The global ultrasonic testing market was valued at USD 2,297.2 million in 2019 and is expected to grow from USD 1,954.4 million in 2020 to USD 8,920.67 million by 2032, reflecting a compound annual growth rate (CAGR) of 11.00% over the forecast period from 2020 to 2032. In 2019, North America led the market, accounting for a dominant share of 38.9%.

The ultrasonic testing market is experiencing significant growth due to increasing demand for non-destructive testing techniques across various industries such as manufacturing, aerospace, automotive, and oil & gas. Ultrasonic testing offers reliable and precise inspection capabilities, making it essential for ensuring structural integrity and safety. Advancements in testing technologies, coupled with rising awareness about quality control and safety regulations, are further driving market expansion. Additionally, the growing need for maintenance and inspection of aging infrastructure is expected to support long-term growth in the global ultrasonic testing market.

Information Source:

https://www.fortunebusinessinsights.com/ultrasonic-testing-market-104865

Ultrasonic testing has emerged as a pivotal technique in various industries, offering precise and non-destructive inspection capabilities. This article delves into the Ultrasonic Testing Market, shedding light on key players, segmentation, driving factors, and recent industry developments.

Key Players: Ultrasonic Testing Market

- Amerapex Corporation (The U.S.)

- Applied Technical Services, Inc. (The U.S.)

- Ashtead Technology (The U.K.)

- General Electric (The U.S.)

- Mistras Group (The U.S.)

- NDT Global GmbH & Co. Kg (The U.S.)

- Nikon Metrology (Japan)

- Olympus Corporation (Japan)

- Sonatest Ltd. (The U.K.)

- Tecscan Systems Inc. (Canada)

- TD Williamson, Inc. (The U.S.)

Segmentation: Ultrasonic Testing Market

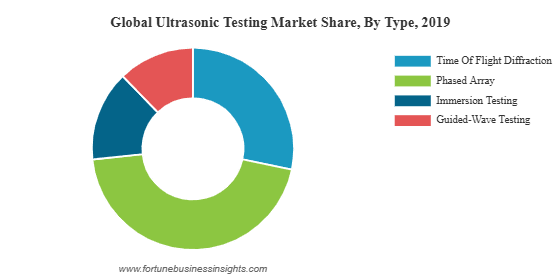

The Ultrasonic Testing Market exhibits a robust segmentation based on various factors, including testing type, industry vertical, and region. Commonly utilized testing types encompass thickness testing, flaw detection, weld inspection, and material characterization. Industries such as oil and gas, manufacturing, aerospace, and healthcare leverage ultrasonic testing for quality assurance and defect identification. Regionally, the market spans North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa.

Driving Factors:

Several factors drive the growth of the Ultrasonic Testing Market. The increasing demand for reliable and accurate non-destructive testing methods in industries like oil and gas and manufacturing propels the market forward. Stringent regulations and standards emphasizing product quality and safety contribute to the adoption of ultrasonic testing techniques. Additionally, the growing awareness about preventive maintenance and the need for early defect detection further boost market expansion.

Industry Developments: Ultrasonic Testing Market

Recent industry developments underscore the dynamic nature of the Ultrasonic Testing Market. Notable advancements include the integration of artificial intelligence and machine learning algorithms into ultrasonic testing devices, enhancing their analytical capabilities. Moreover, the market has witnessed the development of portable and handheld ultrasonic testing devices, providing greater flexibility in various applications. Collaborations and partnerships between key players and research institutions continue to foster innovation in the field.

In September 2020 - Element’s testing laboratory entered into a contract with the Safran Group to provide non-destructive testing services. This agreement followed Safran’s official approval of Element’s laboratory for conducting ultrasonic testing on Safran components.

In conclusion, the Ultrasonic Testing Market is witnessing remarkable growth, driven by key players, effective segmentation, driving factors, and continuous industry developments. As technology evolves, the market is poised to play a pivotal role in ensuring the integrity and quality of materials across diverse sectors.

The aircraft gearbox market was valued at USD 3,381.5 million in 2024 and is projected to grow from USD 3,653.7 million in 2025 to USD 6,094.1 million by 2032, exhibiting a compound annual growth rate (CAGR) of 7.58% during the forecast period. North America dominated the market in 2024, accounting for a significant share of 45.71%.

