Category: Packaging

The global industrial packaging market was valued at USD 74.94 billion in 2024 and is projected to grow to USD 78.5 billion in 2025 , reaching USD 114.54 billion by 2032 at a CAGR of 5.45% during the forecast period. Asia Pacific led the market in 2023, accounting for 41.79% of the global share , driven by rapid industrialization and expanding manufacturing sectors. In the U.S. , the market is expected to reach USD 25.33 billion by 2032 , supported by strong demand for durable and protective packaging solutions across heavy-duty industries such as chemicals, construction, and automotive .

The global industrial packaging market is witnessing significant growth, propelled by rising industrial activities, expansion in manufacturing and logistics, and the increasing focus on sustainability and efficiency in packaging operations. Industrial packaging plays a vital role in protecting goods during storage, handling, and transportation. It is essential for heavy-duty, hazardous, and bulk materials across sectors such as chemicals, pharmaceuticals, food and beverages, and construction.

List of Key Companies Profiled in the Report:

- Mondi Group (U.K.)

- WestRock (U.S.)

- Smurfit Kappa (Ireland)

- Sonoco (U.S.)

- DS Smith (U.K.)

- Amcor Limited (Australia)

- Greif Inc. (U.S.)

- Mauser Packaging Solutions (U.S.)

- Ball Corporation (U.S.)

Market Overview and Growth Factors

Industrial packaging encompasses large-scale packaging products such as drums, intermediate bulk containers (IBCs), corrugated boxes, pallets, and pails used for storage and transport of materials. The market is primarily driven by the growth of global manufacturing sectors, including chemicals, agriculture, automotive, and construction.

Another major growth driver is the increasing requirement for durable and recyclable packaging materials. Companies across industries are focusing on sustainable packaging options to meet environmental regulations and reduce their carbon footprint. The growing demand for supply chain efficiency , coupled with technological innovations such as smart tracking and IoT-based packaging, is also reshaping the industry.

Rising globalization of trade and the expansion of e-commerce logistics have further increased the need for safe and efficient packaging that can withstand long-distance transportation and complex handling conditions.

Market Segmentation

By Material:

Plastic remains the most widely used material in industrial packaging due to its high strength, versatility, and cost-effectiveness. Products such as drums, containers, and IBCs made from high-density polyethylene (HDPE) and polypropylene are extensively used in the chemical and food industries. However, rising environmental concerns are pushing manufacturers to adopt recycled plastics and biodegradable alternatives.

Paper and paperboard packaging are gaining momentum as eco-friendly substitutes, especially for boxes and cartons. Metal packaging, though less common, is used in applications that require superior protection from corrosion or contamination.

By Product Type:

Boxes and cartons account for a major share of the market, given their adaptability to various product sizes and ease of recycling. Drums and IBCs are essential for transporting liquids and chemicals, ensuring leak-proof and safe handling. Pallets, trays, sacks, and pails are also integral to material handling and logistics across multiple industries.

By End-use Industry:

The food and beverage segment leads the market, representing around one-fourth of total demand. The need for secure, hygienic, and durable packaging to maintain product integrity has fueled this segment’s growth. The pharmaceutical sector follows closely, driven by strict safety regulations and the expansion of global medicine distribution networks. The chemical industry also remains a key contributor, as industrial packaging ensures compliance with hazardous material transport standards. Other significant end users include construction, consumer goods, and agriculture.

Read More : https://www.fortunebusinessinsights.com/industrial-packaging-market-107306

Key Market Drivers and Opportunities

- Industrial Expansion and Global Trade:

The rising output of manufacturing and construction industries is fueling the need for large-scale packaging solutions capable of protecting goods in transit and storage. - Sustainability Focus:

Growing environmental awareness and government policies have accelerated the shift toward recyclable, reusable, and biodegradable packaging materials. This trend has opened new opportunities for innovation in eco-friendly packaging designs. - Technological Advancements:

The integration of smart technologies such as RFID tags, sensors, and IoT devices is transforming industrial packaging into an intelligent system that can monitor temperature, humidity, and product safety throughout the supply chain. - Reusable Packaging Systems:

Increasing adoption of reusable containers, drums, and IBCs is helping companies reduce operational costs and waste generation while maintaining efficiency in bulk material handling. - Emerging Market Growth:

Rapid industrialization in emerging economies, including India, Brazil, Indonesia, and Vietnam, presents lucrative opportunities for packaging manufacturers to expand their production and distribution networks.

Regional Insights

Asia Pacific dominated the global industrial packaging market in 2024, holding approximately 41.79% share of the total revenue. The region’s leadership is attributed to rapid industrialization, expanding manufacturing bases in China, India, and Japan, and strong demand from the food processing and pharmaceutical sectors. Government initiatives promoting local manufacturing and infrastructure development have also contributed to market expansion.

North America is the second-largest market, driven by the presence of well-established industrial sectors, advanced supply chain systems, and an increasing emphasis on sustainable materials. The U.S. market benefits from high investments in automation and innovative packaging solutions to optimize logistics and reduce waste.

Europe also holds a substantial share, supported by strict environmental regulations that encourage the use of recyclable and biodegradable materials. However, the region faces challenges related to raw material price volatility and stringent compliance standards.

Key Industry Developments:

- December 2023 – Novvia Group, a worldwide provider of life sciences packaging, announced the acquisition of JWJ Packaging, a U.S.-based supplier of drum pails and other rigid container products. Based in Millstone Township, New Jersey, JWJ Packaging has been serving customers across the tri-state area with a diverse range of products and services.

- July 2023 – Berry Global launched a new version of its high-performance, patented NorDiVent form-fill-seal (FFS) film for powdered products, incorporating up to 50% recycled plastic content, helping its customers achieve sustainability goals.

Challenges and Restraints

Despite strong growth prospects, the market faces challenges such as fluctuating raw material costs, particularly for plastic resins and metals. Compliance with environmental regulations and waste management laws also adds to manufacturing costs. Additionally, maintaining the balance between product durability and sustainability remains a key concern for producers seeking to minimize environmental impact without compromising functionality.

Outlook

The global industrial packaging market is poised for consistent growth through 2032 as sustainability, automation, and digitalization continue to shape the industry. With increasing demand from sectors such as food, pharmaceuticals, and chemicals, the market is expected to maintain a steady expansion trajectory. The shift toward green and smart packaging will be crucial for long-term success, positioning manufacturers that prioritize innovation and environmental responsibility at the forefront of this evolving industry.

Security Printing Market Global Reports, Opportunities, Trends & Forecast 2032

By Sharvari, 2025-10-08

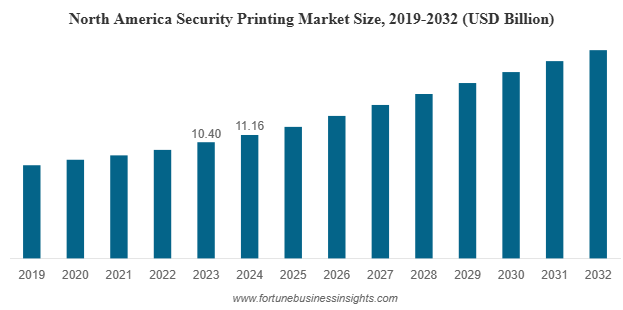

The global security printing market was valued at USD 35.47 billion in 2024 and is expected to grow to USD 37.93 billion in 2025, reaching USD 62.56 billion by 2032. The market is anticipated to expand at a CAGR of 7.41% during the forecast period, with North America leading the market in 2024, accounting for a 31.46% share.

In today’s fast-evolving digital and physical economies, the importance of security printing has never been greater. From currency and government documents to product authentication and packaging, security printing plays a crucial role in protecting organizations, consumers, and governments from the rising tide of counterfeiting and identity fraud.

Some of the Key Companies Profiled in the Report:

- Arrow System Inc. (U.S.)

- Orion Security Print (U.K.)

- Eltronis UK (U.K.)

- A1 Security Print (U.K.)

- ECO3 (Belgium)

- JUI Group (India)

- CETIS d.d (Slovenia)

- The Flesh Company (U.S.)

- TROY Group, Inc. (U.S.)

Growing Concerns Over Counterfeiting and Fraud

One of the primary forces fueling market expansion is the rapid increase in counterfeiting activities across industries such as banking, government, pharmaceuticals, and consumer goods. The proliferation of counterfeit currencies, fake IDs, fraudulent certificates, and imitation products has created an urgent demand for advanced printing solutions that incorporate multiple layers of security.

