Military Personal Protective Equipment (PPE) Market Insights, Growth, Opportunities and Forecast, 2028

By Rishika19, 2025-09-10

The global military personal protective equipment (PPE) market is witnessing rapid growth, fueled by rising defense budgets, geopolitical tensions, and the urgent need to safeguard soldiers in high-risk combat environments. According to Fortune Business Insights™ , the market was valued at USD 17.08 billion in 2020, reached USD 17.85 billion in 2021, and is projected to hit USD 32.30 billion by 2028, registering a CAGR of 8.84%.

In 2020, North America led the market with a 29.45% share, supported by robust defense spending and advanced procurement programs. But Asia Pacific is emerging as a strong growth hub, fueled by increasing cross-border conflicts and rising military modernization programs.

Why Military PPE Matters

As modern battlefields grow increasingly unpredictable, soldier protection is no longer optional—it’s a necessity. Lightweight yet powerful gear, such as body armor, combat helmets, and protective eyewear, is becoming central to mission success. For example, Teijin’s Twaron Ultra Micro 550f1000 yarns are designed for fragment-resistant vests, boosting ballistic protection while ensuring mobility.

The demand for such next-generation solutions highlights the balance armies are seeking: maximum protection with minimal weight.

Key Market Drivers

1. Rising Defense Budgets

Global defense spending reached USD 1,981 billion in 2020, with the U.S., U.K., India, China, and Russia accounting for nearly 62% of it. These funds are increasingly being directed toward modern soldier protection systems, strengthening market opportunities.

2. Growing Security Threats

Escalating terrorism, political instability, and border disputes are raising concerns for troop safety worldwide. This urgency is pushing governments to prioritize investments in cutting-edge PPE.

3. Demand for Lightweight Equipment

Traditional protective gear is heavy and limits soldier agility. The shift toward lighter, more flexible PPE is fueling innovation in materials and design.

4. Market Challenges

Despite growth, the sector faces hurdles such as high development costs and occasional equipment malfunctions, which can delay procurement.

Information Source:

https://www.fortunebusinessinsights.com/military-personal-protective-equipment-ppe-market-103131

Market Segmentation

By Product Type Analysis

Body Armor – Largest Segment in 2020: The body armor segment accounted for the highest share in 2020, driven by strong procurement contracts aimed at enhancing soldier safety. For example, in May 2020, Point Blank Enterprises, Inc. secured an USD 81 million contract from the U.S. Defense Logistics Agency to supply body armor to the U.S. Army, Navy, and Air Force.

Protective Eyewear – Significant Growth Ahead: The protective eyewear segment is projected to grow considerably during 2021–2028, fueled by rising demand for advanced night vision goggles. In January 2020, Intevac signed a USD 8.1 billion contract with the U.S. Army to provide Delta I fused digital night vision goggles featuring augmented reality (AR) capabilities.

Pelvic Protection Systems – Moderate Expansion: The pelvic protection systems segment will witness moderate growth due to rising adoption of blast-protective gear for soldiers. In August 2019, KDH Defense Systems, Inc. was awarded a USD 9 million contract to supply pelvic blast protectors to the U.S. Army.

By Application Analysis

Army – Dominant Segment: The army segment held the largest share of about 57% in 2020 and is expected to continue leading throughout 2021–2028. This dominance is attributed to modernization programs, expanding troop strength, and growing budgets. PPE such as body armor and helmets protect soldiers against shrapnel, IED blasts, and gunfire.

Air Force – Strong Growth Outlook: The air force segment is anticipated to grow significantly during the forecast period, driven by increasing demand for advanced helmets and protective eyewear for fighter pilots.

Navy – Moderate Growth: The navy segment is projected to expand at a steady pace as naval forces invest in protective equipment to enhance safety and operational readiness.

Regional Insights

North America: Leads the global market with strong procurement of eyewear, helmets, and body armor. Presence of key players like 3M, Honeywell, Eagle Industries, and KDH Defense Systems further strengthens the region’s position.

Asia Pacific: Expected to grow fastest, with China, India, and South Korea heavily investing in defense modernization amidst rising security challenges.

Europe: Countries such as Russia, Germany, and the U.K. are expanding defense budgets, driving steady market growth.

Rest of the World: Expected to see moderate expansion as nations increase defense allocations.

Competitive Landscape

Leading companies are racing to integrate AI, biometrics, and wireless sensors into PPE, paving the way for smarter, adaptive soldier gear. Partnerships, contracts, and acquisitions remain core strategies.

April 2021: Microsoft secured a USD 22 billion contract to supply Integrated Visual Augmentation System (IVAS) goggles to the U.S. Army, enhancing soldiers’ ability to see in low-visibility and combat conditions.

June 2021: Elbit Systems won a USD 29 million contract to provide AN/AVS-6 Night Vision Imaging Systems for U.S. Army and National Guard aviation units.

Key Players

3M (U.S.)

ArmorSource LLC (U.S.)

BAE Systems (U.K.)

Eagle Industries (U.S.)

Gentex Corporation (U.S.)

Honeywell International Inc. (U.S.)

Armor Express (U.S.)

Point Blank Enterprises Inc. (U.S.)

Revision Military (U.S.)

Pilot Training Market Insights, Growth, Size, Trends and Forecast, 2025–2032

By Rishika19, 2025-09-09

The global pilot training market size was valued at USD 9.37 billion in 2024 and touched USD 10.74 billion in 2025. This market is estimated to reach USD 24.86 billion by 2032, exhibiting a CAGR of 12.7% during 2025-2032 . Launch of technologically advanced aircraft and rising adoption of virtual reality are likely to fuel industry growth. Fortune Business Insights ™ shares this information in its report titled “ Pilot Training Market, 2025-2032. ”

List of Key Players Profiled in the Report

- CAE Inc.(Canada)

- Lufthansa Aviation Training GmbH. (Germany)

- L3 Harris Technologies Inc.(U.S.)

