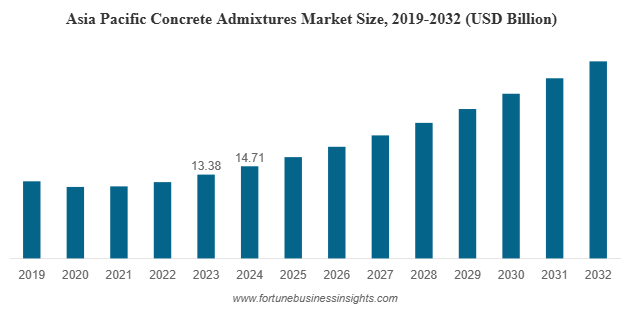

The global concrete admixtures market was valued at USD 22.78 billion in 2024 and is expected to increase from USD 24.90 billion in 2025 to USD 42.90 billion by 2032, registering a CAGR of 8.9% during the forecast period. Asia Pacific led the market in 2024 with a dominant 64.57% share, driven by large-scale infrastructure projects and rapid urbanization. In the United States, the market is anticipated to witness strong growth, reaching an estimated USD 3.08 billion by 2032, supported by rising demand for high-performance concrete across construction sectors.

List of Top Concrete Admixtures Companies:

- Buildtech Products (India)

- Sika AG (Switzerland)

- RAZON ENGINEERING COMPANY PRIVATE LIMITED (India)

- Flowcrete Group Ltd. (U.K.)

- CEMEX S.A.B. de C.V. (Mexico)

- BASF SE (Germany)

- GCP Applied Technologies (U.S.)

- RPM International Inc. (U.S.)

- Fosroc International Inc. (UAE)

Understanding Concrete Admixtures and Their Role in Construction

Concrete admixtures market are specialized chemicals added to concrete before or during mixing to enhance its physical and mechanical properties. They are used to modify characteristics such as workability, strength, setting time, and durability. Common types of admixtures include water-reducing agents, air-entraining agents, accelerators, retarders, waterproofing agents, and superplasticizers.

These additives play a crucial role in ensuring high-quality concrete performance under different environmental and structural conditions. For instance, water-reducing admixtures improve strength and reduce permeability, while air-entraining admixtures enhance freeze–thaw resistance in cold climates. As modern construction projects demand higher standards of performance and sustainability, admixtures have become indispensable to the industry.

Market Dynamics and Growth Drivers

One of the key drivers of the concrete admixtures market is the rapid pace of urbanization and infrastructure development across emerging economies. Countries such as China, India, and Indonesia are witnessing significant growth in residential and commercial construction due to population expansion and industrialization. The rising need for durable, long-lasting structures is boosting the consumption of admixtures that improve concrete’s strength, workability, and longevity.

In addition, sustainability is emerging as a major trend shaping the market. Construction companies are increasingly focusing on reducing the carbon footprint of concrete by optimizing cement content and using admixtures that improve mix efficiency. This helps reduce water and energy consumption during production while enhancing performance. The growing awareness of green building standards and environmental regulations is also encouraging the use of eco-friendly admixtures.

Another growth driver is the development of advanced admixture formulations. Manufacturers are investing in research and development to produce next-generation products tailored for specific construction needs. For example, new types of superplasticizers are designed to offer high workability without compromising strength, while advanced corrosion inhibitors and waterproofing admixtures extend the life of concrete in harsh environments.

Read More : https://www.fortunebusinessinsights.com/concrete-admixtures-market-102832

Regional Insights

Asia Pacific dominates the global concrete admixtures market, accounting for nearly 64.57% of the total share in 2024. The region’s leadership is attributed to massive infrastructure projects, government housing initiatives, and the presence of fast-developing economies such as China, India, and Japan. Rapid urban migration, combined with government-led infrastructure expansion, continues to fuel regional demand.

In North America, the market is benefiting from an increasing focus on infrastructure renovation and repair, especially in the United States and Canada. Modernization of bridges, roads, and public facilities is creating consistent demand for high-performance concrete solutions.

Europe is witnessing steady growth driven by sustainable construction practices, stringent building standards, and renovation of aging structures. Countries such as Germany, the UK, and France are promoting energy-efficient and low-emission construction materials, providing a favorable environment for admixture adoption.

Meanwhile, the Middle East and Africa are emerging as promising markets, supported by rapid urban development, mega-projects, and government investments in tourism and transport infrastructure. Latin America, led by Brazil and Mexico, is also expected to register healthy growth during the forecast period.

Segmental Analysis

By type, water-reducing admixtures hold the largest market share owing to their ability to enhance workability and strength while minimizing water usage. These admixtures are widely used in high-strength and precast concrete applications. Air-entraining admixtures are gaining traction in cold regions, while retarding and accelerating admixtures are used to adjust setting times based on project requirements.

By application, the residential segment leads the market due to increasing housing demand and government-supported affordable housing projects in developing nations. The infrastructure segment is expected to record the fastest growth rate as countries invest heavily in highways, rail networks, and public infrastructure. Industrial and commercial construction also contribute significantly to overall demand.

Challenges in the Market

Despite promising growth, the industry faces challenges such as fluctuating raw material costs, regulatory compliance for chemical manufacturing, and inconsistent quality standards across regions. Moreover, in some developing areas, limited awareness about admixture benefits among small-scale contractors can restrict adoption.

However, these challenges are expected to be mitigated as governments enforce stricter building codes and promote the use of durable, sustainable materials. Continuous innovation and awareness campaigns by leading players will further support market penetration.

Key Industry Developments:

- November 2023: Sika AG announced that the group had expanded its concrete admixture capacity in the U.S. The company continues to invest in its polymer production at its Sealy site in the U.S. state of Texas. Sika’s latest move marks its second polymer investment in the state of Texas in just five years. The company requires polymers for chemical building blocks that are needed to produce Sika ViscoCrete, a high-performance, resource-saving concrete admixture. The company initiated this expansion to meet the growing demand for its products in the U.S. and Canada.

- June 2023: Fosroc India launched a state-of-the-art Concrete Lab in Chennai that will provide advanced building material testing facilities to developers, contractors, and other construction professionals.

Future Outlook and Opportunities

The outlook for the concrete admixtures market remains highly positive through 2032. Increasing emphasis on low-carbon construction materials and circular economy principles will drive innovation. Companies are likely to focus on bio-based or low-VOC admixtures to align with sustainability goals. Additionally, advancements in nanotechnology and smart materials are expected to create opportunities for developing multifunctional admixtures with enhanced performance.

Investment in infrastructure and real estate will continue to fuel long-term demand, particularly in emerging economies. The combination of technological innovation, regulatory support, and environmental awareness positions the concrete admixtures market as a key enabler of the global transition toward sustainable and resilient construction practices.

