Cryogenic Pod Market Growth Analysis, Dynamics, Key Players and Innovations, Outlook and Forecast 2025-2032

By siddheshkapshikar, 2025-09-11

MARKET INSIGHTS

The global cryogenic pod market was valued at USD 6.93 billion in 2024 and is projected to reach USD 10.58 billion by 2031, exhibiting a compound annual growth rate (CAGR) of 6.4% during the forecast period. While North America currently dominates the market due to advanced healthcare infrastructure, Asia-Pacific is anticipated to witness the fastest growth owing to rising medical tourism and increasing healthcare investments.

Cryogenic pods, also known as cryo pods or cryonic pods, are specialized medical devices designed to induce and maintain cryogenic suspension for therapeutic or preservation purposes. These pods utilize advanced cooling technologies to lower body temperatures significantly, with applications ranging from athletic recovery to experimental medical treatments. The equipment integrates temperature control systems, safety monitors, and often liquid nitrogen-based cooling mechanisms to ensure stable cryogenic conditions.

Market growth is primarily driven by increasing applications in sports medicine and rising interest in cutting-edge medical technologies. However, high implementation costs and regulatory challenges in some regions present obstacles to wider adoption. Key players like Cryo Manufacturing and MECOTEC are investing in R&D to develop more efficient and accessible systems, with recent advancements focusing on portable cryo pod solutions for clinical settings.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Adoption of Cryotherapy in Sports Medicine to Accelerate Market Growth

The rising utilization of cryogenic pods for athlete recovery is emerging as a significant market driver, particularly in professional sports. Whole-body cryotherapy treatments have been shown to reduce muscle inflammation and accelerate recovery time by up to 40% compared to traditional methods. The sports medicine sector is witnessing growing investments, with professional athletes and teams incorporating cryogenic pods into their recovery regimens. This trend is further amplified by the expanding global sports industry, valued in the billions, where marginal performance gains can significantly impact competitive outcomes. The effectiveness of cryogenic therapy in reducing recovery periods between training sessions is driving adoption across major sports franchises and fitness centers.

Expanding Applications in Medical Rehabilitation to Fuel Demand

Cryogenic pods are gaining traction in clinical applications beyond sports, particularly in post-surgical recovery and chronic pain management. Medical professionals are increasingly recommending cryotherapy for conditions including arthritis, fibromyalgia, and post-operative rehabilitation, with patients reporting pain reduction of up to 60% following treatments. The global chronic pain management market, projected to grow substantially in coming years, presents significant opportunities for cryogenic pod adoption. Moreover, the non-invasive nature of cryotherapy makes it an attractive alternative to pharmaceutical pain management, aligning with the broader healthcare shift toward drug-free therapeutic solutions.

The expansion of rehabilitation centers specializing in cryotherapy, along with rising insurance coverage for such treatments in some healthcare systems, is expected to further stimulate market growth. Several leading medical institutions have begun conducting clinical trials to establish evidence-based protocols for cryogenic applications.

MARKET RESTRAINTS

High Capital and Operational Costs Limit Market Penetration

The cryogenic pod market faces substantial growth barriers due to the significant investment required for equipment acquisition and maintenance. Prices for commercial-grade cryogenic chambers can exceed several hundred thousand dollars, with additional substantial costs for liquid nitrogen supply systems and specialized facility modifications. These financial requirements create challenges for small clinics and fitness centers looking to adopt the technology. Operating expenses, including regular equipment servicing and cryogen replenishment, add further financial burdens that can deter potential buyers, particularly in price-sensitive markets.

Additional Restraints

Regulatory Uncertainty

The lack of standardized global regulations for cryotherapy devices creates market entry barriers. While some countries have established certification processes, others lack clear guidelines, causing hesitation among healthcare providers to invest in the technology. This regulatory fragmentation particularly affects manufacturers looking to expand into new geographic markets.

Limited Clinical Evidence

Although cryotherapy shows promising results, the current body of peer-reviewed research remains relatively limited compared to more established therapeutic modalities. The absence of large-scale, long-term clinical studies creates uncertainty among mainstream medical professionals, slowing broader adoption in clinical settings.

MARKET CHALLENGES

Safety Concerns and User Education Present Ongoing Challenges

Despite technological advancements, cryogenic pod manufacturers continue to face safety-related challenges. Proper cryotherapy administration requires specialized training, as improper use can lead to cryogenic burns or other cold-related injuries. The market must overcome perception issues stemming from isolated incidents of improper usage, which have led to increased scrutiny from regulatory bodies. There is also a need for comprehensive user education programs to ensure both practitioners and clients understand proper protocols and contraindications.

Additionally, the industry faces the ongoing challenge of establishing standardized treatment protocols. While individual centers have developed their own best practices, the lack of universally accepted guidelines for session duration, frequency, and temperature parameters creates variability in treatment efficacy.

MARKET OPPORTUNITIES

Technological Innovations Open New Application Areas

Emerging technological advancements in cryogenic pod systems present significant growth opportunities. Developments in precise temperature control systems, enhanced safety features, and improved user interfaces are making the technology more accessible. Some next-generation models now incorporate biometric monitoring capabilities, allowing for personalized treatment protocols based on real-time physiological data. These innovations expand potential applications to include wellness programs, cosmetic treatments, and specialized therapeutic uses.

The growing integration of cryotherapy into luxury wellness and spa facilities represents another promising opportunity. High-end resorts and destination spas are increasingly incorporating cryogenic treatments as premium offerings, capitalizing on the technology's reputation for enhancing well-being and recovery. This expanding commercial segment complements the existing medical and sports markets, potentially driving significant revenue growth.

Furthermore, increasing research into potential benefits for neurological conditions and metabolic disorders may open entirely new medical applications for cryogenic technology. Several leading research institutions have initiated studies exploring cryotherapy's potential in managing conditions ranging from multiple sclerosis to metabolic syndrome.

Segment Analysis:

| Segment Category | Sub-Segments | Key Insights |

| By Type |

|

Vertical Cryogenic Pods dominate due to their space-efficient design and widespread use in medical and sports recovery applications. |

| By Application |

|

Athletes Recovering is the leading segment as cryogenic therapy is extensively used for rapid muscle recovery and pain relief in professional sports. |

| By End User |

|

Sports & Fitness Centers are the primary adopters, leveraging cryogenic pods for performance enhancement and recovery therapies for athletes. |

COMPETITIVE LANDSCAPE

Key Industry Players

Innovation and Expansion Fuel Competition in the Cryogenic Pod Market

The global cryogenic pod market features a dynamic competitive landscape characterized by both established players and emerging companies vying for market share. The market is projected to grow at a CAGR of 6.4% from 2024 to 2031, reaching $10.58 billion by the end of the forecast period. This growth is driving intense competition as companies expand their product portfolios and geographic presence.

Cryomed and MECOTEC currently lead the market due to their technological innovation in whole-body cryotherapy solutions. Cryomed's recent launch of its next-generation cryochamber with AI temperature control demonstrates the company's commitment to maintaining its 18% market share in Europe. Meanwhile, MECOTEC has strengthened its position through strategic partnerships with sports medicine clinics across North America.

Specialized players like Impact Cryotherapy and KRION have carved out significant niches by focusing on athletic recovery applications. Impact Cryotherapy's mobile cryo sauna units, deployed at major sporting events, have helped the company capture 12% of the U.S. athletic recovery segment in 2024. KRION's patented rapid cooling technology has similarly gained traction in professional sports franchises.

The competitive environment is further intensified by new entrants such as CryoBuilt and Cryo Innovations , who are disrupting traditional business models with modular, space-efficient pod designs. These companies are gaining market share by addressing the growing demand for compact cryotherapy solutions in urban wellness centers.

List of Key Cryogenic Pod Companies Profiled

-

Cryomed (Russia)

-

MECOTEC (Germany)

-

Cryo Manufacturing (U.S.)

-

Grand Cryo (France)

-

Impact Cryotherapy (U.S.)

-

JUKA (Poland)

-

KRION (Italy)

-

CryoBuilt (U.S.)

-

CRYOPOD (U.K.)

