Aircraft Health Monitoring System Market Trends, Challenges, Dynamics and Forecast, 2027

By Rishika19, 2025-09-15

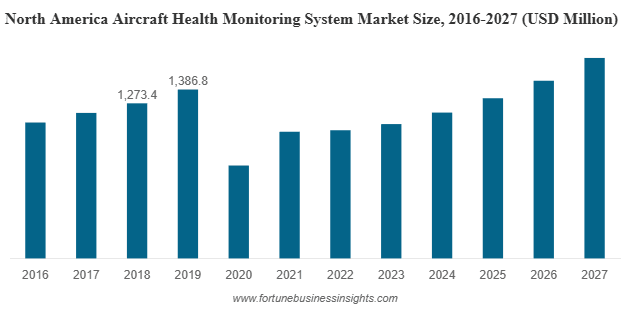

According to Fortune Business Insights™, the global Aircraft Health Monitoring System (AHMS) market was valued at USD 4.20 billion in 2019 and is projected to reach USD 20.58 billion by 2032, growing at a strong CAGR of 13.0% during the forecast period.

Although the market experienced a sharp setback in 2020 with a -44.8% decline due to COVID-19 and aviation shutdowns, recovery has been robust. Increasing demand for next-generation aircraft, predictive maintenance, and passenger safety measures are fueling long-term growth.

Market Segmentation Insights

By sub-system , aero-propulsion systems account for the largest share of the market, primarily because engine monitoring is essential to ensuring flight safety, operational efficiency, and compliance with stringent aviation standards. These systems allow real-time health assessment of engines, helping operators detect anomalies early, reduce in-flight risks, and improve overall fleet availability. The high cost of engines and their central role in aircraft performance further make this segment the cornerstone of health monitoring solutions. In addition, other sub-systems such as airframes, ancillary systems, software, and related components contribute significantly to fleet reliability. These systems provide valuable data on structural integrity, hydraulic performance, avionics, and digital control, collectively enhancing operational safety and lowering long-term maintenance costs.

By technology , prognostic systems lead the market due to their predictive capabilities, which allow airlines and operators to foresee potential component failures well in advance. This enables planned interventions, reduces unexpected downtime, and optimizes maintenance schedules, making them particularly attractive in commercial aviation where fleet utilization is a key profitability driver. In parallel, diagnostic systems, detection systems, adaptive controls, and other supporting technologies continue to play a vital role by providing fault identification, continuous condition monitoring, and corrective responses to real-time anomalies. The combination of prognostic and diagnostic tools offers a comprehensive solution that improves reliability while reducing total lifecycle costs.

By platform , commercial aircraft dominate the AHMS market, driven by rapid global air traffic growth and fleet expansion initiatives by leading airlines. The integration of advanced health monitoring solutions in next-generation aircraft such as the Boeing 787, Airbus A320neo, and A350 reflects this trend, as carriers seek greater operational efficiency and reduced maintenance overhead. Business jets are also embracing these systems, as operators prioritize efficiency, safety, and passenger confidence in high-value private aviation. Regional aircraft are experiencing rising adoption, particularly in emerging economies, where short-haul connectivity is expanding rapidly. Meanwhile, the military aircraft segment contributes steadily, as defense agencies invest in AHMS to extend fleet lifespans, maintain combat readiness, and minimize risks associated with mission-critical operations.

By fit , line-fit installations dominate the market, as most new aircraft are designed with integrated health monitoring systems during production. OEMs are increasingly embedding these solutions into aircraft to comply with modern safety standards and to meet growing customer demand for digitalization and predictive maintenance capabilities. However, the retrofit segment is witnessing the fastest growth and is projected to surpass USD 2.76 billion by 2025, driven by the need to modernize and extend the life of aging fleets worldwide. Airlines operating older aircraft are increasingly investing in retrofit AHMS solutions to enhance safety, reduce operational disruptions, and comply with regulatory requirements, making this segment a key driver of future market expansion.

Regional Insights

North America : Leading region with USD 1.38 billion in 2019, supported by key players like Boeing, Honeywell, and United Technologies, alongside strong regulatory mandates.

Europe : Expected to see steady growth due to predictive maintenance adoption and stringent aviation safety regulations.

Asia Pacific : Poised for the highest CAGR, fueled by rising passenger traffic, growing fleet sizes in China and India, and increased investments in aviation infrastructure.

Rest of the World : Growth supported by expanding fleets in the Middle East, Latin America, and Africa.

Information Source:

https://www.fortunebusinessinsights.com/aircraft-health-monitoring-system-market-105027

Growth Drivers

One of the primary drivers of the Aircraft Health Monitoring System (AHMS) market is the rising demand for next-generation aircraft. Modern aircraft such as the Boeing 787, 777X, Airbus A320neo, and A350 are increasingly being equipped with advanced AHMS solutions. These systems are no longer optional but have become essential for boosting operational efficiency, ensuring compliance with stringent safety standards, and reducing maintenance-related disruptions. The integration of AHMS into new aircraft platforms reflects the industry’s shift toward smarter, data-driven operations.

Another significant factor fueling growth is the focus on predictive maintenance and passenger safety. Predictive maintenance capabilities allow operators to anticipate component failures before they occur, thereby reducing unplanned downtime, lowering maintenance costs, and improving fleet utilization. At the same time, regulatory mandates around passenger safety are driving airlines to adopt real-time monitoring systems that support data-driven decision-making. Together, these developments enhance both operational reliability and customer confidence.

Technological advancements, particularly the adoption of the Internet of Things (IoT) and the shift toward More Electric Aircraft (MEA), are also transforming the AHMS landscape. IoT integration enables seamless, real-time data sharing across operators, maintenance teams, and manufacturers, strengthening predictive capabilities and improving system reliability. Meanwhile, the aviation industry’s move toward MEA platforms—where traditional hydraulic and mechanical systems are replaced with electric ones—creates new demand for advanced monitoring solutions. Electric systems, being highly sensitive and mission-critical, require continuous monitoring to ensure serviceability and cost efficiency, thereby driving further adoption of AHMS solutions.