Governments worldwide are investing in the modernization of official documents such as passports, driver’s licenses, and national identity cards, integrating security features such as holograms, microtext, watermarks, and color-shifting inks. In the private sector, companies are deploying these technologies to safeguard brand integrity, reduce losses, and enhance consumer trust.

Regulatory and Government Initiatives

Regulations and mandates from global authorities are also shaping the security printing landscape. Governments are increasingly enforcing stricter compliance requirements for financial instruments, pharmaceutical labeling, and legal documentation. These initiatives are compelling organizations to adopt secure printing solutions that not only prevent tampering and forgery but also ensure end-to-end traceability throughout the supply chain.

In the healthcare and pharmaceutical sectors, the implementation of serialization and traceability laws to combat counterfeit drugs has driven demand for secure packaging and printed authentication labels. Similarly, the introduction of e-passports and biometric ID systems has opened new opportunities for specialized security printing providers.

Technological Advancements Reshaping the Market

The evolution of printing technologies has revolutionized how security elements are designed and applied. Advanced printing methods such as holographic imaging, micro printing, UV-visible inks, optically variable devices, and embedded RFID or NFC chips are increasingly used to achieve superior protection.

A major trend transforming the market is the integration of digital security features alongside traditional printing techniques. This hybrid approach provides a two-layer defense—physical authenticity through printed features and digital verification through data encryption or scanning technologies. With the rise of connected ecosystems, this synergy ensures real-time authentication and tracking across multiple industries.

Moreover, innovations in software-based anti-counterfeiting measures, such as digital watermarks and blockchain-enabled traceability, are gaining attention. These technologies allow manufacturers to verify products instantly and prevent tampering throughout the distribution network.

Market Segmentation Insights

The global security printing market can be segmented based on printing type, application, and region.

By printing type, offset lithographic printing holds the largest share due to its ability to produce high-quality, complex designs with precision and scalability. Flexographic printing is also gaining traction owing to its versatility and cost-effectiveness, particularly in packaging and label production.

By application, government documents dominate the market, driven by rising demand for secure identification systems, passports, and certificates. Financial instruments such as banknotes, bonds, and checks remain another key segment, supported by the ongoing need for fraud-resistant printing. Additionally, brand protection and product labeling applications are rapidly expanding as manufacturers seek to combat counterfeit goods in industries like electronics, apparel, and cosmetics.

Read More : https://www.fortunebusinessinsights.com/security-printing-market-110211

Regional Overview

North America led the market in 2024, supported by robust government regulations, high awareness levels, and advanced technological infrastructure. The United States, in particular, continues to invest in secure ID and currency printing, making it a major revenue contributor.

Europe follows closely, with countries like Germany, the U.K., and France focusing on upgrading official documentation and adopting environmentally sustainable printing materials.

Asia Pacific, however, is expected to witness the fastest growth during the forecast period. The region’s strong industrial base, growing population, and digitalization initiatives are driving the need for secure documentation and packaging. India, China, and Japan are at the forefront of this expansion, with governments investing heavily in anti-counterfeiting measures and national identity programs.

Challenges and Emerging Opportunities

Despite its strong growth prospects, the market faces challenges such as high implementation costs, complex material requirements, and environmental concerns associated with certain inks and films. However, these challenges are paving the way for innovation in eco-friendly security printing, where manufacturers are focusing on biodegradable materials, recyclable substrates, and sustainable production processes.

Another emerging opportunity lies in the rise of smart packaging and authentication solutions. The integration of QR codes, RFID, and NFC technologies allows instant product verification, offering new levels of transparency to consumers and regulators alike. As global supply chains continue to digitize, security printing is expected to evolve into a cornerstone of trust and traceability.

Key Industry Developments

- September 2024: HP Indigo and Agfa Offset Solutions (now ECO3) launched variable design solutions for brand protection and security printing. The designs provide security and safeguard against counterfeiting and diversion while effortlessly integrating with the original design, maintaining the appearance and essence of the original document or product.

- June 2024: Hitech Print Systems strengthened its dedication to excellence and innovation by acquiring a second nine-color pre-owned Rotatek RK 250 Plus press. This notable enhancement to its production capabilities is set to increase the company's output and further raise its quality and efficiency standards. Hitech focuses on the security printing of crucial documents such as question papers, answer sheets, OMR forms, university diplomas, certificates, and cheques, among others.

Outlook

The global security printing market is entering an era of dynamic transformation, fueled by technology convergence, sustainability initiatives, and growing security threats. Governments, manufacturers, and service providers must collaborate to develop multi-layered security systems that protect not only documents and currency but also digital data and brand value.

As counterfeiting becomes more sophisticated, the future of security printing will depend on continuous innovation, hybrid physical-digital integration, and commitment to sustainability. The companies that embrace these trends today will define the standards of trust and authenticity in tomorrow’s connected world.

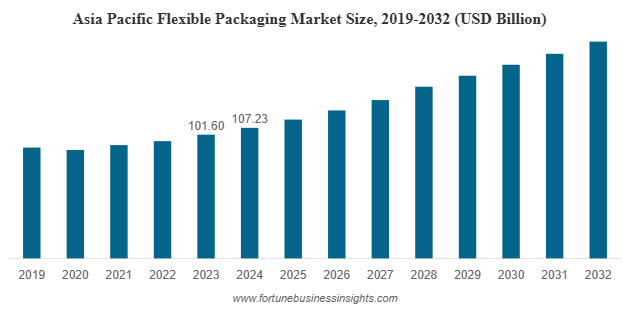

The global flexible packaging market was valued at USD 258.74 billion in 2024 and is projected to rise from USD 270.83 billion in 2025 to USD 406.14 billion by 2032, reflecting a robust CAGR of 5.96% during the forecast period. Asia Pacific led the market in 2024, accounting for a significant 41.44% share of the global revenue.

List of Top Flexible Packaging Companies:

- Amcor Plc (Switzerland)

- Constantia Flexibles (Austria)

- Sonoco Product company (U.S.)

- Mondi (U.K.)

- Huhtamaki Oyj (Finland)

- Berry Global (U.S.)

- Sealed Air (U.S.)

- Graphic Packaging International (U.S.)

- Transcontinental Inc. (U.S.)

- UFlex Limited (India)

Market Overview

Flexible packaging market refers to materials such as plastic films, paper, and foil that can easily bend or form various shapes, allowing for versatile designs and efficient storage. Compared to rigid packaging, flexible formats consume less material, reduce transportation costs, and lower carbon emissions. These advantages are making flexible packaging the preferred choice for manufacturers looking to optimize supply chains and enhance sustainability credentials.

The global market’s expansion is also fueled by changing consumer lifestyles, increased urbanization, and the rapid growth of e-commerce. Consumers are increasingly prioritizing on-the-go products and easy-to-open packaging options, pushing companies to innovate with pouches, wraps, and resealable bags that maintain product freshness while improving convenience.

Regional Insights

The Asia Pacific region dominated the global flexible packaging market in 2024 with a market share of 41.44%. Countries like China, India, Japan, and Indonesia are witnessing significant industrialization and retail expansion, fueling the need for efficient and sustainable packaging solutions. Rising disposable incomes and a growing middle class are increasing consumption of packaged food, beverages, and personal care products—key applications for flexible packaging.

North America and Europe are also major contributors to market growth, driven by technological advancements and strong sustainability initiatives. In Europe, stringent packaging waste regulations have encouraged the use of recyclable and biodegradable materials. Meanwhile, North America continues to innovate in terms of barrier films and advanced laminates that extend shelf life and improve product safety.