- Flight Safety International (U.S.)

- Pan AM Flight Academy (U.S.)

- ATP Flight School. (U.S.)

- Thrust Flight. (U.S.)

- Airbus Flight Academy. (France)

- Indra Sistemas S.A (Spain)

- BAA Training (Lithuania)

Information Source:

https://www.fortunebusinessinsights.com/pilot-training-market-107092

Segments

Flight Training Segment to Dominate due to Demand from Skilled Pilots

By training mode, the market is segmented into flight training and ground training. The flight training segment dominated the global market in 2021 due to the demand for flight training from skilled pilots.

Commercial Pilot License to Grow at a Fast Rate Attributable to Rising Demand for Air Travel

As per type of license, the market is classified into student pilot license, private pilot license, commercial pilot license, airline transport pilot license, and others. The commercial pilot segment is likely TO grow at with the highest CAGR over the forecast period due to rising air travel demand.

Airplane Segment to Dominate Owing to Rising Aircraft Deliveries

Based on aircraft type, the market is categorized into airplane and helicopter. The airplane segment is likely to lead due to rising aircraft deliveries.

Regionally, the market is classified into North America, Europe, Asia Pacific, and the rest of the world.

Report Coverage

The report provides a detailed analysis of the top segments and the latest trends in the market. It comprehensively discusses the driving and restraining factors and the impact of COVID-19 on the market. Additionally, it examines the regional developments and the strategies undertaken by the market's key players.

Drivers and Restraints

Rising Demand for Skilled Pilots to Foster Industry Growth

Pilot training comprises a flight training syllabus encompassing ground and flight schools. It is conducted for 10 to 22 months. Increasing demand for skilled pilots may boost the adoption of advanced flight training methods. Furthermore, the rising adoption of safe travels worldwide is likely to elevate the adoption of advanced training systems. Moreover, the incorporation of advanced technologies and virtual reality is likely to elevate training systems’ adoption. Also, the incorporation of innovative technologies in aircraft is likely to boost the demand for pilot training systems. These factors may drive the pilot training market growth.

However, initial certification costs of pilot training are likely to hinder market progress.

Regional Insights

Presence of Major Players to Foster Industry Growth in North America

North America is projected to dominate the pilot training market share due to the presence of key players. The market in North America stood at USD 0.74 billion in 2021 and is expected to gain a huge portion of the global market share in the coming years. Further, the presence of several airports and well-established training centers is likely to elevate market growth.

In Europe, the presence of numerous training centers for pilots such as Airbus Flight Academy may elevate the adoption of pilot training. Further, the presence of advanced simulator systems may bolster market progress.

Competitive Landscape

Key Players Enter into Partnerships to Provide Advanced Training to Pilots

The prominent companies operating in the market enter into partnerships to provide advanced training to pilots and enhance their brand image. For example, CAE partnered with Joby Aviation in June 2022. This partnership was undertaken by both companies for training pilots using the eVTOL platform. Joby Aviation shall overlook the landing aircraft and all-electric vertical take-off while CAE focuses on the provision and development of training devices. This strategy may enhance their product offerings and boost brand image. Furthermore, companies invest in innovations, research and development, industrial automation, and expansions to enhance their market position.

Key Industry Development

In March 2023 , UAE-based Airways Aviation partnered with Asia Pacific Flight Training Academy Limited (APFT), headquartered in India, to launch an innovative pilot pathway program. The collaboration aims to offer Indian students and airline cadets enhanced access to advanced flight training opportunities.

Aircraft Leasing Market Trends, Growth, Size, Share and Forecast, 2024–2032

By Rishika19, 2025-09-09

The global aircraft leasing market size was valued at USD 178.88 billion in 2023. The market is projected to grow from USD 183.23 billion in 2024 to USD 401.67 billion by 2032, exhibiting a CAGR of 11.1% during the forecast period. A legally binding contract between two parties—typically a lessor and a lessee—is known as an aircraft lease. In return for recurrent sums known as lease payments, the lessor consents to loan the aircraft to the lessee for a specific amount of time. Instead of purchasing aircraft, airlines occasionally lease them. In exchange for a monthly or yearly fee for the use of the aircraft, the leasing firm spends its money to buy it. It then gives the aircraft to the operator. The tenant is the owner. The airline rents the aircraft for a predetermined sum each month or year in exchange for using it with its own logo and frequently in its own color. The aircraft is returned to its owner at the end of the process, after the lease term has expired. The increasing demand for low-cost airlines is a significant factor driving the aircraft leasing market growth. Fortune Business Insights presents this information in their report titled "Global Aircraft Leasing Market, 2024–2032."

List of Key Players Profiled in the Report

- AerCap (GECAS) (Ireland)

- Avolon (Ireland)

- BBAM (U.S.)

- Nordic Aviation Capital (Ireland)

- SMBC Aviation Capital (Ireland)

- ICBC Leasing (China)

- BOC Aviation (Singapore)

- Air Lease Corporation (U.S.)

- DAE Capital (UAE)

- Boeing Capital Corporation (U.S.)

