Category: Business

Market Overview

According to Fortune Business Insights , the global sex toys market size was valued at USD 17.11 billion in 2024 and is projected to reach USD 31.09 billion by 2032, expanding at a CAGR of 7.79% during the forecast period. Growth is driven by rising awareness of sexual wellness, increasing openness toward pleasure products, and technological innovations such as smart vibrators, app-controlled toys, and Bluetooth-enabled devices.

In 2024, North America dominated the market with a 37.17% market share, supported by reduced stigma, high purchasing power, and rapid adoption of innovative products. Vibrators accounted for the largest product segment, while women remained the leading end-user group.

Request FREE Sample Report of Sex Toys Market: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/sex-toys-market-112990

Key Market Insights

- 2024 Market Size: USD 17.11 billion

- 2025 Market Size: USD 18.39 billion

- 2032 Market Size Forecast: USD 31.09 billion

- CAGR (2025–2032): 7.79%

- Regional Leader (2024): North America – 37.17% market share

Market Trends

- North America witnessed sex toys market growth from USD 5.90 billion in 2023 to USD 6.36 billion in 2024.

The sex toys market is witnessing strong growth through e-commerce, as consumers increasingly prefer online purchases for privacy and convenience. Brands such as Goop Inc., Adam & Eve, Stag Shop, Harmony Store, and Sinful UK are boosting sales via digital platforms. Rising adoption of digital payments, wider product choices, and government support for online retail further accelerate the shift toward online shopping for adult toys.

Growth Drivers

- Rising Awareness of Sexual Wellness

Increasing global recognition of sexual wellness as part of overall well-being supports market growth. Sex toys help in stress management, enhancing pleasure, and addressing sexual dysfunction issues. - E-commerce Expansion

Online platforms are fueling sales due to anonymity, convenience, and wide product choices. Growing digital payment adoption and discreet packaging further boost demand. - Technological Advancements

Smart adult toys with features like customizable settings, multiple modes, and wireless connectivity are gaining popularity among tech-savvy consumers.

Market Restraints

- Health & Safety Concerns: Improper cleaning of sex toys can increase the risk of sexually transmitted infections (STIs), leading to cautious consumer adoption.

- Cultural Taboos: In certain conservative regions, stigma and lack of sexual education remain barriers to market growth.

Opportunities

- Increasing demand for premium and innovative products.

- Partnerships between sex tech companies and lifestyle brands.

- Expansion of sexual wellness retail stores and online platforms across emerging economies.

Segmentation Analysis

By Type

- Vibrators – Largest segment due to diverse designs, rechargeable batteries, and multi-speed options.

- Dildos – Widely popular among women; rising adoption for personal pleasure and wellness.

- Sleeves, Sex Dolls, and Others – Gaining attention due to realistic design and innovation.

By End User

- Women – Leading end-user segment with growing awareness of sexual health and wellness.

- Men – Fastest-growing segment, especially among millennials and Gen Z.

- LGBT Community – Increasing adoption with inclusive product offerings.

By Distribution Channel

- Retail Outlets (Offline) – Remain dominant due to immediate product access and physical evaluation.

- E-commerce (Online) – Fastest-growing channel driven by privacy, variety, and convenient shopping experiences.

Regional Insights

- North America: Leading market (USD 6.36 billion in 2024) with strong demand in the U.S., supported by technology adoption and availability of dedicated sex toy retailers.

- Europe: Second-largest market (~29% share) led by Germany, France, and the U.K., where social acceptance and premium spending drive growth.

- Asia Pacific: Fastest-growing market, fueled by rising e-commerce sales, youth awareness, and expanding sexual wellness culture in countries like China and India.

- South America & Middle East & Africa: Emerging markets driven by pop culture influence, online sales, and changing societal perceptions.

Speak To Our Analyst: https://www.fortunebusinessinsights.com/sex-toys-market-112990

Competitive Landscape

The sex toys market is moderately fragmented with several leading players focusing on product innovation, brand expansion, and partnerships.

Key Companies Profiled:

- Church & Dwight Co., Inc. (U.S.)

- LELO (Sweden)

- Doc Johnson Enterprises (U.S.)

- BMS Factory (Canada)

- Lovehoney Group (U.K.)

- TENGA Co., Ltd. (Japan)

- FUN FACTORY GmbH (Germany)

- We-Vibe (U.S.)

- Reckitt Benckiser Group plc. (U.K.)

- Lifestyles (Thailand)

Recent Developments:

- September 2024: Just Eat, a Denmark-based online delivery company, announced plans to deliver sexual wellness items, including adult toys from brands such as We-Vibe and Womanizer.

- April 2022: LELO, a Sweden-based massage items and adult toys manufacturer, partnered with Diesel, an Italy-based clothing retailer, to introduce its vibrators, TOR 2 and SONA Cruise, in revamped looks.

The sex toys market is evolving rapidly, supported by shifting consumer attitudes, technological advancements, and growing awareness of sexual wellness. While health concerns and cultural taboos present challenges, the expansion of e-commerce platforms, smart product innovations, and inclusivity in product design are expected to create lucrative opportunities for market players through 2032.

Tobacco Products Market Regional Share, Size & Growth Forecast 2025–2032

By Industry Outlook, 2025-08-20

Market Overview

According to Fortune Business Insights, the global tobacco products market size was valued at USD 1,018.57 billion in 2024 and is projected to reach USD 1,260.59 billion by 2032 , growing at a CAGR of 2.53% from 2025 to 2032. This market growth is fueled by the rising demand for next-generation products (NGPs) such as e-cigarettes, heated tobacco, and nicotine pouches, alongside strong consumption of traditional cigarettes and cigars across key markets.

Asia Pacific dominated the market with a 48.87% market share in 2024 , led by China, India, and Southeast Asia, where cigarette consumption and flavored nicotine product sales remain strong.

Download Free Sample Report Now to gain insights into market forecasts, segmentation, and competitor strategies. https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/tobacco-products-market-112987

Key Market Insights

- 2024 Market Size : USD 1,018.57 billion

- 2025 Market Size : USD 1,058.20 billion

- 2032 Forecast : USD 1,260.59 billion

- CAGR (2025–2032) : 2.53%

- Leading Region : Asia Pacific (48.87% share in 2024)

- Fastest-Growing Segment : Next-Generation Products (NGPs)

Key Market Trends

- Asia Pacific witnessed tobacco products market growth from USD 475.84 billion in 2023 to USD 497.81 billion in 2024.

- Growing Popularity of Slim & Flavored E-Cigarettes in China and Southeast Asia.

- Social Media Influence – Brands like Philip Morris’ ZYN leverage TikTok, reaching over 700M+ followers .

- Innovation in Heat-Not-Burn Devices – PMI’s IQOS BONDS and JT’s with 2 redefine smoke-free consumption.

Market Dynamics

Market Drivers

- Rising Disposable Income Among Women – Growing female smoking rates, especially in Europe and Asia, are expanding the consumer base.

- Increased Usage of Nicotine Products Among Youth – Social media marketing and flavored offerings are driving high adoption rates.

Market Restraints

- Regulatory Bans on E-Cigarettes in countries like India, Brazil, and Thailand hinder growth opportunities.

Market Opportunities

- Booming Demand for Flavored Nicotine Products – Innovative flavors such as mint, chocolate, fruit, and herbal blends are gaining traction.

- Expansion of Next-Generation Products (NGPs) – Heated tobacco, nicotine pouches, and vapor devices are accelerating global adoption.

Market Segmentation

By Product Type

- Traditional Tobacco Products

- Cigarettes (largest segment)

- Cigars

- Pipe Tobacco

- Roll-Your-Own (RYO) Tobacco

- Raw Tobacco & Chewing Leaves

- E-Cigarettes

- Heated Tobacco Products (HTPs)

- Nicotine Pouches (ZYN, On Plus, etc.)

- Snus

- Herbal Cigarettes, Hookah, Dokha, and Dissolvable Strips

Key Trend:

- Heated Tobacco Products (HTPs) are expected to witness the fastest growth from 2025–2032.

- Nicotine Pouches are the second fastest-growing category , fueled by digital and influencer marketing campaigns.