-

Cryo Innovations (Canada)

CRYOGENIC POD MARKET TRENDS

Rising Adoption of Cryotherapy for Medical and Wellness Applications

The global cryogenic pod market is experiencing significant growth, driven by the increasing adoption of whole-body cryotherapy in medical rehabilitation and sports medicine. Cryogenic pods, originally developed for cryonics, are now widely used for therapeutic applications such as muscle recovery, pain management, and inflammation reduction. Studies indicate that cold therapy can lower tissue temperature by up to 10-15°C, significantly reducing muscle soreness and accelerating healing. The growing acceptance among athletes and healthcare practitioners is contributing to market expansion, with sports medicine alone accounting for approximately 35% of total cryogenic pod applications in 2024.

Other Trends

Technological Advancements in Cryogenic Preservation

Recent innovations in cryogenic pod technology focus on improving safety, precision, and user experience. Modern systems incorporate automated temperature control, real-time biometric monitoring, and enhanced insulation materials to maintain optimal cryogenic conditions. The integration of AI-powered systems has enabled personalized cooling protocols tailored to individual physiological responses, increasing the efficiency of treatment sessions. Furthermore, advancements in nitrogen-based cooling systems have reduced operational costs by nearly 20%, making cryotherapy more accessible to wellness centers and clinics.

Expansion of Cryotherapy in Wellness and Anti-Aging Sectors

The wellness industry's growing focus on anti-aging and holistic health solutions has created new opportunities for cryogenic pod manufacturers. Cryotherapy is gaining attention for its potential benefits in collagen production, skin rejuvenation, and metabolic enhancement. High-end spas and aesthetic clinics are increasingly incorporating cryogenic chambers into their service offerings, with the global wellness market for cryotherapy projected to grow at 8.2% annually through 2031. This trend is particularly strong in developed markets, where disposable incomes allow for premium health and beauty treatments.

While the market shows strong potential, infrastructure requirements and regulatory hurdles in some regions pose challenges to widespread adoption. However, continued research into cryotherapy's long-term benefits and the development of more compact, cost-effective pod designs are expected to drive further market penetration across diverse healthcare and wellness applications.

Europe Europe maintains the second-largest market share, led by Germany, Switzerland, and Russia where cryonics has gained legal recognition. The region shows 35% year-over-year growth in cryotherapy clinic openings , particularly in wellness tourism destinations. Stringent EU regulations on biomedical research restrain whole-body preservation activities, though Eastern European countries are emerging as cost-effective alternatives for cryonics services. The market benefits from cross-border medical tourism, with UK and Scandinavian clients increasingly utilizing Central European cryofacilities.

Asia-Pacific Asia represents the fastest-growing regional market, projected to expand at 8.1% CAGR through 2031 . Japan leads in technological innovation with compact pod designs, while China dominates manufacturing output. India shows remarkable adoption in sports medicine, with cricket franchises and Olympic training centers implementing cryo-recovery systems. Cultural resistance to body preservation persists in most countries, making therapeutic applications the primary revenue driver. Singapore and South Korea are emerging as regional hubs for cryonics research partnerships with Western institutions.

South America Brazil accounts for 60% of regional demand, fueled by elite athlete adoption and medical tourism infrastructure in São Paulo. However, economic volatility constrains market expansion, with most cryotherapy equipment imported from North America and Europe at premium prices. Argentina shows niche growth among wealthy demographics pursuing cryopreservation, though lack of local storage facilities necessitates international partnerships. Regulatory frameworks remain underdeveloped across the region, creating operational uncertainties for service providers.

Middle East & Africa The UAE dominates regional adoption through luxury wellness centers catering to high-net-worth individuals and professional athletes. Saudi Arabia's Vision 2030 healthcare modernization initiatives are driving first-time installations in elite sports academies. South Africa serves as the African leader in therapeutic cryotherapy, though infrastructure limitations hinder widespread adoption. Religious and ethical considerations significantly slow market penetration for whole-body preservation services across most Middle Eastern and African nations.

Report Scope

This market research report offers a holistic overview of global and regional markets for the forecast period 2025–2032. It presents accurate and actionable insights based on a blend of primary and secondary research.

Key Coverage Areas:

-

✅ Market Overview

-

Global and regional market size (historical & forecast)

-

Growth trends and value/volume projections

-

-

✅ Segmentation Analysis

-

By product type or category

-

By application or usage area

-

By end-user industry

-

By distribution channel (if applicable)

-

-

✅ Regional Insights

-

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

-

Country-level data for key markets

-

-

✅ Competitive Landscape

-

Company profiles and market share analysis

-

Key strategies: M&A, partnerships, expansions

-

Product portfolio and pricing strategies

-

-

✅ Technology & Innovation

-

Emerging technologies and R&D trends

-

Automation, digitalization, sustainability initiatives

-

Impact of AI, IoT, or other disruptors (where applicable)

-

-

✅ Market Dynamics

-

Key drivers supporting market growth

-

Restraints and potential risk factors

-

Supply chain trends and challenges

-

-

✅ Opportunities & Recommendations

-

High-growth segments

-

Investment hotspots

-

Strategic suggestions for stakeholders

-

-

✅ Stakeholder Insights

-

Target audience includes manufacturers, suppliers, distributors, investors, regulators, and policymakers

-

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global Cryogenic Pod Market?

-> The Global Cryogenic Pod market was valued at USD 6,928 million in 2024 and is projected to reach USD 10,580 million by 2031 .

Which key companies operate in Global Cryogenic Pod Market?

-> Key players include Cryo Manufacturing, Cryomed, Grand Cryo, Impact Cryotherapy, JUKA, KRION, MECOTEC, CryoBuilt, CRYOPOD, and Cryo Innovations .

What are the key growth drivers?

-> Key growth drivers include rising demand for cryotherapy in sports medicine, increasing adoption in medical treatments, and technological advancements in cryopreservation .

Which region dominates the market?

-> North America holds the largest market share, while Asia-Pacific is expected to witness the fastest growth during the forecast period.

What are the emerging trends?

-> Emerging trends include integration of AI in temperature monitoring, portable cryogenic pod development, and increasing applications in anti-aging treatments .

AI-driven Production Scheduling Solution Market Growth Analysis, Dynamics, Key Players and Innovations, Outlook and Forecast 2025-2032

