Category: Chemicals & Advanced Materials

Aluminum Composite Panels Market Demand, Drivers & Global Growth, Forecast 2032

By Sharvari, 2025-08-12

The global aluminum composite panels market was valued at USD 5.33 billion in 2018 and is anticipated to reach USD 8.71 billion by 2026, reflecting a CAGR of 6.1% over the forecast period. In 2018, Asia Pacific led the market with a 39.23% share. In the United States, the market is expected to witness strong growth, projected to reach USD 2.41 billion by 2032, supported by favorable policies and initiatives aimed at enhancing infrastructure across North America.

Market Overview

The aluminum composite panels (ACP) market has been witnessing significant growth in recent years, driven by the rapid pace of urbanization, rising construction activities, and increasing demand for lightweight yet durable building materials. ACPs, which consist of two thin layers of aluminum bonded to a non-aluminum core, are known for their excellent structural strength, flexibility, and aesthetic appeal. They are widely used in applications such as building facades, signage, interior decoration, and transportation.

List Of Key Companies Profiled In Aluminum Composite Panels Market:

- 3A Composites GmbH

- Arconic

- Mitsubishi Chemical Corporation

- Hyundai Alcomax Co.,Ltd.

- Fairfield Metal LLC

- Jyi Shyang Industrial Co., Ltd.

- ALUMAX INDUSTRIAL CO., LTD.

- Yatai Industrial Group Co., Ltd.

- Shanghai Huayuan New Composite Materials Co., Ltd.

- Guangzhou Xinghe Aluminum Composite Panel Co., Ltd.

Key Market Drivers

- Boom in the Construction Industry

Urbanization and industrial development, particularly in Asia-Pacific countries, have created a surge in demand for modern building materials. ACPs are increasingly preferred in the construction of commercial complexes, high-rise buildings, airports, and residential projects due to their lightweight nature, ease of installation, and ability to withstand extreme weather conditions. - Aesthetic Versatility

Architects and designers appreciate ACPs for their wide range of colors, textures, and finishes. Whether replicating the look of natural stone, wood, or metallic surfaces, ACPs provide cost-effective solutions without compromising visual appeal. This versatility has made them a go-to material for both new construction and renovation projects. - Safety and Functional Improvements

Growing awareness about building safety has pushed demand for fire-resistant ACPs. Manufacturers are introducing mineral-filled cores and advanced coatings that enhance fire resistance, corrosion protection, and UV stability. Antibacterial and anti-toxic panels are also gaining traction, particularly in healthcare, food processing, and public infrastructure projects. - Rising Demand in Signage and Advertising

Beyond construction, ACPs are widely used in outdoor advertising and signage due to their smooth surface, durability, and ability to withstand exposure to sunlight and rain without fading. This segment has seen robust growth with the expansion of retail spaces, transport hubs, and commercial branding. - Technological Advancements

Digital printing technology, nano-coatings for self-cleaning surfaces, and eco-friendly production methods are expanding ACP capabilities. These innovations are making the panels more durable, sustainable, and adaptable to custom design requirements.

Read More : https://www.fortunebusinessinsights.com/aluminum-composite-panels-market-102304

Regional Insights

- Asia-Pacific remains the dominant market for ACPs, accounting for the largest share globally. China, India, and Southeast Asian nations are driving this growth through massive infrastructure projects, affordable housing initiatives, and rapid industrialization. The region’s focus on modernizing city skylines has kept demand high for premium-grade panels.

- North America is experiencing steady growth, supported by infrastructure upgrades, energy-efficient building designs, and increased adoption of ACP in both commercial and residential segments. In the United States, the market benefits from a combination of technological innovation and strong demand from the automotive and transport sectors.

- Europe is focusing on sustainable building solutions, with ACPs playing a key role in energy-efficient facades and renovation projects. Strict building regulations and fire safety standards in countries like Germany, France, and the UK have fueled demand for high-quality, fire-rated panels.

- Latin America and the Middle East & Africa are emerging as promising markets. Economic development, rising construction investment, and urban population growth are creating opportunities for ACP suppliers in these regions.

Market Challenges

Despite its growth potential, the ACP market faces certain challenges:

- Price Volatility of Raw Materials: Fluctuations in the price of aluminum can impact production costs, making it challenging for manufacturers to maintain competitive pricing.

- Regulatory Pressure: Stricter fire safety regulations in some countries have led to increased scrutiny of ACPs with polyethylene cores. While safer mineral-core panels meet compliance standards, they come at a higher cost.

- Competition from Alternative Materials: Glass, fiber cement, and other cladding materials offer alternative solutions, requiring ACP manufacturers to continuously innovate to maintain market share.

Key Industry Developments:

- July 2017 – Fairview Architectural acquired the Stryum business, an intelligent non-combustible aluminum cladding system, from Vitekk Industries. The company includes a variety of high-quality aluminum plate façade panels designed to provide durability and sustainability, complimenting Fairview's current portfolio of cladding solutions, including high-density cement fibre, natural stone, terracotta tiles and the leading non-combustible composite aluminum frame.

Future Outlook

The future of the ACP market appears promising, with several trends shaping its evolution:

- Sustainability and Eco-Friendly Panels: Growing environmental consciousness is pushing manufacturers to develop recyclable ACPs and use eco-friendly production processes.

- Integration with Smart Building Technologies: Panels with integrated solar capabilities and advanced coatings that respond to environmental changes are expected to gain traction.

- Customization and Niche Applications: Demand for custom designs, special finishes, and tailored panel sizes will continue to grow as architects seek more creative freedom.

- Global Expansion of Urban Infrastructure: Mega-projects in emerging economies and renovations in developed nations will ensure a stable flow of demand.

Aluminum composite panels market have evolved from being a niche building material to a core component in modern construction, signage, and transportation industries. Their blend of lightweight strength, design flexibility, and evolving safety features makes them indispensable in today’s market. As global cities continue to expand and building regulations become stricter, ACPs are well-positioned to meet the demands of safety, sustainability, and style. With continuous innovation, the industry is set to maintain its upward trajectory and unlock new opportunities worldwide.

Thermoplastic Elastomer (TPE) Market Demand, Drivers & Global Growth, Forecast 2032

By Sharvari, 2025-08-11

The global thermoplastic elastomer (TPE) market was valued at USD 26,856.8 million in 2019 and is expected to grow to USD 39,424.6 million by 2027, registering a CAGR of 5.7% during the forecast period. In 2019, Asia Pacific led the market, holding a dominant 52.97% share. In the United States, the TPE market is anticipated to reach USD 6,045 million by 2027, fueled by rising demand for lightweight and durable materials across automotive and consumer goods sectors.

Market Size and Growth Outlook

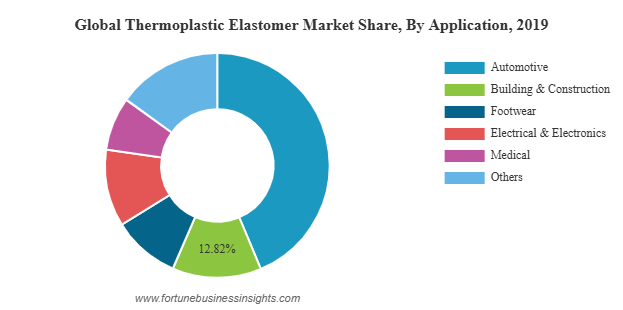

The global Thermoplastic Elastomer (TPE) market is on a strong growth trajectory, driven by increasing demand from automotive, construction, medical, footwear, electronics, and other key industries. TPEs are unique materials that combine the elasticity of rubber with the processability of plastics, offering flexibility, durability, and recyclability. This combination of properties makes them an ideal choice for a wide range of applications, particularly in industries looking for high-performance and sustainable material solutions.

The automotive industry remains the largest consumer of TPEs, using them in products such as seals, gaskets, bumpers, interior components, and weatherproofing materials. Construction, electronics, medical devices, and consumer goods industries are also increasingly adopting TPEs due to their superior performance characteristics.

List Of Key Companies Profiled In Thermoplastic Elastomer Market:

- Arkema SA (Colombes, France)

- Covestro AG (Leverkusen, Germany)

- Evonik Industries AG (Essen, Germany)

- Teknor APEX Company (Rhode Island, U.S.)