Regional Outlook

Asia Pacific

- Market Size (2024): USD 497.81 billion

- Key Drivers: High cigarette consumption in China (291M+ smokers), flavored e-cigarettes in Southeast Asia, and premium betel leaf shops in India.

North America

- Strong adoption of smoke-free products such as e-cigarettes and nicotine pouches.

- U.S. leads the region, with rising cigar and pipe tobacco consumption among women.

Europe

- Significant demand for nicotine pouches and e-cigarettes in the U.K., Sweden, and Switzerland.

- Strict regulations fuel innovation in smoke-free alternatives.

South America & Middle East

- Brazil and Argentina: Regulatory restrictions on smoking increase heat-not-burn product demand .

- Middle East: High cigarette usage but growing shift toward herbal tobaccos and dokha .

To get to know more about this market: https://www.fortunebusinessinsights.com/tobacco-products-market-112987

Competitive Landscape

The global tobacco products market is highly fragmented , with the top 5 players holding only 13.60% share (2024) . Companies are investing heavily in R&D and product innovation to capture the evolving consumer base.

Major Players:

- Philip Morris Products S.A. (U.S.)

- Altria Group, Inc. (U.S.)

- British American Tobacco plc. (U.K.)

- Japan Tobacco Inc. (Japan)

- Imperial Brands plc. (U.K.)

- ITC Limited (India)

- PT Hanjaya Mandala Sampoerna Tbk (Indonesia)

- PT Perusahaan Rokok Tjap Gudang Garam Tbk (Indonesia)

- KT&G Corporation (South Korea)

- China National Tobacco Corporation (China)

Example: In March 2023, Altria Group launched Swic (heated tobacco device) and On Plus (nicotine pouch) to expand its smoke-free portfolio.

Key Industry Developments

- December 2024 - Philip Morris International (PMI) announced the development of affordable next-generation products (NGPs) aimed at the African market. This initiative is driven by the recognition that the smoke-free market in Africa is still in its early stages, and there is a significant demand for cost-effective alternatives among price-sensitive consumers.

- September 2024 - British American Tobacco (BAT) launched a significant global initiative aimed at creating a "Smokeless World." This initiative, unveiled during the company's first Transformation Forum in London, features the Omni™ platform, which serves as an evidence-based resource to facilitate discussions around Tobacco Harm Reduction (THR).

The global tobacco products market is undergoing a significant transformation, driven by innovation, flavored products, and shifting consumer behaviors . While traditional tobacco remains dominant, the fastest growth lies in reduced-risk and next-generation products (NGPs) .

Air Fryer Market Regional Analysis: Size, Share & Growth Forecast 2025–2032

By Industry Outlook, 2025-08-20

Market Overview

According to Fortune Business Insights, the global air fryer market size was valued at USD 8.07 billion in 2024 and is projected to grow from USD 9.40 billion in 2025 to USD 17.71 billion by 2032 , exhibiting a strong CAGR of 9.47% during the forecast period.

The market expansion is fueled by the rising popularity of oil-free and healthy cooking appliances , increased adoption of smart kitchen devices , and the growing influence of social media recipes that encourage consumers to try air-fried meals.

In 2024, Asia Pacific dominated the air fryer market with a 46.22% market share , led by high demand from China, India, Japan, and South Korea .

Request FREE Sample Report of Air Fryer Market: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/air-fryer-market-107276

Key Market Highlights

- 2024 Market Size: USD 8.07 Billion

- 2025 Market Size: USD 9.40 Billion

- 2032 Forecast: USD 17.71 Billion

- CAGR (2025–2032): 9.47%

- Top Region: Asia Pacific – 46.22% share (2024)

- Leading Product Type: Digital Air Fryers (voice control & app connectivity)

- Major End-User: Households (driven by health-conscious consumers)

Key Market Trends

- Asia Pacific witnessed air fryer market growth from USD 2.96 Billion in 2023 to USD 3.73 Billion in 2024.

- Surge in vegan & plant-based cooking using air fryers.

- Growing demand for dual-basket and large-capacity models .

- Expansion of online recipe communities and cooking influencers.

- Rising popularity of subscription services & accessories (liners, racks, baskets).

Air Fryer Market Dynamics

Market Drivers

- Health-Conscious Consumer Shift Toward Oil-Free Cooking

Growing awareness of healthy eating and the benefits of air-fried food is driving household adoption worldwide. - Rising Demand for Energy-Efficient Appliances

Energy-efficient air fryers are increasingly used in modern kitchens and foodservice facilities. Renovation and DIY kitchen upgrades are also accelerating sales. - Social Media & Recipe Trends

Chefs and influencers promoting air fryer recipes on Instagram, TikTok, and YouTube have significantly boosted consumer interest.

Market Restraints

- High Cost of Smart Appliances – Advanced models with connectivity are less affordable for middle-income groups.

- Competition from Substitutes – Traditional ovens, microwaves, and cookware limit adoption in certain regions.

Market Opportunities

- Eco-Friendly & Sustainable Air Fryers – Rising demand for energy-efficient models and eco-design products is creating new opportunities.

- Customization & Premium Features – Growth in demand for dual-basket fryers, voice control, and smart app integration .

Market Challenges

- Short Product Lifecycle – Rapid technological advancements shorten replacement cycles, pressuring manufacturers.

- Consumer Skepticism – Misconceptions about “oil-free cooking” may hinder adoption in certain demographics.

Market Segmentation

By Type

- Digital Air Fryers – Largest segment, favored for multifunctionality (baking, roasting, grilling).

- Manual Air Fryers – Growing among budget-conscious consumers seeking affordable options.

By Model Type

- Basket-Style Models – Most popular due to compact size and affordability.

- Multi-Cookers & Countertop Models – Gaining traction for multifunctionality and premium kitchen setups.

By Capacity

- 3–5 Liters – Dominant segment (42.91% share in 2024), widely used by nuclear families.

- Up to 3 Liters – Rising among single households and mobile home consumers.

- 5–6 Liters & Above 6 Liters – Preferred for large households, foodservice facilities, and hospitality kitchens.

By Distribution Channel

- Supermarkets & Hypermarkets – Leading channel due to wide product availability.

- Online Channels – Fastest-growing, driven by e-commerce adoption and digital-savvy consumers.

- Specialty Stores – Gaining momentum with premium brand sales and after-sales services.

By End-User

- Households – Largest share, driven by home cooking, health awareness, and nuclear family setups.

- Foodservice Facilities – Growing adoption in restaurants, cafés, and hotels.

Regional Insights

Asia Pacific – Market Leader

- Market size in 2024: USD 3.73 Billion

- Strongest demand from China, India, Japan, and South Korea .

- Increasing adoption of smart & connected appliances supports growth.

North America

- Growth fueled by DIY cooking trends, food blogs, and hospitality adoption .

- U.S. consumers show strong preference for multi-cooker models .

Europe

- High adoption in U.K. and Germany driven by health-conscious diets and sustainable appliance demand.

South America & Middle East & Africa

- Brazil & UAE leading growth, supported by e-commerce adoption and demand for premium appliances in urban households.

To get to know more about this market: https://www.fortunebusinessinsights.com/air-fryer-market-107276

Competitive Landscape

The air fryer market is moderately consolidated with global and regional players investing in product innovation, eco-friendly appliances, and smart cooking features .

Key Players

- Groupe SEB (France)

- Midea Group (China)

- Koninklijke Philips N.V. (Netherlands)

- Xiaomi Corporation (China)

- Spectrum Brands, Inc. (U.S.)

- Faber S.p.A. (Italy)

- Conair Corporation (U.S.)

- Meyer Corporation (U.S.)

- TTK Prestige Ltd. (India)

- NuWave, LLC. (U.S.)

Launch: Cosori launched Smart TurboBlaze 6-Quart Air Fryer (2024), featuring 10 functions, app integration, and smart controls.

Key Industry Developments

- January 2024: Versuni, a Koninklijke Philips NV-owned small appliances manufacturing company, opened its second 25,000-square-meter factory in Ahmedabad, India. The factory has an annual production capacity of 500,000 air fryers, 200,000 garment steamers, and hand mixers in India.

