Saudi Arabia Refractories Market Size, Share, Companies & Future Outlook 2029

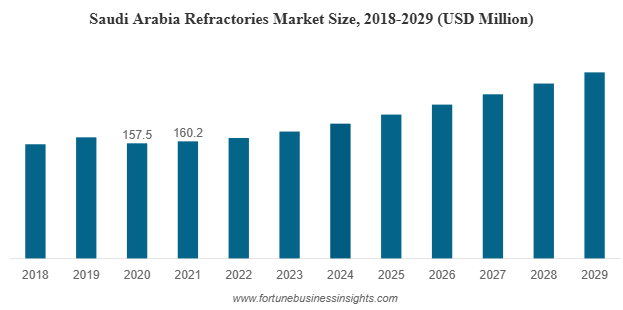

The Saudi Arabia refractories market was valued at USD 160.2 million in 2021 and is expected to expand from USD 164.8 million in 2022 to USD 254.6 million by 2029, registering a CAGR of 6.4% during the forecast period. The COVID-19 pandemic had a significant impact on the industry, with demand falling short of expectations across the country. In fact, the market recorded a 4.9% decline in 2020 compared to 2019, highlighting the challenges faced during the crisis.

Market Size and Forecast

The Saudi Arabia Refractories Market is undergoing rapid transformation, driven by industrial expansion, government initiatives, and rising demand from core industries such as steel, cement, glass, and non-ferrous metals. As the Kingdom works toward its Vision 2030 objectives, refractories are emerging as a crucial component in supporting industrial infrastructure, manufacturing, and construction.

This article explores the size of the market, major growth drivers, challenges, and the future outlook, offering insights for businesses, investors, and stakeholders aiming to understand this fast-growing industry.

List Of Key Companies Profiled:

- Saudi Refractory Industries (Dammam)

- AOSCO Refractory (Dammam)

- FSN Company (Dammam)

- Arabian Refractories Factory Company (Dammam)

- Q & E Company Ltd. (Al Jubail)

- Alfran (Amman)

- Thermal Insulation UAE (Sharjah)

Importance of Saudi Arabia Refractories Market

Saudi Arabia Refractories Market are specialized, heat-resistant materials used to line furnaces, kilns, reactors, and other equipment that must endure extreme heat, chemical corrosion, and mechanical wear. They are indispensable in industries such as iron and steel, cement, glass, and petrochemicals. Without quality refractory linings, these industries cannot achieve efficiency, safety, or cost-effectiveness in their operations.

In Saudi Arabia, where large-scale industrialization is central to economic diversification, the demand for high-performance refractories is expanding at a steady pace.

Key Segments of the Market

By Form

- Bricks and shaped refractories dominate the market, thanks to their extensive use in furnaces, kilns, and metal processing units.

- Monolithic and unshaped refractories are gaining popularity due to their versatility in lining irregular shapes and complex industrial equipment.

By Product Type

- Clay refractories, including fireclay and other affordable compositions, lead in terms of volume because of their cost-effectiveness and wide availability.

- Non-clay refractories, such as high alumina, silica, magnesia, and specialty compositions, are increasingly in demand for high-temperature and high-stress applications.

By End-Use Industry

- Iron and steel remains the largest consumer segment, as steelmaking processes rely heavily on refractory linings for converters, blast furnaces, and ladles.

- Cement and glass industries also contribute significantly, with glass furnaces requiring advanced materials to withstand continuous high-temperature melting operations.

- Non-ferrous metals and petrochemicals represent growing opportunities, especially as Saudi Arabia strengthens its energy and industrial base.

Read More : https://www.fortunebusinessinsights.com/saudi-arabia-refractories-market-106924

Growth Drivers

- Vision 2030 and Industrial Diversification

Saudi Arabia’s Vision 2030 blueprint focuses on diversifying the economy beyond oil. The plan emphasizes boosting steel production, automotive manufacturing, construction, and renewable energy—all sectors that rely heavily on refractory applications. - Megaprojects and Infrastructure Development

Projects like NEOM City, the Red Sea Project, and new industrial hubs are fueling demand for steel, cement, and glass. This directly translates into higher consumption of refractories for production units and industrial infrastructure. - Rising Steel Production

Saudi Arabia is investing heavily in steel plants to meet domestic and export demand. Since steelmaking is one of the most refractory-intensive processes, this sector will remain the backbone of market growth. - Technological Advancements

Innovations in refractory materials—such as non-clay compositions with superior thermal, mechanical, and chemical resistance—are gaining traction. These advanced materials improve efficiency, reduce downtime, and comply with stricter environmental standards.

Challenges Facing the Market

- Raw Material Dependence: Saudi Arabia imports a significant portion of refractory raw materials, making the market vulnerable to global supply chain disruptions and fluctuating costs.

- High Energy and Production Costs: Refractory manufacturing is energy-intensive, and rising energy prices can impact margins for producers.

- Environmental Regulations: As the Kingdom advances its sustainability agenda, manufacturers must adopt eco-friendly production processes, which require additional investment.

- Skilled Workforce Needs: Operating advanced refractory technologies and installations requires technical expertise, which remains a challenge in certain regions.

Future Outlook

The future of the Saudi Arabia refractories market looks highly promising. Between 2022 and 2029, steady growth is expected across all major end-use industries. Steel will continue to dominate demand, while the glass and cement industries are set to expand further due to construction megaprojects.

Advanced non-clay refractories are anticipated to capture greater market share, supported by industries that require superior performance under corrosive and high-temperature conditions. Moreover, local manufacturing capabilities are likely to expand as the Kingdom reduces dependency on imports and promotes domestic production facilities.

The Saudi Arabia Refractories Market is on a growth trajectory, fueled by industrialization, megaprojects, and rising steel and cement production. While challenges such as raw material dependency and environmental regulations persist, the outlook remains highly positive through 2029.

For businesses, this market presents opportunities to innovate, localize production, and align with Vision 2030’s goals. For investors and stakeholders, refractories are not just heat-resistant materials they are the backbone of Saudi Arabia’s industrial transformation.