Software Defined Radio Market Growth Opportunities, Trends, and Forecast to 2032

By Miyasingh, 2025-08-06

The global software defined radio market was valued at USD 14.19 billion in 2023 and is projected to grow from USD 14.94 billion in 2024 to USD 21.97 billion by 2032, exhibiting a CAGR of 4.9% during the forecast period. North America led the market in 2023, accounting for a 32.84% share.

The software defined radio market is gaining momentum globally, driven by increasing demand for flexible and interoperable communication systems across defense, commercial, and public safety sectors. SDR technology allows radios to be reprogrammed and updated via software, enabling seamless adaptation to different frequencies and protocols without changing hardware. This flexibility is particularly valuable in military operations, disaster response, and emerging 5G networks. Growing investments in defense modernization, along with the rising need for secure, high-speed communication, are fueling market growth. Additionally, technological advancements in cognitive radio and the integration of artificial intelligence are expected to create new growth opportunities in the SDR market.

Browse In-depth Summary of This Research Insight:

https://www.fortunebusinessinsights.com/software-defined-radios-market-102524

List of the Companies Operating in the Market:

- BAE Systems PLC (The U.K.)

- Northrop Grumman Corporation (The U.S.)

- Raytheon Technologies Corporation (The U.S.)

- Elbit Systems Ltd. (Israel)

- Thales Group S.A. (France)

- L3Harris Technologies, Inc. (The U.S.)

- General Dynamics Corporation (The U.S.)

- Viasat, Inc. (The U.S.)

- Leonardo S.p.A. (Italy)

- Rohde & Schwarz GmbH & Co. KG (Germany)

Report Coverage:

The Software Defined Radios (SDR) market is projected to grow at a CAGR of 5.3% during the forecast period of 2023 to 2028, reaching an estimated value of USD 16.20 billion by 2028, up from USD 11.60 billion in 2021. The report, spanning 200 pages, provides in-depth analysis covering revenue forecasts, company profiles, the competitive landscape, key growth factors, and the latest market trends. It offers segmentation by type, component, frequency band, platform, and application, along with regional insights across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Key drivers fueling the growth of the SDR market include the increasing adoption of software defined radios for military applications, which offer enhanced interoperability and flexibility, and the growing shift from conventional communication systems to modern, software-driven communication technologies across both defense and commercial sectors.

Market Segmentation:

Based on the type, the market is classified into general-purpose radio, joint tactical radio system (JTRS), cognitive/intelligent radio, and terrestrial trunked radio (TETRA). Based on the component, the market is bifurcated into hardware and software. Moreover, On the basis of frequency band, the market is categorized into MF/HF (Medium/high frequency), VHF (very high frequency), UHF (ultra-high frequency), and other bands. Based on the platform, the market is segregated into airborne, naval, land, and space. On the basis of application, the market is divided into commercial and military & defense. Lastly, based on the region, the market is segregated into North America, Asia-Pacific, Europe, and Rest of the World.

Report Coverage:

The global market report includes qualitative and quantitative analysis of several factors such as the key drivers and restraints that will impact growth. Additionally, the report provides insights into the regional analysis that covers different regions, which are contributing to the growth of the market. It includes the competitive landscape that involves the leading companies and the adoption of strategies by them to announce partnerships, introduce new products, and collaboration that will further contribute to the growth of the market between 2021 and 2028. Moreover, the research analyst has adopted several research methodologies such as SWOT and PESTEL analysis to extract information about the current trends and industry developments that will drive the market growth during the forecast period.

Driving Factors:

Increasing Adoption of the Product across Several Military Applications to Promote Growth

In February 2021, the Indian Army announced its plans to focus on the revamping of its military communication systems by procuring VHF/UHF Manpack software defined radios under the Make-II class. Like India, several countries are focusing on adopting advanced radio communication systems for tactical applications for their militaries. Moreover, the growing adoption of advanced modern radio communication systems across commercial and military applications is expected to surge the adoption of the product. These modern systems provide efficient transmitting and receiving of several modulation methods by adopting a common set of hardware whole enhancing functionality through software modulation. Therefore, such initiatives are anticipated to boost the global software defined radio market growth during the forecast period.

Further Report Findings:

- North America is expected to hold the largest global market growth during the forecast period. This is due to the high military spending and the rapid-paced adoption of advanced communication technologies in countries such as the United States. North America stood at USD 4.9 billion in 2020.

- The market in Asia-Pacific is anticipated to experience exponential growth backed by the high development of the telecommunication sector and supportive government space programs that will boost the demand for advanced software defined radio systems between 2023 and 2028.

- Based on platform, the land segment is expected to hold the largest market share in terms of revenue in the forthcoming years. This is owing to the growing adoption of advanced software defined radio across several cellular base stations. Moreover, the rising installations of these systems on military vehicles is anticipated to lead to the segmental growth during the forecast period.