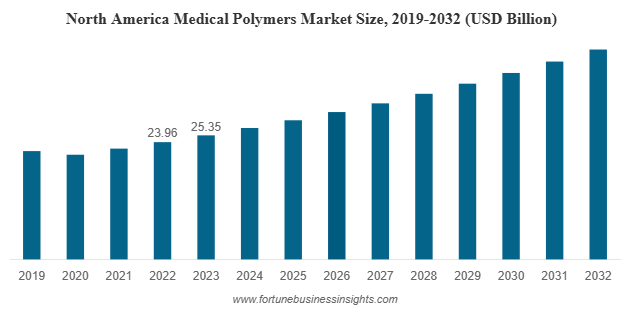

The global medical polymers market was valued at USD 51.63 billion in 2023 and is anticipated to increase from USD 54.84 billion in 2024 to USD 89.73 billion by 2032, registering a CAGR of 6.3% during the forecast period. North America led the market in 2023, accounting for a 49.1% share, driven by strong healthcare infrastructure and growing demand for advanced medical materials.

List of Top Medical Polymers Companies:

- BASF SE (Germany)

- SABIC (Saudi Arabia)

- Covestro Ag (Germany)

- Celanese (U.S.)

- Evonik (Germany)

- Arkema (France)

- Solvay (Belgium)

- Kuraray Co., Ltd. (Japan)

Understanding Medical Polymers and Their Importance

Medical polymers market refer to a broad class of polymeric materials engineered specifically for use in medical applications such as implants, packaging, devices, surgical instruments, and diagnostic tools. These materials offer several advantages over traditional substances like metals or glass, including flexibility, cost-efficiency, sterilizability, and chemical resistance. They also play a critical role in ensuring patient safety and comfort while enhancing device functionality.

Medical polymers market are broadly categorized into three segments — fibers and resins, medical elastomers, and biodegradable polymers. Among these, fibers and resins such as polypropylene (PP), polyethylene (PE), polyvinyl chloride (PVC), and polystyrene (PS) dominate the market due to their widespread use in disposable medical products and packaging. Medical elastomers like silicone, thermoplastic elastomers (TPE), and thermoplastic polyurethane (TPU) are favored for their flexibility and resilience, making them suitable for catheters, tubing, and prosthetics. Meanwhile, biodegradable polymers such as polylactic acid (PLA) and polyhydroxyalkanoates (PHA) are gaining attention for their eco-friendly properties and role in reducing medical waste.

Key Market Drivers

- Growing Demand for Advanced Medical Devices

The increasing adoption of minimally invasive surgeries and the rising prevalence of chronic diseases have accelerated demand for medical devices and components made from high-performance polymers. These materials offer the necessary mechanical strength, transparency, and chemical stability required in surgical instruments, prosthetics, and diagnostic equipment. Their ability to enhance biocompatibility and reduce infection risks has made them indispensable in modern healthcare.

- Expanding Healthcare Infrastructure

Developing economies such as India, China, and Brazil are witnessing significant growth in healthcare infrastructure, supported by government investments and rising patient awareness. This expansion has led to higher consumption of medical devices, packaging materials, and implants — all of which rely heavily on polymer-based components. As healthcare spending increases, so does the adoption of polymer technologies that ensure precision and efficiency.

- Rising Focus on Sustainable and Bio-Based Materials

Sustainability has become a central theme in the global medical materials landscape. Manufacturers are investing in biodegradable and bio-based polymers to reduce environmental impact and comply with stringent regulatory standards. These innovations are not only environmentally beneficial but also align with the global shift toward circular economies and responsible production.

- Technological Advancements in Manufacturing

Modern manufacturing processes such as injection molding, extrusion, blow molding, thermoforming, and 3D printing are revolutionizing how medical polymers are utilized. Among these, injection molding holds a leading position due to its precision, efficiency, and ability to produce large volumes of complex components. 3D printing is also gaining momentum, particularly for custom implants, surgical guides, and patient-specific devices.

Read More : https://www.fortunebusinessinsights.com/medical-polymers-market-109681

Challenges Hindering Market Growth

Despite the strong growth outlook, the medical polymers industry faces certain challenges. Stringent regulatory frameworks governing the approval of medical-grade materials can delay product launches and increase compliance costs. Additionally, maintaining consistency and safety standards for biocompatibility and sterilization remains a complex process.

Raw material price fluctuations and supply chain disruptions, as witnessed during the COVID-19 pandemic, have also posed challenges to manufacturers. Balancing cost-effectiveness with performance and sustainability requirements is another ongoing concern for producers operating in both developed and emerging markets.

Regional Insights

North America dominated the medical polymers market in 2023, accounting for nearly half of the global share. The region’s leadership is attributed to advanced healthcare infrastructure, significant investments in medical device innovation, and a strong regulatory ecosystem supporting product safety and quality.

Asia Pacific is projected to be the fastest-growing region over the forecast period, driven by the rapid expansion of the healthcare sector in countries such as China, India, and Japan. Increasing healthcare expenditure, local manufacturing capabilities, and growing medical tourism have positioned the region as a key growth hub.

Europe also represents a vital market, particularly due to its focus on sustainability and the adoption of biodegradable polymers. Strict environmental regulations in the European Union are prompting companies to shift toward eco-friendly alternatives without compromising on quality or performance.

Key Industry Developments:

- March 2024: SABIC announced that it has achievd successful step towards creation of the circular polymers based on advanced recyalinc of used medical plastics, The company ahs achievd this milestone in collaboration with JESSA HOSPITAL.

- October 2023 – Covestro began operations at its dedicated mechanical recycling compounding line for polycarbonates at its location in Shanghai, China. The company aimed to deliver over 25,000 tons of products annually.

Future Outlook

The future of the medical polymers market is poised to be shaped by sustainability, innovation, and advanced manufacturing technologies. Companies are expected to focus on developing polymers that are not only high-performing but also biodegradable or recyclable. Smart polymers capable of responding to temperature, pH, or biological signals are emerging as the next frontier in material science, promising breakthroughs in drug delivery systems and regenerative medicine.

Collaboration between material scientists, device manufacturers, and healthcare providers will play a crucial role in accelerating product innovation. Moreover, as governments and private players invest in healthcare infrastructure and R&D, the market will continue to witness robust growth opportunities.

