Category: Chemicals & Advanced Materials

Aluminum foil packaging is widely used across multiple industries such as food and beverage, pharmaceuticals, cosmetics, and industrial applications due to its excellent barrier properties, lightweight nature, and recyclability. It provides effective protection against moisture, light, gases, and contaminants, thereby helping to extend the shelf life and quality of packaged products. The market has seen significant growth in recent years, fueled by increasing demand for convenient, sustainable, and efficient packaging solutions.

Market Size and Growth Projection

The global aluminum foil packaging market was valued at USD 13.86 billion in 2023 and is projected to rise from USD 14.54 billion in 2024 to USD 22.24 billion by 2032, registering a CAGR of 5.45%. The U.S. market is expected to reach USD 2.85 billion by 2032, driven by rising demand for flexible, lightweight, and sustainable packaging in food, pharmaceuticals, and consumer goods. Asia Pacific led the market in 2023 with a 49.28% share.

Market Drivers

- Growing Demand for Processed and Convenience Foods : Urban lifestyles and changing dietary habits have fueled demand for packaged food products, increasing the need for high-quality and safe packaging solutions.

- Sustainability and Recycling Focus : Aluminum is infinitely recyclable, making it a sustainable option compared to plastic. Recycling initiatives and government policies are boosting its adoption.

- Pharmaceutical Sector Expansion : Rising healthcare awareness, an aging population, and increasing drug consumption globally support the demand for protective blister and strip packaging.

- Advances in Foil Technology : Innovations in thinner foils, laminated structures, and smart packaging designs are enhancing functionality while reducing environmental impact.

List of Top Aluminum Foil Packaging Companies:

- Amcor plc (U.S.)

- Constantia Flexibles (Austria)

- Qingdao Kingchuan Packaging (China)

- Henan Tendeli Metallurgical Materials Co., Ltd (China)

- Henan Huawei Aluminium Co., Ltd (China)

- Hindalco Industries Ltd. (India)

- Novelis (U.S.)

- Zhejiang Zhongjin Aluminum Industry Co., Ltd. (China)

- KM Packaging (U.K.)

- ProAmpac (U.S.)

- RusAL (Russia)

- Pactiv Evergreen Inc. (U.S.)

Market Segmentation

- By Product Type

- Foil Wraps : Extensively used in households and foodservice to preserve freshness and protect food from contamination.

- Blister Packs and Pouches : Popular in the pharmaceutical sector for packaging tablets and capsules due to their protective qualities.

- Containers and Trays : Widely used in ready-to-eat meals, frozen foods, and institutional catering due to their convenience and heat resistance.

- By Application

- Food and Beverage : The largest application segment, driven by growing demand for shelf-stable, ready-to-eat, and take-out food products.

- Pharmaceuticals : Increasing demand for safe, tamper-proof, and long-lasting packaging solutions has led to higher adoption of foil in blister packs and cold-chain applications.

- Cosmetics and Personal Care : Used for product safety and to create premium packaging designs.

- Industrial and Others : Includes use in insulation, electronics, and specialty applications requiring high-barrier properties.

- By Distribution Channel

- Direct sales

- Retail stores

- Online platforms

- Distributors and wholesalers

Read More : https://www.fortunebusinessinsights.com/aluminum-foil-packaging-market-108056

Regional Insights

- Asia Pacific

Asia Pacific accounted for the largest share of the global market in 2023, with a dominant 49.28% share. This region continues to lead due to high population density, rapid industrialization, and the growing consumption of packaged food and pharmaceutical products. Countries such as China and India are key contributors to regional growth, driven by expanding food processing industries and rising demand for hygienic packaging.

- North America and Europe

North America, especially the U.S., is projected to show significant growth, with the U.S. aluminum foil packaging market expected to reach around USD 2.85 billion by 2032. This growth is attributed to strong demand from the foodservice, pharmaceutical, and e-commerce sectors. In Europe, stringent environmental regulations and an emphasis on sustainable materials continue to push adoption of recyclable packaging formats like aluminum foil.

Challenges in the Market

- Raw Material Price Fluctuations : The price of aluminum is subject to global trade dynamics, which can impact overall production costs.

- Recycling Infrastructure Limitations : Although aluminum is recyclable, the lack of adequate recycling facilities, especially in developing regions, hampers efficient waste management.

- Substitution by Alternative Materials : In certain applications, biodegradable plastics and paper-based alternatives pose competition to foil packaging, especially in countries emphasizing compostable packaging.

Key Industry Developments:

- April 2024 - Shyam Metalics & Energy offered its latest innovation, SEL Tiger Foil. This innovation presents an opportunity for household food safety, crafted with incredible care and a profound commitment to excellence. From 9-meter rolls for occasional usage to generous 72-meter rolls for everyday culinary pursuits, SEL Tiger Foil offers an array of options, ensuring an ideal fit for every need.

- March 2024 - Capri Sun launched recyclable pouches made from aluminum, PE, and PET, which it claims has a lower carbon footprint than any other common beverage packaging. According to the company its current pouch, which weighs only a fifth of any comparable PET bottle and would reduce CO2 emissions by a further 25%.

Opportunities Ahead

The market offers promising growth potential in high-barrier pharmaceutical applications, lightweight flexible packaging, and the development of sustainable laminates. Increasing investment in recycling technology and innovation in mono-material structures are likely to further accelerate demand. As brand owners seek solutions to meet regulatory and environmental goals, aluminum foil packaging is expected to play a pivotal role in the shift toward circular economy packaging systems.

Future Outlook

The aluminum foil packaging market is set to grow steadily through 2032, backed by increased adoption in the food and pharmaceutical sectors. The trend toward lightweight, protective, and eco-friendly packaging continues to shape industry dynamics. Manufacturers investing in R&D and sustainable production processes are well-positioned to benefit from emerging opportunities in both developed and developing markets.

The global plastic packaging market was valued at USD 431.28 billion in 2023 and is expected to grow from USD 454.89 billion in 2024 to USD 733.60 billion by 2032, registering a CAGR of 6.16%. The U.S. market is projected to reach USD 115.05 billion by 2032, driven by demand for lightweight and sustainable solutions in food, healthcare, and e-commerce. Asia Pacific led the market in 2023 with a 51.16% share.

Plastic packaging has become a preferred solution for both manufacturers and consumers due to its durability, cost-efficiency, and versatility. The increase in online shopping, changing consumer lifestyles, and growing demand for ready-to-eat products are some of the major factors contributing to the market’s expansion.

Key Market Drivers

One of the primary drivers of the plastic packaging market is the booming food and beverage industry. As the demand for packaged and processed food grows, so does the need for effective packaging solutions that preserve freshness, ensure hygiene, and offer convenience. Plastic packaging fits these requirements perfectly, offering lightweight, protective, and customizable solutions.

Additionally, the rise in pharmaceutical and healthcare products, particularly in the post-pandemic world, has increased the need for secure, tamper-evident packaging. This sector heavily relies on plastic packaging for items such as blister packs, bottles, and IV bags.

Moreover, the growth of e-commerce and home delivery services has boosted the demand for plastic packaging materials used for wrapping, cushioning, and shipping consumer products. The increased consumption of daily goods through online channels requires strong and flexible packaging to ensure product integrity during transit.

List of Top Plastic Packaging Companies:

- Amcor plc (Switzerland)

- Berry Global (U.S.)

- Nampak (South Africa)

- Silgan Holdings (U.S.)

- Sonoco Products Company (U.S.)