COMPETITIVE LANDSCAPE:

Product Innovation by Eminent Companies to Amplify Their Market Positions

The global market is experiencing significant competition from the players operating in the market. These players are focusing on developing advanced software defined radio systems to cater to the growing demand from the defense and healthcare sector globally. Additionally, adoption of strategies such as merger and acquisition, collaboration, and facility expansion by other companies to maintain their stronghold is expected to favor the market growth in the forthcoming years.

Industry Development:

-

March 2024 – Elta Systems , a subsidiary of Israel Aerospace Industries (IAI) , announced the launch of its latest software-defined radio (SDR). The new SDR is equipped with a modern architecture and supports operations across very high frequency (VHF), ultra high frequency (UHF), and L-band ranges, enhancing its versatility and performance across various mission-critical applicatio

The global magnetometer market was valued at USD 3.64 billion in 2024 and is projected to grow from USD 3.94 billion in 2025 to USD 7.75 billion by 2032, registering a CAGR of 10.2% during the forecast period. North America led the market in 2024, accounting for a 38.74% share.

The global magnetometer market is experiencing steady growth, driven by increasing demand across various sectors such as aerospace, defense, consumer electronics, automotive, and industrial applications. Magnetometers, which measure magnetic field strength and direction, are essential for navigation systems, geological surveys, and emerging technologies like autonomous vehicles and wearable devices. Advancements in miniaturization, sensor accuracy, and integration with IoT and GPS technologies are further boosting market adoption. As industries continue to prioritize precision, safety, and automation, the role of magnetometers is expected to expand significantly, especially in high-growth regions like North America and Asia Pacific.

List of key magnetometer companies profiled:

- Honeywell International Inc. (U.S.)

- Geometrics, Inc. (U.S.)

- Billingsley Aerospace & Defense (U.S.)

- AlphaLab, Inc. (U.S.)

- Applied Physics Systems (U.S.)

- Metrolab Technology SA (Switzerland)

- Bartington Instruments Ltd. (U.K.)

- FOERSTER Holding GmbH (Germany)

- Lake Shore Cryotronics, Inc. (U.S.)

- Marine Magnetics Corp. (Canada)

Information Source:

https://www.fortunebusinessinsights.com/magnetometer-market-112875

Segmentation: Magnetometer Market

Space Segment to Grow Steadily with Satellite-Based Deployments in LEO and Scientific Missions

By platform , the market is segmented into airborne , ground , maritime , and space . The space segment is expected to witness the fastest growth due to increasing launches of LEO (Low Earth Orbit) satellites, which rely on compact and high-precision magnetometers for navigation and attitude control systems.

Aerospace & Defense to Emerge as Dominant End-User Amid Rising Investments in Geospatial Intelligence

By end-user , the magnetometer market is categorized into aerospace & defense , consumer electronics , marine/naval , automotive , and others . The aerospace & defense segment held the largest share in 2024 due to extensive use in military aircraft, submarines, drones, and satellite missions requiring precise magnetic field detection.

North America Leads Global Adoption, Backed by High Investments in Space and Defense Programs

Regionally, the market is analyzed across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa . North America held the largest share in 2024, bolstered by advanced infrastructure, key magnetometer manufacturers, and robust demand from defense and space agencies such as NASA and the U.S. Department of Defense.

MARKET DYNAMICS

Market Drivers

Growing Use of Magnetometers in UAVs and Autonomous Systems to Boost Market Growth

The rising adoption of UAVs and drones in defense and commercial sectors is driving demand for magnetometers. These devices are essential for navigation, especially in GPS-denied environments, by measuring Earth’s magnetic field. Their use in aerospace for satellite positioning and in defense for detecting magnetic anomalies is further accelerating market growth.

Market Restraints

Interference and Calibration Challenges to Hinder Market Growth

Magnetometer performance can be affected by interference from nearby metals or electronic devices, leading to reduced accuracy. Additionally, they require regular calibration and maintenance, increasing operational complexity and costs. These issues may limit wider adoption, particularly in critical aerospace and defense applications.

December 2024 — MDA Space selected Honeywell to supply Attitude Control Systems and Magnetometer Unit components, including Reaction Wheel Assemblies and 3-axis Space Rate Sensors, for the MDA AURORA satellite line. These systems will support Telesat’s LEO constellation by maintaining orientation and enhancing signal reliability and solar energy absorption.

Aerospace Superalloy Fasteners Market Growth Opportunities, Trends, and Forecast to 2031

By Miyasingh, 2025-08-06

The global aerospace superalloy fasteners market was valued at USD 1,128.4 million in 2024 and is projected to grow from USD 1,268.0 million in 2025 to USD 2,716.8 million by 2031, at a CAGR of 13.5%. North America led the market in 2024 with a 41.61% share.

Aerospace superalloy fasteners are high-performance components designed for the demanding environments of the aviation and space industries. Manufactured from materials such as Inconel 718, Waspaloy, MP35N, A286, and titanium alloys, these fasteners exhibit outstanding strength, resistance to corrosion and oxidation, and superior durability at elevated temperatures. They are widely used in engines, turbines, landing gears, and structural assemblies across commercial, military, and space platforms.