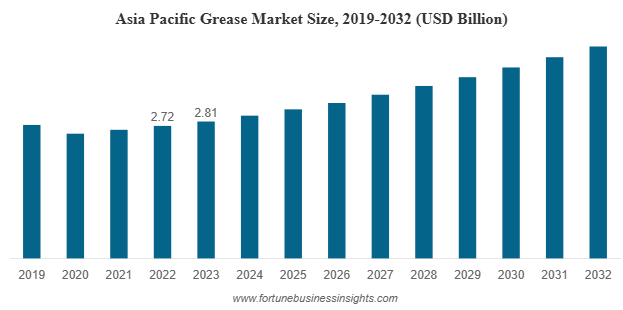

The global grease market was valued at USD 6.60 billion in 2023 and is expected to expand from USD 6.85 billion in 2025 to USD 9.49 billion by 2032, registering a CAGR of 4.60% during the forecast period. Asia Pacific led the market in 2023, accounting for a 44.18% share of the global revenue.

List of Top Grease Companies:

- Exxon Mobil Corporation (U.S.)

- Total Energies (France)

- Shell PLC (U.K.)

- Chevron Corporation (U.S.)

- P. PLC (U.K.)

- FUCHS (Germany)

- Sinopec (China)

- PETRONAS (Malaysia)

Rising Demand from Automotive and Manufacturing Sectors

The automotive sector remains the cornerstone of the grease market, with applications spanning wheel bearings, steering joints, suspension systems, and electric motors. As global vehicle production rises, demand for specialized greases with enhanced temperature resistance, wear protection, and longer service life continues to surge.

A major trend shaping the industry is the transition toward electric vehicles (EVs). EVs demand customized lubricants for high-speed motors, battery systems, and transmission components that operate under unique temperature and torque conditions. Manufacturers are responding with formulations tailored for electric drivetrains, supporting smoother performance and improved energy efficiency.

Beyond automobiles, industrial expansion across construction, mining, power generation, and manufacturing is also driving demand. Grease ensures the reliability of heavy machinery, cranes, turbines, and industrial bearings, making it indispensable in high-load and high-temperature environments.

Shift Toward Sustainable and Bio-Based Greases

Sustainability has become a defining factor in the lubricant industry. Increasing regulatory pressure and customer preference for eco-friendly products are pushing companies to invest in bio-based and biodegradable greases. These greases, derived from renewable base oils such as vegetable oils and synthetic esters, reduce environmental impact while maintaining comparable or superior performance to conventional mineral-based greases.

Bio-based greases are gaining particular attention in environmentally sensitive applications such as marine transport, food processing, and forestry operations. These formulations not only help meet environmental regulations but also align with global efforts toward carbon neutrality and circular manufacturing.

Challenges: Raw Material Volatility and Regulatory Hurdles

While the grease market offers attractive growth potential, it faces challenges stemming from volatile raw material prices and stringent environmental regulations. The cost of base oils, especially mineral and synthetic variants, is highly sensitive to fluctuations in crude oil markets. This volatility affects overall production costs and supply stability.

Additionally, compliance with evolving regulatory standards concerning chemical safety and emissions requires extensive R&D investments. Manufacturers must continually reformulate products to meet performance benchmarks while minimizing environmental impact, which adds to production complexity and cost pressures.

Read More : https://www.fortunebusinessinsights.com/grease-market-110042

Market Segmentation Overview

By Base Oil:

Mineral oil-based greases continue to dominate the global market due to their cost-effectiveness and wide availability. However, synthetic greases are expected to witness faster growth in the coming years, driven by their superior performance under extreme conditions, better oxidation stability, and extended service intervals. Bio-based greases are gradually emerging as the next growth frontier, fueled by environmental awareness and corporate sustainability initiatives.

By Application:

The automotive industry holds the largest market share, accounting for a major portion of global consumption. Power generation, construction, agriculture, and food & beverage sectors also represent substantial demand segments. In the food industry, non-toxic and odorless greases designed to meet strict hygiene standards are increasingly used in machinery that comes into indirect contact with food products.

Regional Insights

Asia Pacific remains the leading regional market, accounting for approximately 44.18% of the global share in 2023. Rapid industrialization, infrastructure investments, and vehicle production in China, India, Japan, and Southeast Asia have positioned the region as a hub for grease consumption. China and India, in particular, are witnessing strong growth due to increased automotive manufacturing and heavy industry expansion.

In North America and Europe, demand is being driven by advanced manufacturing, energy generation, and automation sectors. Stricter environmental regulations in these regions are also fostering the shift toward high-performance synthetic and bio-based greases. Meanwhile, Latin America and the Middle East & Africa are emerging as promising markets owing to large-scale infrastructure projects, mining operations, and oil & gas industry activities.

Key Industry Developments:

- November 2023: B.Grimm Technologies and PETRONAS Lubricants International teamed up to work together and utilize their business expertise to enhance the lubricants market in Thailand. This partnership signified the beginning of future collaborations between B.Grimm and the PETRONAS Group, which would explore new energy solutions in Thailand and the Southeast Asian market.

- March 2023: ExxonMobil announced its plan to invest approximately USD 110 million in constructing a lubricant manufacturing facility in Maharashtra. The new plant would have the capability to produce 159,000 kiloliters of finished lubricants per year, serving the increasing demand of Indian industrial sectors such as steel, manufacturing, mining, power, and construction. The plant is projected to commence operations by the end of 2025.

Future Outlook and Opportunities

The grease market’s future is defined by innovation, sustainability, and regional diversification. As industries move toward automation, precision engineering, and electrification, the need for advanced lubricants will only intensify. Companies that prioritize R&D to develop high-performance, long-life, and eco-friendly greases are likely to capture significant market share.

Moreover, emerging markets offer strong potential for expansion. Strategic partnerships, joint ventures, and localized manufacturing can help global players tap into demand from fast-growing economies. Certifications such as food-grade, biodegradable, and high-performance ratings will also serve as differentiators in this competitive landscape.

In summary, the global grease market is on a growth trajectory fueled by industrial modernization, the rise of electric mobility, and increasing awareness of sustainable lubrication solutions. With strong demand from both traditional and emerging industries, the market is poised for steady and resilient expansion through 2032.

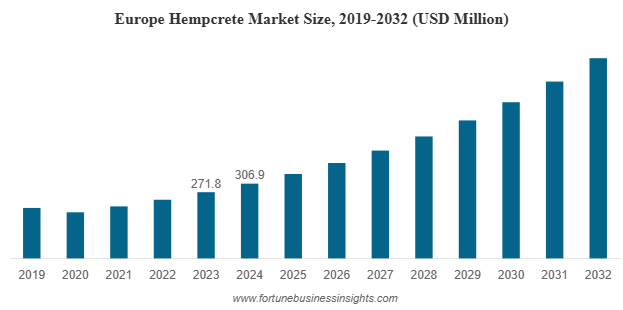

The global hempcrete market was valued at USD 804.8 million in 2024 and is projected to increase from USD 910.1 million in 2025 to USD 2,183.3 million by 2032, registering a strong CAGR of 13.3% during 2025–2032. Europe led the market in 2024, accounting for a 38.13% share of the global revenue.