The market is witnessing steady growth driven by rising aircraft production, increasing demand for fuel-efficient engines, and continuous advancements in aerospace technology. Aircraft gearboxes are essential components that transmit mechanical power and enhance engine efficiency in both commercial and military aviation. Growth is further propelled by expanding global air travel, the ongoing modernization of aircraft fleets, and innovations in gearbox technology, including the use of lightweight materials and enhanced durability. As the aviation sector advances, the demand for high-performance and reliable gearbox systems is expected to grow substantially over the coming years.

These findings are covered in the research report titled “Aircraft Gearbox Market Size, Share, Forecast, and 2025–2032.”

Information Source:

https://www.fortunebusinessinsights.com/aircraft-gearbox-market-105541

List of Key Players Mentioned in the Report:

- Safran (France)

- Liebherr (Switzerland)

- United Technologies Corporation (UTC) (U.S.)

- Rexnord Aerospace (U.S.)

- Triumph Group (U.S.)

- Aero Gear (U.S.)

- CEF Industries Inc. (U.S.)

- The Timken Company (U.S.)

- AAR Corp (U.S.)

- Rolls-Royce plc (U.K.)

- Regal Rexnord (U.S.)

Segmentation:

The global aircraft gearbox market is segmented based on component, platform, gearbox type, end-user, and region. By component, the market includes gear, housing, bearing, and others. In terms of platform, it is categorized into commercial, civil, and military aviation. Based on gearbox type, the market is classified into accessory gearboxes, reduction gearboxes, actuation gearboxes, tail rotor gearboxes, auxiliary power unit (APU) gearboxes, and others. By end-user, the market is divided into OEM, MRO, and others. Regionally, the market is analyzed across North America (U.S. and Canada), Europe (U.K., Germany, France, Russia, and the Rest of Europe), Asia Pacific (China, Japan, India, South Korea, and the Rest of Asia Pacific), and the Rest of the World, which includes Latin America and the Middle East & Africa. Each regional market is further segmented by component, platform, gearbox type, and end-user to provide detailed insights and growth opportunities.

Drivers and Restraints: Aircraft Gearbox Market

Rising Demand for Lightweight Aircraft Components to Boost Market Growth

With airlines and aircraft manufacturers focusing on efficiency, the demand for lightweight components, including gearboxes, is increasing. Lighter components not only enhance fuel efficiency but also improve performance, reduce emissions, and extend component lifespan. Manufacturers are leveraging advanced materials and design techniques to create high-performance, lightweight gear systems.

Stringent Regulations Pose Challenges to Market Expansion

However, the aircraft gearbox market faces challenges from stringent aerospace regulations. The high costs associated with design, development, and certification of gearboxes can hinder new entrants and slow innovation. Regulatory compliance and safety testing add to the complexity and cost of market participation, acting as a restraint on growth.

Regional Insights:

North America to Maintain Dominance Owing to Aerospace Leadership and Military Investment

North America led the global aircraft gearbox market in 2024, with a market value of USD 1,545.82 million. The region benefits from the presence of key players such as Boeing and GE, as well as strong R&D capabilities and government defense programs. The U.S. Department of the Air Force’s FY2025 budget of USD 217.5 billion—featuring USD 29 billion for procurement and USD 37.7 billion for R&D—underscores the scale of investment supporting the gearbox market.

Europe Benefiting from Technological Advancements and Green Aviation Initiatives

Europe holds a significant market share, supported by investments from leading aerospace firms focused on reducing emissions and improving aircraft efficiency. Collaborations between governments and industry players have been key to driving innovation in the region.

Asia Pacific Set to Grow at Fastest Pace Due to Civil Aviation Boom

The Asia Pacific region is projected to witness the highest CAGR due to increasing demand for civil aviation and regional fleet expansions in countries like China and India. Infrastructure development and rising disposable incomes are contributing to a flourishing aviation market and growing demand for reliable gearboxes.

Other Regions See Gradual Growth

The Middle East & Africa are experiencing modest growth through fleet expansion and investments in aviation infrastructure. Latin America, led by Brazil and Mexico, is seeing steady market recovery through a focus on MRO capabilities and aviation development.

Competitive Landscape:

Key Players Focus on Innovation, Contracts, and Partnerships to Strengthen Market Position

The aircraft gearbox market is competitive, with leading players investing heavily in R&D and strategic partnerships to meet evolving industry needs. Companies are also expanding product lines and entering long-term agreements to maintain market leadership.