Key Market Drivers

- Growing Demand from the Food & Beverage Industry

Food and beverages remain the largest end-use segment for flexible packaging market. The ability of pouches, sachets, and wraps to provide superior barrier protection against moisture, oxygen, and light makes them ideal for extending product shelf life. From snacks and frozen foods to dairy and beverages, manufacturers are embracing flexible packaging for its efficiency and design versatility. - Sustainability and the Circular Economy

One of the strongest trends shaping the market is the push for sustainable materials. Manufacturers are increasingly adopting recyclable, compostable, and bio-based films to meet environmental regulations and consumer expectations. Efforts toward establishing a circular economy—where packaging waste is minimized and reused—are gaining momentum globally. Brands are investing in mono-material packaging and bio-plastics that can be more easily recycled without compromising performance. - Technological Advancements in Materials and Printing

Innovation in materials, adhesives, and barrier coatings has significantly improved the durability and functionality of flexible packaging. Advanced digital printing technologies allow for better customization, reduced waste, and faster turnaround times. These improvements help brands enhance visual appeal and strengthen product differentiation in competitive retail environments. - Expansion of E-commerce and Home Delivery Models

The explosive growth of e-commerce and food delivery services has amplified the demand for packaging that is lightweight yet durable enough to protect goods during transit. Flexible packaging, due to its adaptability and lower material usage, has emerged as a key solution for online retail and shipping applications.

Read More : https://www.fortunebusinessinsights.com/flexible-packaging-market-104897

Challenges and Restraints

Despite its advantages, the flexible packaging market faces challenges related to recyclability and waste management. Many products are made from multi-layer laminates that combine plastic, metalized films, and adhesives, making them difficult to recycle using conventional systems. Governments across regions are tightening regulations to encourage recyclability and reduce plastic waste, which may pressure manufacturers to redesign packaging materials and invest in advanced recycling technologies.

Additionally, the high cost of sustainable alternatives remains a hurdle for some small and medium-sized producers. While eco-friendly materials are in demand, they often come with higher production and procurement costs compared to conventional plastics, limiting adoption in price-sensitive markets.

Key Industry Developments:

- April 2024 – Klöckner Pentaplast (kp), a significant food packaging industry company, declared the launch of the first food packaging trays comprising 100% recycled PET (rPET) deriving from trays. The newly launched kp tray is the first to be composed entirely of recycled tray material. This innovation is the major result of KP's Tray2Tray initiative, intending to rewrite the PET recycling rules. The president of food packaging at KP also stated that this achievement is a breakthrough in the packaging industry.

- April 2024 – Parkside announced the launch of Recoflex Paper for sustainable, flexible packaging solutions. The new range of versatile Recoflex Papers is accessible as a single-ply or laminate in numerous specifications. It offers durability, barrier performance, and excellent heat sealability, changing the game for paper-based flexible packaging in a number of market applications. With the launch, the company is stepping up its efforts to help solve the global packaging problem.

Emerging Trends and Opportunities

The future of flexible packaging market lies in innovation and sustainability. The adoption of mono-material packaging, which simplifies recycling, is expected to grow rapidly. Similarly, the use of recycled plastics and bio-based polymers is gaining momentum as brands seek to reduce their carbon footprint. Companies are also exploring smart packaging solutions, integrating QR codes and sensors to enhance traceability and consumer engagement.

Moreover, as global consumers become more health-conscious and environmentally aware, demand for clean-label and transparent packaging is expected to increase. Flexible packaging offers excellent opportunities for creative design, allowing brands to communicate authenticity and sustainability through aesthetics and materials.

Conclusion

The flexible packaging market is on a transformative path, balancing consumer convenience with sustainability goals. With its superior performance, cost-effectiveness, and eco-friendly potential, flexible packaging is reshaping how products are stored, transported, and consumed worldwide. While challenges related to waste management and regulation persist, innovation and collaboration across the value chain are expected to drive long-term growth.

By 2032, flexible packaging market will not only dominate key sectors such as food, beverages, and pharmaceuticals but also play a pivotal role in advancing global sustainability objectives. As industries embrace new materials, circular economy practices, and design innovation, flexible packaging stands out as a defining force in the future of global packaging.

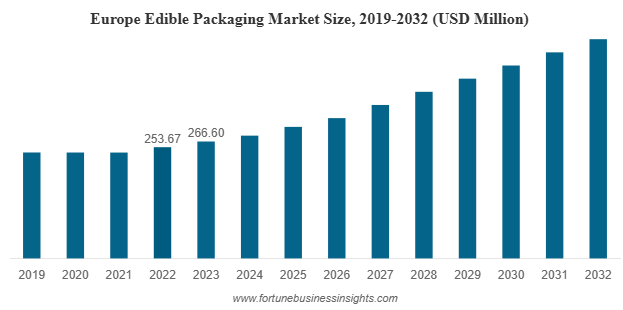

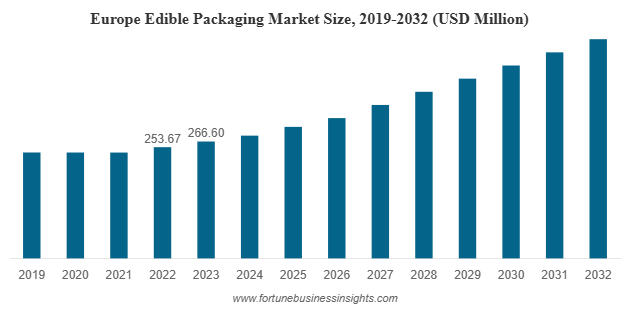

The global edible packaging market was valued at USD 711.09 million in 2023 and is expected to grow from USD 748.06 million in 2024 to approximately USD 1,193.98 million by 2032, reflecting a compound annual growth rate (CAGR) of 6.02% during the forecast period. In 2023, Europe led the market, accounting for 37.49% of the global share. Meanwhile, the U.S. edible packaging market is anticipated to witness substantial growth, reaching an estimated value of USD 282.59 million by 2032. This surge is largely driven by rising awareness around plastic pollution and a growing shift among consumers and businesses toward environmentally sustainable packaging solutions.

The global packaging industry is undergoing a transformative shift as sustainability takes center stage. With increasing awareness about environmental degradation, particularly the harmful impact of plastic waste, industries across the globe are exploring innovative, eco-friendly alternatives. One such emerging trend is edible packaging market a solution that not only reduces environmental footprint but also introduces a new layer of convenience and innovation in packaging technology.

List of Top Edible Packaging Companies:

- XAMPLA (U.K.)

- Notpla Ltd. (U.K.)

- JRF Technology (U.S.)

- MonoSol, LLC (U.S.)

- Evoware (Indonesia)

- Biome Bioplastics (U.K.)

- Decomer Technology OÜ (Estonia)

- Lactips (France)

- FlexSea (U.K.)

- Nagase America (U.S.)

Market Overview and Growth Forecast

Edible packaging market, as the name suggests, refers to packaging materials that can be safely consumed along with the product they contain. Typically made from natural ingredients like proteins, polysaccharides, or lipids, these materials are biodegradable, non-toxic, and often derived from renewable resources. This innovation is gaining traction in food and beverage sectors, as well as pharmaceuticals and personal care industries.

Drivers Fueling Market Expansion

Several factors are driving the growing adoption of edible packaging across industries:

- Environmental Concerns and Regulatory Pressure

Governments and environmental organizations are pushing for a drastic reduction in plastic waste, which accounts for a significant portion of global pollution. Edible packaging presents a viable, sustainable alternative that aligns with these regulatory goals. Bans and restrictions on single-use plastics in many regions have further accelerated the demand for biodegradable and edible solutions. - Consumer Awareness and Preference for Sustainable Products

Today's consumers are increasingly conscious of the environmental impact of their purchases. The rising popularity of zero-waste lifestyles, eco-conscious consumption, and plant-based living has created a favorable environment for edible packaging. Brands that adopt these solutions are often seen as more ethical and forward-thinking, which adds to their market appeal. - Innovation in Materials and Technology

Continuous research and development are leading to advanced edible packaging materials that offer improved shelf-life, moisture resistance, and barrier properties. Innovations such as antimicrobial films, flavored coatings, and functional packaging with added nutrients are enhancing both the utility and appeal of edible packaging. - Convenience and Portion Control

Edible packaging is ideal for single-serve and portion-controlled products. Whether it's an edible coffee cup, a protein bar wrapper, or a soup pod that dissolves in hot water, this type of packaging adds value by reducing waste and simplifying consumption.

Read More : https://www.fortunebusinessinsights.com/edible-packaging-market-107722

Key Market Segments

The edible packaging market is broadly segmented based on material type, product type, and end-use industry.

