Category: Chemicals & Advanced Materials

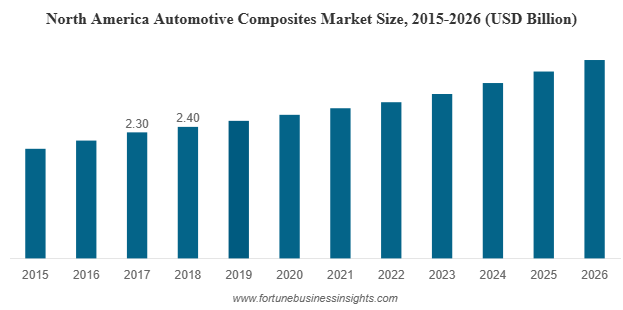

The global automotive composites market was valued at USD 7.67 billion in 2018 and is expected to expand to USD 13.5 billion by 2026, registering a CAGR of 7.56% during the forecast period. In 2018, North America held the leading share at 31.29%, while the U.S. market is projected to reach USD 3.22 billion by 2026, supported by the growing focus on lightweight vehicles and enhanced fuel efficiency.

The global automotive composites industry is experiencing a material revolution. As governments tighten emission standards and consumers demand more efficient vehicles, manufacturers are turning to innovative materials to strike the balance between performance, sustainability, and affordability. Among these, automotive composites are emerging as a game-changer. Lightweight, durable, and versatile, composites are reshaping how vehicles are designed and produced.

List of Top Automotive Composites Market Companies:

- Teijin Ltd.

- Mitsubishi Chemical Corporation

- Toray Industries, Inc.

- SGL Carbon

- RTP Company

- Plasan Carbon Composites

- Owens Corning

- Solvay S.A.

- UFP Technologies, Inc.

- BASF SE

- Other Players

Automotive Composites Market Importance in Automotive Design

One of the greatest challenges for automakers today is reducing vehicle weight without compromising safety, performance, or cost. Composites provide an effective solution. Glass fiber, carbon fiber, and natural fiber composites can significantly reduce vehicle mass when compared to traditional steel and even aluminum.

- Glass fiber composites: Offer a weight reduction of around 15–20% and are widely used due to their cost-effectiveness and durability.

- Carbon fiber composites: Deliver up to 40% weight savings, making them ideal for performance vehicles, though higher costs remain a challenge.

- Natural fiber composites: Increasingly popular in interior applications, offering sustainability benefits and compliance with eco-friendly regulations.

For electric vehicles (EVs), lightweight materials are even more critical. Every kilogram saved translates into a longer driving range or the possibility of reducing battery size, improving cost efficiency. This has driven strong interest in composites for EV body panels, battery enclosures, and structural components.

Resin Trends Driving Market Growth

Automotive composites market are typically classified by the resin system used.

- Thermoset resins currently dominate due to their high strength, dimensional stability, and excellent resistance to heat and stress. They are widely used in exterior body components and structural applications.

- Thermoplastic resins are gaining momentum because of their recyclability, faster production cycles, and potential for mass production. However, challenges such as high melt viscosity and impregnation issues during processing still limit widespread adoption.

As automakers move toward circular economy practices, thermoplastic composites are expected to capture a larger share of future demand.

Key Applications of Automotive Composites Market

Automotive composites market are finding their way into multiple parts of the vehicle.

- Exterior Applications – Body panels, hoods, headlamps, and bumpers dominate composite demand. These components not only reduce weight but also improve corrosion resistance and design flexibility.

- Interior Applications – Natural fiber composites are increasingly replacing plastics in door panels, dashboards, and trim components, offering both weight reduction and eco-friendliness.

- Structural and Powertrain Parts – Although still emerging, composites are being explored for use in chassis components, suspension systems, and under-the-hood applications where high strength and thermal resistance are critical.

Read More : https://www.fortunebusinessinsights.com/automotive-composites-market-102711

Growth Drivers

Several factors are fueling the rise of automotive composites market:

- Light-weighting for Efficiency: Regulatory pressure for reduced CO₂ emissions has made weight reduction a top priority for automakers. Composites provide the most effective path to achieving this.

- Electrification: EV adoption worldwide is accelerating composite demand due to the dual need for lightweighting and structural safety.

- Sustainability Push: Growing consumer and regulatory demand for sustainable products is boosting the use of natural fiber composites and bio-based resins.

- Design Flexibility: Composites allow for more innovative vehicle designs, enabling manufacturers to balance aesthetics with function.

Challenges and Restraints

Despite their benefits, composites face hurdles:

- Recycling Issues: Separating fibers and resins at the end of life is complex and expensive. Current recycling processes are limited, making composites less attractive for circular economy initiatives.

- High Costs: Carbon fiber composites remain expensive compared to metals. Thermoplastic composites, while recyclable, involve higher processing costs.

- Scalability: Manufacturing composites at the scale and speed required by the automotive industry remains a challenge.

These barriers have slowed widespread adoption, particularly in mass-market vehicles.

Regional Insights

- North America continues to dominate due to the presence of leading composite manufacturers, strong R&D capabilities, and adoption in performance and luxury vehicles.

- Europe is driving sustainability efforts, leading to the growing use of natural fiber composites and stricter recycling mandates.

- Asia Pacific is the fastest-growing region, with rising automotive production in China, India, and Thailand, and increasing consumer preference for lightweight vehicles.

Key Industry Developments:

- February 2021 – Teijin Ltd. announced installation of glass fiber sheet molding compound line at the company’s automotive composites business named ‘Benet Automotive s.r.o’. The investment was done to meet growing demand for Teijin’s composite parts from European automotive manufacturers.

- January 2021 – SGL Carbon announced investment of USD 4.5 million at its Arkansas site to expand the production of carbon composites for electric vehicles. The company is engaged in the manufacturing of carbon and glass fiber reinforced products for automotive applications. The new capacity addition will be used to meet growing demand for composite battery enclosures of modern e-car chassis.

Outlook for the Future

The future of the automotive composites market looks promising. With the shift toward electrification, stricter emission norms, and consumer demand for sustainable vehicles, composites are moving from niche applications to mainstream use. As recycling technologies improve and production costs decline, adoption is expected to accelerate further.

Automotive composites are no longer limited to luxury sports cars. They are becoming a necessity for mass-market vehicles aiming to meet the demands of the next generation of drivers. Companies that innovate in sustainable composite materials and scalable production technologies will shape the future of mobility.

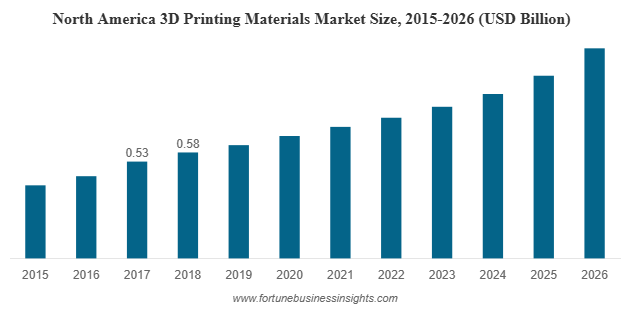

In 2018, the global 3D printing materials market was valued at USD 1.53 billion and is expected to grow significantly, reaching USD 3.78 billion by 2026. This growth represents a robust compound annual growth rate (CAGR) of 12.1% over the forecast period. North America led the global market in 2018, accounting for a dominant share of 37.91%. Within the region, the United States is a key contributor, with its 3D printing materials market projected to hit USD 1.28 billion by 2026, fueled by the increasing adoption of additive manufacturing across a wide range of industries.

The 3D printing materials industry has evolved from a niche prototyping tool into a cornerstone of modern manufacturing. From aerospace to healthcare, industries around the globe are increasingly adopting additive manufacturing for its efficiency, precision, and customization capabilities. At the core of this transformative shift lies the 3D printing materials market, which is experiencing rapid growth as innovations in materials science drive wider application and commercial viability.

List of Top 3D Printing Materials Market Companies:

- Stratasys Ltd.

- 3D Systems, Inc.

- Materialise NV

- Markforged, Inc.

- EOS GmbH

- Höganäs AB

- Arkema

- Royal DSM N.V.

- ExOne

- GE Additive

Market Overview

The 3D printing materials market has grown significantly in recent years, driven by increasing demand for lightweight, high-performance, and cost-efficient components. Industries are shifting from traditional subtractive methods to additive manufacturing, recognizing the benefits in terms of material savings, design freedom, and shorter production cycles.