Information Source:

https://www.fortunebusinessinsights.com/aircraft-leasing-market-107476

Segments:

Narrow Body Aircraft’s Global Demand to Drive Segment Growth

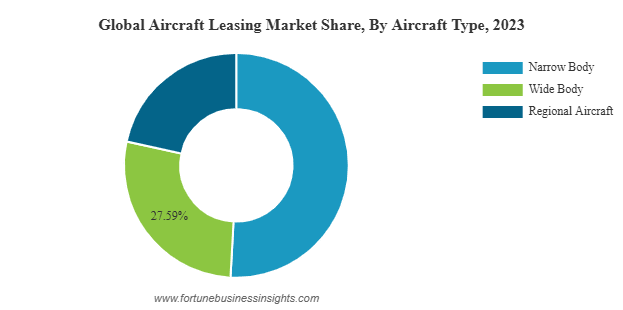

Based on aircraft type, the market is classified into narrow body, wide body, and regional aircraft.

In 2021, the narrow body segment is anticipated to be the largest. The expansion is attributable to an increase in global demand for narrow-body aircraft. Budget airlines and Low-Cost Carriers (LCCs) in the airline business are primarily responsible for the increased demand. The next generation of aircraft can already fly lengthy routes, so the full-service airlines are now looking to increase the number of narrow-body aircraft in their fleets. In addition, the market for low-cost airlines has experienced a rise in demand for and purchases of these aircraft, and despite the pandemic's effects, airlines are currently observed placing large orders. This means that within the predicted period, high growth is anticipated.

Dry Lease Segment to Witness Major Growth Due to Affordability

Based on lease type, the market is segmented into wet lease, dry lease, and damp lease.

Throughout the projected period, the dry lease segment is anticipated to experience significant expansion. The segment's expansion can be attributed to the dry lease aircraft's affordable operation and maintenance costs. In a dry lease, the lessor gives the aircraft to the lessee without a crew, so the lessee is responsible for all operational and maintenance expenditures. Since the lessee or the airline operator has complete control over the financial element, they employ several cost-cutting strategies to make aircraft maintenance and operation affordable. Although it is believed that dry leasing would also work well for the largest airlines, dry leasing is frequently used by low-cost and budget airlines. Additionally, the increasing use of dry-leased aircraft has led to job opportunities.

Report Coverage:

The report offers:

- Major growth drivers, restraining factors, opportunities, and potential challenges for the market.

- Comprehensive insights into regional developments.

- List of major industry players.

- Key strategies adopted by the market players.

- Latest industry developments include product launches, partnerships, mergers, and acquisitions.

Drivers & Restraints:

Low-cost Carriers and Budget Airlines to Propel Market

One of the key movers is the global fleet expansion of low-cost carriers and budget airlines. To keep the cost of maintenance and operation to a minimum, these airline operators prefer to lease every aircraft in their fleet and lease out or return the aircraft after a short period of time. These airlines have been connecting every rural and urban area in their registered countries as a result of increasing passenger air traffic on domestic routes. For instance, low-cost carriers are doing incredibly well in the current climate for European aviation. Flag carriers are failing, slashing workers, and abandoning routes, but the low-cost sector is expanding quickly due to ongoing fleet expansion.

On the contrary, due to the lack of proper infrastructure in developing economies, the aircraft leasing cannot be expanded across the globe, which may impede the market growth.

Regional Insights

Europe Dominates the Market Due to the Presence of Significant Players

In 2021, Europe dominated the aircraft leasing market share. In 2021, the market's size was USD 94.33 billion. The existence of a significant player, Aercap is credited with the area's expansion. More than half of the leased aircraft used by the airline sector is owned by the corporation. Due to its favorable tax structure and convenient business environment, Ireland is home to the majority of lessors. Additionally, the region has witnessed a rise in demand for leased aircraft as a result of the arrival of low-cost carriers. As a result, higher revenue growth rates are predicted during the forecast period.

Competitive Landscape

Businesses Concentrate on Acquisitions and Partnerships for Dominance

In 2021, AerCap successfully acquired GE Capital Aviation Services (GECAS) from General Electric. The combined firm has an order for roughly 450 of the world's most technologically advanced and fuel-efficient aircraft as well as a portfolio of more than 2,000 aircraft and 900 engines. AerCap is a market leader in all facets of aircraft leasing, boasting a robust portfolio and a wide range of clientele. The A320ceo and Neo Families, the A330, A350, 737NG, 737 MAX, and 787 aircraft make up 90% of AerCap's fleet of aircraft; these are the models that are in high demand around the globe.

Key Industry Development:

In April 2022 , Air Lease Corporation (ALC) confirmed an order for 32 additional Boeing 737-8 and 737-9 aircraft, further expanding its fleet portfolio. With global air travel rebounding after the pandemic, ALC is strengthening its 737 MAX family to address rising airline demand for modern, fuel-efficient, and sustainable aircraft operations.

The global cargo vessel market size was valued at USD 37.07 billion in 2022. The market is projected to grow from USD 49.22 billion in 2023 to USD 61.77 billion by 2030, exhibiting a CAGR of 3.3% during the forecast period.

Cargo vessels are used to transport materials and goods from one port to another. The cargo vessels comes in various sizes based on the quantity needed and the size of the port. The increasing maritime trade activities globally is expected to drive cargo vessel market growth during the forecast period.

Fortune Business Insights™ mentioned this in a report titled, “ Cargo Vessel Market, 2023-2030 .”

List of Key Players Present in the Report :

- Hyundai Heavy Industries Co. Ltd (HHI) (South Korea)

- Namura Shipbuilding Co Ltd (Japan)

- Damen Shipyards Group (Netherlands)

- Korea Shipbuilding & Offshore Engineering (South Korea)

- Samsung Heavy Industries (South Korea)

- Daewoo Shipbuilding & Marine Engineering (South Korea)

- General Dynamic NASSCO (U.S.)