Restraining Factor

Lack of Common Industry Standards : Fragmented database management and varying component standards limit interoperability, hindering widespread adoption of AHMS solutions.

Competitive Landscape

The AHMS market is highly consolidated , with strong barriers to entry due to certification requirements and large-scale data management needs.

Key Players:

Airbus S.A.S. (Netherlands)

Boeing (US)

United Technologies Corporation (US)

Honeywell International, Inc. (US)

General Electric (US)

Rolls Royce (UK)

SAFRAN (France)

FLYHT (Canada)

Curtiss-Wright (US)

Tech Mahindra (India)

Meggitt (UK)

Lufthansa Technik (Germany)

Recent Industry Developments

In July 2021, GE Digital announced a strategic alliance with Airbus and Delta TechOps to advance fleet health monitoring and diagnostics solutions. Through this collaboration, the three aviation leaders are combining their expertise in digital analytics, aircraft systems, and airline maintenance operations. The partnership is designed to deliver significant cost savings and enhance network efficiencies, benefiting more than 140 commercial aviation operators worldwide.

AC Servo Motors and Drives Market Analysis, Development, Prospects, Forecast, 2027

By Rishika19, 2025-09-15

According to Fortune Business Insights™, the global AC servo motors and drives market was valued at USD 6.80 billion in 2019 and is projected to reach USD 10.79 billion by 2027, exhibiting a CAGR of 6.64% during the forecast period. The rising adoption of industrial robots, smart machines, and Industry 4.0 technologies is driving demand for advanced AC servo systems worldwide.

Market Overview

An AC servo system is a closed-loop control solution comprising a servo motor and drive, designed to deliver precise speed, motion, and positioning. The drive acts as an electric amplifier, regulating the motor’s performance in real-time. With benefits like superior stability, high efficiency, and reduced sensitivity to parameter variations, these systems are increasingly integrated into modern manufacturing lines, robotics, and aerospace applications.

Market Segmentation

By Product Type :

Servo motors (synchronous & induction) dominate due to their precision and efficiency, especially in aerospace for powering hydraulic pumps and wing flaps. Servo drives are growing rapidly with the development of compact, high-power models.

By Voltage Range :

Low-voltage (<230V) systems lead the market, favored for mobile robotics and compact automation, thanks to their cost-effectiveness and easy maintenance.

By Phase Type :

Three-phase AC servo motors are preferred for heavy-duty automation due to their high torque and speed control.

By Communication Protocol :

Fieldbus currently dominates, but Industrial Ethernet (supporting EtherCAT, PROFINET, EtherNet/IP) is set for strong growth as industries adopt real-time communication and advanced connectivity.

By End-Use Industry :

Automotive & Transportation – largest share, driven by robotic assembly lines.

Semiconductor & Electronics – growing fast with smart devices and IoT expansion.

Aerospace & Defense – using servo systems in flight controls and component manufacturing.

Food & Beverage, Printing & Packaging, Chemicals & Petrochemicals – increasing adoption for automation and efficiency.

Key Takeaways

Industrial automation and robotics remain the primary growth drivers.

Low-voltage and three-phase systems are dominating demand.

Asia Pacific leads globally, while North America and Europe show strong growth potential.

Next-gen Industrial Ethernet protocols are set to transform servo system integration.

Market Drivers

Rising Adoption of Industrial Robots

The International Federation of Robotics reports that more than 373,000 industrial robots valued at USD 13.8 billion were installed worldwide in 2019. With strong demand in the automotive (28%) and electronics (24%) sectors, AC servo systems have become indispensable for high-precision and high-volume manufacturing.

Growing Demand for Smart Servo Systems

As industries transition to smart factories, the need for flexible, durable, and high-performance servo systems is accelerating. AC servo solutions align with Industry 4.0 standards, supporting real-time motion control, faster operations, and enhanced machine efficiency.

Information Source:

https://www.fortunebusinessinsights.com/ac-servo-motor-market-103513

Regional Insights

Asia Pacific : Largest market (USD 2.35 billion in 2019), led by China, Japan, and South Korea. Major players like Yaskawa Electric, Mitsubishi Electric, and Fuji Electric drive innovation.

North America: Strong adoption of robotics in automotive and electronics. The U.S. remains a hub for smart manufacturing.

Europe : Growth supported by advanced automotive and packaging sectors. Investments by companies like Yaskawa Electric underline regional confidence.

Rest of the World : Moderate growth as industries embrace automation and energy-efficient machinery.

Competitive Landscape

The market is consolidated, with global players focusing on R&D, product innovation, and strategic partnerships.

Key Companies:

ABB Group (Switzerland)

Delta Electronics, Inc. (Taiwan)

FANUC Corporation (Japan)

Fuji Electric Co., Ltd. (Japan)

Kollmorgen Corporation (USA)

Mitsubishi Electric Corporation (Japan)

Nidec Corporation (Japan)

Rockwell Automation, Inc. (USA)

Schneider Electric SE (France)

Siemens AG (Germany)

Yaskawa Electric Corporation (Japan)

Recent Developments

July 2020 – Kollmorgen Corporation introduced a new motion package comprising the AKD2G servo drive, 2G Motion System, and AKM2G single-cable servo motors. The AKD2G drive supports three communication protocols—EtherCAT, CANopen, and FSoE—enabling enhanced connectivity. This integrated package is designed to boost machine performance and operational efficiency.