Key Industry Developments:

- February 2025 – Bell Boeing received a USD 46 million contract for the integration and supply of V-22 Gearbox Vibration Monitoring/Osprey Drive System Safety and Health Information (ODSSHI) kits.

- August 2023 – Leonardo announced partnerships to support its AW09 helicopter at Heli-Expo 2023.

- May 2023 – Triumph Group’s Geared Solutions unit secured a long-term contract with GE for LEAP program Inlet Gearboxes.

Report Coverage:

The aircraft gearbox market report offers a comprehensive analysis of global trends, market size, and forecast through 2032. It provides detailed segmentation by component, gearbox type, platform, and end-user. The report highlights key players, competitive dynamics, pricing strategies, regional performance, and recent industry developments. Additionally, it explores market drivers, restraints, and the strategic initiatives shaping the future of aircraft gearbox technologies.

The global air taxi market was valued at USD 1.47 billion in 2024 and is expected to grow from USD 1.75 billion in 2025 to USD 5.16 billion by 2032, registering a compound annual growth rate (CAGR) of 16.7% during the forecast period. In 2024, North America held the largest share of the market, accounting for 38.1%.

The air taxi market is witnessing significant growth due to the rising demand for efficient, sustainable, and time-saving urban mobility solutions. Technological advancements in autonomous systems, electric propulsion, and lightweight aircraft design are driving the development of next-generation air taxis. The market is also benefiting from increasing investments by aerospace companies and startups, as well as supportive government initiatives for urban air mobility (UAM). With applications ranging from intracity to intercity travel, air taxis are poised to transform the future of transportation, offering a faster alternative to ground travel in congested urban areas.

List of Key Companies Profiled

- Airbus (Netherlands)

- Uber Technologies Inc. (U.S.)

- Dassault Systèmes (France)

- Hyundai Motor Company (South Korea)

- Wisk Aero (U.S.)

- Volocopter GmbH (Germany)

- Sarla-Aviation Private Limited (India)

- Joby Aviation (U.S.)

- Archer Aviation Inc. (U.S.)

- BETA Technologies (U.S.)

Information Source:

https://www.fortunebusinessinsights.com/air-taxi-market-112983

Market Drivers and Opportunities

Growing Demand for Urban Air Mobility and Electric Propulsion to Drive Market Growth

The air taxi market is witnessing rapid growth, propelled by urban congestion, demand for fast inter- and intra-city travel, and advancements in electric propulsion systems. These aircraft—capable of vertical takeoff and landing (VTOL)—are being designed for short-distance commutes, often within metropolitan areas, significantly reducing travel time and environmental impact.

Increasing investments from aerospace giants and tech startups are enabling the development of scalable and efficient air taxi infrastructure. Additionally, the adoption of AI-driven autonomous flying systems , battery advancements , and lightweight composite materials is further optimizing flight efficiency and safety.

However, regulatory hurdles , airspace management complexity, and infrastructure limitations remain key restraints in the short term. Collaborative efforts between private stakeholders and government bodies are underway to address certification, pilot licensing, and urban air traffic control.

Segmentation Analysis

- By Offering:

Hardware, Software, Services - By Technology:

Fully Autonomous, Semi-Autonomous, Manual - By Propulsion Type:

Parallel Hybrid, Electric, Turboshaft, Turboelectric, Others - By Aircraft Type:

Multicopter, Side-By-Side Aircraft, Tiltwing Aircraft, Tiltrotor Aircraft, Others - By Range Outlook:

Intercity, Intracity

Regional Insights

North America Leads with Strong Industry Ecosystem and Policy Support

North America is the dominant region in the air taxi market due to advanced aerospace R&D, strategic collaborations, and government support for sustainable transportation. Companies like Joby Aviation , Archer Aviation , and Beta Technologies are rapidly progressing towards commercial deployment. The U.S. FAA’s approval of testing corridors for eVTOLs has further catalyzed growth.

In Europe , nations like Germany, France, and the U.K. are promoting eco-friendly aviation solutions, led by players such as Volocopter and Airbus . In Asia Pacific , rapid urbanization and government-funded smart city programs are creating a fertile ground for air taxi deployment. For instance, South Korea and India have committed to trials and infrastructure readiness by 2028.