- By Material Type:

Protein-based materials currently dominate the market. Derived from sources such as soy, whey, casein, and collagen, these materials offer excellent film-forming properties and are rich in nutrients. Polysaccharide-based materials like starch, cellulose, and pectin are also gaining popularity due to their abundance and biodegradability. Lipid-based films, though less common, are used in applications where moisture barriers are critical. - By Product Type:

Films lead the edible packaging segment due to their flexibility, transparency, and widespread use in food products. Edible coatings are used to preserve fresh produce, meat, and bakery items by creating a protective layer. Edible utensils — such as spoons, straws, and cups — are gaining popularity, especially in the food service industry. - By End-Use Industry:

The food and beverage sector is the largest consumer of edible packaging, driven by demand for on-the-go snacks, sustainable packaging for confectionery, and functional beverages. The pharmaceutical industry is also exploring edible packaging, particularly in the form of capsules and coatings that deliver active ingredients safely and effectively.

Regional Insights

Europe currently holds the largest share of the edible packaging market, thanks to stringent environmental regulations and strong consumer demand for sustainable products. North America, particularly the U.S., is witnessing rapid adoption driven by innovation and favorable policies. Meanwhile, the Asia-Pacific region is emerging as the fastest-growing market due to rising urbanization, environmental awareness, and supportive government initiatives.

Challenges and Restraints

Despite its promise, the edible packaging market faces several hurdles:

- High Production Costs:

Compared to traditional plastic packaging, edible materials are more expensive to produce, limiting their use in cost-sensitive markets. - Durability and Storage Limitations:

Edible packaging materials are generally less robust than plastic and may require additional protection during transportation and storage. They are also more susceptible to moisture, heat, and microbial contamination. - Regulatory and Safety Issues:

Since edible packaging is consumed, it must meet stringent food safety standards. This requires thorough testing and certification, which can be time-consuming and costly for manufacturers.

Key Industry Developments:

- September 2023 – Xampla announced the launch of a remarkable consumer brand, Morro, to develop bio-based and edible packaging solutions that can compete with plastics. The launch of this brand will enable food brands to make an easy switch from single-use plastics and use the company’s breakthrough material.

- August 2022 – Nippon Paint China, the premier coatings company, partnered with BASF to introduce new eco-friendly edible packaging embraced by the Nippon Paint dry-mixed mortar series products.

Future Outlook

Despite these challenges, the edible packaging market holds immense potential. Advances in material science, growing investments in sustainable solutions, and strong consumer support are expected to overcome the current limitations. As economies move toward circular and green models, edible packaging could become a mainstream solution.

Businesses that embrace this shift early stand to benefit from regulatory incentives, brand differentiation, and access to a rapidly expanding consumer base that prioritizes sustainability. With growing awareness and continuous innovation, edible packaging is not just a trend — it's a transformative movement reshaping the future of packaging.

Protective Packaging Market Insights, Challenges, Key Players & Forecast 2030

By Sharvari, 2025-09-24

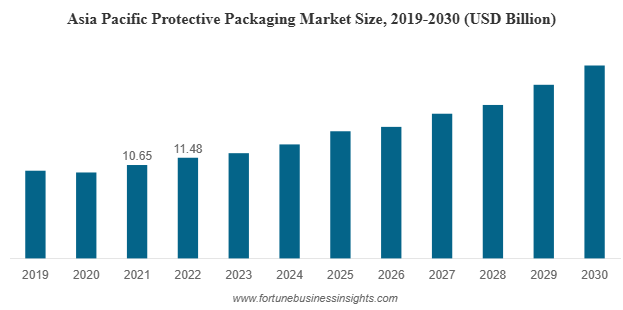

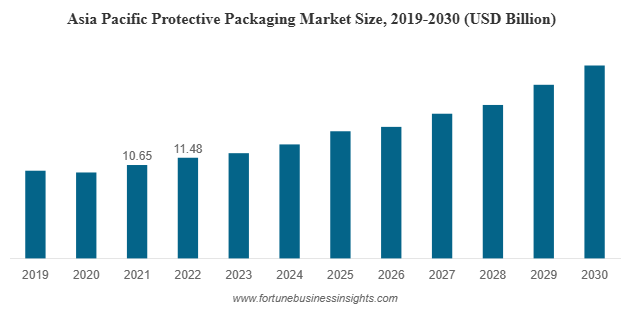

The global protective packaging market was valued at USD 36.31 billion in 2022 and is expected to rise from USD 38.52 billion in 2023 to USD 61.44 billion by 2030, reflecting a CAGR of 6.90% during the forecast period. Asia Pacific led the market in 2022 with a 31.62% share, while the U.S. market is set for strong growth, projected to reach USD 14.80 billion by 2032, fueled by rising demand for protective packaging in international trade.

This steady growth reflects how packaging has transformed from being a functional necessity to a strategic driver of customer satisfaction, sustainability, and supply chain efficiency.

List Of Key Companies Profiled In Protective Packaging Market:

- Smurfit Kappa (Ireland)

- Westrock Company (U.S.)

- Sealed Air Corporation (U.S.)

- Sonoco Product Company (U.S.)

- Huhtamaki (Finland)

- DS Smith PLC (U.K.)

- Pregis LLC (U.S.)

- Pro-Pac Packaging Limited (Australia)

- Storopack (Germany)

- Intertape Polymer Group (U.S.)

Key Drivers of Market Growth

- Expansion of E-Commerce

One of the strongest growth catalysts is the booming e-commerce industry. The rising number of online shoppers has created a pressing need for reliable packaging solutions that protect products from damage during handling, storage, and transportation. Protective packaging ensures a positive customer experience, which is vital for brand loyalty in a highly competitive online retail space.

- Rising Food & Beverage Demand

The food and beverage sector remains the largest end-user of protective packaging. From dairy and bakery products to frozen meals, packaging plays a critical role in maintaining freshness, extending shelf life, and preventing contamination. As global consumption of convenience and packaged foods increases, the reliance on advanced protective packaging solutions continues to grow.

- Growth in Consumer Electronics and Pharmaceuticals

The consumer electronics industry, marked by fragile goods such as smartphones, wearables, and home appliances, requires robust packaging materials that provide cushioning and insulation. Similarly, the pharmaceutical sector depends heavily on protective packaging for the safe transport of sensitive drugs, vaccines, and medical equipment, especially under strict temperature and handling conditions.

Market Segmentation Insights

By Material

Plastic continues to dominate the market due to its lightweight, shock-resistant, and cost-effective properties. However, paper and paperboard materials are gaining traction as industries seek eco-friendly alternatives. The shift toward biodegradable and recyclable materials highlights the industry’s effort to balance durability with sustainability.

By Product Type

Flexible protective packaging, such as wraps, pouches, and cushioning films, holds the largest market share. These solutions are widely favored for their versatility, cost efficiency, and lighter environmental impact compared to rigid packaging.

By Function

Wrapping emerged as the dominant function segment, largely due to its versatility. Whether in food, electronics, or industrial applications, wrapping ensures safety against dust, moisture, and physical impacts during transportation.

By End-Use Industry

- Food & Beverage: Leading application area with rising packaged food consumption.

- Consumer Electronics: Strong growth driven by rising smartphone penetration and online electronics sales.

- Pharmaceuticals: Critical for maintaining the safety and efficacy of medical products.

- Industrial Goods & Personal Care: Increasing adoption due to global shipping needs and consumer awareness.

Read More : https://www.fortunebusinessinsights.com/protective-packaging-market-107319

Regional Market Highlights

- Asia Pacific

Asia Pacific leads the global protective packaging market, accounting for more than 31.62% share in 2022. Countries such as China and India, with their rapidly expanding e-commerce industries, strong manufacturing bases, and rising disposable incomes, are fueling this dominance.

- North America

The region’s growth is supported by advanced supply chain systems and the strong presence of e-commerce giants. Consumer preference for fast and damage-free deliveries makes protective packaging indispensable.

- Europe

Sustainability plays a critical role in shaping Europe’s protective packaging landscape. With stringent regulations against single-use plastics and strong consumer awareness, companies are rapidly adopting paper-based and biodegradable materials.

- Latin America, Middle East, and Africa

These regions are seeing rising demand in online food delivery, cosmetics, and personal care industries. As logistics infrastructure improves, adoption of protective packaging is set to accelerate.

Challenges Facing the Industry

Despite rapid growth, the protective packaging market faces several challenges:

- Regulatory pressure on plastics: Governments across the globe are imposing bans and restrictions on single-use plastics, pushing companies to explore costlier but eco-friendly alternatives.

