Aerospace and Defense Materials Market Size, SWOT Analysis, Trends & Forecast 2032

The aerospace and defense materials industry is one of the most technologically advanced and strategically critical sectors in the world. Behind every aircraft, spacecraft, and defense system lies a foundation of highly engineered materials that provide strength, resilience, and performance. From composites to super alloys, these materials are not just structural components—they are enablers of efficiency, innovation, and security. The aerospace and defense materials market has witnessed consistent growth over the past decade, and its trajectory looks promising as the demand for lighter, stronger, and more durable materials continues to rise.

Market Growth and Forecast

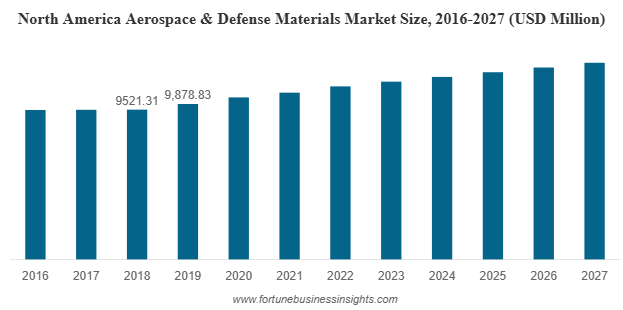

The global aerospace and defense materials market was valued at USD 18,411.83 million in 2019 and is anticipated to reach USD 23,825.45 million by 2027, registering a CAGR of 4.21% over the forecast period. North America led the market in 2019 with a 53.65% share, while the U.S. market alone is expected to generate USD 12,019.42 million by 2027, driven by advancements in lightweight and high-performance materials.

List Of Key Companies Profiled In Aerospace And Defense Materials Market:

- Arconic Inc. (US)

- Toray Composite Materials America, Inc. (US)

- Huntsman (US)

- Evonik Industries (Germany)

- Hexcel Corporation (US)

- Materion Corp. (US)

- AMI Metals Inc. (US)

- TATA Advanced Materials Limited. (India)

- Koninklijke Ten Cate BV (Netherlands)

Key Drivers of Market Growth

- Rising Aircraft Demand

The rapid growth of the global middle class and increasing disposable income have boosted the demand for air travel. Airlines are under pressure to expand their fleets with modern, fuel-efficient aircraft. This surge directly drives the demand for advanced materials such as composites, titanium alloys, and aluminum.

- Focus on Light weighting

Reducing aircraft weight has become a top priority for manufacturers, as lighter planes consume less fuel and emit fewer carbon emissions. Composites and titanium alloys are now widely used in aircraft structures and engines, replacing heavier traditional metals.

- Defense Spending

Geopolitical tensions and modernization programs are fueling growth in the military segment. Countries are investing in advanced fighter jets, drones, and helicopters—all of which require specialized high-performance materials.

- Technological Innovations

New generations of materials, from carbon-fiber composites to heat-resistant super alloys, are pushing the boundaries of aerospace engineering. More than 80% of titanium alloys used in aerospace are dedicated to engines alone, showcasing the importance of high-performance materials in critical components.

Material Segmentation: What’s Leading the Market?

- Composites: Currently the most valuable segment, composites dominate due to their exceptional strength-to-weight ratio. They are expected to grow the fastest in both value and volume, especially as next-generation aircraft integrate higher composite content.

- Aluminum: While newer materials are gaining traction, aluminum remains the most widely used by volume, especially in structural and interior components.

- Titanium Alloys: With superior corrosion resistance and high strength, titanium alloys are the second-fastest growing category, particularly in jet engines and defense applications.

- Super alloys: Accounting for over 16.6% of the market in 2019, super alloys are vital in engine components due to their ability to withstand extreme conditions.

End-User Insights: Commercial vs. Military

- Commercial Aircraft: This segment dominates the aerospace and defense materials market. With global airlines expanding fleets and replacing aging aircraft, commercial aviation accounts for the majority of material demand.

- Military Aircraft: Though smaller in volume, the military segment is growing at a faster pace. Rising defense budgets, territorial disputes, and the development of stealth and unmanned aircraft are driving demand for specialized, durable materials.

Read More : https://www.fortunebusinessinsights.com/aerospace-defense-materials-market-102980

Regional Landscape

- North America: In 2019, North America held more than 53.65% of the global market share. The region benefits from the presence of major aerospace companies such as Boeing, Lockheed Martin, and General Electric, alongside significant defense spending. By 2027, the U.S. aerospace and defense materials market alone is expected to cross USD 12,019.42 million.

- Europe: Europe ranks second, driven by strong aerospace manufacturing in France, Germany, and the U.K. Airbus, Safran, and Rolls-Royce continue to play pivotal roles in boosting demand.

- Asia-Pacific: Expected to be the fastest-growing region, thanks to indigenous aircraft programs in China and India, alongside collaborations with international aerospace players. COMAC’s C919 in China and India’s defense projects are notable drivers.

- Emerging Markets: Latin America, the Middle East, and Africa are also gaining momentum. Brazil, Mexico, Turkey, and Israel are investing in aerospace manufacturing, while the Gulf states are expanding defense capabilities.

Challenges in the Market

While the outlook is promising, the aerospace and defense materials market faces several challenges:

- Stringent Regulations: New materials undergo years of rigorous testing before being approved for aerospace use. This slows the adoption of innovative technologies.

- High Costs: Advanced materials like carbon composites and titanium alloys are significantly more expensive than traditional metals, posing challenges for cost-sensitive airlines and defense programs.

- Supply Chain Disruptions: Events like the COVID-19 pandemic highlighted vulnerabilities in global supply chains, delaying production and project timelines.

Key Industry Developments:

- April 2020 – Hexcel Corporation, an advanced composites manufacturer headquartered in the US, and Woodward, Inc., a key player providing designing, manufacturing and other services in the aerospace industry headquartered in the US, announced mutual termination of merger agreement, which was previously announced in January 2020. The disruption caused by the COVID-19 outbreak has forced the companies to announce the termination of the agreement.

- August 2019 – Teijin Ltd, a Japan-based manufacturer of advanced materials and chemicals, announced the successful acquisition of Renegade Materials Corporation, a key supplier of highly heat-resistant thermoset prepreg for the aerospace industry in North America. This has strengthened Tenjin’s position in the aerospace business and also increased its manufacturing capabilities.

Outlook

The aerospace and defense materials market is set to expand steadily as the aviation sector rebounds, military modernization accelerates, and new technologies enter the mainstream. With light weighting, efficiency, and performance at the core of material innovation, composites, titanium alloys, and super alloys will remain central to industry growth. At the same time, regulatory barriers and high costs may continue to test the pace of adoption.

The aerospace and defense materials market is more than just numbers and forecasts—it is the foundation of innovation in the skies and in defense systems. As manufacturers, suppliers, and governments invest in cutting-edge technologies, the demand for advanced materials will only intensify. By 2027, the market’s steady climb will reflect not just the growth of aviation and defense but also the evolving role of materials as the true backbone of aerospace engineering.