- BASF SE (Ludwigshafen, Germany)

- Huntsman Corporation (Texas, U.S.)

- Sinopec Group (Beijing, China)

- Lubrizol Corporation (Ohio, U.S.)

- Kraton Corporation (Texas, U.S.)

- Tosoh Corporation (Tokyo, Japan)

- Other Key Players

Applications Driving Demand

- Automotive Industry – The largest application segment for TPEs. Automakers are increasingly using TPEs for interior trims, instrument panels, seals, and under-the-hood components. These materials not only reduce vehicle weight, which improves fuel efficiency, but also enhance comfort and aesthetics.

- Medical Sector – TPEs are widely used in medical tubing, seals, syringe plungers, and various device housings due to their biocompatibility and sterilization capabilities. The demand for medical-grade TPEs surged during the COVID-19 pandemic, and this segment continues to see growth due to rising healthcare needs.

- Construction Industry – TPEs are used in roofing membranes, seals, and weatherproofing applications thanks to their flexibility and resistance to harsh environmental conditions.

- Footwear Industry – The flexibility, cushioning, and durability of TPEs make them ideal for shoe soles and sports footwear.

- Electronics and Electrical Applications – TPEs are used for cable insulation, connectors, and various protective casings because of their excellent electrical insulation properties and resistance to heat and chemicals.

Read More : https://www.fortunebusinessinsights.com/thermoplastic-elastomer-tpe-market-104515

Key Market Trends

- Shift Toward Bio-based and Recyclable Materials – Growing environmental awareness and stricter regulations are pushing manufacturers to develop bio-based and fully recyclable TPE products.

- Technological Innovations – Advances in polymer chemistry are leading to improved performance characteristics, making TPEs suitable for more demanding applications.

- Lightweighting in Transportation – As the automotive and aerospace industries strive for greater fuel efficiency, lightweight materials like TPEs are gaining more importance.

- Medical-Grade TPE Development – The healthcare industry is demanding materials that are safe, compliant with global regulations, and suitable for repeated sterilization, leading to innovation in medical-grade TPEs.

Regional Insights

- Asia Pacific is the leading regional market for TPE, accounting for over half of the global share in recent years. Countries like China, India, Japan, and South Korea have robust manufacturing bases, particularly in automotive, footwear, electronics, and industrial products. Rapid urbanization, growing infrastructure projects, and increasing disposable incomes in these countries continue to drive demand for TPE products.

- North America is another significant market, with the United States playing a central role due to its advanced automotive and medical sectors. The region is seeing steady growth, supported by consumer demand for high-performance and sustainable products.

- Europe, led by Germany, France, Italy, and the UK, is focusing on lightweighting in vehicles, environmental compliance, and energy efficiency, all of which favor increased use of TPEs. Meanwhile, emerging markets in Latin America, the Middle East, and Africa are projected to see gradual but consistent growth, spurred by industrial expansion and rising consumer goods manufacturing.

Key Industry Developments:

- August 2020: Lubrizol invested in the thermoplastic polyurethane business globally. The investments include the increased production capabilities of surface paint protection film (PPF) and protection. At the same time, it would provide additional benefits to PPF manufacturers and supply chains.

- November 2020: Evonik announced the cooperation with HP for developing a new co-branded1 elastomer, a flexible high-performance specialty powder based on a thermoplastic amide grade (TPA) for 3D printing.

Challenges in the Market

Despite the strong growth outlook, the TPE market faces certain challenges. Volatility in raw material prices, particularly those derived from petroleum, can affect production costs. In addition, competition from alternative materials, such as cheaper plastics or thermoset rubbers, can slow adoption in cost-sensitive markets. Recycling, while possible with TPEs, is still not widely implemented in many regions, limiting the full realization of their sustainability potential.

Leading Industry Players

Major companies operating in the global TPE market include Arkema SA, BASF SE, Covestro AG, Evonik Industries, Huntsman Corporation, Kraton Corporation, Sinopec, Lubrizol Corporation, Teknor Apex, and Tosoh Corporation. These companies are investing heavily in research and development to create advanced, sustainable TPE products, expand production capacity, and strengthen their market positions through strategic partnerships and acquisitions.

Future Outlook

The future of the TPE market looks promising. Growing environmental regulations, increased focus on recyclability, and the need for high-performance materials will continue to push demand upward. As more industries embrace sustainable manufacturing practices, the role of TPEs will expand, particularly in automotive, healthcare, and electronics sectors.

With ongoing innovations, expanding applications, and strong growth in emerging markets, the TPE industry is set to remain a dynamic and competitive sector over the coming decade. Manufacturers that can balance cost, performance, and sustainability are likely to capture the largest share of the market’s future growth.

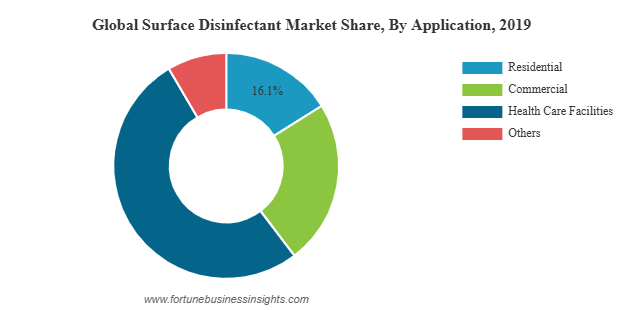

In 2019, the global surface disinfectant market was valued at USD 770.6 million and is anticipated to grow to USD 1,547.7 million by 2027, reflecting a CAGR of 9.1% from 2020 to 2027. North America led the market that year with a 38.92% share. In the U.S., the market is expected to experience substantial expansion, projected to reach USD 524.4 million by 2027. This growth is fueled by rising awareness of sanitation and hygiene, particularly in the aftermath of the pandemic, driving demand across healthcare, residential, and commercial sectors.

Market Size and Growth

The global surface disinfectant market has undergone a remarkable transformation over the past few years, evolving from a primarily healthcare-focused segment into an essential component of public health, commercial hygiene, and household cleaning practices. The COVID-19 pandemic served as a catalyst for unprecedented demand, but even beyond the crisis, awareness of hygiene and sanitation has become deeply embedded in both institutional policies and consumer habits.

North America dominated the global market in 2019, accounting for 38.92% of total revenue. The U.S., in particular, is forecast to experience significant growth, with the market expected to reach USD 524.4 million by 2027. The region’s advanced healthcare infrastructure, rigorous hygiene standards, and strong retail distribution networks have positioned it as a leader in both consumption and innovation.

List of Top Surface Disinfectant Companies:

- 3M (U.S.)

- The Proctor & Gamble Company (U.S.)

- Kimberley-Clark Corporation (U.S.)

- SC Johnson Professional (U.S.)

- The Clorox Company (U.S.)

- Ecolab (U.S.)

- Metrex Research LLC(U.S.)

- Reckitt Benckiser Group Plc (U.K.)

- Diversey Inc.(U.S.)

- STERIS plc (Ireland)

- Whiteley Corporation (Australia)

- Other Key Players

Key Market Drivers

- Post-Pandemic Hygiene Awareness

The global health crisis fundamentally changed public attitudes toward cleanliness. Disinfecting surfaces is no longer viewed as an occasional precaution but as an integral part of daily routines for both households and businesses. Schools, offices, hotels, and restaurants have institutionalized frequent cleaning schedules, driving consistent demand for surface disinfectants. - Healthcare Sector Requirements

Hospitals and clinics are under constant pressure to prevent hospital-acquired infections (HAIs). Regular disinfection of high-touch surfaces such as doorknobs, bed rails, and examination tables is a crucial preventive measure. As healthcare services expand globally, the use of surface disinfectants continues to rise proportionally. - Regulatory Standards

Governments and health authorities have implemented stringent hygiene regulations across multiple sectors. From food processing plants to public transportation hubs, mandatory sanitation protocols ensure steady market demand. - Commercial and Industrial Adoption

Beyond healthcare, industries such as manufacturing, retail, and hospitality have adopted robust disinfection protocols to protect both employees and customers. This widespread adoption has expanded the application base far beyond its traditional boundaries.