- Sealed Air (U.S.)

- Huhtamaki (Finland)

- UFlex Limited (India)

- ALPLA Group (Austria)

- Constantia Flexibles (Austria)

- Greif (U.S.)

- Graphic Packaging (U.S.)

Segmentation Overview

- By Product Type

The plastic packaging market is segmented into rigid and flexible packaging. Rigid packaging includes bottles, containers, and caps, commonly used in beverages, pharmaceuticals, and household care products. It offers better protection and a longer shelf life. On the other hand, flexible packaging includes pouches, bags, and wraps, which are lightweight, cost-effective, and more space-saving. Flexible packaging is gaining traction, especially in the food, cosmetics, and logistics sectors.

- By Material

Common materials used in plastic packaging include polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), polystyrene (PS), and polyvinyl chloride (PVC). Among these, PE holds a major share due to its high flexibility and affordability. The use of bioplastics is also on the rise, propelled by environmental concerns and regulatory support.

- By Application

Plastic packaging finds its application in a wide range of industries such as food and beverages, pharmaceuticals, personal care, industrial goods, and others. The food and beverage segment dominates the market, accounting for the largest share, owing to the increasing demand for on-the-go food products, frozen meals, snacks, and beverages. The healthcare and cosmetics industries also show strong growth potential due to rising consumption and product innovations.

Read More : https://www.fortunebusinessinsights.com/dairy-packaging-market-108071

Regional Insights

- Asia Pacific emerged as the leading region in the plastic packaging market in 2023, accounting for the largest market share. This dominance is attributed to the rapid industrialization, urbanization, and population growth in countries such as China, India, and Southeast Asian nations. Moreover, the expansion of the retail sector and increasing demand for packaged food contribute to market growth in this region.

- North America follows as another significant contributor to the plastic packaging market, supported by strong demand in healthcare, e-commerce, and personal care industries. The presence of well-established manufacturing infrastructure and advanced packaging technologies also supports regional growth.

- Europe is anticipated to grow steadily, driven by stringent regulations focused on sustainability and recycling. The region is making significant progress in adopting eco-friendly and recyclable packaging solutions, further propelling the market for bioplastics and innovative packaging formats.

- Other regions, including Latin America and the Middle East & Africa, are witnessing moderate growth due to improved economic conditions, growing consumer awareness, and the increasing presence of multinational packaging firms.

Key Industry Developments:

- May 2024 - ALPLA launched a recyclable wine bottle manufactured from PET to reduce carbon emissions by 50%. The bottle weighs around an eighth of a glass bottle and is 30% less costly than the other bottles.

- April 2024 - Berry Global announced the innovation of new lightweight closures for the protein powder market, including 120-Special Next Gen Deep Skirt Screw On Closure Ribbed (120 Deep Skirt) and 110/400 Wide-mouth Screw On Closure Ribbed (Lightweight 110/400). The closure contains PCR content, made of extensively recyclable polypropylene, and is food-contact safe.

Trends and Opportunities

- One of the major trends shaping the future of plastic packaging is the shift towards sustainability. With increasing global focus on reducing plastic waste, companies are investing in recyclable, biodegradable, and reusable packaging materials. This trend is further supported by government regulations and initiatives encouraging circular economy practices.

- Technological advancements in smart packaging, including the use of sensors, QR codes, and temperature indicators, are gaining traction, especially in food and pharmaceutical applications. These innovations enhance product safety, traceability, and customer engagement.

- Additionally, manufacturers are exploring the use of lightweight materials and advanced designs to reduce raw material consumption and lower carbon footprints. Customization and personalization of packaging for branding purposes are also becoming more prevalent.

Future Outlook

The plastic packaging market is poised for continued growth over the coming years. While sustainability challenges persist, the ongoing innovations in materials, processing techniques, and recycling infrastructure offer new growth avenues. Companies that embrace sustainable practices, leverage digital tools, and respond to changing consumer expectations will likely lead the way.

As industries and consumers alike become more environmentally conscious, the push for eco-friendly plastic packaging solutions will reshape the market dynamics. However, plastic packaging will remain indispensable in various sectors due to its cost-efficiency, adaptability, and performance benefits.

Solid waste management market is a critical environmental and economic issue worldwide, involving the systematic control of generation, storage, collection, transport, processing, and disposal of solid waste. As urbanization accelerates and global populations rise, the amount of waste generated continues to increase rapidly. This growing volume has led to increased demand for efficient and sustainable waste management systems, making the sector a major focus of government policies and private sector investment.

Market Size & Growth Outlook

The Global solid waste management market was valued at USD 285.16 billion in 2019 and is expected to reach USD 366.52 billion by 2027, growing at a CAGR of 3.3% during the forecast period. In 2019, Europe led the market with a 31.57% share. Additionally, the U.S. solid waste management market is anticipated to witness substantial growth, projected to reach USD 93.46 billion by 2032, supported by its advanced collection, processing, and disposal systems, along with the strong presence of major industry players such as Waste Management Inc., Covanta Holdings Corporation, and Clean Harbors Inc.

List Of Key Players Profiled:

- Waste Management Inc. (USA)

- SUEZ Group (France)

- Veolia Environment S.A. (France)

- Biffa PLC (U.K.)

- Clean Harbors Inc. (USA)

- Covanta Holdings Corporation (USA)

- Hitachi Zosen Corporation (Japan)

- Remondis AG & Co. Kg (Germany)

- Republic Services Inc. (USA)

- Stericycle Inc. (USA)

Key Drivers of Market Expansion

Several core factors are propelling the expansion of the solid waste management market:

- Urban Population Growth : Rapid urbanization, especially in emerging economies, has resulted in higher waste generation per capita, prompting the need for more advanced waste management systems.

- Government Regulations and Environmental Policies : Strict laws surrounding landfill use, waste segregation, and emissions control are encouraging the adoption of more sustainable disposal and treatment solutions.

- Circular Economy Initiatives : There is a growing emphasis on reducing, reusing, and recycling waste as part of global efforts to transition toward a circular economy. This has created a demand for new recycling technologies and material recovery facilities.

- Technological Advancements : Innovations in sorting, waste-to-energy (WTE), anaerobic digestion, and digital monitoring systems are improving efficiency and cutting operational costs.

- Public Awareness : Increased awareness about environmental degradation and climate change has encouraged communities to adopt better waste disposal practices, boosting demand for advanced solid waste solutions.

Read More : https://www.fortunebusinessinsights.com/solid-waste-management-market-103045

Market Segmentation

- By Waste Type

- Municipal Solid Waste (MSW) : Includes household waste, commercial refuse, and other non-industrial sources. It forms a large portion of the market and is expected to grow steadily.

- Industrial Waste : Waste generated by manufacturing and production industries; often more hazardous and requires specialized treatment.

- Electronic Waste (E-Waste) : A rapidly growing category due to the global expansion of consumer electronics.

- Medical and Hazardous Waste : Requires specific handling and disposal methods to prevent contamination and health risks.

- By Treatment Method

- Landfilling : Still widely used, though its share is declining due to environmental concerns.

- Incineration : Offers volume reduction and energy recovery, though emissions remain a concern.

- Recycling : A growing segment, supported by government incentives and circular economy policies.

- Composting and Biological Treatment : Particularly relevant for organic and food waste.

- Waste-to-Energy (WTE) : Converts non-recyclable waste into usable energy, reducing landfill dependency.

- By End-Use Industry

- Residential : Households are a primary waste source; collection and segregation at source are key areas of focus.