Advanced Air Mobility Market Growth, Insights, Demand, Prospects and Forecast, 2025–2032

By Rishika19, 2025-09-12

According to Fortune Business Insights™, the global advanced air mobility market size was valued at USD 11.41 billion in 2024 and is projected to grow from USD 13.27 billion in 2025 to USD 65.91 billion by 2032, exhibiting a robust CAGR of 25.7% during the forecast period.

Advanced Air Mobility (AAM) is reshaping the future of transportation by introducing electric and hybrid aircraft, autonomous technologies, and integrated air traffic management solutions into urban and regional airspace. The market covers Urban Air Mobility (UAM) for intra-city transport, Regional Air Mobility (RAM) for inter-city connectivity, and specialized cargo delivery systems, designed to enhance speed, safety, and sustainability.

Market Dynamics

Drivers

Technological Advancements in Propulsion & Autonomy:

Breakthroughs in battery energy density, lightweight airframes, and charging infrastructure are improving the feasibility of electric vertical takeoff and landing (eVTOL) aircraft. At the same time, AI-driven autonomous flight systems are enabling safer navigation, reducing reliance on pilots, and lowering operating costs.

Growing Urban Congestion:

Cities worldwide are grappling with severe road congestion. AAM offers an attractive solution by using vertical flight corridors, cutting travel times by up to 70%, while reducing emissions compared to traditional ground transport.

Restraints

Regulatory and Certification Challenges:

Strict certification standards from FAA, EASA, and other regulators require extensive safety trials, which can significantly delay commercialization and inflate development costs. Harmonizing regulations across regions remains a key hurdle.

Opportunities

Leveraging Existing Aviation Infrastructure:

Instead of depending only on new vertiports, AAM operators can utilize regional airports and general aviation facilities to speed up deployment. This reduces capital investments, simplifies regulatory approvals, and connects seamlessly to established passenger networks.

Challenges

Safety, Noise, and Privacy Concerns

Public adoption hinges on addressing:

Safety risks of autonomous flight in dense urban areas.

Noise pollution from rotor systems.

Privacy issues linked to aerial monitoring and data collection.

Developing quieter propulsion technologies and transparent safety frameworks will be critical for market acceptance.

Information Source:

https://www.fortunebusinessinsights.com/advanced-air-mobility-market-113574

Market Trends

Rise of Regional Air Mobility (RAM): Beyond air taxis, RAM is becoming central for short- to mid-range connectivity, supported by hybrid-electric and hydrogen-powered aircraft.

Vertiport Development: Companies like Skyports and Ferrovial are rapidly building dedicated takeoff and landing hubs.

Airline Partnerships: Major airlines (e.g., United Airlines, American Airlines) are collaborating with AAM firms to integrate future air taxi and regional services.

Segmentation Overview

By Component

Hardware (Dominant in 2024): The hardware segment led the market in 2024 due to strong demand for motors, batteries, sensors, and advanced airframes that form the backbone of advanced air mobility platforms.

Software (Fastest Growing): Software is projected to expand at the fastest pace, supported by innovations in AI, automation, and predictive analytics that enable autonomous flight and optimize operational safety.

By Product

Rotary Blade (Largest Share in 2024): Rotary blade systems held the largest market share in 2024, as they provide vertical takeoff and landing (VTOL) capability, making them ideal for urban transport solutions in congested areas.

Hybrid (Fastest Growth): The hybrid segment is expected to grow rapidly, combining fixed-wing efficiency with VTOL flexibility, which enhances payload capacity and operational range.

By Propulsion Type

Electric (Leading Segment): Electric propulsion dominated in 2024, driven by its sustainability benefits, reduced noise levels, and lower operating costs compared to conventional propulsion systems.

Hybrid (Fastest CAGR): Hybrid propulsion is forecast to grow at the highest CAGR, offering extended mission ranges by integrating electric systems with auxiliary power sources.

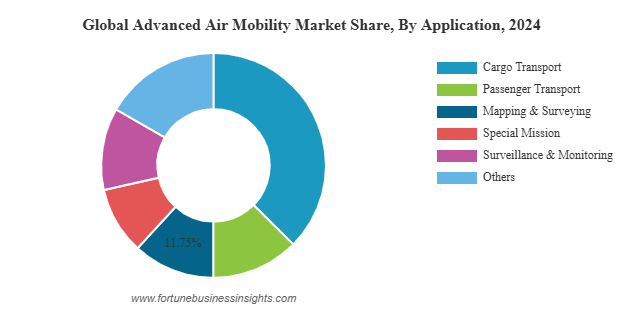

By Application

Cargo Transport (Largest in 2024): Cargo transport was the leading application in 2024, fueled by e-commerce expansion and the demand for faster, same-day delivery services.

Surveillance & Monitoring (Fastest Growth): Surveillance and monitoring is projected to expand at the fastest pace, driven by increasing use cases in defense operations, search and rescue, and infrastructure inspections.

By End-Use

Commercial (Dominant in 2024): The commercial sector dominated in 2024, supported by adoption among logistics providers and passenger mobility companies seeking efficient transport solutions.

Government & Military (High Growth): Government and military applications are anticipated to grow strongly during 2025–2032, with advanced air mobility systems being deployed in emergency response, disaster relief, and national security operations.

Regional Insights

North America (USD 3.92 billion in 2024):

Leads global adoption with FAA-led regulatory advances, high R&D funding, and major players such as Joby Aviation, Archer Aviation, and Boeing.

Europe:

Focuses heavily on green aviation initiatives. Nations like Germany, France, and the U.K. are advancing sustainable eVTOL programs, supported by EASA’s harmonized regulations.

Asia Pacific:

China, Japan, and South Korea are investing heavily in AAM, supported by government incentives, smart city initiatives, and rapid urbanization.

Rest of the World:

Countries like UAE (Dubai’s air taxi projects) and Brazil (leveraging Embraer’s expertise) are piloting regional AAM adoption.