As global attention increasingly shifts toward reducing carbon emissions and promoting sustainable building materials, hempcrete market has emerged as one of the most promising eco-friendly alternatives to conventional concrete. The hempcrete market is gaining rapid traction worldwide, driven by its excellent insulation properties, environmental benefits, and suitability for modern green architecture.

List Of Key Hempcrete Companies Profiled

- Australian Hemp Masonry Company (Australia)

- Sativa Building Products (U.S.)

- IsoHemp (Belgium)

- Hempitecture (U.S.)

- Hemp Homes Australia (Australia)

- Carmeuse Group (Belgium)

- Rare Earth Global (U.K.)

- UK Hempcrete (U.K.)

Benefits of Hempcrete Market

Hempcrete market is a bio-composite material made from the woody core of the hemp plant—known as hemp hurds—combined with a lime-based binder and water. The result is a lightweight, breathable, and highly insulative material used for wall infill, insulation, and flooring. Unlike traditional concrete, hempcrete is carbon-negative, meaning it absorbs more carbon dioxide during its life cycle than it emits during production.

Hempcrete’s market benefits include:

- Excellent insulation – providing natural thermal and acoustic balance.

- Moisture regulation – maintaining stable humidity levels and reducing mold risk.

- Fire and pest resistance – offering durability and long-term stability.

- Lightweight structure – reducing load on building frameworks.

However, it is important to note that hempcrete market is not load-bearing and must be used alongside a structural framework made of timber, steel, or reinforced concrete.

Market Drivers and Opportunities

- Rising Demand for Sustainable Building Materials

Growing awareness about environmental impact, climate change, and energy efficiency has led to a surge in the use of renewable and eco-friendly materials. Builders, developers, and consumers are increasingly adopting hempcrete market to reduce the carbon footprint of construction projects while improving indoor air quality and energy performance.

- Supportive Regulations and Green Building Initiatives

Governments worldwide are promoting green building certifications and carbon reduction policies. In Europe, initiatives such as LEED and BREEAM certification standards are encouraging the use of sustainable materials like hempcrete market. Additionally, relaxed regulations surrounding industrial hemp cultivation in countries such as the U.S. and Canada have strengthened raw material supply chains, fueling market expansion.

- Technological Advancements

Ongoing research and innovation in hemp processing and binder formulations have improved the mechanical performance and workability of hempcrete market. The development of hybrid hemp-lime composites and pre-cast hemp blocks has also enhanced its structural applications, making it easier to integrate into modern construction systems.

- Growing Use in Retrofitting and Heritage Restoration

Hempcrete’s market breathable and non-toxic characteristics make it ideal for renovating older buildings. It helps regulate humidity, prevents condensation, and enhances thermal efficiency without damaging existing structures—offering significant opportunities in the restoration and retrofitting segment.

Market Restraints

Despite its strong growth prospects, the hempcrete industry faces several challenges.

- Structural limitations: Hempcrete market cannot replace load-bearing concrete in large-scale constructions, restricting its use primarily to residential and low-rise buildings.

- Low compressive strength: Compared to traditional materials, hempcrete market has lower strength, which limits its structural applications.

- Limited awareness: Many architects, builders, and regulators remain unfamiliar with hempcrete’s market properties and potential. Wider adoption will require increased training, technical knowledge, and inclusion in national building codes.

- Inconsistent regulations: In some regions, hemp cultivation laws and material standards remain unclear, hindering supply chain stability.

Addressing these barriers through education, standardization, and innovation will be essential for the hempcrete market to reach full potential.

Read More : https://www.fortunebusinessinsights.com/hempcrete-market-110107

Segmentation Overview

By Application:

The hempcrete market is segmented into walls, floors, and roofs. Walls dominate the segment due to hempcrete’s market superior insulation and moisture-regulating capabilities, which are ideal for building envelopes. Floors and roofs are emerging areas as builders explore full eco-housing designs.

By End-Use:

The residential sector accounts for the majority of hempcrete market usage, driven by rising demand for energy-efficient and sustainable housing. The commercial segment is also growing, particularly in eco-resorts, educational institutions, and public infrastructure projects that prioritize environmental performance.

Regional Insights

- Europe remains the largest regional market, holding approximately 13% of the global share in 2024. Countries such as France, the U.K., and Germany have led in hemp cultivation and sustainable construction policies, enabling faster market adoption.

- North America is experiencing rapid growth due to favorable regulatory changes and the rising popularity of green building projects across the U.S. and Canada.

- Asia Pacific shows strong potential as nations like China expand hemp cultivation and invest in sustainable housing initiatives.

- Latin America and the Middle East & Africa are emerging regions with high potential, particularly for affordable and climate-resilient housing solutions.

Key Industry Developments

- March 2024: The Australian Hemp Masonry Company reported a significant increase in their hempcrete production, tripling their annual supply to 120 homes from 40 homes per year over the past decade. This growth highlights the increasing demand for sustainable and eco-friendly building materials such as hempcrete.

- January 2024: The International Code Council (ICC) added an appendix on hemp-lime construction to its 2024 International Residential Code (IRC). Such developments are helpful for builders to obtain permits and approvals to use hempcrete.

Future Outlook

The future of the hempcrete market looks promising, with ongoing innovation and a global shift toward sustainable infrastructure. Companies are exploring hybrid composites, pre-cast modular systems, and hemp-based insulation panels to enhance performance and expand application areas.

As building codes evolve and governments continue to emphasize sustainability, hempcrete market is expected to play an increasingly vital role in carbon-neutral construction. The combination of environmental benefits, energy efficiency, and material versatility positions hempcrete market as a cornerstone of future green building technologies.

The hempcrete market is on a path of substantial growth, supported by sustainability trends, technological progress, and favorable regulations. With a projected value exceeding USD 2,183.3 million by 2032, hempcrete represents not just an innovative building solution but also a strategic step toward reducing the environmental impact of the global construction industry.

As awareness continues to grow and performance innovations expand its usability, hempcrete market will likely become a mainstream material in modern architecture—defining the future of eco-friendly construction.

Epoxy Resin Market Opportunities, Companies, Global Analysis & Forecast 2032

By Sharvari, 2025-10-13

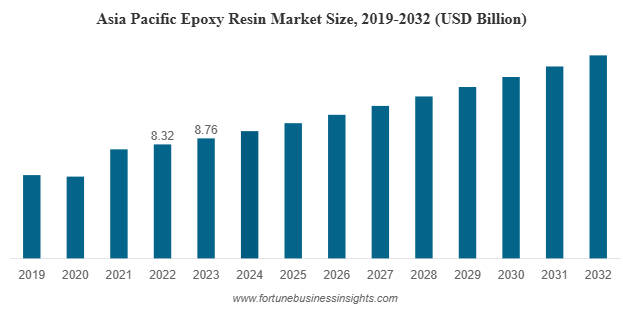

The global epoxy resin market was valued at USD 12.74 billion in 2023 and is expected to reach USD 21.37 billion by 2032, growing at a CAGR of 5.9% during the forecast period. Asia Pacific led the market in 2023, accounting for 68.76% of the global share.