The market is witnessing a strong revival post-COVID-19 disruptions, fueled by resurgent aircraft production, modernization programs, and technological advancements. The ongoing Russia-Ukraine conflict is also reshaping global supply chains and creating opportunities for domestic production in key aerospace nations.

Fortune Business Insights™ displays this information in a report titled, "Aerospace Superalloy Fasteners Market, 2025–2031."

LIST OF KEY COMPANIES PROFILED IN THE REPORT

- LISI Aerospace SAS (France)

- Precision Castparts Corp. (U.S.)

- Howmet Aerospace Inc. (U.S.)

- TriMas (U.S.)

- Arconic Corporation (U.S.)

- National Aerospace Fasteners Corporation (Taiwan)

- SPS Technologies Ltd. (U.K.)

- TFI Aerospace Corporation (Canada)

- B&B Specialties, Inc. (U.S.)

Information Source:

https://www.fortunebusinessinsights.com/aerospace-superalloy-fasteners-market-113525

Segmentation: Aerospace Superalloy Fasteners Market

Rivets Dominated Market Owing to Their Robust Design

By product, the market is segmented into rivets, screws, nuts & bolts, and others. The rivets segment held the largest market share in 2024 due to their durability and essential role in aircraft structural integrity. The screws segment is expected to grow rapidly due to increasing demand for easy maintenance and modular aircraft parts.

Fixed-Wing Aircraft Represented Largest Market Share

Based on platform, the market is bifurcated into fixed-wing and rotary-wing aircraft. The fixed-wing segment dominated in 2024, fueled by rising aircraft production by major OEMs like Boeing and Airbus. The expansion of global commercial fleets is a major contributing factor.

Airframe Segment Led Due to Fleet Modernization

By application, the market is categorized into airframe, engine, interior, and others. The airframe segment led the market due to the ongoing replacement of aging aircraft and increased MRO (Maintenance, Repair, and Overhaul) activities. The engine segment is set to grow significantly due to the increasing use of fasteners that can withstand high heat and stress environments.

Drivers and Restraints

Increased Adoption for Advanced Aircraft Engines to Boost Product Demand

The rising adoption of next-gen aircraft engines requiring high-temperature, high-strength fasteners is a major driver. Alloys like MP35N and AEREX 350 are gaining traction due to their exceptional performance under extreme stress and temperatures.

Stringent Aerospace Certification Standards Hampering Market Entry

Strict regulatory and quality standards such as AS9100, MIL-SPEC, and NAS create high barriers to entry and extend product development cycles, impacting smaller players and startups.

Opportunities & Trends

Growing Demand for Lightweight, High-Strength Materials in Modern Aircraft

Aircraft manufacturers are prioritizing fuel efficiency and sustainability, increasing the demand for high-performance materials like superalloy fasteners.

Adoption of Additive Manufacturing and AI-Powered QC

The integration of 3D printing and AI-based quality control systems enables rapid prototyping, lower production waste, and highly customizable fastener designs. These innovations support real-time adaptation to evolving aircraft design requirements.

Regional Insights

North America Dominated Global Market

North America led the market in 2024 with a market size of USD 469.56 million. The presence of aerospace giants such as Boeing, Lockheed Martin, and Precision Castparts Corp., along with advanced manufacturing infrastructure and FAA regulatory support, gives the region a significant edge.

Europe’s Growth Fueled by Airbus and Defense Investments

Europe holds a significant market share, led by France, the U.K., and Germany. Airbus's expanding aircraft production and R&D activities across platforms like the A350 and A330neo are major contributors to regional demand.

Asia Pacific to be Fastest Growing Region

China and India are experiencing a boom in commercial and defense aviation. Growing fleet sizes, new airport developments, and local manufacturing expansion are expected to drive rapid growth in the region.

Rest of the World Shows Steady Growth

The Middle East & Africa are investing in airport infrastructure and fleet expansion, especially in Gulf nations. Latin America is gaining traction due to increased aircraft deliveries and test programs in high-altitude regions like Mexico and Bolivia.

Competitive Landscape

Ongoing Technological Advancements Sustain Market Leadership

Key market players are investing in next-gen materials, including nickel-cobalt-chromium alloys and proprietary compositions for superior performance. Sustainability is also becoming a key differentiator, with leading firms adopting eco-friendly production techniques.

Notable Industry Development

February 2025 – TriMas announced a multi-year global contract with Airbus, expanding the role of its aerospace brands (Monogram, Allfast, and Mac Fasteners) across Airbus's supply chain. This contract enhances TriMas Aerospace's footprint in commercial aircraft fastener solutions.

The global military drone market was valued at USD 14.14 billion in 2023 and is expected to expand from USD 16.07 billion in 2024 to USD 47.16 billion by 2032, registering a robust CAGR of 13.15% during the forecast period. In 2023, North America led the market, accounting for a 36.1% share. The U.S. military drone market, in particular, is projected to witness substantial growth, reaching approximately USD 10.71 billion by 2030, fueled by rising R&D investments from key players including Sikorsky, Boeing, and other prominent regional manufacturers.

