Category: Chemicals & Advanced Materials

3D Printing Materials Market Insights, Challenges, Key Players & Forecast 2032

By Sharvari, 2025-09-08

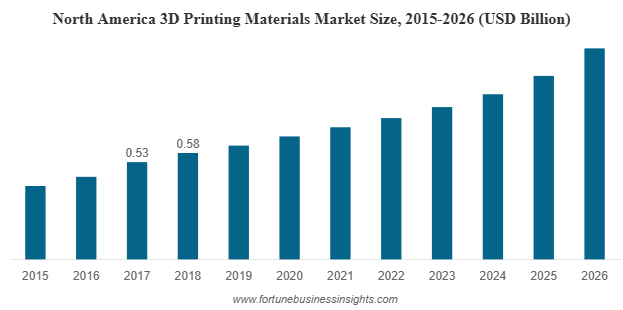

The global 3D printing materials market size was valued at USD 1.53 billion in 2018 and is expected to reach USD 3.78 billion by 2026, registering a CAGR of 12.1% over the forecast period. North America led the market with a 37.91% share in 2018, while the U.S. market alone is projected to hit USD 1.28 billion by 2026, fueled by the rapid adoption of additive manufacturing across diverse industries.

The 3D printing materials market is experiencing rapid expansion as industries across the globe embrace additive manufacturing for prototyping, production, and customization. From plastics and metals to advanced composites and biocompatible materials, the demand for innovative and efficient 3D printing solutions continues to reshape industries such as aerospace, automotive, healthcare, and consumer goods. This article explores the market size, growth drivers, material segments, regional dynamics, and future outlook of this fast-growing industry.

Market Size and Growth Projections

The global 3D printing materials market has grown from being a niche sector to a multi-billion-dollar industry. In recent years, the market size has increased significantly due to the rising adoption of 3D printing technologies in both prototyping and large-scale production. Forecasts suggest that the market will maintain strong momentum, with double-digit compound annual growth rates (CAGR) projected over the next decade.

Plastics remain the most widely used material type, primarily due to their affordability and versatility. However, metals and specialty materials are quickly catching up, especially in high-performance sectors like aerospace and medical implants. The combination of increasing industrial adoption, technological innovations, and declining costs is positioning the market for exponential growth.

List of Top 3D Printing Materials Market Companies:

- Stratasys Ltd.

- 3D Systems, Inc.

- Materialise NV

- Markforged, Inc.

- EOS GmbH

- Höganäs AB

- Arkema

- Royal DSM N.V.

- ExOne

- GE Additive

- Evonik Industries AG

Key Market Drivers

- Rapid Prototyping and Customization

One of the primary drivers of the 3D printing materials market is the ability to produce prototypes quickly and at a lower cost. Unlike traditional manufacturing methods, 3D printing allows designers and engineers to test and refine products in days rather than weeks. Customization is another strong advantage, enabling industries to create tailored products, from medical implants to consumer electronics casings.

- Increasing Demand Across Industries

Sectors such as aerospace, automotive, and healthcare are leading adopters of 3D printing. Aerospace companies use lightweight yet strong 3D printed parts to enhance fuel efficiency. Automakers are deploying 3D printing for prototyping, spare parts, and even functional components. In healthcare, biocompatible 3D printing materials are revolutionizing prosthetics, implants, and surgical tools.

- Waste Reduction and Sustainability

3D printing materials support sustainability goals by reducing material waste compared to subtractive manufacturing processes. Companies are also investing in recyclable and eco-friendly materials to align with global sustainability initiatives.

- Advancements in Material Science

The continuous development of new materials—ranging from high-performance metals to flexible polymers and composite blends—is fueling innovation. These materials expand the scope of 3D printing applications and improve performance across industries.

Market Restraints

Despite strong growth prospects, the market faces certain challenges. The cost of 3D printing materials is considerably higher compared to traditional raw materials, often 10 to 15 times more expensive. This cost factor restricts adoption in small and medium-sized enterprises. Additionally, technical barriers such as material limitations, slower production speed compared to conventional methods, and lack of skilled professionals can hinder widespread adoption.

Material Segment Analysis

- Plastics: The most dominant material segment, offering cost-effective and versatile options for prototyping and functional parts.

- Metals: Gaining momentum with applications in aerospace, automotive, and healthcare. Titanium, aluminum, and steel are widely used for their strength and durability.

- Photopolymers: Known for their precision and surface finish, these materials are increasingly popular in dental and medical applications.

- Composites and Others: High-performance composites are emerging as game-changers, providing enhanced strength-to-weight ratios and durability for demanding industries.

Read More : https://www.fortunebusinessinsights.com/3d-printing-material-market-102296

Future Trends

The future of the 3D printing materials market is defined by innovation and expansion. Key trends include:

- Sustainable Materials: Increased focus on recyclable and biodegradable 3D printing materials.

- Multi-Material Printing: The ability to combine multiple materials in a single print to create advanced, multifunctional products.

- AI Integration: Artificial intelligence will optimize material use, improve quality control, and enhance design capabilities.

- Healthcare Innovations: Growth in bio-printing and customized medical devices will continue to transform the healthcare industry.

Regional Insights

- North America: Currently the largest regional market, supported by strong aerospace and defense industries, along with significant investments in healthcare innovation.

- Europe: A major hub for automotive and industrial applications, with countries like Germany, France, and the UK adopting advanced 3D printing technologies.

- Asia Pacific: Expected to grow at the fastest pace due to expanding manufacturing industries in China, Japan, and South Korea. Rising investments and government initiatives are fueling adoption across the region.

- Rest of the World: Countries in Latin America and the Middle East are gradually adopting 3D printing technologies, especially in industrial and healthcare applications.

Industry Applications

- Aerospace and Defense: Lightweight, high-strength materials are widely used for structural and functional parts, reducing fuel costs and improving efficiency.

- Automotive: Automakers leverage 3D printing for design validation, custom components, and spare parts production.

- Healthcare: Biocompatible materials enable the production of prosthetics, implants, surgical instruments, and even experimental bio-printing.

- Consumer Goods and Electronics: Customization, rapid design, and aesthetic flexibility drive demand for 3D printed materials in fashion, electronics, and household products.

Key Industry Developments:

- September 2019 – 3D Systems launched new materials for 3D printing namely PRO-BLK 10, and HI-TEMP 300-AMB. The new products will diversify the company’s product portfolio and expand the range of applications for customers.

- November 2018 – Royal DSM N.V. launched “Arnitel ID2060 HT”, a high-performance thermoplastic copolyester for 3D printing by using fused filament fabrication. The filament offers a balance of properties such as chemical resistance, flexibility, and high-temperature resistance.

Future Outlook

The global 3D printing materials market is on an impressive growth trajectory, driven by rapid prototyping, industrial adoption, sustainability goals, and breakthroughs in material science. While high costs remain a challenge, continuous research, innovation, and scaling will reduce barriers over time. With industries from aerospace to healthcare embracing additive manufacturing, the demand for advanced 3D printing materials will only accelerate. The future of this market is not just about replacing traditional manufacturing but about reshaping how products are designed, developed, and delivered worldwide.

Liquid Waste Management Market Global Reports, Opportunities, Trends & Forecast 2032

By Sharvari, 2025-09-08

The global liquid waste management market has become one of the fastest-growing sectors in the environmental and utility industries. Rising urbanization, population growth, water scarcity, and strict government regulations are driving the adoption of efficient wastewater treatment and recycling systems. As the demand for clean water continues to surge, the market for managing, treating, and recycling liquid waste is expected to expand steadily over the forecast period.

Market Size and Growth Outlook

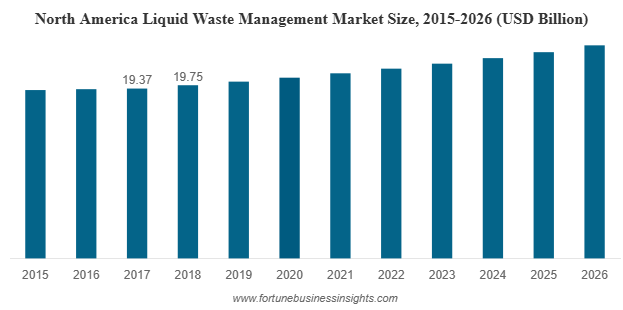

The global liquid waste management market size was valued at USD 65.93 billion in 2018 and is expected to grow to USD 85.02 billion by 2026, registering a steady CAGR of 3.3% over the forecast period. North America led the market in 2018 with a 29.96% share, supported by advanced infrastructure and strict environmental standards. Within the region, the U.S. market is forecast to reach USD 22.29 billion by 2026, driven by rising industrial waste disposal requirements and the enforcement of stringent environmental regulations.