Competitive Landscape

The AAM market is characterized by a mix of aerospace giants and agile startups :

Aerospace Leaders: Airbus, Boeing, Bell Textron, Embraer.

Innovators: Joby Aviation, Aurora Flight Sciences, Lilium, EHang, Vertical Aerospace.

Infrastructure & Tech Providers: Skyports, Ferrovial, Honeywell, Collins Aerospace.

Airline Partners: United Airlines, American Airlines integrating AAM into future networks.

Key Industry Developments

May 2025 – Wisk Aero, a leading advanced air mobility (AAM) company developing the first all-electric, self-flying air taxi in the U.S., announced a new five-year partnership with NASA under a Non-Reimbursable Space Act Agreement (NRSAA). The collaboration will support NASA’s Air Traffic Management Exploration (ATM-X) project, focusing on critical research to enable the safe integration of autonomous aircraft operations under Instrument Flight Rules (IFR) within the U.S. National Airspace System (NAS).

Satellite Payload Market Size, Share, Growth, Trends, Insights, Competitive Analysis and Forecast, 2025–2032

By Rishika19, 2025-09-12

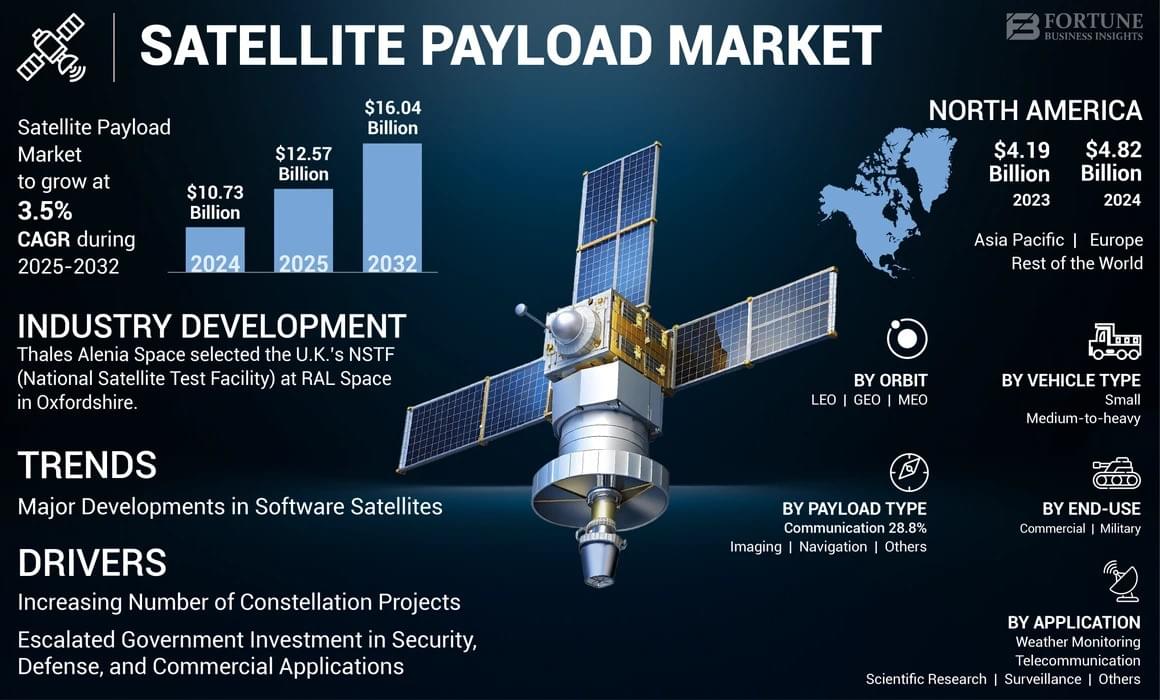

According to Fortune Business Insights™, the global satellite payload market size was valued at USD 10.73 billion in 2024. The market is projected to grow from USD 12.57 billion in 2025 to USD 16.04 billion by 2032, exhibiting a CAGR of 3.5% during the forecast period.

Satellite payloads are the scientific and technological instruments carried onboard satellites that perform the mission’s core functions, such as imaging, communication, navigation, and data collection. The increasing adoption of software-defined satellites, capable of reconfiguration during missions, is driving the demand for advanced payload technologies.

Key Market Segmentation

By payload type , the market is segmented into imaging, communication, and navigation & others. Imaging payloads dominated the market in 2024, largely due to the rising demand for earth observation and geospatial data. The communication segment is expected to witness the fastest growth between 2025 and 2032, driven by increasing requirements for space-based connectivity. Meanwhile, navigation and other payloads continue to support diverse applications in defense, research, and commercial services.

By vehicle type , the market is divided into medium-to-heavy and small satellites. Medium-to-heavy satellites accounted for the largest share in 2024, supported by extensive government and commercial satellite launches. However, small satellites are projected to experience the highest growth rate, fueled by the increasing deployment of miniaturized satellites for research, communication, and constellation-based projects.

By orbit , the market is categorized into Low Earth Orbit (LEO), Geostationary Orbit (GEO), and Medium Earth Orbit (MEO). LEO held the largest and fastest-growing share in 2024, owing to the surge in communication and imaging satellite launches. GEO continues to expand steadily due to its advantages in wide-area communication coverage, while MEO remains a key orbit for navigation and specialized defense applications.

By application , the market includes telecommunication, weather monitoring, scientific research, surveillance, and others. Telecommunication dominated in 2024, supported by growing SATCOM demand and the launch of high-throughput communication satellites. Weather monitoring applications are gaining traction with the rising need for climate tracking and hazard forecasting, while scientific research, surveillance, and other applications are also witnessing increased adoption across commercial and defense missions.