- June 2023: Versuni, a Koninklijke Philips N.V.-owned small appliances manufacturing company, established a partnership with SAP SE, a European software company, to utilize the SAP Sustainability Control Tower to monitor the recycling process of used air fryers in Sao Paulo, Brazil.

The air fryer market is poised for rapid growth, backed by health-conscious consumer lifestyles, rising urbanization, and digital appliance adoption . While high costs and substitute competition remain challenges, opportunities in eco-friendly models, e-commerce expansion, and smart connectivity will drive long-term growth.

Market Overview

According to Fortune Business Insights, the global wax melts market size was valued at USD 1.46 billion in 2024 and is projected to reach USD 2.12 billion by 2032 , growing at a CAGR of 4.84% during the forecast period (2025–2032). The market growth is driven by rising consumer demand for home fragrance solutions , increasing awareness of home hygiene & décor , and the surge in e-commerce availability of scented products.

In 2024, North America dominated the wax melts market with a 36.06% market share , supported by strong home décor trends, high home sales, and the growing popularity of gifting options.

Request FREE Sample Report of Wax Melts Market: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/wax-melts-market-112079

Key Market Insights

- 2024 Market Size: USD 1.46 Billion

- 2025 Market Size: USD 1.52 Billion

- 2032 Forecast: USD 2.12 Billion

- CAGR (2025–2032): 4.84%

- Leading Region (2024): North America – 36.06% share

- Top Product Type: Paraffin Wax – 36.56% share

- Dominant Fragrance Type: Fresh/Citrus

- Key Growth Channel: E-commerce/Online

Key Market Trends

- North America witnessed wax market growth from USD 507.64 Million in 2023 to USD 526.41 Million in 2024.

- Rising popularity of DIY wax melts among home consumers.

- Expansion of subscription-based wax melt services .

- Increasing collaborations between home décor brands and fragrance companies .

Wax Melts Market Dynamics

Market Drivers

- Growing Awareness of Home Hygiene & Décor

Rising consumer preference for scented products such as wax melts, essential oils, and candles is boosting demand. The surge in residential construction and urbanization in countries such as India, Brazil, and Vietnam also supports growth. - Wax Melts as a Popular Gifting Option

Their versatile scents, attractive packaging, and customization options make wax melts a rising trend in the global gifting market.

Market Restraints

- Competition from Substitutes: Products such as scented candles, diffusers, and incense sticks limit adoption.

- Low-Quality Counterfeits: Rising counterfeit and substandard products affect brand reputation and profitability.

Market Opportunities

- Sustainability & Eco-Friendly Products: Consumer preference for soy wax and beeswax melts is creating opportunities for green, chemical-free alternatives.

- E-commerce Expansion: Online retail platforms such as Amazon, Flipkart, Alibaba, and eBay are driving global product reach with discounts, promotions, and broad accessibility.

Wax Melts Market Segmentation

By Product Type

- Paraffin Wax – Largest segment (36.56% share in 2024), widely used in commercial & residential spaces.

- Beeswax – Fastest-growing segment, favored for natural aroma and eco-friendly appeal.

- Soy Wax – Gaining popularity due to sustainability and long burn time.

- Others – Including blends and niche options.

By Fragrance Type

- Fresh/Citrus – Dominates due to aromatherapy and mood-boosting qualities.

- Floral – Expected to record highest CAGR; associated with relaxation and stress reduction.

- Fruity & Others – Popular among younger consumers.

By Distribution Channel

- Retail Outlets/Offline – Currently the largest channel; strong presence in supermarkets, specialty stores, and convenience shops.

- E-commerce/Online – Fastest-growing channel; increasing consumer shift toward online shopping with product variety and price comparison benefits.

Regional Insights

North America – Market Leader

- Market size in 2024: USD 526.41 Million

- U.S. leads due to rising demand for home fragrances & gifting trends .

- Canada shows strong growth supported by housing sales and home décor spending .

Europe – Rapid Growth Expected

- Strong adoption in the U.K., Germany, France, and Italy due to rising disposable income and eco-friendly product demand.

Asia Pacific – Fastest Expansion

- Countries like India, China, and Thailand are driving growth due to urbanization, rising disposable income, and awareness of home hygiene.

South America

- Growth supported by rising income levels, lifestyle upgrades, and real estate investments in Brazil, Argentina, and Colombia .

Middle East & Africa

- High demand in UAE, Saudi Arabia, and South Africa for luxury and eco-friendly home fragrance products.

To get to know more about this market: https://www.fortunebusinessinsights.com/wax-melts-market-112079

Competitive Landscape

The wax melts market is highly competitive , with companies focusing on geographic expansion, sustainable product launches, and premium packaging to attract a wider consumer base.

Key Players in the Wax Melts Market

- The Yankee Candle Company, Inc. (U.S.)

- East Coast Candles Company (U.S.)

- Bramble Bay Collections (Australia)

- Bridgewater Candle Company (U.S.)

- C. JOHNSON & SON, INC. (U.S.)

- Procter & Gamble (U.S.)

- Hampshire Candles (U.K.)

- Shearer Candles (U.K.)

- OLOR (U.K.)

- Kana Creations (India)

These players are investing in eco-friendly wax melts, aromatherapy blends, and personalized gift sets to gain a competitive edge.

Key Industry Developments

- October 2024: IRIS Home Fragrances, an India-based home fragrance products manufacturer, announced a new range of four exquisite Diwali gift sets. This set consisted of candles, wax melts, reed diffusers, and other products to create a serene and peaceful environment.

- August 2023: Classic Candle, a U.K.-based home fragrance brand, announced the launch of MiniPot Wax Melts. These wax melts were created from white wax and featured in the brand’s signature classic packaging.

The wax melts market is set for steady growth driven by home fragrance demand, gifting trends, and eco-friendly innovations . While competition from substitutes remains a challenge, opportunities in sustainability and e-commerce will shape the industry’s future.

Corporate Apparel Market Insights: Growth, Size & Share Forecast 2025–2032

By Industry Outlook, 2025-08-19

According to Fortune Business Insights , the global corporate apparel market size was valued at USD 288.82 billion in 2024 and is projected to grow from USD 305.56 billion in 2025 to USD 458.24 billion by 2032 , registering a CAGR of 6.01% (2025–2032) .

- Asia Pacific led the market in 2024 with a 94.8% market share , fueled by employment growth and government investments in MSMEs across India, China, and Vietnam .

- Asia Pacific witnessed corporate apparel market growth from USD 110.53 billion in 2023 to USD 116.59 billion in 2024 .

- Formal shirts dominated in 2024 as the most widely adopted apparel type for corporate branding, while formal pants & trousers are expected to register the fastest CAGR due to increasing dual-purpose usage.

- Men’s segment accounted for the largest share in 2024, while women’s segment is forecast to grow fastest, driven by rising female workforce participation, especially in India and Southeast Asia.

- Hypermarkets/supermarkets remain the leading distribution channel, while e-commerce is set to grow at the highest pace, driven by digital adoption, smartphone penetration, and convenience.

Leading players include Aditya Birla Management Corporation Pvt. Ltd., Raymond Limited, VF Corporation, and PVH Corp. —all expanding their global presence with sustainable apparel collections and wider retail reach.

Request FREE Sample Copy of Corporate Apparel Market: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/corporate-apparel-market-113426

Market Trends

- Ethical & Sustainable Fabrics Gain Traction

Workplaces are increasingly adopting eco-conscious apparel made from organic cotton, recycled polyester, vegan leather, and blended fabrics . Zero-waste manufacturing and circular fashion initiatives are also reshaping procurement policies for corporate uniforms.

- Personalization & Branding

Corporates are investing in branded uniforms with embroidered logos and custom designs to reinforce professional identity and boost team cohesion.

- 3D Printing in Apparel Manufacturing

The use of 3D printing technology for creating customized designs, on-demand logos, and sustainable apparel is reducing production waste and inventory risks, opening new revenue streams for suppliers.

Market Dynamics

Drivers

- Rising global workforce participation (India’s employment grew 36% between 2014–2024).

- Urbanization & industrial development in emerging economies.

- Corporate culture & branding needs across IT, retail, BFSI, and logistics sectors.