Product and Composition Insights

Surface disinfectants are available in multiple forms, each suited to specific applications:

- Liquid Disinfectants dominate the market due to their versatility and ease of application across a wide range of surfaces. They are commonly used in spray bottles, mop buckets, and automated cleaning systems.

- Wipes offer convenience and portability, making them ideal for quick disinfection of personal workspaces, electronic devices, and public seating areas.

- Sprays and Aerosols are gaining traction for their ability to cover large areas quickly and evenly.

In terms of composition, alcohol-based disinfectants lead the market due to their rapid action and proven effectiveness against a broad spectrum of pathogens. However, other formulations, such as chlorine compounds, hydrogen peroxide, quaternary ammonium compounds, and phenolic agents, are also widely used depending on the specific requirements of the application. Increasingly, there is a push toward eco-friendly and less toxic alternatives that meet both efficacy and environmental safety standards.

Read More : https://www.fortunebusinessinsights.com/surface-disinfectant-market-103062

Application Areas

- Healthcare Facilities – Hospitals, clinics, and long-term care centers remain the largest end-users due to the critical need for infection prevention.

- Residential Use – Post-pandemic consumer habits have cemented the role of surface disinfectants in households for everyday cleaning.

- Commercial Establishments – Retail stores, offices, gyms, and hotels use disinfectants to maintain hygiene and instill customer confidence.

- Industrial and Institutional Settings – Schools, transportation systems, and manufacturing plants require large-scale disinfection solutions.

Key Industry Developments:

- January 2019 – Reckitt Benckiser formed a strategic alliance with Diversey to increase its presence in North America. This strategic alliance will help Reckitt Benckiser to expand its reach to educational institutes, food establishments, and hospitals.

- February 2020 – The Procter and Gamble Company launched a new line of antibacterial cleaners named Microban 24. The new product line is said to protect the applied surface for a complete 24 hours, even when the surface has been contacted multiple times.

Regional Overview

- North America: The largest market, driven by strong institutional demand, regulatory enforcement, and high consumer awareness.

- Europe: Focuses on environmentally friendly disinfectants and compliance with strict safety regulations, particularly in healthcare and food industries.

- Asia Pacific: Expected to register the fastest growth, fueled by expanding healthcare infrastructure, urbanization, and increased public health spending in countries such as China and India.

- Latin America and Middle East & Africa: Gradual adoption of advanced disinfection practices, supported by improving public health awareness and infrastructure investments.

Challenges and Opportunities

While the market outlook is positive, it faces certain challenges:

- Raw Material Price Volatility: Fluctuations in the cost of key ingredients can impact production costs and profit margins.

- Health and Safety Concerns: Some chemical disinfectants may pose risks to human health or the environment if not used correctly.

- Competition from Alternative Cleaning Methods: Technologies like UV disinfection and steam cleaning may reduce reliance on chemical solutions in certain environments.

Opportunities exist in developing biodegradable and non-toxic disinfectants, enhancing formulation efficiency, and leveraging automation in large-scale cleaning systems. Innovation in packaging, such as refillable containers and concentrated solutions, can also appeal to eco-conscious consumers.

Competitive Landscape

The market is highly competitive, with leading companies focusing on expanding their product portfolios, improving efficacy, and meeting sustainability goals. Key players are investing in research and development to introduce advanced formulations capable of addressing emerging pathogens while minimizing environmental impact.

Future Outlook

The surface disinfectant market is poised for sustained growth well beyond the pandemic era. Rising global health standards, ongoing threat of infectious diseases, and consumer preference for cleanliness will ensure steady demand. In the coming years, advancements in sustainable chemistry, improved delivery systems, and increased accessibility in emerging markets are likely to define the next phase of market development.

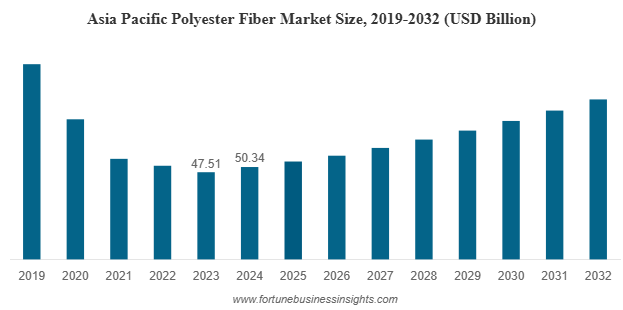

The global polyester fiber market was valued at USD 77.07 billion in 2024 and is expected to increase from USD 82.07 billion in 2025 to USD 129.97 billion by 2032, reflecting a CAGR of 6.8% during the forecast period. In 2024, Asia Pacific led the market, holding a 65.32% share.

Polyester fiber market is one of the most widely used synthetic fibers in the world. Its ability to mimic natural fibers while offering improved durability and affordability makes it the preferred choice in textiles, home furnishings, industrial applications, and even specialized fields like medical textiles.

Growth Drivers

Several factors are contributing to the expansion of the polyester fiber market:

- Rising Apparel Consumption: Fast fashion trends and an increasing global population are driving high volumes of textile production, with polyester as a key raw material.

- Durability and Performance: Polyester’s resistance to wrinkles, shrinking, and stretching makes it a go-to choice for both consumers and manufacturers.

- Industrial Demand: The fiber’s strength and resilience make it ideal for heavy-duty industrial applications, further boosting its market share.

- Cost-Effectiveness: Polyester is cheaper to produce than many natural fibers, making it a competitive option for mass production.

- Technological Advancements: Innovations in fiber engineering have improved polyester’s comfort, breathability, and sustainability, expanding its market reach.

List Of Key Polyester Fiber Companies Profiled

- Reliance Industries Limited. (India)

- Indorama Ventures Public Company Limited. (Thailand)

- Toray Industries, Inc. (Japan)

- Sinopec Yizheng Chemical Fibre Limited Liability Company (China)

- Zhejiang Hengyi Group Co., Ltd (China)

- Tongkun Holding Group (China)

- Sanfame Group (China)

- Far Eastern New Century Corporation (Taiwan)

- Alpek Polyester. (Mexico)

- ADVANSA (Turkey)

Emerging Trends

- Sustainable Polyester: Environmental concerns are pushing manufacturers to focus on recycled polyester, often made from post-consumer PET bottles. This shift aligns with global sustainability goals and appeals to eco-conscious consumers.

- Blended Fabrics: Blending polyester with natural fibers creates fabrics that combine the best qualities of both materials, expanding the fiber’s versatility.

- High-Performance Textiles: Advances in processing technology have led to specialized polyester fibers with moisture-wicking, UV-resistant, and antibacterial properties, catering to sportswear and outdoor gear markets.

- Digital Textile Printing: Polyester’s compatibility with digital printing methods is making it popular in the fashion and home décor industries, enabling more customization and faster turnaround.

Regional Landscape

The Asia Pacific region dominates the global polyester fiber market, accounting for 65.32% of the total market share in 2024. Countries such as China, India, Japan, and South Korea have established themselves as major production hubs due to the availability of raw materials, advanced manufacturing facilities, and cost-effective labor. China, in particular, plays a significant role not only as a leading producer but also as a top consumer, thanks to its robust textile and garment industry.

Asia Pacific’s dominance is expected to continue in the coming years as infrastructure for polyester production and processing improves further. Additionally, growing middle-class populations in these countries are fueling demand for apparel, home décor, and automotive textiles, all of which require large volumes of polyester fiber.

North America and Europe also hold substantial market shares, driven by strong demand in apparel, home furnishing, and technical textile segments. In these regions, the focus is shifting toward sustainable and recycled polyester due to increasing environmental awareness and regulatory requirements.

Product Segmentation

Polyester fiber is typically categorized into two main types: polyester staple fiber (PSF) and polyester filament yarn (PFY).

- Polyester Staple Fiber (PSF): PSF is short-length fiber often blended with natural fibers like cotton or wool to enhance fabric performance. It is widely used in clothing, upholstery, and nonwoven products like diapers, wipes, and filtration materials. In 2024, PSF holds the largest share of the market due to its versatility and cost advantages.

- Polyester Filament Yarn (PFY): PFY consists of continuous strands of fiber, ideal for making fabrics with smooth textures and high strength. It is extensively used in sportswear, home textiles like curtains and bed linens, and industrial applications. PFY demand is growing steadily as fashion trends lean toward lightweight yet durable fabrics.