The U.S. continues to spearhead global military drone developments, awarding significant contracts such as the USD 389 million deal with General Atomics for MQ-1C Gray Eagle drones. Meanwhile, drones are playing a pivotal role in modern warfare, as seen in Ukraine’s use of over 700 kamikaze drones and Russia’s deployment of Shahed-136 drones in high-conflict zones. China and Israel remain dominant exporters, supplying advanced UAVs to allied nations, while the UK boosts tactical drone investments to strengthen ISR capabilities under its military modernization agenda.

This information is provided by Fortune Business Insights™ in its research report, titled “Military Drone Market Size, Share, Forecast and 2024-2032”.

List of Key Players Mentioned in the Report:

- General Atomics Aeronautical Systems, Inc. (U.S.)

- Northrop Grumman Corporation (U.S.)

- Elbit Systems Ltd. (Israel)

- Israel Aerospace Industries Ltd. (Israel)

- AeroVironment, Inc. (U.S.)

- Lockheed Martin Corporation (U.S.)

- Thales Group (France)

- Boeing (U.S.)

- BAE Systems (U.K.)

- SAAB Group (Sweden)

- Textron Systems (U.S.)

Information Source:

https://www.fortunebusinessinsights.com/military-drone-market-102181

Segmentation:

Fixed Wing Segment to Register Substantial Demand Impelled by Rising Use for Long Distance Operations

Based on product type, the market is segmented into hybrid wing, fixed wing, and rotary wing. Of these, the fixed wing segment is set to dominate the product type segment over the study period. The growth is on account of rising deployment of the product for long-distance missions such as mapping, surveillance, and defense.

EVLOS Segment to have Fastest CAGR Driven by Escalating Adoption in Electronic Warfare

By range, the market is subdivided into Beyond Line of Sight (BLOS), Visual Line of Sight (VLOS), and Extended Visual Line of Sight (EVLOS). The EVLOS segment is expected to register fastest CAGR over the forecast period. The rise is propelled by the soaring product adoption in long-range missions, electronic warfare, and proper battle management.

Remotely Operated UAVs Segment to Record Appreciable Expansion Driven by Surging Adoption

Based on technology, the market is subdivided into semi-autonomous drones, remotely operated drones, and autonomous drones. The remotely operated drones segment is estimated to depict an appreciable surge over the estimated period. The expansion is on account of stringent government requirements for autonomous flying over long distances.

A irframe Segment to Dominate due to Increasing Adoption of UAVs by the Armed Forces

By system, the market is classified into payload, avionics, airframe, propulsion, software, and others. The airframe segment held the highest market share. The growth is impelled by the growing UAV adoption for a range of operations such as monitoring, surveillance, reconnaissance, and others.

ISRT Segment to Emerge as a Leading Segment Considering Growing Awareness for Strengthening the Defense System

Based on application, the market is segmented into logistics & transportation, Intelligence, Surveillance, Reconnaissance, and Targeting (ISRT), battle damage management, combat operations, and others. The surge is propelled by the growing role of UAVs in the defense sector.

Based on geography, the market is fragmented into Asia Pacific, Europe, North America, and the rest of the world.

Report Coverage:

The report gives a comprehensive coverage of the major trends augmenting the market share over the forecast period. It further offers an insight into the key factors boosting the global business landscape over the ensuing years. Other aspects in the market comprise an account of merger agreements, acquisitions, and additional initiatives adopted by leading industry participants for strengthening their business positions.

Drivers and Restraints:

Rising Military Expenditure to Propel Industry Expansion

One of the key factors propelling the military drone market growth is the escalation in military expenditure. The industry expansion is further propelled by the surging procurement of next-generation military drones.

However, the industry expansion could be affected by the high cost of modern systems.

Regional Insights:

North America to Emerge as Dominant Region Owing to the Presence of OEMs

The North America military drone market share is slated to dominate the global market over the forecast period. The surge is on account of the presence of several OEMs in the region.

The Europe market is poised to exhibit considerable expansion throughout the forecast period. The rise is due to the growing awareness associated with the improvement of military, navy, and air force capabilities.

Competitive Landscape:

Major Companies Ink Partnership Agreements to Strengthen Market Foothold

Leading market players are focused on adopting a series of strategic initiatives for strengthening their industry positions. These include merger agreements, collaborations, and the formation of alliances. Additional aspects comprise an increase in research activities and the development of new products.

Key Industry Development:

February 2023 – The Indian Army announced plans to procure 850 indigenous nano drones to support special military operations. These drones will be used primarily for surveillance and counter-terrorism missions.

February 2023 – The U.S. Air Force completed the development of facial recognition technology integrated into UAVs. These autonomous drones are capable of identifying and engaging targets independently. They are intended for use by special operations forces to gather intelligence and support mission-critical activities.