Competitive Landscape

Innovation, Strategic Partnerships, and Regional Expansion are Key Focus Areas

Leading players are focusing on prototyping, strategic collaborations , and fundraising to scale operations and gain first-mover advantage. Many companies are developing vertiports , forming alliances with ridesharing platforms, and integrating digital air traffic solutions. Mergers, acquisitions, and government partnerships are expected to intensify competition over the forecast period.

Key Industry Development

January 2025 – Sarla Aviation , a Bengaluru-based aerospace startup, unveiled its prototype electric air taxi, Shunya , at the Bharat Mobility Global Expo . Designed for short-range travel (20–30 km) with a top speed of 250 km/h, Shunya aims to enter service by 2028 to revolutionize urban commuting in India.

Report Coverage

The global air taxi market report provides comprehensive analysis including market size, segmentation by offering, technology, aircraft type, propulsion type, and range outlook , and a breakdown by region and key countries . It examines industry trends, pricing analysis, value chain dynamics, R&D activity , and profiles of major market participants. Insights into regulatory landscapes , competitive positioning , and innovation roadmaps are also included.

The global avionics market was valued at USD 91.32 billion in 2023 and is expected to grow from USD 99.33 billion in 2024 to USD 179.44 billion by 2032, registering a compound annual growth rate (CAGR) of 7.67% during the forecast period. In 2023, North America led the market, accounting for a 37.25% share.

The global avionics market is experiencing steady growth due to increasing demand for advanced electronic systems in both commercial and military aircraft. Factors such as rising air travel, modernization of existing aircraft fleets, and the growing need for enhanced flight safety and efficiency are driving market expansion. Technological advancements in navigation, communication, and surveillance systems further support the adoption of modern avionics. Additionally, the development of next-generation aircraft and the increasing focus on automation and digitalization in aviation are expected to contribute significantly to the market’s growth in the coming years.

Fortune Business Insights™ provides this information in its research report, titled “Avionics Market Size, Share, Forecast, and 2025-2032”.

List of Key Players Mentioned in the Report:

- BAE Systems PLC (U.K.)

- Cobham PLC (U.K.)

- Raytheon Technologies Corporation (U.S.)

- Garmin Ltd. (U.S.)

- General Electric Company (U.S.)

- Honeywell International Inc. (U.S.)

- L3Harris Technologies Inc.(U.S.)

- Meggitt Ltd. (U.K.)

- Safran S.A. (France)

- Teledyne Technologies Incorporated. (U.S.)

- Thales Group (France)

- Transdigm Group Inc. (U.S.)

Information Source:

https://www.fortunebusinessinsights.com/industry-reports/avionics-market-101819

Segmentation:

Hardware Segment to Exhibit Substantial Growth Due to Trajectory Projection Capabilities

On the basis of system, the market is fragmented into software and hardware. The hardware segment is poised to expand at a considerable CAGR over the projected period. The segment held a leading share in the market in 2022 impelled by the multitasking capability of the system.

Commercial Segment to Gain Traction Considering the Rising Product Demand

By platform, the market is categorized into helicopters, general aviation, business jets, military, and commercial. The commercial segment accounted for a large market share and is estimated to record a substantial CAGR over the study period. The expansion is driven by the soaring demand for commercial aircraft.

Aftermarket Segment to Lead Impelled by Increase in Aircraft Upgradation Opportunities

By end-use, the market is segmented into aftermarket and original equipment manufacturers. The aftermarket segment accounted for a key market share in 2022 and is set to expand at an appreciable pace over the forecast period. The rise is driven by an increase in upgradation programs from numerous commercial airlines.

Based on geography, the market for avionics is segregated into North America, Europe, Asia Pacific, and Rest Of The World.

Report Coverage:

The report offers a comprehensive analysis of the vital trends impelling industry expansion over the projected period. It further gives an overview of the major factors fueling market growth over the forthcoming years. Additional aspects of the report comprise an impact of the COVID-19 pandemic and an account of the significant steps undertaken by leading companies for strengthening their industry positions.

Drivers and Restraints:

Rising Adoption of Flight Management System to Impel Industry Expansion

One of the key factors impelling avionics market growth is the soaring adoption of flight management and aircraft computing systems. These solutions provide surveillance systems, integrated cabin electronics solutions, navigation systems, proline fusion capabilities, and others.