Restraints

- Shift toward casual workwear in tech, creative, and consulting industries.

- Hybrid work culture reducing day-to-day demand for formal corporate apparel.

Opportunities

- 3D printing & digital customization in production.

- Social media-driven visibility & influencer marketing .

- Sustainable formal wear demand in North America, Europe, and Asia Pacific.

Segmentation Analysis

By Type

- Formal Shirts – Largest share due to adoption as corporate uniforms with branding.

- Formal Pants & Trousers – Fastest growing, driven by fashion-conscious employees seeking dual-purpose wear.

- Others – Includes blazers, skirts, ties, and accessories.

By End-User

- Men – Dominated 2024 share, influenced by grooming and fashion awareness.

- Women – Expected highest CAGR; workforce participation in India rose from 22% (2018) to 40.3% (2024) .

By Distribution Channel

- Hypermarkets & Supermarkets – Leading due to product availability and convenience.

- E-commerce/Online – Fastest growth, with Amazon, Flipkart, Noon, and eBay expanding reach.

- Convenience Stores & Others – Remain supplementary but important in local markets.

Get to know more about this market; Please visit: https://www.fortunebusinessinsights.com/corporate-apparel-market-113426

Regional Outlook

- Asia Pacific (USD 116.59 Billion in 2024): Largest market, led by India, China, and Vietnam. Rising MSME investments and urban workforce expansion drive demand.

- North America: Significant growth expected. U.S. payroll jobs rose by 228,000 in March 2025 , boosting demand for formalwear.

- Europe: Strong focus on sustainable, designer corporate apparel across U.K., Germany, and France.

- South America & Middle East & Africa: Growth driven by e-commerce penetration, social media marketing, and eco-conscious consumer trends .

Competitive Landscape

The corporate apparel industry is moderately consolidated with global and regional players.

Key Players Include:

- Aditya Birla Management Corporation Pvt. Ltd. (India)

- Raymond Limited (India)

- PVH Corp. (U.S.)

- H&M Group (Sweden)

- Lefty Production Co. (U.S.)

- INDITEX (Spain)

- Giorgio Armani S.p.A. (Italy)

- Ralph Lauren Media LLC (U.S.)

- Casablanca Apparels (India)

- Cottonking (India)

Strategies:

- Geographic expansion into high-growth regions (Asia Pacific, Middle East).

- Sustainability initiatives (eco-friendly fabrics, ethical sourcing).

- E-commerce partnerships & D2C channels to target younger demographics.

- Product innovation via 3D printing, customizable designs, and luxury formal wear collections.

Key Industry Developments

- April 2025: Raymond Limited, an India-based textile and apparel manufacturing company, announced the opening of 900 new outlets in India. The launch will help the company expand its business across India.

- January 2024: Corneliani S.p.a., an Italy-based manufacturer, announced the launch of its formal and wedding line ‘Code’ in India. The formal wear line features a selection of suits, tuxedos, morning coats, and others.

- November 2022: Aditya Birla Fashion and Retail Ltd (ABFRL), a subsidiary firm of Aditya Birla Management Corporation Pvt. Ltd., partnered with Galeries Lafayette to open a luxury store in India. As per the company, they will open two flagship stores - one in Mumbai and another in New Delhi.

The corporate apparel market is projected to reach USD 458.24 billion by 2032 , fueled by workforce expansion, branding needs, and demand for sustainable fashion. While casual dress codes pose challenges, opportunities in digital customization, eco-friendly apparel, and online retail will shape the industry’s future growth.

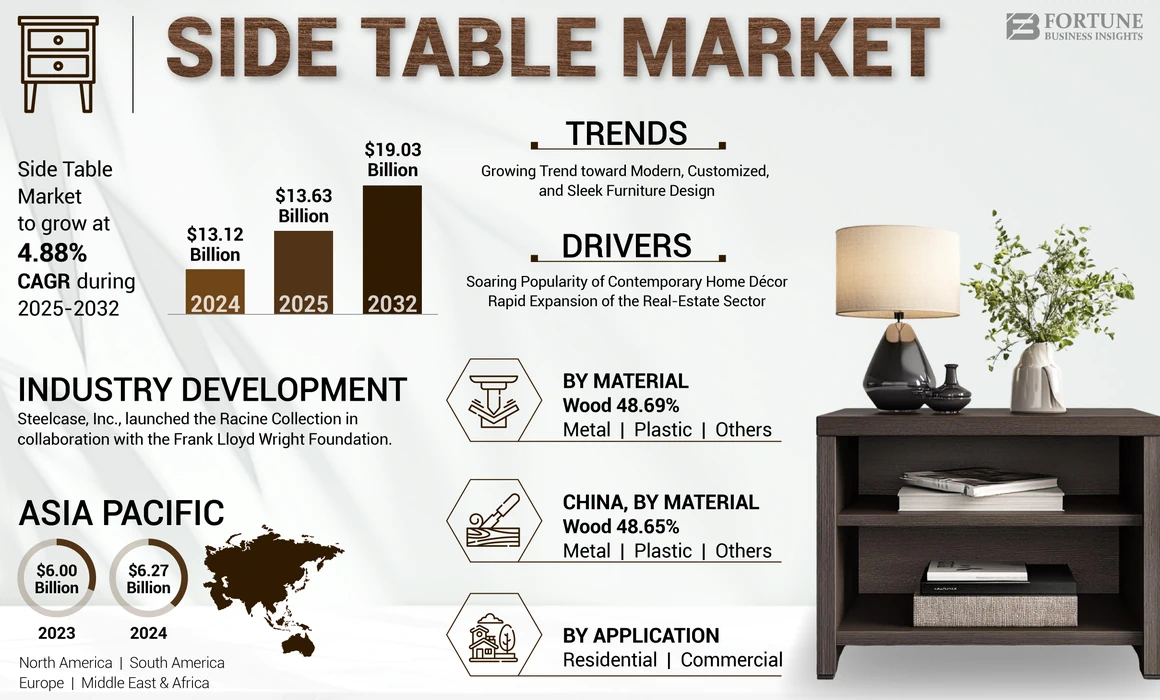

According to Fortune Business Insights, the global side table market size was valued at USD 13.12 billion in 2024 and is projected to grow from USD 13.63 billion in 2025 to USD 19.03 billion by 2032 , at a CAGR of 4.88% during the forecast period.

- Asia Pacific held 47.79% market share in 2024 , driven by rapid urbanization and its role as a global furniture manufacturing hub.

- Asia Pacific witnessed side table market growth from USD 6.00 Billion in 2023 to USD 6.27 Billion in 2024.

- The U.S. side table market is projected to reach USD 3.51 billion by 2032 , supported by a strong home ownership culture and evolving design preferences.

- By material, the wood segment is expected to hold 48.89% share in 2025 , due to its elegant, timeless appeal.

- By application, the residential segment is projected to generate USD 8.26 billion by 2025 , as consumers increasingly invest in home décor and furnishings.

Request FREE Sample PDF Copy of Side Table Market: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/side-table-market-110179

Global Side Table Market Overview

Market Size Outlook (USD Billion)

- 2024: 13.12

- 2025: 13.63

- 2032: 19.03

Market Share by Region (2024)

- Asia Pacific: 47.79%

- North America: Rising demand from U.S. and Canada

- Europe: CAGR of 3.25%

- India: Strong CAGR of 7.61%

- Japan: USD 0.65 billion by 2025

Side Table Market Trends

1. Rising Preference for Modern & Customized Furniture

Modern side tables featuring clean lines, sleek finishes, and compact designs are in high demand, especially among urban consumers with limited living space . Customization options such as finish, color, and material selection are enhancing consumer appeal.

2. Growth of Multifunctional Furniture

Side tables with drawers, storage compartments, convertible designs, or charging ports are gaining traction as multifunctional furniture becomes essential in compact homes and work-from-home setups .

3. Expansion of Online Furniture Retail

E-commerce platforms and virtual showrooms are boosting sales of side tables, providing consumers with diverse design options, customization features, and easy price comparisons.

