Salt Market Demand, Drivers & Global Growth, Forecast 2032

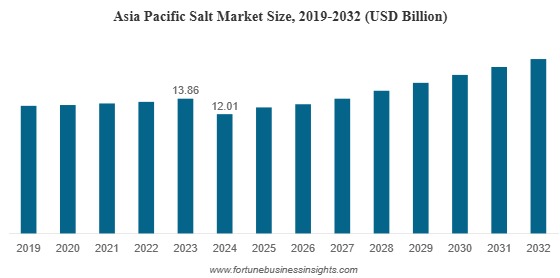

The global salt market was valued at USD 25.98 billion in 2024 and is expected to increase from USD 26.92 billion in 2025 to USD 36.13 billion by 2032, reflecting a CAGR of 4.3% over the forecast period. Asia Pacific led the market in 2024, holding a 46.23% share, supported by strong industrial and food industry demand. Meanwhile, the U.S. salt market is anticipated to reach USD 4.91 billion by 2032, driven by rising consumption of food-grade salt along with expanding applications in industrial processes and de-icing.

Market Overview

Salt has been an indispensable part of human civilization for centuries. Beyond its essential role in food preservation and seasoning, it has become a critical raw material in industries ranging from chemicals and pharmaceuticals to water treatment and de-icing. Today, salt is not only a kitchen staple but also a multi-billion-dollar global commodity driving significant industrial processes worldwide.

Salt’s enduring importance lies in its versatility. While table salt remains its most visible use, the majority of global salt production goes into chemical processing, industrial applications, and de-icing in colder regions. Its ability to support essential industrial chains makes it a non-substitutable raw material, particularly in chlorine–alkali industries.

List Of Key Salt Companies Profiled

- American Rock Salt (U.S.)

- Cargill Salt (U.S.)

- Compass Minerals International, Inc. (U.S.)

- INEOS Enterprises Salt (U.K.)

- K+S Aktiengesellchaft (Germany)

- China National Salt Industry (China)

- Qemetica (Poland)

- US Salt LLC (U.S.)

- Ahir Salt Industries (India)

- GHCL Limited (India)

Market Drivers

Several factors are driving the continued growth of the salt market:

- Chemical Industry Demand – The chlorine–alkali sector, which relies heavily on salt, remains a cornerstone of global industrial activity. Salt is irreplaceable in producing chlorine, caustic soda, and other essential chemicals.

- Food Industry Expansion – As global populations rise and processed food consumption increases, demand for edible salt continues to climb steadily. Salt’s role in flavor enhancement and preservation makes it critical for food manufacturing.

- De-icing Applications – In regions with severe winters, salt is a cost-effective and widely used material for maintaining road safety. This segment consistently drives demand in North America and Europe.

- Water Treatment Growth – Salt plays an important role in water softening and purification processes, which are gaining traction as access to clean water becomes a pressing global concern.

Read More : https://www.fortunebusinessinsights.com/salt-market-103011

Emerging Trends

One of the most notable trends reshaping the salt market is the rising popularity of gourmet and specialty salts. Products like Himalayan pink salt, fleur de sel, and black lava salt are increasingly sought after by health-conscious consumers and culinary professionals. These varieties are valued not only for their unique taste and mineral content but also for their visual appeal, making them a premium alternative to conventional table salt.

Another growth area lies in micronized salt, which has found widespread use in processed foods such as baked goods, confectionery, meats, and beverages. With its fine particle size, superior purity, and longer shelf life, micronized salt is becoming a preferred ingredient for modern food manufacturing.

In addition, increasing awareness about health and nutrition is influencing consumer preferences. While concerns about excessive sodium intake persist, the market is simultaneously experiencing growth in low-sodium salt alternatives and fortified salts enriched with minerals such as iodine, iron, or potassium. This diversification of product offerings is opening new avenues for manufacturers to capture niche segments.

Market Segmentation by Type and Source

When categorized by type, rock salt holds the largest market share. Rock salt’s widespread availability, cost-effectiveness, and suitability for large-scale applications like road de-icing and industrial processing make it a preferred choice globally.

Other significant types include solar salt and vacuum-evaporated salt. Solar salt, derived from seawater evaporation, is widely used in culinary applications and food preservation. Vacuum salt, known for its purity, caters to specialized industries such as pharmaceuticals, textiles, and high-quality food production.

In terms of sources, salt mining continues to dominate global supply. Vast underground reserves ensure long-term availability and support large-scale extraction. Solar evaporation, while smaller in volume compared to mining, remains vital in coastal regions where climatic conditions are favorable.

Regional Insights

- Among regions, Asia-Pacific dominates the salt market, accounting for nearly half of the global share in 2024. Countries like China, India, and Australia are major producers and consumers of salt due to vast reserves, cost-efficient production techniques, and strong demand from chemical and food sectors. Asia-Pacific’s leadership is expected to continue, supported by industrial growth, rapid urbanization, and large-scale consumption in food processing.

- North America and Europe also hold significant shares, driven primarily by demand for road de-icing and chemical manufacturing. The United States, for instance, remains a key player with steady growth in both production and consumption. Its salt market is projected to grow modestly, supported by industrial applications and winter maintenance needs. Meanwhile, Europe continues to witness stable demand from its established chemical and processed food industries.

- Other regions such as Latin America and the Middle East & Africa show promising growth prospects. These markets are benefiting from rising food industry expansion, infrastructure development, and increasing adoption of water treatment systems.

Key Industry Developments

- December 2024: GHCL, a key salt manufacturer and part of the Dalmia Group, invested USD 40.44 million to create a salt field in Kutch. The Zara Zumara Salt Field will be developed in the Jara area of Kutch.

- May 2023: Cargill’s salt business signed an agreement with CIECH Group, a leading supplier of evaporated salt products. Through this agreement, Cargill extended its range of specialty and evaporated food salt solutions for European food manufacturers.

Challenges

Despite its robust outlook, the salt industry faces certain challenges. Regulatory frameworks around mining and environmental concerns regarding large-scale extraction can limit supply expansion. In some regions, obtaining mining licenses and permits is a time-consuming process that hampers new projects. Moreover, growing health concerns about sodium consumption may restrain demand for conventional table salt in certain markets, prompting the industry to adapt with innovative, healthier alternatives.

Future Outlook

The future of the salt market is shaped by a blend of traditional demand and emerging opportunities. Industrial applications will continue to anchor its importance, while the food industry’s shift toward premium, gourmet, and health-oriented salts will add new growth avenues. Advancements in mining and refining technologies, coupled with innovations in product offerings, are likely to further strengthen the industry’s global position.

Overall, the salt market stands as a resilient and expanding sector, rooted in centuries of human use yet constantly evolving to meet modern needs. From roads to refineries and kitchens to chemical plants, salt remains one of the world’s most essential and versatile commodities—poised to grow steadily in the years ahead.