By siddheshkapshikar, 2025-09-11

MARKET INSIGHTS

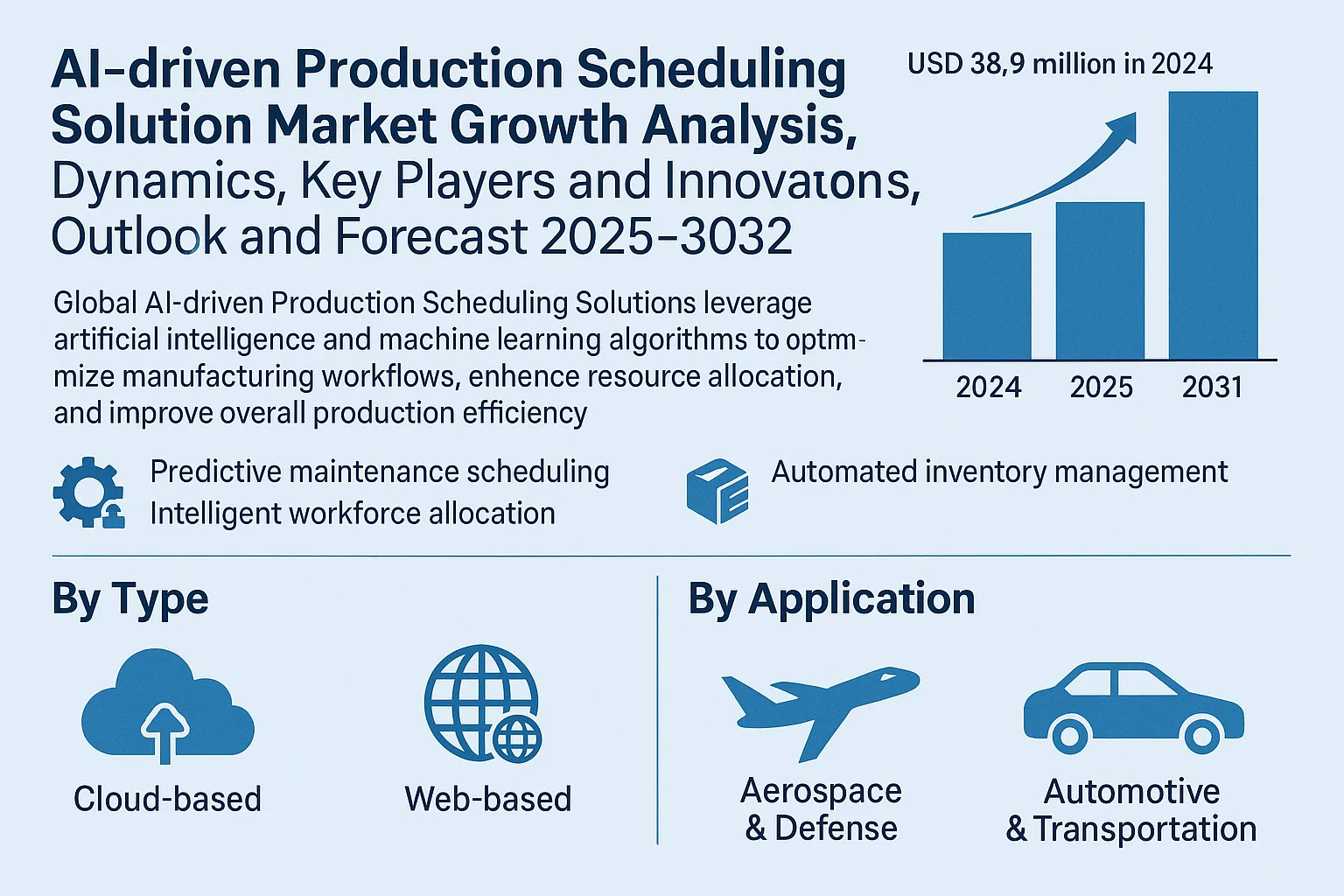

Global AI-driven Production Scheduling Solution market size was valued at USD 38.9 million in 2024. The market is projected to grow from USD 43.6 million in 2025 to USD 87.7 million by 2031, exhibiting a CAGR of 12.1% during the forecast period.

AI-driven Production Scheduling Solutions leverage artificial intelligence and machine learning algorithms to optimize manufacturing workflows, enhance resource allocation, and improve overall production efficiency. These advanced systems analyze real-time operational data, predict potential bottlenecks, and dynamically adjust production schedules to maximize throughput while minimizing downtime. The solutions encompass capabilities such as predictive maintenance scheduling, intelligent workforce allocation, and automated inventory management.

The market growth is primarily driven by increasing adoption of Industry 4.0 technologies, growing emphasis on operational efficiency, and rising demand for smart manufacturing solutions. Cloud-based deployment models are gaining particular traction due to their scalability and real-time accessibility, projected to account for over 45% of the market by 2026. Key industry players like o9 Solutions and C3.ai are expanding their AI capabilities through strategic partnerships, while manufacturing giants increasingly integrate these solutions into their digital transformation initiatives to maintain competitive advantage.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Complexity in Manufacturing Operations Accelerates AI Adoption

Modern manufacturing environments face unprecedented complexity due to globalized supply chains, fluctuating demand, and the need for mass customization. Traditional scheduling methods struggle to adapt to real-time disruptions, creating inefficiencies that cost manufacturers billions annually. AI-driven production scheduling solutions dynamically optimize workflows by processing real-time data from IoT devices, ERP systems, and supplier networks. Facilities implementing these solutions report 15-30% improvements in production throughput while reducing inventory costs by up to 25%. The automotive sector leads adoption with 43% of tier-1 suppliers now utilizing predictive scheduling algorithms to manage just-in-time manufacturing.

Industry 4.0 Investments Create Favorable Ecosystem

The global Industry 4.0 market size exceeding $130 billion demonstrates significant infrastructure support for AI scheduling solutions. Smart factories increasingly deploy edge computing architectures that enable real-time AI decision-making at the production line level. Semiconductor manufacturers using these systems achieved 22% shorter cycle times during recent supply chain disruptions. Government initiatives like Germany's Platform Industrie 4.0 and China's Made in China 2025 policy further stimulate adoption through tax incentives and digital transformation grants.

Cloud Computing Democratizes Advanced Scheduling Capabilities

Cloud-based deployment now accounts for 62% of new AI scheduling implementations, eliminating upfront infrastructure costs that previously limited adoption to large enterprises. Mid-market manufacturers gain access to enterprise-grade optimization through subscription models priced 30-40% below on-premise solutions. Recent platform enhancements incorporate digital twin technology, allowing manufacturers to simulate schedule changes before implementation with 95%+ accuracy in outcome prediction.

MARKET RESTRAINTS

Legacy System Integration Challenges Impede Rollout

While AI scheduling promises significant benefits, 58% of manufacturers report integration difficulties with existing MES and ERP systems. Data silos and incompatible protocols create implementation timelines averaging 9-15 months for comprehensive deployments. The aerospace sector faces particular challenges where certification requirements limit software update frequencies, causing lag between AI recommendations and executable schedules.

Additional Constraints

Workforce Resistance to Autonomous Decision-Making

Production managers accustomed to manual scheduling often distrust algorithmic recommendations, especially when redundancies are suggested. Change management accounts for 30% of total implementation costs as organizations retrain staff to interpret AI-driven insights rather than override them.

Regulatory Uncertainty in Critical Industries

Pharmaceutical and defense manufacturers face strict validation requirements for scheduling changes. Recent FDA guidance on continuous manufacturing highlights gaps in current AI solutions' audit trail capabilities, delaying adoption in regulated environments.

MARKET OPPORTUNITIES

Supply Chain Volatility Creates New Optimization Horizons

The post-pandemic emphasis on supply chain resilience drives demand for multi-echelon inventory optimization within scheduling platforms. Solutions incorporating supplier risk analytics command 20-25% premium pricing while reducing stockout risks by 40%. Automotive OEMs now require suppliers to demonstrate AI-driven scheduling capabilities as part of vendor qualification processes.

Sustainability Initiatives Align with Efficiency Gains

Energy-aware scheduling algorithms that minimize carbon footprint during production are gaining traction, particularly in the EU where carbon border taxes take effect. Early adopters report 15-18% reductions in energy consumption through intelligent batch scheduling that optimizes equipment usage during off-peak utility rates.

Edge AI Enables Real-Time Shop Floor Adaptation

Next-generation solutions embed lightweight AI models directly into PLCs and industrial PCs, reducing cloud dependency for time-sensitive decisions. This architecture proves particularly valuable in high-mix environments where changeovers occur every 15-20 minutes. Pilot implementations show 30% faster response to unplanned downtime events compared to cloud-dependent systems.

Segment Analysis:

By Type

Cloud-based Solutions Lead the Market Due to Scalability and Real-time Data Processing Advantages

The market is segmented based on type into:

-

Cloud-based

-

Subtypes: SaaS models, hybrid solutions, and others

-

-

Web-based

-

On-premise

-

Subtypes: Customized enterprise solutions, standalone systems

-

-

Hybrid

-

Others

By Application

Industrial Manufacturing Dominates Application Segment Due to Complex Production Needs

The market is segmented based on application into:

-

Aerospace & Defense

-

Automotive & Transportation

-

Industrial Manufacturing

-

Electronics

-

Others

By Technology

Machine Learning Integration Holds Major Share for Predictive Scheduling Capabilities

The market is segmented based on technology into:

-

Machine Learning

-

Deep Learning

-

Predictive Analytics

-

Natural Language Processing

-

Others

By Deployment Model

Enterprise-wide Deployments Gain Traction for Unified Production Management

The market is segmented based on deployment model into:

-

Departmental

-

Plant-wide

-

Enterprise-wide

-

Supply Chain-wide

COMPETITIVE LANDSCAPE

Key Industry Players

Leading Providers Accelerate AI-Driven Innovation to Capture Market Share

The AI-driven production scheduling solution market features a dynamic competitive environment with both established technology providers and emerging startups. Skyplanner APS and o9 Solutions, Inc. have emerged as frontrunners, collectively commanding significant market share through their comprehensive platforms that integrate machine learning with enterprise resource planning (ERP) systems. The U.S.-based players dominate the landscape, benefiting from early adoption in manufacturing hubs.

Plataine , specializing in IIoT and AI optimization for factories, has gained traction in aerospace and automotive sectors, while C3.ai leverages its enterprise AI expertise to deliver predictive scheduling at scale. These companies have demonstrated 30-45% year-over-year revenue growth since 2022, outperforming market averages.

The market sees intense competition in cloud-based deployments, where Solvoyo and Praxie are disrupting traditional players with SaaS models offering rapid implementation. Meanwhile, European challengers like Cybertec and DUALIS are gaining ground through tailored solutions for medium enterprises.