Market Growth Drivers

1. Increasing Popularity of Contemporary Home Décor

Social media, home décor shows, and influencer-driven design trends are fueling demand for stylish, durable, and minimalist side tables that complement modern, industrial, and Scandinavian interiors .

2. Real Estate & Housing Market Growth

The boom in residential construction and home ownership—especially in Asia Pacific and North America —is driving demand for essential furniture items such as bedside tables, corner tables, and side tables with storage .

Restraining Factors

- Raw material price fluctuations (wood, steel, glass) increase manufacturing costs, limiting affordability in emerging markets.

- Rising competition from low-cost, mass-produced furniture alternatives may affect branded furniture demand.

Segmentation Analysis

By Material

- Wood (48.89% share in 2025): Preferred for durability and premium aesthetic appeal.

- Metal: Industrial-style interiors and modern design trends fuel growth.

- Plastic: Affordable, lightweight, and popular in outdoor settings.

- Others (glass, rattan, plywood): Increasing use in compact, modular designs .

By Application

- Residential (USD 8.26 billion by 2025): Growth supported by home décor trends, work-from-home setups, and leisure-driven furniture investments.

- Commercial: Hotels, offices, and retail spaces use side tables as part of branding and interior design strategies .

Regional Insights

- Asia Pacific (USD 6.27 billion in 2024): Market leader, driven by urbanization, home construction, and strong manufacturing presence in China, India, and Vietnam .

- North America: Growth driven by home ownership, luxury furniture demand, and online retail expansion .

- Europe (CAGR 3.25%): Renovation projects and higher disposable incomes fuel furniture spending.

- South America & Middle East & Africa: Hospitality and tourism industry expansions support commercial furniture demand .

To Get to Know More about this market; please visit: https://www.fortunebusinessinsights.com/side-table-market-110179

Competitive Landscape

Leading companies are focusing on:

- Smart furniture innovations: Integration of wireless charging, adjustable heights, and storage solutions .

- Sustainability: Eco-friendly materials and recyclable designs.

- Expansion in online sales channels through customization tools and AR-enabled shopping experiences .

For example, MillerKnoll (Herman Miller) reported a 74.3% surge in net sales in FY2022 , showcasing rising demand for luxury and multifunctional furniture .

List of Top Side Table Companies:

- Steelcase Inc. (U.S.)

- MillerKnoll, Inc. (U.S.)

- Ashley Furniture Industries, Inc. (U.S.)

- GLOBAL FURNITURE USA (U.S.)

- KOKUYO Co., Ltd. (Japan)

- Ethan Allen Global, Inc. (U.S.)

- Godrej & Boyce Mfg. Co. Ltd. (India)

- B&B ITALIA SPA (Italy)

- Sunpan Trading & Importing, Inc. (Canada)

- CB2 (U.S.)

- Pepperfry Limited (India)

- IKEA (Sweden)

- HNI Corporation (U.S.)

- Natuzzi S.p.A. (Italy)

- Dorel Industries Inc. (Canada)

Key Industry Developments:

- February 2023 - Steelcase, Inc., a global furniture manufacturing company, in partnership with the Frank Lloyd Wright Foundation, introduced the Racine Collection, featuring a range of items, including dining chairs, side tables, and desks. These offerings embody contemporary design elements, utilizing high-performance fabrics, materials, and adjustments to enhance user comfort.

- September 2022 – Tidelli, a specialist outdoor living furniture developer launched, Rio, a line of Rio de Janeiro-inspired arm chairs and a side table in the Peruvian market. These products are designed with differentiated features details on the base and an overlap of aluminum structure at the top.

The global side table market is set to grow steadily through 2025–2032 , driven by urbanization, home décor trends, and multifunctional furniture innovations . While raw material cost fluctuations may limit growth, opportunities lie in customization, smart furniture, and online retail expansion .

Home Decor Market Regional Analysis: Size, Share & Growth Forecast 2025–2032

By Industry Outlook, 2025-08-19

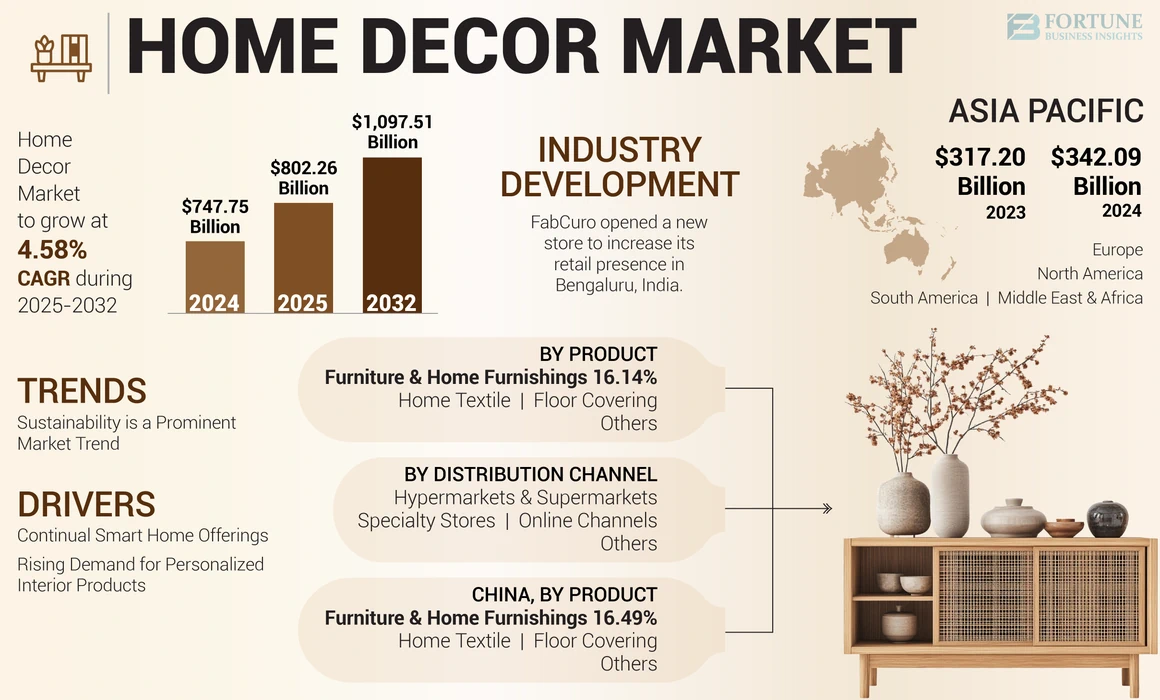

According to Fortune Business Insights, the global home decor market size was valued at USD 747.75 billion in 2024 and is projected to grow from USD 802.26 billion in 2025 to USD 1,097.51 billion by 2032 , exhibiting a CAGR of 4.58% during the forecast period.

- Asia Pacific dominated the home decor market with a 45.74% market share in 2024 , fueled by rapid urbanization, residential projects, and rising demand for modern furnishings.

- Asia Pacific witnessed home decor market growth from USD 317.20 Billion in 2023 to USD 342.09 Billion in 2024.

- The U.S. home decor market is expected to reach USD 305.51 billion by 2032 , driven by smart décor, virtual design consultations, and renovation projects.

- Floor covering is the largest product category, while furniture & home furnishing is the fastest-growing, fueled by luxury and multifunctional product demand.

Growing consumer focus on interior design trends, DIY décor, and sustainable furnishings continues to drive market expansion worldwide.

Request a Free Sample Report: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/home-decor-market-109906

Market Snapshot (2025–2032)

- 2024 Market Size: USD 747.75 billion

- 2025 Market Size: USD 802.26 billion

- 2032 Forecast Size: USD 1,097.51 billion

- CAGR (2025–2032): 4.58%

Market Share (2024)

- Asia Pacific: 45.74%

- Floor Covering Segment: Largest share due to rising renovation demand

- Furniture & Home Furnishings: Fastest-growing segment

- Distribution Channels: Hypermarkets & supermarkets dominate; online channels growing rapidly

Home Decor Market Trends

1. Sustainability Driving Home Décor Choices

Consumers are increasingly adopting eco-friendly and recycled décor products , from sustainable wood furniture to bio-material designs. For example, in May 2023, Laurence Carr Inc. launched a sustainable capsule collection crafted from durable biomaterials like Stonecast and Naturescast.