By end-use , the market is split into military and commercial sectors. The military segment led the market in 2024, bolstered by expanding defense budgets allocated to surveillance and geo-mapping missions. On the other hand, the commercial segment is projected to record the highest CAGR from 2025 to 2032, driven by increasing demand for telecommunication and navigation services.

Information Source:

https://www.fortunebusinessinsights.com/industry-reports/satellite-payload-market-101829

Regional Insights

North America – Dominated the market with a valuation of USD 4.82 billion in 2024 (44.9% share), supported by strong satellite programs from NASA, SpaceX, Boeing, and Lockheed Martin.

Asia Pacific – Expected to witness the fastest growth, led by China, India, and Japan’s investments in satellite constellations and navigation systems.

Europe – Growth driven by ESA and private players expanding small satellite programs.

Middle East, Africa, and Latin America – Moderate growth, supported by emerging space initiatives in UAE, Saudi Arabia, and Brazil.

Market Drivers & Restraints

Drivers

Expansion of satellite constellation projects by governments and private firms.

Increasing investments in defense surveillance and intelligence systems.

Rising adoption of software-defined and AI-enabled payloads.

Restraints

Sensor and payload malfunctions, leading to mission failures and financial losses.

Harsh space environments causing sensor degradation and operational risks.

Competitive Landscape

The market is moderately consolidated, with leading companies investing heavily in R&D, product innovation, and strategic partnerships to strengthen market presence.

Key Players

Airbus S.A.S (Netherlands)

L3Harris Technologies (U.S.)

Lockheed Martin Corporation (U.S.)

Maxar Technologies (U.S.)

Northrop Grumman Corporation (U.S.)

Sierra Nevada Corporation (U.S.)

SpaceX (U.S.)

ST Engineering (Singapore)

Thales Group (France)

The Boeing Company (U.S.)

Recent Industry Developments

- December 2023 – Thales Alenia Space, a joint venture between Thales and Leonardo, selected the U.K.’s National Satellite Test Facility (NSTF) at RAL Space in Oxfordshire to carry out the first full assembly, integration, and testing campaign for the European Space Agency’s (ESA) FLEX (Fluorescence Explorer) satellite. Designed to enhance understanding of Earth’s vegetation, the FLEX satellite will map chlorophyll fluorescence in plants, providing vital data on global ecosystem health and agricultural productivity.

Border Security Market Trends, Size, Share, Growth, Strategic Outlook and Forecast, 2025–2032

By Rishika19, 2025-09-11

The global border security market is entering a critical growth phase as governments worldwide step up investments in advanced surveillance and protection technologies. According to Fortune Business Insights™, the market was valued at USD 53.24 billion in 2024 and is projected to rise from USD 58.24 billion in 2025 to USD 95.65 billion by 2032, reflecting a CAGR of 7.3% during the forecast period.

The expansion is largely driven by geopolitical tensions, cross-border conflicts, illegal migrations, and growing threats of terrorism and trafficking. Countries are turning to modern solutions—including AI-powered drones, biometric systems, advanced radar, and satellite surveillance—to secure perimeters more effectively.

Key Market Players

Some of the leading companies shaping the border security industry include:

- Northrop Grumman Corporation (U.S.)

- Airbus SE (U.S.)

- Raytheon Technologies Corporation (U.S.)

- Elbit Systems Ltd. (Israel)

- Thales Group (France)

- BAE Systems plc (U.K.)

- Israel Aerospace Industries Ltd. (IAI) (Israel)

- Leonardo SpA. (Italy)

- Rafael Advanced Defense Systems Ltd. (France)

- Teledyne FLIR LLC (U.S.)

These firms focus on contracts, partnerships, and R&D to deliver next-generation border security systems.

Information Source:

https://www.fortunebusinessinsights.com/border-security-system-market-105208

Market Segmentation

By system , radar systems remain the dominant segment owing to their critical role in wide-area monitoring, perimeter surveillance, and counter-drone operations. With growing cross-border threats, illegal infiltration, and the rising use of unmanned aerial vehicles (UAVs), militaries and security agencies are increasingly deploying advanced radar technologies capable of long-range detection and real-time tracking. Biometric systems, on the other hand, are projected to witness the fastest growth during the forecast period. The need for secure, automated identity verification at border checkpoints is fueling demand for facial recognition, iris scanning, and multi-factor authentication tools, making them central to next-generation border security frameworks. Other systems, including cargo scanners, isotope detectors, ground sensors, unmanned systems, night-vision goggles, satellite surveillance, and communication solutions, are also gaining traction as part of integrated security infrastructures. These technologies complement radar and biometrics by ensuring layered security and improved situational awareness across diverse terrains.

From a platform perspective, land ports account for the largest market share, supported by the deployment of advanced radar arrays, surveillance towers, and vehicle inspection systems. These technologies are essential in detecting illegal crossings, smuggling activities, and unauthorized trade, especially in regions with vast land borders. Maritime ports are emerging as another critical area of investment, as global trade growth and heightened risks of trafficking, piracy, and illegal shipping necessitate modernized naval security systems, advanced scanning equipment, and perimeter monitoring solutions. The aviation sector is expected to experience the fastest growth among platforms, driven by surging passenger volumes and the adoption of biometric-based screening systems. Airports worldwide are investing heavily in AI-driven passenger management, automated border control kiosks, and advanced baggage inspection systems, making aviation a central hub for the implementation of next-generation border security solutions.

Regional Insights

Asia Pacific – The dominant region with 53.48% market share in 2024, fueled by rising defense budgets, border disputes, and large-scale illegal migration challenges in India, China, and South Korea.

Europe – Expected to be the fastest-growing region, with the Russia-Ukraine war spurring higher investments in AI-driven drones, biometric checkpoints, and surveillance systems.

North America – Strong growth led by U.S. initiatives such as DHS contracts for autonomous surveillance towers and smart cargo-tracking technologies.