Strategic moves are shaping the competitive dynamics – from o9 Solutions' 2023 acquisition of process mining firm Fluxicon to Plataine's partnership with Siemens Digital Industries. Such consolidations allow vendors to offer end-to-end digital thread capabilities, a key differentiator as manufacturers seek unified platforms.

List of Key AI-Driven Production Scheduling Solution Providers

-

Skyplanner APS (Denmark)

-

o9 Solutions, Inc. (U.S.)

-

Plataine (Israel)

-

Solvoyo (U.S.)

-

Praxie (U.S.)

-

C3.ai (U.S.)

-

EasyFlow (Germany)

-

SCW.AI (U.K.)

-

GMDH, Inc (U.S.)

-

Cybertec (Germany)

-

DUALIS (Germany)

-

theurer.com GmbH (Germany)

AI-DRIVEN PRODUCTION SCHEDULING SOLUTION MARKET TRENDS

Integration of AI and Predictive Analytics Reshaping Manufacturing Efficiency

The adoption of AI-driven production scheduling solutions is accelerating due to their ability to process vast datasets in real-time, optimize workflows, and reduce operational inefficiencies. These systems leverage machine learning algorithms to predict equipment failures, material shortages, and labor constraints before they disrupt production. Recent advancements in predictive analytics have enabled manufacturers to achieve up to 30% improvement in throughput by dynamically adjusting schedules based on real-time demand and supply fluctuations. Furthermore, AI-powered tools now integrate with IoT-enabled devices, allowing seamless communication between machines and software for end-to-end visibility across production lines.

Other Trends

Cloud-based Deployment Gaining Momentum

Cloud-based AI scheduling solutions are experiencing rapid growth due to their scalability, cost-efficiency, and remote accessibility. Industry data indicates that cloud deployments account for over 45% of new implementations, as they eliminate the need for on-premise infrastructure while enabling real-time collaboration across global teams. This shift has been particularly significant in SMEs, where limited IT resources make cloud adoption a practical choice. The flexibility of web-based and hybrid models further supports multi-site manufacturing operations, ensuring synchronized scheduling even in distributed environments.

Sector-Specific Customization Driving Adoption

Automotive and aerospace manufacturers are leading the adoption of tailored AI scheduling solutions to manage complex assembly processes and stringent compliance requirements. In automotive, just-in-time production models rely on AI to balance supply chain volatility, with some OEMs reporting 20-25% reduction in inventory costs. Meanwhile, industrial manufacturing segments are using these tools to optimize energy-intensive processes, aligning production schedules with off-peak utility rates for additional savings. The ability to customize algorithms for specific operational constraints—such as tooling dependencies in semiconductor fabrication—is proving critical for high-precision industries.

Regional Analysis: AI-driven Production Scheduling Solution Market

North America

North America remains the dominant market for AI-driven production scheduling solutions, fueled by rapid Industry 4.0 adoption and substantial investments in smart manufacturing. The U.S., in particular, accounts for the largest regional market share due to its advanced technological infrastructure and early adoption of AI-powered industrial solutions. Key factors driving growth include the strong presence of automotive and aerospace manufacturers leveraging predictive scheduling tools, alongside increasing investments by tech giants in cloud-based solutions. Challenges persist in legacy system integration, but the growing demand for real-time optimization in high-value manufacturing continues to accelerate market expansion.

Europe

The European market demonstrates robust growth, characterized by stringent operational efficiency standards and a thriving industrial automation sector. Germany leads regional adoption, given its extensive manufacturing base and emphasis on digital transformation initiatives under Industry 4.0 policies. There is particular demand for AI scheduling solutions in automotive and pharmaceutical industries, where compliance with tight production timelines is critical. However, data privacy concerns under GDPR and hesitancy among small-to-midsize manufacturers pose adoption barriers. Several EU-funded smart manufacturing projects are gradually overcoming these challenges by demonstrating ROI in dynamic scheduling applications.

Asia-Pacific

Asia-Pacific is witnessing the fastest market growth, with China, Japan, and South Korea spearheading adoption across electronics and automotive sectors. China's dominance stems from government-backed smart manufacturing initiatives and the presence of massive production facilities requiring complex scheduling. Japan's focus on Lean manufacturing principles synergizes well with AI-driven optimization tools. While India shows promising growth due to expanding automotive and textile industries, uneven digital infrastructure across the region creates adoption disparities. Cloud-based solutions are gaining traction, particularly among multinational manufacturers with distributed supply chains.

South America

The South American market is developing steadily, with Brazil and Argentina showing gradual uptake in automotive and food processing industries. Economic volatility sometimes restricts large-scale investments, prompting manufacturers to prioritize basic scheduling modules over comprehensive AI solutions. However, the growing need to compete in global supply chains is driving interest in production optimization tools. Local providers are emerging with simpler, cost-effective versions of AI scheduling software tailored for mid-sized factories. The region offers long-term potential as manufacturing sectors mature and digital transformation gains momentum.

Middle East & Africa

This region represents an emerging market where adoption is concentrated in oil & gas and discrete manufacturing sectors. UAE and Saudi Arabia lead in implementing advanced scheduling solutions, often integrated with broader smart factory initiatives. While market penetration remains low compared to other regions, increasing foreign direct investment in manufacturing and government digital transformation agendas are creating demand. Infrastructure limitations and skills gaps currently restrain faster adoption, though partnerships between local manufacturers and global AI solution providers are beginning to bridge these gaps through customized implementations.

Report Scope

This market research report offers a holistic overview of global and regional markets for the forecast period 2025–2032. It presents accurate and actionable insights based on a blend of primary and secondary research.

Key Coverage Areas:

-

✅ Market Overview

-

Global and regional market size (historical & forecast)

-

Growth trends and value/volume projections

-

-

✅ Segmentation Analysis

-

By product type or category

-

By application or usage area

-

By end-user industry

-

By distribution channel (if applicable)

-

-

✅ Regional Insights

-

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

-

Country-level data for key markets

-

-

✅ Competitive Landscape

-

Company profiles and market share analysis

-

Key strategies: M&A, partnerships, expansions

-

Product portfolio and pricing strategies

-

-

✅ Technology & Innovation

-

Emerging technologies and R&D trends

-

Automation, digitalization, sustainability initiatives

-

Impact of AI, IoT, or other disruptors (where applicable)

-

-

✅ Market Dynamics

-

Key drivers supporting market growth

-

Restraints and potential risk factors

-

Supply chain trends and challenges

-

-

✅ Opportunities & Recommendations

-

High-growth segments

-

Investment hotspots

-

Strategic suggestions for stakeholders

-

-

✅ Stakeholder Insights

-

Target audience includes manufacturers, suppliers, distributors, investors, regulators, and policymakers

-

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global AI-driven Production Scheduling Solution Market?

-> The global AI-driven Production Scheduling Solution market was valued at USD 38.9 million in 2024 and is projected to reach USD 87.7 million by 2031 .

Which key companies operate in Global AI-driven Production Scheduling Solution Market?

-> Key players include Skyplanner APS, o9 Solutions, Inc., Plataine, Solvoyo, Praxie, C3.ai, EasyFlow, SCW.AI, GMDH, Inc, and Cybertec , among others.

What are the key growth drivers?

-> Key growth drivers include rising demand for manufacturing automation, increasing complexity in supply chains, and the need for real-time production optimization .

Which region dominates the market?

-> North America holds the largest market share, while Asia-Pacific is expected to witness the fastest growth during the forecast period.

What are the emerging trends?

-> Emerging trends include integration with IoT platforms, predictive maintenance capabilities, and cloud-based deployment models .

https://sidintelmarketresearch.blogspot.com/2025/09/spinal-fluid-manometer-market-growth_10.html

https://sidintelmarketresearch.blogspot.com/2025/09/sectional-valve-market-growth-analysis_10.html

https://sidintelmarketresearch.blogspot.com/2025/09/lightning-warning-system-market-growth_10.html

https://sidintelmarketresearch.blogspot.com/2025/09/vehicle-exhaust-emission-control_9.html

https://sidintelmarketresearch.blogspot.com/2025/09/industrial-grade-ferrous-sulfate.html

https://sidintelmarketresearch.blogspot.com/2025/09/roof-lift-system-market-growth-analysis.html

https://sidintelmarketresearch.blogspot.com/2025/09/graphite-braided-packing-market-growth.html

Multi-Function Wall Mount Handshower Market Growth Analysis, Dynamics, Key Players and Innovations, Outlook and Forecast 2025-2032

By siddheshkapshikar, 2025-09-11

According to a new report from Intel Market Research , the global Multi-Function Wall Mount Handshower market was valued at USD 2,600 million in 2024 and is projected to reach USD 3,188 million by 2031 , growing at a CAGR of 3.4% during the forecast period (2025-2031). This steady growth reflects increasing consumer demand for premium bathroom fixtures and technological innovations in shower systems worldwide.