2. Smart Home Integration

Smart décor products—such as connected lighting, decorative smart speakers, and tech-enabled appliances —are gaining traction. In the U.K., 25% of home buyers now consider smart décor technology a must-have feature in new homes.

3. Personalized & DIY Home Décor

The demand for customized furniture, DIY craft décor, and monogrammed items is increasing. Households prefer multifunctional furniture with storage, space-saving features, and modular designs.

4. Outdoor & Garden Décor Gaining Popularity

According to the American Institute of Architects (AIA), 65% of Americans prefer decorative decks and patios , with outdoor fireplaces and indoor-outdoor blending also trending.

Market Growth Drivers

- Rising Residential Projects: Urban housing and real estate developments boost spending on home interiors.

- Luxury & Lifestyle Influence: Consumers invest in premium décor accents such as candles, artworks, and luxury textiles to elevate interiors.

- E-commerce Expansion: Online platforms enhance accessibility to diverse product categories with customization and virtual fitting tools .

- Post-COVID Digital Transformation: Virtual consultations and digital design tools accelerated interior product adoption.

Restraining Factors

- High Cost of Premium Products restricts adoption among middle- and lower-income households.

- Counterfeit Products in emerging economies erode brand trust and reduce premium product sales.

Segmentation Analysis

By Product

- Floor Covering (Largest Segment): Driven by renovation trends and innovations like PVC-free flooring.

- Furniture & Home Furnishings (Fastest-Growing): Increasing demand for luxury sofas, modular furniture, and multifunctional designs .

- Home Textile: Rising demand for bedding, curtains, and window coverings .

- Others: Includes lighting, wall décor, and accessories such as sculptures and decorative art.

By Distribution Channel

- Hypermarkets & Supermarkets: Dominate due to wide product access and discounts.

- Specialty Stores: Growth driven by luxury brand stores and affluent buyers.

- Online Channels (Fastest-Growing): Expansion fueled by digital retail, AR/VR design tools, and convenience .

- Others: Includes wholesale and upholstery shops, especially in developing markets.

Regional Insights

Asia Pacific (Dominant Market)

- Valued at USD 342.09 billion in 2024 , Asia Pacific will remain the largest and fastest-growing region .

- Growth fueled by China, India, and Southeast Asia , where homeowners prefer modern, space-saving furniture.

North America

- U.S. market to reach USD 305.51 billion by 2032 .

- Strong demand for smart décor, sustainable furniture, and home renovation projects .

Europe

- Rising consumer interest in eco-friendly furniture and recycled materials .

- Example: In 2022, Omega PLC (U.K.) launched new furniture collections made from 100% recycled wood .

South America

- Brazil and Argentina show growth in luxury home décor and kitchen upgrades .

Middle East & Africa

- High-income households demand modern kitchen storage, premium furnishings, and luxury décor solutions .

- Africa’s rising income levels fuel demand for stylish yet functional products .

To get to know more about this market; please visit: https://www.fortunebusinessinsights.com/home-decor-market-109906

Competitive Landscape

Leading companies in the global home décor market include:

- Williams Sonoma Inc. – Expanding retail presence (new San Diego store in 2023).

- Ashley Furniture Industries, Inc. – Focused on luxury furniture innovations.

- Inter IKEA Systems B.V. – Strengthening global product portfolio with sustainable and affordable offerings .

Key strategies include:

- Retail footprint expansion into Asia Pacific & Middle East.

- Sustainability-focused product launches.

- Digital marketing & influencer partnerships to attract younger demographics.

List of Top Home Decor Companies:

- 1888 Mills, LLC. (U.S.)

- Inter IKEA Systems B.V. (Netherlands)

- Williams-Sonoma Inc. (U.S.)

- Ashley Furniture Industries, LLC. (U.S.)

- Idea Nuova (U.S.)

- Ethan Allen Global, Inc. (U.S.)

- American Textile Company (U.S.)

- Ralph Lauren Corporation (U.S.)

- Welspun Flooring (India)

- Kimball International, Inc. (U.S.)

- Herman Miller, Inc. (U.S.)

- Steelcase, Inc. (U.S.)

Key Industry Developments:

- May 2024: Remax Furnitures, an Indian luxury furniture brand, launched a new store in New Delhi, India, to expand its retail presence in the country.

- March 2024: FabCuro, a stylish furniture boutique, opened a new store to increase its retail presence in Indiranagar, Bengaluru, India.

- February 2024: Havenly, a U.S.-based interior designer group, acquired The Citizenry, a direct-to-consumer home decor brand, to build its product portfolio with ethically crafted rugs, decorative textiles, and accents.

The global home decor market (2025–2032) is set to witness robust growth, fueled by sustainable products, smart home integration, luxury décor trends, and online retail expansion . While premium pricing and counterfeit goods pose challenges, innovation, personalization, and e-commerce growth will drive the next phase of industry evolution.

Cycling Gloves Market Key Drivers with Size, Share & Forecast 2025–2032

By Industry Outlook, 2025-08-18

According to Fortune Business Insights , the global cycling gloves market size was valued at USD 3.26 billion in 2023 and is projected to grow from USD 3.41 billion in 2024 to USD 5.49 billion by 2032, at a CAGR of 6.12% during the forecast period.

- Asia Pacific witnessed cycling gloves market growth from USD 1.08 billion in 2022 to USD 1.12 billion in 2023.

- Asia Pacific dominated the market with a 34.36% share in 2023.

- The U.S. cycling gloves market is expected to reach USD 0.91 billion by 2032, driven by the rising popularity of cycling as a fitness and recreational activity.

- By product, the full-finger segment is projected to hold 71.26% market share in 2025.

- By end-user, the male segment is expected to generate USD 2.08 billion in revenue by 2025.

Key players are investing heavily in R&D and advanced glove technologies to improve comfort, grip, and performance, while focusing on ergonomic and customizable designs to meet diverse consumer needs.

Request FREE Sample PDF Copy of Cycling Gloves Market: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/cycling-gloves-market-110725

Global Cycling Gloves Market Overview

Market Size (USD Billion)

- 2023: 3.26 USD Billion

- 2024: 3.41 USD Billion

- 2032 Forecast: 5.49%

Market Share (2023)

- Asia Pacific: 34.36%

- Full-finger gloves: 71.26% share expected by 2025

- Male end-users: USD 2.08 billion revenue expected by 2025

Key Country Highlights

- United States: USD 0.91 billion by 2032

- Japan: USD 0.14 billion by 2025

- India: CAGR of 6.76% (2024–2032)

- Europe: CAGR of 6.53%

Cycling Gloves Market Trends

- Rising Adoption of E-bikes

E-bikes have boosted demand for cycling accessories, including gloves that prevent hand fatigue, numbness, and discomfort. In 2023, the EU and U.K. saw 5.1 million e-bike sales, significantly increasing glove consumption.

- Customization & Ergonomic Designs

Cyclists increasingly prefer personalized cycling gloves with advanced features. For instance, Monton offers custom glove design services for teams and individuals.

Market Dynamics

Drivers

- Fitness & Recreation Growth: Rising demand for outdoor and eco-friendly activities.

- Technological Advancements: Use of gel inserts, memory foam, and silicone pads for better grip and comfort.

Restraints

- High Prices: Premium gloves limit affordability in emerging markets.

Opportunities

- Branding & Social Media Marketing: Influencer-driven campaigns boost consumer reach.

Challenges

- Counterfeit Products: Fake gloves undermine brand trust and consumer confidence.

Impact of COVID-19

The pandemic initially disrupted supply chains but later boosted cycling as a safe transportation alternative, driving sales of cycling gloves and accessories.

Segmentation Analysis

By Product

- Full-finger gloves: 71.26% share by 2025 (preferred for safety & all-weather use).

- Half-finger gloves: Popular in warm climates for breathability.

By End-user

- Male Segment: USD 2.08 billion by 2025, driven by competitive and extreme cycling.

- Female Segment: Growing participation in cycling clubs and fitness activities.

By Distribution Channel

- Offline Sales: Dominant, due to personalized shopping and fit testing.