The global military aircraft market was valued at USD 40.22 billion in 2018 and is projected to reach USD 85.79 billion by 2032, at a CAGR of 6.0%. North America led the market in 2018 with a 40.5% share.

Military aircraft are designed for both combat and non-combat operations and are deployed by national military forces and security agencies. Combat variants like fighters and bombers are meant for attack, defense, and reconnaissance, whereas non-combat aircraft include transport, training, and surveillance platforms. This sector is deeply influenced by geopolitical tensions and national defense spending and is highly consolidated in terms of both suppliers and buyers.

The Russia-Ukraine war has triggered renewed interest in air superiority and increased procurement activities globally, especially across NATO allies and countries in Eastern Europe. The Asia Pacific region is also accelerating fleet modernization, while the Middle East’s growth remains restrained by budget limitations.

Fortune Business Insights™ displays this information in a report titled, " Military Aircraft Market, 2024–2032. "

LIST OF KEY COMPANIES PROFILED IN THE REPORT

- Airbus S.A.S. (Netherlands)

- The Boeing Company (U.S.)

- Dassault Aviation SA (France)

- Lockheed Martin Corporation (U.S.)

- Saab AB (Sweden)

- Embraer S.A. (Brazil)

- GE Aviation (U.S.)

- Hindustan Aeronautics Limited (India)

- Bell Textron Inc. (U.S.)

- Sukhoi Corporation (Russia)

- Korea Aerospace Industries (South Korea)

- Chengdu Aircraft Industry Group (China)

Information Source:

https://www.fortunebusinessinsights.com/military-aircraft-market-102771

Segmentation: Military Aircraft Market

Fixed-Wing Aircraft Led the Market in 2024 Due to Strong Global Investments

Based on type, the market is segmented into fixed-wing and rotary-blade aircraft. The fixed-wing segment dominated the market in 2024, driven by global procurements of advanced multirole and stealth aircraft such as the F-35, Rafale, and Su-35. Meanwhile, rotary-blade aircraft are expected to grow rapidly due to increasing demand in Asia, the Middle East, and Africa.

Multirole Aircraft Dominated Due to Operational Versatility

By application, the market is categorized into combat, multirole, transport, maritime patrol, reconnaissance & surveillance, and others. Multirole aircraft held the highest market share in 2024, supported by their flexible mission capabilities. The U.S., India, Russia, and China remain major buyers. The demand for reconnaissance and maritime patrol aircraft is also rising, particularly in emerging economies.

Engine Systems Held the Largest Share; Avionics to Grow Fastest

Based on system, the market is segmented into airframe, engine, avionics, landing gear, and weapon systems. The engine segment led the market in 2024 due to growing interest in fuel-efficient and hybrid propulsion. The avionics segment is projected to witness the fastest growth, as autonomous technology and integrated sensor systems gain prominence.

Drivers and Restraints

Rising Need to Replace Aging Fleets

Military aircraft fleets in countries like the U.S. are aging rapidly, prompting demand for advanced replacements. Modern aircraft with better sensors, fuel efficiency, and versatility are in high demand.

Fifth-Generation Aircraft Drive Innovation

The adoption of fifth-generation jets like the F-35, J-20, and AMCA (India) is reshaping air warfare. These aircraft offer stealth, supercruise, and sensor fusion, becoming central to modern defense strategies.

Global Arms Race to Accelerate Procurement

As geopolitical tensions rise, countries are boosting their air force capabilities. India, South Korea, and France are ramping up fighter programs, while nations like the U.S. continue their modernization with platforms like the B-21 Raider.

UAV Proliferation May Hinder Market Growth

The increasing use of unmanned aerial vehicles (UAVs) for reconnaissance, combat, and logistics could reduce the demand for traditional manned aircraft in some segments.

Regional Insights

North America Dominated the Market in 2018 and Will Retain Lead

The U.S. is expected to continue leading global military aircraft demand, with significant investments in stealth, transport, and bomber programs like the F-35, B-21 Raider, and KC-46.

Europe Boosting Procurement Amid Rising Security Threats

European nations are increasing their defense spending. Collaborative programs like FCAS (France-Germany) are reshaping the regional outlook.

Asia Pacific Rising Fast Due to Border Conflicts and Modernization

Countries like India and China are heavily investing in indigenous aircraft programs. India’s HAL AMCA and Tejas Mk2, along with China’s J-20 and FC-31, are shaping regional capabilities.

Middle East Growth Constrained by Budget Challenges

Despite demand for new aircraft, economic volatility and fiscal pressures are slowing market growth in this region.

Competitive Landscape

Boeing and Lockheed Martin Hold Market Leadership Due to Strategic U.S. Government Contracts

Major players are benefiting from long-term military contracts. Boeing’s $14.3 billion U.S. Air Force deal in April 2019 for the B-1B and B-52 bombers highlights sustained investment in long-range strike capabilities.

