Agricultural Films Market Demand, Drivers & Global Growth, Forecast 2032

The global agricultural films market was valued at USD 11.28 billion in 2023 and is expected to increase from USD 11.96 billion in 2024 to USD 19.66 billion by 2032, registering a CAGR of 6.3% over the forecast period. Asia Pacific led the market in 2023 with a 53.81% share, while the U.S. market is projected to reach USD 2.57 billion by 2032, fueled by rising demand across diverse plasticulture agricultural applications.

Market Size & Growth Outlook

The global agricultural films market has emerged as a key contributor to modern farming efficiency, helping farmers boost productivity, conserve resources, and adopt sustainable practices. These films, which include mulching films, greenhouse films, and silage films, play a vital role in crop protection, water conservation, soil health management, and yield enhancement. With increasing pressure to feed a growing global population and combat climate challenges, demand for advanced agricultural films is steadily rising across regions.

List Of Key Companies Profiled:

- Rani Plast (Finland)

- Armando Alvarez (Spain)

- BASF SE (Germany)

- Berry Global Inc. (U.S.)

- Kuraray Co., Ltd. (Japan)

- Coveris (U.K.)

- rkw Group (Germany)

- Trioworld Industrier AB (Sweden)

- Exxon Mobil Corporation (U.S.)

- Groupe Barbier (France)

- Novamont S.p.A (Italy)

Key Market Drivers

- Rising Food Demand

Global population growth continues to put pressure on the agricultural sector to produce more food with limited resources. Agricultural films improve crop yields by creating optimal growing conditions, extending growing seasons, and reducing the risks of pests, weeds, and adverse weather.

- Technological Advancements

Modern agricultural films now incorporate multi-layer structures, UV-blocking agents, infrared filters, and anti-drip properties. These innovations enable farmers to better control temperature, humidity, and light exposure for crops, directly improving quality and productivity.

- Water Conservation Efforts

In water-scarce regions, agricultural films help retain soil moisture, reduce evaporation, and minimize irrigation requirements. This function is particularly important in areas facing drought and water management challenges.

- Sustainability Trends

Environmental concerns are pushing the market toward biodegradable and recyclable film solutions. These alternatives help reduce plastic waste while maintaining the benefits of traditional films, making them increasingly popular among environmentally conscious farmers and regions with strict environmental regulations.

Read More : https://www.fortunebusinessinsights.com/agricultural-films- market-102701

Market Segmentation

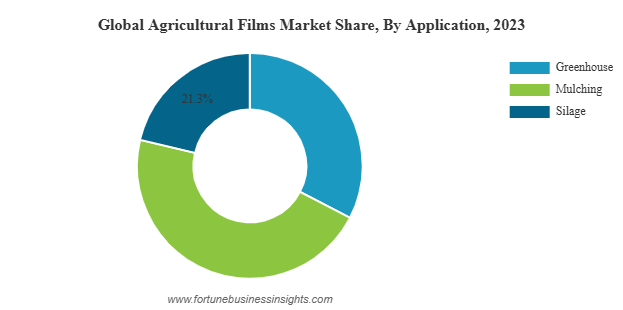

By Application

- Mulching Films: Represent the largest segment, accounting for more than 40% of the market in 2023. They are widely used for weed suppression, soil temperature control, and moisture retention.

- Greenhouse Films: Expected to see the fastest growth due to increasing greenhouse farming, particularly in regions with harsh climatic conditions. These films enable year- round cultivation and protect crops from pests and extreme temperatures.

- Silage Films: Used primarily for preserving animal feed, ensuring high nutritional value for livestock throughout the year.

By Material

- LLDPE (Linear Low-Density Polyethylene): Dominates the market due to its flexibility, durability, and cost-effectiveness.

- LDPE (Low-Density Polyethylene): Valued for its transparency and ease of processing, used in specific applications like greenhouse covers.

- EVA (Ethylene Vinyl Acetate): Anticipated to grow rapidly because of its clarity, UV resistance, and compatibility with biodegradable formulations.

- Others: Including biodegradable plastics and specialty polymers tailored for niche farming needs.

Regional Insights

- Asia-Pacific: The largest and fastest-growing market, holding over 50% of global share in 2023. Countries such as China, India, and Japan lead adoption due to expanding agricultural activity, government support for modern farming methods, and the growing use of protected cultivation.

- North America: A mature market with high adoption of advanced and eco-friendly agricultural films. Demand is supported by technological innovation and the shift toward sustainable farming practices.

- Europe: Driven by stringent environmental regulations and increasing popularity of organic farming. European farmers are adopting biodegradable films at a faster pace compared to other regions.

- Middle East & Africa: Growth is fueled by the need to maximize productivity in arid climates and the expansion of greenhouse farming to combat extreme weather conditions.

- Latin America: Countries like Brazil and Argentina are adopting agricultural films to support large-scale farming operations and improve crop yields in both staple and cash crops.

Opportunities & Challenges

Opportunities

- Development of fully biodegradable films that match the performance of traditional plastics.

- Integration of “smart” films that monitor and adjust growing conditions automatically.

- Expansion in emerging markets with untapped potential for protected agriculture.

Challenges

- High initial costs for advanced films can deter small-scale farmers.

- Limited recycling infrastructure in certain regions, causing environmental concerns for non-biodegradable films.

- Fluctuating raw material prices affecting production costs.

Key Industry Developments:

- March 2023– Rani Plast and eight other progressive companies announced collaboration on a novel nation-wide recycling collection system. The move is expected to help reduce

- difficulties in the disposal of used agricultural plastic.

- May 2022 – Berry Global announced a collaboration with CleanFarms and Poly-Ag Recycling on a close-loop method for Canada’s Circular economy.

Future Trends

- Sustainable Materials: The push for eco-friendly products will drive research and investment into biodegradable polymers and recyclable plastics.

- Precision Agriculture Integration: Films embedded with sensors could provide real- time data on soil moisture, temperature, and crop health.

- Multi-Functional Films: Combining multiple benefits such as pest resistance, nutrient delivery, and light diffusion in a single product.

- Government Incentives: Subsidies and grants encouraging adoption of agricultural films, especially in developing countries.

Outlook

The agricultural films market is set for strong growth over the next decade, supported by population growth, climate challenges, and the need for sustainable farming practices. As technology evolves, films are becoming more advanced, offering better protection, higher yields, and improved environmental performance. With Asia-Pacific leading the charge, other regions are also stepping up adoption, making agricultural films a vital component of global food security and modern agriculture.