Materials used in 3D printing materials market have become more diverse and specialized. Initially dominated by standard thermoplastics, the market now includes high-performance polymers, metals, ceramics, and composite materials, each tailored for specific industrial applications. This evolution in materials has opened the door to functional end-use parts, not just prototypes.

Key Market Drivers

- Expansion of Industrial Applications

One of the main drivers of the 3D printing materials market is the expansion of additive manufacturing into end-use production. Aerospace companies are using lightweight metal alloys to reduce fuel consumption. Automotive manufacturers are integrating 3D-printed components to streamline prototyping and accelerate product development. In healthcare, biocompatible materials are being used to create patient-specific implants and surgical tools. These advancements are pushing material innovation at a rapid pace. - Advancements in Material Science

Ongoing research and development have led to the creation of more durable, heat-resistant, and functionally specialized materials. For example, carbon fiber-reinforced composites are becoming popular in automotive and sports industries due to their superior strength-to-weight ratio. Similarly, biodegradable and eco-friendly materials are gaining attention as sustainability becomes a global priority. - Customization and Personalization Trends

In industries such as dental, medical, and consumer products, the ability to produce custom and patient-specific items is a key benefit of 3D printing. This level of customization would be prohibitively expensive or technically unfeasible with traditional manufacturing methods. As more sectors seek personalized solutions, demand for compatible and specialized printing materials continues to grow.

Read More : https://www.fortunebusinessinsights.com/3d-printing-material-market-102296

Material Categories and Usage

- Polymers

Polymers remain the most commonly used materials in 3D printing, especially in desktop and low-cost applications. Thermoplastics like PLA, ABS, and PETG are widely used due to their ease of use and affordability. For industrial applications, high-performance polymers like PEEK and PEI offer superior mechanical and thermal properties.

- Metals

The use of metals in 3D printing has revolutionized industries such as aerospace, automotive, and healthcare. Stainless steel, titanium, aluminum, and cobalt-chrome are among the most commonly used metals. They are ideal for producing parts that require strength, durability, and resistance to extreme conditions.

- Ceramics

Although still in the early stages of commercialization, ceramic materials offer exciting possibilities in sectors like biomedical implants, electronics, and high-temperature applications. They are ideal for applications that require hardness, chemical resistance, or thermal insulation.

- Composites

Composite materials, including fiber-reinforced plastics and metal matrix composites, combine the best properties of different substances to create highly functional materials. These materials are gaining attention for their high strength-to-weight ratios and versatility in demanding environments.

Regional Insights

The 3D printing materials market is witnessing growth across all major regions. North America currently leads the market due to its strong industrial base, technological innovation, and supportive infrastructure. Europe is close behind, with a growing emphasis on sustainable and advanced manufacturing. Meanwhile, the Asia-Pacific region is emerging as a key player, fueled by rapid industrialization, government support, and growing adoption of digital manufacturing.

Opportunities and Challenges

Opportunities

- The increasing demand for lightweight and efficient components in aerospace and automotive industries presents significant growth opportunities.

- Healthcare applications, particularly in prosthetics, dental, and implants, are driving demand for biocompatible materials.

- The push for sustainability is creating opportunities for bio-based and recyclable printing materials.

- Education and research institutions are increasingly using 3D printing to teach engineering and design, further expanding the material market.

Challenges

- High material costs remain a barrier, especially for metals and high-performance polymers.

- Limited availability and standardization of materials in some regions can slow down adoption.

- Post-processing requirements and quality assurance still pose challenges in some sectors.

- Intellectual property concerns and regulatory issues, especially in healthcare and aerospace, can hinder material innovation.

Key Industry Developments:

- September 2019 – 3D Systems launched new materials for 3D printing namely PRO-BLK 10, and HI-TEMP 300-AMB. The new products will diversify the company’s product portfolio and expand the range of applications for customers.

- November 2018 – Royal DSM N.V. launched “Arnitel ID2060 HT”, a high-performance thermoplastic copolyester for 3D printing by using fused filament fabrication. The filament offers a balance of properties such as chemical resistance, flexibility, and high-temperature resistance.

Future Outlook

The future of the 3D printing materials market looks highly promising. As the technology becomes more integrated into mainstream manufacturing, the need for high-quality, reliable, and application-specific materials will grow. Innovations in nanomaterials, smart materials, and multi-material printing are expected to unlock new possibilities, making additive manufacturing more efficient and versatile.

Collaboration between material scientists, manufacturers, and end-users will be key to driving innovation and meeting the complex demands of various industries. Additionally, as economies of scale improve and production costs decrease, 3D printing materials market will become more accessible, pushing adoption even further.

The 3D printing materials market is at the forefront of a manufacturing revolution. With ongoing technological advancements and increasing industrial adoption, the demand for advanced materials is set to rise significantly in the coming years. Companies that invest in research, sustainability, and quality will be well-positioned to lead in this rapidly evolving landscape. As the capabilities of additive manufacturing continue to expand, so too will the opportunities for innovation and growth across global industries.

Liquid Waste Management Market Key Challenges, Opportunities & Forecast 2032

By Sharvari, 2025-09-29

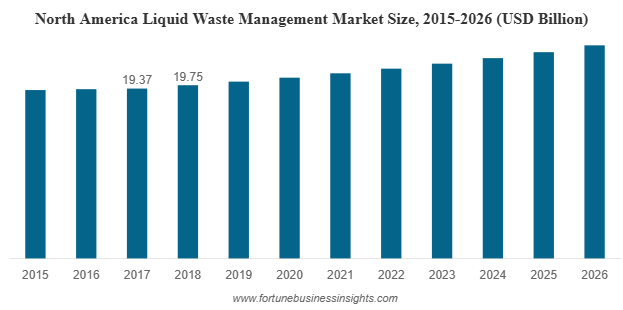

The global liquid waste management market was valued at USD 65.93 billion in 2018 and is expected to reach USD 85.02 billion by 2026, growing at a compound annual growth rate (CAGR) of 3.3% over the forecast period. North America led the market in 2018, accounting for 29.96% of the global share. In particular, the U.S. market is projected to hit USD 22.29 billion by 2026, fueled by the enforcement of stricter environmental regulations and the rising need for effective industrial waste disposal solutions.

Market Growth and Size

The global liquid waste management market has seen consistent growth over the past decade. This upward trend is driven by several interrelated factors: increasing industrial activity, strict environmental regulations, and a growing awareness of sustainability. As industries and municipalities generate more liquid waste, demand for effective treatment solutions continues to surge.

Key market indicators show that the industry is expanding steadily, with a compound annual growth rate (CAGR) that reflects rising investment and innovation. The growing recognition of wastewater as a potential resource — particularly in water-scarce regions — is encouraging public and private sectors to invest in advanced treatment technologies and infrastructure.

List of Top Liquid Waste Management Companies:

- Veolia Environmental Services

- SUEZ Environment SA

- Xylem

- Evoqua Water Technologies Corporation

- Covanta Holding Corporation

- Clean Harbors, Inc.

- GFL Environmental Inc.

- Cleanaway

- Aqua America Inc.

What is Liquid Waste Management?

Liquid waste management market refers to the collection, treatment, and proper disposal of waste materials in liquid form. This waste may originate from households (such as sewage), industries (such as chemical effluents), commercial establishments (like restaurants), and even storm water runoff. It includes both hazardous and non-hazardous forms and must be handled carefully to avoid contamination and health risks.

The goal of liquid waste management market is not only to prevent pollution but also to enable recycling and reuse of water and valuable by-products. Depending on the type and source of waste, various treatment methods are employed, including physical, chemical, and biological processes. These may include sedimentation, filtration, disinfection, chemical precipitation, and the use of microorganisms to break down organic matter.

Major Drivers of the Market

- Rising Urban Population

As more people move into cities, urban infrastructure is put under pressure. Water usage increases, leading to greater volumes of domestic wastewater. Municipalities are thus investing in larger and more efficient wastewater treatment plants to manage this surge.

- Industrialization

Industries like textiles, pharmaceuticals, chemicals, food processing, and paper manufacturing generate enormous volumes of liquid waste. Without adequate treatment, this waste can pollute rivers, lakes, and groundwater. Regulatory bodies are now enforcing stricter norms, pushing industries to adopt cleaner production methods and invest in in-house treatment facilities.

- Environmental Regulations

Governments across the world are implementing stricter laws for waste disposal. Regulatory agencies require proper treatment and documentation of waste disposal practices. Failure to comply often results in heavy fines, business license suspensions, and reputational damage.