- Commercial : Includes offices, retail, and hospitality sectors; waste is mostly non-hazardous and recyclable.

- Industrial : Generates large quantities of complex waste requiring advanced processing.

- Healthcare : Medical institutions generate biohazardous waste needing specialized treatment.

Regional Insights

- Asia Pacific dominates the global solid waste management market, largely due to its population density, urban expansion, and increasing waste generation. Countries such as China and India are implementing large-scale initiatives to improve waste handling and recycling.

- North America has established infrastructure and strong regulatory frameworks, making it a mature market. Adoption of smart waste technologies is high in this region.

- Europe leads in sustainable practices and innovation in waste diversion from landfills. The European Union's waste directives have helped set high recycling and recovery targets.

- Latin America , Africa , and the Middle East are emerging markets. These regions face challenges such as lack of infrastructure and low public awareness but are seeing gradual improvements through public-private partnerships.

Key Industry Developments:

- July 2019 – The consortium BCE led by SUEZ Group signed a 25 years contract with municipal company Beogradske Elektrane to sell heat produced from waste-to-energy in Belgrade, Serbia. By signing this contact, the municipal company is aiming to introduce renewable energy by reducing its energy dependency on natural gas. The plant operation will be handled by SUEZ Group and the plant will process 500 Kilo Tons of Municipal waste and 200 Kilo Tons of construction & demolition waste per year.

- December 2019 – Covanta Holdings Corporation agreed with Zhao County, China to build & operate a new Energy-from-waste facility. The project will offer sustainable waste management solutions to the county. With this agreement, the company is aiming to expand its geographical footprints into Chinese market.

Opportunities and Trends

- Smart Waste Management : IoT-enabled bins, route optimization software, and automated sorting systems are revolutionizing waste collection and processing.

- Increased Recycling Rates : Governments and businesses are investing in facilities to improve recycling efficiency and output.

- Waste-to-Energy Integration : Growing interest in converting waste into renewable energy sources.

- Plastic Waste Reduction : Rising bans on single-use plastics are creating demand for sustainable packaging alternatives and better sorting technologies.

Challenges

- High Costs : Infrastructure setup and operation are capital-intensive, particularly in developing regions.

- Lack of Segregation : Mixed waste streams reduce the efficiency of recycling processes.

- Regulatory Compliance : Meeting various national and international waste management standards can be complex.

- Environmental Impact : Improper waste disposal leads to air, water, and soil pollution.

Future Outlook

Solid waste management market plays a vital role in public health, environmental protection, and sustainable development. As global waste generation increases, the need for innovative, efficient, and eco-friendly waste management solutions continues to rise. The market is expected to remain on an upward trajectory, driven by regulatory support, technological progress, and increased public engagement.

Aluminum Composite Panels (ACPs) have become a key component in the modern construction and architectural sectors. These panels are made of two aluminum sheets bonded to a non-aluminum core, offering outstanding strength, durability, and versatility. Their high aesthetic appeal, weather resistance, and ease of installation have driven demand across a wide range of applications, including external facades, signage, cladding, roofing, and interior decoration.

Market Size and Growth Forecast

The global aluminum composite panels market was valued at USD 5.33 billion in 2018 and is expected to reach USD 8.71 billion by 2026, registering a CAGR of 6.1% during the forecast period. Asia Pacific led the market in 2018 with a dominant share of 39.23%. In the U.S., the aluminum composite panels market is projected to witness significant growth, reaching approximately USD 2.41 billion by 2032, supported by favorable policies and initiatives in North America aimed at enhancing infrastructure.

List Of Key Companies Profiled In Aluminum Composite Panels Market:

- 3A Composites GmbH

- Arconic

- Mitsubishi Chemical Corporation

- Hyundai Alcomax Co.,Ltd.

- Fairfield Metal LLC

- Jyi Shyang Industrial Co., Ltd.

- ALUMAX INDUSTRIAL CO., LTD.

- Yatai Industrial Group Co., Ltd.

- Shanghai Huayuan New Composite Materials Co., Ltd.

- Guangzhou Xinghe Aluminum Composite Panel Co., Ltd.

Key Drivers of Growth

Several factors are driving the expansion of the ACP market:

- Urbanization and Infrastructure Development: Rapid urbanization in Asia-Pacific and other developing regions is increasing the demand for efficient and aesthetic construction materials. Governments around the world are investing heavily in infrastructure development, further fueling demand for ACPs.

- Energy Efficiency and Sustainability: ACPs are increasingly being used in green buildings due to their insulation properties, recyclability, and compatibility with energy-efficient construction practices. These panels contribute to thermal insulation, which helps in energy savings and meeting modern building codes.

- Rising Demand in the Automotive and Transportation Sectors: ACPs are also finding use in vehicle manufacturing for lightweight body panels. The demand is especially rising in commercial vehicles, buses, and trains due to the need for fuel-efficient and durable materials.

- Technological Advancements: Innovations in coatings and surface finishes have improved the fire resistance, UV protection, and anti-bacterial properties of ACPs, making them suitable for high-rise buildings, hospitals, and commercial complexes.

Market Segmentation

- By Type

The market is segmented based on product types such as fire-resistant panels, antibacterial panels, and anti-static panels. Among these, fire-resistant panels are gaining high traction due to increasing emphasis on building safety regulations.

- By Coating Base

Polyvinylidene fluoride (PVDF) coated panels continue to dominate the market due to their excellent weather and corrosion resistance. Polyester-coated panels are also widely used, particularly in low-rise structures and signage applications.

- By Application

The building and construction segment remains the largest application area for ACPs. Their use in facades, curtain walls, and partitions is widespread due to durability and design flexibility. Other application areas include advertising boards, corporate identity signage, and interior design in commercial spaces.

Read More : https://www.fortunebusinessinsights.com/aluminum-composite-panels-market-102304

Regional Insights

- Asia Pacific

Asia Pacific accounted for the largest market share in 2024, representing over 41% of the global revenue. The region is expected to continue dominating the market during the forecast period, driven by rapid infrastructure development in countries like China, India, and Southeast Asian nations. Increasing urban population and supportive government policies are propelling construction and industrial growth, further boosting ACP demand.

- North America

North America holds the second-largest market share. The rising adoption of energy-efficient and fire-retardant construction materials is contributing to regional growth. Moreover, the demand for visually appealing and long-lasting cladding solutions is increasing among commercial and institutional buildings.

- Europe

Europe is witnessing growing demand for ACPs due to the renovation of old buildings and stringent regulations regarding energy conservation. The region is also focusing on sustainable construction practices, which aligns well with the recyclability and eco-friendliness of aluminum composite panels.

Key Industry Developments:

- July 2017 – Fairview Architectural acquired the Stryum business, an intelligent non-combustible aluminum cladding system, from Vitekk Industries. The company includes a variety of high-quality aluminum plate façade panels designed to provide durability and sustainability, complimenting Fairview's current portfolio of cladding solutions, including high-density cement fibre, natural stone, terracotta tiles and the leading non-combustible composite aluminum frame.

Opportunities and Challenges

Opportunities in the market include expansion across emerging economies driven by rising urbanization, increased adoption of fire-retardant and eco-friendly aluminum composite panels (ACPs), and growing demand in interior decoration and signage applications. However, the market faces challenges such as volatility in raw material prices—especially aluminum—regulatory restrictions in certain countries concerning non-fire-rated panels, and competition from substitutes like glass fiber panels and high-pressure laminates.

