Automotive Composites Market Demand, Drivers & Global Growth, Forecast 2032

The global automotive composites market was valued at USD 7.67 billion in 2018 and is expected to grow to USD 13.5 billion by 2026, registering a CAGR of 7.56% during the forecast period. North America led the market in 2018 with a 31.29% share, while the U.S. market is projected to reach USD 3.22 billion by 2026, driven by increasing demand for lightweight materials and enhanced fuel efficiency.

Market Growth

The automotive industry is at a crossroads, where sustainability, performance, and innovation are shaping the next generation of vehicles. Among the many technological shifts, the rise of automotive composites stands out as a game-changer. These lightweight yet durable materials are redefining how cars are designed, produced, and utilized. With automakers striving to reduce emissions, increase efficiency, and meet growing consumer demand for advanced vehicles, the automotive composites market is experiencing rapid growth and is expected to expand significantly in the coming years.

While the numbers vary depending on methodology, the message is consistent: the market for automotive composites is accelerating. The demand for lightweight materials, paired with the shift to electric vehicles (EVs) and stricter emission norms worldwide, ensures that composites will remain integral to the industry’s evolution.

List of Top Automotive Composites Companies:

- Teijin Ltd.

- Mitsubishi Chemical Corporation

- Toray Industries, Inc.

- SGL Carbon

- RTP Company

- Plasan Carbon Composites

- Owens Corning

- Solvay S.A.

- UFP Technologies, Inc.

- BASF SE

- Other Players

What’s Driving the Growth?

- The Push for Lightweighting

Vehicles are becoming heavier due to added safety features, infotainment systems, and in the case of EVs, large battery packs. Lightweight materials like carbon fiber, glass fiber, and natural fiber composites help reduce overall weight, improving fuel economy in conventional cars and extending range in EVs. A 10% reduction in vehicle weight can improve fuel efficiency by nearly 6–8%, making lightweighting a priority for automakers. - Environmental Regulations and Sustainability

Governments around the globe are implementing stringent emission regulations, compelling manufacturers to redesign vehicles with efficiency at the forefront. Composites allow automakers to strike a balance between performance and environmental responsibility. - Electrification of Mobility

The global shift toward EV adoption is another crucial growth driver. Since battery packs add significant weight, composites are being integrated into EV bodies, interiors, and structural components to offset this challenge. Their role is particularly vital in extending driving ranges, which remains a key consumer concern. - Technological Advancements in Manufacturing

Innovations such as high-pressure resin transfer molding (HP-RTM), compression molding, and automation are making composites more accessible and cost-effective. These processes reduce cycle times, improve precision, and allow for larger-scale applications, moving composites beyond luxury and sports cars into mainstream production vehicles.

Read More : https://www.fortunebusinessinsights.com/automotive-composites-market-102711

Market Segmentation: Fiber, Resin, and Application

By Fiber Type

- Glass Fiber Composites dominate the market due to their balance of cost-effectiveness, strength, and versatility.

- Carbon Fiber Composites are growing at a rapid pace, particularly in EVs and performance cars, thanks to their superior strength-to-weight ratio.

- Natural Fiber Composites are emerging as sustainable alternatives and are gaining traction in interiors and non-structural applications.

By Resin Type

- Thermoset Resins currently lead the segment due to their durability and heat resistance.

- Thermoplastic Resins, however, are gaining attention as they offer recyclability, faster processing, and suitability for mass production.

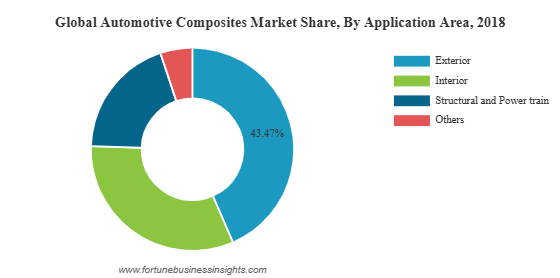

By Application

- Exterior Applications such as body panels, bumpers, and hoods account for the largest share today.

- Interior Components including dashboards, door panels, and trims are increasingly being replaced with composites for both weight reduction and design flexibility.

- Structural and Powertrain Components are also seeing higher adoption as composites prove their capability in withstanding mechanical stress.

Regional Insights

- Asia Pacific is the largest and fastest-growing market for automotive composites. Countries like China, India, and Japan dominate due to high vehicle production, government support for EV adoption, and robust manufacturing ecosystems. Asia accounts for nearly half of the global demand.

- Europe is another stronghold, with Germany, Italy, and France leading innovation in lightweighting. The region benefits from a strong luxury and performance car market where carbon fiber adoption is more prevalent.

- North America is witnessing rising demand due to sustainability initiatives and growing interest in natural fiber composites. Major automakers are investing heavily in R&D for integrating composites in both passenger and commercial vehicles.

Key Industry Developments:

- February 2021 – Teijin Ltd. announced installation of glass fiber sheet molding compound line at the company’s automotive composites business named ‘Benet Automotive s.r.o’. The investment was done to meet growing demand for Teijin’s composite parts from European automotive manufacturers.

- January 2021 – SGL Carbon announced investment of USD 4.5 million at its Arkansas site to expand the production of carbon composites for electric vehicles. The company is engaged in the manufacturing of carbon and glass fiber reinforced products for automotive applications. The new capacity addition will be used to meet growing demand for composite battery enclosures of modern e-car chassis.

Challenges

Despite the promising outlook, the market faces certain challenges:

- High Cost of Materials: Carbon fiber composites and advanced resin technologies remain expensive, restricting widespread adoption in cost-sensitive vehicle segments.

- Recycling Limitations: Thermoset composites, once cured, are difficult to recycle. This presents environmental challenges and may limit acceptance unless new recycling technologies mature.

- Production Scalability: While progress has been made, achieving large-scale, cost-effective production is still a hurdle for many automakers.

Key Players Leading the Market

The competitive landscape of the automotive composites market includes several global leaders such as Toray Industries, SGL Carbon, Teijin Limited, Mitsubishi Chemical Holdings, Hexcel Corporation, Owens Corning, Solvay, and DuPont de Nemours. These companies are heavily investing in R&D to introduce cost-effective and sustainable composite solutions, aiming to capture a larger share of the growing market.

Future Outlook

The future of the automotive composites market looks highly promising. As the world moves toward electrification, sustainability, and high-performance mobility, composites will continue to play a central role. While cost and recyclability remain hurdles, innovations in manufacturing and material science are rapidly closing the gap. For automakers, composites are no longer a niche option reserved for premium sports cars—they are becoming essential components of everyday vehicles. For consumers, this shift translates into lighter, safer, and more fuel-efficient cars that also align with global sustainability goals. In short, the automotive composites market is not just about materials—it’s about driving the future of mobility.