- Water Scarcity and Reuse Initiatives

Many regions are experiencing chronic water shortages. This has led to a paradigm shift in how wastewater is viewed. Instead of disposal, treated wastewater is now being reused for irrigation, industrial cooling, and even potable use in some advanced applications. This not only reduces the burden on freshwater resources but also opens up new market opportunities.

- Technological Advancements

Innovations in treatment technologies such as membrane filtration, UV disinfection, and biological nutrient removal are making processes more efficient and cost-effective. In addition, automation and IoT-based monitoring are allowing for real-time data analysis, predictive maintenance, and greater control over treatment processes.

Market Segmentation

The liquid waste management market can be segmented based on source, service, and industry application:

- By Source: Residential, commercial, and industrial. The residential segment continues to generate the highest volume of liquid waste globally, largely due to sewage and greywater.

- By Service: Collection, transportation, treatment, and disposal. Treatment remains the most crucial and investment-intensive segment.

- By Industry: Chemical and pharmaceutical, food & beverage, textiles, oil & gas, and paper & pulp are among the top contributors to industrial wastewater.

Read More : https://www.fortunebusinessinsights.com/liquid-waste-management-market-102643

Regional Insights

- North America holds a significant market share due to its well-established infrastructure, stringent regulations, and active participation of private players.

- Europe leads in sustainable practices and reuse of treated wastewater, especially in agriculture and industrial cooling.

- Asia-Pacific is the fastest-growing region, driven by rapid industrial expansion, urbanization, and increasing environmental awareness in countries like India and China.

- Middle East & Africa are focusing on water reuse technologies to combat water scarcity, while Latin America is investing in modernizing its aging water treatment infrastructure.

Challenges Facing the Market

Despite its growth, the liquid waste management market faces several challenges:

- High Operational Costs: Setting up and maintaining treatment facilities requires substantial investment, which can be a deterrent for small businesses and underfunded municipalities.

- Lack of Awareness: In many developing regions, there is a lack of awareness and urgency regarding proper waste disposal, leading to illegal dumping and untreated discharges.

- Skilled Labor Shortage: Operating advanced treatment systems requires technical expertise, which may not be readily available in all regions.

- Fragmented Regulations: Different countries and regions have different environmental standards, making it difficult for multinational service providers to standardize operations.

Key Industry Developments:

- February 2020: SUEZ NWS, Shanghai Chemical Industry Park (SCIP) and SAIC Motor entered into a partnership to recover hazardous liquid waste in an Industrial park. The new joint venture has been established by SUEZ to provide high-quality waste treatment services to SCIP & SAIC and to expand into the Chinese Market.

- June 2019: AngloGold Ashanti, the world’s third-largest gold producer from South Africa entered into a contract with Veolia Ghana Limited for all water treatment plants in Ghana. Veolia will manage four wastewater treatment plants for three years.

The Road Ahead

The future of liquid waste management market lies in innovation, integration, and sustainability. As climate change intensifies and natural resources become scarcer, the pressure to treat, reuse, and recover from liquid waste will only increase. Advanced technologies like AI-powered monitoring, solar-powered treatment units, and decentralized systems are making inroads into the market.

Moreover, public-private partnerships and government subsidies are helping smaller cities and rural areas gain access to better waste management solutions. Education, capacity building, and community engagement will also play critical roles in shaping a cleaner and more sustainable future.

Future Outlook

Liquid waste management market is no longer just a back-end process — it is a critical component of sustainable development. With growing environmental awareness, regulatory pressures, and technological progress, the market is set to expand and evolve. Stakeholders across industries must prioritize responsible waste handling practices, not only to comply with regulations but to ensure the protection of ecosystems and public health.

As the world continues to urbanize and industrialize, the demand for robust liquid waste management solutions will remain strong — making this sector a key player in the global environmental landscape.

Construction Chemicals Market Demand, Drivers & Global Growth, Forecast 2032

By Sharvari, 2025-09-29

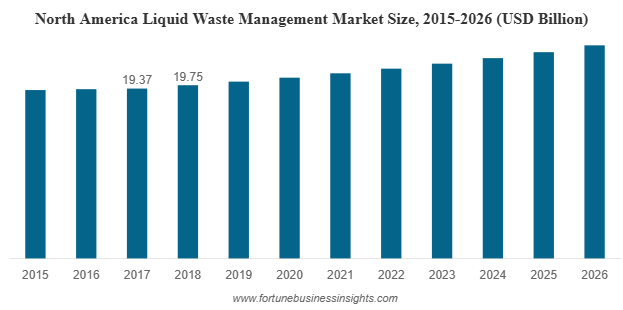

The global liquid waste management market was valued at USD 65.93 billion in 2018 and is expected to reach USD 85.02 billion by 2026, growing at a compound annual growth rate (CAGR) of 3.3% over the forecast period. North America led the market in 2018, accounting for 29.96% of the global share. In particular, the U.S. market is projected to hit USD 22.29 billion by 2026, fueled by the enforcement of stricter environmental regulations and the rising need for effective industrial waste disposal solutions.

Market Growth and Size

The global liquid waste management market has seen consistent growth over the past decade. This upward trend is driven by several interrelated factors: increasing industrial activity, strict environmental regulations, and a growing awareness of sustainability. As industries and municipalities generate more liquid waste, demand for effective treatment solutions continues to surge.

Key market indicators show that the industry is expanding steadily, with a compound annual growth rate (CAGR) that reflects rising investment and innovation. The growing recognition of wastewater as a potential resource — particularly in water-scarce regions — is encouraging public and private sectors to invest in advanced treatment technologies and infrastructure.

List of Top Liquid Waste Management Companies:

- Veolia Environmental Services

- SUEZ Environment SA

- Xylem

- Evoqua Water Technologies Corporation

- Covanta Holding Corporation

- Clean Harbors, Inc.

- GFL Environmental Inc.

- Cleanaway

- Aqua America Inc.

What is Liquid Waste Management?

Liquid waste management market refers to the collection, treatment, and proper disposal of waste materials in liquid form. This waste may originate from households (such as sewage), industries (such as chemical effluents), commercial establishments (like restaurants), and even storm water runoff. It includes both hazardous and non-hazardous forms and must be handled carefully to avoid contamination and health risks.

The goal of liquid waste management market is not only to prevent pollution but also to enable recycling and reuse of water and valuable by-products. Depending on the type and source of waste, various treatment methods are employed, including physical, chemical, and biological processes. These may include sedimentation, filtration, disinfection, chemical precipitation, and the use of microorganisms to break down organic matter.

Major Drivers of the Market

- Rising Urban Population

As more people move into cities, urban infrastructure is put under pressure. Water usage increases, leading to greater volumes of domestic wastewater. Municipalities are thus investing in larger and more efficient wastewater treatment plants to manage this surge.

- Industrialization

Industries like textiles, pharmaceuticals, chemicals, food processing, and paper manufacturing generate enormous volumes of liquid waste. Without adequate treatment, this waste can pollute rivers, lakes, and groundwater. Regulatory bodies are now enforcing stricter norms, pushing industries to adopt cleaner production methods and invest in in-house treatment facilities.

- Environmental Regulations

Governments across the world are implementing stricter laws for waste disposal. Regulatory agencies require proper treatment and documentation of waste disposal practices. Failure to comply often results in heavy fines, business license suspensions, and reputational damage.

- Water Scarcity and Reuse Initiatives

Many regions are experiencing chronic water shortages. This has led to a paradigm shift in how wastewater is viewed. Instead of disposal, treated wastewater is now being reused for irrigation, industrial cooling, and even potable use in some advanced applications. This not only reduces the burden on freshwater resources but also opens up new market opportunities.

- Technological Advancements

Innovations in treatment technologies such as membrane filtration, UV disinfection, and biological nutrient removal are making processes more efficient and cost-effective. In addition, automation and IoT-based monitoring are allowing for real-time data analysis, predictive maintenance, and greater control over treatment processes.

Market Segmentation

The liquid waste management market can be segmented based on source, service, and industry application:

- By Source: Residential, commercial, and industrial. The residential segment continues to generate the highest volume of liquid waste globally, largely due to sewage and greywater.

- By Service: Collection, transportation, treatment, and disposal. Treatment remains the most crucial and investment-intensive segment.

- By Industry: Chemical and pharmaceutical, food & beverage, textiles, oil & gas, and paper & pulp are among the top contributors to industrial wastewater.

Read More : https://www.fortunebusinessinsights.com/liquid-waste-management-market-102643

Regional Insights

- North America holds a significant market share due to its well-established infrastructure, stringent regulations, and active participation of private players.

- Europe leads in sustainable practices and reuse of treated wastewater, especially in agriculture and industrial cooling.