The market outlook indicates that the need for innovative, affordable, and eco-friendly wastewater treatment solutions will only rise as global populations expand and freshwater resources decline.

List of Top Liquid Waste Management Market Companies:

- Veolia Environmental Services

- SUEZ Environment SA

- Xylem

- Evoqua Water Technologies Corporation

- Covanta Holding Corporation

- Clean Harbors, Inc.

- GFL Environmental Inc.

- Cleanaway

- Aqua America Inc.

- Hulsey Environmental Services

Key Drivers of the Market

- Rapid Urbanization and Population Boom

Global urban populations are increasing rapidly, with more than two-thirds of the world’s people projected to live in cities by 2050. This rapid urbanization leads to a significant rise in domestic and industrial wastewater generation. The growing need to treat and recycle this wastewater is a major driver for the liquid waste management industry.

- Growing Water Scarcity and Recycling Needs

Freshwater demand is expected to grow by nearly 50% by 2030. Many countries are already facing acute water stress, which makes recycling and reuse of wastewater essential. Liquid waste management systems not only help meet water demand but also ensure environmental sustainability.

- Stringent Environmental Regulations

Governments around the world have enforced strict environmental laws to control water pollution. Regulations require industries to meet effluent discharge standards, compelling investment in wastewater treatment facilities. Compliance with these rules is a strong factor driving market growth.

- Technological Advancements

Emerging technologies are reshaping the wastewater sector. Solar-powered degradation methods, advanced membrane filtration, reverse osmosis, sludge digestion, and chemical treatment techniques are enabling cost-efficient and sustainable management of liquid waste. These innovations reduce operational costs and improve overall treatment efficiency.

Market Segmentation

By Source

- Residential: The largest contributor to wastewater, accounting for 70–80% of domestic water usage that is converted into liquid waste.

- Commercial and Industrial: Includes wastewater generated from industries such as pulp and paper, textiles, chemicals, petrochemicals, and food & beverage.

By Technology

- Membrane Filtration

- Reverse Osmosis

- Biological Treatment

- Chemical Precipitation

- Sludge Digestion

Each of these technologies plays a vital role in ensuring cost-effective and efficient treatment of liquid waste across different sectors.

Read More : https://www.fortunebusinessinsights.com/liquid-waste-management-market-102643

Key Trends Shaping the Market

- Shift Toward Circular Economy: Increasing focus on recycling and reusing wastewater to create a closed-loop system.

- Green and Sustainable Technologies: Adoption of renewable energy-powered treatment methods such as solar degradation.

- Smart Water Management: Use of IoT and AI technologies to monitor, predict, and optimize wastewater treatment operations.

- Public-Private Partnerships: Collaboration between governments and private firms to invest in infrastructure development..

Regional Insights

- North America

North America leads the global liquid waste management market, accounting for nearly 30% of the total share. The region benefits from advanced infrastructure, strong government policies, and high investment in modern wastewater plants. The U.S. in particular treats more than 95% of its wastewater, with mega treatment plants in cities like Chicago and Boston.

- Asia-Pacific

Asia-Pacific is the fastest-growing regional market. Industrialization, rapid urban growth, and rising freshwater demand are driving investment in liquid waste management. India, for example, is projected to face a massive water demand of more than 1.5 trillion cubic meters by 2030, pushing the need for large-scale treatment and recycling systems.

- Europe

Europe has one of the highest levels of wastewater treatment compliance. Countries like Germany treat over 90% of their wastewater, supported by strong regulatory frameworks and high technological adoption.

- Latin America, Middle East & Africa

Latin America shows varying levels of adoption, with Chile treating over 90% of wastewater while some countries treat less than 10%. In the Middle East and Africa, treated wastewater is increasingly used in agriculture and landscaping, helping to conserve freshwater resources.

Key Industry Developments:

- February 2020: SUEZ NWS, Shanghai Chemical Industry Park (SCIP) and SAIC Motor entered into a partnership to recover hazardous liquid waste in an Industrial park. The new joint venture has been established by SUEZ to provide high-quality waste treatment services to SCIP & SAIC and to expand into the Chinese Market.

- June 2019: AngloGold Ashanti, the world’s third-largest gold producer from South Africa entered into a contract with Veolia Ghana Limited for all water treatment plants in Ghana. Veolia will manage four wastewater treatment plants for three years.

Market Challenges

Despite strong growth, the liquid waste management market faces certain challenges:

- High Costs of Treatment: Establishing advanced wastewater treatment plants requires heavy investment, particularly in low-income countries where adoption remains limited.

- Infrastructure Limitations: In many regions, old and poorly maintained piping systems reduce efficiency and increase the cost of treatment.

Low Awareness in Developing Countries: Many industries and communities in underdeveloped regions still lack awareness and resources to adopt modern wastewater solutions

Future Outlook

The global liquid waste management market is on track for steady growth through 2032 and beyond. Growing awareness of environmental issues, rising water scarcity, and advancements in treatment technologies are expected to create significant opportunities. Governments, industries, and households alike will continue to invest in efficient systems that ensure sustainability, compliance, and long-term resource security.

The liquid waste management market is entering a new phase of growth, supported by rising demand for clean water, rapid industrialization, and regulatory pressure. While challenges remain, particularly in developing regions, ongoing innovations and global investments in infrastructure will ensure that wastewater treatment becomes a central pillar of sustainable development.

With steady growth projected in the coming years, companies operating in this market have a unique opportunity to contribute to global water security while driving long-term profitability.

Personal Protective Equipment Market Size, Share, Companies & Future Outlook 2032

By Sharvari, 2025-09-05

In an increasingly safety-conscious world, Personal Protective Equipment (PPE) market has emerged as a cornerstone of workplace safety across industries. From healthcare and construction to oil and gas, PPE is not just a regulatory requirement—it's a crucial tool for protecting workers and ensuring operational continuity. As global industries evolve, so does the demand for effective and innovative safety equipment.

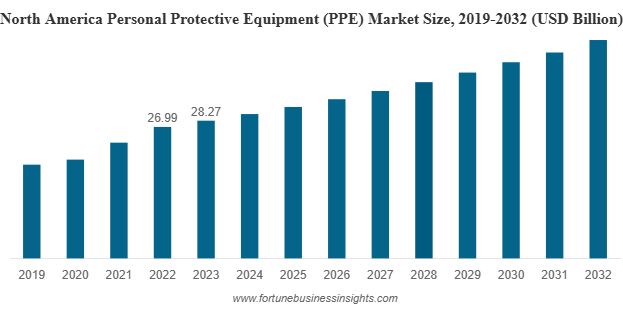

The global personal protective equipment (PPE) market was valued at USD 83.91 billion in 2023 and is expected to grow from USD 87.69 billion in 2024 to USD 128.57 billion by 2032, reflecting a compound annual growth rate (CAGR) of 4.9% during the forecast period. North America led the market in 2023, accounting for a 33.69% share of the global revenue. In particular, the U.S. PPE market is poised for substantial growth, projected to reach approximately USD 37.98 billion by 2032, fueled by expanding infrastructure development and rising construction activity across the country.

Key Market Segments Driving Growth

The personal protective equipment (PPE) market spans a wide range of products, but some categories are leading the way. Hand protection remains the most dominant segment, with gloves used extensively across manufacturing, healthcare, and chemical industries. Other major product segments include protective clothing, safety footwear, eye and face protection, and hearing protection. As industries become more complex and the work environment more hazardous, companies are investing in comprehensive PPE solutions that address multiple risk factors.

List Of Top Ppe Companies:

- 3M (U.S.)

- Ansell Ltd. (Australia)

- Alpha ProTech (Canada)

- DuPont (U.S.)

- Avon Rubber p.l.c. (U.K.)

- Mallcom (India) Limited (India)

- Bullard (U.S.)

- Delta Plus Group (France)

Market Drivers: From Regulations to Innovation

Several powerful forces are propelling the PPE market forward.

- Stricter Safety Regulations

Governments worldwide are tightening workplace safety laws, making personal protective equipment (PPE) market compliance non-negotiable. Regulatory bodies across regions are mandating the use of protective equipment and conducting regular inspections. These regulations are particularly strict in high-risk industries, forcing organizations to invest more heavily in compliant PPE solutions.

- Post-Pandemic Awareness

The COVID-19 pandemic fundamentally shifted global awareness about personal protection. While demand for personal protective equipment (PPE) market surged during the crisis, many of the habits and safety protocols developed during the pandemic have remained in place. Organizations are now more proactive about maintaining a stockpile of essential gear and training employees on proper usage.