Notable Industry Development

April 2019 – The Boeing Company secured a USD 14.3 billion contract from the U.S. Department of Defense

This agreement focused on upgrading and supporting B-1B Lancer and B-52 Stratofortress bombers. The initiative will enhance aircraft survivability, responsiveness, and weapon integration capabilities, including radar and communication system modernization.

The global sustainable aviation fuel market was valued at USD 1,845.2 million in 2024 and is projected to grow from USD 2,723.8 million in 2025 to USD 28,636.36 million by 2032, at a CAGR of 48%. North America led the market in 2024 with a 46% share.

Sustainable Aviation Fuel (SAF) is an eco-friendly option to the conventional jet fuel and derived from non-petroleum feedstocks. These fuels play a key role in reducing carbon emissions from air travel, making the aviation sector eco-friendlier in its operations. This fuel can be mixed with other traditional fuels; the content of SAF can range from 10% to 50%, depending on the feedstock and production method used. The increasing awareness of the environmental impact of air travel will bolster the market’s growth.

The COVID-19 pandemic restricted the market’s development as the frequency of air travel reduced drastically during this period owing to government-imposed travel restrictions and nationwide lockdowns. This factor reduced the demand for Sustainable Aviation Fuel (SAF).

Fortune Business Insights™ displays this information in a report titled, "Sustainable Aviation Fuel Market, 2025-2032."

LIST OF KEY COMPANIES PROFILED IN THE REPORT

- Neste (Finland)

- World Energy (U.S.)

- Gevo, Inc. (U.S.)

- Alder Fuels (U.S.)

- SkyNRG (Netherlands)

- Air BP (U.K.)

- Shell Aviation (Netherlands)

- TotalEnergies (France)

- Vitol Aviation (Switzerland)

- LanzaTech (U.S.)

- Fulcrum Bioenergy (U.S.)

Informational Source:

https://www.fortunebusinessinsights.com/sustainable-aviation-fuel-saf-market-111563

Segmentation: Sustainable Aviation Fuel Market

High Compatibility With Existing Aircraft Increased Use of Biomass-based SAF

Based on type, the market is divided into biofuel and synthetic fuel. The biofuel segment captured the biggest market share in 2024 as this type of fuel is quite compatible with the current aircraft, thereby facilitating easier integration when compared to other fuel types.

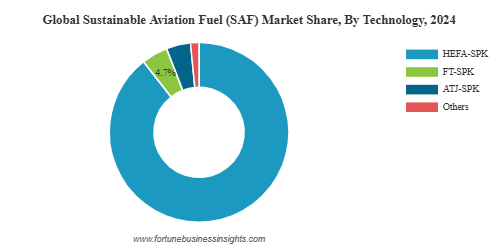

HEFA-SPK Technology to Gain Major Traction Due to Strong Government Support for Renewable Fuels

Based on technology, the market is classified into HEFA-SPK (Hydroprocessed Esters and Fatty Acids Synthetic Paraffinic Kerosene), FT-SPK (Fischer-Tropsch Synthetic Paraffinic Kerosene), ATJ-SPK (Alcohol-to-Jet Synthetic Paraffinic Kerosene), and others. Others include HFS-SIP (Hydroprocessed Fermented Sugars to Synthetic Isoparaffins), Co-processing, Electro-fueled sustainable aviation fuel, and other technologies used to develop SAF. The HEFA-SPK segment is anticipated to dominate the global market as governments across the world are implementing various policies to support the production and use of renewable fuels.

Net-Zero Emission Goals of Airlines Boosted Use of Sustainable Aviation Fuel in Blending Capacity of 30-50%

Based on blending capacity, the sustainable aviation fuel market is segmented into 5% to 30%, 30% to 50%, and above 50%. The 30-50% segment held the biggest global Sustainable Aviation Fuel (SAF) market share in 2024 as several airlines and airports across the world have made their commitment to achieving net-zero emissions.

Rising Awareness of Environmental Impact of Conventional Jet Fuel Boosted Product Use in Commercial Aviation

Based on end use, the market is classified into commercial aviation, military aviation, and others. Others include business and general aviation. The commercial aviation segment dominated the market in 2024 as there is a rising global awareness about the environmental effects of using traditional jet fuel in commercial planes.

Product Adoption Rose in Fixed-Wing Aircraft Owing to Government Support for Developing SAF

Based on application, the market is segmented into fixed-wing aircraft and rotary-wing aircraft. The fixed-wing aircraft segment held the biggest market share in 2024 as governments across the world are offering their support in the form of subsidies and incentives to encourage the development and sale of Sustainable Aviation Fuel (SAF). This encouraged fixed-wing aircraft manufacturers to use this fuel.

The global market report analyzes the market’s growth across regions, such as North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Report Coverage:

The report has conducted a detailed study of the market and highlighted several critical areas, such as leading types, technologies, applications, and prominent market players. It has also focused on the latest market trends and the key industry developments. Apart from the aforementioned factors, the report has given information on many other factors that have helped the market grow.