Future Outlook

The global aluminum composite panels market is expected to witness robust growth through 2032. Advancements in technology and manufacturing processes, along with rising demand for aesthetic and sustainable building materials, are likely to play a crucial role in shaping the future of this industry. As cities grow and architectural styles evolve, ACPs are well-positioned to become a standard component of modern infrastructure.

The global protective clothing market is experiencing significant growth due to rising awareness about worker safety, stringent occupational safety regulations, and ongoing technological advancements in textiles. Protective clothing is essential in various industries to shield workers from physical, chemical, biological, thermal, and electrical hazards. These garments play a crucial role in ensuring safety in sectors such as construction, manufacturing, oil & gas, healthcare, firefighting, mining, and pharmaceuticals.

Market Size and Growth Forecast

The global protective clothing market was valued at USD 12.48 billion in 2019 and is expected to grow to USD 34.31 billion by 2027, registering a CAGR of 14% during the forecast period. North America led the market in 2019 with a 37.4% share, after reaching USD 4.34 billion in 2018. The U.S. market is projected to hit USD 10.45 billion by 2027, driven by stringent workplace safety regulations and rising demand in the healthcare sector.

List of Top Protective Clothing Companies:

- Honeywell International Inc. (U.S.)

- Lakeland Inc. (U.S.)

- L. Gore & Associates, Inc. (U.S.)

- PBI Performance Products, Inc. (U.S.)

- TenCate Protective Fabrics (U.S.)

- Kimberly-Clark Corporation (U.S.)

- Ansell Microgard Ltd. (U.K.)

- DuPont (U.S.)

- Bennett Safetywear Ltd. (U.K.)

- TEIJIN LIMITED (Japan)

- Udyogi (India)

Key Market Drivers

One of the primary factors propelling the market is the increasing enforcement of workplace safety regulations by governmental bodies. Industries such as oil & gas, chemical processing, construction, and healthcare are increasingly mandated to provide workers with appropriate personal protective equipment (PPE), including protective clothing. Additionally, rapid urbanization and infrastructure development in emerging economies are supporting the expansion of industries that require safety wear.

The healthcare sector, in particular, has become a major consumer of protective apparel. The COVID-19 pandemic reinforced the importance of biological protection in hospitals, laboratories, and diagnostic centers. The demand for disposable and reusable protective garments surged, and many governments increased their investments in healthcare safety infrastructure.

Technological Advancements and Innovation

Innovation plays a vital role in shaping the protective clothing market. Modern garments are now designed with smart textiles that offer enhanced breathability, thermal resistance, and chemical protection. The integration of features like flame retardance, water repellency, and antimicrobial coatings is becoming standard in high-risk work environments.

Some clothing options now feature embedded sensors to monitor body temperature, exposure to harmful substances, and worker fatigue in real-time. These advancements are finding applications in sectors such as aerospace, mining, and defense, where real-time safety monitoring is critical.

Read More : https://www.fortunebusinessinsights.com/protective-clothing-market-102707

Market Segmentation

- Protective clothing can be categorized based on material, application, end-use industry, and distribution channel. Materials used include aramid and blends, polyolefin and blends, polybenzimidazole (PBI), cotton fibers, and laminated polyester, among others. Each type is selected based on the required protection—such as flame resistance, thermal insulation, or chemical barrier.

- Applications vary widely and include thermal & flame protection, chemical defense, biological & radiation protection, mechanical protection, cleanroom protection, and visibility enhancement. These garments are used across diverse end-use industries like oil & gas, construction, pharmaceuticals, healthcare, law enforcement, firefighting, and mining.

- Distribution of protective clothing occurs through multiple channels, including direct sales, distributors, and increasingly through online platforms, which offer wider reach and product accessibility.

Regional Insights

Asia Pacific dominated the global protective clothing market in 2024, driven by rapid industrialization, rising construction activities, and government initiatives for worker safety in countries like China, India, and Southeast Asian nations. North America also holds a significant market share, attributed to well-established industrial safety regulations and technological innovation in protective wear. Europe, too, is a vital region, benefiting from strict occupational safety laws and the growing demand for sustainable and recyclable materials.

Key Industry Developments:

- In March 2020 - Protective Industrial Products (PIP) announced the expansion of salesforce in Latin America for industrial protective products. This will help the company in expanding the supply chain and support the growing demand of customers through better distribution network to the local market.

- In February 2019 - Protective Industrial Products Inc. acquired West Chester Protective Gear. The company specializes in the manufacturing of protective apparel for industrial purposes. This acquisition will help in strengthening product portfolio and complement the customer base.

Challenges and Opportunities

While the market outlook is positive, several challenges exist. High manufacturing costs for advanced protective clothing can hinder adoption among small and medium-sized enterprises (SMEs), particularly in developing economies. Raw material price fluctuations and supply chain disruptions can also affect overall market performance.

On the opportunity side, the rising trend toward eco-friendly and biodegradable protective apparel presents a promising growth avenue. Additionally, the increasing adoption of multi-functional, lightweight, and smart protective gear is expected to open new market segments and encourage further innovation.

Future Outlook

The global protective clothing market is on a strong growth trajectory, driven by regulatory mandates, technological innovation, and rising safety concerns in high-risk industries. As industrial activities expand and new threats emerge, the demand for advanced, sustainable, and smart protective clothing is expected to rise significantly. Manufacturers that focus on innovation, functionality, and eco-friendly solutions will be best positioned to succeed in the coming years.

The global smart coatings market is witnessing significant growth due to increasing demand for high-performance materials across several industries. Smart coatings are advanced materials that provide functionalities beyond traditional protective coatings. These include self-healing, anti-corrosion, anti-fouling, self-cleaning, and anti-microbial properties. Such features make smart coatings highly desirable in industries like automotive, aerospace, construction, healthcare, marine, and electronics.

As technological advancements continue and the need for sustainable and durable materials rises, smart coatings are becoming increasingly prevalent. They not only enhance the longevity of materials but also reduce the need for frequent maintenance, which contributes to cost savings over time.

Market Size and Growth Forecast

The global smart coatings market was valued at USD 7.17 billion in 2024 and is projected to rise from USD 8.34 billion in 2025 to USD 26.15 billion by 2032, registering a strong CAGR of 17.7% during the 2025–2032 forecast period. In 2024, Asia Pacific led the market with a dominant share of 45.33%.

List Of Key Smart Coating Companies Profiled

- 3M (U.S.)

- AkzoNobel N.V. (Netherlands)

- Axalta Coating Systems LLC (U.S.)

- DuPont (U.S.)

- Hempel AS (Denmark)

- Jotun Group (Norway)

- NEI Corporation (U.S.)

- PPG Industries, Inc. (U.S.)

- RPM International Inc. (U.S.)

- The Sherwin-Williams Company (U.S.)

Key Market Drivers

The growth of the smart coatings market can be attributed to several key factors:

- Increased Demand from End-Use Industries: Industries such as construction, automotive, and aerospace are turning to smart coatings to enhance the performance and durability of their products. For instance, anti-corrosion coatings are heavily used in marine and offshore applications, while self-healing and self-cleaning coatings are gaining traction in automotive and building sectors.

- Rising Infrastructure Development: Smart coatings are widely applied in buildings and infrastructure to provide protection from environmental factors, reduce energy consumption, and improve aesthetics. The global construction boom, particularly in Asia-Pacific and the Middle East, is fueling demand.