What are Multi-Function Wall Mount Handshowers?

Multi-function wall mount handshowers are advanced bathroom fixtures that combine the convenience of a handheld unit with the stability of wall-mounted systems. These premium products offer multiple spray patterns including rain, massage, mist, and jet streams , controlled through intuitive selector mechanisms. Modern iterations feature water-saving technologies that reduce consumption by 20-30%, along with ergonomic designs for enhanced user comfort and anti-lime scale nozzles for longevity.

The category has evolved significantly from basic showerheads, now incorporating smart home integrations and precision engineering. Leading brands like Grohe and Kohler have recently introduced voice-controlled and temperature-regulating models, pushing the boundaries of bathroom technology.

Download FREE Sample Report :

Multi-Function Wall Mount Handshower Market - View in Detailed Research Report

Key Market Drivers

1. Growing Demand for Premium Bathroom Experiences

The market is witnessing notable growth due to consumers prioritizing bathroom renovations as personal wellness spaces. With bathroom remodels accounting for nearly 30% of global home improvement spending , homeowners are increasingly opting for multi-functional fixtures that combine aesthetic appeal with advanced functionality. These products outperform conventional showerheads by offering customized water flow patterns and easy-to-use controls.

2. Smart Technology Integration

Approximately 40% of new bathroom installations in developed markets now incorporate smart features. Manufacturers are responding with handshowers featuring temperature memory functions, voice control compatibility through home assistants, and real-time water usage monitoring. Government regulations mandating water efficiency (typically 2.0 gallons per minute maximum flow rates) are further accelerating adoption of these intelligent systems.

3. Commercial Sector Adoption

The hospitality industry represents a significant growth channel, with 65% of four- and five-star hotels incorporating multi-function handshowers in renovation projects. Healthcare facilities are also adopting these fixtures for their accessibility benefits, particularly in senior care and mobility-impaired patient accommodations.

Market Challenges

The industry faces several meaningful obstacles that require strategic solutions:

-

Price Sensitivity: With a 40-60% price premium over basic showerheads, mainstream adoption faces barriers in cost-conscious markets. Installation complexity requiring professional plumbing services further limits DIY installations in developing regions.

-

Supply Chain Pressures: Brass and stainless steel components (comprising 75% of product materials) continue to face supply disruptions, with lead times extending to 12-16 weeks in some markets. Raw material cost fluctuations have compressed manufacturer margins by 8-12% over recent years.

-

Performance Variability: Inconsistent water pressure (particularly below the required 30 psi minimum in older buildings) leads to suboptimal performance, requiring manufacturers to invest in pressure-compensating technologies that increase production costs.

Emerging Opportunities

The market presents several promising growth avenues:

-

Aging Population Solutions: With over 1 billion people aged 60+ worldwide, demand is surging for accessible bathroom fixtures featuring ergonomic grips and anti-slip surfaces designed in collaboration with occupational therapists.

-

Emerging Market Expansion: The Asia-Pacific middle class , projected to reach 3.5 billion by 2030, is driving demand for localized product variations including integrated water filtration systems for regions with hard water challenges.

-

Smart Ecosystem Integration: The 15% CAGR growth projected for smart bathrooms creates opportunities for handshowers to serve as control interfaces in connected bathroom ecosystems featuring synchronized lighting, ventilation, and water temperature presets.

Regional Market Insights

The market demonstrates distinct regional characteristics:

-

North America: Leads global adoption with an 80% market share in the region held by the U.S., driven by WaterSense-compliant products and smart home integration trends.

-

Europe: Shows strong preference for sustainable solutions, with Germany and France collectively representing 45% of regional demand for water-efficient models meeting strict EU ErP regulations.

-

Asia-Pacific: Emerging as the fastest-growing region ( 5.2% CAGR ), with China, Japan, and South Korea accounting for 70% of regional demand across both premium and value segments.

-

Middle East: Luxury hotel developments in UAE and Saudi Arabia drive 60% of regional sales , showcasing preference for imported European brands and premium finishes.

Market Segmentation

By Material Type

-

Stainless Steel

-

Brass

-

Other Materials

By Application

-

Residential

-

Commercial (Hospitality, Healthcare, Others)

By Technology

-

Standard

-

Smart (WiFi/Bluetooth Connected)

By Distribution Channel

-

Retail Stores

-

Specialty Bath Showrooms

-

Online Platforms

Get Full Report Here :

Multi-Function Wall Mount Handshower Market - View in Detailed Research Report

Competitive Landscape

The market features a mix of established plumbing brands and innovative disruptors:

-

Industry Leaders: Grohe and Kohler collectively hold approximately 28% market share , recently launching advanced models like the Euphoria SmartHand Shower with temperature memory functionality.

-

European Innovators: Companies like Hansgrohe distinguish themselves with water-efficient designs, including models that reduce consumption by 60% compared to conventional units .

-

Market Challengers: Emerging players like Waterpik and Brizo compete through focused strategies in wellness and luxury segments respectively, accelerating product innovation cycles to every 24 months .

Download FREE Sample Report :

Multi-Function Wall Mount Handshower Market - View in Detailed Research Report

About Intel Market Research

Intel Market Research is a leading provider of strategic intelligence, offering actionable insights in consumer goods , building products , and home improvement markets . Our research capabilities include:

-

Real-time competitive benchmarking

-

Global product innovation tracking

-

Regional market trend analysis

-

Over 500+ industry reports annually

Trusted by Fortune 500 companies, our insights empower decision-makers to drive innovation with confidence.

Website : https://www.intelmarketresearch.com

International : +1 (332) 2424 294

Asia-Pacific : +91 9169164321

LinkedIn : Follow Us

https://sidintelmarketresearch.blogspot.com/2025/09/spinal-fluid-manometer-market-growth_10.html

https://sidintelmarketresearch.blogspot.com/2025/09/sectional-valve-market-growth-analysis_10.html

https://sidintelmarketresearch.blogspot.com/2025/09/lightning-warning-system-market-growth_10.html

https://sidintelmarketresearch.blogspot.com/2025/09/vehicle-exhaust-emission-control_9.html

https://sidintelmarketresearch.blogspot.com/2025/09/industrial-grade-ferrous-sulfate.html

https://sidintelmarketresearch.blogspot.com/2025/09/roof-lift-system-market-growth-analysis.html

https://sidintelmarketresearch.blogspot.com/2025/09/graphite-braided-packing-market-growth.html

Double Sided Labeler Market Growth Analysis, Dynamics, Key Players and Innovations, Outlook and Forecast 2025-2032

By siddheshkapshikar, 2025-09-11

According to a new report from Intel Market Research , the global Double Sided Labeler market was valued at USD 730 million in 2024 and is projected to reach USD 1,040 million by 2031 , growing at a steady CAGR of 5.3% during the forecast period (2025–2031). This expansion is driven by increasing demand across food & beverage, pharmaceuticals, and cosmetics industries, along with advancements in automated labeling solutions.

What is a Double Sided Labeler?

A Double Sided Labeler is a specialized labeling machine designed to apply labels simultaneously on both sides of products or containers. These systems are crucial for industries requiring dual-side product information, branding, or regulatory compliance labels. The machines utilize precision mechanisms to ensure accurate label placement, with configurations ranging from semi-automatic to fully automated high-speed solutions.

Modern double sided labelers feature advanced vision systems for alignment verification, PLC-controlled operation , and compatibility with various label materials including paper, synthetic films, and thermal-transfer printed labels. Leading manufacturers are increasingly incorporating IoT capabilities for real-time performance monitoring and predictive maintenance.

Download Sample Report :

Double Sided Labeler Market - View in Detailed Research Report

Key Market Drivers

1. Stringent Labeling Regulations in Pharma & Food Industries

The pharmaceutical industry's track-and-trace requirements and food sector's nutrition labeling mandates are compelling manufacturers to adopt dual-sided labeling solutions. For instance, FDA's Drug Supply Chain Security Act (DSCSA) and EU's Falsified Medicines Directive require comprehensive product information, often necessitating additional label space.

