Saudi Arabia Refractories Market Demand, Drivers & Global Growth, Forecast 2032

The Saudi Arabia refractories market was valued at USD 160.2 million in 2021 and is expected to grow from USD 164.8 million in 2022 to USD 254.6 million by 2029, registering a CAGR of 6.4% during the forecast period. The COVID-19 pandemic had a significant impact on the market, leading to lower-than-expected demand across the country compared to pre-pandemic projections. In 2020, the market experienced a 4.9% decline compared to 2019, highlighting the disruption caused by the global health crisis.

Key Growth Drivers

One of the primary factors fueling market growth is the rapid expansion of the steel industry. Saudi Arabia is currently the largest steel-producing country in the Gulf Cooperation Council (GCC) region, with more than 40 steel manufacturing facilities operating across the country. These facilities have an estimated production capacity of over 18 million tons per year, and refractories are essential materials in their operations. They are used to line high-temperature furnaces, kilns, and reactors, ensuring structural integrity and efficiency.

Alongside steel, sectors such as cement and glass manufacturing are also contributing significantly to demand for refractory products. Mega projects like NEOM, the Red Sea Development, and various other infrastructure programs are creating long-term demand for cement and construction materials. These projects require refractory linings in the production process of essential materials, which further accelerates consumption.

Additionally, the petrochemical and non-ferrous metal industries are becoming prominent end users of refractories. These sectors rely heavily on high-temperature processes for refining, smelting, and processing, all of which demand high-performance refractory materials that can withstand extreme environments.

List Of Key Companies Profiled

- Arkema SA (France)

- Ashland (U.S.)

- DuPont (U.S.)

- LG Chem (South Korea)

- The Dow Chemical (U.S.)

- Nitta Gelatin, NA Inc. (Japan)

- BASF SE (Germany)

- SNF (France)

- Kuraray Co., Ltd. (Japan)

- Kemira (Finland)

Market Segmentation and Trends

The Saudi refractories market is broadly segmented based on form, chemistry, and end-use industries.

By form, the market includes shaped and unshaped refractories. Shaped refractories—typically in the form of bricks and blocks—dominate the market due to their widespread application in large furnaces and kilns. However, unshaped refractories, also known as monolithic refractories, are gaining popularity because of their ease of installation and ability to form complex shapes. These are often used for repair purposes or in custom high-temperature applications.

By chemical composition, refractories are divided into acidic, basic, and neutral types. Basic refractories, such as those made with magnesia and dolomite, are highly sought after due to their resistance to alkaline slags, making them ideal for steel and cement industries. Acidic refractories made from silica and fireclay are also in demand, especially in glass manufacturing.

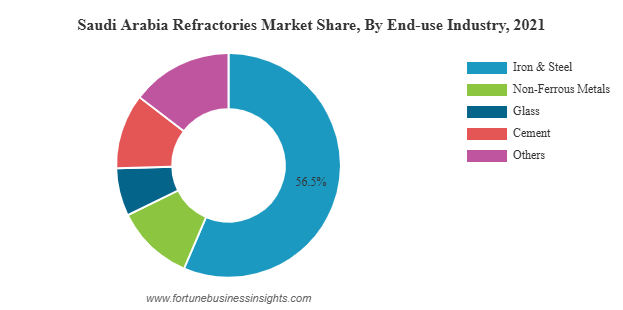

In terms of end-use, the iron and steel industry remains the largest consumer of refractories in the Saudi market. Frequent replacement of refractory linings due to wear and tear from constant exposure to high temperatures ensures steady demand. Other key industries include cement, petrochemical, glass, power generation, and non-ferrous metallurgy.

Read More : https://www.fortunebusinessinsights.com/saudi-arabia-refractories-market-106924

Opportunities in Localization and Sustainability

A significant opportunity in the Saudi Arabia refractories market lies in the localization of production. The government is increasingly focused on reducing dependence on imports by promoting local manufacturing. This creates strong prospects for both domestic and international players willing to establish production facilities within the country. Establishing local production can also help tackle issues such as supply chain disruptions and long lead times.

Sustainability is another growing focus area. As part of the Saudi Green Initiative and its broader commitment to carbon neutrality by 2060, there is increasing emphasis on energy-efficient and eco-friendly refractories. Manufacturers are exploring the use of recycled raw materials and developing products that reduce heat loss, thereby conserving energy during industrial processes.

Furthermore, advancements in refractory technology such as nanotechnology-enhanced materials and longer-lasting linings are creating added value for end users. These innovations improve performance, reduce maintenance frequency, and lower operational costs, making them attractive in the context of rising raw material prices.

Key Industry Developments

- March 2022 – Kemira bolstered its position as a prominent provider of sustainable chemical solutions for water-reliant industries by launching the world’s first full scale production of its recently designed bioderived polymers. Helsinki Region Environmental Services (HSY) received the first volumes for trials at one of their wastewater treatment facilities.

- September 2020 – BASF expanded its business in a water-soluble polyacrylate manufacturing unit at Ludwigshafen, Germany. The manufacturing unit will allow customers in the home and commercial cleaning sector and chemical and formulator industries to benefit from increased specialized chemical capacity.

Challenges Ahead

Despite the promising outlook, the market faces certain challenges. Volatility in the prices of raw materials such as bauxite, alumina, and magnesia can affect the cost of production and profitability. Additionally, the reliance on imports for some critical raw materials exposes the market to global supply chain uncertainties.

Environmental regulations are also becoming more stringent, particularly concerning emissions and waste disposal. Refractory manufacturers will need to adapt their production processes to comply with new standards while maintaining cost efficiency.

Future Outlook

The Saudi Arabia refractories market is set on a strong growth trajectory, supported by industrial expansion, mega infrastructure projects, and favorable government policies. As industries evolve and shift toward more sustainable and efficient production methods, the demand for advanced refractory solutions will continue to rise. Companies that invest in innovation, localization, and sustainable manufacturing will be best positioned to capitalize on the growing opportunities in this dynamic market.