However, the industry expansion may be hampered by the high cost associated with the maintenance of avionics systems.

Regional Insights:

North America to Emerge as Key Region Owing to Increasing Commercial Aircraft Demand

North America avionics market share is anticipated to expand at a substantial rate over the study period. The region accounted for a dominating share in 2022 owing to the presence of key manufacturers.

The Europe market is poised to grow at a considerable CAGR over the estimated period. The rise is driven by the extensive portfolios of key companies in the region.

Competitive Landscape:

Major Companies Enter Strategic Deals to Strengthen Industry Foothold

Leading industry players devise various strategies for strengthening their market positions. These comprise merger agreements, partnerships, and the launch of new products. Other initiatives include acquisitions, collaborations, R&D activities, and the formation of alliances.

Key Industry Development:

- April 2023 – GE Aerospace inked an agreement with AJW Group for supporting electrical power systems and avionics across the B737, B777, and A320/30/40 family of aircraft.

According to Fortune Business Insights™, the global magnetometer market was valued at USD 3.64 billion in 2024 and is projected to reach USD 7.75 billion by 2032, growing from USD 3.94 billion in 2025 at a compound annual growth rate (CAGR) of 10.2% during the forecast period. North America held the largest market share in 2024, driven by the widespread adoption of advanced magnetometer systems in defense, space exploration, and industrial applications.

Magnetometers are precision instruments used to measure magnetic field strength and direction. They are integral to various sectors such as aerospace, marine navigation, automotive systems, consumer electronics, and geophysical surveys. As industries continue to advance toward smarter, more compact sensing technologies, the demand for magnetometers is increasing due to their high accuracy, small size, and seamless integration with digital systems.

List of Key Magnetometer Companies Profiled

- Honeywell International Inc. (U.S.)

- Geometrics, Inc. (U.S.)

- Billingsley Aerospace & Defense (U.S.)

- AlphaLab, Inc. (U.S.)

- Applied Physics Systems (U.S.)

- Metrolab Technology SA (Switzerland)

- Bartington Instruments Ltd. (U.K.)

- FOERSTER Holding GmbH (Germany)

- Lake Shore Cryotronics, Inc. (U.S.)

- Marine Magnetics Corp. (Canada)

Information Source:

https://www.fortunebusinessinsights.com/magnetometer-market-112875

Segmentation: Magnetometer Market

Space Segment to Grow Steadily with Satellite-Based Deployments in LEO and Scientific Missions

By platform , the market is segmented into airborne , ground , maritime , and space . The space segment is expected to witness the fastest growth due to increasing launches of LEO (Low Earth Orbit) satellites, which rely on compact and high-precision magnetometers for navigation and attitude control systems.

Aerospace & Defense to Emerge as Dominant End-User Amid Rising Investments in Geospatial Intelligence

By end-user , the magnetometer market is categorized into aerospace & defense , consumer electronics , marine/naval , automotive , and others . The aerospace & defense segment held the largest share in 2024 due to extensive use in military aircraft, submarines, drones, and satellite missions requiring precise magnetic field detection.

North America Leads Global Adoption, Backed by High Investments in Space and Defense Programs

Regionally, the market is analyzed across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa . North America held the largest share in 2024, bolstered by advanced infrastructure, key magnetometer manufacturers, and robust demand from defense and space agencies such as NASA and the U.S. Department of Defense.

December 2024 – MDA Space selected Honeywell to supply Attitude Control Systems and Magnetometer Unit components, including Reaction Wheel Assemblies and 3-axis Space Rate Sensors, for the MDA AURORA satellite line. These systems will support Telesat’s LEO constellation by maintaining orientation and enhancing signal reliability and solar energy absorption.

The global space launch services market was valued at USD 4.28 billion in 2023 and is projected to grow from USD 4.91 billion in 2024 to USD 10.98 billion by 2032, reflecting a compound annual growth rate (CAGR) of 10.6% during the forecast period. In 2023, North America dominated the market, holding a 42.06% share. Notably, the U.S. market is set for significant growth, with an estimated value of approximately USD 7,480.1 million by 2030, driven by favorable government regulations that support the development and deployment of launch services.

