Salt Market Global Report, Opportunities, Share & Forecast 2032

The global salt market size was valued at USD 25.98 billion in 2024 and is expected to expand from USD 26.92 billion in 2025 to USD 36.12 billion by 2032, reflecting a steady CAGR of 4.29% throughout the forecast period. In 2024, Asia Pacific emerged as the leading region, capturing a 46.23% share of the market. Meanwhile, the U.S. salt market is projected to reach USD 4.91 billion by 2032, supported by rising demand for food-grade salt as well as increased use in industrial processes and de-icing. Key industry players include Cargill Salt, Compass Minerals International, Inc., INEOS Enterprises, and American Rock Salt, all of whom play a vital role in shaping the competitive landscape.

Salt is one of the world’s most essential commodities, deeply rooted in human civilization for centuries. From preserving food and seasoning meals to powering chemical industries and ensuring road safety during winter, salt continues to prove its versatility in the modern world. While it may appear to be a simple mineral, the global salt market tells a story of growth, innovation, and evolving demand across multiple sectors.

Global Market Dynamics

The salt market is not confined to kitchen tables. In fact, the largest share of global demand comes from industries, with chemical processing leading the way. Salt is an indispensable raw material in the production of chlorine, caustic soda, and soda ash—all of which serve as critical inputs in the manufacturing of plastics, glass, textiles, paper, and detergents. The continued expansion of industrial applications is expected to sustain the upward momentum of the market over the forecast period.

At the same time, the food and beverage sector continues to be a strong driver. Salt market remains a staple in diets worldwide, both as a flavor enhancer and a preservative. The rising popularity of specialty salts such as sea salt, Himalayan pink salt, and smoked salts reflects shifting consumer preferences toward premium, natural, and gourmet food products.

List Of Key Salt Companies Profiled

- American Rock Salt (U.S.)

- Cargill Salt (U.S.)

- Compass Minerals International, Inc. (U.S.)

- INEOS Enterprises Salt (U.K.)

- K+S Aktiengesellchaft (Germany)

- China National Salt Industry (China)

- Qemetica (Poland)

- US Salt LLC (U.S.)

- Ahir Salt Industries (India)

- GHCL Limited (India)

Growth Drivers

Several factors are fueling the expansion of the global salt market:

- Industrial Demand: The chlorine-alkali industry remains one of the largest consumers of salt. As demand for plastics, detergents, and glass continues to grow globally, so too does the requirement for salt as a key raw material.

- Food and Nutrition Trends: Beyond basic seasoning, consumers are gravitating toward natural and specialty salts. The wellness movement has spurred interest in minimally processed sea salts, Himalayan pink salt, and other varieties perceived as healthier alternatives.

- Infrastructure and Safety: In colder countries, rock salt remains vital for de-icing roads, sidewalks, and airport runways. The ongoing need for public safety during winter ensures consistent demand for this segment.

- Population Growth: With rising populations worldwide, especially in developing regions, demand for processed and packaged food continues to rise—directly boosting the need for salt as both a preservative and a flavoring agent.

Read More : https://www.fortunebusinessinsights.com/salt-market-103011

Market Segmentation

The salt market can be segmented in several ways, highlighting the diversity of its applications:

- By Type: Rock salt leads the market, particularly in de-icing and chemical processing. Other forms, including solar salt and vacuum salt, also hold importance for different industries.

- By Source: Salt extracted from mines accounts for the largest share, given the accessibility of underground reserves and the efficiency of mining operations. Sea salt production, while smaller in volume, caters to niche markets and health-conscious consumers.

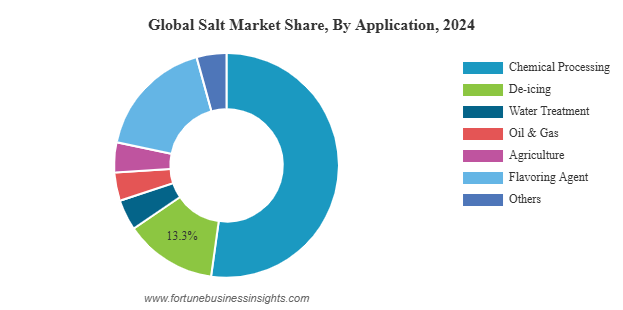

- By Application: Chemical processing dominates global demand, followed by food-grade uses, water treatment, and de-icing. While de-icing may seem seasonal, it contributes significantly to annual salt consumption in colder climates.

Regional Highlights

- Asia-Pacific: The Global Leader

The Asia-Pacific region dominates the global salt market, accounting for nearly half of total revenue in 2024. Countries like China, India, and Australia are at the forefront, benefiting from vast natural reserves, growing populations, and strong industrial demand. Expanding chemical industries in China and India, in particular, are creating sustained demand for large volumes of salt, while the food processing sector continues to grow alongside urbanization and changing dietary habits.

- United States: A Key Growth Market

In the U.S., the salt market is projected to increase around USD 4.91 billion by 2032. This growth is driven by demand across three primary areas: food-grade salt, industrial applications, and de-icing. Every winter, millions of tons of rock salt are spread on American roads to improve safety during snow and ice storms. At the same time, the country’s robust food industry ensures consistent demand for table and processed salts.

- Europe and Beyond

European markets are also significant, particularly in countries with cold winters where road de-icing is essential. Meanwhile, the Middle East and Africa show potential growth due to ongoing industrial developments and the availability of abundant salt deposits.

Key Industry Developments

- December 2024: GHCL, a key salt manufacturer and part of the Dalmia Group, invested USD 40.44 million to create a salt field in Kutch. The Zara Zumara Salt Field will be developed in the Jara area of Kutch.

- May 2023: Cargill’s salt business signed an agreement with CIECH Group, a leading supplier of evaporated salt products. Through this agreement, Cargill extended its range of specialty and evaporated food salt solutions for European food manufacturers.

- April 2022: Tata Salt, one of India's most trusted brands and pioneers of the salt iodization movement, launched Tata Salt Immuno. This innovative product, a first of its kind in the Indian edible salt segment. Along with mandated iodization, the product has added zinc, which is known to support a healthy immune system.

Challenges and Considerations

Despite its steady growth, the salt market faces some challenges. Health concerns related to excessive sodium intake have prompted governments and health organizations to encourage reduced salt consumption in diets. This could slightly impact demand in the food sector, particularly in developed countries.

Additionally, environmental concerns surrounding salt mining and large-scale de-icing are prompting industries to explore more sustainable solutions. Nevertheless, these challenges also create opportunities for innovation, such as low-sodium salt alternatives and eco-friendly de-icing products.

The Future of the Salt Market

Looking ahead, the salt market will continue to evolve in response to both traditional and emerging demands. Industrial uses will remain a cornerstone, while consumer trends toward specialty and premium salts will add new dimensions of growth. At the same time, technological advancements in mining, production, and sustainability practices are likely to shape the industry’s trajectory over the next decade.

What remains clear is that salt market an age-old mineral once valued as “white gold”—still holds immense importance in shaping modern economies and daily life. From the roads we drive on in winter to the food we eat and the products we use, salt remains as relevant as ever, with a global market poised for steady expansion in the years to come.