Read More : https://www.fortunebusinessinsights.com/polyester-fiber-market-111384

Key Industry Developments

- March 2025 - ADVANSA’s ADVAtex is a 100% recycled polyester fiber made from pre-consumer textile waste. It reduces reliance on virgin materials while maintaining quality. The process transforms textile waste into durable fibers for furniture and mattresses, addressing global textile waste challenges. Certified by GRS and Oeko-Tex.

- July 2024 - Indorama Ventures has joined a consortium of seven companies across five countries to establish a sustainable polyester fiber supply chain. This initiative utilizes CO₂-derived, renewable, and bio-based materials, replacing traditional fossil resources. The resulting polyester fiber is planned for use in THE NORTH FACE products in Japan.

Applications

Polyester fiber’s wide-ranging applications are a major driver of its market growth. Key segments include:

- Textiles and Apparel: Polyester’s wrinkle resistance, durability, and color retention make it a preferred choice in clothing, from casual wear to high-performance sportswear. Its affordability compared to natural fibers like cotton adds to its appeal.

- Home Furnishings: Used in carpets, curtains, bed linens, and upholstery, polyester offers durability and easy maintenance, which is especially attractive in the home décor sector.

- Industrial Applications: Polyester fibers are used in conveyor belts, tire cords, ropes, safety belts, and geotextiles due to their high strength and resistance to stretching and shrinking.

- Nonwoven Fabrics: Polyester plays a critical role in producing hygiene products, insulation materials, and filtration media.

- Medical Textiles: Its ability to be engineered for specific properties makes polyester valuable in surgical gowns, drapes, and other healthcare products.

Competitive Landscape

The market is characterized by intense competition among key players, including Reliance Industries Limited, Indorama Ventures, Toray Industries, Sinopec Yizheng Chemical Fibre, and Zhejiang Hengyi Group. These companies are investing in capacity expansions, technological innovations, and sustainable practices to strengthen their market positions.

Mergers, acquisitions, and partnerships are common strategies to enhance production capabilities and expand into new geographic markets. Many leading manufacturers are also increasing their focus on recycled polyester to meet environmental targets and regulatory requirements.

Future Outlook

The global polyester fiber market is expected to maintain a steady growth trajectory over the next decade. Asia Pacific will likely remain the largest and fastest-growing regional market, while North America and Europe will see increased demand for sustainable and high-performance polyester products.

With its adaptability, cost advantages, and continuous innovations, polyester fiber is well-positioned to meet the evolving needs of industries and consumers worldwide. The transition toward recycled and eco-friendly fibers will further reshape the market, offering opportunities for forward-thinking manufacturers to lead in both volume and sustainability.

The global sodium lactate market was valued at USD 358.9 million in 2023 and is expected to rise from USD 388.0 million in 2024 to USD 746.6 million by 2032, reflecting a CAGR of 8.5% during the forecast period. In 2023, North America led the market, accounting for a 35.72% share.

Market Leadership and Regional Trends

In 2023, North America dominated the sodium lactate market, holding a market share of 35.72%. This leadership is supported by the region’s well-established healthcare and pharmaceutical industries, coupled with strong growth in the food processing and personal care sectors. The demand for sodium lactate in North America is also fueled by increasing consumer awareness about ingredient safety, clean-label products, and multifunctional additives that can enhance product performance.

Asia Pacific is emerging as a fast-growing market, driven by rising consumer incomes, urbanization, and increased spending on processed food, cosmetics, and healthcare products. Countries such as China, India, and Japan are becoming key markets due to expanding manufacturing capabilities and growing domestic consumption. Europe also maintains a strong presence, with a focus on sustainable production and regulatory compliance, especially in food safety and cosmetic standards.

List Of Top Sodium Lactate Companies:

- JIAAN BIOTECH (India)

- Musashino Chemical Laboratory, Ltd. (Japan)

- Jungbunzlauer Suisse AG, Basel (Switzerland)

- Fengchen Group Co., Ltd (China)

- Hawkins, Inc. (U.S.)

- Junsei Chemical Co.,Ltd. (Japan)

- Kishida Chemical Co.,Ltd. (Japan)

- Avanschem (India)

Key Growth Drivers

Several factors are fueling the expansion of the sodium lactate market:

- Clean-Label Demand – Consumers are increasingly seeking products made from safe, naturally derived ingredients. Sodium lactate’s renewable sourcing and multifunctional nature make it an ideal fit for this trend.

- Versatility – Its diverse applications, from skincare hydration to food preservation and medical use, make sodium lactate a valuable ingredient across multiple industries.

- Rising Healthcare Demand – The growing use of intravenous solutions and electrolyte-replacement therapies is boosting demand in the medical sector.

- Expanding Cosmetics Industry – The personal care sector’s focus on natural, sustainable ingredients is accelerating the use of sodium lactate in premium and mass-market skincare products.

- Globalization of Food Processing – Increased production of packaged and processed foods in emerging economies is driving growth in food-grade sodium lactate.

Read More : https://www.fortunebusinessinsights.com/sodium-lactate-market-110698

Form Insights

The market is segmented by form into liquid and powder sodium lactate. The liquid form currently dominates due to its high solubility, ease of blending, and wide use in applications such as intravenous solutions, meat preservation, and skincare products. Liquid sodium lactate is especially popular in food and pharmaceutical applications because it integrates seamlessly into formulations without requiring additional processing.

The powder form, while holding a smaller share, is steadily gaining traction, particularly in the cosmetics and personal care industry. Its longer shelf life and ease of storage make it an attractive choice for manufacturers seeking stable, high-quality ingredients for lotions, creams, and other beauty products.

Application Insights

By application, the cosmetics and personal care segment accounts for the largest market share. Sodium lactate is valued for its humectant properties, helping to maintain skin hydration and improve texture in products such as moisturizers, body lotions, facial creams, and serums. With growing interest in natural and clean-label skincare products, sodium lactate is increasingly being used as a safer alternative to synthetic moisturizers.

The pharmaceutical sector is another significant consumer, making use of sodium lactate in intravenous fluids, electrolyte solutions, and dialysis treatments. Its role in maintaining pH balance and hydration levels in medical applications is vital, particularly in critical care settings. In 2023, this segment accounted for nearly 29.8% of the market share.

In the food and beverage industry, sodium lactate serves as a natural preservative and flavor enhancer. It extends the shelf life of meat products, prevents bacterial growth, and improves product safety without compromising taste. The rising demand for processed meat and ready-to-eat meals is driving greater adoption of sodium lactate in this sector.

Challenges

Despite its growth potential, the sodium lactate market faces certain challenges:

- Raw Material Costs – Fluctuations in raw material availability and prices can impact manufacturing costs.

- Regulatory Variations – Different regions have varying regulations for the use of sodium lactate in food, cosmetics, and pharmaceuticals, requiring careful compliance strategies.

- Competition from Alternatives – Other preservatives and humectants can compete with sodium lactate in certain applications, requiring continuous innovation to maintain market share.

Opportunities

The future offers multiple opportunities for market players:

- Product Innovation – Development of high-purity grades and customized formulations can meet the specific needs of specialized industries.

- Sustainability Initiatives – Leveraging environmentally friendly production methods can appeal to eco-conscious consumers and brands.

- Emerging Markets – Expanding distribution networks in Asia, Latin America, and Africa can unlock new revenue streams.

- Brand Collaborations – Partnering with cosmetics, pharmaceutical, and food brands to develop innovative products can enhance market visibility and demand.

Outlook

The sodium lactate market is set for robust growth, fueled by strong demand across multiple industries, rising health and wellness trends, and ongoing product development. North America will likely maintain its leading position, while Asia Pacific will see the fastest growth, thanks to expanding industrial capacity and consumer demand. With a strong focus on clean-label, multifunctional, and sustainable solutions, sodium lactate is poised to become an even more integral ingredient in the global supply chain.

In 2023, the global self-adhesive labels market was valued at USD 48.03 billion. It is expected to rise to USD 50.65 billion in 2024 and further expand to USD 82.17 billion by 2032, registering a CAGR of 6.1% over the forecast period. Asia Pacific led the market in 2023, holding a 38.93% share. In the United States, the market is anticipated to witness notable growth, reaching approximately USD 9.47 billion by 2032, fueled by increasing demand for consumables, ready-to-eat meals, and packaged food and beverages.

