Industrial Fasteners Market Growth Drivers, Size & Forecast 2032

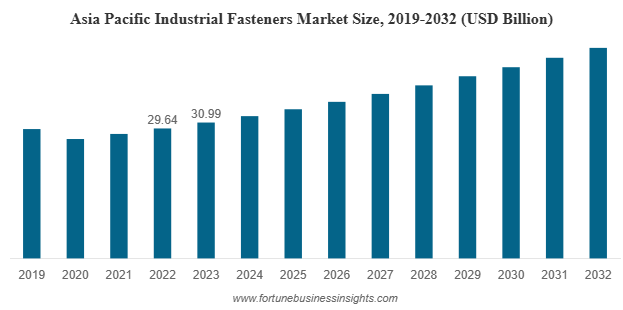

The global industrial fasteners market was valued at USD 85.83 billion in 2023 and is expected to grow to USD 89.34 billion in 2024, reaching approximately USD 125.87 billion by 2032. This growth represents a compound annual growth rate (CAGR) of 4.3% over the forecast period. In 2023, Asia Pacific led the market, accounting for 36.11% of the global share. Meanwhile, the U.S. industrial fasteners market is projected to see significant expansion, with its value expected to reach around USD 21.13 billion by 2032, largely driven by the increasing production of electric vehicles in the country.

The global industrial fasteners market is undergoing a period of steady growth, driven by rising demand from key sectors such as automotive, aerospace, construction, and industrial machinery. As industries evolve to meet sustainability targets, technological advancements, and increasing infrastructure needs, the role of fasteners—essential components used to hold two or more objects together—has become more critical than ever.

List Of Key Companies Profiled:

- Howmet Aerospace Inc. (U.S.)

- ATF Inc. (U.S.)

- Nifco Inc. (Japan)

- MW Industries, Inc. (MWI) (U.S.)

- LISI Group - Link Solutions for Industry (France)

- Sesco Industries, Inc. (U.S.)

- Birmingham Fastener and Supply Inc. (U.S.)

- BPF (India)

- Elgin Fastener Group (U.S.)

- Eastwood Manufacturing (U.S.)

Market Overview and Size Projections

From complex aerospace systems to consumer electronics, fasteners play an indispensable role in ensuring mechanical reliability, safety, and durability. Recent market research highlights strong growth potential through the end of this decade, with key regions and materials emerging as leaders in innovation and revenue generation.

While this is a moderate growth trajectory, it is sustained by long-term industry trends such as electrification, infrastructure expansion, lightweight material innovations, and global trade recovery.

Key Market Segments

The industrial fasteners market is segmented primarily by material, product type, and application.

- By Material

Metal fasteners continue to dominate the market owing to their superior strength, load-bearing capacity, and reliability. Steel, stainless steel, aluminum, and brass are among the most commonly used metals. However, the demand for plastic fasteners is rising steadily, particularly in industries where weight reduction, corrosion resistance, and insulation are critical—such as electronics, automotive interiors, and lightweight machinery.

Plastic fasteners are also gaining traction as industries move toward sustainability and recyclable materials. Despite being less durable than metal counterparts, their ease of installation and lower cost make them attractive in specific applications.

- By Product Type

Externally threaded fasteners (like bolts and screws) hold the largest market share due to their extensive use in automotive and construction. Internally threaded fasteners, non-threaded fasteners (such as rivets and pins), and specialty fasteners designed for aerospace and electronics industries also contribute significantly to the market.

The push for fasteners that meet both performance and environmental requirements is leading to innovations in design, coating, and material science.

- By Application

The automotive industry is the largest end-user of industrial fasteners and is expected to maintain its lead during the forecast period. Automotive manufacturers increasingly demand lightweight, durable, and cost-efficient fasteners that align with fuel efficiency and emissions standards. As electric vehicles (EVs) gain global momentum, this sector will see even more demand for advanced fastening solutions that can handle high-voltage systems, battery modules, and compact mechanical assemblies.

Other major application sectors include building and construction, aerospace and defense, machinery manufacturing, electronics, and marine. In the construction sector, the rise in commercial real estate, infrastructure modernization, and residential development—especially in developing economies—are pushing up demand for high-strength fasteners.

Read More : https://www.fortunebusinessinsights.com/industrial-fasteners-market-102732

Market Drivers

Several factors are driving sustained demand in the global industrial fasteners market:

- Infrastructure Development: With massive infrastructure projects underway in emerging economies, demand for heavy-duty fasteners used in bridges, buildings, and transportation networks is rising.

- Automotive Electrification: The global shift toward EVs necessitates a rethinking of fastening systems, prompting growth in demand for lightweight and high-strength materials.

- Aerospace Industry Expansion: High-performance fasteners are crucial in aircraft manufacturing. With increased air travel and defense investments, this segment is expected to grow rapidly.

- Technological Advancements: Smart fasteners with sensors and integrated features are being developed to enhance efficiency, particularly in complex industrial machinery and robotics.

Regional Market Insights

- The Asia-Pacific region led the global industrial fasteners market in 2023, accounting for over one-third of the total market share. Countries like China, India, Japan, and South Korea are key contributors, thanks to their robust manufacturing capabilities, infrastructure investments, and rapidly expanding automotive sectors.

- China, in particular, is a manufacturing powerhouse for fasteners, supplying both domestic and international markets. India's "Make in India" initiative is also stimulating local production and attracting foreign investment in manufacturing and infrastructure, thereby boosting fastener consumption.

- North America, especially the United States, is seeing growth due to rising electric vehicle production and demand for lightweight, high-performance components. Europe remains a mature yet innovative market, with countries like Germany and France investing in aerospace and precision manufacturing.

Challenges and Restraints

Despite the positive outlook, the market faces several challenges. One of the primary restraints is the emergence of alternative joining technologies, such as adhesives, welding, and clinching, which can replace traditional fasteners in certain applications. These methods offer weight savings and aesthetic advantages, particularly in automotive design.

Additionally, raw material price fluctuations, stringent regulatory standards, and rising labor and manufacturing costs can create hurdles, especially for small and medium-sized fastener manufacturers.

Key Industry Developments:

- June 2022- Belenus acquired the Tellep Brand, a renowned fastener brand owned by Metalac SPS Ind. e Com. Ltda. (Sorocaba, SP), a Precision Castparts Corp member group. The brand is a line of screw hexagon sockets with several head kinds (cylindrical, flat, bulging, and others) and items made for application in fastening systems with high resistance demand.

- April 2022- Birmingham Fastener announced the acquisition of Champion Sales and Manufacturing, Inc. This acquisition strengthens Birmingham Fastener’s waterworks product offering and manufacturing diversity.

Competitive Landscape

The industrial fasteners market is moderately fragmented, with key players competing on quality, innovation, and supply chain efficiency. Leading companies include manufacturers specializing in aerospace-grade fasteners, automotive OEM fasteners, and custom-engineered fastening systems.

Strategic collaborations, mergers and acquisitions, and expansion into emerging markets are commonly employed to strengthen market position. Companies are also investing in R&D to develop corrosion-resistant, tamper-proof, and environmentally sustainable products.

Outlook

The industrial fasteners market is poised for steady growth over the next decade, driven by global industrialization, urban infrastructure development, and the ongoing transformation of the automotive and aerospace industries. To capitalize on this momentum, manufacturers must innovate in materials, enhance production efficiency, and adapt to shifting customer needs across industries and geographies.

Businesses that prioritize sustainability, compliance, and technology integration in their fastening solutions will be well-positioned to lead in this evolving market.