- Innovation and Smart PPE

Technology is transforming traditional safety gear into connected, data-driven solutions. Smart PPE—such as intelligent safety gloves, sensor-equipped helmets, and wearable monitoring systems—is growing rapidly. These products can track worker movement, detect harmful gases, monitor fatigue levels, and provide real-time alerts, improving both safety and efficiency. The smart PPE market is growing at an even faster pace, with double-digit CAGR projections over the next decade.

- Sustainable Materials and Green Manufacturing

Sustainability is emerging as a key theme in personal protective equipment (PPE) market development. Manufacturers are increasingly using bio-based, recyclable, and environmentally friendly materials to reduce the ecological footprint of their products. For example, biodegradable gloves and hard hats made from sugarcane-derived polymers are gaining traction. These innovations help companies align their safety policies with broader ESG (Environmental, Social, and Governance) goals.

Industries Leading PPE Adoption

While personal protective equipment (PPE) market is used across almost every sector, certain industries are driving its adoption at a faster pace. Manufacturing leads the charge, followed closely by construction, healthcare, oil and gas, and automotive. In these high-risk sectors, the need for protective equipment is embedded not just in regulatory requirements but also in operational protocols.

For instance, the construction industry requires helmets, gloves, high-visibility clothing, and harnesses as standard, while the healthcare sector prioritizes surgical masks, gowns, and gloves. In oil and gas, flame-resistant clothing, respiratory masks, and chemical-resistant gloves are essential.

Read More : https://www.fortunebusinessinsights.com/personal-protective-equipment-ppe-market-102015

Regional Insights: North America Leads, Asia-Pacific Rising

North America remains the largest market for PPE, accounting for over 33% of global revenue in 2023. The region's strong industrial base, strict safety regulations, and high compliance rates have contributed to this dominance. The U.S. Occupational Safety and Health Administration (OSHA), the National Institute for Occupational Safety and Health (NIOSH), and other regulatory bodies play a key role in setting and enforcing standards that drive PPE adoption.

However, Asia-Pacific is expected to see the fastest growth over the next decade. Rapid industrialization, a growing labor force, and increasing awareness of workplace safety are all fueling demand in countries like China, India, and Southeast Asian nations. Governments in these regions are also stepping up safety regulations, further supporting market growth.

Key Industry Developments:

- March 2023: Ansell opened its Greenfield Manufacturing Plant in India, investing USD 80 million in the plant. The new facility aims at providing the most innovative and highest quality surgical gloves to healthcare professionals across the country.

- April 2022: Honeywell acquired Norcross Safety Products L.L.C., a manufacturer of PPE, for USD 1.2 billion. This acquisition would provide the company with a platform in the fragmented global business projected to provide significant growth opportunities. This investment in Norcross allows the company to enter into a highly regulated industrial safety market completely.

Challenges Facing the PPE Market

Despite robust growth, the personal protective equipment (PPE) market is not without its challenges. Counterfeit and substandard products are a major concern, especially in developing regions where regulatory oversight may be weaker. Poorly made PPE not only fails to protect workers but also undermines trust in legitimate suppliers.

Another key challenge is the rising cost of high-quality and smart personal protective equipment (PPE) market. Small and medium-sized enterprises (SMEs) often struggle to afford advanced gear, even when it offers long-term value. Additionally, issues like discomfort, lack of proper sizing—particularly for women—and resistance to technology adoption can slow the uptake of new personal protective equipment (PPE) market solutions.

Supply chain disruptions, such as those experienced during the pandemic, also remain a risk. Many countries are now focusing on building local personal protective equipment personal protective equipment (PPE) market manufacturing capabilities to ensure supply security.

Future Outlook

As the global workplace evolves, so too does the importance of personal protective equipment (PPE) market. Companies are no longer viewing it as just another cost of doing business, but as a strategic investment in worker safety, productivity, and brand reputation. With regulations tightening, technologies advancing, and sustainability rising in importance, the PPE industry is poised for a strong and transformative decade. Whether through smart innovations, better materials, or broader access to safety gear across developing regions, the future of personal protective equipment (PPE) market is not just bigger but smarter and more responsible.

Aluminum Foil Packaging Market Global Trend, Size, Share, Growth & Forecast 2032

By Sharvari, 2025-09-05

The global aluminum foil packaging market was valued at USD 13.86 billion in 2023 and is expected to grow to USD 14.54 billion in 2024, reaching approximately USD 22.24 billion by 2032. This represents a steady compound annual growth rate (CAGR) of 5.45% over the forecast period. In the United States, the market is also poised for substantial growth, projected to hit USD 2.85 billion by 2032, driven by rising demand for flexible, lightweight, and sustainable packaging—particularly across the food, pharmaceutical, and consumer goods sectors. Asia Pacific led the global market in 2023, accounting for a dominant 49.28% share, supported by rapid industrialization and a surge in packaged product consumption across the region.

Market Overview

The global aluminum foil packaging market is witnessing a steady and promising upward trend, backed by increasing demand for convenient, sustainable, and efficient packaging solutions across industries. With growing awareness of environmental sustainability and the need for longer shelf life of consumables, aluminum foil packaging has become a preferred material in sectors such as food and beverage, pharmaceuticals, personal care, and more.

List of Top Aluminum Foil Packaging Companies:

- Amcor plc (U.S.)

- Constantia Flexibles (Austria)

- Qingdao Kingchuan Packaging (China)

- Henan Tendeli Metallurgical Materials Co., Ltd (China)

- Henan Huawei Aluminium Co., Ltd (China)

- Hindalco Industries Ltd. (India)

- Novelis (U.S.)

- Zhejiang Zhongjin Aluminum Industry Co., Ltd. (China)

- KM Packaging (U.K.)

- ProAmpac (U.S.)

Aluminum Foil: A Packaging Powerhouse

Aluminum foil packaging market has long been valued for its versatility and protective qualities. It is lightweight, flexible, non-toxic, and highly effective at blocking moisture, light, oxygen, and bacteria. These properties make it especially suitable for packaging sensitive items such as food, medicine, and cosmetic products. The foil acts as a complete barrier, preserving the product's freshness, aroma, and integrity.

In the food and beverage sector, aluminum foil packaging market is widely used for wrapping, container linings, lids, and pouches. Ready-to-eat meals, dairy products, snacks, and confectionery items often rely on foil packaging to ensure product safety and long shelf life. The rising popularity of on-the-go food consumption and the increasing demand for packaged and frozen meals are significantly contributing to the growing usage of aluminum foil in this industry.

In the pharmaceutical sector, aluminum foil packaging market is considered essential due to its ability to provide high-level protection from external contaminants. Aluminum blister packs, strip packs, and cold-form foil are commonly used for packaging tablets, capsules, and injectables. With an aging global population and the expansion of healthcare access in developing countries, demand for pharmaceutical packaging continues to rise, directly fueling the aluminum foil packaging market.

Sustainability: A Key Growth Driver

One of the most critical factors propelling the aluminum foil packaging market is its alignment with sustainability goals. Aluminum is 100% recyclable without any loss in quality. Unlike plastic, which often ends up in landfills or the ocean, aluminum can be reused indefinitely, making it a preferred material in the age of circular economies and environmentally conscious production.

Consumers are increasingly favoring eco-friendly packaging, and manufacturers are responding by incorporating more recycled content in their aluminum products. Furthermore, governments around the world are implementing stricter regulations and incentives to encourage sustainable packaging, including bans on single-use plastics and support for recyclable materials. These policy changes create a favorable landscape for the continued adoption of aluminum foil in packaging solutions.

Regional Insights and Market Dominance

Geographically, the Asia Pacific region dominates the global aluminum foil packaging market and accounted for nearly half of the global market share in 2023. This dominance is driven by rising urbanization, growing disposable incomes, and the rapid expansion of food delivery and e-commerce sectors in countries like China, India, and Southeast Asia. In addition, the strong presence of manufacturing facilities and favorable government initiatives are boosting regional production and consumption of aluminum foil products.

North America also represents a significant market, with the United States expected to reach USD 2.85 billion in aluminum foil packaging sales by 2032. The region is benefiting from a high demand for sustainable packaging, technological advancements in foil processing, and a strong presence of major players focused on innovation and environmental responsibility.

Europe, too, is a strong contributor to market growth, with stringent regulations around plastic usage and a mature consumer base that values high-quality, recyclable packaging. Germany, France, and the UK are key markets driving this trend forward.