- Growing Environmental and Regulatory Pressures: With the rise of stringent environmental regulations, there is a greater push for sustainable, low-VOC (volatile organic compound) materials. Smart coatings meet these needs by offering long-lasting protection and reducing the frequency of recoating, which in turn lessens waste and chemical usage.

- Technological Advancements: Ongoing R&D in nanotechnology and materials science has led to the development of more sophisticated coatings with tailored properties. Smart coatings now integrate sensors and stimuli-responsive features that adjust to changes in the environment, such as temperature or humidity.

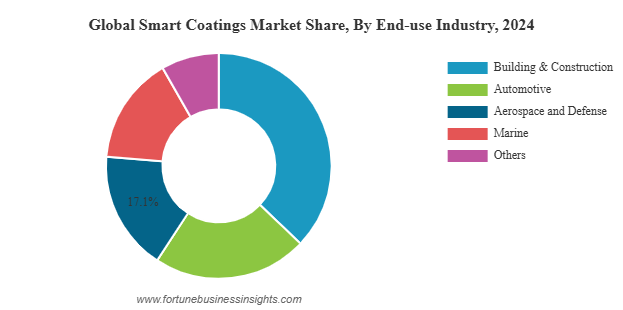

Segmentation Overview

Smart coatings can be categorized based on:

- Functionality: This includes anti-corrosion, self-cleaning, anti-microbial, anti-icing, anti-fouling, and color-shifting coatings. Each type serves a specific need, such as extending product life, improving hygiene, or offering visual effects.

- End-Use Industries: These include automotive and transportation, building and construction, aerospace and defense, marine, electronics, and healthcare. Each sector utilizes different types of coatings based on the required performance parameters.

- Geography: The market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

Read More : https://www.fortunebusinessinsights.com/smart-coatings-market-113374

Regional Insights

- Asia-Pacific held the largest share of the smart coatings market in 2024, driven by rapid industrial growth, large-scale construction, and increasing automotive production. China, India, and Southeast Asian countries are major contributors to this growth.

- North America remains a significant market due to its advanced industrial base, rising demand from the aerospace sector, and growing adoption of smart and sustainable materials.

- Europe is expected to witness steady growth, fueled by stringent environmental regulations and strong emphasis on innovation and green building technologies.

- Latin America and the Middle East & Africa are emerging as potential growth markets due to infrastructure development and growing demand for energy-efficient materials.

Key Industry Developments

- July 2024 – AkzoNobel expanded its portfolio with Resicoat EV powder coatings, designed for electric vehicle components to enhance insulation, corrosion resistance, and thermal management.

- November 2023 – Covestro AG launched Impranil CQ DLU, a bio-based polyurethane dispersion with 34% plant-derived carbon, targeting sports, automotive, and technical textiles. This replaces petroleum-based alternatives while maintaining durability.

Market Challenges

Despite promising growth prospects, the smart coatings market faces some challenges:

- High Cost of Raw Materials and Technology: Smart coatings are often more expensive than conventional alternatives due to the complexity of their formulation and application process.

- Limited Awareness in Developing Regions: In some regions, lack of awareness and limited access to advanced technologies hinder market penetration.

- Technical Barriers: Application methods for smart coatings may require specialized skills and equipment, making it harder for some industries to adopt them widely.

Future Outlook

The future of the smart coatings market looks promising, with growing demand across multiple sectors. As sustainability becomes a top priority and smart infrastructure gains momentum, smart coatings will continue to gain market share. The integration of digital technologies and the development of multifunctional coatings will open new doors for innovation and market expansion.

The market is poised to benefit from increasing R&D activities and growing government support for green technologies. With the rise in urban population and industrialization, particularly in emerging markets, the smart coatings industry is set to experience unprecedented growth in the coming years.

Carbon Fiber Reinforced Plastic Market Size, Share, Companies & Forecast 2032

By Sharvari, 2025-07-30

The global carbon fiber reinforced plastic (CFRP) market was valued at USD 18.92 billion in 2024 and is expected to grow to USD 20.72 billion in 2025, reaching USD 38.02 billion by 2032. This growth reflects a compound annual growth rate (CAGR) of 9.1% over the forecast period. In 2024, Asia Pacific led the market, accounting for a 34.36% share.

Carbon Fiber Reinforced Plastics (CFRPs) are high-performance composite materials known for their superior strength, lightweight properties, and resistance to corrosion and fatigue. These materials are made by combining carbon fibers with a polymer resin, often epoxy or thermoplastic. CFRPs are widely used across various industries including aerospace, automotive, construction, wind energy, sports, and consumer goods, due to their ability to enhance performance while reducing weight and energy consumption.

List Of Key Market Players Profiled In The Report

- Hexcel Corporation (U.S.)

- TORAY INDUSTRIES, INC. (Japan)

- SGL Carbon (Germany)

- Mitsubishi Chemical Group Corporation. (Japan)

- TEIJIN LIMITED. (Japan)

- Solvay (Belgium)

Market Drivers

- One of the primary drivers of the CFRP market is the increasing demand for lightweight materials in transportation sectors, particularly in aerospace and automotive. CFRPs offer a substantial weight reduction compared to traditional materials like steel or aluminum, which leads to better fuel efficiency, lower emissions, and improved performance.

- The growing focus on renewable energy, especially wind energy, is also boosting the market. CFRPs are used extensively in the manufacture of wind turbine blades, where their strength-to-weight ratio allows for longer, more efficient blades capable of generating more power.

- Technological advancements in manufacturing processes such as automated fiber placement, 3D weaving, and resin transfer molding are reducing production costs and increasing adoption across sectors. These improvements also contribute to the development of more complex and durable CFRP components.

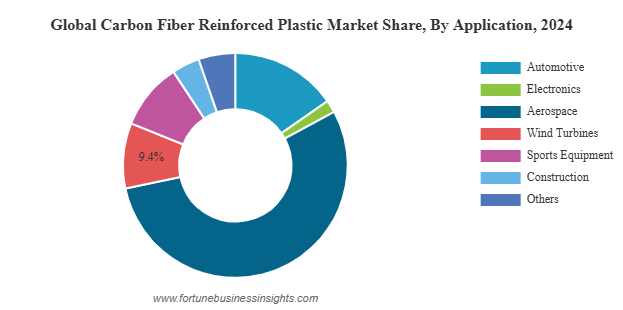

Key Segments and Applications

- CFRPs are segmented by type, resin, and application. Based on type, PAN-based CFRP holds the largest share due to its high tensile strength, excellent fatigue resistance, and cost-effectiveness. Pitch-based CFRP, although more expensive, is used in niche applications that require higher modulus performance.

- In terms of resin, thermosetting CFRPs dominate the market due to their structural integrity, temperature resistance, and extensive use in aerospace and defense applications. Thermoplastic CFRPs are growing in popularity as they offer benefits such as recyclability, shorter processing times, and toughness, making them ideal for automotive and consumer electronics.

- By application, the aerospace and defense sector continues to be the leading consumer of CFRPs, accounting for a significant portion of total market demand. The material’s ability to reduce aircraft weight, thereby improving fuel efficiency and reducing carbon emissions, makes it indispensable in aircraft structures and components. The automotive industry is another key segment, where CFRPs are increasingly used to meet emission norms, enhance vehicle performance, and extend the range of electric vehicles. Wind energy, construction, marine, and sports equipment are also major application areas contributing to the market's expansion.