- Online Sales: Growing rapidly with virtual fitting tools, reviews, and customization options.

Get Full Summary of Cycling Gloves Market: https://www.fortunebusinessinsights.com/cycling-gloves-market-110725

Regional Outlook

- Asia Pacific (34.36% in 2023): Strong growth in China, India, and Japan due to infrastructure development and government cycling initiatives.

- Europe: CAGR 6.53%, driven by eco-friendly transport adoption.

- North America: Expansion of bike-sharing programs boosts demand.

- South America & Middle East & Africa: Growth supported by e-commerce penetration.

Competitive Landscape

Key players are enhancing market presence through:

- New product launches (e.g., GripGrab’s Ride Comfort Max gloves with 90% recycled materials).

- Mergers & acquisitions for portfolio expansion.

- Branding & lifestyle marketing (e.g., HandUp Gloves building cycling communities).

List of Top Cycling Gloves Companies:

- GIRO (U.S.)

- Trek Bikes (U.S.)

- Rapha (U.K.)

- Assos (Switzerland)

- GripGrab (Denmark)

- Altura (U.K.)

- Specialized Bicycle Components (U.S.)

- Pearl Izumi (U.S.)

- Endura (Scotland)

- Showers Pass (U.S.)

Key Industry Developments

- December 2023 – Fox Racing, a U.S.-based sports equipment manufacturing company, launched ‘Defend Pro Winter Gloves.’ This range is known for its warmth and weatherproofing and incorporates insulated materials and touchscreen compatibility for convenience during rides.

- January 2023 – GIRO, a sports goods company, introduced the Rodeo MTB Glove, featuring the cutting-edge D3O 'Ghost Knuckle' Protection. This launch implies a significant advancement in the market. The innovative technology provides enhanced safety for cyclists and improves grip while ensuring comfort and flexibility during rides.

The cycling gloves market is set for significant growth through 2024–2032, supported by urban mobility trends, e-bike adoption, and ergonomic product innovations. While price sensitivity and counterfeit products pose challenges, strong branding, e-commerce expansion, and customization trends are expected to propel the market forward.

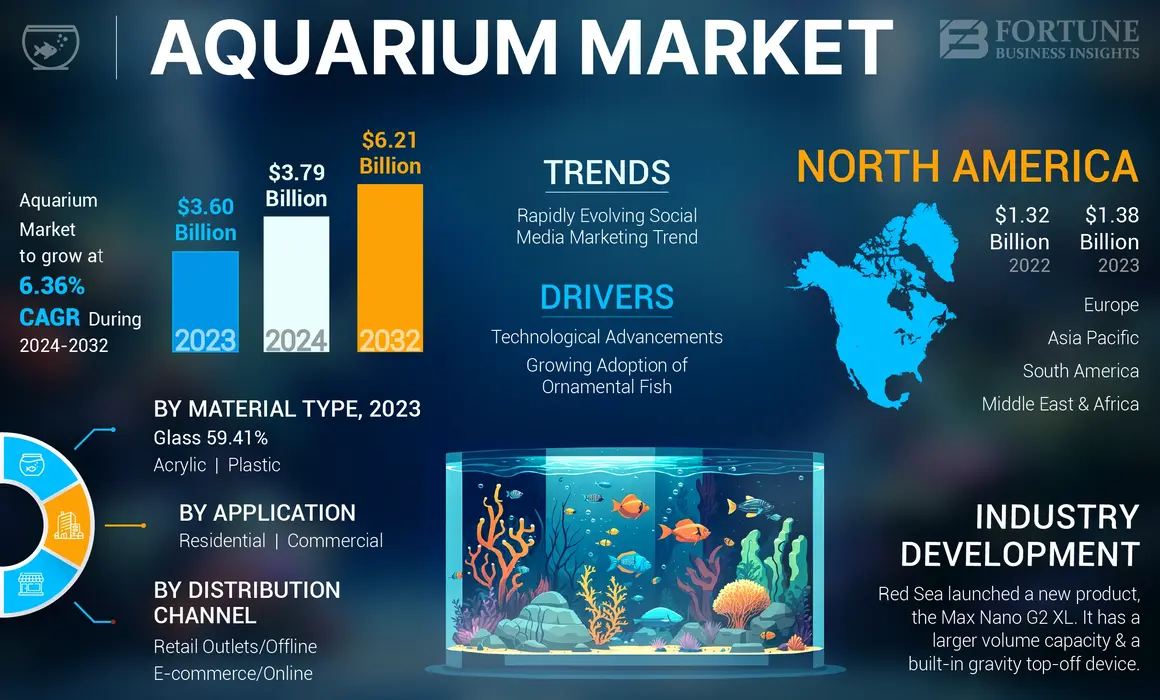

According to Fortune Business Insights , the global aquarium market size was valued at USD 3.60 billion in 2023 and is projected to grow from USD 3.79 billion in 2024 to USD 6.21 billion by 2032, at a CAGR of 6.36% during the forecast period.

- North America witnessed aquarium market growth from USD 1.32 Billion in 2022 to USD 1.38 Billion in 2023.

North America dominated the market with a 38.33% market share in 2023, led by strong ornamental fish demand and rising home aquarium adoption. The U.S. aquarium market is expected to reach USD 1.91 billion by 2032, supported by advanced aquatic equipment, growing pet ownership, and the popularity of stylish interior décor.

An aquarium (fish tank) is a glass or acrylic container designed to house aquatic animals, including fish, reptiles, and invertebrates. Tanks are available in various shapes (rectangular, round, square, triangular) and sizes (small, mid-sized, large), attracting diverse consumers worldwide. The growing availability of aquariums through pet stores, online platforms, and specialty retailers continues to fuel demand.

Request FREE Sample PDF Copy of Aquarium Market: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/aquarium-market-110692

Impact of COVID-19 on the Aquarium Market

The COVID-19 pandemic had a mixed effect:

- Positive Impact: Adoption of ornamental fish rose as consumers invested in pets for companionship and home décor.

- Negative Impact: Global supply chain disruptions and quarantine measures restricted imports and exports of aquariums and ornamental fish, slowing growth in some regions.

Aquarium Market Trends

- Social Media Marketing Driving Growth

Manufacturers are leveraging social media platforms (Instagram, YouTube, Facebook, Pinterest) for digital marketing and customer engagement. With 4.3 billion global smartphone users in 2023 (GSMA), online campaigns significantly enhance brand awareness and product sales.

- Technological Advancements in Smart Aquariums

Smart technology has transformed aquarium-keeping with automated feeding systems, customizable lighting, real-time monitoring via apps, and voice assistant integration. These features improve convenience and enhance the aquarium experience, driving product adoption.

- Rising Adoption of Ornamental Fish

Ornamental fish such as goldfish, neon tetras, and fantails are increasingly used for home decoration, office aesthetics, and hospitality spaces. According to OEC (2022), the U.S., China, Germany, and the U.K. were top importers of ornamental fish, reflecting growing global demand.

Market Growth Factors

- Technological innovation (smart monitoring, LED lighting, automatic feeding).

- Rising pet ownership and demand for aesthetic home décor .

- Expanding e-commerce distribution with easy product access.

- Increasing commercial installations in luxury hotels, restaurants, and offices.

Market Restraints

- Strict government regulations on ornamental fish trade (e.g., U.S. ban on Banggai Cardinalfish imports in 2023, India’s restrictions on 158 species).

- Environmental concerns regarding the impact of exotic fish trade.

Segmentation Analysis

By Material Type

- Glass Tanks (59.41% share in 2023): Durable, cost-effective, scratch-resistant.

- Plastic Tanks: Lightweight, affordable, available in diverse designs.

- Acrylic Tanks: Premium, clearer than glass, but more expensive.

By Application

- Residential: Dominates due to increasing investments in interior décor and lifestyle improvements.

- Commercial: Growing in hospitality and office spaces for enhancing ambience.

By Distribution Channel

- Offline Retail: Still preferred for physical inspection and customization.

- Online/E-commerce: Fastest-growing, supported by convenience, product variety, and attractive discounts.

Get full report: https://www.fortunebusinessinsights.com/aquarium-market-110692

Regional Insights

- North America (USD 1.38 billion in 2023): Largest market, led by U.S. ornamental fish demand.