- Asia-Pacific is the fastest-growing region, driven by rapid industrial expansion, urbanization, and increasing environmental awareness in countries like India and China.

- Middle East & Africa are focusing on water reuse technologies to combat water scarcity, while Latin America is investing in modernizing its aging water treatment infrastructure.

Challenges Facing the Market

Despite its growth, the liquid waste management market faces several challenges:

- High Operational Costs: Setting up and maintaining treatment facilities requires substantial investment, which can be a deterrent for small businesses and underfunded municipalities.

- Lack of Awareness: In many developing regions, there is a lack of awareness and urgency regarding proper waste disposal, leading to illegal dumping and untreated discharges.

- Skilled Labor Shortage: Operating advanced treatment systems requires technical expertise, which may not be readily available in all regions.

- Fragmented Regulations: Different countries and regions have different environmental standards, making it difficult for multinational service providers to standardize operations.

Key Industry Developments:

- February 2020: SUEZ NWS, Shanghai Chemical Industry Park (SCIP) and SAIC Motor entered into a partnership to recover hazardous liquid waste in an Industrial park. The new joint venture has been established by SUEZ to provide high-quality waste treatment services to SCIP & SAIC and to expand into the Chinese Market.

- June 2019: AngloGold Ashanti, the world’s third-largest gold producer from South Africa entered into a contract with Veolia Ghana Limited for all water treatment plants in Ghana. Veolia will manage four wastewater treatment plants for three years.

The Road Ahead

The future of liquid waste management market lies in innovation, integration, and sustainability. As climate change intensifies and natural resources become scarcer, the pressure to treat, reuse, and recover from liquid waste will only increase. Advanced technologies like AI-powered monitoring, solar-powered treatment units, and decentralized systems are making inroads into the market.

Moreover, public-private partnerships and government subsidies are helping smaller cities and rural areas gain access to better waste management solutions. Education, capacity building, and community engagement will also play critical roles in shaping a cleaner and more sustainable future.

Future Outlook

Liquid waste management market is no longer just a back-end process — it is a critical component of sustainable development. With growing environmental awareness, regulatory pressures, and technological progress, the market is set to expand and evolve. Stakeholders across industries must prioritize responsible waste handling practices, not only to comply with regulations but to ensure the protection of ecosystems and public health.

As the world continues to urbanize and industrialize, the demand for robust liquid waste management solutions will remain strong — making this sector a key player in the global environmental landscape.

Construction Chemicals Market Demand, Drivers & Global Growth, Forecast 2032

By Sharvari, 2025-09-29

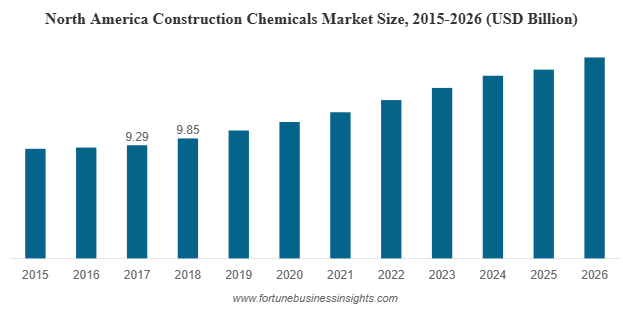

The global construction chemicals market was valued at USD 42.32 billion in 2018 and is expected to expand to USD 70.91 billion by 2026, reflecting a CAGR of 6.7% over the forecast period. North America led the market in 2018, accounting for 23.28% of the share. Within the region, the U.S. market is anticipated to reach USD 12.73 billion by 2026, supported by accelerating urbanization and growing infrastructure investments.

Market Overview

The global construction chemicals industry is witnessing rapid transformation, driven by urbanization, smart city initiatives, and rising demand for durable infrastructure. One of the key enablers of this growth is the construction chemicals sector. Construction chemicals are specialized compounds that improve the quality, strength, and durability of buildings and infrastructure projects. From concrete admixtures to waterproofing compounds, these chemicals have become indispensable in both residential and non-residential projects.

List Of Key Companies Profiled In Construction Chemicals Market:

- BuildCore Chemicals

- Croda International Plc

- ACC Limited

- Evonik

- BASF SE

- Fosroc, Inc.

- CHRYSO India

- SWC Brother Company Limited.

- Sika AG

- 3M Company

- Other Key Players

Product Segmentation

The market is segmented into several categories, each contributing to construction efficiency and sustainability.

- Concrete Admixtures – This segment leads the market due to its widespread use in improving workability, setting times, and durability of concrete. Admixtures help in optimizing water usage and reducing cement content, making them both cost-effective and eco-friendly.

- Flooring Chemicals – Epoxy and polyurethane-based flooring chemicals are in high demand across industrial, commercial, and residential projects. They offer superior protection against abrasion, heavy loads, and chemical exposure.

- Waterproofing Chemicals – With rising awareness of moisture-related damage, waterproofing solutions are gaining traction in both residential and non-residential applications.

- Repair and Rehabilitation Compounds – The growing need to extend the lifespan of aging infrastructure is driving demand for these products, which help in restoring structural integrity.

- Adhesives and Sealants – These play a vital role in improving structural bonding, preventing leakages, and enhancing overall project sustainability.

Applications

The demand for construction chemicals varies across different applications:

- Non-Residential Construction: This segment dominates the global market due to large-scale infrastructure projects, commercial complexes, industrial buildings, and government-led initiatives. Roads, bridges, tunnels, and airports are key drivers here.

- Residential Construction: Rising urban migration and an increasing focus on quality housing have significantly boosted the use of construction chemicals in residential projects. Energy-efficient homes and modern housing solutions are further accelerating this trend.

Read More : https://www.fortunebusinessinsights.com/construction-chemicals-market-102539

Growth Drivers

Several factors are propelling the expansion of the construction chemicals market:

- Urbanization and Infrastructure Development

The rapid pace of urbanization worldwide is fueling demand for modern infrastructure, housing, and commercial spaces. Governments are heavily investing in large-scale projects, which in turn increase the need for advanced construction chemicals. - Focus on Sustainability

Growing awareness of environmental impact is pushing builders and manufacturers toward green construction. Chemicals that reduce water consumption, improve energy efficiency, and lower carbon footprints are witnessing rising demand. - Technological Advancements

Innovations such as polycarboxylate ether-based admixtures, self-healing concrete, and low-VOC (volatile organic compound) coatings are transforming the construction landscape. These technologies enhance durability and meet global sustainability standards. - Mergers and Acquisitions

Leading players are expanding their market presence through strategic partnerships and acquisitions. For instance, global companies have been acquiring regional players to diversify their portfolios and access emerging markets.

Challenges

Despite strong growth prospects, the construction chemicals market faces several challenges:

- Environmental Concerns: VOC emissions from certain products can cause health issues such as respiratory irritation, skin problems, and long-term environmental damage. This has led to stricter regulations worldwide.

- Raw Material Price Volatility: Most construction chemicals rely on petrochemical derivatives, making them vulnerable to fluctuating oil and feedstock prices.

- Fragmentation and Competition: The market consists of numerous global and regional players, leading to intense competition and price pressures.

- Adoption Barriers in Developing Nations: Cost sensitivity, lack of technical awareness, and limited skilled manpower can slow down the adoption of advanced chemical solutions.

Opportunities

Looking ahead, the construction chemicals industry is poised for significant transformation. Companies focusing on eco-friendly formulations, such as low-VOC coatings and bio-based admixtures, will gain a competitive edge. Investment in research and development is expected to unlock innovative solutions like nanotechnology-based chemicals and multifunctional admixtures.

Localization of manufacturing facilities in emerging markets will also be crucial to reduce costs and respond quickly to regional demand. Additionally, partnerships between chemical producers and construction firms can strengthen supply chains and foster the adoption of advanced solutions.

Key Industry Developments:

- In July 2021 – Saint-Gobain entered into an agreement to acquire Chryso, a leading global player in the construction chemicals market. The acquisition of Chryso perfectly fits within Saint-Gobain’s strategic vision of worldwide leadership for sustainable construction. It will further expand the Group’s presence in the growing construction chemicals market with combined sales of more than €3 billion across 66 countries.

- In June 2021 – JSW Cement, India’s leading Green cement company, has entered the Construction Chemical sector with the launch of a unique green product range in the category. The Construction Chemical category offers new opportunities for JSW Cement to combine innovation in concrete mix products with responsible construction. With this development, the company will expand its business.