- Rising raw material costs: Volatility in the prices of paper, polymers, and aluminum is straining profit margins.

- Supply chain disruptions: Geopolitical tensions, trade restrictions, and global shipping delays can negatively impact the availability of packaging materials.

Key Industry Developments:

- August 2023 – Ranpack launched Wrap’n Go converter for protective honeycomb paper. The company brought its Geami Wrap’n Go converter, which turns kraft paper into protective, pack-in-store packaging for fragile items, to the North American market, providing an alternate option to the plastic solution.

- February 2023 – The circular materials company Cruz Foam announced the launch of a revolutionary new product family of environmentally protective packaging, introducing highly efficient solutions that meet the specific needs of customers in transporting sensitive and temperature-sensitive goods to consumers and businesses.

Emerging Trends and Innovations

The industry is experiencing rapid innovation to meet the twin goals of protection and sustainability. Some notable trends include:

- Paper-based bundling solutions replacing traditional plastic shrink wraps for beverages and multipacks.

- Biodegradable foams and cushioning materials made from renewable resources that reduce environmental impact.

- Advanced moisture-resistant coatings applied to paper packaging to improve durability and expand its use in diverse industries.

- Smart packaging technologies that incorporate tracking features to improve logistics efficiency and ensure product authenticity.

Future Outlook

The protective packaging market is on track for strong expansion through 2030, driven by global commerce, digital retail, and consumer demand for convenience. However, the path forward will be shaped by how the industry addresses sustainability challenges. Companies that embrace innovation in eco-friendly materials, invest in recycling systems, and adopt circular economy models are expected to lead the market.

As packaging continues to be a bridge between businesses and consumers, its role goes beyond protection—serving as a tool for brand reputation, compliance, and environmental responsibility.

The global edible packaging market was valued at USD 711.09 million in 2023 and is expected to increase from USD 748.06 million in 2024 to USD 1,193.98 million by 2032, registering a CAGR of 6.02% during the forecast period. In 2023, Europe led the market with a 37.49% share, while the U.S. market is anticipated to expand significantly, projected to reach USD 282.59 million by 2032. This growth is fueled by rising awareness of plastic pollution and the growing shift of consumers and businesses toward eco-friendly, sustainable packaging solutions.

Market Size and Forecast

The global edible packaging industry is undergoing a remarkable transformation as sustainability and environmental responsibility become critical priorities. Among the most innovative solutions emerging in this landscape is edible packaging market a packaging material designed to be both biodegradable and safe for consumption. Unlike conventional plastics that take centuries to decompose, edible packaging is made from natural polymers such as proteins, polysaccharides, and lipids, offering a safe, eco-friendly, and waste-free alternative. With consumers, businesses, and regulators pushing for greener choices, the edible packaging market is gaining strong momentum.

List of Top Edible Packaging Companies:

- XAMPLA (U.K.)

- Notpla Ltd. (U.K.)

- JRF Technology (U.S.)

- MonoSol, LLC (U.S.)

- Evoware (Indonesia)

- Biome Bioplastics (U.K.)

- Decomer Technology OÜ (Estonia)

- Lactips (France)

- FlexSea (U.K.)

- Nagase America (U.S.)

Key Growth Drivers

- Rising Environmental Awareness

Plastic waste has become one of the most pressing global environmental issues. Governments, NGOs, and environmental advocates are pushing for alternatives that reduce waste and pollution. Edible packaging directly addresses these concerns by offering a zero-waste solution.

- Consumer Demand for Sustainable Options

Today’s consumers are more informed and conscious about their purchasing decisions. They prefer brands that demonstrate environmental responsibility. Edible packaging aligns perfectly with this trend by offering safe, innovative, and eco-friendly product experiences.

- Innovation and Technological Advancements

The industry has seen advancements such as nanotechnology integration, active coatings, and the inclusion of antioxidants or antimicrobial agents in edible films. These innovations extend shelf life, improve functionality, and enhance food safety.

- Growth in Food & Beverage Sector

The food and beverage industry has become the largest consumer of edible packaging, particularly in bakery, confectionery, dairy, and ready-to-eat products. Growing urbanization and changing lifestyles further support this trend.

Read More : https://www.fortunebusinessinsights.com/edible-packaging-market-107722

Market Segmentation

By Material

- Proteins dominate the market due to their superior gas barrier properties, transparency, and flexibility. Proteins such as casein, whey, soy, and gluten are widely used.

- Polysaccharides represent another important segment, valued for their biodegradability and functional properties.

By Product Type

- Edible films hold the largest share, accounting for nearly 45% of the market in 2023. They are especially popular for wrapping bakery and confectionery products.

- Edible coatings and utensils are also gaining popularity as sustainable alternatives to plastic cutlery and packaging layers.

By End Use

- Food and Beverages remain the leading end-use industry, with applications ranging from fresh produce to dairy and confectionery.

- Pharmaceuticals are also adopting edible packaging for safer, controlled dosage delivery.

Regional Insights

- Europe leads the global market, accounting for nearly 37.49% of the share in 2023. Strict regulations on plastic usage and strong consumer awareness have driven adoption across the region.

- Asia Pacific is the fastest-growing market, supported by rapid urbanization, rising disposable incomes, and government initiatives promoting eco-friendly packaging.

- North America is also a significant market, with the United States playing a key role in driving demand for sustainable packaging.

Key Industry Developments:

- September 2023 – Xampla announced the launch of a remarkable consumer brand, Morro, to develop bio-based and edible packaging solutions that can compete with plastics. The launch of this brand will enable food brands to make an easy switch from single-use plastics and use the company’s breakthrough material.

- August 2022 – Nippon Paint China, the premier coatings company, partnered with BASF to introduce new eco-friendly edible packaging embraced by the Nippon Paint dry-mixed mortar series products.

Challenges and Restraints

Despite its potential, the edible packaging market faces several hurdles:

- High Production Costs: Manufacturing edible packaging materials requires advanced processes and natural raw materials, making them more expensive compared to plastics.

- Shelf Life Concerns: Edible packaging is sensitive to moisture, contamination, and handling conditions, often requiring secondary packaging.

- Regulatory Compliance: Strict food safety standards mean manufacturers must meet rigorous hygiene and quality requirements, which can slow adoption.

These challenges highlight the need for continuous research and technological innovation to make edible packaging market more affordable and practical.

Future Outlook

The edible packaging market presents a significant opportunity for innovation, sustainability, and growth. While high costs and regulatory barriers remain, advancements in material science and increased investment in eco-friendly solutions are expected to overcome these challenges.

For businesses, edible packaging market offers a chance to differentiate products, meet sustainability goals, and appeal to eco-conscious consumers. For policymakers, it provides an effective tool to reduce plastic waste and promote circular economies. And for consumers, edible packaging promises a cleaner, greener, and more responsible future.

With strong momentum and growing awareness, the edible packaging market is set to play a vital role in redefining the future of sustainable packaging worldwide.

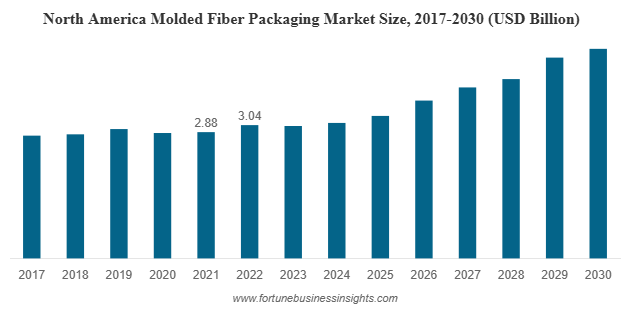

The global molded fiber packaging market was valued at USD 7.68 billion in 2022 and is expected to grow from USD 8.13 billion in 2023 to USD 12.56 billion by 2030, registering a compound annual growth rate (CAGR) of 6.41% over the forecast period. North America led the market in 2022, accounting for a 39.58% share. In particular, the United States is poised for strong growth, with the market projected to reach USD 4.35 billion by 2032. This growth is being fueled by advancements in packaging aesthetics and performance, especially for high-end products such as cosmetics and electronics.

In recent years, the packaging industry has undergone a significant transformation. As the world confronts the challenges of climate change, plastic pollution, and unsustainable manufacturing, businesses and consumers alike are turning toward greener alternatives. One of the most promising and rapidly growing solutions in this space is molded fiber packaging market an innovation that combines sustainability with strength, versatility, and cost-effectiveness.