Drivers and Restraints:

Increasing Demand for Alternative Fuels to Boost Product Adoption

Industries across the world, including aviation, are becoming aware of the harmful effects of using fossil fuels on the environment, such as global warming and climate change. This factor has prompted them to take various measures to reduce their greenhouse gas emissions and make their business operations eco-friendlier. This is expected to fuel the adoption of Sustainable Aviation Fuel (SAF) in the aviation sector as this fuel has the potential to decrease emissions by nearly 80%, depending on the production technique and type of feedstock used. This can make the aviation industry more sustainable in its operations.

However, high cost and limited availability of feedstock can hinder the Sustainable Aviation Fuel (SAF) market growth.

Regional Insights:

North America Dominated Global Market Owing to Implementation of Strict Environmental Regulations

North America held the biggest sustainable aviation fuel market share in 2024 and might retain its dominance during the forecast period as well as governments across the region have imposed several stringent environmental regulations to reduce their carbon emissions. They have also formulated various policies to support the adoption of cleaner fuels in various industries.

Europe is also increasing its reliance on Sustainable Aviation Fuel (SAF) owing to the strict regulations imposed by the governments to decrease the carbon emissions of its industries, including aviation.

Competitive Landscape:

Market Players to Focus On Launch of Innovative Fuels to Cater to Wider Audience

Some of the top companies driving the global Sustainable Aviation Fuel (SAF) market growth are focusing on developing and launching a wide range of eco-friendly fuels for different industries. They are increasing their investments in research & development programs to find out about the latest technologies and use them to manufacture SAF.

Notable Industry Development:

September 2024- TotalEnergies signed an agreement with Air France-KLM to help the former deliver around 1.5 million tons of Sustainable Aviation Fuel (SAF) over a period of 10 years until 2035. This deal was one of the biggest SAF purchase agreements for Air France-KLM to date. It strengthened the airline’s dominance in the use of SAF, accounting for 17% and 16% of the global SAF production in 2022 and 2023, respectively.

The global microwave devices market was valued at USD 5.85 billion in 2021 and is projected to grow from USD 6.09 billion in 2022 to USD 9.88 billion by 2029, registering a CAGR of 7.15% during the forecast period. North America dominated the market in 2021 with a 33.33% share, driven by advanced infrastructure and strong R&D investments. The market is witnessing steady growth fueled by ongoing technological advancements and rising demand across sectors such as telecommunications, defense, and healthcare. As microwave technologies find broader applications, the industry is attracting significant investment. With supportive market dynamics and expanding end-use opportunities, the microwave devices market is set for sustained and consistent growth in the years ahead.

List of Key Players Profiled in the Microwave Devices Market Report:

- Analog Devices Inc. (U.S.)

- Communications & Power Industries LLC (U.S.)

- General Dynamics Corporation (U.S.)

- Kratos Defense & Security Solutions, Inc. (U.S.)

- L3Harris Technologies, Inc. (U.S.)

- MACOM Technology Solutions Inc. (U.S.)

- Microsemi Corporation (U.S)

- Microwave Technology, Inc. (U.K.)

- Qorvo Inc. (U.S.)

- Richardson Electronics, Ltd. (U.S.)

- Teledyne Technologies Incorporated (U.S.)

- Thales Group (France)

- TMD Technologies Ltd (U.K.)

- Toshiba Corporation (Japan)

- Cytec Corporation (U.S.)

Information Source:

https://www.fortunebusinessinsights.com/microwave-devices-market-103542

Segmentation:

The microwave devices market is segmented by type, frequency, end-use industry, and geography. By type, the market is bifurcated into active and passive, with the active segment expected to lead due to growing demand in telecom and networking services. Based on frequency, the market includes Ku-Band, Ka-Band, S-Band, C-Band, X-Band, L-Band, and others, where the Ku-Band segment dominates owing to its expanding applications in space and defense. In terms of end-use industry, the market is segmented into telecommunication, space, defense, industrial, healthcare, and others, with telecommunication emerging as the leading segment driven by rising global demand for telecom services. Geographically, the market is categorized into North America, Europe, Asia Pacific, and the Rest of the World.

Report Coverage:

The report provides completely analyzed data regarding recent developments and trends in the microwave devices market, including the impact of COVID-19 pandemic. Also, the ongoing Russia-Ukraine ware crisis is discussed further in this report. Drivers and restraints affecting the global market growth during the forecast period are highlighted further along with the regional insights on segmented market areas. A list of key market players is mentioned further in this report.

Drivers & Restraints:

Increasing Demand for Improved Communication Services to Bolster Market Growth

The microwave devices market is expected to witness rapid growth during the projected period due to increasing demand for 5G network services in various industries. Also, the rising demand for medical instruments equipped with microwave devices is expected to fuel the market growth in the coming years. Furthermore, the increasing need for enhanced communication services is anticipated to drive the global market.

However, the high risk of communication jamming may hamper the market growth in the coming years.