Outlook

The construction chemicals market is set for robust growth in the coming decade, fueled by rapid urbanization, infrastructure expansion, and the global push for sustainable building solutions. While environmental regulations and raw material costs pose challenges, companies that innovate and adapt will thrive. With strong demand across both residential and non-residential sectors, construction chemicals will continue to play a pivotal role in shaping the future of global infrastructure.

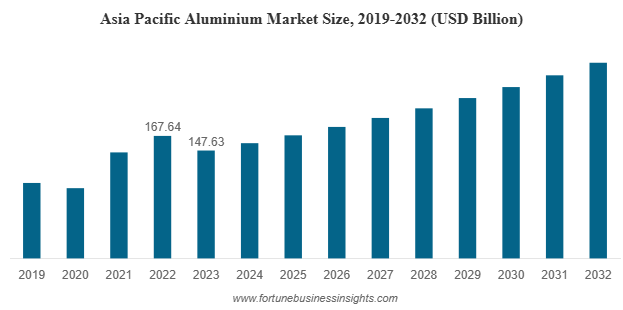

In 2023, the global aluminium market was valued at USD 229.85 billion. It is expected to grow from USD 249.83 billion in 2024 to USD 403.29 billion by 2032, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period. The Asia Pacific region led the market, accounting for 64.23% of global share in 2023. In the United States, the aluminium market is also set to experience substantial growth, with projections estimating it will reach USD 43.05 billion by 2032. This growth is largely driven by the increasing use of aluminium in electric vehicles as manufacturers seek to reduce vehicle weight and improve energy efficiency.

The global aluminium market is entering a period of robust expansion, driven by rising demand across key industries such as transportation, construction, packaging, and renewable energy. With its unique combination of light weight, high strength, corrosion resistance, and recyclability, aluminium market continues to be the metal of choice in a world increasingly focused on sustainability and efficiency.

List of Top Aluminium Companies:

- RusAL (Russia)

- Aluminum Corporation of China Limited (CHALCO) (China)

- Rio Tinto (U.K.)

- Alcoa Corporation (U.S.)

- Emirates Global Aluminium (UAE)

- Norsk Hydro ASA (Norway)

- Hindalco Industries Ltd. (India)

- Vedanta Aluminium & Power (India)

- China Hongqiao Group Limited (China)

Key Market Drivers

- Surge in Transportation and Electric Vehicles

One of the most prominent demand drivers for aluminium market is the transportation sector. Aluminium market strength-to-weight ratio makes it an ideal material for automotive, aerospace, and marine applications. As industries aim to reduce carbon emissions and improve fuel efficiency, the demand for lightweight materials like aluminium market is surging.

Electric vehicle (EV) manufacturers are particularly heavy adopters of aluminium market. It is increasingly used in battery enclosures, chassis, wheels, doors, and structural frames. With EV adoption expected to rise globally, aluminium market consumption in this sector is set to accelerate.

- Construction and Infrastructure Development

The construction sector remains one of the largest consumers of aluminium,market and this trend is expected to continue in the coming years. Urbanization, population growth, and infrastructure development projects—especially in emerging economies—are contributing to rising demand for aluminium market in applications such as window frames, curtain walls, roofing, and structural components.

Moreover, aluminium market aesthetic appeal, resistance to corrosion, and high durability make it a preferred material for modern architecture and green buildings.

- Sustainability and Recycling

Aluminium market is one of the most recyclable materials available, retaining its properties even after repeated recycling. Recycling aluminium market consumes up to 95% less energy than producing primary aluminium market from bauxite ore. This energy efficiency has turned recycled, or secondary, aluminium market into a major growth area.

As industries and governments move towards circular economy models, the use of secondary aluminium market is expected to increase significantly. Recycled aluminium market is being widely adopted in automotive parts, construction materials, and consumer products.

- Rising Demand for Aluminium Market Packaging

With growing concerns about plastic waste and increasing regulatory restrictions on single-use plastics, aluminium market is emerging as a sustainable alternative in the packaging industry. Aluminium market cans, foils, and containers are fully recyclable, lightweight, and suitable for preserving food and beverages.

This trend is driving growth in the aluminium packaging segment, particularly in food and beverage applications where sustainability credentials are increasingly important to consumers and regulators alike.

- Technological Advancements and Low-Carbon Aluminium Market

Aluminium market producers are increasingly investing in cleaner and more efficient technologies to produce low-carbon aluminium market. Innovations in smelting processes, renewable energy usage, and carbon capture are helping to reduce the environmental footprint of aluminium market production.

Major producers are entering into long-term power purchase agreements with renewable energy suppliers and exploring breakthrough technologies such as inert anode smelting, which replaces carbon-based anodes with materials that emit oxygen instead of carbon dioxide during the electrolysis process.

Read More : https://www.fortunebusinessinsights.com/industry-reports/aluminium-market-100233

Market Segmentation Highlights

The aluminium market is segmented based on product form, alloy type, and end-use application. In terms of product form, cast products held the largest share in 2023, driven by their widespread use in automotive components, machinery, and general engineering. However, the sheet segment is expected to witness the highest growth rate, fueled by increased usage in vehicle body panels, packaging, and building materials.

By alloy type, wrought aluminium market alloys are expected to maintain a leading share due to their superior mechanical properties and ease of fabrication. Cast alloys remain important for specific industrial uses where complex shapes and lower costs are priorities.

In terms of end-use industries, transportation held the largest market share in 2023, with continued growth anticipated due to light weighting trends and EV proliferation. The construction sector is also projected to grow rapidly, followed by packaging, electrical, and machinery applications.

Regional Outlook

Asia Pacific dominated the global aluminium market in 2023, accounting for over 64% of total consumption. This dominance is attributed to rapid industrialization, urban development, and manufacturing activity in countries such as China and India.

North America is experiencing steady growth, especially in automotive and aerospace sectors. The United States is also seeing a surge in aluminium market demand due to new EV manufacturing plants and infrastructure upgrades.

In Europe, environmental regulations and the region’s focus on sustainable manufacturing are propelling demand for green aluminium market. Meanwhile, Latin America, the Middle East, and Africa are witnessing gradual growth, driven by infrastructure investments and industrial development.

Key Industry Players and Strategic Moves

Leading players in the aluminium market include RUSAL, Aluminium Corporation of China (CHALCO), Alcoa Corporation, Rio Tinto, Emirates Global Aluminium, Norsk Hydro ASA, Hindalco Industries, and Vedanta. These companies are focusing on capacity expansions, technological innovation, strategic partnerships, and sustainability initiatives to strengthen their market positions.

For instance, Emirates Global Aluminium market has introduced digital manufacturing platforms to enhance efficiency, while companies like Alcoa and Rio Tinto are advancing their low-carbon aluminium market offerings to meet rising environmental standards.

Key Industry Developments:

- May 2024 - Emirates Global Aluminium launched the region’s first digital manufacturing platform with a vision to advance its Industry 4.0 strategy. The move is anticipated to unlock additional value for the company.

- January 2024 - Alcoa announced that it would supply low-carbon aluminium to global cable manufacturer Nexans, manufactured using ELYSIS technology. ELYSIS is a technology partnership for the production of aluminium without direct greenhouse gas emissions, generating oxygen as a byproduct.

Future Outlook and Strategic Recommendations

The outlook for the global aluminium market is highly positive. As demand continues to grow across sectors, companies must adapt to shifting dynamics through innovation, sustainability, and strategic investments.

Key recommendations for industry stakeholders include:

- Expanding recycling infrastructure to tap into the growing demand for secondary aluminium

- Investing in energy-efficient and low-carbon production technologies

- Targeting high-growth sectors such as EVs, construction, and packaging

- Forming strategic alliances to enhance technological capabilities and global reach

- Aligning business strategies with environmental regulations and ESG expectations

In conclusion, aluminium market’s unique properties, combined with favorable market trends and regulatory shifts, are positioning it as a critical material for the future. Whether it's powering the next generation of electric vehicles or supporting sustainable urban infrastructure, aluminium market is poised to play a central role in shaping tomorrow’s industries.