Once seen as a niche product, molded fiber packaging market has now found its place at the forefront of the global packaging revolution. Backed by strong market growth, increasing regulatory pressure, and rising consumer awareness, this eco-conscious packaging method is no longer an option it’s becoming a necessity.

Market Growth and Projections

- A global push to reduce single-use plastics

- Stricter environmental regulations

- Increasing awareness among consumers about eco-friendly products

- Expanding demand from the food & beverage and e-commerce sectors

In short, molded fiber packaging market is no longer a fringe solution. It is becoming mainstream fast.

List Of Key Companies Profiled:

- Sonoco Product Company (U.S.)

- Robert Cullen Ltd (U.K.)

- Hartmann (Denmark)

- CKF Inc. (Canada)

- FiberCel Packaging LLC (U.S.)

- Huhtamäki Oyj (Finland)

- Green packing Environmental Protection Technology Co., Ltd. (China)

- Dongguan City Luheng Papers Company Ltd. (China)

- Keiding, Inc.(U.S.)

What Is Molded Fiber Packaging?

Molded fiber packaging market, often referred to as molded pulp packaging, is made from recycled paper, cardboard, or natural fibers like sugarcane bagasse and wheat straw. The process involves molding these materials into specific shapes using heat and pressure, resulting in a durable, biodegradable, and compostable product.

Commonly used for egg trays, food containers, electronics cushioning, and industrial packaging, molded fiber packaging offers several advantages over traditional plastic. It is lightweight, shock-absorbent, breathable, and fully recyclable making it a favorite among industries looking to reduce their environmental impact.

Key Industry Drivers

- Environmental Concerns and Regulation

Governments around the world are tightening their grip on plastic pollution. Many countries have introduced bans or restrictions on single-use plastics and are encouraging the use of sustainable alternatives. Molded fiber packaging market fits perfectly into this policy framework, offering a natural solution to one of the world's most pressing problems.

- Shifting Consumer Behavior

Modern consumers are more eco-conscious than ever before. Millennials and Gen Z, in particular, prefer brands that demonstrate environmental responsibility. This trend has pushed companies to redesign packaging strategies to align with sustainable values—and molded fiber offers both form and function without harming the planet.

- Growth in E-commerce

With the rise of online shopping, packaging needs have surged. Consumers expect products to arrive safely, but without excessive plastic. Molded fiber packaging market offers excellent shock resistance, making it ideal for protecting goods during transit, while still being environmentally friendly.

- Rising Demand from Food & Beverage Sector

From trays and drink carriers to takeaway boxes and clamshell containers, the food and beverage industry is one of the largest users of molded fiber packaging. Its breathability, compostability, and ability to handle moisture make it ideal for packaging perishable goods.

Read More : https://www.fortunebusinessinsights.com/molded-fiber-packaging-market-104894

Market Segmentation and Product Insights

The molded fiber packaging market is segmented based on pulp type, product type, and end-use applications.

- By pulp type, transfer molded fiber leads the pack. This method is commonly used to manufacture egg cartons and trays, due to its balance of cost and strength.

- By product, trays dominate the market. These are followed by clamshells, bowls, cartons, inserts, and protective packaging for electronics.

- By application, the food and beverage segment remains the largest consumer of molded fiber packaging, followed by electronics, healthcare, automotive, and industrial goods.

Regional Market Trends

The adoption of molded fiber packaging market varies by region, with North America currently holding the largest market share. The U.S. and Canada have embraced sustainable packaging solutions rapidly due to strong environmental awareness and strict regulations.

Asia-Pacific, on the other hand, is witnessing the fastest growth. Countries like China and India are seeing massive increases in demand due to expanding e-commerce markets, rapid urbanization, and rising environmental consciousness.

Europe also continues to see strong adoption, driven by policies like the European Green Deal and a cultural shift toward sustainability.

Key Industry Developments:

- September 2023 - Guamolsa, a part of Molpack Corporation, one of Latin America's leading providers of molded fiber packaging, partnered with HP to digitize and transform the industrial production of molded fiber products. Molpack is making significant progress in reducing carbon emissions and replacing single-use plastics with more sustainable packaging solutions through this revolutionary collaboration.

- June 2022 - Huhtamaki announced its plans to expand its molded fiber product manufacturing unit in Indiana, U.S., as a part of its investment in Fiber Solutions. The USD 100 million investment would help the company to better serve new and existing customers in North America. This financial commitment supported the development and production of a broad range of fully recyclable, sustainable, and compostable, fiber-based packaging solutions, all manufactured from 100% recycled North American raw materials.

Challenges to Watch

Despite its advantages, the molded fiber packaging industry isn’t without challenges:

- Raw Material Fluctuations: Supply chain issues for recycled paper or agricultural fibers can impact production consistency.

- Cost of Transition: Initial investments in molds, equipment, and production lines can be high especially for companies shifting from plastic.

- Design Limitations: While improving, molded fiber still has some design constraints compared to plastic, especially for high-end or luxury packaging.

However, ongoing R&D and increasing consumer demand are helping overcome these hurdles.

Future Outlook

The future of molded fiber packaging market looks promising. With technology improving, design capabilities expanding, and sustainability taking center stage in business strategies, this market is well-positioned for continued growth.

Companies that embrace molded fiber today are not only meeting current environmental standards they’re building future-ready brands. As the global community becomes more conscious of its ecological footprint, sustainable packaging won’t just be an option it will be an expectation.

The global protective packaging market was valued at USD 36.31 billion in 2022 and is expected to grow from USD 38.52 billion in 2023 to USD 61.44 billion by 2030, reflecting a compound annual growth rate (CAGR) of 6.90% over the forecast period. Asia Pacific led the global market in 2022, accounting for 31.62% of the total share. In addition, the U.S. protective packaging market is anticipated to experience substantial growth, projected to reach approximately USD 14.80 billion by 2032, driven by the rising demand for protective packaging in international trade.

In today’s rapidly evolving global economy, the need for effective and reliable packaging has never been more critical. Protective packaging plays a vital role in ensuring that products reach consumers in perfect condition, whether they are delicate electronics, perishable foods, or pharmaceuticals. As e-commerce, international trade, and sustainability awareness grow, the protective packaging market has seen significant expansion and innovation. This article explores the key drivers behind this growth, the market’s current state, challenges it faces, and future opportunities.

List Of Key Companies Profiled In Protective Packaging Market:

- Smurfit Kappa (Ireland)

- Westrock Company (U.S.)

- Sealed Air Corporation (U.S.)

- Sonoco Product Company (U.S.)

- Huhtamaki (Finland)

- DS Smith PLC (U.K.)

- Pregis LLC (U.S.)

- Pro-Pac Packaging Limited (Australia)

- Storopack (Germany)

- Intertape Polymer Group (U.S.)

Market Growth and Size

This growth is not limited to a single geography. While regions like North America and Europe continue to have strong demand due to their mature retail and industrial bases, the Asia Pacific region is rapidly emerging as the largest market. Factors such as increasing industrial production, expanding e-commerce markets, and rising consumer spending are propelling demand in countries like China, India, and Southeast Asian nations.

Understanding Protective Packaging

Protective packaging market refers to materials and solutions designed to shield products from damage during storage, handling, and transportation. Unlike simple packaging that focuses on containment, protective packaging emphasizes safeguarding the product against shocks, vibrations, temperature variations, moisture, and contamination.

Some common types of protective packaging include:

- Cushioning materials such as foam, bubble wrap, and air pillows.

- Void fillers that prevent movement within a package.

- Wrapping films that protect surfaces.

- Insulation materials to maintain temperature-sensitive goods.

- Rigid inserts and containers for heavy or fragile items.

These protective solutions are widely used across industries such as consumer electronics, food and beverage, pharmaceuticals, cosmetics, and automotive parts.

Key Drivers of Market Expansion

Several factors are fueling the growth of the protective packaging market, making it an exciting sector for businesses, marketers, and content creators alike:

1. E-commerce Boom

The exponential rise of online shopping is arguably the most significant catalyst behind the protective packaging surge. With more consumers ordering products online, the need to secure these items during transit has never been higher. Packages must withstand longer shipping distances and more handling points, creating demand for advanced protective solutions.