Strong Market Growth

The self-adhesive labels market has evolved from a simple product identification tool into a vital component of modern packaging and branding strategies. With increasing demand across multiple sectors, the market is on an upward growth trajectory, supported by innovations, sustainability trends, and strong industrial activity worldwide.

List Of Key Companies Profiled

- 3M Company (U.S.)

- Axicon Labels (U.K.)

- Avery Products Corporation (U.S.)

- ETIS Slovakia (Slovakia)

- UPM Raflatac (Finland)

- Müroll GmbH (Austria)

- Royston Labels Ltd (U.K.)

- S&K LABEL (U.S.)

- SVS Etikety (Czech Republic)

- Mondi Group (Austria)

Key Growth Drivers

Several factors are driving the expansion of the self-adhesive labels market:

- Growing Packaging Industry – The rise of consumerism and global trade has elevated packaging from a functional necessity to a strategic branding tool.

- E-commerce Boom – Increasing online retail sales require efficient, durable labeling for order processing, tracking, and brand presentation.

- Regulatory Compliance – Stricter global regulations in food and pharmaceuticals mandate clear, accurate labeling to ensure consumer safety.

- Cost-Effectiveness – Compared to alternative labeling methods, self-adhesive labels are easy to apply, scalable, and versatile.

Trends Shaping the Future

Sustainability is a defining trend. Environmental concerns have prompted a shift toward recyclable, biodegradable, and linerless labels that reduce waste and carbon footprint. Paper-based labels are gaining traction in sectors aiming to replace plastic packaging components.

Smart labels are another growing trend. By integrating technologies such as RFID, NFC, and QR codes, labels now serve as gateways to product information, authentication, and supply chain transparency. This is particularly valuable in industries combating counterfeiting, such as luxury goods and pharmaceuticals.

Digital printing advancements are also transforming the market. These technologies allow for shorter runs, faster turnaround times, and customization, enabling brands to respond quickly to changing market demands.

Read More : https://www.fortunebusinessinsights.com/self-adhesive-labels-market-104289

Product Types Driving Demand

By type, release liner labels dominate the market. These labels feature a backing layer that protects the adhesive until application, making them suitable for industries requiring clean, dust-free, and efficient labeling. They are particularly popular in food, beverage, and pharmaceutical applications.

In terms of label form, permanent labels hold the largest share. These are known for their strong adhesion and durability, making them ideal for packaging that requires long-lasting branding or critical safety information. Industries such as automotive, chemicals, and consumer goods rely heavily on this type for product identification and hazard warnings.

Leading Applications

- The food and beverage sector accounts for the largest share of the market. Rising demand for packaged and ready-to-eat meals has led to greater use of labels for branding, nutritional transparency, and tamper evidence. The growth of online food delivery platforms has further boosted demand, as tamper-proof labels are essential for ensuring product safety.

- Pharmaceuticals form another key application area. Strict regulations require detailed labeling for medicines, from dosage instructions to safety warnings. Self-adhesive labels are preferred for their precision, reliability, and ability to integrate advanced features such as serialization and anti-counterfeiting measures.

- Logistics and e-commerce also represent a rapidly growing segment. The sector requires durable labels that can withstand handling, moisture, and temperature variations during shipping, while ensuring clear barcode scanning for tracking and inventory control.

Asia Pacific Leads the Way

Asia Pacific held the largest share of the global market in 2023, commanding nearly 39% of the total value. Countries such as China, India, Indonesia, and Japan have witnessed significant growth in manufacturing, retail, and logistics, which in turn fuels the demand for self-adhesive labels.

China, with its extensive manufacturing capacity and thriving e-commerce industry, is a dominant contributor. India is emerging as one of the fastest-growing markets due to expansion in the food processing, pharmaceuticals, and personal care industries. Government initiatives promoting organized retail and stricter labeling regulations are further accelerating adoption.

Key Industry Developments

- February 2024 – Mondi collaborated with multiple stakeholders along the value chain to recycle and release liner production waste. These stakeholders include Soprema, WEPA, and Vwyzle. They are working together to convert Mondi’s coated paper waste produced at its release liner plants into secondary raw material for a range of applications.

- May 2021 - Herma, a German self-adhesive technology specialist launched 52W, a new wash-off label adhesive developed especially for PET bottles.

Challenges to Overcome

Despite its strong growth potential, the market faces certain challenges. Volatility in raw material prices, particularly adhesives, films, and specialty papers, can impact profitability. Regulatory hurdles in terms of food-safe inks and adhesives require continuous compliance efforts. Additionally, competition from numerous regional players often results in pricing pressures.

Competitive Landscape

The global market is characterized by the presence of leading companies such as 3M, Avery Dennison Corporation, Mondi Group, UPM Raflatac, H.B. Fuller, and CCL Industries. These players are focusing on product innovation, sustainable material development, and strategic collaborations to strengthen their market position.

Recent developments in the industry include collaborations between label manufacturers and recycling companies to repurpose release liner waste into usable raw materials. Such initiatives not only address environmental concerns but also create opportunities for circular economy practices within the labeling industry.

Opportunities Ahead and Outlook

Looking forward, the self-adhesive labels market is well-positioned to capitalize on the convergence of sustainability, technology, and consumer expectations. Brands that adopt eco-friendly materials, leverage smart label capabilities, and invest in design innovation will be able to enhance both their environmental credentials and customer engagement.

As packaging continues to serve as a primary touchpoint between brands and consumers, the role of self-adhesive labels will only expand. Whether in a supermarket aisle, a pharmacy shelf, or a courier package, these labels are not just identifiers—they are storytellers, quality markers, and trust builders in the modern marketplace.

The global organic cotton market was valued at USD 1,113.5 million in 2023 and is expected to rise from USD 1,585.5 million in 2024 to USD 25,890.2 million by 2032, registering an impressive CAGR of 40.0% during the forecast period (2024–2032). Asia Pacific led the market in 2023, accounting for 65.7% of the global share. In the United States, the organic cotton market is anticipated to witness substantial growth, reaching approximately USD 504.56 million by 2032, fueled by the rising consumer preference for sustainable and eco-friendly textiles.

Market Size and Growth Outlook

The global organic cotton market is experiencing unprecedented growth as environmental awareness, ethical fashion trends, and sustainable supply chain practices gain momentum worldwide. Once considered a niche segment of the textile industry, organic cotton has now emerged as a key driver in the transition toward eco-friendly and socially responsible manufacturing.

List Of Key Companies Profiled

- Cargill Incorporated (U.S.)

- Plexus Cotton Ltd. (U.K.)

- Staple Cotton Cooperative Association (U.S.)

- Calcot Ltd. (U.S.)

- The Rajlakshmi Cotton Mills (P) Limited (India)

- Remei AG (Switzerland)

- Arvind Limited(India)

- Noble Ecotech (India)

- Louis Dreyfus Company (Netherlands)

- Texas Organic Cotton Marketing Cooperative (U.S.)

Key Market Drivers

Several factors are contributing to the rapid expansion of the organic cotton market:

- Sustainability Trends in Fashion – Consumers are becoming more conscious of the environmental footprint of their clothing. Organic cotton is grown without synthetic pesticides, fertilizers, or genetically modified seeds, making it a cleaner and greener alternative to conventional cotton.

- Brand Commitments to Ethical Sourcing – Many leading apparel brands and retailers have committed to increasing the share of organic cotton in their supply chains. These commitments are often part of larger sustainability targets aimed at reducing environmental impact.

- Supportive Government and NGO Initiatives – Policies promoting organic agriculture, financial incentives for farmers, and the growing network of certification bodies have helped expand organic cotton cultivation worldwide.

- Consumer Health Awareness – Organic cotton products are free from harmful chemicals, making them safer for consumers with sensitive skin or allergies, further enhancing their appeal.

Emerging Trends

One of the most notable trends shaping the market is the push toward supply chain transparency. Brands are increasingly investing in technologies that trace the journey of organic cotton from farm to finished product. This not only assures consumers of authenticity but also promotes fair trade and ethical labor practices.