Middle East & Africa – Increasing demand for security systems due to regional conflicts and cross-border crime.

Latin America – Modernization of port and land borders driving regional expansion.

Market Drivers

Increasing Migration Pressures – UNHCR reported 130 million forcibly displaced people in 2024, driving governments to upgrade legacy systems with AI and biometrics.

Adoption of High-Tech Systems – Drones, radar, surveillance towers, and biometric authentication are becoming essential for perimeter and checkpoint security.

Government Funding – EU allocated USD 2.4 billion in 2024 for its Secure Borders Initiative, while the U.S. DHS signed a USD 450 million contract with Anduril for autonomous towers.

Market Restraints

The high financial burden of integrating advanced EO/IR (Electro-Optical/Infrared) systems with legacy military platforms poses challenges. Costs tied to hardware upgrades, testing, and personnel training can slow adoption.

Key Trends

Shift toward AI-driven drones and biometric authentication at borders.

Integrated cross-border solutions where countries collaborate to fight trafficking and terrorism.

Standardization of systems across regions, reducing costs and boosting adoption.

Expansion of satellite-enabled surveillance networks for wide-area monitoring.

Opportunities Ahead

Joint security initiatives like the EU-Africa Sahel Shield (USD 1.8 billion) for drones and biometrics.

Private sector investments in digital border management technologies.

Interoperable systems that streamline trade while strengthening national defense.

Recent Developments

March 2025 – U.S. Customs and Border Protection (CBP) awarded the initial border wall construction contract to Granite Construction Co. valued at USD 70.29 million. The project covers the development of approximately seven miles of new wall in Hidalgo County, Texas, located within the Rio Grande Valley (RGV) Sector of the U.S. Border Patrol (USBP). Once completed, the wall is expected to strengthen the Department of Homeland Security (DHS) by improving its ability to deter and prevent illegal crossings, as well as disrupt drug- and human-trafficking activities carried out by cartels in the region.

Defense Cyber Security Market Scenario, Size, Share, Growth, Trends, Insights, Analysis and Forecast, 2032

By Rishika19, 2025-09-11

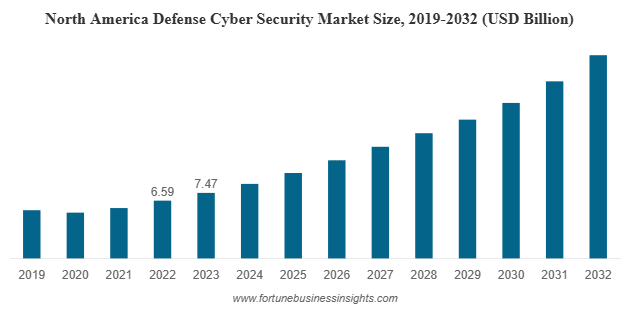

According to Fortune Business Insights™, the global defense cyber security market size stood at USD 16.45 billion in 2023 and is projected to grow from USD 19.14 billion in 2024 to USD 63.38 billion by 2032, at a strong CAGR of 16.1% during the forecast period. North America held the dominant share in 2023, valued at USD 7.47 billion, supported by robust defense budgets and the presence of leading industry players.

What is Defense Cyber Security?

Defense cyber security encompasses technologies and solutions that detect, monitor, and counter cyber threats aimed at military infrastructure, classified data, and mission-critical systems. These solutions protect against advanced threats such as malware, phishing, ransomware, and spyware, ensuring confidentiality, operational continuity, and resilience in both peacetime and conflict environments.

Key Players

Prominent companies shaping this market include:

Lockheed Martin Corporation (U.S.)

The Thales Group (France)

BAE Systems plc (U.K.)

General Dynamics (U.S.)

Northrop Grumman Corporation (U.S.)

Raytheon Technologies (U.S.)

Booz Allen Hamilton (U.S.)

Leonardo (Italy)

Leidos (U.S.)

L3Harris Technologies (U.S.)

These players emphasize cyber infrastructure modernization, zero-trust frameworks, encryption technologies, AI-driven threat detection, and global expansion via partnerships and acquisitions.

Information Source:

https://www.fortunebusinessinsights.com/defense-cyber-security-market-105139

Market Segmentation

By Platform

- Software & Service – This segment holds the largest share of the market, fueled by the rapid adoption of cloud-based and on-premise defense cyber solutions. Nations are increasingly deploying advanced software platforms to enhance situational awareness and secure mission-critical systems.

- Hardware – Growth in this segment is driven by the modernization of IT infrastructure across militaries, including servers, secure routers, and specialized defense-grade computing systems.

By Solution

- Cyber Threat Protection – The leading segment, encompassing firewalls, sandboxing, TLS/SSL inspection, and browser isolation. Defense organizations prioritize this area to mitigate the growing wave of malware, phishing, and ransomware attacks.

- Threat Evaluation – Supports early detection and analysis of vulnerabilities, ensuring rapid response to potential breaches.

- Content Security – Focused on email and web traffic encryption, this solution ensures confidentiality and prevents data exfiltration in defense communications.

- Others – Includes supporting technologies that enhance layered cyber defense strategies.

By Type

- Application Security – The fastest-growing segment, driven by the need for secure coding practices, encryption methods, and multi-layer authentication in military-grade applications.

- Critical Infrastructure Security & Resilience – Safeguards vital assets such as radars, command centers, and defense logistics networks against advanced cyberattacks.

- Cloud Security – Increasing adoption of cloud-hosted platforms within defense networks makes this a crucial area for growth.

- Others – Covers niche security solutions integrated across diverse defense ecosystems.

By End User

- Land Forces – Largest share of the market, as these forces require robust cyber security for mobile command centers, tactical communications, and vehicle-mounted networks.

- Naval Forces – Investments are directed toward protecting maritime communication links, naval command systems, and underwater defense networks.