Regional Insights:

North America Dominates Global Market Share Due to Rising Adoption of Advanced Communication Services

North America dominated the global microwave devices market share in 2021. The regional market stood at USD 1.95 billion in 2021. This is attributed to the increasing adoption of advanced communication systems in aviation, defense, commercial, and industrial sectors.

Europe is expected to grow at a substantial CAGR during the forecast period due to increasing semiconductor production and its utilization in healthcare, automotive, and manufacturing industries in the U.K., Germany, and France.

Competitive Landscape:

New Product Launch Allow Companies to Propel Growth

The key players focus on implementing several strategies to improve their business performance. These strategies include forming strategic alliances, collaborations, and partnerships. Also, introducing new products and getting recognized for these launches allow key players to enhance their brand value globally.

Key Industry Development:

In June 2024 , Communications & Power Industries (CPI) announced the spin-off of its Electron Device Business, which is now functioning as an independent entity. This division specializes in the development and manufacturing of a wide range of RF and microwave products for essential defense and commercial applications.

In February 2025 , Kratos Defense reported a rise in revenues within its Microwave Products division, driven by organic growth in its Turbine Technologies, C5ISR, and Defense Rocket Support sectors. This growth highlights the company's expanding involvement in microwave technologies for defense applications.

Air Ambulance Services Market Growth Strategies 2025-2032: Insights and Analysis

By Miyasingh, 2025-08-04

The global air ambulance services market was valued at USD 6.50 billion in 2023 and is expected to grow from USD 7.00 billion in 2024 to USD 11.46 billion by 2032, registering a CAGR of 6.4% during the forecast period. North America led the market in 2023 with a 44.62% share. In the U.S., the air ambulance services market is anticipated to witness strong growth, reaching approximately USD 3,957.3 million by 2032, driven by rising demand for patient airlift services and the expansion of long-term service contracts.

List of the Companies Profiled in the Global Market for Air Ambulance Services:

- Air Methods Corporation (The U.S.)

- Global Medical Response Inc. (The U.S.)

- Acadian Companies (The U.S.)

- PHI Inc. (The U.S.)

- REVA Inc. (The U.S.)

- Express Aviation Services (The U.S.)

- European Air Ambulance (Luxembourg)

- Babcock Scandinavian Air Ambulance (Sweden)

- Air Charter Services Pvt. Ltd. (India)

- Gulf Helicopters (Qatar)

Information Source:

https://www.fortunebusinessinsights.com/air-ambulance-services-market-102577

What does the Report Include?

The market report includes qualitative and quantitative analysis of several factors such as the key drivers and restraints that will impact growth. Additionally, the report provides insights into the regional analysis that covers different regions, which are contributing to the growth of the market. It includes the competitive landscape that involves the leading companies and the adoption of strategies by them to announce partnerships, introduce new products, and collaboration that will further contribute to the growth of the market between 2020 and 2027. Moreover, the research analyst has adopted several research methodologies such as SWOT and PESTEL analysis to extract information about the current trends and industry developments that will drive the market growth during the forecast period.

DRIVING FACTORS

DRIVING FACTORS Rising Geriatric Population Globally to Augment Growth

According to a report by the United Nations publication, there were about 703 million people over the age of 65 years in 2019, and it is estimated that the number will rise to over 1.5 billion by 2050. The rising geriatric population presents a lucrative opportunity for the high adoption of air ambulance services to provide medical care to the elderly. Additionally, the growing prevalence of chronic disease demands an agile medical services response from the healthcare industry to treat the patients across remote areas. This is likely to boost the global air ambulance services market growth in the forthcoming years.

SEGMENTATION

Independent Segment to Hold Largest Market Share

The independent segment, based on the service operator, is expected to hold the largest share of the global market for air ambulance services backed by the increasing partnerships between community health organizations and private players.

REGIONAL INSIGHTS

North America to Remain at Forefront; Availability of Advanced Medical Services to Promote Growth

Among all the regions, North America is expected to remain dominant and hold the highest position in the global emergency services market during the forecast period. This is attributable to the availability of advanced medical services, along with the presence of established air ambulance services providers in the region. North America stood at USD 2,142.8 in 2019.

The market in Asia-Pacific is expected to gain momentum owing to the increasing investment in healthcare programs by the government in countries such as India and China that is likely to boost the adoption of advanced air ambulance services in the region between 2020 and 2027.

COMPETITIVE LANDSCAPE

Prominent Companies Focus on Contract Signing to Amplify Their Market Positions

The global air ambulance services market is consolidated by the presence of several multinational companies that are focusing on securing lucrative government contracts to boost their positions and expand their air ambulance services. Furthermore, other key players are adopting strategies such as facility expansion, collaboration, and merger and acquisition to maintain their strongholds in the global marketplace.

Industry Development:

- July 2020 - GAMA Aviation secures a five-year contract by the Government of Jersey and the Government of Guernsey. As per the contract, GAMA will provide its advanced and efficient air ambulance services between Channel Island and the U.K. mainland.