The space launch services market includes both commercial and governmental initiatives for transporting payloads—such as satellites, cargo, and crew—into space. This market is fueled by increasing demand for satellite-based services, heightened interest in space exploration, and rising investments from public and private sectors. Key players range from established aerospace leaders to emerging private firms, all vying to provide cost-effective, reliable, and innovative launch solutions. Technological advancements, including reusable rockets and miniaturized satellites, are transforming the market landscape, making space more accessible than ever.

Fortune Business Insights™ presents this information in its research report titled “Space Launch Services Market Size, Share, Forecast, and 2025-2032.”

Information Source:

https://www.fortunebusinessinsights.com/industry-reports/space-launch-services-market-101931

List of Key Players Mentioned in the Space Launch Services Market Report:

- Antrix Corporation Limited (India)

- ArianeGroup SAS (France)

- Rocket Lab (U.S.)

- United Launch Alliance (U.S.)

- Space Exploration Technologies Corp. (SpaceX) (U.S.)

- Mitsubishi Heavy Industries, LTD. (Japan)

- Northrop Grumman Systems Corporation (U.S.)

- Roscosmos (Russia)

- NASA (U.S.)

- Jaxa (Japan)

- CNSA (China)

- China Aerospace Science and Technology Corporation (China)

Segmentation:

LEO Segment Accounted for Prominent Share Due to Increasing Launch of Satellites

On the basis of orbit type, the market for space launch services is subdivided into GEO, LEO, and others. The LEO segment registered a dominating share in the market. This is driven by the growing initiatives focused on the launch of satellites in this orbit.

Heavy Lift Launch Vehicle Segment Garnered Key Share Owing to Soaring Number of Rideshare Missions

Based on launch vehicle, the market is segmented into medium lift launch vehicle, small lift launch vehicle, and heavy lift launch vehicle. The heavy lift launch vehicle segment captured a leading share in the global market. An escalation in the number of ride share missions at the global level is anticipated to drive the dominance of the segment.

Commercial Segment to Expand at the Fastest Pace Impelled by Increasing Launch of Commercial Offerings

Based on end user, the market for space launch services is bifurcated into civil & military and commercial. The commercial segment is set to emerge as the fastest growing segment. Private organizations are directing their efforts toward the launch of commercial space-based services, which is one of the vital factors driving the segmental growth.

Human Spacecraft Segment to Surge at the Fastest Rate Due to Rise in Space Tourism

By payload, the market is segmented into human spacecraft, cargo, satellite, and testing probes. The human spacecraft segment is slated to grow at the fastest rate over the study period. This can be attributed to an escalation in space tourism and a rise in the number of manned space missions.

Based on geography, the market for space launch services has been studied across Asia Pacific, Europe, North America, Latin America, and the Middle East & Africa.

Get A Free Sample PDF:

https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/space-launch-services-market-101931

Report Coverage:

The report presents an account of the pivotal initiatives undertaken by major industry participants to gain a strong space launch services market footing. An account of the market scenario based on various segments has also been provided in the report. The industry has been analyzed on the basis of orbit type, launch vehicle, end user, payload, and geography.

Drivers and Restraints:

Industry Value to Rise with Increased Emergence of Private Players

Several startups have emerged in the space industry which are keen to provide low cost and advanced technologies for facilitating a range of space services. These startups are operational in the areas of remote sensing, navigation, earth observation, communication, and others. This places a greater emphasis on the need for satellite constellations, which is expected to favor space launch services market growth.

However, issues pertaining to space debris could create challenges for industry expansion.

Regional Insights:

North America Emerged as Leading Region Due to Increasing Product Deployment for Commercial Purposes

The North America market accounted for a dominant position in the space launch services market. The rising deployment of services offered by private players for a range of commercial purposes is one of the key factors boosting the dominance of the segment.

The Asia Pacific space launch services market share is poised to expand at the fastest growth rate over the analysis period. The increasing demand for launch services from the surveillance, communication satellites, and telecommunication industries from China, India, Japan, and South Korea is set to drive the regional expansion.

Competitive Landscape:

Industry Players Focus on Optimizing the Cost of Offerings to Gain an Edge over Competitors

Companies are engaged in collaborations and optimizing the cost of per-kg launch. These steps are being adopted for outpacing their competitors in the space launch services sector. Some of the key market players are SpaceX and Antrix Corporation Limited.

Key Industry Development:

July 2023 – Rocket Lab USA, Inc., announced its launch of seven satellites. The satellites were launched for NASA, Spire Global, and Space Flight Laboratory from New Zealand.