Read More : https://www.fortunebusinessinsights.com/aluminum-foil-packaging-market-108056

Industry Players and Strategic Moves

Several major companies are actively investing in the aluminum foil packaging sector to strengthen their market positions and address growing demand. For instance, prominent industry player Novelis Inc. has invested significantly in aluminum recycling and production capacity, including a USD 2.5 billion facility in the United States focused on sustainable aluminum rolling and recycling. Such investments reflect the industry’s focus on reducing environmental impact and increasing supply chain efficiency.

Meanwhile, companies like RUSAL are committing billions toward enhancing production infrastructure and alumina refining capabilities. Pactiv Evergreen Inc., through acquisitions and expansions, is increasing its footprint in food service packaging and leveraging aluminum foil’s benefits for high-performance applications.

These strategic moves highlight a competitive landscape where innovation, sustainability, and scalability are key differentiators.

Challenges to Watch

Despite its many advantages, the aluminum foil packaging market does face a few challenges. Fluctuating raw material prices, especially the volatility of aluminum prices in global markets, can impact profit margins and supply chain stability. Additionally, the energy-intensive nature of aluminum production raises concerns about carbon emissions, although this is being offset to some extent by the growing use of recycled aluminum.

Another potential hurdle is competition from alternative packaging materials, such as bioplastics and paper-based solutions. However, aluminum foil’s superior barrier properties and recyclability still give it a significant edge, particularly in applications where product preservation is critical.

Key Industry Developments:

- April 2024 - Shyam Metalics & Energy offered its latest innovation, SEL Tiger Foil. This innovation presents an opportunity for household food safety, crafted with incredible care and a profound commitment to excellence. From 9-meter rolls for occasional usage to generous 72-meter rolls for everyday culinary pursuits, SEL Tiger Foil offers an array of options, ensuring an ideal fit for every need.

- March 2024 - Capri Sun launched recyclable pouches made from aluminum, PE, and PET, which it claims has a lower carbon footprint than any other common beverage packaging. According to the company its current pouch, which weighs only a fifth of any comparable PET bottle and would reduce CO2 emissions by a further 25%.

Future Outlook

The aluminum foil packaging market is set to continue its upward trajectory through 2032 and beyond, driven by rising demand for safe, sustainable, and efficient packaging solutions. With increasing awareness of environmental issues, evolving consumer preferences, and supportive policy environments, aluminum foil stands out as a strong contender in the future of global packaging.

Aluminum foil packaging market players that focus on innovation, recycling infrastructure, and strategic expansion are likely to lead the way in shaping this dynamic and essential market segment. As sustainability becomes a non-negotiable aspect of modern business, aluminum foil packaging is well-positioned to meet the demands of both consumers and industries around the world.

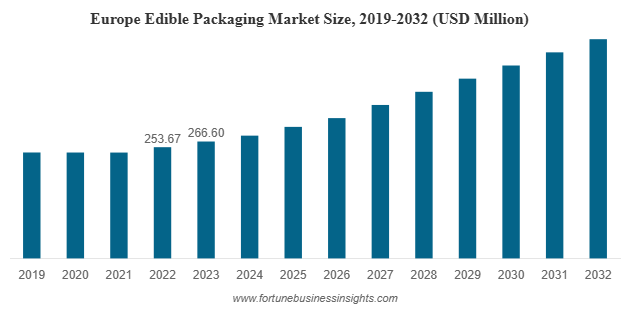

The global edible packaging market was valued at USD 711.09 million in 2023 and is expected to rise from USD 748.06 million in 2024 to nearly USD 1,193.98 million by 2032, registering a CAGR of 6.02% during the forecast period. Europe led the market in 2023 with a 37.49% share, while the U.S. market is projected to reach USD 282.59 million by 2032, fueled by growing awareness of plastic pollution and the shift toward sustainable, eco-friendly packaging solutions.

Market Overview

The edible packaging industry is undergoing a remarkable transformation as eco-conscious innovations reshape the way products are wrapped, preserved, and delivered. Among these, edible packaging has emerged as one of the most promising solutions to global concerns around plastic waste and environmental degradation. This innovative packaging is not only biodegradable but also consumable, offering dual benefits of reducing waste and enhancing consumer convenience. With strong growth projections and rising demand across the globe, the edible packaging market is stepping into a new era of expansion.

Key Trends Driving the Market

- Rising Demand for Biodegradable Films:

With global attention on plastic waste reduction, edible films are increasingly viewed as the next-generation sustainable packaging solution. Their potential to replace single-use plastics in food wraps, cutlery coatings, and beverage pouches is driving adoption. - Nanotechnology in Packaging:

Innovations in nanotechnology are enhancing the performance of edible packaging. Features like nano-encapsulation and controlled release systems improve barrier properties, shelf life, and nutritional benefits. Intelligent packaging with indicators for freshness and oxygen levels is also becoming a reality. - Health and Hygiene Focus:

Post-pandemic, consumer demand for hygienic and safe packaging has grown significantly. Edible packaging offers portion-controlled, contamination-resistant solutions that align with this demand while cutting down on packaging waste. - Shift Towards Plant-Based Materials:

The surge in plant-based diets and vegan lifestyles is fueling the use of plant-derived ingredients in packaging. Edible wraps made from seaweed, rice, and potato starch are now being explored by startups and established players alike.

List of Top Edible Packaging Companies:

- XAMPLA (U.K.)

- Notpla Ltd. (U.K.)

- JRF Technology (U.S.)

- MonoSol, LLC (U.S.)

- Evoware (Indonesia)

- Biome Bioplastics (U.K.)

- Decomer Technology OÜ (Estonia)

- Lactips (France)

- FlexSea (U.K.)

- Nagase America (U.S.)

Material Insights

By material, protein-based packaging dominates the edible packaging landscape. Derived from sources such as soy protein, whey protein, gluten, and casein, these materials are favored for their superior gas barrier properties and biodegradability. Their ability to maintain product freshness without altering taste makes them particularly suitable for perishable goods.

Polysaccharides such as starch and cellulose are also gaining traction due to their availability and versatility. Lipid-based packaging, although less common, is used for applications requiring moisture resistance. Together, these materials represent the innovation at the heart of edible packaging, balancing sustainability with functionality.

Product Insights

Among product types, films account for the largest share, holding more than 44% of the market in 2023. Edible films are widely used to coat food products, preserve freshness, and reduce microbial contamination. Their transparent and tasteless nature makes them attractive to both manufacturers and consumers.

Other product categories include capsules and coatings, often used in pharmaceuticals and nutraceuticals. These not only enhance dosage accuracy but also provide controlled release of active ingredients. Such diversity in applications ensures that edible packaging is not confined to the food industry but extends into healthcare and personal care as well.

Read more : https://www.fortunebusinessinsights.com/edible-packaging-market-107722

Regional Insights

Europe currently leads the edible packaging market, holding more than 37.49% of global revenue in 2023. This dominance is supported by strong environmental policies, consumer awareness, and significant research investments. Countries across the region are actively encouraging industries to adopt biodegradable and edible options, thereby setting benchmarks for sustainability.

North America is another fast-growing region, with the United States expected to contribute significantly to future growth. The U.S. edible packaging sector alone is projected to reach over USD 282.59 million by 2032, fueled by rising demand for sustainable solutions in food and beverages as well as pharmaceuticals. Meanwhile, Asia Pacific markets such as India and China are witnessing rapid adoption due to increasing population, growing food industries, and rising environmental consciousness. Emerging economies in Latin America and Africa are also stepping up, driven by their rising middle class and government-backed initiatives to curb plastic pollution.

Challenges Facing the Industry

Despite its potential, edible packaging faces several hurdles. Production costs remain higher compared to conventional plastic packaging, which limits scalability. The need for secondary packaging to ensure hygiene and safety often undermines the eco-friendly benefits. Additionally, regulatory challenges, particularly in markets like the United States, pose obstacles for faster adoption.

Consumer acceptance is another factor. While sustainability-conscious buyers are enthusiastic, others may hesitate to consume packaging directly, raising awareness and education as crucial steps for wider acceptance.

Key Industry Developments:

- September 2023 – Xampla announced the launch of a remarkable consumer brand, Morro, to develop bio-based and edible packaging solutions that can compete with plastics. The launch of this brand will enable food brands to make an easy switch from single-use plastics and use the company’s breakthrough material.

- August 2022 – Nippon Paint China, the premier coatings company, partnered with BASF to introduce new eco-friendly edible packaging embraced by the Nippon Paint dry-mixed mortar series products.

Opportunities

The edible packaging market holds immense promise across multiple sectors. In the food and beverage industry, it offers a way to reduce plastic waste and enhance consumer appeal. In pharmaceuticals, edible capsules and films provide functional benefits such as controlled drug release and improved dosage accuracy. The cosmetics industry is also exploring edible packaging for innovative applications.