Read More : https://www.fortunebusinessinsights.com/carbon-fiber-reinforced-plastics-cfrps-market-110101

Regional Insights

The Asia Pacific region dominated the global CFRP market in 2024, holding a significant market share of around 34.36%. This dominance is attributed to the growing industrial base, rising automotive production, and increased use of CFRPs in construction and renewable energy projects, particularly in countries like China, Japan, and South Korea. North America follows closely, driven by strong demand from the aerospace and defense sectors, while Europe is supported by innovations in automotive design and green energy initiatives.

Key Industry Developments

- March 2025: Hexcel and FIDAMC have partnered to advance composite materials for aerospace and industrial applications. Their collaboration focuses on developing innovative manufacturing processes to enhance lightweight, high performance composites. This partnership aims to improve efficiency and sustainability in composite production.

- November 2024: Toray advanced composites expanded its thermoplastic composites portfolio by acquiring Gordon Plastics assets in Colorado. The new 47,000 sq.ft facility enhances R&D and scalable production of high-performance composite tapes for aerospace, sports, oil & gas, and industrial markets.

Challenges

Despite its advantages, the CFRP market faces some challenges. High manufacturing and raw material costs remain a major barrier to mass adoption, especially in price-sensitive sectors. In addition, the recycling of CFRP materials, particularly thermosetting composites, is still a technical challenge due to the irreversible curing process.

Limited standardization and the need for specialized design and engineering capabilities also restrict widespread adoption. Furthermore, the high cost and energy-intensive production of carbon fiber limit its use to high-end applications.

Opportunities

- There are growing opportunities for CFRP in emerging sectors such as electric vehicles, where the demand for lightweight materials to increase driving range and efficiency is rapidly rising. Infrastructure development and the use of CFRPs in strengthening bridges, buildings, and tunnels also present future growth avenues.

- The shift toward more sustainable and recyclable composites is another opportunity. Thermoplastic CFRPs, which can be reshaped and recycled, are expected to witness increasing demand as environmental regulations become more stringent and circular economy initiatives gain momentum.

The global Carbon Fiber Reinforced Plastics market is poised for substantial growth in the coming years. With increasing demand across multiple industries, rapid technological advancements, and a growing focus on sustainability and performance, CFRPs are becoming essential materials in modern engineering and design. While challenges such as cost and recyclability need to be addressed, the overall outlook for the CFRP market remains positive and promising.

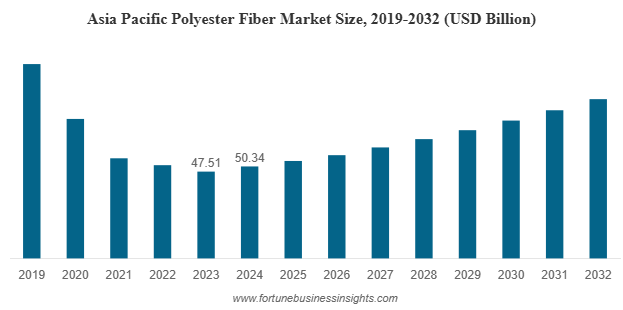

The global polyester fiber market was valued at USD 77.07 billion in 2024 and is expected to increase from USD 82.07 billion in 2025 to USD 129.97 billion by 2032, registering a CAGR of 6.8% during the forecast period. In 2024, Asia Pacific led the market with a dominant share of 65.32%.

Polyester fibers are primarily made from polyethylene terephthalate (PET), a synthetic polymer derived from petroleum. Their resistance to stretching, shrinking, abrasion, and wrinkles, combined with their quick-drying properties, makes them suitable for a broad range of applications. Polyester fibers are available in various forms, including staple and filament, and are widely used in both woven and non-woven fabrics.

Market Size and Growth

The polyester fiber market was valued at a significant amount in recent years and is projected to witness steady growth over the forecast period. This growth is attributed to the fiber’s extensive usage in clothing and upholstery, as well as its growing importance in nonwoven applications like insulation, filters, and construction materials. The increasing consumption of polyester in developing countries and the expansion of the textile and garment industries are key drivers contributing to this market's expansion.

Furthermore, the demand for affordable and durable textile materials continues to rise globally. Polyester, due to its easy availability and performance benefits, is increasingly replacing traditional materials such as cotton and wool in various end-user sectors.

List Of Key Polyester Fiber Companies Profiled

- Reliance Industries Limited. (India)

- Indorama Ventures Public Company Limited. (Thailand)

- Toray Industries, Inc. (Japan)

- Sinopec Yizheng Chemical Fibre Limited Liability Company (China)

- Zhejiang Hengyi Group Co., Ltd (China)

- Tongkun Holding Group (China)

- Sanfame Group (China)

Market Segmentation

- By Product Type:

The polyester fiber market can be segmented into polyester staple fiber (PSF) and polyester filament yarn (PFY). PSF is commonly used in the production of nonwoven fabrics and is widely adopted in applications such as fiberfill, automotive interiors, and textiles. PFY, on the other hand, is extensively used in weaving and knitting to produce fabrics for garments and home textiles. - By Application:

The market spans several applications including apparel, home furnishings, automotive textiles, filtration, and industrial fabrics. The apparel segment holds a significant share of the market due to the widespread use of polyester in manufacturing casual wear, sportswear, and workwear. The home furnishing segment is also growing rapidly, fueled by increasing consumer spending on interior decor and home improvement products. - By End-Use Industry:

Major end-use industries include textiles, automotive, construction, healthcare, and packaging. The textile industry remains the dominant end-user, while the automotive sector is increasingly adopting polyester fibers for seat covers, carpets, insulation, and airbags due to their strength and flexibility.

Read More : https://www.fortunebusinessinsights.com/polyester-fiber-market-111384

Regional Insights

- Asia Pacific dominates the global polyester fiber market, holding the largest share due to the presence of major textile manufacturing hubs in China, India, Vietnam, and Indonesia. The region benefits from lower production costs, abundant labor, and high domestic consumption. China, in particular, is the largest producer and consumer of polyester fiber, accounting for a substantial portion of the global output.

- North America and Europe are mature markets, characterized by high demand for sustainable and recycled polyester products. Increasing environmental awareness and regulatory policies are encouraging manufacturers in these regions to invest in eco-friendly production methods.

- Latin America, the Middle East, and Africa are emerging as potential markets with growing urbanization, industrialization, and investments in textile and construction sectors.

Key Market Trends

- Sustainability and Recycling: One of the most significant trends in the polyester fiber market is the shift towards sustainable and recycled fibers. Recycled polyester, often made from post-consumer PET bottles, is gaining traction as companies and consumers seek environmentally responsible alternatives.

- Innovation in Technical Textiles: Polyester fibers are increasingly used in technical textile applications such as geotextiles, medical textiles, and filtration media. These applications require high-performance materials that offer specific functional benefits like durability, chemical resistance, and ease of processing.

- Rising Demand in Automotive and Construction Sectors: The use of polyester fiber in automotive applications such as seat belts, insulation, and airbags is growing. In the construction industry, polyester-based materials are used for reinforcing concrete and insulation purposes.

- Cost Competitiveness: Polyester fibers offer a cost advantage over natural fibers such as cotton. Their consistent quality and availability make them a preferred choice for mass production in the textile industry.

Key Industry Developments

- March 2025 - ADVANSA’s ADVAtex is a 100% recycled polyester fiber made from pre-consumer textile waste. It reduces reliance on virgin materials while maintaining quality. The process transforms textile waste into durable fibers for furniture and mattresses, addressing global textile waste challenges. Certified by GRS and Oeko-Tex.