2. Increasing Consumer Expectations

Modern consumers expect their products to arrive undamaged and in pristine condition. This expectation has pushed brands and retailers to invest in superior packaging solutions. Damaged goods not only lead to financial loss but also harm customer trust and brand reputation.

3. Sustainability and Eco-Friendly Packaging

The environmental impact of packaging waste, particularly plastics, has come under intense scrutiny worldwide. Governments, consumers, and businesses alike are demanding sustainable alternatives. As a result, the protective packaging industry is innovating with biodegradable materials, recyclable paper-based solutions, and reusable packaging systems.

4. Technological Innovations

Protective packaging is no longer just about physical protection; it’s evolving with technology. Smart packaging that incorporates sensors to monitor temperature, humidity, or shocks during transit is becoming increasingly prevalent, especially in pharmaceuticals and food logistics.

Read More : https://www.fortunebusinessinsights.com/protective-packaging-market-107319

Market Segmentation Insights

Breaking down the market helps businesses and content creators understand where the biggest opportunities lie:

- Material Types: Plastic materials dominate due to their cushioning properties and cost-effectiveness, but paper and paperboard materials are gaining traction because of sustainability trends.

- Product Types: Flexible packaging, including wraps and films, continues to grow thanks to its versatility and lightweight properties. Rigid packaging remains essential for heavy or extremely fragile items.

- Functions: Cushioning remains the most crucial function, followed by void filling, insulation, and bracing.

- End-Use Industries: Food and beverage represent the largest application segment, given the need for freshness and contamination protection. E-commerce, pharmaceuticals, and consumer electronics are also key sectors.

Opportunities

The future of the protective packaging market is bright, with several promising opportunities on the horizon:

- Sustainability Leadership: Companies that invest in green packaging materials and circular economy models can differentiate themselves and meet increasing regulatory and consumer demands.

- Customization and Personalization: With advances in manufacturing technology, tailored protective packaging solutions can better serve unique product needs, enhancing brand value.

- Smart Packaging Growth: Integration of IoT and sensor technologies will improve supply chain visibility and product safety, especially for sensitive items like pharmaceuticals.

- Emerging Markets: Rapid urbanization and digital adoption in emerging economies will continue to drive demand for protective packaging solutions.

Key Industry Developments:

- August 2023 – Ranpack launched Wrap’n Go converter for protective honeycomb paper. The company brought its Geami Wrap’n Go converter, which turns kraft paper into protective, pack-in-store packaging for fragile items, to the North American market, providing an alternate option to the plastic solution.

- February 2023 – The circular materials company Cruz Foam announced the launch of a revolutionary new product family of environmentally protective packaging, introducing highly efficient solutions that meet the specific needs of customers in transporting sensitive and temperature-sensitive goods to consumers and businesses.

Challenges in Protective Packaging

Despite the optimistic growth outlook, the industry faces several challenges:

- Regulatory Pressure: Increased regulations around plastic use and waste management require manufacturers to adapt quickly to new standards.

- Raw Material Price Volatility: Fluctuating prices of plastics, paper, and other raw materials can squeeze margins.

- Supply Chain Disruptions: Global events and logistics bottlenecks can impact material availability and delivery timelines.

Addressing these challenges demands innovation, strategic sourcing, and strong partnerships across the supply chain.

Future Outlook

The protective packaging market is a dynamic and rapidly growing sector critical to modern commerce. Driven by e-commerce growth, rising consumer expectations, and sustainability imperatives, protective packaging solutions are more important than ever. Businesses that understand these trends and innovate accordingly are well-positioned to thrive.

For anyone interested in free content submissions or marketing strategies, protective packaging presents an excellent topic to explore. Writing insightful, data-backed articles about this booming market can help attract attention, build authority, and rank highly in search engines.

Nutraceutical Packaging Market Global Opportunities, Trends, Outlook & Forecast 2032

By Sharvari, 2025-07-16

The global nutraceutical packaging market was valued at USD 3.90 billion in 2023 and is expected to grow to USD 4.08 billion in 2024, reaching USD 6.24 billion by 2032. This growth reflects a compound annual growth rate (CAGR) of 5.45% over the forecast period. In the United States, the market is anticipated to expand steadily, with projections reaching USD 1.79 billion by 2032. The increasing consumer inclination toward health supplements and functional foods is driving demand for innovative, eco-friendly packaging solutions. In 2023, Asia Pacific led the global market with a dominant share of 47.69%.

The rising global focus on preventive healthcare and wellness is significantly contributing to the surge in nutraceutical consumption. The shift toward healthier lifestyles, coupled with the aging population, has increased demand for dietary supplements, vitamins, minerals, herbal extracts, and fortified foods. This, in turn, is driving the need for reliable, safe, and efficient packaging that not only protects the contents but also enhances shelf appeal and ensures regulatory compliance.

Key Market Drivers

One of the major factors propelling the nutraceutical packaging market is the growing demand for supplements and functional products that support immunity, digestion, cognitive function, and overall well-being. Consumers are becoming more conscious of ingredient transparency and product safety, which has raised expectations for packaging that offers protection against moisture, oxygen, light, and contamination.

The expansion of e-commerce and direct-to-consumer models has also fueled demand for robust and visually appealing packaging solutions. Brands are focusing on packaging formats that ensure durability during shipping, are easy to open and reseal, and offer a strong brand presence on digital platforms.

Sustainability has emerged as another major trend shaping the packaging industry. With environmental regulations tightening and consumers becoming more eco-conscious, manufacturers are opting for recyclable, biodegradable, and compostable materials. Packaging companies are responding by developing eco-friendly solutions without compromising functionality or performance.

List of Top Nutraceutical Packaging Companies:

- Amcor (Australia)

- Gerresheimer (Germany)

- Graham Packaging (U.S.)

- Sanner Group (Germany)

- Glenroy, Inc. (U.S.)

- Jones Healthcare Group (Canada)

- Brook + Whittle (U.S.)

- Arizona Nutritional Supplements (U.S.)

- Comar (U.S.)

- Flex Pack (U.S.)

Material and Packaging Type Trends

Among the various materials used, plastic dominates the nutraceutical packaging market. Materials such as polyethylene terephthalate (PET) and polypropylene (PP) are favored for their durability, lightweight nature, and excellent barrier properties. Despite concerns over plastic waste, its widespread use continues due to its versatility and cost-effectiveness.

However, alternatives like paperboard, glass, and aluminum are gaining traction, especially in premium product segments. Paper-based packaging offers a sustainable edge, while glass containers are often used for high-value products requiring enhanced protection and preservation.

In terms of packaging types, bottles and jars lead the market, especially for solid dosage forms like tablets, capsules, and gummies. These formats are popular for their convenience, product protection, and familiarity among consumers. Blister packs are widely used in pharmaceutical-style supplement packaging, offering precise dosage and tamper-evident features.

Sachets, stick packs, and pouches are rapidly gaining market share due to their convenience, portability, and suitability for single-dose applications. These formats are particularly popular in protein powders, drink mixes, and vitamin-enriched products, where portion control and easy consumption are critical.

Application Areas

- The nutraceutical packaging market serves a variety of product categories, including dietary supplements, functional foods, sports nutrition, and herbal products.

- Dietary supplements constitute the largest application segment. Packaging in this category must meet stringent regulatory requirements to ensure product safety, maintain shelf life, and prevent contamination. Features like child-resistant closures, tamper-evident seals, and desiccant systems are commonly integrated into supplement packaging.

- Functional foods and beverages, which include products fortified with vitamins, minerals, probiotics, and fiber, are gaining popularity, particularly among health-conscious consumers. The packaging for these products must maintain freshness, support easy consumption, and comply with food safety standards.

- Herbal nutraceuticals and traditional medicines are also seeing increased demand, especially in regions with strong herbal and Ayurvedic traditions. Packaging for these products must align with both regulatory standards and consumer expectations for authenticity and sustainability.

Read More : https://www.fortunebusinessinsights.com/nutraceutical-packaging-market-108091

Regional Insights

- Regionally, North America holds a significant share of the global nutraceutical packaging market, owing to its well-established health supplement industry and high consumer awareness. The presence of major market players, strict regulations regarding labeling and safety, and an active e-commerce landscape contribute to the region’s dominance.

- Asia Pacific is anticipated to witness the fastest growth during the forecast period. Rapid urbanization, rising disposable income, and increasing health consciousness are driving supplement consumption in countries like China, India, Japan, and South Korea. The region also benefits from growing investments in manufacturing and packaging infrastructure.