Another trend is the integration of circular economy principles into organic cotton production. This includes recycling cotton waste, promoting durability and repairability in clothing, and encouraging textile take-back programs to reduce waste.

Read More : https://www.fortunebusinessinsights.com/organic-cotton-market-106612

Market Potential in the United States

The United States is projected to see substantial growth in the organic cotton market, with its value expected to reach approximately USD 504.56 million by 2032. The surge is being driven by a sharp rise in demand for sustainable and eco-friendly textiles, increasing consumer awareness of environmental issues, and the willingness of major U.S. retailers to integrate organic cotton into their apparel, home textiles, and lifestyle products. The presence of prominent sustainable fashion brands in North America further boosts the adoption of organic cotton in the region.

Applications Across Industries

The largest application segment for organic cotton is apparel, covering everyday wear, activewear, children’s clothing, and high-end fashion collections. Brands are integrating organic cotton into their main product lines to cater to environmentally conscious shoppers.

Beyond fashion, organic cotton is increasingly used in home textiles such as bed linens, towels, and curtains, as well as personal care items including baby clothing, wipes, and hygiene products. The demand for organic cotton in eco-friendly packaging is also on the rise, as brands aim to align their packaging materials with their sustainability messaging.

Regional Leadership: Asia Pacific at the Forefront

Asia Pacific dominated the market in 2023, accounting for a commanding 65.7% share. This dominance can be attributed to the region’s strong textile manufacturing base, availability of agricultural land for organic farming, and rising consumer awareness regarding sustainable clothing. Countries such as India, China, and Turkey have emerged as major producers and exporters of organic cotton, supplying both domestic and international markets.

India, in particular, has positioned itself as a global leader in organic cotton cultivation, supported by favorable climatic conditions, government subsidies, and certification programs. Meanwhile, China continues to strengthen its role in organic cotton processing and garment manufacturing, meeting the growing demand from global fashion retailers.

Challenges to Overcome

Despite the strong growth outlook, the organic cotton market faces several challenges:

- Higher Production Costs – Organic farming is more labor-intensive and requires strict compliance with certification standards, which can make organic cotton more expensive than its conventional counterpart.

- Lower Yields – Organic cotton generally produces lower yields per acre compared to conventionally grown cotton, affecting scalability.

- Seed Supply Limitations – Access to high-quality organic cotton seeds remains a challenge for farmers in some regions.

- Market Price Sensitivity – While demand is growing, higher retail prices for organic cotton products can limit adoption in price-sensitive markets.

Competitive Landscape

The organic cotton market is moderately fragmented, with a mix of large multinational textile producers and smaller regional players. Leading companies are focusing on vertical integration, from farming to finished garments, to ensure quality control and supply consistency. Strategic partnerships between brands and farmer cooperatives are also becoming common, as they help secure long-term organic cotton supply and provide farmers with better income stability.

Investments in research and development are aimed at improving organic farming techniques, enhancing yields, and developing innovative organic cotton blends for specialized applications.

Outlook

The future of the organic cotton market looks exceptionally promising. Rising environmental awareness, growing consumer demand for sustainable products, and the willingness of brands to adopt ethical sourcing practices are creating a strong foundation for continued growth. While challenges such as cost and yield limitations remain, ongoing innovations in farming, processing, and supply chain management are expected to make organic cotton increasingly competitive with conventional cotton.

In the coming years, the industry will likely witness greater collaboration among farmers, manufacturers, brands, and policymakers to ensure the organic cotton sector not only grows in scale but also maintains its environmental and social integrity.

Water Soluble Polymers Market Demand, Drivers & Global Growth, Forecast 2032

By Sharvari, 2025-08-07

The global water soluble polymers market was valued at USD 38.56 billion in 2023 and is expected to increase from USD 40.66 billion in 2024 to USD 62.96 billion by 2032, registering a CAGR of 5.5% during the forecast period. In 2023, Asia Pacific led the market, accounting for a dominant 43.23% share. In the United States, the market is anticipated to witness substantial growth, reaching approximately USD 10.19 billion by 2032. This growth is primarily driven by the increasing demand from the oil and gas sector, where water soluble polymers offer enhanced customizability compared to other injection fluids used in enhanced oil recovery (EOR) processes.

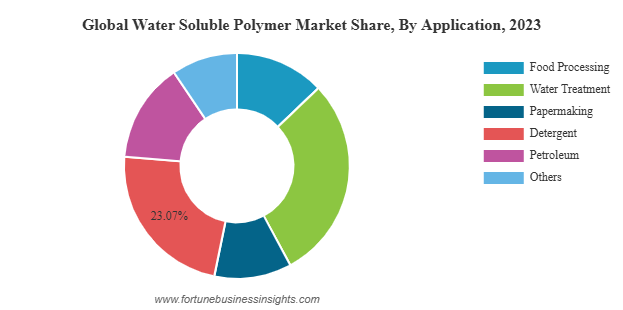

Water soluble polymers market are macromolecules that dissolve, disperse, or swell in water and alter the physical properties of aqueous systems in terms of thickening, gel formation, emulsification, flocculation, and stabilization. These characteristics have made them indispensable in industries where performance, environmental sustainability, and safety are paramount.

Key Market Drivers

One of the primary drivers for this market is the growing global emphasis on water treatment. As freshwater scarcity increases and regulatory norms around water pollution become stricter, municipalities and industries are investing heavily in water purification systems. Water soluble polymers, especially polyacrylamides, are used extensively as flocculants and coagulants to remove impurities and suspended solids from wastewater. These polymers improve filtration efficiency and enable compliance with environmental standards.

Another major factor fueling market expansion is their application in the oil and gas sector, particularly in enhanced oil recovery (EOR). Polymers like partially hydrolyzed polyacrylamide (PHPA) improve oil mobility and sweep efficiency, enhancing yield during tertiary recovery processes. As global oil reserves become harder to extract and more companies focus on cost-effective recovery techniques, the use of water soluble polymers in EOR is expected to rise significantly.

In addition, the food processing and pharmaceutical industries are increasingly utilizing natural and synthetic water soluble polymers. In food applications, they serve as thickeners, stabilizers, emulsifiers, and texture modifiers. In pharmaceuticals, these polymers are widely employed in drug formulation and delivery systems, including controlled-release tablets, suspensions, and gels.

List Of Key Companies Profiled

- Arkema SA (France)

- Ashland (U.S.)

- DuPont (U.S.)

- LG Chem (South Korea)

- The Dow Chemical (U.S.)

- Nitta Gelatin, NA Inc. (Japan)

- BASF SE (Germany)

- SNF (France)

- Kuraray Co., Ltd. (Japan)

- Kemira (Finland)

Polymer Types and Application Segments

Among the various types of water soluble polymers, polyacrylamide holds the largest market share due to its high effectiveness as a flocculant in water treatment and EOR. Polyvinyl alcohol (PVA) is also gaining traction owing to its excellent film-forming and adhesive properties. In the pharmaceutical industry, PVA is used in contact lenses and drug formulations. Other significant types include guar gum, gelatin, methylcellulose, xanthan gum, and carboxymethyl cellulose—mostly used in food, cosmetic, and pharmaceutical applications.

From an application standpoint, the water treatment segment dominates the global market. Governments across developing and developed regions are adopting advanced wastewater management policies, and this trend is projected to continue. Other notable application areas include detergents and personal care products, where water soluble polymers enhance product performance and texture.

Regional Insights

Asia Pacific emerged as the leading regional market in 2023, accounting for over 43% of the global market share. Rapid industrialization, growing urban populations, and increasing investments in water infrastructure across countries like China, India, and Southeast Asian nations are fueling demand in the region. India alone witnessed strong growth, with its market expected to grow at a CAGR of over 4% during the forecast period, driven by expansion in wastewater treatment plants, packaged food consumption, and pharmaceutical production.

North America and Europe also hold significant shares, supported by stringent environmental regulations, advanced oil recovery techniques, and robust healthcare sectors. In the United States, the emphasis on sustainable industrial practices and bio-based product development is encouraging polymer manufacturers to innovate with eco-friendly alternatives.

