall market penetration. Additionally, the expansion of accessories and network devices, including wireless microphones, speakers, and rugged PTT-enabled devices with advanced multimedia storage, is contributing to market expansion. Furthermore, rapid advances in communication networks such as LTE and 5G are enabling the deployment of mission-critical PTT solutions with greater speed, scalability, and reliability, creating new growth opportunities.

Information Source:

https://www.fortunebusinessinsights.com/industry-reports/push-to-talk-market-100079

Restraining Factors

Despite its promising outlook, the push-to-talk market faces a few challenges that could hinder its growth. One of the primary restraints is latency in communication, particularly for users in areas with weak or limited network coverage, where LMR-based systems often experience delays. Another barrier is the high infrastructure cost associated with deploying PTT systems, which poses a challenge for small and medium-sized enterprises with limited budgets. Additionally, the market continues to struggle with lack of awareness and infrastructure gaps, particularly in emerging economies where adoption of PTT solutions is slower due to insufficient technological readiness. These factors collectively act as bottlenecks to widespread adoption, though advancements in next-generation communication technologies are expected to gradually mitigate these issues.

Segmentation Overview

By Component

Devices (largest share): Rugged, innovative PTT devices with enhanced displays, multimedia, and longer battery life drive adoption.

Software & Services: Software innovation is improving workflow efficiency. For instance, in 2020 Honeywell launched Smart Talk software enabling VoIP, messaging, and collaboration for mobile workers.

By Network Type

Land Mobile Radio (LMR): Strong adoption in defense, law enforcement, and public safety.

Push-to-Talk over Cellular (PoC): Expected to register the fastest CAGR due to cost-efficiency, broad coverage, and high-quality audio. In 2019, Hytera launched PNC370 PoC radio , strengthening flexible dispatching and wide-area communication.

By Enterprise Size

Large Enterprises (leading share): Adopt cloud-based PTT to bridge communication gaps across dispersed operations.

SMEs: Favor cost-effective PoC solutions for real-time secure communication without high infrastructure investments.

By Sector

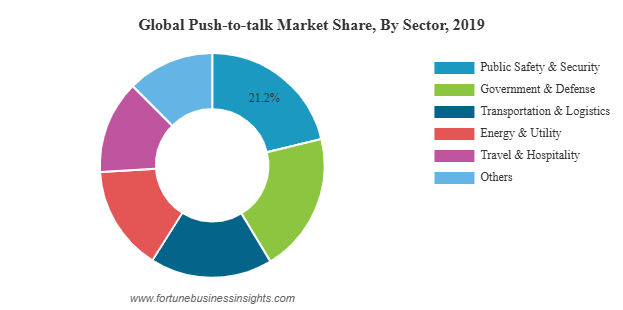

Public Safety & Security (largest share, 21.2% in 2019): Adoption of ultra-rugged devices and mission-critical communication solutions. In 2020, AT&T launched MCPTT-based FirstNet solutions for public safety.

Government & Defense: Adoption supported by growing border security concerns.

Transportation & Logistics, Energy & Utility, Travel & Hospitality: Rising demand for cost-effective, cloud-based communication solutions.

Market Trends

Shift from LMR to LTE-based solutions: Enterprises are migrating to LTE platforms for broader coverage and scalability.

Device innovation: Companies such as Kyocera and Motorola Solutions are introducing ruggedized LTE/5G-enabled PTT devices for harsh environments.

Strategic collaborations: Firms like Siyata Mobile, Verizon, and AT&T are collaborating to launch next-gen MCPTT solutions for enterprises and public safety agencies.

Regional Insights

North America (leading share): Growth driven by presence of key players (Motorola Solutions, AT&T), advanced telecom infrastructure, and public safety investments.

Asia-Pacific (fastest-growing region): Strong adoption in China and India due to public safety investments and IT infrastructure development. Example: In 2018, Kyocera launched ultra-rugged DuraForce PRO 2 smartphone with Verizon Wireless.

Europe: Presence of key providers such as iPTT and Azetti Networks, with steady adoption in hospitality, transportation, and construction sectors.

Middle East & Africa & Latin America: Growth supported by IoT, cloud, and AI adoption, alongside rising public safety needs in Brazil and Mexico.

Key Industry Players

Major companies in the push-to-talk market include:

- Motorola Solutions Inc. (US)

- Zebra Technologies Corporation (US)

- AT&T Intellectual Property (US)

- Verizon Wireless (US)

- Qualcomm Technologies, Inc. (US)

- Harris Corporation (US)

- ICOM Inc. (Japan)

- Kyocera

- Siyata Mobile (Canada)

- ECOM Instruments GmbH (US)

- RugGear (US)

- Telefonaktiebolaget LM Ericsson (Sweden)

- Sonim Technologies (US)

- Simoco (India)

- Airbus DS Communications (US)

Recent Industry Developments

March 2020 – Ericsson acquired Genaker, a Spain-based MCPTT solutions provider, strengthening its mission-critical communication offerings.

March 2019 – Motorola Solutions acquired Avtec, Inc., enhancing its software portfolio and expanding PTT solutions for public safety customers.

Rocket and Missile Market Insights, Size, Trends, Growth, and Forecast, 2022–2029

By Rishika19, 2025-08-22

According to Fortune Business Insights™, the global rocket and missile market size is projected to reach USD 84.77 billion by 2029, growing at a CAGR of 4.58% during the forecast period. The market expansion is primarily driven by the increasing adoption of 3D printing technology in the production of advanced weapon systems, enabling faster prototyping and cost-efficient manufacturing of rockets and missiles for both military and space applications.