- Mitsubishi Heavy Industries (Japan)

- Mazagon Dock Shipbuilders Limited (India)

- China State Shipbuilding Corporation (China)

Information Source:

https://www.fortunebusinessinsights.com/cargo-vessel-market-108601

Segments

Bulk Carriers Segment to Grow due to their Rising Demand to Transport Goods

By ship type, the market is segmented into tanker, bulk carriers, container ships, general cargo vessel, roll on/roll off ships, and others. The bulk carriers segment is the fastest-growing segment during the forecast period. The growth is attributed to the rising demand for bulk carriers to transport large amounts of goods, including coal, grains, cement, ore, cereals, and others.

Rising Decarbonization Efforts by Key Players Boosted Diesel and Gasoline Segment Growth

Based on fuel type, the segment is divided into diesel and gasoline, hybrid, LNG, and others. The diesel and gasoline segment held the largest market share in 2022. The growth is attributed to the rising decarbonization efforts by various market players using advanced gases and fuels for marine propulsion.

High Demand of 50000 – 120000 GT Ships to Transport Goods Drives 50000 – 120000 GT Segment Growth

By gross tonnage, the market is classified into below 50000 GT, 50000 – 120000 GT, and above 120000 GT. The 50000 – 120000 GT segment is expected to be the fastest-growing during the forecast period owing to the high demand for 50000 – 120000 GT ships to transport goods across many industries.

75000 – 200000 DWT Segment to Grow Due to Increasing Demand of 75000 – 200000 DWT Ships Globally

Based on deadweight, the market is classified into below 75000 DWT, 75000 – 200000 DWT, and above 200000 DWT. The 75000 – 200000 DWT segment held the largest market share in 2022 and will be the fastest-growing segment during the forecast period. The growth is attributed to the increasing global demand for 75000 – 200000 DWT ships, including oil tankers, bulk carriers, and others.

Geographically, the market is studied across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

Report Coverage

The report offers:

- Major growth drivers, restraining factors, opportunities, and potential challenges for the market.

- Comprehensive insights into regional developments.

- List of major industry players.

- Key strategies adopted by the market players.

- The latest industry developments include product launches, partnerships, mergers, and acquisitions.

Drivers & Restraints

Increasing Adoption of Green Fuels Globally to Drive Market Growth

The rising adoption of green fuels, such as liquified petroleum gas, LNG, hydrogen, methanol, and others that can replace fossil fuels, is expected to drive the cargo vessel market growth during the forecast period. According to various studies, shipping is a significant source of anthropogenic SOx and Nox emissions, accounting for 13% of the global Sox and 15%.

However, the cyclic nature of cargo vessels and raw materials inflations, especially steel, may hinder market growth during the projected period.

Regional Insights

Increased Marine Fleet by Asia Pacific Countries to Aid Market Growth in Asia Pacific

Asia Pacific is expected to be the fastest-growing region in the market during the forecast period and held the largest cargo vessel market share in 2022. The growth is attributed to the increased marine fleet by Asia Pacific nations, including South Korea, China, and Japan.

Europe is estimated to be the second fastest-growing region during the projected period due to the increasing investments from private companies to build marine ships in the region.

Competitive Landscape

Growing Key Players Focus on Mergers and Acquisition Strategies to Propel Market Growth

The cargo vessel market is consolidated with several key players, such as General Dynamics Corporation, Thales Group, Hyundai Heavy Industries Co. Ltd, BAE Systems, and Mitsubishi Heavy Industries Co. Ltd. The increasing focus of these key players on adopting mergers and acquisition strategies to drive market growth during the forecast period.

Key Industry Development

February 2023 – Wartsila and NYK LNG Ship Management, a Japanese operator, signed an eight-year agreement covering the two Wartsila X72DF main engines on an LNG carrier vessel designed to maximize the vessel availability and ensure its operation from dry dock to dry dock.

Main Battle Tank Market Size, Forecast, Share, Growth and Trends, 2023–2030

By Rishika19, 2025-09-08

The global main battle tank market size was valued at USD 5.35 billion in 2022. The market is projected to grow from USD 5.54 billion in 2023 to USD 6.90 billion by 2030, exhibiting a CAGR of 3.2% during the forecast period. Main battle tanks are armored vehicles equipped with advanced fire control systems, guns, and armor protection. They provide maneuverability and direct fire features are in high demand as countries work on enhancing their military strength amid geopolitical tensions, which will contribute to their increased demand. This information is provided by Fortune Business Insights , in its report titled, “ Main Battle Tank Market, 2023-2030 .”

Russia-Ukraine War Impact:

Increasing Deployment of Tanks in the Russia-Ukraine War to Elevate Market Proliferation

Main battle tanks have been highly deployed by Russia and Ukraine amid the ongoing war. While Russia employed its T-90 and T-72 tanks, Ukraine depended on its T-64, T-84, Oplot-M models. Both sides have suffered significant losses and claim that they have destroyed various enemy tanks. The increased military budget of both economies will generate significant demand for main battle tanks and aid market expansion in the coming years. Moreover, other countries are focused on increasing their military strength, which will contribute to product demand, thus driving market growth.

List of Key Players Mentioned in the Report:

- General Dynamics Corporation (U.S.)

- Hyundai Rotem (South Korea)

- BAE Systems plc (U.K.)

- Nexter Systems (France)

- BMC (Turkey)

- Israel Military Industries (Israel)

- Rheinmetall AG (U.S.)