Epoxy resins market have become an essential component in modern industrial applications, known for their outstanding mechanical strength, chemical resistance, and adhesive properties. These versatile polymers are widely used in coatings, adhesives, composites, electrical components, and structural materials across sectors such as construction, automotive, aerospace, and electronics. The rising global demand for durable, lightweight, and high-performance materials is significantly boosting the epoxy resin market’s growth trajectory.

List Of Key Companies Profiled

- Kukdo Chemical Co., Ltd. (South Korea)

- Huntsman Corporation (U.S.)

- Olin Corporation (U.S.)

- Nan Ya Plastics Corporation (Taiwan)

- Hexion Inc. (Westlake Chemicals) (U.S.)

- Chang Chun Group (Taiwan)

- Aditya Birla Chemicals (India)

- Sika Group (Switzerland)

- DIC Corporation (Japan)

Expanding Applications Across Key Industries

The growing construction sector remains a dominant consumer of epoxy resins, particularly in protective coatings, flooring systems, and structural adhesives. The material’s excellent adhesion to metals, concrete, and composites makes it ideal for bridges, industrial floors, pipelines, and marine structures. As infrastructure modernization continues across developing economies, the demand for epoxy resins in paints and coatings is expected to surge.

In the automotive industry, epoxy resins are used in lightweight composite parts that enhance fuel efficiency and reduce emissions. Electric vehicle manufacturers are increasingly turning to epoxy-based materials for battery casings, electrical insulation, and high-strength components. Similarly, the aerospace sector relies on epoxy composites for their superior strength-to-weight ratio, thermal stability, and resistance to environmental degradation.

Another key area driving growth is the electronics industry, where epoxy resins are used in encapsulation, circuit boards, and semiconductor packaging. The rapid adoption of 5G technology and consumer electronics is creating new opportunities for epoxy resin manufacturers to develop advanced formulations with improved dielectric properties and heat resistance.

Renewable Energy Fuels Market Momentum

One of the most significant growth drivers for the epoxy resin market is the global transition toward renewable energy sources. Epoxy-based composites are essential in the fabrication of wind turbine blades, offering high mechanical strength and resistance to fatigue. As countries accelerate wind energy installations to meet decarbonization goals, the demand for epoxy resins in this segment is projected to rise sharply.

The increasing investment in solar power infrastructure also contributes to market growth, with epoxy systems being used in photovoltaic panels and energy storage units. These materials ensure long-term stability and weather resistance, which are critical for energy systems exposed to harsh environmental conditions.

Sustainability and Bio-Based Innovations

Sustainability has become a defining trend in the chemical industry, prompting manufacturers to develop bio-based epoxy resins market derived from renewable sources such as vegetable oils, lignin, and natural sugars. These formulations reduce reliance on petroleum-based feedstocks and minimize carbon emissions throughout the production cycle.

Companies are also focusing on lowering volatile organic compound (VOC) emissions and improving recyclability in epoxy systems. Such advancements align with evolving environmental regulations and the growing preference for eco-friendly materials in construction, automotive, and consumer goods. The shift toward greener chemistry not only addresses sustainability goals but also offers a competitive edge in attracting environmentally conscious clients.

Read More : https://www.fortunebusinessinsights.com/epoxy-resin-market-106597

Regional Insights

Asia Pacific dominates the global epoxy resin market, accounting for approximately 68.76% of total share in 2023. The region’s strong industrial base, coupled with large-scale infrastructure projects and growing manufacturing activities, particularly in China, India, Japan, and South Korea, continues to drive demand. Rapid urbanization and the expansion of renewable energy infrastructure further contribute to market growth in this region.

Europe remains a major market for epoxy resins, supported by advanced automotive production, aerospace innovation, and environmental regulations promoting sustainable materials. Meanwhile, North America shows robust growth prospects, particularly due to the adoption of lightweight composites and electric vehicles. Emerging economies in Latin America and the Middle East & Africa are also witnessing rising consumption of epoxy materials in construction, energy, and industrial applications.

Market Challenges

Despite strong demand, the epoxy resin market faces several challenges. Volatility in raw material prices, particularly for petroleum-derived feedstocks such as bisphenol-A and epichlorohydrin, can affect production costs and profit margins. Moreover, stringent regulatory standards on hazardous chemicals and emissions impose compliance burdens on manufacturers. Supply chain disruptions, as observed during the COVID-19 pandemic, have also highlighted vulnerabilities in global logistics and raw material sourcing.

To overcome these challenges, leading players are investing in vertical integration, sustainable production technologies, and regional manufacturing hubs to minimize dependency on global supply chains.

Strategic Developments

For instance, Grasim Industries expanded its epoxy resin capacity in Gujarat to meet rising domestic demand, while DCM Shriram announced a new investment to enhance production capabilities. Several companies are also exploring bio-based epoxy technologies and digital manufacturing processes to achieve operational efficiency and sustainability goals.

Key Industry Developments

- March 2024 – Grasim Industries Limited, in its Chemical business, inaugurated the capacity expansion project of Epoxy resins and formulation capacity at Vilayat, Gujarat. Grasim Industries Limited is a subsidiary of Aditya Birla Group. With this capacity expansion, the company’s overall capacity for its advanced materials will increase to 246,000 tons per annum.

- February 2024 – India’s DCM Shriram announced the expansion of its epoxy manufacturing plant with an investment plan of USD 120.6 million over the next years.

Future Outlook

The epoxy resin market is set for continuous expansion through 2032, supported by industrial modernization, clean energy initiatives, and the growing use of high-performance composites. Companies that embrace innovation in sustainable materials, process optimization, and strategic collaborations will remain at the forefront of this transformation.

As industries increasingly prioritize durability, performance, and sustainability, epoxy resins will continue to play a pivotal role in shaping the next generation of infrastructure, transportation, and clean energy solutions worldwide.