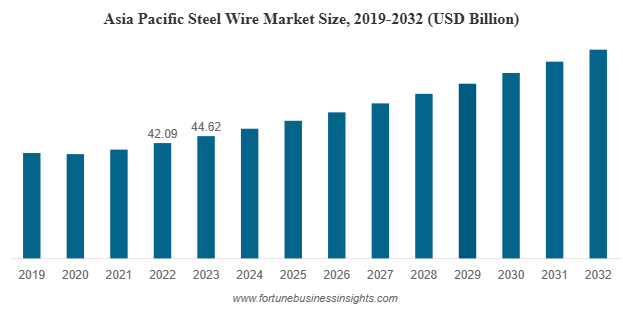

The global steel wire market was valued at USD 68.90 billion in 2023 and is expected to rise to USD 72.84 billion in 2024, reaching approximately USD 114.59 billion by 2032. This represents a steady compound annual growth rate (CAGR) of 5.8% over the forecast period. In 2023, Asia Pacific led the market, accounting for a dominant 64.76% share, largely driven by rapid infrastructure development and industrial expansion in the region. Meanwhile, the U.S. steel wire market is also poised for significant growth, with projections estimating it will reach USD 7.68 billion by 2032. This growth is fueled by increasing adoption of steel wire in the electric vehicle (EV) sector and ongoing demand from the construction industry.

List Of Key Companies Profiled:

- ArcelorMittal S.A. (Luxembourg)

- Bridon-Bekaert Ropes Group (Belgium)

- Heico Companies’ Metal Processing Group (U.S.)

- Optimus Steel (U.S.)

- HBIS GROUP (China)

- KOBE STEEL, LTD. (Japan)

- WireCo WorldGroup Inc. (U.S.)

- JFE Steel Corporation (Japan)

- Nippon Steel Corporation (Japan)

- Insteel Industries (U.S.)

Current Market Outlook

The global steel wire market is experiencing robust growth, with projections indicating a significant surge by 2032. This growth is underpinned by rising demand across various industries including construction, automotive, energy, and manufacturing. As nations around the world push for infrastructure development and industrial expansion, steel wire remains a vital material due to its strength, versatility, and reliability.

Key Drivers of Market Growth

- Infrastructure and Construction Boom

Construction remains the single largest consumer of steel wire globally. With ongoing urbanization, particularly in Asia-Pacific, the demand for steel wire in bridges, buildings, tunnels, and transport systems continues to rise. Steel wire is commonly used for reinforcing concrete structures, securing scaffolding, and in fencing and binding applications. The increasing need for durable and cost-effective construction materials makes steel wire indispensable.

Government initiatives across developing economies to build roads, railways, and urban housing further contribute to demand. For instance, large infrastructure projects in India, China, and Southeast Asia are driving a massive uptick in steel consumption, including steel wire.

- Automotive Industry Expansion

Another major application area is the automotive sector, where steel wire is used in tire reinforcement, suspension springs, and engine components. With the global shift toward electric vehicles (EVs), there is a growing requirement for high-strength, lightweight, and corrosion-resistant steel wires. Wires are also integral in EV battery compartments, wire harnesses, and control systems.

As automakers invest heavily in innovation and lightweight materials, the demand for specialized steel wire products is anticipated to grow in parallel. The increasing focus on vehicle safety and efficiency continues to fuel the need for high-performance wire solutions.

- Industrial Machinery and Tools

Steel wire is a core material in industrial tools, conveyor belts, cranes, and machinery. It is widely used for lifting, pulling, and mechanical transmission applications due to its strength and resilience. As industries modernize and automate, the demand for reliable wire products grows. Additionally, the expansion of manufacturing hubs in Asia, Eastern Europe, and South America is creating fresh opportunities in this space.

- Energy Sector Growth

Steel wire plays a crucial role in power transmission lines, oil rigs, and wind turbines. The global transition toward renewable energy is also opening up new avenues for steel wire applications. Wind energy, in particular, requires high-strength steel wires for turbine components, while the electrification of rural areas in developing nations is boosting the use of steel wire in transmission infrastructure.

Read More : https://www.fortunebusinessinsights.com/steel-wire-market-102581

Material Trends in the Steel Wire Market

Carbon Steel Leads the Pack

Among the various grades, carbon steel continues to dominate the market due to its cost-effectiveness and widespread availability. It is preferred in applications where tensile strength is crucial, such as construction and automotive parts. Carbon steel wire is also easier to process and weld, adding to its popularity.

Stainless and Alloy Steels Gaining Traction

While carbon steel holds the largest share, stainless steel and alloy steel wires are growing steadily in demand. These are used in applications that require corrosion resistance, higher temperature tolerance, and longevity—such as in chemical plants, marine environments, and medical devices.

Thickness Preferences and Market Segmentation

Steel wire is produced in a wide range of thicknesses. Wires with diameters between 0.5 mm and 1.6 mm account for the largest market share. These are versatile and used in everything from fencing and fasteners to springs and mesh.

However, ultra-thin wires—especially those under 0.02 mm—are expected to be the fastest-growing segment. These ultra-fine wires are increasingly used in electronics, aerospace, and medical equipment where precision and miniaturization are essential.

Regional Highlights

- Asia-Pacific Dominates

Asia-Pacific remains the largest and fastest-growing region in the steel wire market, accounting for nearly two-thirds of global demand. Countries like China, India, Japan, and South Korea are leading both in production and consumption. Rapid urbanization, strong manufacturing bases, and government-backed infrastructure projects are key contributors.

- Europe and North America Remain Stable

While growth in Europe and North America is more moderate, both regions have mature industrial sectors with steady demand for steel wire in automotive, construction, and renewable energy projects. Innovation in wire manufacturing and sustainability practices are strong focus areas in these markets.

Challenges and Market Restraints

Despite its growth, the steel wire market faces several challenges. The availability of substitutes like synthetic and composite materials in applications such as ropes and cables is putting competitive pressure on steel wire. These alternatives often offer lighter weight or higher corrosion resistance, though not always the same strength or durability.

Additionally, fluctuating raw material prices and energy costs can impact profitability for manufacturers. Regulatory pressures around carbon emissions and sustainability are also pushing companies to invest in cleaner production technologies.

Key Industry Developments:

- July 2023: KOBE Steel announced that its Kobenable Steel, a low-CO2 blast furnace steel product, has opted for special steel wire rods in automobiles in Japan for the first time.

- March 2023 - Systematic Group, one of the leading GI wire manufacturers in India has acquired a new manufacturing unit in Kolkata to expand their operations and introduce wires made from Green Steel in the country. This development has the helped the company to cater to the Eastern market region.

Future Outlook and Opportunities

Looking ahead, the steel wire market holds promising opportunities:

- Rising demand for electric vehicles and green energy projects

- Expansion of telecommunication and electrical infrastructure in developing countries

- Increasing applications of specialty wires in aerospace, medical, and electronics sectors

- Strong investments in construction and smart city projects

Manufacturers that can innovate in wire design, improve energy efficiency, and offer customized solutions for niche applications will be best positioned for future growth.

The steel wire market is poised for steady expansion, driven by infrastructure development, industrialization, and the evolving needs of modern industries. With the global economy continuing to prioritize construction, electrification, and clean energy, steel wire will remain a critical material well into the next decade. As companies adapt to sustainability demands and technological shifts, the industry is set to transform while sustaining its essential role in global development.

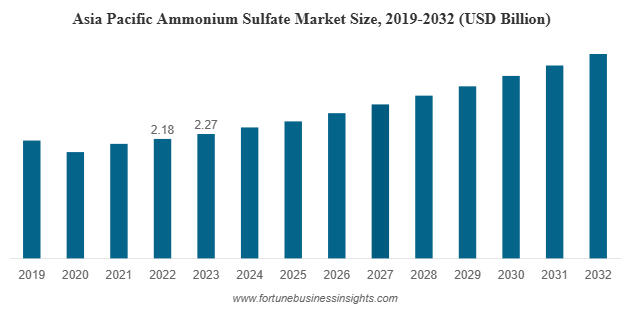

The global ammonium sulfate market was valued at USD 8.20 billion in 2023 and is expected to expand from USD 8.58 billion in 2024 to USD 13.00 billion by 2032, registering a CAGR of 5.3% during the forecast period. Asia Pacific led the market in 2023 with a 27.68% share, while the U.S. market is projected to reach USD 2.29 billion by 2032, driven by the increasing use of nitrogen-based fertilizers in agriculture and the rising demand across various industrial applications.

List Of Key Companies Profiled:

- BASF (Germany)

- Evonik (Germany)

- Sumitomo Corporation (Japan)

- Lanxess (Germany)

- Domo Chemicals (Germany)

- Arkema (France)

- Fibrant (Netherlands)

- Royal DCM (Netherlands)

- Novus International (U.S.)

- ArcelorMittal (Luxembourg)

Market Growth and Forecast

The increasing use of ammonium sulfate market as a nitrogen fertilizer is the core growth driver. Its efficiency in alkaline soils and its role in replenishing sulfur levels make it a preferred choice in modern agriculture. Additionally, its growing applications across industrial sectors add further momentum to the market outlook.

