Lithium Metal Market Global Growth, Market Analysis, Trends & Forecast 2032

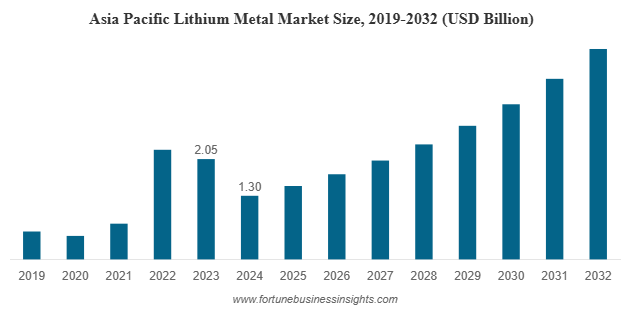

The global lithium metal market was valued at USD 2.21 billion in 2024 and is anticipated to rise from USD 2.55 billion in 2025 to reach USD 7.25 billion by 2032, registering a strong CAGR of 16.0% during the forecast period. Asia Pacific emerged as the leading region, accounting for 58.82% of the market share in 2024.

List Of Key Lithium Metal Companies Profiled

- Ganfeng Lithium Group Co. Ltd. (China)

- Techtone Inorganic Co., Ltd. (China)

- Chengxin Lithium Group Co., Ltd. (China)

- Rio Tinto (U.K.)

- CNNC Jianzhong Nuclear Fuel Co., Ltd. (China)

- Albemarle Corporation (U.S.)

- Li-Metal Corp. (Canada)

- Tianqi Lithium Inc. (China)

- ATT Advanced Elemental Materials Co., Ltd. (U.S.)

- Merck KGaA (Germany)

Market Overview

Lithium metal market is an essential component in next-generation battery technologies, particularly solid-state and lithium-sulfur batteries. These advanced systems offer higher energy density, faster charging, and improved safety compared to traditional lithium-ion batteries. The growing need for efficient energy storage across multiple sectors — from electric mobility to renewable energy integration — has positioned lithium metal as one of the most strategic materials of the decade.

The Asia Pacific region dominated the global market in 2024, accounting for over 58.82% share. Countries like China, Japan, and South Korea continue to lead due to strong investments in EV manufacturing, battery innovation, and local production capacities. Europe and North America are also emerging as significant players, supported by growing clean energy initiatives and strategic collaborations among automakers and battery suppliers.

Market Segmentation

By Form

- Ingot: This segment dominates the market, as lithium ingots are widely used in battery production and alloy manufacturing due to their high purity and uniformity.

- Powder: Lithium powder is gaining popularity in niche applications, including additive manufacturing, chemical synthesis, and compact battery designs.

- Others: Various customized forms of lithium metal cater to research and specialized industrial applications.

By Application

- Batteries: The battery segment leads the global market, driven by rising adoption of solid-state and lithium-sulfur batteries that rely heavily on lithium metal anodes. These batteries promise longer life cycles and higher efficiency for EVs and portable devices.

- Alloys: Lithium metal is also used in aluminum-lithium and magnesium-lithium alloys, offering lightweight strength for aerospace, defense, and automotive sectors.

- Others: Additional uses include electronics, pharmaceutical synthesis, and specialty chemicals.

Key Growth Drivers

- Electric Vehicle Expansion

The surge in global EV production remains the strongest growth catalyst. Lithium metal’s ability to store more energy per unit weight makes it ideal for high-performance batteries that extend vehicle range and reduce charging times. As governments worldwide push for zero-emission mobility, the demand for lithium metal is expected to grow rapidly.

- Rising Renewable Energy Integration

As solar and wind power adoption increases, so does the need for reliable energy storage systems. Lithium metal batteries provide the stability and energy density required for grid-level storage, supporting renewable energy continuity even during fluctuations in generation.

- Advances in Battery Technology

Ongoing research in solid-state batteries and lithium-sulfur batteries is reshaping the energy storage landscape. Lithium metal anodes are central to these innovations, offering up to twice the energy density of conventional lithium-ion systems. These technological breakthroughs are expected to open new growth avenues in both mobility and stationary storage sectors.

- Supportive Policies and Investments

Governments across regions are implementing favorable policies and subsidies for domestic battery manufacturing and raw material sourcing. Major automakers and energy firms are forming joint ventures with lithium producers to secure long-term supply chains, strengthening overall market growth.

Read More : https://www.fortunebusinessinsights.com/lithium-metal-market-113413

Challenges and Restraints

Despite its potential, the lithium metal market faces several obstacles. The high cost and volatility of raw materials continue to impact profitability for producers. Moreover, lithium extraction and purification are resource-intensive, involving significant water consumption and environmental considerations.

Limited global production capacity and supply chain constraints add another layer of challenge, particularly as demand outpaces current output. Furthermore, emerging alternative technologies such as sodium-ion and advanced solid-state chemistries could pose competition in certain applications if they achieve commercial scalability at lower costs.

Emerging Opportunities

The next wave of growth is likely to come from technological advancements in extraction and processing. Innovations such as direct lithium extraction (DLE) and recycling from used batteries could significantly reduce production costs and environmental impact.

Vertical integration is another major trend reshaping the industry. Leading producers are expanding across the value chain — from mining to refining and battery production — to secure raw material availability and enhance supply reliability.

Additionally, aerospace and defense sectors are increasingly adopting lithium-based alloys for lightweight structural components, offering steady niche demand outside the energy domain.

Competitive Landscape

The companies are investing heavily in R&D and capacity expansion to strengthen their foothold. Strategic acquisitions and partnerships are shaping the competitive environment. For example, large corporations are acquiring smaller lithium metal producers to expand production capabilities and secure access to patented technologies.

Key Industry Developments

- March 2025: Rio Tinto completed its USD 6.7 billion acquisition of Arcadium Lithium, positioning itself as a global leader in the supply of energy transition materials and significantly expanding its lithium portfolio to support the growing demand for clean energy solutions.

- August 2024: Arcadium Lithium acquired Li-Metal Corp.’s lithium metal business for USD 11 million in an all-cash deal. This acquisition included intellectual property, patents, and a pilot production facility in Ontario, Canada. This acquisition aimed to enhance Arcadium’s capabilities in producing lithium metal from various grades of lithium carbonate feedstock.

Future Outlook

Looking ahead, the lithium metal market is expected to continue its strong upward trajectory through 2032. The convergence of sustainability goals, EV adoption, and advancements in energy storage technology will create an ecosystem where lithium metal becomes a cornerstone material for the global energy transition.

As the world shifts toward a greener future, lithium metal’s high energy efficiency, lightweight nature, and adaptability across applications will ensure its critical role in shaping tomorrow’s clean energy economy. With ongoing technological progress and increasing investments, the market is set to enter an era of rapid expansion, positioning lithium metal as a key enabler of the next generation of batteries and energy systems.