Aerospace & Defense Materials Market Global Opportunities, Insights, Size, Growth & Forecast 2032

By Sharvari, 2025-10-13

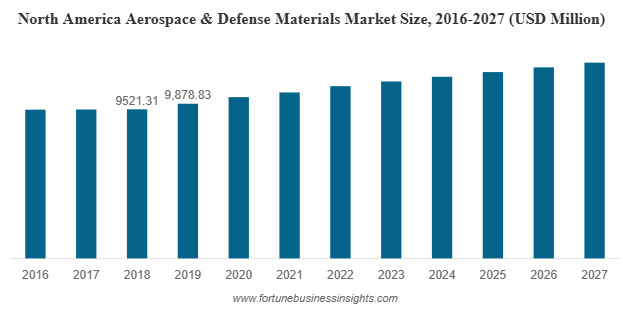

The global aerospace and defense materials market was valued at USD 18,411.83 million in 2019 and is expected to rise to USD 23,825.45 million by 2027, exhibiting a CAGR of 4.21% during the forecast period. North America led the market with a dominant 53.65% share in 2019, driven by strong demand from aircraft manufacturers and defense programs. The U.S. market alone is anticipated to reach USD 12,019.42 million by 2027, fueled by ongoing advancements in lightweight and high-performance materials.

List Of Key Companies Profiled In Aerospace And Defense Materials Market:

- Arconic Inc. (US)

- Toray Composite Materials America, Inc. (US)

- Huntsman (US)

- Evonik Industries (Germany)

- Hexcel Corporation (US)

- Materion Corp. (US)

- AMI Metals Inc. (US)

Market Overview and Forecast

The global aerospace and defense materials market is undergoing a significant transformation as the industry pivots toward lightweight, high-performance, and sustainable materials. With the growing need for fuel efficiency, reduced emissions, and enhanced aircraft performance, material science has become a central focus for both commercial and military aerospace sectors. The latest insights highlight a steady market expansion driven by technological advancements, strategic collaborations, and rising defense budgets worldwide.

While commercial aircraft continue to dominate demand, the defense segment is catching up quickly. Many nations are increasing investments in next-generation aircraft, satellites, and unmanned systems, each requiring specialized materials that can withstand extreme conditions. The push for stronger, lighter, and more heat-resistant materials has redefined the competitive landscape of aerospace manufacturing.

Key Market Drivers

The aerospace and defense materials market is primarily driven by the demand for lightweight and fuel-efficient aircraft. Reducing an aircraft’s weight by just 1% can save thousands of liters of fuel annually, translating to significant cost and emission reductions. This has encouraged manufacturers to shift from conventional metals toward advanced composites and titanium-based materials.

Another major driver is the growing emphasis on safety, durability, and regulatory compliance. Aerospace materials must meet strict certification and performance standards, leading to increased R&D investments by material suppliers. Additionally, rapid advancements in additive manufacturing and hybrid composites are opening new possibilities for efficient, customized component production.

The rising adoption of next-generation aircraft, both commercial and military, also boosts the market. As nations focus on upgrading fleets and developing indigenous aircraft programs, the demand for advanced materials is set to increase.

Key Material Segments

The market is segmented by material type into aluminum alloys, titanium alloys, super alloys, steel, and composites. Among these, composites hold the largest share in terms of market value and are projected to be the fastest-growing category during the forecast period. These materials are preferred for their high strength-to-weight ratio, corrosion resistance, and ability to reduce fuel consumption.

Aluminum alloys remain dominant by volume due to their versatility, cost-effectiveness, and ease of manufacturing. They are extensively used in fuselages, wings, and interior structures of commercial and military aircraft. Meanwhile, titanium alloys are gaining popularity for critical components that require high thermal stability, such as engine parts and landing gears. Super alloys and advanced steels are also expected to see moderate growth, driven by their use in engines and structural reinforcements where high temperature and stress tolerance are crucial.

Commercial vs. Military Demand

Commercial aviation continues to represent the largest segment of the market, primarily due to the global rise in air travel and fleet expansion initiatives by major airlines. As passenger traffic continues to recover and grow, aircraft manufacturers are ramping up production to meet delivery targets. Lightweight materials play a crucial role in improving fuel efficiency and reducing carbon footprints, making them central to new aircraft design strategies.

The military segment, however, is expected to experience the highest growth rate. Increasing geopolitical tensions, border security concerns, and ongoing modernization of air forces across regions are driving substantial investments in advanced defense aircraft. Many governments are focusing on replacing aging fleets with modern fighter jets and surveillance aircraft built with high-performance materials that enhance durability and mission capability.

Read More : https://www.fortunebusinessinsights.com/aerospace-defense-materials-market-102980

Regional Insights

North America dominated the global aerospace and defense materials market in 2019, accounting for over half of total revenue. The United States remains the largest contributor, supported by a robust aerospace industry and substantial defense spending. Major OEMs and material suppliers in the region continue to lead innovations in composite manufacturing, titanium processing, and additive manufacturing technologies.

Europe follows closely, led by countries such as France, Germany, and the United Kingdom. The region benefits from a well-established aviation industry, strong R&D initiatives, and collaborative defense projects under the European Union framework.

Asia Pacific is expected to emerge as the fastest-growing region during the forecast period. Rising air passenger traffic, expanding domestic aircraft production, and growing investments in military modernization programs are fueling regional demand. Countries such as China, India, Japan, and South Korea are investing heavily in aerospace research, defense infrastructure, and manufacturing capacity.

Challenges and Restraints

Despite promising growth, the market faces several challenges. The high cost of advanced materials such as composites and titanium alloys remains a barrier for smaller manufacturers. The certification process for new materials is also lengthy and expensive, often requiring years of testing before approval. Supply chain disruptions, like those seen during the pandemic, have further exposed vulnerabilities in sourcing and production.

Additionally, recycling and reusability of composite materials pose environmental challenges that industry players are actively working to address. The development of recyclable composites and bio-based materials represents an emerging opportunity for sustainable growth.

Key Industry Developments:

-

April 2020 – Hexcel Corporation, an advanced composites manufacturer headquartered in the US, and Woodward, Inc., a key player providing designing, manufacturing and other services in the aerospace industry headquartered in the US, announced mutual termination of merger agreement, which was previously announced in January 2020. The disruption caused by the COVID-19 outbreak has forced the companies to announce the termination of the agreement.

- August 2019 – Teijin Ltd, a Japan-based manufacturer of advanced materials and chemicals, announced the successful acquisition of Renegade Materials Corporation, a key supplier of highly heat-resistant thermoset prepreg for the aerospace industry in North America. This has strengthened Tenjin’s position in the aerospace business and also increased its manufacturing capabilities.

Future Outlook

The future of the aerospace and defense materials market lies in innovation and sustainability. As the industry transitions toward electric and hybrid aircraft, the demand for materials that can endure new temperature, vibration, and energy storage requirements will increase. Collaborative R&D, digital manufacturing, and material innovation will remain critical to maintaining competitiveness.

By 2027, the market is expected to see widespread adoption of advanced composites, additive manufacturing techniques, and eco-friendly material solutions. With defense spending and commercial aviation on a steady rise, the global aerospace and defense materials market is set to play a pivotal role in shaping the future of flight and security.