- Krauss-Maffei Wegmann GmbH and Co. KG (Germany)

- Mitsubishi Heavy Industries (Japan)

- Safran (U.S.)

Information Source:

https://www.fortunebusinessinsights.com/main-battle-tank-market-107367

Segments:

Turret System Segment to Lead Due to its Broad Functionality and Overall Cost

Based on component, the market is split into turret system, internal combustion engine, wheel & tracks, situational awareness, weaponry systems, and others. Among these, the turret system segment dominated the main battle tank market share in 2022 as turret is a combination of parts mounted on it and a rotating bearing so that it can rotate 360 degrees.

Heavy Weight Segment to Dominate Backed by its Rising Demand for Frontline Security

According to weight, the market is arrayed into light weight, medium weight, and heavy weight. The heavy weight segment captured a significant share in the global market in 2022 due to surging demand for frontline security. For example, as per SIPRI, in 2018, Finland ordered 100 Leopard-2A6 tanks from the Netherlands for USD 200 million.

Line Fit Segment to Hold Major Share Stoked by Rising Indigenous Manufacturing of MBTs in Emerging Economies

By solution, the market is bifurcated into line fit and retro fit. Among these, the line fit segment captured the largest market share in 2022, owing to increasing indigenous manufacturing of main battle tanks in Russia, India, Germany, and South Korea.

Geographically, the market is segregated into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Report Coverage:

The report sheds light on drivers and challenges affecting market trends over the forecast timeframe. Moreover, the market is studied exhaustively and statistical information for each segment and region is given. The impact of COVID-19 on the global economy is analyzed and solutions are provided. The competitive landscape section lists key players in the global market and mentions tactical decisions made by them to maximize profits.

Drivers and Restraints:

Upgrade of Existing Fleet with Next-generation Base Equipment to Drive Market

Developing nations are focused on upgrading their existing fleets, situational awareness systems, and weaponry systems to improve combat capabilities and lethality, which will drive the main battle tank market growth. For example, in February 2023, Turkey awarded SNT Heavy Industries with a contract to supply an automatic transmission mechanism for Altay tank engines. The company will provide a V-type, 12-cylinder, water-cooled, turbo diesel power unit to produce 1,500 horsepower and 4600 N-m of torque. This agreement worth USD 217.9 million will be completed by 2030. On the other hand, the surging demand for anti-tank missiles owing to their range, ease of usage, and weightless nature will hinder market expansion in the coming years.

Regional Insights:

North America to Lead Stoked by Presence of Leading Companies and Upgrading of Existing Fleet

North America dominated the global market in 2022 backed by the presence of leading players and upgrading of existing fleet with advanced technology-based systems and equipment. Widespread export of battle tanks worldwide will also attribute to market expansion in this region.

Europe is projected to grow significantly during the forecast period owing to the surging demand for tanks due to the ongoing Russia Ukraine war. Russia, France, and Hungary are also contributing to product demand and market proliferation in this region.

Asia Pacific is likely to register the highest growth rate across the world due to rising procurement of MBTs by India, Bangladesh, Thailand, Indonesia, and Pakistan due to increasing border conflicts. For example, in September 2021, the Indian Defense Ministry sealed a contract to procure 118 Arjun Mk-1A and its combat capabilities.

Competitive Landscape:

Procurement Contracts Signed Between Governments and Leading Companies to Aid Market Augmentation

Geopolitical tensions are on an all-time high due to Russia’s invasion of Ukraine. This, in turn, has put all the economies on a guard and they are making efforts to prepare themselves and increase their military strength by buying new equipment. This will contribute to the market share and help industry leaders to gather larger revenues. For example, in June 2022, The State Department of Poland awarded General Dynamics Land Systems with a USD 6 billion contract to manufacture and supply M1A2SEPv3 Abrams to the Polish Army. As a part of the deal, Poland also plans to purchase 500 M240C 7.62mm machine guns, 276 M2 .50 caliber machine guns, and other equipment and parts needed to operate the weapon systems.

Key Industry Development:

May 2021 : British Army awarded a contract to Rheinmetall BAE Systems Land (RBSL) to replace their existing fleet of Challenger 2 with next generation Challenger 3 tanks. Under this agreement, the U.K. will get 148 tanks for USD 964.72 million.

According to Fortune Business Insights™, the global drone sensors market was valued at USD 394.7 million in 2020 and is projected to reach USD 2,342.1 million by 2028, exhibiting a strong CAGR of 25.08% during the forecast period (2021–2028). Growth is being propelled by the increasing integration of unmanned aerial systems (UAS) across both defense and commercial applications worldwide.

Market Overview

The drone sensors market is gaining significant momentum, fueled by the rising adoption of UAVs in industries such as agriculture, logistics, aerial imaging, public safety, and defense. Drones depend on a wide range of sensors—including image, inertial, pressure, and distance sensors—to achieve precise navigation, stable flight, and accurate real-time data capture.

The demand for high-performance sensors has escalated as industries seek smarter, more autonomous operations. Advanced sensor systems enable drones to execute long-range flights, precision imaging, and enhanced surveillance, making them indispensable across both commercial and defense operations.

Market Drivers

Rising Military Adoption of Unmanned Systems

Military forces worldwide are rapidly adopting unmanned systems for intelligence, surveillance, reconnaissance, and targeting (ISRT) missions. According to SIPRI, global defense spending exceeded USD 1.9 trillion in 2019 and continues to grow. Modernization programs increasingly emphasize UAV procurement, driving the demand for advanced sensors such as infrared, LiDAR, pressure, and inertial sensors for precise operations.