2. E-commerce Packaging Demands

The exponential growth of e-commerce has created new labeling requirements where products need:

- Consumer-facing branding on one side

- Shipping/fulfillment information on the reverse

- SCM barcodes for warehouse automation

This dual-labeling need has driven a 32% increase in demand from logistics packaging operations since 2022.

3. Automation in Manufacturing

The push towards Industry 4.0 has accelerated the adoption of automated labeling systems that can:

- Process 300+ products per minute in high-speed lines

- Integrate with ERP/MES systems

- Self-correct label placement errors in real-time

Market Challenges

The industry faces several operational and economic challenges:

- High initial investment : Automated dual labelers can cost $75,000-$250,000 , creating barriers for SMEs

- Material compatibility issues : Some adhesive formulations struggle with unconventional packaging surfaces

- Skilled labor shortages for maintaining advanced electro-mechanical systems

Emerging Opportunities

Several technological advancements are creating new possibilities:

- Smart label integration with NFC/RFID capabilities

- AI-powered vision systems for 100% inspection

- Compact modular designs for small-batch production

Notably, Pack Leader Machinery recently introduced a new generation of dual-labelers featuring:

- Touchless label application

- Energy-saving servo motors

- FDA-compliant stainless steel construction

Get Full Report Here :

Double Sided Labeler Market - View in Detailed Research Report

Regional Market Insights

- North America : Dominates with 38% market share due to strict FDA regulations and advanced manufacturing infrastructure

- Europe : Strong growth in pharmaceutical labeling applications, particularly in Germany and Switzerland

- Asia-Pacific : Fastest growing region, with China and India investing heavily in packaging automation

Market Segmentation

By Type

- Automatic

- Semi-automatic

By Application

- Food and Beverage

- Pharma

- Electronics

- Cosmetics

- Others

Competitive Landscape

The report analyzes 17+ key players including:

- Albertina Machinery

- Herma France

- Neostarpack

- Quadrel Labeling Systems

- Zhejiang Haizhou

About Intel Market Research

Intel Market Research is a leading provider of strategic intelligence, offering actionable insights across industrial automation and packaging technology sectors. Our research capabilities include:

- Manufacturing technology benchmarking

- Production capacity analysis

- Supply chain evaluation

- Over 300 industrial equipment reports annually

Trusted by Fortune 500 companies, our insights empower decision-makers to optimize their packaging operations.

Website : https://www.intelmarketresearch.com

International : +1 (332) 2424 294

Asia-Pacific : +91 9169164321

LinkedIn : Follow Us

https://sidintelmarketresearch.blogspot.com/2025/09/spinal-fluid-manometer-market-growth_10.html

https://sidintelmarketresearch.blogspot.com/2025/09/sectional-valve-market-growth-analysis_10.html

https://sidintelmarketresearch.blogspot.com/2025/09/lightning-warning-system-market-growth_10.html

Disc Bowl Centrifuge Market Growth Analysis, Dynamics, Key Players and Innovations, Outlook and Forecast 2025-2032

By siddheshkapshikar, 2025-09-11

MARKET INSIGHTS

The global disc bowl centrifuge market size was valued at USD 1.09 billion in 2024. The market is projected to grow from USD 1.14 billion in 2025 to USD 1.43 billion by 2031, exhibiting a CAGR of 4.0% during the forecast period.

https://www.intelmarketresearch.com/disc-bowl-centrifuge-market-10166

Disc bowl centrifuges are high-speed separation devices that use centrifugal force to separate solids from liquids or immiscible liquids of different densities. These centrifuges consist of stacked conical discs that create multiple separation channels, significantly increasing efficiency compared to conventional settling tanks. The technology is widely applied in industries such as food & beverage, pharmaceuticals, chemicals, and oil & gas , where precise separation of components is critical.

Market growth is driven by increasing industrialization, stricter environmental regulations requiring efficient waste treatment, and rising demand for processed food products. The liquid-liquid separation segment holds significant market share due to applications in edible oil refining and biodiesel production. Geographically, Asia-Pacific dominates the market due to rapid industrialization in China and India, while North America maintains strong demand from pharmaceutical and biotechnology sectors. Key players like Alfa Laval, GEA, and ANDRITZ GROUP continue to innovate with energy-efficient designs to meet evolving industry needs.

MARKET DYNAMICS

MARKET DRIVERS

Growing Demand from Food & Beverage Industry Accelerates Market Expansion

The global food and beverage industry's rapid growth serves as a primary driver for disc bowl centrifuges, with increasing applications in dairy processing, edible oil refining, and beverage clarification. Modern food processing plants require high-throughput separation systems that maintain product quality while meeting strict hygiene standards. Disc bowl centrifuges excel in these applications with separation efficiencies exceeding 99% for many liquid-liquid and solid-liquid separations. As consumer demand for processed foods continues rising projected to grow at 5-7% annually through 2030 manufacturers are expanding production capacities and upgrading equipment, creating sustained demand for advanced centrifugal separation technologies.

Environmental Regulations Drive Adoption in Wastewater Treatment

Stringent environmental policies regarding industrial effluent treatment are compelling manufacturers across sectors to invest in advanced separation technologies. Disc bowl centrifuges play a critical role in sludge dewatering, oil-water separation, and byproduct recovery processes that help companies meet discharge regulations. The technology achieves superior separation performance with total suspended solids removal rates of 90-95% in many applications, making it indispensable for compliance. With wastewater treatment expenditures projected to surpass $90 billion globally by 2025, the demand for high-efficiency centrifuges continues gaining momentum across chemical, petroleum, and pharmaceutical industries.

Furthermore, the equipment's ability to recover valuable byproducts from waste streams creates additional economic incentives for adoption. Modern centrifuges can extract reusable oils, metals, and other materials with purity levels exceeding commercial specifications, transforming waste treatment from a cost center into a potential revenue stream.

MARKET RESTRAINTS

High Capital and Maintenance Costs Limit Market Penetration

While disc bowl centrifuges deliver superior performance, their high initial investment typically ranging from $50,000 to over $500,000 depending on capacity and specifications creates a significant barrier for small and medium enterprises. The sophisticated mechanical design incorporating precision-balanced rotors and specially alloyed components drives manufacturing costs substantially higher than alternative separation technologies. Additionally, operational expenses including power consumption (often 30-100 kW for industrial units), spare parts, and specialized maintenance personnel add considerable lifetime costs that some operators find prohibitive.

Other Restraints

Space and Infrastructure Requirements

Industrial-scale disc bowl centrifuges require substantial floor space and specialized foundations to dampen vibrations, along with robust electrical and utilities infrastructure. These requirements complicate retrofits in existing facilities and can trigger additional construction costs that inflate total project budgets by 15-25% in some cases.

Alternative Technologies

Emerging membrane filtration systems and improved sedimentation technologies continue narrowing the performance gap with centrifuges while offering lower operational complexity. For applications not requiring ultra-fine separations, these alternatives present cost-effective solutions that capture an increasing share of the separation equipment market.

MARKET OPPORTUNITIES

Bioprocessing Sector Creates New Growth Frontiers

The rapidly expanding biopharmaceutical industry presents significant opportunities for disc bowl centrifuge manufacturers, particularly in cell harvesting, debris removal, and product concentration applications. Biologics manufacturing requires gentle yet efficient separation of delicate cellular materials a capability where modern centrifuges with advanced bowl designs excel. With the global bioprocessing equipment market projected to exceed $30 billion by 2028, equipment suppliers are developing specialized centrifuge models featuring sterile designs, CIP/SIP capabilities, and compliance with stringent FDA and EMA regulations.

Additionally, the growing biofuels industry relies heavily on centrifugation for algae harvesting and oil extraction processes. As renewable fuel production scales up to meet decarbonization targets, demand for large-capacity centrifuges optimized for biofuel applications continues rising. Manufacturers responding with products specifically engineered for these emerging applications gain first-mover advantages in high-growth market segments.

MARKET CHALLENGES

Technical Complexity Demands Specialized Expertise

Proper operation and maintenance of disc bowl centrifuges requires highly trained personnel familiar with the equipment's mechanical intricacies and process requirements. The industry faces a growing skills gap as experienced operators retire and fewer technically qualified replacements enter the workforce. Improper operation can lead to catastrophic failures high-speed rotational forces make even minor imbalances potentially dangerous, with repair costs for major incidents often exceeding $100,000.