The integration of additive manufacturing techniques has transformed the aerospace and defense sectors. Governments and private defense manufacturers are leveraging 3D printing to design and engineer rockets and missiles with complex geometries. For instance, Lockheed Martin announced plans to develop the U.S.’s next-generation intercontinental ballistic missiles (ICBMs) using 3D printing. Similarly, NASA and SpaceX are exploring additive manufacturing for rocket engines, further driving market growth.

Key Companies in the Market

The report profiles several prominent players, including:

Thales Group (France)

ROKETSAN A.S. (Turkey)

Rafael Advanced Defense Systems Ltd. (Israel)

MESKO (Poland)

Lockheed Martin Corporation (U.S.)

General Dynamics Corporation (U.S.)

Saab AB (Sweden)

Raytheon Technologies Corporation (U.S.)

Nammo AS (Norway)

MBDA (France)

KONGSBERG (Norway)

Denel Dynamics (South Africa)

Information Source:

https://www.fortunebusinessinsights.com/industry-reports/rocket-and-missiles-market-101822

Market Segmentation

By Type:

The market is divided into rockets and missiles. Among missiles, ballistic missiles (including SRBMs, MRBMs, IRBMs, and ICBMs) and cruise missiles (subsonic, supersonic, and hypersonic) dominate the landscape. Hypersonic cruise missiles, with speeds exceeding Mach 5, are witnessing increasing development in China and India. The rocket segment is expected to record strong growth due to rising artillery and air-launched systems across Europe and Asia Pacific.

By Platform:

The market is categorized into airborne, naval, and ground platforms. Ground platforms dominate due to the widespread deployment of land-attack cruise missiles. Airborne platforms launch missiles from fighter aircraft, while naval platforms enhance offensive capabilities via aircraft carriers, corvettes, and other vessels. The naval segment is expected to grow significantly, holding a 23.12% share in 2021.

By Launch Mode:

Launch modes include surface-to-surface, surface-to-air, air-to-air, air-to-surface, subsea-to-surface, and sea-to-sea. Surface-to-surface missiles dominate due to their extensive use in ground-based attacks. Air-to-air missiles are employed for aerial combat, and submarine-launched missiles target terrestrial sites.

By Propulsion:

The propulsion segment includes solid, liquid, hybrid, scramjet, cryogenic, and others (ramjet, turbojet, pulsejet). Solid-fueled propulsion leads the market, benefiting from storage advantages and high thrust generation. Liquid fuel systems provide high impulse rates, while hybrid propulsion combines the benefits of both solid and liquid systems.

Latest Trends

The market is witnessing rapid transformation, primarily driven by the adoption of 3D-printed missile components. Advanced 3D printers enable the creation of single-piece structures such as warheads and engines, reducing production complexity and costs. In May 2022, AgniKul Cosmos filed a patent for its Agnilet, the world’s first single-piece 3D-printed second-stage engine.

Technological advancements in warfare are also key drivers. Countries like the U.S., China, and Russia are developing hypersonic missiles capable of reaching Mach 5 speeds. India is expanding its adoption of C5ISR systems to improve battlefield efficiency. In April 2022, North Korea tested a new tactical guided weapon enhancing its nuclear capability.

Automatic Target Recognition (ATR) missile systems are gaining prominence due to rising demand. ATR systems detect and identify enemy assets, including armored personnel carriers, tanks, and artillery, using artificial neural networks combined with Imaging Infrared (IR) technology. For instance, BAE Systems received a USD 7 billion contract to advance ATR and multi-source fusion algorithms, improving target recognition capabilities.

Regional Insights

North America is the largest market, valued at USD 19.29 billion in 2021 , driven by extensive military modernization programs, fiber optic guidance systems, and the presence of key players such as Lockheed Martin, General Dynamics, and Raytheon.

Asia Pacific is expected to grow at the fastest CAGR, supported by China, Japan, and Australia’s increased defense spending, as well as initiatives like India’s Tejas MK-1A and South Korea’s KF-21 integrating advanced missile systems.

Europe is witnessing growth through private sector investments in precision-guided and autonomous targeting technologies. For instance, Russia signed a contract for 3M22 Zircon hypersonic missiles in August 2021.

Middle East growth is fueled by Saudi Arabia and Turkey’s missile deployments and regional defense modernization programs.

Rest of the World is expected to expand due to rising defense budgets in Latin America and Africa, focusing on fleet modernization and anti-poaching or surveillance operations.

Competitive Landscape

The rocket and missile market is highly competitive, driven by collaborations between governments and private defense contractors. Frequent awarding of contracts for missile development, modernization, and deployment underscores the market’s dynamic nature.

Key Focus Areas:

Hypersonic missile development

Integration of 3D printing in missile and rocket production

Advanced propulsion systems (solid, liquid, hybrid)

Precision-guided and autonomous targeting technologies

Recent Industry Developments

January 2022: The U.S. Air Force awarded SpaceX a USD 102 million contract for rocket transport of military supplies and humanitarian aid—the largest cargo contract to date.

February 2022: The U.S. Missile Defense Agency granted Raytheon, Lockheed Martin, and Northrop Grumman contracts of approximately USD 20 million each to develop hypersonic missile interception prototypes.