With continuous advancements in material science, nanotechnology, and biodegradable solutions, the industry is expected to overcome many of its current challenges. Collaborations between startups, research institutions, and large corporations will further accelerate development and commercialization.

Outlook

Edible packaging market is not just a trend; it represents a significant step towards solving the global plastic waste crisis. By combining innovation, sustainability, and functionality, this market is set to redefine packaging standards for the future. Though challenges such as cost and regulations persist, the long-term outlook remains optimistic. With steady growth projected and rising demand across industries, edible packaging is poised to become an integral part of the global sustainability movement.

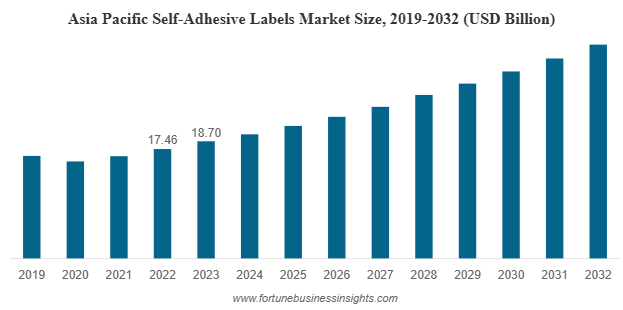

The global self-adhesive labels market size was valued at USD 48.03 billion in 2023 and is expected to reach USD 50.65 billion in 2024, before expanding to USD 82.17 billion by 2032 at a CAGR of 6.1% during the forecast period. In 2023, Asia Pacific led the market, accounting for 38.93% of the global share, driven by robust growth in food, beverage, and retail sectors. Meanwhile, the U.S. market is set to witness substantial expansion, projected to reach USD 9.47 billion by 2032, fueled by rising demand for consumables, ready-to-eat meals, and packaged food and beverages.

Market Overview

The global self-adhesive labels market is witnessing remarkable growth, driven by rising demand across industries such as food and beverages, pharmaceuticals, personal care, logistics, and retail. Self-adhesive labels, also known as pressure-sensitive labels, are widely used for product identification, branding, tracking, and conveying critical product information. They are easy to apply, versatile in design, and available in a variety of materials, making them a preferred choice for manufacturers worldwide.

List Of Key Companies Profiled

- 3M Company (U.S.)

- Axicon Labels (U.K.)

- Avery Products Corporation (U.S.)

- ETIS Slovakia (Slovakia)

- UPM Raflatac (Finland)

- Müroll GmbH (Austria)

- Royston Labels Ltd (U.K.)

- S&K LABEL (U.S.)

- SVS Etikety (Czech Republic)

- Mondi Group (Austria)

- B Fuller (U.S.)

Key Market Drivers

- Rising Demand for Packaged Foods and Beverages

The packaged food industry is among the largest consumers of self-adhesive labels. With urbanization, rising disposable incomes, and busy lifestyles, the consumption of ready-to-eat, frozen, and processed foods has surged. Self-adhesive labels are crucial for displaying nutritional information, expiry dates, barcodes, and branding elements. Beverage companies also rely heavily on these labels for durable and visually appealing packaging.

- Growth in the Pharmaceutical and Healthcare Sector

The pharmaceutical sector requires precise labeling to ensure regulatory compliance and patient safety. Self-adhesive labels are extensively used for medicine bottles, syringes, diagnostic kits, and medical devices. They provide features such as tamper-evidence, chemical resistance, and the ability to withstand extreme conditions. As global healthcare spending increases and demand for medicines grows, the pharmaceutical sector will remain a key growth driver for this market.

- Expansion of E-commerce and Logistics

E-commerce has transformed global trade, and with it, the logistics industry has experienced unprecedented growth. Self-adhesive labels play a critical role in shipping and distribution, where they are used for barcoding, tracking, and ensuring timely deliveries. As online shopping continues to expand worldwide, the demand for logistics labels is expected to rise substantially.

- Increasing Importance of Branding and Aesthetics

Modern consumers are heavily influenced by attractive packaging. Companies use self-adhesive labels not just for information, but also as a tool for marketing and differentiation. Innovations in printing technology, including digital printing, allow manufacturers to produce vibrant, customizable labels that enhance product appeal and brand recognition.

- Sustainability and Eco-Friendly Materials

With growing environmental concerns, manufacturers are shifting toward recyclable and biodegradable label materials. Eco-friendly adhesives and the use of sustainable paper or film-based substrates are becoming increasingly common. This trend is creating new opportunities in the market as companies look to align with consumer preferences and regulatory guidelines for sustainable packaging.

Market Segmentation

- By Type:

- Permanent labels (widely used for durability and tamper resistance).

- Removable and repositionable labels (gaining traction in retail and promotional applications).

- Food and beverages

- Pharmaceuticals and healthcare

- Personal care and cosmetics

- Logistics and transportation

- Retail and consumer goods

- Digital printing

- Flexographic printing

- Lithography

- Others

Among these, digital printing is gaining rapid popularity due to its ability to provide cost-effective, high-quality, and customizable designs in shorter lead times.

Read More : https://www.fortunebusinessinsights.com/self-adhesive-labels-market-104289

Key Industry Developments

- February 2024 – Mondi collaborated with multiple stakeholders along the value chain to recycle and release liner production waste. These stakeholders include Soprema, WEPA, and Vwyzle. They are working together to convert Mondi’s coated paper waste produced at its release liner plants into secondary raw material for a range of applications.

- May 2021 - Herma, a German self-adhesive technology specialist launched 52W, a new wash-off label adhesive developed especially for PET bottles.

Regional Insights

- Asia-Pacific leads the global market, accounting for nearly 39% of the total share in 2023. Countries such as China, India, and Japan are driving growth due to expanding consumer markets, urbanization, and the rise of organized retail. The region’s booming e-commerce and FMCG industries make it a hub for label manufacturers.

- North America is another significant market, fueled by high demand for customized and innovative labels in the food, beverage, and healthcare sectors. The United States and Canada are witnessing steady growth due to strong logistics networks and the rise of private-label brands.

- Europe is focusing heavily on sustainability, with stringent regulations on packaging and labeling. This has led to innovation in recyclable adhesives and eco-friendly materials, further shaping market growth.

- Latin America and the Middle East & Africa are emerging markets where rising consumer awareness, industrial growth, and urbanization are increasing the demand for self-adhesive labels.

Future Opportunities

The future of the self-adhesive labels market lies in smart labeling technologies such as RFID-enabled and QR-code labels that enhance product tracking, authenticity, and customer engagement. With the integration of digitalization and sustainability, manufacturers are likely to focus on developing intelligent, eco-friendly labeling solutions to cater to evolving consumer demands. Emerging economies also present significant opportunities for expansion as modern retail and organized trade gain momentum.

Market Challenges

While the outlook is promising, the self-adhesive labels market faces some challenges. Rising raw material prices, particularly for paper and adhesives, can affect production costs. Additionally, the trend of direct printing on packaging is emerging as an alternative to labeling, which could limit growth in certain applications. However, continuous innovation, especially in smart and eco-friendly labels, is expected to mitigate these challenges.

Outlook

The global self-adhesive labels market is on a growth trajectory, supported by strong demand from key industries and the rising importance of packaging in consumer decision-making. With advancements in printing technology, increased emphasis on sustainability, and expansion in emerging markets, the industry is poised for steady growth in the coming years. While challenges like fluctuating raw material costs and competition from direct printing exist, innovation and eco-friendly practices are expected to drive long-term success.

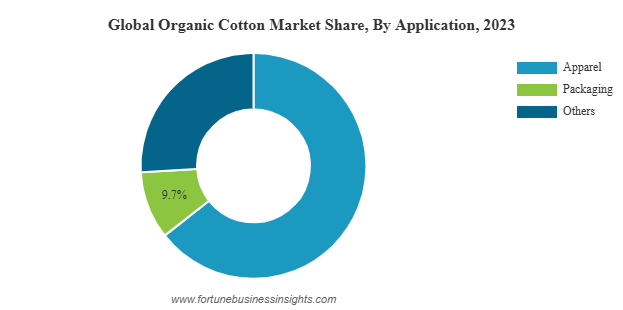

The global organic cotton market size was valued at USD 1,113.5 million in 2023 and is expected to expand from USD 1,585.5 million in 2024 to USD 25,890.2 million by 2032, registering a robust CAGR of 40.0% during 2024–2032. Asia Pacific led the market in 2023 with a 65.7% share, while the U.S. market is projected to reach USD 504.56 million by 2032, driven by rising consumer preference for sustainable and eco-friendly textiles.