- Air Forces – Focused on safeguarding airborne platforms, avionics, and satellite-enabled communication channels against hostile intrusions.

Market Dynamics

Key Drivers

Rising Cyber Threats in Defense – Global cyberattacks surged 38% in 2022; government and military sectors experienced 1,600+ weekly attacks.

Digital Transformation of Military Operations – Investments in AI, automation, and cloud adoption; the U.S. DoD allocated USD 13.5 billion in FY 2024 for cyber modernization.

Strategic Investments in Cyber Capabilities – U.S., China, Australia, and EU countries are expanding cyber defense infrastructure with vendor collaborations.

Restraint

Talent Shortage & Training Costs – Over 0.7 million cyber defense jobs remain unfilled in the U.S. Training costs for skilled personnel often exceed USD 100,000, straining budgets, especially in developing nations.

Regional Insights

North America – Largest market (USD 7.47 billion in 2023); dominance driven by high budgets, leading players, and advanced military modernization.

Asia Pacific – Rapid growth; key contributions from China, Japan, and Australia. Five Eyes cooperation and CERT initiatives strengthen defenses.

Europe – Accelerated adoption post Russia-Ukraine war; EU Cyber Defense Policy and NATO cyber drills increase preparedness.

Rest of the World – Moderate growth; UAE, Israel, Saudi Arabia, and Brazil investing in next-gen defense cyber solutions.

Impact of the Russia-Ukraine War

The conflict significantly accelerated global cyber defense investments. Ukraine’s defense spending rose 640% in 2022, while NATO members increased cyber cooperation. State-sponsored attacks such as Sandworm’s “Prestige” ransomware against Polish and Ukrainian networks underscore the urgency of strengthening military-grade cyber defenses.

Recent Industry Developments

June 2023 – Leonardo unveiled integrated solutions to protect naval infrastructure from combined physical and cyber threats.

April 2023 – Thales launched SCRED, a collaborative French project to develop a unified cyber threat intelligence platform.

Degaussing System Market Size, Demand, Analysis, Market Dynamics and Future, 2032

By Rishika19, 2025-09-10

The global degaussing system market is witnessing steady growth, driven by rising naval security threats, fleet modernization programs, and increasing adoption of advanced stealth technologies. According to Fortune Business Insights™, the market was valued at USD 0.90 billion in 2023 and is projected to grow from USD 0.93 billion in 2024 to USD 1.46 billion by 2032, reflecting a CAGR of 5.7% during the forecast period.

Degaussing systems are increasingly seen as mission-critical solutions, ensuring that naval vessels remain stealthy and resilient against modern mine warfare.

What is a Degaussing System and Why It Matters?

Ships and submarines made from ferromagnetic materials generate a magnetic signature when they move through the Earth’s magnetic field. This signature can be detected by enemy mines, submarines, or surveillance systems, leaving vessels vulnerable.

A degaussing system reduces or eliminates this magnetic field by using coils, power supplies, and control units, making ships less detectable. This capability is crucial in naval warfare, where stealth is often the difference between mission success and failure.

The importance of these systems has grown due to:

Increasing sophistication of naval mines with magnetic and hybrid triggers.

Rising global maritime tensions in regions such as the South China Sea, Arctic, and Black Sea.

The need for stealth technologies in modern naval fleets to protect both manned and unmanned vessels.

Key Market Drivers

Increasing Naval Mine Threats

Modern smart mines with multi-influence triggers (magnetic, pressure, acoustic).

Growing stockpiles in regions of conflict.

Rising Defense Budgets

U.S. defense budget for FY2024 exceeds USD 800 billion, boosting naval shipbuilding.

India and China expanding blue-water navies.

Technological Advancements

Shift toward HTS-based systems offering compact, energy-efficient solutions.

Integration of AI and automation in monitoring systems.

Fleet Modernization Programs

Over 1,500 naval vessels worldwide expected to undergo upgrades by 2032.

High retrofit demand in Asia Pacific and Europe.

Market Restraints

High Installation Costs – Advanced systems require significant upfront investment.

Technical Complexity – Integration challenges with legacy vessels.

Budget Constraints in Developing Nations – Slows adoption despite need.

Information Source:

https://www.fortunebusinessinsights.com/degaussing-system-market-108153

Market Segmentation Insights

By Component: Degaussing coils represent the largest and fastest-growing segment, playing a critical role in retrofitting and upgrading existing naval fleets to protect vessels against magnetic detection and mine threats. Power supply units ensure stable and reliable power delivery to these coil systems, which is essential for maintaining operational effectiveness. Control units and monitoring systems facilitate automation and real-time performance checks, enhancing efficiency while reducing the need for manual intervention.

By Solution: Degaussing onboard systems form the core solution, widely implemented across surface vessels and submarines to consistently reduce magnetic signatures. Deperming, performed in specialized shore facilities, provides long-term calibration by erasing permanent magnetization, ensuring vessels retain low signatures over time. Ranging solutions are employed for testing and recalibrating vessel signatures at naval ranges, enabling periodic validation of stealth performance.

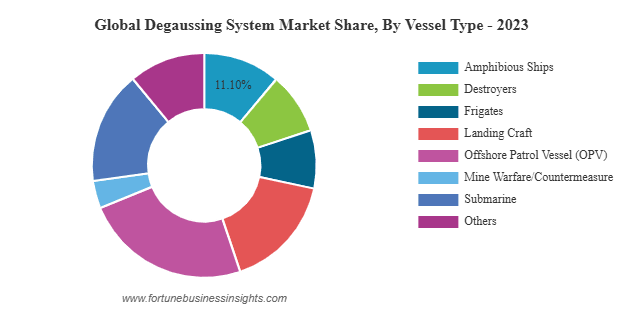

By Vessel Type: Frigates are the fastest-growing category, fueled by increasing demand for multipurpose combat vessels across global navies. Destroyers and amphibious ships also see significant adoption due to their large magnetic signatures, necessitating robust degaussing capabilities. Submarines rely on continuous degaussing to maintain stealth during undersea operations, making them a key focus area. Offshore patrol vessels (OPVs) and mine countermeasure vessels are witnessing growing demand as coastal security and littoral warfare operations expand worldwide.