Key Market Trends

Adoption of Advanced Production Technologies

Manufacturers are implementing advanced technologies such as vacuum thermal stripping and vacuum absorption to produce high-purity crystalline ammonium sulfate. These innovations improve resource recovery, enhance efficiency, and ensure sustainable production practices.

Rising Focus on Sustainability

With global emphasis on reducing carbon footprints, the ammonium sulfate industry is shifting toward greener production processes. Companies are exploring renewable energy sources, optimizing supply chains, and innovating in eco-friendly packaging and distribution.

Expansion of Industrial Applications

While agriculture remains the largest consumer, ammonium sulfate is increasingly being used in water treatment, flame retardants, textile dyeing, leather processing, and as a food additive. It also finds roles in pharmaceutical manufacturing, laboratory processes such as NMR spectroscopy, and even vaccine production.

Launch of Liquid Ammonium Sulfate Products

The introduction of liquid ammonium sulfate variants, which are easier to apply and mix with other agricultural inputs, is gaining popularity. Such innovations are expected to support market expansion in the coming years.

Growth Drivers

- Agricultural Demand

Rising population and limited arable land have increased the need for efficient fertilizers. Ammonium sulfate provides nitrogen while improving soil sulfur levels, making it ideal for intensive farming. - Industrial Utilization

Its versatile applications in chemicals, textiles, food processing, and pharmaceuticals create steady demand outside of agriculture. - Regional Growth in Asia Pacific

Government support for fertilizer usage, rising mechanized farming practices, and growing food production needs continue to make Asia Pacific a key market. - Technological Advancements

New production technologies enhance cost efficiency and product quality, encouraging wider adoption across industries.

Read More : https://www.fortunebusinessinsights.com/ammonium-sulphate-market-102306

Challenges in the Market

Despite promising growth, the ammonium sulfate market faces several challenges:

- Toxicity Concerns: Exposure can cause health risks such as skin and eye irritation, while environmental impacts on aquatic life raise regulatory concerns.

- Raw Material Volatility: Dependence on ammonia, sulfur, and energy inputs exposes producers to price fluctuations.

- Regulatory Compliance: Stricter safety and environmental regulations in certain regions may increase operational costs.

- Market Competition: Intense competition and limited differentiation among products can lead to price pressures and reduced margins.

Regional Insights

- Asia Pacific: The largest market, supported by extensive agricultural activities, growing populations, and government subsidies for fertilizers.

- North America: Demand is supported by modern farming practices, growing specialty fertilizer usage, and water treatment applications.

- Europe: Strong agricultural industry combined with stringent environmental standards drive consistent but regulated demand.

- Latin America and Middle East & Africa: Emerging markets with rising agricultural mechanization and growing industrial activities are expected to provide new opportunities.

Key Industry Developments:

- July 2022 - Evonik Industries AG announced that it signed a supply agreement with Interoceanic Corporation (IOC), a manufacturer of fertilizers and industrial chemicals, to supply blueSulfate, a liquid ammonium sulfate (8-0-0-9) solution.

- July 2019—Arkema completed the acquisition of Arrmaz, a manufacturer of specialty surfactants for crop nutrition, infrastructure, and the mining market. This acquisition is another milestone in Arkema’s journey toward specialty chemicals and is expected to reinforce the company's product profile.

Future Outlook

The ammonium sulfate market is poised for significant growth over the next decade. Rising global food demand, technological innovations, and increasing industrial adoption will continue to drive momentum. However, companies must balance growth with environmental compliance and sustainable practices to remain competitive.

Future opportunities lie in:

- Developing eco-friendly and differentiated ammonium sulfate products.

- Expanding production in high-demand regions like Asia Pacific.

- Leveraging advanced technologies for cost efficiency and product purity.

- Exploring partnerships in industrial applications such as water treatment and pharmaceuticals.

The ammonium sulfate market presents a blend of traditional agricultural demand and modern industrial applications, making it an attractive sector for both established and emerging players. With a projected CAGR of 5.3% from 2024 to 2032, the industry’s growth potential remains strong. By focusing on innovation, sustainability, and strategic regional expansion, market leaders can unlock new opportunities and secure long-term success.

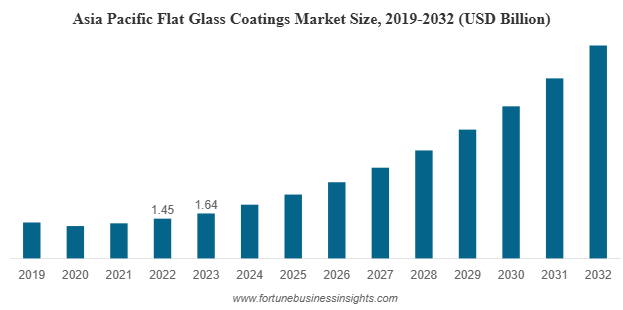

In 2023, the global flat glass coatings market was valued at USD 2.50 billion and is expected to grow steadily, reaching USD 2.98 billion in 2024 and surging to approximately USD 11.5 billion by 2032. This reflects a robust compound annual growth rate (CAGR) of 18.0% over the forecast period. Asia Pacific led the market in 2023, accounting for a dominant 65.6% share due to rapid urbanization and infrastructure development. Meanwhile, the U.S. market is also poised for strong growth, with projections estimating it will reach around USD 802.46 million by 2032, largely fueled by rising demand for flat glass coatings in architectural applications.

The global flat glass coatings market is undergoing a significant transformation, driven by advancements in technology, rising demand for energy-efficient solutions, and increasing construction and infrastructure development across the world. What was once a niche segment is now becoming central to various industries including construction, automotive, solar energy, and consumer electronics.

List Of Key Companies Profiled:

- Arkema S.A. (France)

- The Sherwin-Williams Company (U.S.)

- Nippon Sheet Glass Co., Ltd (Japan)

- Guardian Glass (U.S.)

- Ferro Corporation (U.S.)

- Fenzi Group (Italy)

- Corning Inc. (U.S.)

- Vitro Architectural Glass (Mexico)

- Hesse GmbH & Co. KG (Germany)

- Viracon (U.S.)

Market Overview

Flat glass coatings market are applied to glass surfaces to enhance durability, improve aesthetics, and offer functional benefits such as anti-reflection, UV protection, anti-glare, self-cleaning, and energy efficiency. These coatings are used in numerous sectors, but their primary demand comes from architectural applications (both commercial and residential), solar power installations, and the automotive industry.

The coatings are manufactured using different technologies such as solvent-based, water-based, and nano coatings. The resin systems used include acrylic, epoxy, polyurethane, and others, each offering specific benefits depending on the application. Among them, acrylic-based coatings have gained significant traction due to their durability, weather resistance, and cost-effectiveness.

Key Market Drivers

- Surge in Solar Energy Installations

The growing global emphasis on renewable energy has led to a surge in solar panel installations. Flat glass coatings are crucial for enhancing the efficiency and longevity of photovoltaic panels. Coatings like anti-reflective and self-cleaning types not only boost energy absorption but also reduce maintenance costs. As governments across the globe push for clean energy adoption, the demand for coated solar glass is expected to increase exponentially.

- Growth in Green Building and Infrastructure Projects

Urbanization, rising energy costs, and environmental awareness have led to increased demand for green buildings. Coated flat glass plays a pivotal role in energy-efficient architecture. These coatings help reduce heat ingress, improve insulation, and allow natural light to enter buildings without harmful UV rays. This reduces the need for artificial cooling and lighting, cutting down on energy bills and environmental impact.

- Advancements in Nano Coating Technology

The rise of nano coatings is another major driver. Nano coatings offer advanced properties such as self-cleaning, antimicrobial, and anti-fogging capabilities. Their microscopic structure enables enhanced adhesion and durability without compromising the transparency of the glass. These coatings are now widely used in luxury buildings, hospitals, and high-tech automotive designs.

- Expanding Automotive Industry

In the automotive sector, flat glass coatings are used for windshields, windows, and sunroofs to improve visibility, safety, and passenger comfort. Features like glare reduction, UV filtering, and hydrophobic (water-repellent) surfaces are becoming standard in modern vehicles. As the automotive industry continues to innovate and grow, especially in electric vehicles and autonomous driving systems, the demand for coated flat glass is expected to rise.

Read More : https://www.fortunebusinessinsights.com/flat-glass-coatings-market-102910

Regional Insights

Asia Pacific leads the global market and accounted for over 65.6% of the market share in 2023. Countries like China and India are investing heavily in infrastructure development, solar power projects, and high-rise buildings. India, in particular, is projected to grow at a CAGR of over 18% during the forecast period.

