Saudi Arabia Refractories Market Competitive Landscape & Forecast 2029

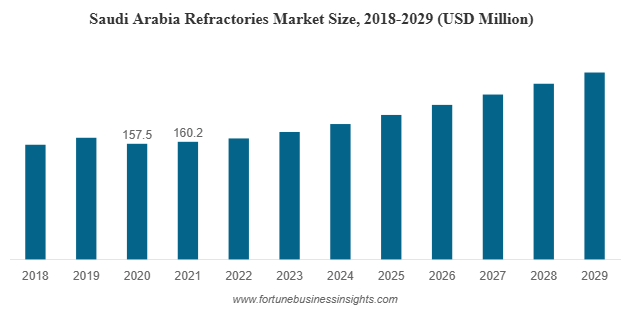

The Saudi Arabia refractories market was valued at USD 160.2 million in 2021 and is expected to grow steadily, reaching USD 254.6 million by 2029. This represents a compound annual growth rate (CAGR) of 6.4% over the forecast period from 2022 to 2029. Like many industries, the market faced significant challenges during the global COVID-19 pandemic, which led to a sharper decline in demand than anticipated. In fact, the market contracted by 4.9% in 2020 compared to 2019, reflecting the broader impact of pandemic-related disruptions across the country.

In recent years, Saudi Arabia refractories market has been rapidly transforming its economy, pushing beyond oil dependency and embracing large-scale industrial development. Amid this wave of progress, one crucial but often overlooked sector is making quiet but steady gains the refractories market.

Saudi Arabia refractories market are materials that can withstand extremely high temperatures, corrosion, and physical wear. They’re essential for lining furnaces, kilns, incinerators, and reactors used in heavy industries like steel, cement, glass, and non-ferrous metals. As these industries grow in Saudi Arabia, so does the demand for reliable refractory solutions.

List Of Key Companies Profiled:

- Saudi Refractory Industries (Dammam)

- AOSCO Refractory (Dammam)

- FSN Company (Dammam)

- Arabian Refractories Factory Company (Dammam)

- Q & E Company Ltd. (Al Jubail)

- Alfran (Amman)

- Thermal Insulation UAE (Sharjah)

Vision 2030: Fueling the Fire

At the heart of Saudi Arabia’s industrial surge is Vision 2030 — the Kingdom’s strategic roadmap for diversifying its economy. This ambitious plan is bringing massive infrastructure projects to life, including NEOM City, the Red Sea Project, and a host of new industrial zones and transportation networks.

All of these projects require raw materials like steel, glass, and cement — industries that heavily rely on high-performance refractories. Every furnace that melts steel or kiln that produces cement must be lined with refractory materials to handle the extreme heat and wear. As industrial output increases, so does the need for these specialized materials.

Steel and Glass: Two Refractory Giants

The steel sector in Saudi Arabia refractories market is already a major consumer of refractories. With more than 40 steel producers operating within the Kingdom and production capacity exceeding 18 million tons annually, it’s no surprise that this segment dominates refractory demand.

Glass manufacturing is another rising star. As urban development expands, the need for construction glass, automotive glass, and solar panel components is growing. Refractories are vital in glass furnaces that operate continuously at high temperatures — making them indispensable to the entire production process.

Refractory Types: Shaped vs. Unshaped, Clay vs. Non-Clay

The market can be divided based on the form and material of refractories.

By form:

- Bricks & shaped refractories are leading the market. These traditional, pre-formed blocks are used for lining fixed structures like furnaces and kilns.

- Monolithic & unshaped refractories are gaining popularity in applications requiring on-site installation and complex shapes, such as in oil refineries or custom furnace designs.

By material:

- Clay-based refractories are currently more common. They’re cost-effective, easy to source, and suitable for many standard applications.

- Non-clay refractories, which include high-alumina, magnesia, and silicon carbide materials, offer superior performance in terms of heat resistance and chemical durability. These are becoming more sought-after in high-tech or highly corrosive environments.

Read More : https://www.fortunebusinessinsights.com/saudi-arabia-refractories-market-106924

Opportunities to Watch

While challenges exist, the opportunities in this sector are substantial:

- Localization of raw materials: If Saudi Arabia can explore and utilize local sources of refractory raw materials like bauxite, alumina, or fire clay, it could significantly reduce import reliance and create new jobs.

- Technological innovation: Companies investing in automated production, waste recycling, or eco-friendly formulations are likely to gain a competitive edge, especially as green certifications become more important.

- Specialized applications: As industries like aerospace, energy, and advanced manufacturing grow in the region, there will be a need for niche refractory solutions with extreme heat and corrosion resistance.

- Government support: Incentives for domestic manufacturing and technology upgrades could stimulate more growth, particularly for small and mid-sized companies.

Challenges on the Horizon

Despite its strong growth potential, the refractories market in Saudi Arabia faces several challenges:

- Import dependency

Much of the refractory raw materials and even finished products are still imported. This creates vulnerabilities in the supply chain, especially in times of global disruption. Local manufacturers are pushing to reduce this dependency, but developing a robust domestic supply chain will take time and investment. - Environmental regulations

Refractory production and usage can contribute to environmental issues such as CO₂ emissions and waste generation. As Saudi Arabia strengthens its environmental regulations, manufacturers must adapt with cleaner technologies, emissions controls, and more sustainable practices — all of which can increase costs. - High operating costs

Producing refractories — especially high-performance types — requires significant energy and specialized equipment. This can be a barrier for new entrants and a profitability concern for smaller players in the market.

Outlook

The Saudi Arabia refractories market in Saudi Arabia is entering a phase of exciting growth, closely tied to the country’s broader industrial and infrastructure development goals. With strong demand from steel, glass, cement, and other sectors — and backing from Vision 2030 — the market is well-positioned for expansion.

Still, to unlock its full potential, the industry must navigate challenges related to imports, sustainability, and cost-efficiency. Those who invest early in innovation, local sourcing, and regulatory compliance will likely emerge as the long-term winners in this high-heat, high-stakes industry.