- July 2024 - Indorama Ventures has joined a consortium of seven companies across five countries to establish a sustainable polyester fiber supply chain. This initiative utilizes CO₂-derived, renewable, and bio-based materials, replacing traditional fossil resources. The resulting polyester fiber is planned for use in THE NORTH FACE products in Japan.

Challenges

Despite its benefits, polyester fiber faces certain challenges. Environmental concerns regarding its non-biodegradability and microplastic shedding during washing are prompting stricter regulations and growing consumer scrutiny. Moreover, fluctuations in raw material prices, especially crude oil derivatives, can impact production costs and profit margins.

Future Outlook

The polyester fiber market is expected to grow steadily over the coming years, driven by innovations in fiber manufacturing, increased focus on recycled and sustainable fibers, and expanding demand in developing regions. Advancements in fiber blending, improved dyeing techniques, and circular economy initiatives are expected to further support market growth.

As manufacturers adopt more eco-friendly practices and invest in technological advancements, polyester fiber will continue to play a central role in modern textile and industrial applications.

The global potassium formate market was valued at USD 730.53 million in 2023 and is expected to grow from USD 756.54 million in 2024 to USD 1,073.08 million by 2032, registering a CAGR of 4.5% during the 2024–2032 forecast period. In 2023, North America held the largest market share at 32.5%.

Key Growth Drivers

- Environmentally Friendly De-Icing Agent

Potassium formate is widely recognized for its environmentally friendly characteristics, making it a preferred alternative to traditional chloride-based de-icing agents. Unlike sodium chloride or calcium chloride, potassium formate has a lower corrosive effect on infrastructure, vehicles, and the environment. Its biodegradability and minimal impact on soil and water systems make it a suitable choice for use in airports, bridges, highways, and runways. As environmental regulations become stricter across the globe, municipalities and airport authorities are increasingly shifting toward using potassium formate for winter maintenance.

- Demand in the Oil and Gas Industry

One of the most significant applications of potassium formate is in the oil and gas sector. It is commonly used as a high-density, low-solids brine in well-drilling operations. Its unique properties make it ideal for use in high-pressure, high-temperature (HPHT) wells, especially in environmentally sensitive areas such as offshore drilling sites. Potassium formate brines improve drilling efficiency by enhancing wellbore stability, minimizing formation damage, and reducing environmental risks. As exploration and production activities increase globally, particularly in deepwater and shale regions, the demand for potassium formate in this segment is expected to rise.

- Use in Heat Transfer Fluids

Potassium formate also finds extensive use in heat transfer applications, especially in refrigeration systems and industrial cooling processes. It is favored for its high thermal conductivity, non-toxic nature, and compatibility with various materials. In addition, it performs well at low temperatures, making it ideal for secondary refrigerant systems in food storage and processing facilities, data centers, and sports complexes. With industries seeking more energy-efficient and environmentally safe cooling solutions, the use of potassium formate-based heat transfer fluids is growing steadily.

- Agricultural and Chemical Applications

In agriculture, potassium formate is used as a feed preservative and growth promoter due to its antibacterial properties. It helps improve animal digestion and feed efficiency, particularly in pig and poultry farming. Furthermore, it serves as a key raw material or intermediate in the manufacture of various chemicals, especially in specialty chemical and pharmaceutical industries. These additional applications expand its utility across diverse industrial domains.

List Of Key Market Players Profiled In The Report

- Hawkins (U.S.)

- Geocon Products (India)

- Weifang Tainuo Chemical Co., Ltd. (China)

- Shandong Xinhua Pharma. (China)

- Dongying Shuntong Chemical (Group) Co., Ltd. (China)

- Sidley Chemical Co., Ltd. (China)

- Perstorp AB (Sweden)

- Honeywell International Inc. (U.S.)

- ADDCON GmbH (Germany)

- Dynalene, Inc. (U.S.)

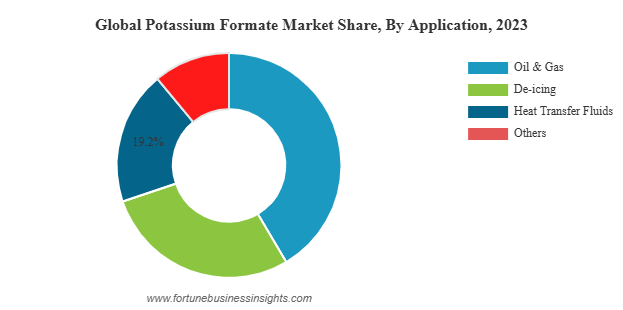

Market Segmentation

By Form:

- Liquid: Liquid or brine form dominates the market due to ease of handling and direct use in drilling and de-icing applications. It is preferred in industries requiring bulk storage and transport.

- Solid: The solid form is gaining traction for use in regions with specific transportation or storage limitations. It offers longer shelf life and easier dosing in certain applications.

By Application:

- Oil & Gas: This segment accounts for the largest market share due to potassium formate’s widespread use as a drilling and completion fluid.

- De-icing: A rapidly growing application area, especially in colder regions that prioritize eco-friendly alternatives for road and runway maintenance.

- Heat Transfer Fluids: Increasing demand in industrial and commercial refrigeration systems drives this segment forward.

- Others: Includes agriculture, chemical manufacturing, and food processing, which contribute to consistent demand across smaller but stable end-use industries.

Read More : https://www.fortunebusinessinsights.com/potassium-formate-market-109687

Regional Insights

- North America

North America leads the global potassium formate market, primarily due to advanced oilfield operations in the United States and Canada. The region’s well-developed infrastructure for de-icing and strong awareness of environmental sustainability further supports high consumption levels. Additionally, the presence of major industry players contributes to market consolidation.

- Europe

Europe follows closely, driven by high environmental standards and significant adoption of potassium formate for both de-icing and industrial heat transfer applications. The region’s cold climate and focus on green alternatives make it a major consumer, particularly in countries like Germany, the UK, and Scandinavia.

- Asia Pacific

Asia Pacific is emerging as the fastest-growing regional market. The region’s increasing energy exploration activities, combined with growing industrialization in countries like China, India, and Southeast Asian nations, are boosting demand. Moreover, infrastructure expansion and modernization in cold-climate regions such as Northern China contribute to higher usage in de-icing applications.

- Rest of the World

Latin America and the Middle East & Africa regions are witnessing steady adoption due to the rise in oil exploration projects and improved infrastructure development.

Key Industry Developments

- October 2021 – BASF SE introduced a new line of potassium formate-based fluids specifically designed for aviation de-icing and anti-icing applications.

- August 2021 – Perstorp Potassium Formate (PoFO) was registered as a fertilizer under EC 2002/2003, simplifying the process for farmers using PoFO-based fertilizers like Amicult K 42. This registration eliminated the need for local raw material registration, thereby enhancing crop quality and yields.

Challenges Facing the Market

- Despite its many advantages, the potassium formate market faces some challenges. One of the primary concerns is its higher cost compared to traditional alternatives like sodium chloride. This price differential can limit its widespread adoption in price-sensitive markets. Additionally, volatility in the prices of raw materials such as formic acid can impact overall production costs and profitability for manufacturers.

- Another restraint is the lack of widespread awareness about the benefits of potassium formate, particularly in developing nations. Education and awareness campaigns by manufacturers and regulatory support may help overcome these limitations.