- Asia Pacific: Fastest-growing region, fueled by urbanization, rising incomes, and increasing aquarium installations in China, India, and Japan.

- Europe: Growth supported by energy-efficient designs and high pet adoption rates.

- South America & Middle East & Africa: Expansion driven by online sales channels, luxury hospitality demand, and awareness of smart aquariums.

Key Industry Players

The aquarium industry is highly competitive, with companies investing in product innovation, partnerships, and digital marketing campaigns to strengthen market presence.

Leading Companies:

- EHEIM GmbH & Co. KG. (Germany)

- Aqua Design Amano Co., Ltd. (Japan)

- Tropical Marine Centre (TMC) (U.K.)

- Sensen Group Co., Ltd. (China)

- TSUNAMI AQUARIUMS (U.S.)

- Spectrum Brands, Inc. (U.S.)

- UWEL Aquarium AG & Co. KG. (Germany)

- Guangzhou Akaida Aquarium Co., Ltd. (China)

- Aquarium Design India (India)

- JUWEL Aquarium AG & Co. KG. (Germany)

These companies focus on smart aquarium technologies, energy-efficient systems, and strong retail/e-commerce distribution to capture growing consumer demand.

Key Industry Developments:

- March 2024— Interpet, a manufacturer of fish tanks & related products, announced the launch of the Aqua Smart Bluetooth Aquarium LED range. This product offers smart features such as adjustable LED output and intensity, Bluetooth connectivity, and pre-set lighting programs.

- January 2024— Red Sea, which manufactures fish tanks and related accessories, launched the Max Nano G2 XL. The newly launched product has a larger volume capacity and a built-in gravity top-off device.

The global aquarium market is set to expand strongly, reaching USD 6.21 billion by 2032, fueled by ornamental fish adoption, smart aquarium technology, and rising consumer interest in home décor and pet ownership. While regulations on aquatic pets present challenges, growing opportunities in e-commerce, commercial spaces, and smart aquarium solutions are expected to drive long-term market growth.

Handloom Sarees Industry Growth, Market Share & Size Forecast 2025–2032

By Industry Outlook, 2025-08-14

According to Fortune Business Insights , the global handloom sarees market size was valued at USD 3.72 billion in 2024 and is projected to grow from USD 3.99 billion in 2025 to USD 7.29 billion by 2032, registering a CAGR of 8.99% during the forecast period.

Asia Pacific led the market in 2024 with a 68.82% market share, supported by strong domestic demand, government initiatives like “ Vocal for Local ” , and the revival of traditional weaving practices.

Market Overview

Handloom sarees are traditional Indian garments woven using age-old techniques, valued for their intricate craftsmanship, cultural heritage, and timeless appeal. Each region of India has its own distinctive style, from the rich Kanjeevaram sarees of Tamil Nadu to the vibrant Maheshwari sarees of Madhya Pradesh and the regal Banarasi sarees of Uttar Pradesh.

Leading market players such as Maheshwari Handloom, BHOLI SAREES, Ajmera Fashion Limited, and HMR Handlooms are innovating with eco-friendly raw materials, sustainable packaging, and modern printing techniques to attract younger consumers while maintaining traditional aesthetics.

Request FREE Sample PDF Copy of Handloom Sarees Market: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/handloom-sarees-market-113034

Global Handloom Sarees Market Snapshot

- 2024 Market Size: USD 3.72 billion

- 2025 Market Size: USD 3.99 billion

- 2032 Market Size Forecast: USD 7.29 billion

- CAGR (2025–2032): 8.99%

Key Market Highlights:

- Material Leader: Cotton sarees dominate due to comfort, breathability, and popularity during festivals and weddings.

- Top Distribution Channel: Retail outlets/offline sales lead due to personalized service and fabric inspection benefits.

- Fastest-Growing Channel: E-commerce, driven by urban demand, wider variety, and affordable pricing.

Regional Insights:

- India: Largest producer and consumer; exports to 20+ countries.

- U.S. & Canada: Demand driven by South Asian diaspora and premium fabrics like Mysore silk and Banarasi.

- Europe: Rising interest in ethical, artisanal, and sustainable fashion.

- Middle East & Africa: Online retail and social media promotions fuel growth.

Handloom Sarees Market Trends

- Government & Private Sector Investment

Governments across Asia are providing financial aid, infrastructure upgrades, and marketing support to boost handloom production. Simultaneously, private players are investing in modern design innovations and global marketing campaigns.

- Revival of Weaving Traditions

Traditional weaving styles—Khadi, Maheshwari, Banarasi, Kanjeevaram—are being rebranded as luxury heritage products to appeal to younger consumers seeking cultural connection.

- Social Media-Driven Demand

Manufacturers are increasingly leveraging Instagram, Facebook, and TikTok marketing to reach global audiences, offering engaging content, influencer collaborations, and exclusive online collections.

Market Dynamics

Drivers

- Cultural Significance & Exclusivity: Handloom sarees offer unique, non-replicable designs unlike machine-made fabrics.

- Festive & Wedding Demand: Especially high for silk, cotton, and zari work sarees during Diwali, Navratri, and weddings.

- Government Promotion: Campaigns like Vocal for Local and subsidies for weavers support market growth.

Restraints

- High Production Costs: Use of natural fibers, hand-dyeing, and skilled labor make sarees more expensive than machine-made alternatives.

- Limited Production Volume: Low scalability keeps prices high, limiting mass adoption.

Opportunities

- E-commerce Expansion: Platforms like Amazon, Flipkart, Noon, and Namshi provide global access to Indian handloom sarees.

- Luxury Positioning: Growing demand for premium handloom sarees in North America, Europe, and the Middle East.

Market Segmentation

By Material

- Cotton: Largest market share; popular for comfort, breathability, and festive wear.

- Silk: Preferred for weddings, ceremonies, and export markets.

- Linen: Fastest-growing segment; lightweight, breathable, and ideal for warm climates.

- Wool: Niche demand for winter collections and luxury segments.

By Distribution Channel

- Retail Outlets/Offline: Specialty stores and hypermarkets dominate due to personalized service and fabric inspection.

- E-commerce/Online: Growing rapidly; offers global reach, seasonal discounts, and a wider variety.

Regional Outlook

- Asia Pacific: USD 2.56 billion in 2024; India leads production and exports, supported by strong domestic demand and government schemes.

- North America: Growth driven by South Asian diaspora and luxury silk saree imports.

- Europe: Demand for sustainable, handcrafted fashion is on the rise.

- Middle East & Africa: Social media ads and online availability drive sales.

- South America: Niche market for cultural fashion and festive wear.

Competitive Landscape

Key players are focusing on new product launches, sustainable practices, and brand collaborations to expand their reach.

Major Companies Include:

- Maheshwari Handloom (India)

- BHOLI SAREES (U.S.)

- Ajmera Fashion Limited (India)

- HMR Handlooms (India)

- Albeli (India)

- KTC Fashion (India)

- Jagg Hastakala (India)

- Dhananjay Creations Private Limited (India)

- Sameer Handloom (India)

- Mrignayani (India)

These players are enhancing market presence through digital marketing campaigns, international exhibitions, and strategic retail partnerships .

KEY INDUSTRY DEVELOPMENTS

- November 2024: Chhunchi, an India-based online saree brand, has announced the launch of a one-stop online store for handloom saree enthusiasts. The store contains

- October 2024: RmKV, an India-based company announced the launch of range of thematic authentic handloom silk saree with natural dye. This saree are available in 4,000 colors and its colors are derived from diversified natural sources such as myrobalan, indigo, Indian madder, gooseberry, lac, pomegranate, and Indian red creeper.

- July 2024: KCPC Bandhani, an India-based manufacturing company, announced the launch of Banarasi Katan Handloom Saree with blouse. The launch would help the company increase its product offerings.

The global handloom sarees market is set for robust growth through 2032, powered by heritage craftsmanship, sustainable fashion trends, and e-commerce expansion. Asia Pacific will remain the dominant hub for production and exports, while North America and Europe emerge as lucrative markets for premium and luxury handloom sarees.