The growing integration of artificial intelligence into drone automation is further expected to accelerate market expansion.

Expanding Commercial Applications

Drones are revolutionizing industries through applications like aerial photography, delivery services, precision farming, and infrastructure monitoring. According to Goldman Sachs, drones could create opportunities worth USD 11 billion in the construction sector and USD 5.9 billion in agriculture.

Precision farming—enabled by multispectral and thermal imaging sensors—supports soil monitoring, crop health assessment, and pesticide spraying, significantly improving yields. These advancements are set to propel commercial drone adoption, creating strong demand for advanced sensor systems.

Restraining Factors

Despite strong growth, challenges remain. Drone sensors are sensitive to extreme environmental conditions, which may cause performance issues in harsh climates. Moreover, the high cost of advanced sensor systems—due to complex circuit designs and dependencies on multiple technologies—remains a barrier for wider adoption, particularly in cost-sensitive markets.

Information Source:

https://www.fortunebusinessinsights.com/drone-sensor-market-102596

Segmentation Analysis

By Sensor Type

The drone sensors market is segmented into inertial sensors, image sensors, speed & distance sensors, position sensors, and other sensor categories such as pressure, altimeter, ultrasonic, current, and light sensors. Inertial sensors include accelerometers, gyroscopes, tilt sensors, and magnetometers, and are projected to generate USD 312.5 million by 2025. Meanwhile, image sensors—covering thermal, infrared, and multispectral technologies—are expected to record the highest CAGR through 2028, primarily due to their increasing use in aerial photography and advanced imaging applications. Speed and distance sensors include radar, LiDAR, and proximity solutions, while position sensors rely on GPS and GNSS technologies to ensure accurate navigation. These diverse sensors collectively form the backbone of UAV functionality by enabling precise navigation, mapping, and operational stability.

By Platform

In terms of platform, the market is categorized into VTOL, fixed-wing, and hybrid systems. The fixed-wing segment dominated in 2020, largely because of its extensive use in military operations, including mapping, surveillance, and intelligence gathering, where advanced sensors are essential for reliable data collection. However, the VTOL segment is expected to register the highest CAGR during the forecast period as demand rises in commercial logistics applications such as food delivery, parcel distribution, medical supply transport, and sample collection. VTOL drones held a 29.7% market share in 2020, reflecting their growing versatility and adaptability across industries. Hybrid systems, which combine features of both fixed-wing and VTOL drones, are also gaining traction for their ability to support long-range missions with greater efficiency.

By Application

Based on application, the market is segmented into navigation, collision detection & avoidance, data acquisition, motion detection, air pressure measurement, power monitoring, and other functions. Among these, the navigation segment dominates the market and is projected to account for 29% of the share by 2025. This strong positioning is attributed to the widespread reliance on GPS and advanced mapping systems that enable drones to operate in complex environments with high accuracy. Navigation sensors are particularly critical in emergency applications such as disaster management, search & rescue operations, and remote sensing, where precision in positioning and direction is vital. Meanwhile, applications such as collision detection, motion sensing, and power monitoring continue to grow in importance as drone operations expand across both commercial and defense sectors.

Regional Insights

North America : Valued at USD 143.2 million in 2020, leading the market with strong defense spending and commercial drone adoption in the U.S. and Canada. Smart agriculture applications also drive growth.

Europe : Expected to grow at a 24.57% CAGR, supported by demand in Germany, France, and Russia for commercial drones.

Asia Pacific : Anticipated to record healthy growth due to rising military spending in China, India, and Japan. China is projected to grow at 25.33% CAGR, while Japan’s drone sensor market is set to reach USD 48.79 million by 2025.

Rest of the World : Holds a smaller share due to limited UAV procurement, but opportunities exist in emerging markets.

Key Players

The market is moderately fragmented, with global leaders and emerging players competing through product innovation and strategic investments.

Leading Companies:

Trimble (U.S.)

Bosch Sensortec (Germany)

TDK InvenSense (U.S.)

Sparton NavEx (U.S.)

Raytheon (U.S.)

AMS AG (Austria)

Flir Systems (U.S.)

KVH Industries (U.S.)

TE Connectivity (Switzerland)

Lord MicroStrain (U.S.)

Strategic Moves:

In November 2020 , the U.S. Department of Defense awarded USD 93.3 million to General Atomics for developing advanced sensors for the MQ-9 Reaper under the Smart Sensor Project, integrating AI-driven object recognition for improved autonomous control.

Aircraft Communication System Market Insights, Trends, Size, Growth and Forecast, 2024–2032

By Rishika19, 2025-09-05

According to Fortune Business Insights™, the global aircraft communication system market was valued at USD 17.12 billion in 2024 and is projected to reach USD 33.52 billion by 2032, growing at a CAGR of 8.8% during the forecast period. North America dominated the market in 2023, accounting for 33.08% of the share.

The market is witnessing steady growth due to increasing adoption of advanced technologies in aviation, ensuring efficient, secure, and real-time communication between aircraft and ground stations. For instance, Airborne Wireless Network (AWN) is developing high-speed communication systems to provide cost-effective broadband connectivity to aircraft, highlighting industry innovations driving market expansion.

Growth Factors

Increase in Aircraft Deliveries:

The growing demand for commercial and military aircraft is boosting procurement of communication systems, including audio integrating systems, antennas, cockpit voice recorders, and static dischargers. For example, the AV-530 aircraft antenna is widely used for in-flight broadband communication, supporting high-altitude operations up to 50,000 ft. Military UAV programs and next-generation fighter aircraft initiatives are further propelling market growth.