The global microwave devices market was valued at USD 5.85 billion in 2021 and is expected to increase from USD 6.09 billion in 2022 to USD 9.88 billion by 2029, reflecting a compound annual growth rate (CAGR) of 7.15% during the forecast period. In 2021, North America led the market, holding a 33.33% share.

The microwave devices market is experiencing notable growth, driven by advancements in technology and increasing demand across various sectors. As applications for microwave devices expand, from telecommunications to medical equipment, the market is expected to attract significant investment. Key regions, particularly North America, continue to dominate due to their strong infrastructure and innovative capabilities. Overall, the outlook for the microwave devices market remains positive, with sustained growth anticipated in the coming years.

List of Key Players Profiled in the Microwave Devices Market Report:

- Analog Devices Inc. (U.S.)

- Communications & Power Industries LLC (U.S.)

- General Dynamics Corporation (U.S.)

- Kratos Defense & Security Solutions, Inc. (U.S.)

- L3Harris Technologies, Inc. (U.S.)

- MACOM Technology Solutions Inc. (U.S.)

- Microsemi Corporation (U.S)

- Microwave Technology, Inc. (U.K.)

- Qorvo Inc. (U.S.)

- Richardson Electronics, Ltd. (U.S.)

- Teledyne Technologies Incorporated (U.S.)

- Thales Group (France)

- TMD Technologies Ltd (U.K.)

- Toshiba Corporation (Japan)

- Cytec Corporation (U.S.)

Browse In-depth Summary of This Research Insight:

https://www.fortunebusinessinsights.com/microwave-devices-market-103542

Russia-Ukraine War Impact:

The Russia-Ukraine war crisis-affected the avionics and electronic industry globally. The closure of national borders affected the supply of essential electronic and semiconductor devices required by the aviation sector. Also, Ukraine is the largest provider of noble gas neon and semiconductor-grade neon tube. The war crisis affected the supply chain of these gases from Ukraine to other countries.

Segmentation:

Active Segment to Lead the Market Due to Rising Demand from Networking & Telecom Services

By type, the microwave devices market is bifurcated into active and passive. The active segment is expected to hold a dominant share in the global market due to increasing demand for these devices in telecom and networking services.

Increasing Adoption of Ku-Band to Drive the Segment Growth

Based on frequency, the market is divided into Ku-Band, Ka-Band, S-Band, C-Band, X-Band, L-Band, and others. The Ku-Band segment leads the market share due to its rising space and defense application adoption during the forecast period.

Rising Demand for Telecommunication Services to Bolster Segmental Growth

On the basis of end-use industry, the market is segmented into telecommunication, space, defense, industrial, healthcare, and others. The increasing demand for telecommunication services is expected to fuel the segmental growth.

Finally, by geography, the market is categorized into North America, Europe, Asia Pacific, and the Rest of the World.

Report Coverage:

The report provides completely analyzed data regarding recent developments and trends in the microwave devices market, including the impact of COVID-19 pandemic. Also, the ongoing Russia-Ukraine ware crisis is discussed further in this report. Drivers and restraints affecting the global market growth during the forecast period are highlighted further along with the regional insights on segmented market areas. A list of key market players is mentioned further in this report.

Drivers & Restraints:

Increasing Demand for Improved Communication Services to Bolster Market Growth

The microwave devices market is expected to witness rapid growth during the projected period due to increasing demand for 5G network services in various industries. Also, the rising demand for medical instruments equipped with microwave devices is expected to fuel the market growth in the coming years. Furthermore, the increasing need for enhanced communication services is anticipated to drive the global market.

However, the high risk of communication jamming may hamper the market growth in the coming years.

Regional Insights:

North America Dominates Global Market Share Due to Rising Adoption of Advanced Communication Services

North America dominated the global microwave devices market share in 2021. The regional market stood at USD 1.95 billion in 2021. This is attributed to the increasing adoption of advanced communication systems in aviation, defense, commercial, and industrial sectors.

Europe is expected to grow at a substantial CAGR during the forecast period due to increasing semiconductor production and its utilization in healthcare, automotive, and manufacturing industries in the U.K., Germany, and France.