Market Dynamics

Organic cotton market differs from conventional cotton as it is cultivated without the use of synthetic pesticides, fertilizers, or genetically modified seeds. This makes it safer for the environment, farmers, and end consumers. Over the last decade, the textile industry has been under growing scrutiny for its environmental impact, pushing both brands and consumers to explore sustainable alternatives. Organic cotton has emerged as a natural solution, aligning with the values of eco-conscious shoppers and companies aiming to meet sustainability targets.

One of the strongest drivers of growth is the rising awareness about sustainability in the apparel industry. Fashion brands across the globe are incorporating organic cotton into their collections to reduce their ecological footprint. Additionally, organic cotton is gaining traction in industries beyond apparel, including packaging, medical textiles, and personal care products. Its antibacterial properties, UV protection, and biodegradability make it ideal for applications ranging from hospital gowns to eco-friendly packaging materials.

List Of Key Companies Profiled

- Cargill Incorporated (U.S.)

- Plexus Cotton Ltd. (U.K.)

- Staple Cotton Cooperative Association (U.S.)

- Calcot Ltd. (U.S.)

- The Rajlakshmi Cotton Mills (P) Limited (India)

- Remei AG (Switzerland)

- Arvind Limited(India)

- Noble Ecotech (India)

- Louis Dreyfus Company (Netherlands)

- Texas Organic Cotton Marketing Cooperative (U.S.)

Key Growth Drivers

- Sustainable Consumer Trends

Modern consumers are increasingly favoring environmentally responsible products. With growing awareness about fast fashion’s impact, organic cotton products are seen as healthier, safer, and ethically produced alternatives. - Dominance of Apparel Segment

Apparel remains the leading application of organic cotton, with brands launching premium collections using organic fibers. From casual wear to luxury fashion, the adoption of organic cotton has been significant. - Rising Medical Applications

The global pandemic highlighted the need for safer medical textiles. Organic cotton, being hypoallergenic and chemical-free, is being increasingly used in medical supplies such as gowns, masks, and bandages. - Packaging Innovations

With the shift toward eco-friendly packaging, organic cotton is finding use in wrapping, carrying solutions, and as part of sustainable packaging materials. - Transparency and Traceability

End-to-end traceability has become crucial in supply chains. Consumers want to know where their products come from, and organic cotton certifications provide the assurance of ethical and sustainable production.

Read More : https://www.fortunebusinessinsights.com/organic-cotton-market-106612

Segmentation Insights

- By Type: Middle-staple cotton dominates the market, especially for everyday apparel. Extra-long and long-staple varieties are used for premium textiles, while short-staple cotton finds applications in packaging and medical fields.

- By Quality: Upland cotton leads in volume, catering to mass apparel production. Supima/Pima and Giza cotton serve the luxury segment due to their superior quality and softness.

- By Application: Apparel remains the largest application segment, while packaging and medical textiles are growing at a faster pace, creating new opportunities for manufacturers.

Regional Highlights

- Asia Pacific: This region leads the global organic cotton market, accounting for nearly two-thirds of the total share in 2023. Countries like India and China play a critical role due to high cotton cultivation, expanding textile industries, and growing domestic demand for sustainable products. The regional market was valued at over USD 730 million in 2023 and is set for robust growth.

- North America: The U.S. market is forecasted to reach around USD 504 million by 2032. Strong consumer awareness and the adoption of organic products in fashion, cosmetics, and healthcare drive growth in this region.

- Europe: European countries are focusing on luxury and high-quality textiles, making the region an attractive hub for premium organic cotton products. The emphasis on sustainability regulations also fuels demand.

- Latin America and Middle East & Africa: These regions are gradually expanding their presence in the market, supported by agricultural potential, rising disposable incomes, and awareness about sustainable lifestyles.

Competitive Landscape

The organic cotton market is fragmented, with several global and regional players competing through innovation, collaborations, and sustainability-driven initiatives. Leading companies include Cargill Inc., Plexus Cotton Ltd., Staple Cotton Cooperative Association, Calcot Ltd., Rajlakshmi Cotton Mills, Remei AG, Arvind Limited, Noble Ecotech, Louis Dreyfus Company, and Texas Organic Cotton Marketing Cooperative. These players are focusing on expanding their product portfolios, strengthening supply chains, and investing in sustainable farming practices to meet rising demand.

Market Challenges

Despite its rapid growth, the organic cotton market faces challenges. High production costs remain a barrier, as organic farming requires more labor and careful crop management compared to conventional methods. Limited yields and seed availability also restrict supply, leading to a gap between demand and production. Many regions still lack the infrastructure to scale up organic farming, which could hinder long-term supply stability.

Future Outlook

The future of the organic cotton market looks promising, as industries and consumers increasingly align with sustainability goals. Apparel will continue to dominate, but medical and packaging applications are expected to expand significantly. With growing investments in organic farming and government support in certain regions, supply challenges are likely to ease over time.

Furthermore, as global fashion brands commit to using organic and sustainable materials, the organic cotton market is set to become an integral part of the textile industry’s transformation. Technological advancements in farming and better certification practices will also help in bridging the gap between supply and demand.

The organic cotton market is no longer a niche—it is rapidly becoming mainstream. With an exceptional growth rate and rising global awareness about sustainability, organic cotton stands at the forefront of the textile industry’s green revolution. Although high costs and supply limitations pose challenges, innovation, investment, and consumer-driven demand are paving the way for a brighter, more sustainable future.

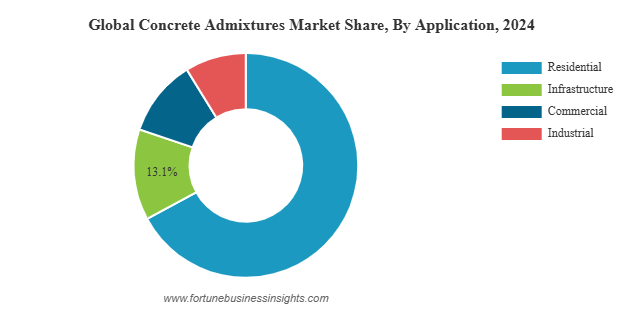

The global concrete admixtures market size was valued at USD 22.78 billion in 2024 and is set to expand steadily in the coming years. The market is forecast to increase from USD 24.90 billion in 2025 to nearly USD 42.90 billion by 2032, reflecting a robust CAGR of 8.9% over the forecast period. In 2024, Asia Pacific emerged as the leading region, accounting for 64.57% of the global market share. Meanwhile, the market in the United States is expected to witness notable growth, reaching approximately USD 3.08 billion by 2032, supported by the rising adoption of high-performance concrete solutions.

This upward trajectory reflects rising demand for improved construction materials that can withstand harsh environmental conditions, meet sustainability goals, and support the surge in global infrastructure development.

Market Overview and Growth Drivers

Concrete admixtures market are ingredients added to concrete before or during mixing to modify its properties. They enhance workability, strength, durability, and setting time, making concrete more versatile for diverse applications. The increasing adoption of water-reducing admixtures is a key driver of growth. These additives reduce water requirements without compromising strength, ensuring higher-quality concrete and cost efficiency.

Urbanization, housing demand, and government investments in infrastructure are fueling rapid market expansion. The residential construction sector dominates consumption, with homeowners and developers alike seeking stronger, longer-lasting, and more sustainable structures. At the same time, infrastructure projects—ranging from highways and bridges to airports and railways—are accounting for a significant share of demand. In 2024, infrastructure applications are projected to represent about 13.1% of global consumption by volume.

List of Top Concrete Admixtures Companies:

- Buildtech Products (India)

- Sika AG (Switzerland)

- RAZON ENGINEERING COMPANY PRIVATE LIMITED (India)

- Flowcrete Group Ltd. (U.K.)

- CEMEX S.A.B. de C.V. (Mexico)

- BASF SE (Germany)

- GCP Applied Technologies (U.S.)

- RPM International Inc. (U.S.)

Segment Insights: Products and Applications

The market can be segmented by product type and application, each contributing uniquely to the industry’s momentum.

Product Trends

- Water-reducing admixtures remain the largest and most influential category. Their ability to reduce water demand while improving concrete strength and durability makes them indispensable in both residential and commercial projects.

- Other products such as retarding agents, accelerating admixtures, and air-entraining agents are also gaining traction, especially in regions where climate extremes necessitate better control over setting time and freeze-thaw resistance.

Application Trends

- Residential construction remains the largest application segment, supported by global housing demand, urban population growth, and easier access to housing credit.

- Infrastructure is the fastest-growing segment, with massive government-led projects creating demand for specialized admixtures that can deliver long-lasting performance under heavy loads and challenging conditions.

