Aerospace and Defense Materials Market Demand, Drivers & Global Growth, Forecast 2032

In 2019, the global aerospace and defense materials market was valued at USD 18,411.83 million and is expected to reach USD 23,825.45 million by 2027, registering a CAGR of 4.21% over the forecast period. North America led the market in 2019 with a 53.65% share, while the U.S. market alone is anticipated to hit USD 12,019.42 million by 2027, driven by advancements in lightweight and high-performance materials.

Market Size & Forecast

The aerospace and defense materials market is witnessing substantial growth as advancements in technology, manufacturing processes, and material science reshape the sector. From next-generation fighter jets to commercial aircraft and space exploration vehicles, the demand for lighter, stronger, and more durable materials is accelerating. Governments, defense organizations, and private aerospace companies are investing heavily in advanced materials that enhance performance, reduce weight, improve fuel efficiency, and meet stringent safety standards.

List Of Key Companies Profiled In Aerospace And Defense Materials Market:

- Arconic Inc. (US)

- Toray Composite Materials America, Inc. (US)

- Huntsman (US)

- Evonik Industries (Germany)

- Hexcel Corporation (US)

- Materion Corp. (US)

- AMI Metals Inc. (US)

- TATA Advanced Materials Limited. (India)

- Koninklijke Ten Cate BV (Netherlands)

- Sofitec (Spain)

- Teijin Ltd. (Renegade Materials Corp.) (Japan)

- Others

Key Growth Drivers

- Rising Aircraft Production

The surge in passenger travel, growth in low-cost carriers, and replacement of aging fleets are increasing the production rates of commercial aircraft. This directly boosts the demand for lightweight and high-performance materials. - Military Modernization Programs

Defense budgets are rising in many nations, with modernization programs focusing on stealth technology, high-speed maneuverability, and survivability. These requirements drive the use of specialized alloys, composites, and advanced ceramics. - Fuel Efficiency & Sustainability

Airlines and defense forces are under pressure to reduce carbon emissions and operating costs. Lightweight materials, particularly composites and advanced aluminum alloys, enable fuel savings while maintaining structural integrity. - Space Exploration & Satellites

The renewed interest in lunar missions, Mars exploration, and satellite deployment increases the demand for materials capable of withstanding extreme temperatures, radiation, and vacuum conditions.

Future Trends

- Sustainability Initiatives

The shift toward recyclable materials and energy-efficient manufacturing processes will continue to shape R&D efforts. - Additive Manufacturing

3D printing is enabling cost-effective production of complex aerospace parts using advanced alloys and composites. - Nanomaterials

The incorporation of nanotechnology can enhance strength, reduce weight, and improve resistance to heat and wear. - Smart Materials

Self-healing composites and shape-memory alloys could revolutionize aerospace maintenance and durability.

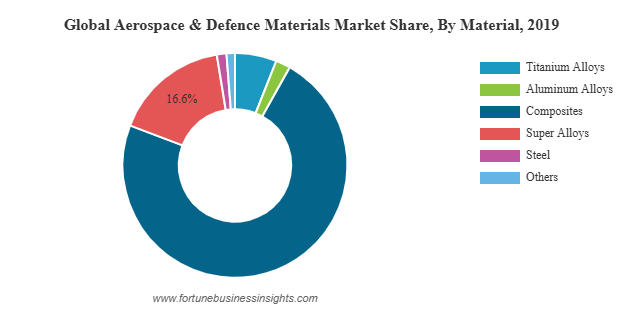

Material Segmentation

- Composites

Composites have emerged as the dominant material category, offering exceptional strength-to-weight ratios and corrosion resistance. Carbon fiber reinforced polymers are extensively used in aircraft fuselages, wings, and interior components. - Aluminum Alloys

Aluminum alloys remain critical for aerospace structures due to their light weight, recyclability, and cost-effectiveness. Advanced grades, such as the 7000 series, provide high strength for load-bearing applications. - Titanium Alloys

Titanium is preferred for components exposed to high stress and temperatures, such as landing gear, engine parts, and airframes. Its corrosion resistance makes it valuable for both aerospace and naval defense applications. - Super Alloys & Advanced Metals

Nickel-based and cobalt-based superalloys are essential for high-temperature environments like jet engines and rocket propulsion systems. - Ceramic Matrix Composites (CMCs)

These advanced materials are gaining attention for their lightweight nature and ability to withstand extreme heat, particularly in engine components.

Read More : https://www.fortunebusinessinsights.com/aerospace-defense-materials-market-102980

Regional Insights

- North America

Home to major aerospace manufacturers and defense contractors, North America dominates the global market. The presence of companies involved in both commercial and military aircraft production ensures strong demand for advanced materials. - Europe

With leading players in aircraft manufacturing and defense systems, Europe maintains a strong market share. Strict environmental regulations in the EU drive innovations in lightweight and recyclable materials. - Asia-Pacific

This region is experiencing the fastest growth, driven by rising air passenger traffic, increasing defense budgets, and growing domestic manufacturing capabilities in countries like China, India, and Japan. - Middle East & Africa

Investments in aviation hubs, defense procurement, and infrastructure development are gradually expanding the market presence in these regions.

Challenges Facing the Industry

While growth prospects are strong, several challenges could impact market expansion:

- High Production Costs: Advanced materials, particularly composites and titanium alloys, can be expensive to produce and process.

- Complex Certification Processes: Aerospace materials must meet rigorous safety and performance standards, requiring lengthy testing and approval procedures.

- Supply Chain Vulnerabilities: Dependence on specialized suppliers and raw material sources can create disruptions.

- Geopolitical Risks: Trade restrictions, tariffs, and international tensions can impact material availability and pricing.

Key Industry Developments:

- April 2020 – Hexcel Corporation, an advanced composites manufacturer headquartered in the US, and Woodward, Inc., a key player providing designing, manufacturing and other services in the aerospace industry headquartered in the US, announced mutual termination of merger agreement, which was previously announced in January 2020. The disruption caused by the COVID-19 outbreak has forced the companies to announce the termination of the agreement.

- August 2019 – Teijin Ltd, a Japan-based manufacturer of advanced materials and chemicals, announced the successful acquisition of Renegade Materials Corporation, a key supplier of highly heat-resistant thermoset prepreg for the aerospace industry in North America. This has strengthened Tenjin’s position in the aerospace business and also increased its manufacturing capabilities.

Outlook

The aerospace and defense materials market is on a steady growth trajectory, powered by advancements in technology, rising global defense spending, and the relentless pursuit of lighter, stronger, and more sustainable materials. Companies that focus on innovation, cost efficiency, and sustainability are well-positioned to capture growth opportunities in the years ahead. As commercial aviation, defense modernization, and space exploration continue to expand, the demand for cutting-edge materials will only intensify, making this sector one of the most dynamic in the global economy.