Read More : https://www.fortunebusinessinsights.com/water-soluble-polymers-market-106175

Key Industry Developments

- March 2022 – Kemira bolstered its position as a prominent provider of sustainable chemical solutions for water-reliant industries by launching the world’s first full scale production of its recently designed bioderived polymers. Helsinki Region Environmental Services (HSY) received the first volumes for trials at one of their wastewater treatment facilities.

- September 2020 – BASF expanded its business in a water-soluble polyacrylate manufacturing unit at Ludwigshafen, Germany. The manufacturing unit will allow customers in the home and commercial cleaning sector and chemical and formulator industries to benefit from increased specialized chemical capacity.

Sustainability and Innovation

Sustainability remains at the forefront of product development in this market. With rising environmental concerns and pressure to reduce carbon footprints, manufacturers are exploring bio-based and biodegradable polymers. Natural polymers such as starch derivatives, chitosan, and plant-based gums are gaining popularity as replacements for synthetic polymers in various applications.

Furthermore, innovations in polymer chemistry are leading to the creation of high-performance, multi-functional polymers that can operate effectively in challenging industrial environments. Companies are also investing in research to develop water soluble polymers that offer enhanced recyclability and reduced ecological impact.

Challenges and Future Outlook

Despite its promising growth trajectory, the water soluble polymers market faces challenges such as price volatility of raw materials, limited availability of certain natural polymers, and performance trade-offs in bio-based alternatives. Additionally, environmental concerns associated with synthetic polymers like polyacrylamide continue to drive regulatory scrutiny.

However, the future outlook remains optimistic. As industries worldwide transition toward sustainable practices and invest in efficient resource management, the demand for water soluble polymers is expected to soar. Emerging technologies, increasing focus on eco-design, and supportive government policies are set to bolster market expansion in the years ahead.

The water soluble polymers market stands at a pivotal moment of growth, innovation, and sustainability. With their versatile properties and crucial applications across water treatment, oil recovery, food, pharmaceuticals, and personal care, these polymers are poised to shape the next decade of industrial and environmental advancements. As consumer awareness and regulatory standards evolve, the market will continue to move toward greener, more efficient, and safer polymer solutions.

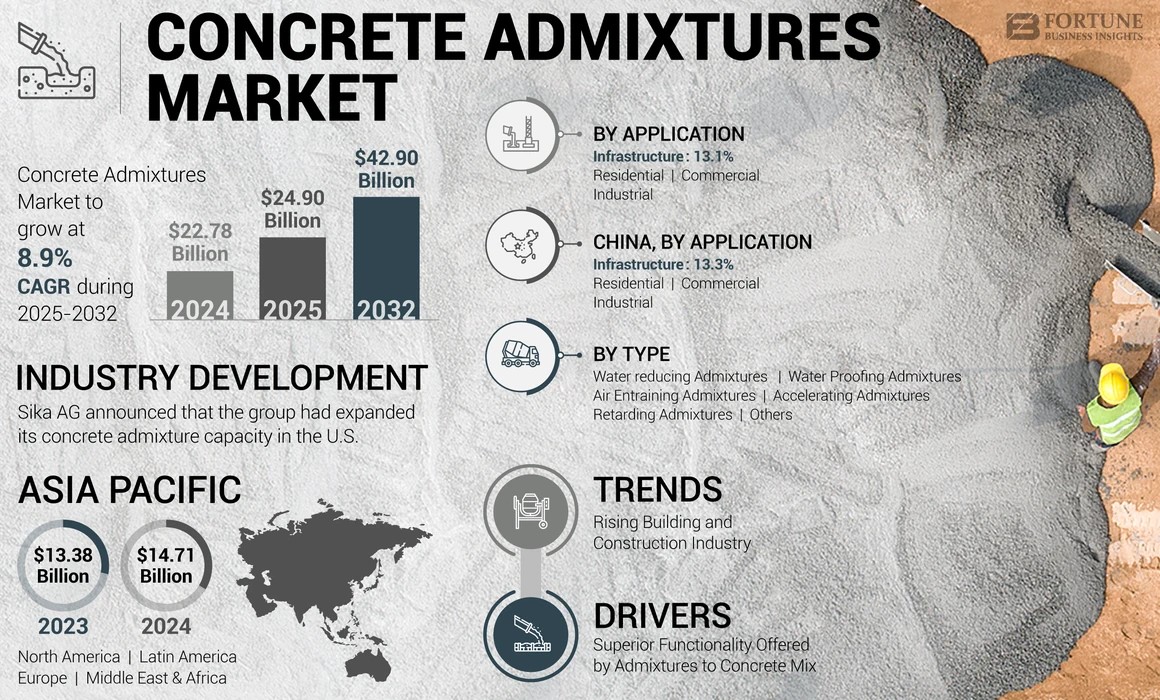

The global concrete admixtures market is undergoing rapid transformation, fueled by booming construction activities, rising demand for high-performance concrete, and increasing emphasis on sustainability. As the backbone of modern infrastructure, concrete must meet a wide range of performance requirements—and concrete admixtures play a critical role in achieving these. These chemical additives are mixed with concrete to modify its properties and improve workability, durability, strength, and other performance parameters. As urbanization accelerates and environmental concerns deepen, the concrete admixtures market is poised for substantial growth.

The global concrete admixtures market was valued at USD 22.78 billion in 2024 and is expected to expand from USD 24.90 billion in 2025 to USD 42.90 billion by 2032, registering a CAGR of 8.9% during the forecast period. Asia Pacific led the market in 2024, accounting for 64.57% of the global share. In the United States, the market is anticipated to witness strong growth, reaching approximately USD 3.08 billion by 2032, fueled by increasing adoption of high-performance concrete solutions.

Key Growth Drivers

Multiple factors are contributing to the sustained expansion of the concrete admixtures market. The most significant growth driver is the unprecedented rise in construction activity worldwide. Both public and private sector investments in infrastructure, coupled with supportive government policies, are creating a favorable environment for market expansion.

Another major driver is the increasing awareness around the benefits of using admixtures to enhance concrete performance. Contractors and developers are increasingly opting for value-added solutions that provide long-term durability, improved workability, and lower maintenance costs. Admixtures also enable the use of recycled materials and low-grade aggregates, thereby contributing to cost-efficiency and sustainability.

Environmental concerns and strict regulatory norms have also encouraged the adoption of eco-friendly admixtures. Many manufacturers are innovating to offer bio-based, non-toxic, and low-carbon formulations that align with green building certifications such as LEED and BREEAM. The push toward circular economy practices is further boosting demand for products that reduce concrete waste, extend structure life, and minimize energy consumption.

List of Top Concrete Admixtures Companies:

- Buildtech Products (India)

- Sika AG (Switzerland)

- RAZON ENGINEERING COMPANY PRIVATE LIMITED (India)

- Flowcrete Group Ltd. (U.K.)

- CEMEX S.A.B. de C.V. (Mexico)

- BASF SE (Germany)

- GCP Applied Technologies (U.S.)

- RPM International Inc. (U.S.)

Product Insights and Market Segmentation

Concrete admixtures can be broadly categorized based on their functions—water-reducing, retarding, accelerating, air-entraining, plasticizers, and others. Among these, water-reducing admixtures are leading the market and held the largest share in 2024. These admixtures enhance the flow characteristics of concrete while maintaining its strength and durability, making them highly desirable across applications.

High-range water reducers, also known as superplasticizers, are gaining traction in the construction of high-rise buildings and complex infrastructure that require superior strength and performance. Air-entraining admixtures are also in demand, especially in regions prone to freeze-thaw conditions, as they improve concrete’s resistance to environmental stressors.

From an application standpoint, the residential sector emerged as the leading end-user in 2024. The segment has benefitted from growing urban housing demand, increased homeownership, and government-backed affordable housing programs. However, the commercial and infrastructure segments are expected to witness faster growth in the coming years due to rising investment in roads, bridges, airports, water treatment plants, and public utilities.

Read More : https://www.fortunebusinessinsights.com/concrete-admixtures-market-102832

Dominance of Asia Pacific and Regional Trends

Asia Pacific continues to dominate the global concrete admixtures market, accounting for approximately 64.6% of the total market share in 2024. The region’s leadership is primarily driven by massive infrastructure investments in countries such as China, India, Indonesia, and Vietnam. Rapid urbanization, population growth, and government-led infrastructure projects have significantly increased the consumption of concrete admixtures across residential, commercial, and industrial segments.