- Commercial construction also contributes significantly, particularly in developed economies where commercial real estate continues to expand.

Read More : https://www.fortunebusinessinsights.com/concrete-admixtures-market-102832

Regional Dynamics: Asia Pacific Leads the Way

The Asia Pacific region stands as the undisputed leader in the concrete admixtures market, commanding over 64.57% of global share in 2024. The market here is expanding rapidly, rising from USD 13.38 billion in 2023 to USD 14.71 billion in 2024, largely driven by construction booms in China, India, and Southeast Asia.

- China continues to be a powerhouse, supported by large-scale infrastructure investments and a strong focus on urban development. With a 13.3% share in 2024, China remains a cornerstone of the global market.

- India is seeing rapid growth as housing demand escalates, driven by population migration to urban areas and government-backed affordable housing initiatives.

- Southeast Asian nations are also contributing significantly, with smart city projects and infrastructure upgrades playing a crucial role.

Elsewhere, North America and Europe are also showing strong momentum. The United States market is forecast to reach USD 3.08 billion by 2032, as infrastructure rehabilitation, smart city development, and demand for high-performance concrete increase. In Germany and other European markets, sustainability regulations are encouraging the adoption of low-VOC and eco-friendly admixtures, signaling a move toward greener construction practices.

In Latin America, particularly Brazil and Mexico, government-backed infrastructure development programs are supporting market expansion. Meanwhile, the Middle East is witnessing robust demand, spurred by mega-projects such as Saudi Arabia’s NEOM and the UAE’s Vision 2030 initiatives, which are reshaping skylines with modern, technologically advanced infrastructure.

Key Industry Developments:

- November 2023: Sika AG announced that the group had expanded its concrete admixture capacity in the U.S. The company continues to invest in its polymer production at its Sealy site in the U.S. state of Texas. Sika’s latest move marks its second polymer investment in the state of Texas in just five years. The company requires polymers for chemical building blocks that are needed to produce Sika ViscoCrete, a high-performance, resource-saving concrete admixture. The company initiated this expansion to meet the growing demand for its products in the U.S. and Canada.

- June 2023: Fosroc India launched a state-of-the-art Concrete Lab in Chennai that will provide advanced building material testing facilities to developers, contractors, and other construction professionals.

Opportunities and Challenges Ahead

The market outlook for concrete admixtures is highly promising, but it also comes with challenges. Rising raw material prices and stringent regulations regarding chemical usage can increase production costs and affect supply chains. However, these challenges are being met with innovation. Leading manufacturers are focusing on developing eco-friendly, high-performance admixtures that align with sustainability goals and regulatory requirements.

Another key opportunity lies in emerging markets, where rapid industrialization and urbanization continue to fuel massive construction activity. Countries in Asia, Africa, and Latin America present significant untapped potential for admixture producers, especially those offering products tailored to local environmental and regulatory conditions.

Outlook

The global concrete admixtures market is set to nearly double in size by 2032, powered by strong demand across housing, infrastructure, and commercial construction. Asia Pacific will continue to dominate, but North America, Europe, and the Middle East are also poised for substantial growth, driven by sustainability initiatives, smart infrastructure projects, and regulatory shifts.

Concrete admixtures market may be small in proportion compared to cement or aggregates, but their impact is enormous. By improving performance, reducing costs, and enabling sustainable construction, they are shaping the future of the built environment. As the world moves toward greener cities and resilient infrastructure, admixtures will play an increasingly vital role in laying the foundation for growth and innovation.

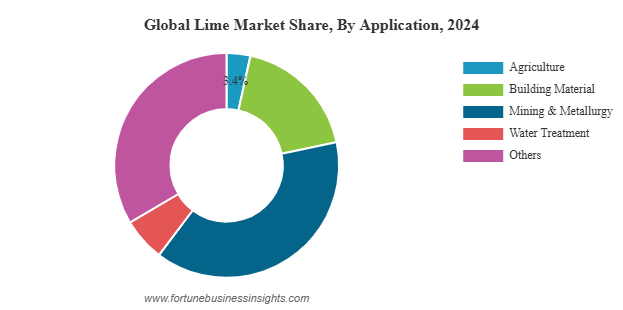

The global lime market size was valued at USD 46.68 billion in 2024 and is anticipated to expand from USD 47.40 billion in 2025 to nearly USD 56.64 billion by 2032, reflecting a compound annual growth rate (CAGR) of 2.6% during the forecast period. In 2024, Asia Pacific emerged as the leading region, accounting for 66.67% of the overall market share.

Market Dynamics and Trends

The lime market’s growth is being propelled by several converging trends:

- Infrastructure Development: Rapid urbanization, particularly in emerging economies, is fueling construction activity. This directly increases demand for lime in cement and building materials.

- Environmental Regulations: Countries like the U.S., China, and India are implementing stricter pollution control measures, boosting lime consumption in flue gas and wastewater treatment.

- Steel Industry Demand: With global steel demand projected to rise steadily, lime’s role as a flux ensures its continued necessity.

- Agricultural Needs: Population growth and the need for sustainable food production are increasing the use of lime to improve soil health and crop yields.

List Of Key Lime Companies Profiled

- Carmeuse (Belgium)

- Lhoist Group (Belgium)

- Graymont Limited (Canada)

- Mississippi Lime Company (U.S.)

- United States Lime & Minerals Inc. (U.S.)

- Afrimat (South Africa)

- Linwood Mining & Minerals Corporation (U.S.)

- Minerals Technologies, Inc. (U.S.)

- Cheney Lime & Cement Company (U.S.)

Key Applications

The versatility of lime is a cornerstone of its global demand. Among its most notable applications:

- Steel Industry: Lime acts as a flux in steelmaking, helping remove impurities such as silica, sulfur, and phosphorus. Its role in both basic oxygen and electric arc furnaces is indispensable.

- Construction: Lime is a vital ingredient in cement, mortar, and plaster. It improves workability, enhances durability, and supports eco-friendly building practices. With infrastructure and housing demand surging globally, lime’s importance in construction continues to grow.

- Agriculture: By neutralizing soil acidity and enriching calcium content, lime significantly improves soil health and crop productivity. This function is particularly vital in regions facing soil degradation.

- Environmental Applications: Lime is increasingly used in wastewater treatment and flue gas desulfurization. It efficiently removes pollutants such as lead, phosphorus, and sulfur dioxide, supporting global efforts to reduce industrial emissions.

Interestingly, lime’s use in building materials is projected to grow at a striking CAGR of over 2.6% during 2025–2032, underscoring the rising importance of construction and sustainable housing developments.

Regional Market Performance

- Asia Pacific: The Powerhouse

Asia Pacific dominates the lime market, commanding more than two-thirds of global revenue in 2024. This regional strength is largely driven by rapid industrialization and surging demand across steel, paper, chemical, and construction industries. China remains the largest contributor, owing to its leadership in global steel production. India and Japan are also significant players, with projections estimating their lime markets to surpass USD 0.75 million and USD 1.27 billion, respectively, by 2025. Strong infrastructure projects, rising urbanization, and strict environmental regulations in the region further fuel demand.

- Europe: Steady Growth Backed by Industry

Europe holds the second-largest share of the lime market. Valued at more than USD 8.32 billion in 2025, the region benefits from a strong presence of steel and automotive industries. Lime continues to serve as a critical material in steel refining, construction, and wastewater treatment across key economies such as Germany, France, and Italy. Moreover, Europe’s ambitious climate goals and emphasis on reducing carbon emissions are driving additional demand for lime in environmental applications, particularly in flue gas desulfurization.

- North America: Expanding with Infrastructure

North America, led by the United States, is forecasted to reach nearly USD 0.33 billion in lime market value by 2025. Demand is largely supported by infrastructure investments, water treatment initiatives, and the mining sector. Stringent regulations surrounding environmental safety and the growing push for sustainable building materials further support lime consumption in this region.

- Emerging Regions

Latin America and the Middle East & Africa present moderate but promising growth. Construction projects, oil and gas developments, and increasing steel consumption in countries like Brazil, South Africa, and the Gulf nations are laying the foundation for long-term opportunities. These regions are expected to gradually increase their market

Read More : https://www.fortunebusinessinsights.com/lime-market-104548

Key Industry Developments

- January 2024 – Mississippi Lime Company (MLC) has invested in constructing a state-of-the-art, sustainable kiln at its newly acquired lime operation in Bonne Terre, Missouri. The construction began in early 2024, and commissioning will be completed by 2026.

- September 2023 – Lohist Group announced its decision to expand its lime production capacity in Texas, U.S. The purpose of the production expansion was to establish the company’s business presence in the U.S. and maximize its revenue from the lime segment.