North America and Europe are also significant markets, driven by stringent energy efficiency regulations, advanced construction technologies, and high demand for luxury architectural finishes. The presence of major players and research centers in these regions further supports innovation and growth.

Challenges in the Market

Despite the positive outlook, the flat glass coatings market faces several challenges:

- Environmental Regulations: Solvent-based coatings emit volatile organic compounds (VOCs), which are harmful to the environment. Regulatory bodies across the world are imposing strict norms to limit VOC emissions, pushing manufacturers to invest in water-based and eco-friendly alternatives.

- High Production Costs: The development and application of advanced coatings such as nano and multi-functional coatings can be cost-intensive. This can affect adoption in price-sensitive markets.

- Raw Material Volatility: The availability and cost of raw materials, such as specialty chemicals and resins, can fluctuate significantly due to geopolitical tensions, supply chain disruptions, or inflation.

Key Industry Developments:

- September 2021: Guardian Glass started to produce 130” x 240” or superjumbo, SunGuard coatings on clear or Guardian UltraClear float glass at its Carleton, Michigan facility. The flat glass manufacturer has responded to the demand from architects who have pushed design boundaries with buildings that maximize views and natural light for occupants in forward-thinking facades while also reaching energy performance codes and standards.

- April 2021: Ferro Corporation, a leading global supplier of technology-based functional coatings and color solutions, announced that Prince International Corporation (Prince) has completed the previously announced acquisition of Ferro.

Future Outlook

The future of the flat glass coatings market looks promising. With ongoing innovations, increased awareness of energy-efficient solutions, and government initiatives supporting clean technologies, the demand for high-performance glass coatings is expected to keep rising.

Moreover, the integration of smart coatings, such as electrochromic and thermochromic glass, will open new avenues for market expansion, especially in smart buildings and automotive applications.

In conclusion, the flat glass coatings industry stands at the intersection of technology, sustainability, and design. As consumer expectations grow and regulatory frameworks evolve, companies that prioritize innovation, efficiency, and environmental compliance will be best positioned to lead this rapidly growing market.

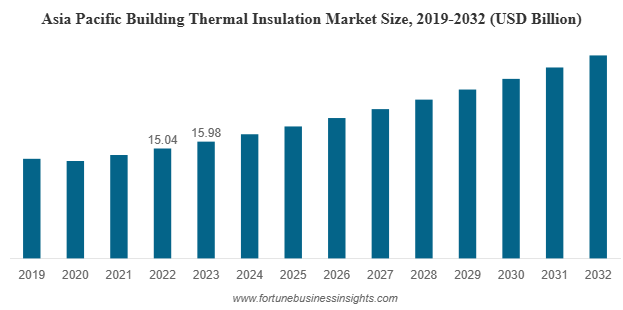

The global building thermal insulation market was valued at USD 32.53 billion in 2023 and is expected to expand from USD 33.98 billion in 2024 to USD 48.60 billion by 2032, registering a CAGR of 4.5% during the forecast period. Asia Pacific led the market in 2023 with a dominant 49.12% share, driven by rapid urbanization and construction growth. In the United States, the market is projected to reach USD 7.60 billion by 2032, supported by strong government initiatives promoting energy-efficient technologies in the building and construction sector.

List Of Top Building Thermal Insulation Companies:

- BASF (Germany)

- Atlas Roofing Company (U.S.)

- Cellofoam North America Inc. (U.S.)

- DuPont (U.S.)

- Knauf Insulation (U.S.)

- Owens Corning (U.S.)

- Armacell S.A. (Luxembourg)

- Beijing New Building Material (Group) Co., Ltd. (China)

- Evonik (Germany)

- Bondor Indonesia (Indonesia)

- BYUCKSAN (South Korea)

Key Growth Drivers

- Infrastructure Expansion and Urbanization in Asia-Pacific

Asia-Pacific continues to be the leading region in the global building thermal insulation market, accounting for nearly half of the global share in 2023. Rapid urbanization in countries such as China, India, and those in Southeast Asia is creating a surge in demand for new residential and commercial buildings. Governments in these regions are also prioritizing energy-efficient building codes, further fueling the adoption of insulation materials.

- Energy Efficiency and Regulatory Frameworks

One of the most significant growth drivers is the increasing focus on reducing energy consumption in buildings. Heating and cooling account for a large portion of energy use, and effective thermal insulation plays a crucial role in minimizing losses. Governments across Europe, North America, and Asia are implementing stricter building codes and energy performance standards. These regulations are compelling builders and property owners to incorporate insulation materials to meet compliance requirements and reduce energy costs.

- Rise of DIY-Friendly Products

With rising labor costs and increasing consumer interest in cost-saving solutions, there is growing demand for insulation materials that can be installed without professional assistance. Manufacturers are responding by introducing user-friendly products such as spray foams, lightweight panels, and easy-to-apply insulating sheets. This trend is particularly strong in developed markets, where homeowners are keen on undertaking small renovation projects themselves.

Market Segmentation Insights

- By Material

Foamed plastics, which include expanded polystyrene (EPS), extruded polystyrene (XPS), polyurethane (PU), and polyisocyanurate (PIR), dominated the market in 2023. These materials are preferred for their lightweight properties, cost-effectiveness, and versatility in different climatic conditions. Mineral wool, comprising glass wool and stone wool, is also widely used due to its excellent fire resistance and acoustic insulation qualities. Other advanced materials, such as aerogels and cellulose, are gaining attention for their superior performance, though their high cost limits mass adoption.

- By Application

Roof and ceiling insulation accounted for the largest market share in 2023. Roofs are often the most exposed part of a building, and effective insulation in this area significantly reduces heat transfer. Wall insulation is another major segment, particularly important in both hot and cold climates. Floors and basements also represent a growing application area, especially in regions with extreme weather conditions where comprehensive building insulation is necessary.

- By End-Use Sector

The residential sector continues to dominate the market, driven by urban growth, government incentives, and consumer awareness. Rising middle-class populations in emerging economies are also contributing to residential construction growth. Meanwhile, non-residential buildings such as offices, retail spaces, hospitals, and educational institutions are adopting insulation solutions to comply with green building standards and to cut operational costs.

Challenges and Restraints

Despite strong growth prospects, the industry faces several challenges. Certain insulation materials, such as glass wool, can cause respiratory irritation during installation, raising concerns about worker safety. Similarly, foamed plastics like polystyrene have faced regulatory scrutiny due to emissions of potentially harmful compounds. These health and environmental concerns could restrain adoption unless manufacturers develop safer alternatives.

Another major restraint is the high cost of advanced materials. While products like aerogels deliver exceptional thermal performance, their elevated price makes them less accessible in cost-sensitive markets. This limits their usage primarily to specialized applications where performance outweighs cost considerations.

Read More : https://www.fortunebusinessinsights.com/building-thermal-insulation-market-102708

Regional Outlook

- Asia-Pacific: The region remains the largest and fastest-growing market, driven by massive construction activities, urban population growth, and government-led initiatives for sustainable infrastructure.

- North America: Growth is fueled by incentives for energy-efficient construction, heightened awareness of sustainable building practices, and infrastructure investments. The United States and Canada are leading in the adoption of innovative insulation products.

- Europe: The region is focusing heavily on retrofitting older buildings to improve energy efficiency. Strict building regulations, combined with consumer awareness of sustainability, are spurring demand for mineral wool and eco-friendly materials.

Key Industry Developments:

- April 2021 – Atlas Roofing Company introduced SureSlope prefabricated tapered products. The new product family of polyiso roof insulation components is ideal for roofing applications, reducing job site waste and decreasing installation time.

- March 2021 - Owens Corning acquired vliepa GmbH, a company specializing in coating, printing, and finishing nonwovens, film, and paper for the construction industry. The acquisition widens the company’s nonwovens portfolio for European customers working in the regional construction industry.

Future Opportunities

The future of the building thermal insulation market looks promising, with several opportunities shaping the landscape:

- Green Building and Net-Zero Energy Goals: With global momentum around green certifications and net-zero energy buildings, demand for high-performance insulation materials is expected to soar.

- Retrofitting Projects: Developed regions are witnessing a growing need to insulate existing structures, offering significant opportunities for insulation providers.

- Innovation in Materials: Companies investing in sustainable, non-toxic, and biodegradable insulation solutions are likely to gain a competitive edge.

- Expansion of DIY Market: Products designed for easy installation are set to become a mainstream growth driver, catering to homeowners and small-scale projects.

Outlook