Other Challenges

Material Compatibility Issues

Centrifuges processing corrosive or abrasive materials experience accelerated wear of critical components like bowl liners and discharge mechanisms. While advanced materials like duplex stainless steels and ceramic coatings improve durability, they increase costs significantly and still require frequent inspection and replacement in harsh operating environments.

Supply Chain Disruptions

The precision mechanical components used in centrifuge manufacturing face extended lead times due to global supply chain constraints. Specialty bearings, corrosion-resistant alloys, and custom machined parts often have procurement timelines exceeding six months, delaying equipment deliveries and aftermarket support.

Segment Analysis:

| Segment Category | Sub-Segments | Key Insights |

| By Type |

|

Liquid-Solid Separation remains the dominant segment due to its critical role in wastewater treatment, mining, and chemical processing industries, which require efficient solid removal. |

| By Application |

|

Food & Beverage is a leading application segment, driven by the need for high-purity liquid clarification in dairy, brewing, and edible oil processing. |

| By End User |

|

Manufacturing Industries account for the highest adoption rate, particularly in sectors requiring continuous separation processes at high volumes. |

| By Operation Mode |

|

Continuous operation systems are preferred in industrial settings for their ability to handle high throughput with minimal downtime. |

COMPETITIVE LANDSCAPE

Key Industry Players

Leading Manufacturers Focus on Technological Advancements to Maintain Market Position

The global disc bowl centrifuge market exhibits a moderately consolidated structure, with established multinational corporations dominating the revenue share while smaller regional players cater to niche applications. Alfa Laval and GEA Group collectively held approximately 32% of the total market revenue in 2024, owing to their comprehensive product lines spanning food processing, pharmaceutical, and industrial applications.

Recent strategic movements have intensified competition, particularly in the Asian market where demand growth outpaces other regions. ANDRITZ GROUP significantly expanded its operations in China through a joint venture announced in Q3 2023, while Mitsubishi Kakoki Kaisha launched three new energy-efficient models specifically designed for Southeast Asian palm oil processing facilities.

The landscape continues evolving as mid-tier competitors adopt aggressive strategies. Flottweg SE has gained market share through patented Turbo Decanter technology that combines disc stack and decanter centrifugation, particularly effective in challenging wastewater treatment applications. Similarly, Pieralisi strengthened its position in the olive oil sector with a 15% increase in Mediterranean region sales during 2023.

Emerging technological trends are reshaping competitive dynamics. Several manufacturers including IHI Corporation and Hutchison Hayes Separators have introduced IoT-enabled centrifuges with predictive maintenance capabilities, responding to growing Industry 4.0 adoption across end-use sectors. However, price competition remains intense in standard models, pressuring margins for manufacturers without differentiated offerings.

List of Key Disc Bowl Centrifuge Manufacturers

-

Alfa Laval (Sweden)

-

GEA Group (Germany)

-

ANDRITZ GROUP (Austria)

-

SPX Plow (U.S.)

-

Mitsubishi Kakoki Kaisha (Japan)

-

Flottweg SE (Germany)

-

Pieralisi (Italy)

-

IHI Corporation (Japan)

-

Polat Group (Turkey)

-

Hutchison Hayes Separators (U.S.)

-

HAUS Centrifuge Technologies (Turkey)

-

Tomoe Engineering (Japan)

-

GN Separation & Conveying (China)

DISC BOWL CENTRIFUGE MARKET TRENDS

Rising Demand for Efficient Separation Technologies Drives Market Growth

The global disc bowl centrifuge market is experiencing steady growth, driven by increasing demand for high-efficiency separation technologies across multiple industries. The food and beverage sector accounts for approximately 35% of total market applications, followed by pharmaceuticals at 22% , as these industries require precise separation of liquids and solids for product refinement. Industrial modernization initiatives in developing economies are accelerating the adoption of advanced centrifugation systems capable of handling larger volumes with greater precision. Manufacturers are focusing on developing centrifuges with energy efficiency improvements of 15-20% compared to previous generations, responding to both economic and environmental pressures.

Other Trends

Pharmaceutical Industry Expansion

The pharmaceutical sector's rapid growth is significantly boosting demand for disc bowl centrifuges, particularly for vaccine production and biopharmaceutical processing. With global vaccine production volumes increasing by 8-10% annually , centrifuges play a critical role in downstream processing. Modern units now feature compliant designs that meet stringent regulatory standards while offering sterile separation capabilities. The ability to process sensitive biological materials without degradation makes these systems indispensable for biotech applications, with newer models reducing product loss rates to less than 2% in most applications.

Technological Innovations in Centrifugal Separation

Manufacturers are implementing advanced technologies such as automated control systems and IoT integration to enhance operational efficiency. Recent innovations include self-cleaning disc stack designs that reduce downtime by 30-40% and hybrid systems capable of simultaneous liquid-liquid and liquid-solid separation. The development of corrosion-resistant materials extends equipment lifespan in harsh industrial environments, particularly in chemical and marine applications. Furthermore, the integration of predictive maintenance algorithms through embedded sensors is helping operators reduce unplanned outages by up to 50% , making these systems more reliable for continuous process industries.

Regional Analysis: Disc Bowl Centrifuge Market

North America The North American market remains technology-driven, with emphasis on high-performance centrifuges for pharmaceutical and specialty chemical applications. The United States accounts for over 70% of regional demand, led by strict FDA compliance requirements and advanced food processing standards. While the market is mature, replacement demand and retrofitting opportunities sustain growth, particularly in dairy processing and marine applications along the Great Lakes region.

Europe European demand focuses on energy-efficient and compact disc bowl centrifuges, particularly in Germany, France, and the Nordic countries. The market benefits from stringent environmental regulations governing industrial waste treatment and strong R&D in centrifugal technologies. However, high equipment costs and the presence of alternative separation technologies moderate growth in price-sensitive segments like municipal wastewater treatment.

South America Brazil and Argentina drive regional demand, primarily in food processing and mining applications. While economic volatility impacts capital investments, the growing palm oil industry in Colombia and expanding dairy sector in Uruguay present emerging opportunities. Market penetration remains challenged by widespread use of traditional separation methods and import dependency for advanced centrifugal equipment.

Middle East & Africa The region shows promising growth in oil processing and desalination applications, particularly in GCC countries. However, limited local manufacturing capabilities and reliance on imported equipment constrain market expansion. South Africa remains the most developed market, with established food processing and mining sectors driving steady demand for maintenance and replacement of existing centrifugal systems.

Report Scope

This market research report offers a holistic overview of global and regional markets for the forecast period 2025–2032. It presents accurate and actionable insights based on a blend of primary and secondary research.

Key Coverage Areas:

-

✅ Market Overview

-

Global and regional market size (historical & forecast)

-

Growth trends and value/volume projections

-

-

✅ Segmentation Analysis

-

By product type or category

-

By application or usage area

-

By end-user industry

-

By distribution channel (if applicable)

-

-

✅ Regional Insights

-

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

-

Country-level data for key markets

-

-

✅ Competitive Landscape

-

Company profiles and market share analysis

-

Key strategies: M&A, partnerships, expansions

-

Product portfolio and pricing strategies

-

-

✅ Technology & Innovation

-

Emerging technologies and R&D trends

-

Automation, digitalization, sustainability initiatives

-

Impact of AI, IoT, or other disruptors (where applicable)

-

-

✅ Market Dynamics

-

Key drivers supporting market growth

-

Restraints and potential risk factors

-

Supply chain trends and challenges

-

-

✅ Opportunities & Recommendations

-

High-growth segments

-

Investment hotspots

-

Strategic suggestions for stakeholders

-

-

✅ Stakeholder Insights

-

Target audience includes manufacturers, suppliers, distributors, investors, regulators, and policymakers

-

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global Disc Bowl Centrifuge Market?

-> The global disc bowl centrifuge market was valued at USD 1.09 billion in 2024 and is projected to reach USD 1.43 billion by 2031 , growing at a CAGR of 4.0% during the forecast period.

Which key companies operate in Global Disc Bowl Centrifuge Market?