Competitive Landscape:

New Product Launch Allow Companies to Propel Growth

The key players focus on implementing several strategies to improve their business performance. These strategies include forming strategic alliances, collaborations, and partnerships. Also, introducing new products and getting recognized for these launches allow key players to enhance their brand value globally.

Key Industry Development:

In June 2024 , Communications & Power Industries (CPI) announced the spin-off of its Electron Device Business, which is now functioning as an independent entity. This division specializes in the development and manufacturing of a wide range of RF and microwave products for essential defense and commercial applications.

In February 2025 , Kratos Defense reported a rise in revenues within its Microwave Products division, driven by organic growth in its Turbine Technologies, C5ISR, and Defense Rocket Support sectors. This growth highlights the company's expanding involvement in microwave technologies for defense applications.

The global gallium nitride device market was valued at USD 20.56 billion in 2019 and is projected to grow from USD 21.18 billion in 2020 to USD 39.74 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 5.20% during the forecast period from 2020 to 2032. In 2019, North America led the market, accounting for a significant 35.89% share, driven by strong adoption of GaN technologies in high-frequency, power, and RF applications.

The global gallium nitride (GaN) device market has experienced steady growth in recent years, driven by increasing demand for high-efficiency, high-performance semiconductor solutions across various applications such as power electronics, RF components, and optoelectronics. The market was valued at USD 20.56 billion in 2019 and is projected to reach USD 39.74 billion by 2032, growing at a compound annual growth rate (CAGR) of 5.20% over the forecast period. North America accounted for the largest market share in 2019, supported by robust investments in advanced technologies and strong presence of key industry players.

Information Source:

https://www.fortunebusinessinsights.com/gallium-nitride-gan-devices-market-103367

A list of all the prominent Gallium Nitride Device Market Key Players:

- Infineon Technologies AG (Germany)

- Efficient Power Conversion Corporation. (The U.S.)

- EPISTAR Corporation (Taiwan)

- GaN Systems (Canada)

- MACOM (The U.S.)

- Microsemi (The U.S.)

- Mitsubishi Electric Corporation (Japan)

- NICHIA CORPORATION (Japan)

- Northrop Grumman Corporation (The U.S.)

- NXP Semiconductors. (Netherland)

- Qorvo, Inc (The U.S.)

- Texas Instruments Incorporated. (The U.S.)

- Toshiba Corporation (Japan)

Drivers & Restraints

Expansion of the Telecommunications Sector to Boost Growth

The increasing demand for energy-efficient gallium nitride (GaN) devices is being driven by the rapid expansion of the telecommunications sector. Many internet service providers are now prioritizing lower latency through optical fiber connections, along with enhancing connectivity and network capacity. Additionally, the growing adoption of GaN devices in 5G infrastructure is expected to further accelerate gallium nitride device market growth in the coming years. However, the high costs associated with the maintenance and development of gallium nitride devices may pose a challenge to this growth.

Segmentation- Gallium Nitride Device Market

Opto-semiconductor Device Segment to Grow Rapidly Backed by Increasing Usage in Lasers

Based on device type, the opto-semiconductor device segment procured the highest gallium nitride device market share in 2019. This growth is attributable to their increasing usage in various aerospace applications, such as Light Detection and Ranging (LiDAR) and pulsed lasers. Besides, they are used in optoelectronics, LEDs, lasers, photodiodes, and solar cells.

Regional Insights- Gallium Nitride Device Market

High Demand for Wireless Devices to Favor Growth in Europe

Geographically, North America generated USD 7.38 billion in 2019 because of the presence of numerous prominent manufacturers, such as MACOM, Cree, Inc., Northrop Grumman Corporation, Efficient Power Conversion Corporation, Microsemi, and others in this region.

Europe, on the other hand, is anticipated to grow significantly on account of the rising demand for wireless devices in Germany, France, and the U.K. In Asia Pacific, the rising demand for gallium nitride devices from emerging nations, such as India and China would aid growth.

Get A Free Sample PDF:

https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/gallium-nitride-gan-devices-market-103367

Key Industry Developments:

January 2025 - Wolfspeed launched its Gen 4 MOSFET technology platform, delivering breakthrough performance for high-power applications, enhancing efficiency and reliability in real-world conditions.

November 2024 - Infineon introduced the world's first 300mm power gallium nitride (GaN) wafer technology at electronica 2024, marking a significant advancement in power electronics manufacturing.