- Europe remains a strong market due to high health awareness, established pharmaceutical standards, and a focus on sustainability. Countries like Germany, the UK, and France are key contributors to the region’s nutraceutical packaging demand.

- Latin America, the Middle East, and Africa are emerging markets with significant growth potential. Increasing awareness about health and wellness, coupled with a gradual rise in nutraceutical consumption, is expected to drive demand for high-quality packaging in these regions.

Key Industry Developments:

- June 2024 – The Keystone Folding Box, a specialist in cardboard packaging, launched a paperboard blister for medical tablets under the Push-Pak brand. The solution's simple push-open system eliminates the need for complicated opening instructions and features a recessed, more efficient push-up layout that reduces package size.

- April 2024 – Berry Global launched two lightweight packages for the protein powder market. The cabin design uses less material than previous models. The combination of the new design and the reduction of cabin air makes the company stand out. The new packaging is part of B Berry's comprehensive product and packaging solutions, which use engineering expertise and proprietary cell technology to reduce the environmental impact of its products.

Challenges and Opportunities

Despite the positive growth trajectory, the nutraceutical packaging market faces challenges such as fluctuating raw material prices and complex regulatory landscapes across different regions. Maintaining consistent product quality, ensuring safety and compliance, and minimizing environmental impact are top priorities for manufacturers and packaging companies.

However, these challenges also present opportunities. The growing demand for personalized nutrition, smart packaging solutions, and sustainable materials opens new avenues for innovation. Technologies such as QR codes, tamper-evident features, and eco-friendly inks and adhesives are being increasingly adopted to enhance consumer engagement and brand transparency.

Packaging companies that invest in R&D, adapt to changing consumer preferences, and align with environmental goals are well-positioned to capitalize on market opportunities.

The global nutraceutical packaging market is on a steady growth path, supported by rising health awareness, increased supplement consumption, and a strong emphasis on sustainability and innovation. With the market projected to reach over USD 6 billion by 2032, manufacturers and packaging providers are focusing on delivering functional, attractive, and eco-friendly solutions that meet evolving consumer expectations and regulatory demands. The future of the market lies in balancing performance, sustainability, and consumer convenience, making it a dynamic and promising space in the broader packaging industry.

Contract Packaging Market Global Opportunities, Trends, Outlook & Forecast 2032

By Sharvari, 2025-07-15

The global contract packaging market has been witnessing strong growth due to the increasing trend among companies to outsource their packaging operations. In 2024, the market was valued at USD 93.26 billion and is projected to grow to USD 98.77 billion in 2025. By 2032, the market is expected to reach USD 141.14 billion, registering a compound annual growth rate (CAGR) of 5.23% during the forecast period from 2025 to 2032. This growth is attributed to the advantages that contract packaging provides in terms of flexibility, cost-efficiency, expertise, and scalability.

Contract packaging, also known as co-packing, involves outsourcing packaging operations to third-party service providers. These services are increasingly being adopted across industries such as food and beverage, pharmaceuticals, cosmetics, personal care, electronics, and more. Manufacturers benefit from outsourcing by focusing on their core competencies while leveraging the expertise and infrastructure of packaging specialists.

Key Drivers of Market Growth

One of the key drivers of this market is the growing demand for outsourced services in manufacturing industries. Companies are focusing on reducing capital expenditure and operational costs by outsourcing packaging tasks instead of investing in in-house facilities. Contract packagers help businesses avoid the high costs associated with packaging machinery, workforce, and maintenance.

Another major factor contributing to market expansion is the rapid growth of the e-commerce industry . With the increasing popularity of online shopping, brands are seeking efficient, scalable, and customized packaging solutions to meet fluctuating demand and enhance consumer experience. Contract packaging providers are well-positioned to meet these needs through value-added services such as kitting, assembly, labeling, and distribution support.

Additionally, the rising focus on sustainable and eco-friendly packaging solutions is influencing the contract packaging market positively. Businesses are under increasing pressure from regulatory bodies and environmentally conscious consumers to adopt sustainable practices. Contract packaging companies are responding by offering recyclable, biodegradable, and reusable packaging options, helping their clients meet environmental goals.

The pharmaceutical sector also plays a vital role in market growth. Pharmaceutical products require high levels of safety, compliance, traceability, and tamper-evident packaging. Contract packaging companies with expertise in regulatory requirements and specialized facilities are preferred partners for packaging prescription drugs, over-the-counter medications, and medical devices.

List of Key Companies Profiled:

- Silgan Unicep (U.S.)

- Summit Packaging Solutions (U.S.)

- Stamar Packaging (U.S.)

- Sharp Services, LLC (U.S.)

- Aaron Thomas Company Inc. (U.S.)

- Green Sustainable Packaging (U.S.)

- Co-Pak Packaging Corporation (U.S.)

- Assemblies Unlimited Inc. (U.S.)

- AmeriPac Inc. (U.S.)

Market Segmentation

The contract packaging market can be segmented by packaging type , material , and end-use industry .

By packaging type, primary packaging holds the largest share. This includes materials that directly enclose the product, such as bottles, blister packs, tubes, and pouches. It plays a critical role in protecting the product, preserving its quality, and maintaining hygiene. Secondary and tertiary packaging, which focus on grouping and shipping products, also contribute significantly but to a lesser extent.

By material, plastic-based packaging leads the market due to its durability, lightweight nature, and versatility. However, paper and paperboard are gaining popularity due to their recyclability and lower environmental impact. Other materials used in contract packaging include glass, metal, and composite materials, depending on the product’s requirements and industry standards.

In terms of end-use industry, the food and beverage sector is the largest contributor. The demand for packaged food and beverages, especially ready-to-eat and convenience foods, continues to grow, driving the need for contract packaging. The pharmaceutical industry is another significant segment due to strict regulatory requirements and the need for specialized packaging. Other important sectors include personal care and cosmetics , electronics , and household products .

Read More : https://www.fortunebusinessinsights.com/contract-packaging-market-106869

Regional Insights

- Regionally, Asia Pacific held the largest market share of 34.15% in 2024, accounting for USD 31.85 billion. The region’s dominance is driven by rapid industrialization, expanding e-commerce, and a growing consumer base in countries like China, India, and Southeast Asian nations. Rising disposable incomes and increased demand for consumer goods further contribute to the region’s market leadership.

- North America is another key region, with significant demand from the pharmaceutical, food, and personal care sectors. The region is characterized by a well-established industrial base, high levels of automation, and a strong focus on sustainable packaging.

- Europe follows closely, driven by strict environmental regulations and technological advancements in packaging. Countries in Western Europe are investing heavily in sustainable packaging innovations and are at the forefront of adopting recyclable and biodegradable materials.

- Emerging markets in Latin America and the Middle East & Africa are showing promising growth due to increased industrial activities, urbanization, and rising awareness of packaged goods. These regions offer significant opportunities for contract packaging companies to expand their footprint.

Key Industry Developments:

- October 2023 – Sharp, a global leader in commercial pharmaceutical packaging and clinical trial supply services, announced the acquisition of Berkshire Sterile Manufacturing (BSM). BSM is a Massachusetts-based fill-finish Contract Development and Manufacturing Organization (CDMO) for clinical and commercial sterile injectable products.

- August 2023 – The Shippers Group partnered with Pacific Coast Producers to stock the shelves of local food banks.

Challenges and Opportunities

While the contract packaging market shows strong growth potential, it is not without challenges. Fluctuations in raw material prices , especially plastics and paperboard, can impact profitability. Additionally, supply chain disruptions caused by global events such as pandemics or geopolitical tensions can affect production timelines and delivery schedules.

Regulatory compliance is another critical challenge, particularly in industries like pharmaceuticals and food. Companies must adhere to strict guidelines related to safety, hygiene, and traceability, requiring constant investment in quality control and certifications.

However, the market is filled with opportunities. The ongoing automation and digital transformation in packaging processes are enhancing efficiency and precision. Technologies such as robotics, AI, and real-time tracking are being increasingly adopted to streamline operations.

Furthermore, the shift toward smart and intelligent packaging , which includes features like QR codes, sensors, and tamper-evidence, is expected to boost market demand. Contract packaging companies that invest in innovation and customization will be well-positioned to capitalize on these trends.