Adoption of Software Defined Radio (SDR):

SDR enables digital radio communication over aircraft computing platforms, improving operational efficiency. It decodes radio signals, provides precise aircraft data, and enhances communication systems in both commercial and military aviation. The rising deployment of SDR solutions is expected to significantly boost market growth.

Restraining Factors

High Development Costs:

Building robust aircraft communication systems involves substantial investment in advanced antennas, radios, and audio integration systems. Rapid technological advancements require frequent upgrades, and limited availability of government-regulated radio spectrum poses additional challenges for market expansion.

Market Trends

Airborne Wireless Network (AWN) Technologies:

AWN is creating airborne broadband mesh networks by connecting multiple aircraft, forming a digital communication superhighway in the sky. This innovation supports real-time data sharing and enhances flight operations.

5G High-Speed In-flight Connectivity:

The increasing demand for high-speed internet onboard aircraft, supported by Ku-band antennas, is a key market trend. Airlines like American Airlines leverage satellite-based Gogo 2Ku systems to provide live TV and internet access, enhancing passenger experience.

Information Source:

https://www.fortunebusinessinsights.com/aircraft-communication-system-market-102541

Market Segmentation

By Component: The antenna segment is the dominant and fastest-growing component in the aircraft communication system market, widely used for air-to-ground and in-flight communication, with examples including the AV-17 RAMI and AV-529 RAMI antennas. Transponders are also experiencing significant growth, driven by ADS-B technology that enables real-time aircraft position tracking, such as uAvionix’s tailBeaconX Mode S ES ADS-B OUT transponder for UAVs and general aviation aircraft. Other components, including receivers, transmitters, transceivers, displays and processors, radio tuning units, and software-defined radio (SDR) systems, play an essential role in supporting modern aircraft communication operations.

By System: The radio communication segment holds the largest share, as it is critical for both commercial and military aviation, encompassing VHF and HF transceivers. The cockpit voice recorder (CVR) segment is growing due to stricter ICAO regulations, with the FAA proposing to extend recording time to 25 hours for newly manufactured aircraft. Passenger address and interphone systems are witnessing increased adoption in commercial and military aircraft, further supporting market growth.

By Connectivity: SATCOM is the fastest-growing and largest connectivity segment, fueled by the adoption of satellite-based voice and data services. The VHF/UHF/L Band segment is also expanding, driven by in-flight TV broadcasting and line-of-sight communication applications, while HF communication continues to support long-range aircraft communication needs.

By Fit Type: The line fit segment dominates the market, largely due to the rising deliveries of UAVs and commercial aircraft. The retrofit segment is expected to grow steadily, driven by upgrades to next-generation antennas and communication systems, including the introduction of 5G-enabled solutions.

By Platform: Fixed-wing aircraft represent the fastest-growing segment, driven by commercial aircraft deliveries such as the Boeing 787, Airbus A320, and Airbus A380. The rotary-wing segment, including military and commercial helicopters, is supported by the increasing deployment of GPS, HF, and VHF antennas. Meanwhile, UAVs are seeing growing adoption across surveillance, defense, and commercial applications, further contributing to market expansion.

Regional Insights

North America: Largest market, valued at USD 5.26 billion in 2023, supported by increasing air traffic and UAV adoption.

Asia Pacific: Fastest-growing region, driven by UAV utilization, 3D-printed antennas, and government-backed aviation programs.

Europe: Growth fueled by military UAV investments and GPS-enabled SAR operations.

Middle East & Africa and Latin America: Expanding use of helicopters for commercial and oil & gas exploration applications.

Key Players

Leading companies focus on technological innovations, strategic contracts, and partnerships to maintain competitiveness:

Cobham Plc

General Dynamics Corporation

Thales Group

Harris Corporation

Honeywell International Inc.

Iridium Communications Inc.

L3 Technologies, Inc.

Lockheed Martin Corporation

Northrop Grumman Systems Corporation

Raytheon Company

Rohde & Schwarz GmbH & Co KG

United Technologies Company

Viasat, Inc.

Recent Developments

April 2024: BAE Systems secured a USD 459 million contract from the U.S. Department of Defense for hardware, repair, and technical support for the AN/ARC-231/A Multi-mode Aviation Radio Suite.

April 2024: Survivable Airborne Operations Center (SAOC) announced adoption of a modular aircraft with advanced secure communication and mission planning capabilities.

Report Coverage

The report provides:

Comprehensive insights on market trends, drivers, and restraints.

Detailed analysis of components, systems, connectivity, fit type, and platforms.

Evaluation of competitive landscape including mergers, acquisitions, and partnerships.

SWOT analysis and Porter’s Five Forces assessment.

Regional and global market forecasts from 2024 to 2032.

Process Spectroscopy Market Size, Share, Trends, Growth and Insights, 2024–2032

By Rishika19, 2025-09-05

According to Fortune Business Insights™, the global process spectroscopy market was valued at USD 15.93 billion in 2023 and is projected to grow from USD 20.41 billion in 2024 to USD 116.49 billion by 2032, registering a CAGR of 24.3% during the forecast period. The increasing adoption of spectroscopy technologies for real-time analysis, product quality assurance, and operational efficiency is driving market growth across multiple industries.

What is Process Spectroscopy?

Process spectroscopy is an analytical technique used to monitor and analyze end products across industries. It enables companies to maintain high-quality standards, reduce operational time, and lower surveillance costs. Its applications are expanding in pharmaceutical safety testing, food inspection, oil and gas processes, and water treatment, contributing to the growing demand globally.