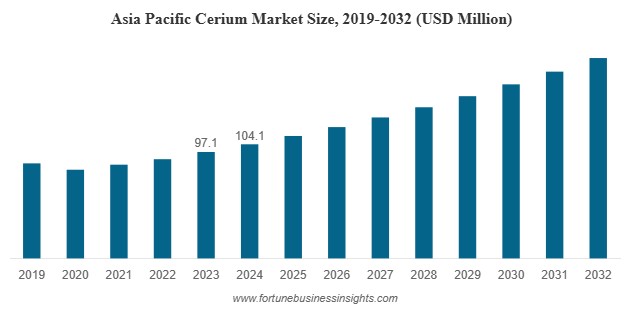

The global cerium market was valued at USD 143.9 million in 2024 and is expected to grow from USD 153.8 million in 2025 to USD 244.9 million by 2032, reflecting a CAGR of 6.9% over the forecast period. In 2024, Asia Pacific led the market, holding a 72.34% share.

This growth is primarily fueled by rising environmental concerns, technological advancements, and the growing need for cleaner and more efficient energy solutions. The widespread application of cerium oxide in catalysts, glass polishing, and fuel cells further boosts market expansion.

List Of Key Cerium Companies Profiled

- The Shepherd Chemical Company (U.S.)

- Avalon Advanced Materials (Canada)

- IREL (India)

- Canada Rare Earth Corporation (Canada)

- Lynas Corporation (Australia)

- MITSUI MINING & SMELTING CO.,LTD. (Japan)

- Vizag chemical (India)

- Star Earth Minerals (India)

- Lobachemie (India)

- Gujarat Mineral Development Corporation Ltd. (India)

- Key Market Drivers

Key Market Drivers

- Growing Demand in Automotive Catalysts

One of the most significant factors driving the cerium market is its use in automotive catalytic converters. Cerium oxide, commonly known as ceria, acts as an oxygen storage component that enhances the performance of catalysts in reducing harmful emissions such as carbon monoxide, nitrogen oxides, and hydrocarbons. As emission standards become stricter worldwide, the adoption of cerium-based catalysts continues to rise, especially in emerging economies where vehicle production is expanding rapidly.

- Expanding Use in Glass and Ceramics

Cerium oxide is widely used for polishing glass surfaces and decolorizing glass in the production of windows, mirrors, optical lenses, and electronic displays. The increasing production of smartphones, tablets, and flat-screen televisions has accelerated the demand for precision glass polishing materials, thereby creating a robust growth opportunity for the cerium market.

- Applications in Clean Energy and Nanotechnology

With the transition toward renewable and sustainable energy sources, cerium is gaining importance in fuel cells, photovoltaic systems, and energy storage applications. Cerium-based materials are being explored for use in solid oxide fuel cells, hydrogen generation, and lithium-ion batteries. In addition, cerium nanoparticles are showing great potential in catalysis, biomedical research, and environmental remediation due to their unique redox properties.

- Growth in Electronics and Phosphor Materials

Cerium compounds are essential in producing phosphors for color displays, LED lighting, and television screens. The growing demand for high-efficiency lighting solutions and advanced display technologies supports the market for cerium-based phosphor materials.

Read More : https://www.fortunebusinessinsights.com/cerium-market-112828

Market Segmentation Insights

By Type

Cerium oxide dominates the market due to its extensive use in catalysts, polishing compounds, and electronics. Other forms of cerium, such as cerium chloride and cerium nitrate, are used in niche applications like specialty coatings and laboratory reagents.

By Application

The glass and ceramics segment holds the largest market share, driven by demand from the electronics and construction industries. The catalyst segment follows closely, supported by emission control mandates. Emerging segments such as energy and nanotechnology applications are expected to grow significantly during the forecast period.

By Region

Asia Pacific remains the leading regional market, accounting for over 70% of global cerium consumption in 2024. China, being a major producer and exporter of rare earth elements, dominates global production and supply. Other key markets such as Japan, South Korea, and India are witnessing increasing usage of cerium in automotive, electronics, and energy sectors. North America and Europe are also expected to register steady growth driven by clean energy initiatives and research investments.

Challenges in the Cerium Market

Despite promising growth prospects, the cerium market faces several challenges. One of the most critical issues is supply chain dependency. A large portion of the world’s rare earth production is concentrated in China, leading to potential supply risks for other regions. Geopolitical tensions, export restrictions, or environmental policies in key producing countries can impact global availability and pricing.

Another concern is environmental sustainability. The mining and processing of rare earth elements, including cerium, involve complex extraction methods that can lead to environmental degradation if not managed responsibly. Increasing regulatory scrutiny and the push for green mining practices are encouraging companies to invest in recycling and cleaner extraction technologies.

Emerging Opportunities

- Recycling and Circular Economy Initiatives

Recycling cerium from used catalytic converters, electronic waste, and industrial residues presents a sustainable solution to reduce supply pressure. The adoption of circular economy models can help stabilize prices and promote resource efficiency.

- Diversification of Supply Sources

Countries such as Australia, India, the United States, and Canada are exploring new mining and refining projects to reduce dependence on Chinese supply. This diversification of supply sources will enhance global market stability and support long-term growth.

- Technological Advancements

Innovations in nanotechnology, catalysis, and material science are expanding the potential uses of cerium-based compounds. For example, cerium oxide nanoparticles are being studied for applications in biomedical imaging, drug delivery, and environmental purification.

- Growing Role in Renewable Energy

As the global transition toward sustainable energy accelerates, cerium’s role in hydrogen production, energy storage, and clean fuels is expected to expand significantly. Its ability to act as a redox catalyst makes it a vital component in next-generation green technologies.

Outlook

The cerium market is poised for steady growth through 2032, driven by its versatile applications in automotive catalysts, glass manufacturing, electronics, and emerging clean energy technologies. With increasing environmental regulations, rising industrialization in Asia Pacific, and growing research in nanotechnology, cerium’s importance in modern industry will continue to rise.

However, to ensure long-term sustainability, stakeholders must focus on responsible sourcing, diversification of supply chains, and recycling initiatives. As global demand for rare earth materials continues to climb, cerium will play a crucial role in supporting the world’s transition toward cleaner, smarter, and more efficient technologies.

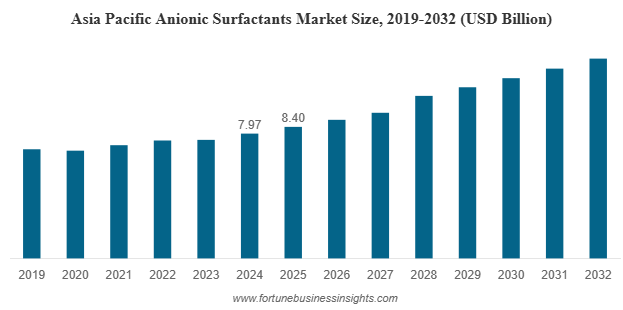

The global anionic surfactants market was valued at USD 21.33 billion in 2024 and is anticipated to rise from USD 22.43 billion in 2025 to USD 32.01 billion by 2032, registering a CAGR of 5.1% during the forecast period. Asia Pacific led the market, accounting for a 37.45% share in 2025.