-> Key players include Alfa Laval, GEA, ANDRITZ GROUP, SPX Plow, Mitsubishi Kakoki Kaisha, Flottweg, Pieralisi, IHI, Polat Group, and Hutchison Hayes , among others.

What are the key growth drivers?

-> Key growth drivers include increasing demand from food & beverage industries, wastewater treatment applications, and rising adoption in pharmaceutical and chemical processing .

Which region dominates the market?

-> Asia-Pacific is the fastest-growing region due to industrialization, while Europe holds significant market share with advanced manufacturing capabilities.

What are the emerging trends?

-> Emerging trends include energy-efficient centrifuges, IoT-enabled smart separation systems, and automated self-cleaning technologies .

https://www.intelmarketresearch.com/disc-bowl-centrifuge-market-10166

https://sidintelmarketresearch.blogspot.com/2025/09/spinal-fluid-manometer-market-growth_10.html

https://sidintelmarketresearch.blogspot.com/2025/09/sectional-valve-market-growth-analysis_10.html

https://sidintelmarketresearch.blogspot.com/2025/09/lightning-warning-system-market-growth_10.html

https://sidintelmarketresearch.blogspot.com/2025/09/vehicle-exhaust-emission-control_9.html

https://sidintelmarketresearch.blogspot.com/2025/09/industrial-grade-ferrous-sulfate.html

https://sidintelmarketresearch.blogspot.com/2025/09/roof-lift-system-market-growth-analysis.html

https://sidintelmarketresearch.blogspot.com/2025/09/graphite-braided-packing-market-growth.html

High Speed Labeler Market Growth Analysis, Dynamics, Key Players and Innovations, Outlook and Foreca

By siddheshkapshikar, 2025-09-11

MARKET INSIGHTS

Global high speed labeler market size was valued at USD 1,369 million in 2024 and is projected to grow from USD 1,439 million in 2025 to USD 2,019 million by 2031, exhibiting a CAGR of 5.8% during the forecast period. The U.S. market is estimated at USD 420 million in 2024, while China is expected to reach USD 310 million by 2031.

High speed labelers are automated or semi-automated machines designed to apply labels efficiently across industries such as food and beverage, pharmaceuticals, electronics, and cosmetics . These systems utilize various labeling methods including wrap-around, wipe-on, and front-and-back concurrent application to enhance production line efficiency. By synchronizing with conveyor systems, high-speed labelers ensure precise placement, rapid changeovers, and reduced downtime, making them critical for high-volume manufacturing.

The market is expanding due to increasing automation in packaging, stricter labeling regulations (especially in pharma and food safety ), and demand for sustainable labeling solutions. For instance, in 2023, multinational brands like Nestlé and Unilever adopted advanced labeling systems to comply with EU packaging waste directives. Key players such as Multivac, Herma France, and JBT Corporation dominate the market, with the top five companies holding approximately 35% revenue share in 2024. Innovations like RFID-integrated labels and IoT-enabled labelers are further driving adoption.

MARKET DYNAMICS

MARKET DRIVERS

Growing Demand for Packaged Goods Accelerates High-Speed Labeler Adoption

The global packaged food industry continues its upward trajectory, with markets expanding at nearly 5% annually as consumer lifestyles become increasingly convenience-oriented. This surge directly fuels demand for high-speed labeling solutions capable of handling production line speeds exceeding 400 packages per minute. Manufacturers are investing heavily in automated labeling systems to maintain throughput while ensuring 99.9% labeling accuracy – a critical requirement for compliance with stringent FDA and EU packaging regulations. Recent advancements in servo motor technology now enable label placement precision within ±0.5mm, making these systems indispensable for industries requiring batch coding and expiry date labeling.

Pharmaceutical Serialization Mandates Drive Technological Investments

Stringent track-and-trace regulations across major pharmaceutical markets are compelling drug manufacturers to upgrade their labeling infrastructure. The implementation of DSCSA in the U.S. and FMD in the EU has created a $1.2 billion opportunity for high-speed labelers equipped with vision systems and data matrix printing capabilities. Modern units now integrate seamlessly with enterprise resource planning (ERP) systems, allowing real-time serial number generation and verification. This convergence of regulatory compliance and Industry 4.0 technologies has elevated high-speed labelers from mere packaging components to mission-critical quality control nodes in pharmaceutical production lines.

Other Key Growth Drivers

Sustainability Initiatives

The shift toward recyclable packaging materials necessitates advanced labeling systems capable of handling delicate bio-based films and paper substrates without compromising line speeds.

E-commerce Expansion

With global e-commerce packaging volumes projected to double by 2028, fulfillment centers require labeling solutions that can adapt to variable package sizes while maintaining 99%+ read rates for automated sorting systems.

MARKET RESTRAINTS

High Capital Investment Deters SME Adoption

While large enterprises readily absorb the $150,000-$500,000 price points of premium high-speed labeling systems, small and mid-sized manufacturers face significant budgetary constraints. The total cost of ownership extends beyond equipment purchases to include specialized operator training, maintenance contracts, and potential production line reconfiguration. Return on investment timelines stretching beyond three years make adoption challenging for facilities running legacy equipment at lower throughputs. This economic barrier persists despite recent cost reductions in servo motor and vision system components.

Operational Complexity Challenges

Modern high-speed labelers demand sophisticated integration with upstream and downstream processes, requiring dedicated engineering resources. Misfeeds and label application errors at peak speeds can result in waste exceeding 5% of production output before systems are properly tuned. The industry continues grappling with a shortage of technicians qualified to maintain these electromechanical systems, particularly in emerging markets where local support networks remain underdeveloped.

MARKET CHALLENGES

Material Compatibility Issues Disrupt Production Efficiency

The proliferation of sustainable packaging materials presents unforeseen technical hurdles for high-speed labeling systems. Bio-based films and recycled plastics exhibit variable surface energies that challenge conventional adhesive technologies. Industry studies indicate that label application failures increase by 30-40% when transitioning from traditional PET to compostable packaging substrates. Manufacturers must balance sustainability goals against the operational reality that each material changeover can require 4-8 hours of line downtime for system recalibration.

Regulatory Fragmentation

Diverging labeling requirements across jurisdictions complicate equipment specification and deployment. Pharmaceutical manufacturers operating globally must maintain labeling systems capable of accommodating 15+ regional variations in serialization formats, while food producers juggle evolving allergen declaration rules. This regulatory patchwork forces equipment OEMs to develop modular systems with costly software customization options.

MARKET OPPORTUNITIES

AI-Powered Vision Inspection Creates New Value Propositions

The integration of machine learning algorithms with high-speed camera systems opens transformative possibilities for quality assurance. Advanced systems now detect label placement errors, print defects, and substrate inconsistencies at 600+ items per minute with 99.95% accuracy. This capability allows manufacturers to shift from statistical process control to 100% inspection paradigms. Early adopters in the medical device sector report scrap rate reductions exceeding 60% after implementing these intelligent labeling solutions.

Modular Systems Address Flexible Production Needs

The rise of small-batch production and SKU proliferation creates demand for labelers with rapid changeover capabilities. Next-generation platforms featuring tool-less adjustment mechanisms can switch between label sizes and formats in under 90 seconds - a 70% improvement over traditional systems. This flexibility proves particularly valuable for contract manufacturers handling 50+ product variants daily. Equipment vendors offering modular architectures with plug-and-play components are gaining market share in these dynamic production environments.

Segment Analysis:

| Segment Category | Sub-Segments | Key Insights |

| By Type |

|

Automatic High Speed Labelers dominate due to their higher efficiency, reduced labor requirements, and seamless integration with production lines. |

| By Application |

|

Food and Beverage leads the application segment, fueled by stringent labeling regulations and high-volume packaging needs. |

| By Labeling Method |

|

Wrap-around labeling is most prevalent due to its compatibility with cylindrical containers and aesthetic appeal. |

| By Operation Speed |

|

Mid-range 200-500 labels/min systems are most widely adopted, offering optimal balance between speed and precision for diverse industrial applications. |

COMPETITIVE LANDSCAPE

Key Industry Players

Innovation and Automation Drive Competitive Strategy in High-Speed Labeling

The global high-speed labeler market features a diverse competitive landscape with multinational corporations, specialized manufacturers, and emerging regional players competing for market share. While the market remains competitive due to technological advancements, Avery Dennison Printer Systems Division and Herma France currently dominate with their comprehensive portfolio of automated labeling solutions for industries ranging from food & beverage to pharmaceuticals.