Future Outlook

The potassium formate market is poised for consistent growth, supported by increasing industrial applications, rising environmental awareness, and regulatory encouragement for eco-friendly chemical usage. Its ability to serve as a high-performance, low-impact solution in diverse industries such as oil and gas, de-icing, and thermal management ensures strong long-term potential. Manufacturers investing in cost reduction, product innovation, and expanding application scope are likely to lead the next phase of market expansion.

The global adhesives and sealants market has been experiencing steady growth, driven by rising demand across packaging, automotive, construction, and electronics industries. Adhesives are used for bonding similar or dissimilar materials, while sealants are applied to block the passage of fluids through surfaces or joints. Together, they play a crucial role in product assembly, structural integrity, insulation, and packaging.

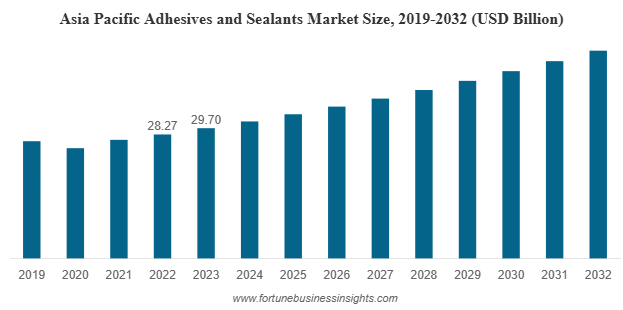

Market Size and Growth Forecast

The global adhesives and sealants market was valued at USD 79.38 billion in 2023 and is expected to rise from USD 82.88 billion in 2024 to USD 118.83 billion by 2032, reflecting a CAGR of 4.6% during the forecast period. In 2023, Asia Pacific led the market, holding the largest share. The adhesives and sealants market in the United States is anticipated to grow substantially, with its value projected to reach USD 22.36 billion by 2032, driven by growing demand in both residential and non-residential construction sectors.

List Of Key Companies Profiled:

- 3M (U.S.)

- Arkema S.A. (France)

- Henkel Corporation (Germany)

- Ashland Inc. (U.S.)

- Avery Dennison (U.S.)

- BASF SE (Germany)

- Evonik Industries (Germany)

- H.B. Fuller Company (U.S.)

- PPG Industries (U.S.)

Key Market Drivers

- Expansion in Packaging and E-Commerce

The packaging industry continues to be a major driver of adhesives consumption. Increased demand for flexible, eco-friendly, and secure packaging—especially due to the surge in e-commerce—has significantly boosted market growth. Adhesives are widely used in labeling, carton sealing, flexible packaging laminates, and other bonding applications that require precision and reliability. - Infrastructure and Construction Growth

The building and construction sector is a vital consumer of sealants and structural adhesives. Urbanization, increasing residential and commercial development, and renovation projects are contributing to rising usage in tiling, flooring, glazing, weatherproofing, and insulation systems. Sealants help improve energy efficiency and protect buildings from water damage, while adhesives are used in modular and prefabricated construction. - Automotive Industry Demand

In the automotive industry, the push toward lightweighting and electric vehicle (EV) production is encouraging the use of high-performance adhesives and sealants. These materials allow the joining of different substrates such as metals, plastics, and composites, replacing traditional welding or mechanical fastening. They also contribute to noise reduction, corrosion protection, and better vehicle aerodynamics. - Sustainable and Low-VOC Formulations

Environmental regulations are influencing product development, with a strong push toward low-VOC (volatile organic compound) and eco-friendly formulations. Water-based, hot-melt, and reactive systems are gaining popularity as they offer reduced environmental impact while maintaining high performance. The demand for green building certifications and sustainable packaging is further accelerating this trend. - Electronics and Appliances

With growing demand for consumer electronics and smart devices, adhesives and sealants are being increasingly used for circuit boards, displays, camera modules, and batteries. These materials provide insulation, shock resistance, and protection against dust and moisture, supporting durability and miniaturization in electronics manufacturing.

Market Segmentation Highlights

By Resin Type:

- Acrylic adhesives dominate due to their excellent bonding strength and weather resistance.

- Silicone sealants are preferred in construction and electronics for their flexibility and resistance to extreme temperatures.

- Polyurethane adhesives are widely used in automotive, construction, and footwear for their toughness and impact resistance.

- Epoxy adhesives offer high strength and are primarily used in structural and industrial applications.

By Technology:

- Water-based adhesives hold the largest share, thanks to low toxicity and widespread use in paper, packaging, and consumer goods.

- Hot-melt adhesives are gaining traction in packaging and automotive interiors due to fast setting time and efficiency.

- Solvent-based adhesives are used where high resistance is required, though their use is declining due to environmental regulations.

- Reactive adhesives like polyurethane and epoxy are favored for high-performance bonding applications.

By Application:

- Packaging remains the leading application segment for adhesives, driven by growing consumption in food and consumer goods.

- Building and construction is the largest end-use segment for sealants, especially in glazing, expansion joints, and insulation.

- Automotive, electronics, healthcare, and footwear are also important industries contributing to market expansion.

Read More : https://www.fortunebusinessinsights.com/industry-reports/adhesives-and-sealants-market-101715

Regional Insights

- Asia Pacific accounted for the largest market share of 37.4% in 2023, driven by rapid industrialization, a booming construction sector, and strong automotive manufacturing in countries like China, India, and Japan. The region’s dominance is also supported by low labor costs, abundant raw materials, and large-scale infrastructure development.

- North America and Europe are also significant contributors, with growing demand for sustainable construction solutions and increasing use of electric vehicles. These regions are characterized by stringent environmental regulations, prompting manufacturers to invest in cleaner, compliant formulations.

- Latin America, Middle East, and Africa are emerging markets with strong potential, as governments focus on infrastructure projects and industrial diversification.

Key Industry Developments

- July 2023: Sika announced the acquisition of a family-owned business named “Chema” based in Peru. Chema is a well-established brand in the Peruvian mortar market and provides a range of tile grouts, tile adhesives, and other high-quality products. The acquisition strengthens its presence in the distribution channel in Peru and the development of Sika’s Building Finishing portfolio.

- March 2023: Arkema acquired Polytec PT, specialized in adhesives for batteries and electronics. With this acquisition, Arkema would strengthen Bostik’s product offerings to serve the fast-growing batteries and electronics markets. This bolt-on acquisition is part of the Group’s strategy to become a full system provider and support its customers to develop sustainable solutions for the batteries and electronics markets.

Challenges and Restraints

Despite positive growth trends, the industry faces several challenges:

- Volatility in Raw Material Prices: Fluctuations in prices of petrochemical-based inputs such as resins and solvents affect manufacturing costs and pricing strategies.

- Stringent Environmental Regulations: Compliance with safety and environmental standards adds complexity and cost to product development.

- Availability of Substitutes: In certain applications, traditional mechanical fastening, welding, or other joining methods still compete with adhesive solutions.

- Technical Barriers: In advanced structural applications, adhesives must meet stringent performance and durability standards, posing technical hurdles in formulation and testing.

Outlook

The global adhesives and sealants market is poised for steady and sustained growth over the coming years. The shift toward eco-conscious products, technological advancements in adhesive chemistry, and demand from key end-use industries are expected to continue driving market expansion. Companies that focus on innovation, sustainability, and meeting evolving customer needs will be best positioned to capitalize on emerging opportunities.

As industries increasingly prioritize performance, cost-efficiency, and environmental responsibility, adhesives and sealants will play a central role in shaping the future of manufacturing, packaging, and construction.