India, for example, is witnessing a surge in smart city development, highway expansion, metro rail projects, and affordable housing schemes. Similarly, China remains a global construction powerhouse, with ambitious urban planning and transportation infrastructure fueling sustained demand for advanced construction materials. Southeast Asia is also emerging as a promising market, supported by favorable policy frameworks and increasing foreign direct investment in construction and real estate.

Meanwhile, North America and Europe are seeing moderate but steady growth, primarily driven by renovation of aging infrastructure, energy-efficient building mandates, and rising focus on environmentally friendly construction. The United States, in particular, is expected to witness considerable growth in demand for concrete admixtures, especially in infrastructure modernization, bridge rehabilitation, and commercial construction.

Key Industry Developments:

- November 2023: Sika AG announced that the group had expanded its concrete admixture capacity in the U.S. The company continues to invest in its polymer production at its Sealy site in the U.S. state of Texas. Sika’s latest move marks its second polymer investment in the state of Texas in just five years. The company requires polymers for chemical building blocks that are needed to produce Sika ViscoCrete, a high-performance, resource-saving concrete admixture. The company initiated this expansion to meet the growing demand for its products in the U.S. and Canada.

- June 2023: Fosroc India launched a state-of-the-art Concrete Lab in Chennai that will provide advanced building material testing facilities to developers, contractors, and other construction professionals.

Innovation and Future Outlook

The future of the concrete admixtures market will be shaped by innovation and technological advancements. Self-healing concrete, nanotechnology-based admixtures, and crystalline waterproofing solutions are gaining popularity for their superior performance and environmental benefits. Automation and digital construction technologies are also influencing product usage, as real-time monitoring of concrete behavior becomes more feasible on-site.

Leading companies in the market are focusing on expanding their geographic footprint, developing sustainable products, and forming strategic collaborations to tap into emerging markets. Research and development efforts are increasingly directed toward admixtures that cater to the specific climatic and structural needs of different regions.

As construction standards evolve and infrastructure becomes more complex, the demand for specialized and high-performance concrete admixtures will continue to rise. The market offers immense opportunities for product innovation, regional expansion, and sustainable solutions that align with the future of construction.

Saudi Arabia Refractories Market Demand, Drivers & Global Growth, Forecast 2032

By Sharvari, 2025-08-07

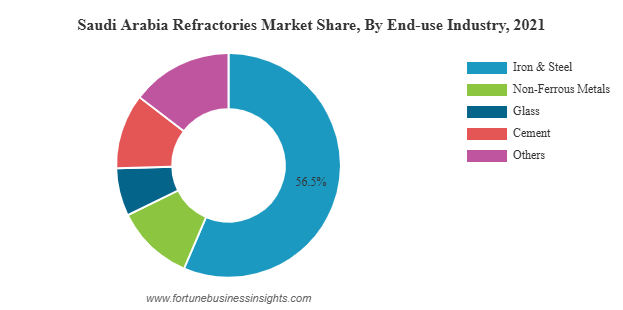

The Saudi Arabia refractories market was valued at USD 160.2 million in 2021 and is expected to grow from USD 164.8 million in 2022 to USD 254.6 million by 2029, registering a CAGR of 6.4% during the forecast period. The COVID-19 pandemic had a significant impact on the market, leading to lower-than-expected demand across the country compared to pre-pandemic projections. In 2020, the market experienced a 4.9% decline compared to 2019, highlighting the disruption caused by the global health crisis.

Key Growth Drivers

One of the primary factors fueling market growth is the rapid expansion of the steel industry. Saudi Arabia is currently the largest steel-producing country in the Gulf Cooperation Council (GCC) region, with more than 40 steel manufacturing facilities operating across the country. These facilities have an estimated production capacity of over 18 million tons per year, and refractories are essential materials in their operations. They are used to line high-temperature furnaces, kilns, and reactors, ensuring structural integrity and efficiency.

Alongside steel, sectors such as cement and glass manufacturing are also contributing significantly to demand for refractory products. Mega projects like NEOM, the Red Sea Development, and various other infrastructure programs are creating long-term demand for cement and construction materials. These projects require refractory linings in the production process of essential materials, which further accelerates consumption.

Additionally, the petrochemical and non-ferrous metal industries are becoming prominent end users of refractories. These sectors rely heavily on high-temperature processes for refining, smelting, and processing, all of which demand high-performance refractory materials that can withstand extreme environments.

List Of Key Companies Profiled

- Arkema SA (France)

- Ashland (U.S.)

- DuPont (U.S.)

- LG Chem (South Korea)

- The Dow Chemical (U.S.)

- Nitta Gelatin, NA Inc. (Japan)

- BASF SE (Germany)

- SNF (France)

- Kuraray Co., Ltd. (Japan)

- Kemira (Finland)

Market Segmentation and Trends

The Saudi refractories market is broadly segmented based on form, chemistry, and end-use industries.

By form, the market includes shaped and unshaped refractories. Shaped refractories—typically in the form of bricks and blocks—dominate the market due to their widespread application in large furnaces and kilns. However, unshaped refractories, also known as monolithic refractories, are gaining popularity because of their ease of installation and ability to form complex shapes. These are often used for repair purposes or in custom high-temperature applications.

By chemical composition, refractories are divided into acidic, basic, and neutral types. Basic refractories, such as those made with magnesia and dolomite, are highly sought after due to their resistance to alkaline slags, making them ideal for steel and cement industries. Acidic refractories made from silica and fireclay are also in demand, especially in glass manufacturing.

In terms of end-use, the iron and steel industry remains the largest consumer of refractories in the Saudi market. Frequent replacement of refractory linings due to wear and tear from constant exposure to high temperatures ensures steady demand. Other key industries include cement, petrochemical, glass, power generation, and non-ferrous metallurgy.

Read More : https://www.fortunebusinessinsights.com/saudi-arabia-refractories-market-106924

Opportunities in Localization and Sustainability

A significant opportunity in the Saudi Arabia refractories market lies in the localization of production. The government is increasingly focused on reducing dependence on imports by promoting local manufacturing. This creates strong prospects for both domestic and international players willing to establish production facilities within the country. Establishing local production can also help tackle issues such as supply chain disruptions and long lead times.

Sustainability is another growing focus area. As part of the Saudi Green Initiative and its broader commitment to carbon neutrality by 2060, there is increasing emphasis on energy-efficient and eco-friendly refractories. Manufacturers are exploring the use of recycled raw materials and developing products that reduce heat loss, thereby conserving energy during industrial processes.

Furthermore, advancements in refractory technology such as nanotechnology-enhanced materials and longer-lasting linings are creating added value for end users. These innovations improve performance, reduce maintenance frequency, and lower operational costs, making them attractive in the context of rising raw material prices.

Key Industry Developments

- March 2022 – Kemira bolstered its position as a prominent provider of sustainable chemical solutions for water-reliant industries by launching the world’s first full scale production of its recently designed bioderived polymers. Helsinki Region Environmental Services (HSY) received the first volumes for trials at one of their wastewater treatment facilities.

- September 2020 – BASF expanded its business in a water-soluble polyacrylate manufacturing unit at Ludwigshafen, Germany. The manufacturing unit will allow customers in the home and commercial cleaning sector and chemical and formulator industries to benefit from increased specialized chemical capacity.

Challenges Ahead

Despite the promising outlook, the market faces certain challenges. Volatility in the prices of raw materials such as bauxite, alumina, and magnesia can affect the cost of production and profitability. Additionally, the reliance on imports for some critical raw materials exposes the market to global supply chain uncertainties.

Environmental regulations are also becoming more stringent, particularly concerning emissions and waste disposal. Refractory manufacturers will need to adapt their production processes to comply with new standards while maintaining cost efficiency.

Future Outlook

The Saudi Arabia refractories market is set on a strong growth trajectory, supported by industrial expansion, mega infrastructure projects, and favorable government policies. As industries evolve and shift toward more sustainable and efficient production methods, the demand for advanced refractory solutions will continue to rise. Companies that invest in innovation, localization, and sustainable manufacturing will be best positioned to capitalize on the growing opportunities in this dynamic market.