Digital Shipyard Market Projection, Landscape, Challenges and Insights, 2028

According to Fortune Business Insights™, the global digital shipyard market was valued at USD 963.6 million in 2020 and is projected to rise from USD 1,129.6 million in 2021 to USD 3,444.5 million by 2028, registering a robust CAGR of 17.27% during the forecast period. This rapid growth reflects the maritime industry’s ongoing shift toward Industry 4.0 technologies, automation, and enhanced operational efficiency across both commercial and defense shipbuilding.

What is a Digital Shipyard?

Digital shipyards represent a paradigm shift in the shipbuilding industry. Traditional processes are being replaced with IoT-enabled systems, artificial intelligence (AI), digital twins, robotics, and additive manufacturing. These advanced tools are helping shipbuilders move toward real-time decision-making, optimized life-cycle management, and improved production agility.

Key enablers such as cyber-physical systems (CPS) and robotic process automation (RPA) are streamlining manufacturing operations, reducing costs, and accelerating vessel delivery. With governments modernizing naval fleets and global trade expanding, digital shipyards are no longer an option—they’re becoming a strategic necessity.

Key Market Insights

Digital twins, IoT sensors, and 3D modeling are revolutionizing ship design, maintenance, and operations.

Leading shipbuilders are deploying predictive analytics and robotics to enhance safety and productivity.

Navantia (Spain) partnered with Siemens Digital Industries Software in 2019 to digitalize its operations, highlighting industry-wide momentum.

Market Segmentation

By Shipyard Type

Commercial Shipyards: These held the largest market share in 2020, driven by the rising demand for global seaborne trade. According to UNCTAD, nearly 80% of the world’s trade volume is transported by sea, which continues to fuel demand for digitalization in commercial shipbuilding.

Military Shipyards: This segment is growing steadily as governments worldwide adopt digital twin technologies to modernize naval programs. The integration of smart solutions helps enhance operational readiness, fleet maintenance, and long-term cost efficiency for defense vessels.

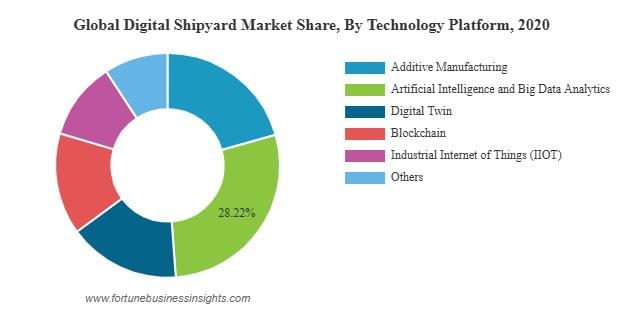

By Technology Platform

Robotic Process Automation (RPA): RPA accounted for the largest share in 2020, especially in processes such as welding, cutting, and painting. For instance, an Ulsan-based shipyard achieved USD 9.4 million in annual savings through welding automation, highlighting the cost-efficiency benefits of robotic integration.

AI & Big Data Analytics: Representing 28.22% of the market in 2020, this segment is expected to expand rapidly. The use of AI-powered systems and big data enables predictive analytics, reduces manual workloads, and improves overall decision-making in ship design and production.

Additive Manufacturing, Digital Twins, Blockchain, and IIoT: These emerging technologies are transforming shipbuilding by enhancing design accuracy, supply chain transparency, and real-time operational monitoring—making them the future of smart shipyards.

By Digitalization Level

Semi-Digital Shipyards: This segment held the largest share in 2020, as many shipbuilders have adopted partial automation and digital systems while still relying on traditional methods for certain operations.

Fully Digital Shipyards: Expected to record the fastest CAGR during the forecast period, this segment is gaining momentum with the adoption of Industrial IoT (IIoT), augmented reality (AR), and digital twin integration. Fully digital shipyards are seen as the next stage in Industry 4.0-driven maritime transformation.

Information Source:

https://www.fortunebusinessinsights.com/digital-shipyard-market-106561

Market Drivers

Industrial IoT Integration: Advanced sensors and AI analytics improve productivity, reduce downtime, and enhance safety.

Robotics in Shipbuilding: Shipyard giants like Hyundai Heavy Industries, Samsung Heavy Industries, and DSME are deploying robots across welding, assembly, and painting lines to reduce labor costs and improve precision.

Market Challenges

The biggest hurdle for digital shipyards remains high capital investment . Transitioning to advanced systems requires heavy upfront costs in hardware (sensors, navigation systems), software, and system integration. While large shipbuilders can manage these costs, SMEs face financial barriers —slowing adoption rates across the industry.

Emerging Trends

Additive Manufacturing (3D Printing): Accelerates part production, reduces downtime, and enhances flexibility in maintenance.

AI-Powered Smart Shipyards: In September 2024 , ST Engineering launched a next-gen smart shipyard in Singapore, leveraging AI, 5G, IoT, and predictive maintenance —setting new benchmarks for the industry.

Regional Insights

Asia Pacific: Market size was USD 323.3 million in 2020 , the largest globally, driven by South Korea, Japan, and China—responsible for building over 90% of global cargo ships .

Europe: Growth driven by robotics, 3D visualization, and strong investments in automation.

North America: Expansion supported by naval digitalization projects and strong R&D focus.

Middle East, Africa & South America: Moderate growth expected, led by fleet modernization programs.

Competitive Landscape

The digital shipyard market is highly competitive , with companies focusing on automation, collaborations, and cloud-based solutions .

Key Players Include:

IFS AB (Sweden)

Pemamek Oy (Finland)

Dassault Systèmes (France)

BAE Systems (U.K.)

Altair Engineering (U.S.)

AVEVA Group Plc. (U.K.)

Wärtsilä (Finland)

KUKA AG (Germany)

Damen Shipyards Group (Netherlands)

Prostep AG (Germany)

Recent Developments:

June 2021: Drydocks World partnered with IFS Cloud for asset management and digital transformation.

February 2021: Damen Shipyard Group collaborated with Sea Machines Robotics to test collision avoidance AI on ships.