The technology helps optimize production processes, improve product quality, and ensure regulatory compliance. Moreover, the introduction of advanced spectroscopic instruments by major manufacturers is expected to further propel market growth during the forecast period.

Market Growth Factors

Rising Demand for High-Quality and Specialized Products

The growing consumer preference for high-quality products is driving the adoption of process spectroscopy. Spectroscopy enables the identification and quantification of chemical compounds, ensuring product quality in industries such as food & beverages, pharmaceuticals, and material sciences.

Companies are also leveraging spectroscopy to optimize production, comply with regulatory standards, and enhance operational efficiency. For instance, Exum Industries partnered with Edge Scientific to distribute its LALI-TOF-MS instruments in Canada, expanding the market reach for high-precision solid sample analysis.

Increasing Use of Mass Spectrometry in Drug Discovery

Mass spectrometry (MS) plays a critical role in drug discovery and development (DDD). It is widely used for monitoring drug metabolism, pharmacokinetics, pharmacodynamics, and lead optimization. MS-based screenings help identify compounds that bind to specific protein targets and monitor drug concentrations and metabolic pathways.

An example of market activity includes the October 2023 partnership between Sai Life Sciences and Dassault Systèmes, leveraging advanced solutions for drug discovery and research process optimization, accelerating pharmaceutical development.

Restraining Factors

High Initial Costs of Spectroscopy Instruments

The development, deployment, and maintenance of spectroscopic instruments require significant investment. High initial costs can be a barrier for new entrants, while operational expenses, such as protein identification in LC/MS analysis or large-scale proteomics experiments, further increase costs.

Rapid Technological Changes

Frequent updates and innovations in spectroscopy instrumentation, including mass spectrometry and process analytical systems, require constant investment by companies, which may hinder adoption among smaller players.

Information Source:

https://www.fortunebusinessinsights.com/process-spectroscopy-market-105549

Market Trends

Adoption of Process Analytical Technology (PAT)

Process Analytical Technology (PAT) enables the design, analysis, and control of manufacturing processes by measuring critical parameters. PAT is particularly important in pharmaceutical manufacturing for monitoring reaction pathways and improving process safety.

In September 2023, the MAVERICK in-line Raman PAT system offered advantages over conventional Raman analyzers, providing cost-effective and accurate process monitoring without the complexities of traditional methods.

Market Segmentation

By Type: The Nuclear Magnetic Resonance (NMR) spectroscopy segment is the dominant and fastest-growing category, widely used across chemical, healthcare, and pharmaceutical industries due to its ability to provide detailed structural and molecular information. Infrared (IR) spectroscopy follows as the second-largest segment, valued for its capability to perform both qualitative and quantitative analysis of organic and inorganic compounds. Additionally, Ultraviolet-Visible (UV/VIS), Raman, and X-ray spectroscopy are contributing to market growth, particularly in specialized industrial applications that require precise material characterization.

By Technology: Atomic Absorption Spectroscopy (AAS) dominates the market due to its cost-effectiveness and suitability for high-throughput analysis of metals in various samples. The Atomic Emission Spectroscopy (AES) segment holds the second-largest position, offering high sensitivity and accuracy for trace element detection. Atomic Fluorescence Spectroscopy (AFS) accounted for a 17.31% market share in 2023 and is widely used for precise elemental analysis, adding significant value to the overall market.

By End-User: The food & beverage industry is the largest and fastest-growing end-user segment, driven by the increasing need for quality control, composition analysis, and nutritional assessment. The healthcare segment ranks second, with growth supported by the use of mass spectrometry in diagnostics, biomarker detection, and toxicology studies. Other industries, including agriculture, chemicals, oil & gas, and manufacturing, are also increasingly adopting spectroscopy techniques for process optimization and quality assurance.

By Component: The hardware segment led the market in 2023 and is projected to maintain the fastest growth, fueled by rising research and development efforts for advanced spectroscopic equipment. Meanwhile, the software segment is expected to witness significant expansion due to innovations in process control, data analysis, and automation solutions that enhance the efficiency and accuracy of spectroscopy applications.

Regional Insights

North America: Largest market, valued at USD 5.19 billion in 2023, driven by advanced research facilities, government initiatives, and presence of major players such as Bruker Corporation, Danaher, and Thermo Fisher Scientific.

Europe: Second-largest market, supported by government regulations, funding programs, and initiatives like Thermo Fisher Scientific’s IsoFootprint project for sustainable manufacturing.

Asia Pacific: Fastest-growing region, with key players including HORIBA, Shimadzu, and Yokogawa Electric Corporation, supported by new product launches and increasing adoption.

Rest of the World: Moderate growth due to rising investments in spectroscopy technology and infrastructure.

Key Industry Players

Leading players are focusing on R&D, technological advancements, and expanding distribution networks. Major companies include:

Agilent Technologies Inc. (U.S.)

ABB Ltd. (Switzerland)

BUCHI Labortechnik AG (Switzerland)

Bruker Corporation (U.S.)

Danaher Corporation (U.S.)

Foss A/S (Denmark)

HORIBA, Ltd. (Japan)

Kett Electric Laboratory (Japan)

Shimadzu Corporation (Japan)

Sartorius AG (Germany)

Thermo Fisher Scientific Inc. (U.S.)

Yokogawa Electric Corporation (Japan)

Recent Industry Developments

May 2024: Leading manufacturers showcased new innovations at Analytica 2024 in Munich, including advanced spectroscopy instruments for industrial and research applications.

January 2024: Bruker Corporation acquired Tornado Spectral Systems Inc., enhancing capabilities in advanced process Raman spectroscopy for pharmaceuticals and biotechnology quality control.