- September 2023 – Graymont Limited announced its plans to expand its business in Southeast Asia. For this, the company acquired Compact Energy, a major lime processing facility in Malaysia. Through this move, the company is expected to produce 600,000 tons of quicklime and 170,000 tons of hydrated lime annually.

- September 2023 – Carmeuse and Tallman Technologies Inc. announced a strategic partnership to enhance the lime injection offerings. Together with Carmeuse’s expertise in raw materials and lime handling and Coperion’s expertise in dense phase conveyance, Tallman Technologies will bring design and engineering expertise in supersonic injection to enable Carmeuse to offer a complete lime injection system from truck offloading.

Competitive Landscape

The lime market is highly competitive, with several global and regional players shaping its direction. Leading companies include:

- Lhoist Group

- Graymont Limited

- Mississippi Lime Company

- Carmeuse

- United States Lime & Minerals Inc.

- Afrimat

- Sigma Minerals Ltd.

These companies are actively expanding their production capacities, investing in sustainable practices, and exploring mergers and acquisitions to strengthen their market presence. For example, Mississippi Lime Company enhanced its capabilities by acquiring Valley Minerals, a producer of dolomitic quicklime in Missouri. Such strategic moves highlight the ongoing consolidation and growth within the sector.

Outlook

Looking ahead, the lime market is poised for steady expansion. Its crucial role across diverse industries ensures consistent demand, while global megatrends such as urbanization, sustainability, and food security create new avenues for growth. By 2032, with a projected market value of more than USD 56.64 billion, lime will continue to prove itself as a foundational material for modern economies.

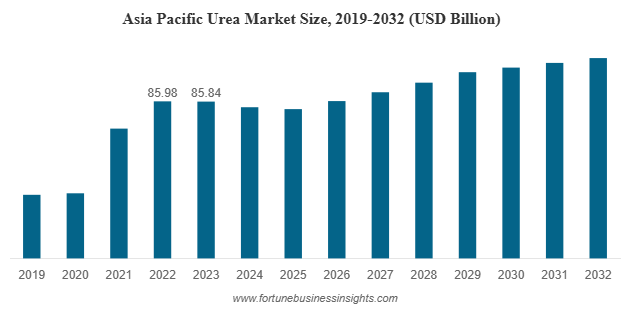

The global urea market size was valued at USD 128.92 billion in 2023 and is anticipated to expand from USD 123.95 billion in 2024 to USD 160.67 billion by 2032, reflecting a CAGR of 2.2% over the forecast period. Asia Pacific emerged as the leading region, accounting for 66.58% of the market share in 2023. Meanwhile, the U.S. market is expected to witness substantial growth, projected to reach USD 14.40 billion by 2032, fueled by the rising demand for nitrogen-based fertilizers to enhance crop production.

The Role of Urea in Modern Agriculture

Urea market is the backbone of modern farming practices due to its high nitrogen content, which is crucial for plant growth and soil fertility. Farmers across the world rely on urea market to boost crop yields, particularly in staple crops such as rice, wheat, maize, and other cereals that form the foundation of food security.

In 2023, agriculture dominated the application segment of the urea market, reinforcing its status as the key driver of demand. As global population growth accelerates, the pressure to increase agricultural productivity has never been greater. Fertilizer efficiency and affordability make urea the preferred choice for large-scale farming, ensuring it remains the cornerstone of the sector.

List of Top Urea Companies:

- SABIC (Saudi Arabia)

- Qatar Fertilizer Company (Qatar)

- EuroChem (Switzerland)

- Yara International ASA (Norway)

- Nutrien AG (Canada)

- OCI N.V. (Netherlands)

- Acron Group (Russia)

- CF Industries Holdings (U.S.)

Key Market Drivers

Several factors are shaping the growth trajectory of the urea market:

- Population Growth and Food Security

Rising global population continues to drive demand for staple crops, reinforcing the importance of urea in boosting agricultural productivity. - Government Policies and Subsidies

Many countries, particularly in Asia-Pacific, support fertilizer consumption through subsidies and incentives, ensuring steady demand for urea. - Industrial Diversification

Expanding use of urea in industries such as resins, adhesives, plastics, and emissions control is diversifying the market beyond agriculture. - Technological Advancements

Precision agriculture and improved fertilizer application techniques are enhancing efficiency, ensuring that urea remains a critical tool for farmers.

Industrial Applications of Urea

While agriculture accounts for the largest share, urea’s role in industrial applications is equally important. Urea is widely used in the manufacture of melamine, adhesives, plastics, and resins. It also serves as a raw material in the production of urea-formaldehyde resins, which are employed in particleboard, plywood, and other wood products.

Additionally, the chemical is gaining prominence in environmental applications, such as diesel exhaust fluid (DEF), which helps reduce harmful nitrogen oxide emissions from vehicles. With increasing emphasis on sustainability and environmental compliance, the demand for urea in these emerging applications is expected to remain strong.

Asia-Pacific The Growth Powerhouse

Asia-Pacific leads the global urea market, contributing 66.58% of the total share in 2023. Several factors explain the region’s dominance. Population growth, coupled with rapid urbanization, continues to fuel demand for food, leading to an increase in agricultural activities. Countries like China and India are at the forefront of this growth, with government support and favorable policies encouraging fertilizer consumption to enhance food security.

Beyond agriculture, Asia-Pacific is also witnessing rising industrial consumption of urea. The chemical is used in resins, adhesives, coatings, and as a feedstock in various industries. This dual role—supporting both farming and industrial needs—solidifies the region as the epicenter of global urea production and consumption.

The U.S. Market Emerging Opportunities

Although smaller in comparison to Asia-Pacific, the U.S. urea market is set to witness notable growth. By 2032, the market is expected to reach USD 14.40 billion, driven by rising demand for nitrogen-based fertilizers to support crop production. Increasing emphasis on agricultural sustainability, efficient farming techniques, and productivity enhancement are expected to further bolster the role of urea in the U.S. farming landscape.

Domestic production and imports are both likely to grow as farmers seek reliable and cost-effective fertilizer solutions. The U.S. also benefits from technological advancements in precision farming, which may influence the efficient use of urea and create additional opportunities for innovation in the sector.

Read More : https://www.fortunebusinessinsights.com/urea-market-106850

Challenges to Growth

Despite its widespread use, the urea market faces several challenges. Overuse of nitrogen fertilizers can lead to soil degradation, water pollution, and greenhouse gas emissions. Environmental concerns and regulatory restrictions are pushing the industry to adopt more sustainable practices.

Additionally, fluctuating natural gas prices—since urea is produced using natural gas as a feedstock—can impact production costs and profitability. Market participants must balance affordability with sustainable production to maintain growth momentum.

Key Industry Developments

- March 2023: SABIC announced that it is collaborating with two U.S.-based companies, BiOWiSH Technologies and ADM, to supply Bio-Enhanced Urea to farmers for 2023’s growing season to support sustainable agriculture.

- June 2022: Nutrien Ag announced that it is increasing its fertilizer production capability. This move is expected to enable the company to respond to changes in global energy, agriculture, and fertilizer markets.

- March 2022: EuroChem announced that it has entered into exclusive negotiations to acquire the nitrogen business of the Borealis group after having submitted a binding offer.

- March 2022: Egypt-based Misr Fertilizers Production Company (MOPCO) announced plans to improve its overall annual carbamide production capacity to 70 kilo tons. The company also announced investment to build a new melamine plant. With this investment, MOPCO aimed to strengthen its position in Egypt and overseas markets.

The Road Ahead

Looking toward 2032, the urea market is expected to grow steadily, reaching nearly USD 160.67 billion. Agriculture will continue to dominate demand, but industrial applications and environmental uses are likely to gain more prominence. Asia-Pacific will retain its position as the global leader, while the U.S. and other regions will see incremental opportunities driven by food demand and industrial expansion.

Stakeholders—from fertilizer manufacturers and farmers to industrial users and policymakers—must collaborate to ensure that urea’s potential is harnessed sustainably. Investment in research and development, improved application methods, and greener production techniques will play a pivotal role in shaping the future of this market.

Outlook

The urea market is a vital component of the global economy, serving as both a cornerstone of agricultural productivity and a versatile material for industrial applications. With a projected CAGR of 2.2% from 2024 to 2032, the market’s growth reflects the essential role urea plays in feeding the world and supporting diverse industries.

As the world grapples with the twin challenges of feeding a growing population and ensuring environmental sustainability, urea will remain at the heart of solutions. Its journey from the farm to the factory floor highlights not only its versatility but also its enduring relevance in shaping the future of agriculture and industry.