By End User: The aftermarket segment holds the largest share, reflecting the high maintenance and calibration requirements across existing fleets. OEMs contribute through new shipbuilding programs that integrate advanced degaussing technologies, while service providers offer installation, testing, and lifecycle management solutions to ensure long-term system performance and operational readiness.

Regional Outlook

Asia Pacific – Largest Market Share (46.67% in 2023): The region leads the global degaussing market, driven by rapid naval modernization in China, India, South Korea, and Australia. Rising tensions in the South China Sea are prompting fleet upgrades, while the increasing deployment of deperming stations in China supports large-scale fleet operations and magnetic signature management.

Europe – Strong Growth Potential: Demand is rising across Europe due to geopolitical tensions in the Baltic and Black Sea regions. Modernization programs in the U.K., France, and Germany focus on countering stealth threats, with NATO emphasizing mine warfare and magnetic protection capabilities.

North America – Advanced Adoption: The U.S. Navy’s modernization initiatives and high-tech R&D investments are fueling adoption of advanced degaussing solutions. There is growing demand for High-Temperature Superconductor (HTS)-based systems, with major contracts involving companies such as American Superconductor, L3Harris, and Raytheon.

Rest of the World: In the Middle East and Africa, the focus is on safeguarding oil and gas sea lanes, while Latin America, particularly Brazil, is gradually adopting degaussing systems as part of broader naval modernization efforts.

Recent Industry Developments

May 2023 – U.S. DoD awarded USD 526 million to Fincantieri’s Marinette Marine for Constellation-class frigates with advanced degaussing.

Dec 2022 – American Superconductor Corp. partnered with Huntington Ingalls Industries on HTS systems.

Aug 2022 – Bollinger Shipyards received contract from U.S. Navy for unmanned mine countermeasure ships.

2021 – Wärtsilä and L&T signed multiple agreements for naval vessel upgrades in Asia Pacific.

Competitive Landscape

Major companies operating in the market include:

Wärtsilä Corporation (Finland)

Larsen & Toubro Limited (India)

Ultra Electronics Holdings plc (U.K.)

L3 Harris Technologies, Inc. (U.S.)

American Superconductor Corporation (U.S.)

Raytheon Technologies Corporation (U.S.)

Hensoldt AG (Germany)

These players are focusing on:

Strategic collaborations and defense contracts.

Development of next-generation superconducting systems.

Expanding aftermarket services for fleet support.

U.S. Space Launch Services Market Trends and Prospects, Growth and Analysis, 2030

By Rishika19, 2025-09-10

The U.S. space launch services market is entering an exciting growth phase, with projections showing a CAGR of 12.7% from 2023 to 2030. Fueled by government funding, private-sector investments, and rapid advances in launch vehicle technologies, the industry is becoming one of the most dynamic sectors in aerospace. From small satellite rideshares to reusable rocket systems, the U.S. is firmly positioning itself as a global leader in space launch innovation.

Market Drivers

Rise in Small Satellite Launches

The surge in small satellite deployments—for communication, defense, and Earth observation—has been a major growth catalyst. Traditionally launched as secondary payloads, these satellites are increasingly benefiting from dedicated small launch vehicles such as Rocket Lab’s Electron.

SpaceX Transporter-1 (January 2021): Carried 143 spacecraft in a single record-breaking mission.

Transporter-2 (June 2021): Launched 85 payloads, expanding affordable rideshare opportunities.

By offering customized orbits and greater flexibility, small satellite launches are reshaping the economics of U.S. space services.

Drone Ships Transforming Recovery

Another breakthrough has been the deployment of Autonomous Spaceport Drone Ships (ASDS) by SpaceX. These ocean-going barges, fitted with landing platforms and autonomous navigation systems, allow rockets to land at sea when fuel reserves are insufficient for a return to land.

This innovation has dramatically boosted reusability, cutting launch costs and making sustainable missions a reality.

Market Challenges

High Cost of Launch Infrastructure

Despite technological strides, the sector faces a significant hurdle: capital-intensive investments. Space launch services require massive funding for:

Launch pad construction and maintenance

Payload integration systems

Supporting infrastructure

With costs ranging from USD 1 million to over USD 100 million per launch, new entrants face tough barriers to entry, and even established players are pressured to balance profitability with innovation.

Information Source:

https://www.fortunebusinessinsights.com/u-s-space-launch-services-market-107568

Key Players

The competitive U.S. market features a mix of private space companies, defense contractors, and government programs. Notable participants include:

SpaceX (U.S.)

Blue Origin Enterprises, L.P. (U.S.)

United Launch Alliance (U.S.)

Lockheed Martin Corporation (U.S.)

Northrop Grumman Systems Corporation (U.S.)

NASA (U.S.) – via its Launch Services Program (LSP)

International firms like ArianeGroup (France), Antrix Corporation (India), and Mitsubishi Heavy Industries (Japan) also play supporting roles, often through collaborative projects.

Industry Developments

The sector has been buzzing with activity, underscoring the pace of innovation:

November 2022: Rocket Lab secured a USD 14 million contract for satellite separation systems.

August 2022: NASA awarded SpaceX five more astronaut missions worth USD 1.4 billion under the Commercial Crew Program.

September 2021: Rocket Lab USA received USD 24.35 million to develop the upper stage of the Neutron rocket, funded by the U.S. Space Force.

These developments highlight the growing reliance on private players, as NASA and the U.S. military partner with companies to accelerate space access.