List Of Key Anionic Surfactant Companies Profiled

- BASF (Germany)

- Nouryon (Netherlands)

- Clariant (Switzerland)

- Dow (S.)

- Croda International Plc (U.K)

- Stepan Company (U.S.)

- Kao Corporation. (Japan)

- Galaxy (India)

- KLK OLEO (Malaysia)

- Pilot Chemical Company (U.S.)

- Esteem Industries (India)

- NOF CORPORATION. (Japan)

Market Overview

The global anionic surfactants market is witnessing significant momentum, driven by increasing consumer awareness about hygiene, expanding demand for personal care and cleaning products, and a growing preference for sustainable and bio-based ingredients. As a crucial component in detergents, soaps, shampoos, and various industrial formulations, anionic surfactants play a vital role in modern lifestyles and industrial processes. The market is expected to continue expanding in the coming years, supported by technological innovations and environmental advancements across industries.

This robust growth trajectory is largely influenced by rising urbanization, changing consumer lifestyles, and the continuous innovation of cleaning and personal care formulations that rely heavily on surfactant technology.

Understanding Anionic Surfactants

Anionic surfactants market are surface-active agents characterized by their negatively charged hydrophilic heads. They help lower surface tension between liquids or between a liquid and a solid, making them highly effective cleansing and foaming agents. Common examples include linear alkylbenzene sulfonates (LAS), alpha olefin sulfonates (AOS), alkyl sulfates (AS), and alkyl ether sulfates (AES). These compounds are extensively used in detergents, shampoos, dishwashing liquids, and industrial cleaners.

Key Growth Drivers

- Rising Demand for Cleaning and Hygiene Products

The surge in awareness about hygiene and sanitation has significantly influenced market demand. Post-pandemic consumer behavior shows a strong inclination toward regular cleaning and disinfection, both in households and public spaces. Detergents, surface cleaners, and hand washes containing anionic surfactants have seen increased consumption across all regions.

- Expanding Personal Care Industry

The booming cosmetics and personal care sector, particularly in Asia Pacific and North America, is another major growth catalyst. Anionic surfactants are essential for producing foaming and emulsifying effects in shampoos, face washes, and body cleansers. Their ability to efficiently remove oil and dirt while creating a rich lather makes them a preferred choice among formulators.

- Industrial and Institutional Applications

Beyond consumer goods, industries such as textiles, agriculture, construction, and oilfield chemicals increasingly use anionic surfactants. They serve as emulsifiers, dispersing agents, and wetting agents in numerous formulations. With industrialization on the rise in developing economies, this segment will continue to support market expansion.

- Innovation Toward Eco-Friendly Alternatives

Growing environmental concerns are encouraging manufacturers to develop biodegradable, renewable, and plant-based surfactants. Companies are investing in research to replace petrochemical-derived surfactants with sustainable alternatives derived from natural oils, fatty acids, and sugars. This shift not only reduces environmental impact but also aligns with consumer demand for “green” and safe products.

Read More : https://www.fortunebusinessinsights.com/anionic-surfactants-market-113516

Market Challenges

Despite their benefits, traditional anionic surfactants face certain limitations. Some synthetic surfactants are known to cause skin irritation and dryness with prolonged exposure. Additionally, non-biodegradable formulations can lead to environmental issues such as aquatic toxicity and soil contamination. Stringent government regulations on chemical usage, especially in developed markets, are compelling manufacturers to enhance product safety and sustainability. Overcoming these challenges through innovation and eco-certification will be crucial for long-term market growth.

Market Segmentation

By Type

The market is segmented into alpha olefin sulfonates (AOS), linear alkylbenzene sulfonates (LAS), lignosulfonates, alkyl ether sulfates (AES), alkyl sulfates (AS), and others. Among these, alpha olefin sulfonates hold a leading share due to their superior biodegradability, excellent foaming properties, and compatibility with diverse formulations.

By Application

Key application areas include household cleaning, personal care, agriculture, textiles, and construction. The household cleaning segment dominates the global market, fueled by the increasing use of detergents, dishwashing products, and multipurpose cleaners. The personal care segment is also witnessing rapid growth, driven by rising demand for premium skin and hair care products.

By Region

The Asia Pacific region remains the largest market for anionic surfactants, accounting for over one-third of global revenue in 2025. High population density, industrial growth, and increased spending on hygiene and personal care in countries such as China, India, and Japan are propelling regional demand. North America and Europe follow closely, with strong emphasis on innovation, eco-friendly formulations, and brand diversification. Meanwhile, emerging economies in Latin America and the Middle East & Africa offer new opportunities for market expansion due to rising consumer awareness and improving economic conditions.

Recent Industry Developments

- Manufacturers are increasing production of alpha olefin sulfonates to meet rising demand from detergent and personal care industries.

- New eco-friendly surfactants derived from natural oils such as coconut and palm are gaining traction in the market.

- Companies are adopting advanced formulation technologies to improve the performance, mildness, and biodegradability of surfactant-based products.

Key Industry Developments

- January 2025: The Planet Chemical Company announced the expansion of its anionic surfactant production capacity at its Middletown, Ohio, manufacturing site. The expansion will help the company to double its alpha olefin sulfonate production and to supply it to the household, industrial and institutional, and personal care markets. The expansion project started in January 2025 and will be completed by 2027.

- June 2023: BASF announced that it has expanded its production capacity for bio-based alkyl polyglucosides in Asia Pacific and North America. The expansion will help the company to strengthen its position and serve customers even faster and more flexibly from the regional supply points.

Future Outlook

Looking ahead, the global anionic surfactants market is poised for continued growth, supported by evolving consumer preferences, sustainability initiatives, and expanding industrial applications. The shift toward biodegradable and bio-based surfactants is expected to reshape the industry landscape. Innovations in formulation science and raw material sourcing will play a pivotal role in balancing performance, safety, and environmental responsibility.

The anionic surfactants market is on a steady growth path, projected to reach USD 32.01 billion by 2032. The demand for hygiene, personal care, and eco-friendly products will remain the primary driving forces. Companies that successfully blend technological innovation with sustainability will gain a competitive edge in this evolving market. As the world moves toward greener chemistry and responsible consumption, anionic surfactants will continue to play an indispensable role in shaping a cleaner and more sustainable future.