Battery Electrode Coating Market Requires Innovation to Overcome Technological and Financial Barriers

The global Battery Electrode Coating Market is undergoing a transformative phase, driven by the growing demand for energy storage solutions across industries. From electric vehicles to consumer electronics and grid storage, the adoption of lithium-ion batteries is surging, elevating the importance of battery electrode coatings. These coatings improve performance, increase energy density, and extend battery life. However, despite strong growth prospects, the market faces several hurdles that could restrain its full potential.

Rising Raw Material Costs

One of the foremost challenges hindering market growth is the volatility in raw material prices. The coatings used in battery electrodes often rely on expensive and limited materials such as carbon, metal oxides, and binders. Any fluctuation in the prices of lithium, cobalt, nickel, or graphite significantly affects production costs. Moreover, the geopolitical dependence on a few countries for these materials creates supply chain vulnerabilities. These issues can delay manufacturing, reduce profitability, and discourage new players from entering the market.

Technological Complexity and R&D Costs

Battery electrode coatings require high-precision manufacturing and advanced materials science, leading to high research and development (R&D) costs. Developing coatings that enhance conductivity, prevent degradation, and support fast charging involves significant investments in laboratories, skilled personnel, and time-consuming experimentation. Smaller companies may struggle to keep up with technological advancements, creating a barrier to market competition. Additionally, many technologies are patented, restricting access and leading to licensing costs for newer entrants.

Environmental and Regulatory Challenges

The environmental impact of battery production is under increasing scrutiny. Coating processes often involve solvents and chemicals that may be harmful to the environment if not properly managed. As a result, regulatory authorities are tightening their grip on emissions, waste management, and resource consumption related to battery manufacturing. Companies in the market must comply with a complex web of regulations across different regions, which can delay production timelines and add to operational expenses.

Moreover, sustainability concerns are pushing manufacturers to develop eco-friendly coatings, which may not always meet performance requirements or come with higher costs. Balancing environmental responsibility with performance efficiency remains a tough equation for many companies in the sector.

Limited Manufacturing Infrastructure

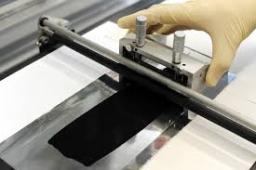

Though the demand for battery electrode coatings is expanding rapidly, the current manufacturing infrastructure may not be sufficient to meet this growth. Coating battery electrodes at a commercial scale while maintaining quality and consistency is a significant technical hurdle. The scaling-up process from lab-scale to large-scale production is not straightforward and requires substantial capital investment. In emerging economies, inadequate access to skilled labor and high-precision machinery further constrains production.

In addition, many existing production facilities are designed for conventional battery types and may need to be completely overhauled to adapt to newer, high-performance electrode coating technologies. This infrastructural gap slows down the global adoption rate of next-generation battery systems.

Market Fragmentation and Competition

The battery electrode coating market is highly fragmented, with numerous players focusing on different types of coating technologies, including ceramic, conductive polymer, and carbon-based coatings. This fragmentation can lead to inconsistent quality standards, making it difficult for manufacturers and OEMs to select reliable partners. Additionally, intense competition puts pressure on pricing, reducing margins and limiting the ability to invest in innovation.

While established companies have the resources to maintain technological leadership, newer firms often find it difficult to gain visibility and market share without significant partnerships or funding. The disparity in resources and capabilities between large multinational players and startups results in an uneven playing field.

Evolving Market Dynamics and Uncertain Demand

Another challenge is the rapidly evolving nature of end-use industries such as electric vehicles (EVs), renewable energy, and portable electronics. Shifts in government policies, changing consumer behavior, and technological breakthroughs can cause unpredictable fluctuations in demand. For example, a slowdown in EV adoption due to economic conditions can temporarily reduce the demand for advanced battery coatings, impacting revenue forecasts for suppliers.

Moreover, competition from alternative energy storage technologies like solid-state batteries or supercapacitors could disrupt market projections. While electrode coatings remain vital in current battery systems, future innovations could change the landscape quickly, making long-term planning difficult for manufacturers and investors alike.

Conclusion

While the battery electrode coating market shows immense potential due to its essential role in modern energy storage systems, several growth challenges must be addressed for sustained expansion. Rising material costs, high R&D expenditure, regulatory hurdles, and inconsistent infrastructure are some of the major roadblocks. Overcoming these challenges will require collaboration across the value chain, government support, innovation in materials science, and a commitment to sustainable practices. Addressing these issues proactively will not only unlock new opportunities but also solidify the foundation for the battery industry of the future.