Category: Chemicals & Advanced Materials

The U.S. green cement market size was worth USD 11.08 billion in 2022 and is projected to grow at a CAGR of 10.1% during the forecast period.

The growing awareness of climate change, coupled with stringent environmental regulations, is a key driver behind this surge. The Biden administration’s push for net-zero emissions by 2050 and various green building initiatives across states have provided the perfect backdrop for the adoption of eco-friendly materials, including green cement.

Market Overview and Growth Forecast

As the U.S. green cement market marches toward ambitious climate targets and embraces sustainable infrastructure, one sector quietly undergoing a transformation is the cement industry. Traditional cement is responsible for a significant share of global carbon emissions — nearly 8% of total CO₂ emissions worldwide. In response, green cement is emerging as a game-changer, offering a more environmentally responsible alternative without compromising strength or durability.

U.S. green cement market refers to a range of cementitious products designed to reduce the carbon footprint of construction. Unlike traditional Portland cement, which is energy-intensive and highly polluting, green cement incorporates recycled materials like fly ash, blast furnace slag, and other industrial by-products. The manufacturing process also consumes less energy and emits fewer greenhouse gases.

List Of Key Companies Profiled:

- Green Cement Inc. (U.S.)

- Holcim Ltd (Switzerland)

- CEMEX S.A.B. de C.V. (Mexico)

- CRH plc (Ireland)

- Heidelberg Cement (Germany)

- Eco Material Technologies (U.S.)

Driving Factors Behind Market Expansion

Several factors are contributing to the rise of green cement usage in the U.S.

- Environmental Regulations and Climate Goals

Stricter environmental norms and national commitments to lower carbon emissions are pushing industries to rethink their processes. Cement producers are under pressure to reduce emissions and embrace sustainable practices. Green cement offers a viable route to meet these expectations without drastically overhauling existing supply chains. - Demand for Sustainable Construction

Sustainability is no longer a buzzword — it’s a fundamental requirement in today’s construction industry. Developers, architects, and civil engineers are increasingly integrating green materials into their projects to meet environmental certifications such as LEED (Leadership in Energy and Environmental Design). Green cement helps improve a project’s overall sustainability score, which is a growing priority for both public and private sector projects. - Urbanization and Infrastructure Development

Rapid urbanization in the U.S. has led to increased demand for residential and non-residential infrastructure. With cities expanding and federal investments pouring into public infrastructure, the demand for durable and sustainable construction materials is also rising. Green cement, with its lower environmental impact and high performance, fits this demand perfectly. - Innovation in Material Science

The cement industry has seen remarkable innovations in recent years. Advanced manufacturing techniques, along with research into alternative raw materials, have led to significant improvements in green cement’s performance. Fly ash-based and slag-based green cements now offer comparable — and sometimes superior — properties to traditional cement, including better thermal insulation and longer lifecycle.

Read More : https://www.fortunebusinessinsights.com/u-s-green-cement-market-109205

Market Segmentation Insights

The green cement market is broadly segmented by type and application.

By Type, fly ash-based green cement holds the largest market share. Fly ash, a by-product of coal combustion, is widely available in the U.S. and offers excellent binding properties. Slag-based and recycled aggregate cement are also gaining attention as viable alternatives.

By Application, the residential segment dominates the market. The push for sustainable housing developments, energy-efficient homes, and green building certifications is contributing to this trend. The non-residential and infrastructure segments are also expanding steadily, supported by government-backed construction projects emphasizing sustainability.

Key Industry Developments:

- March 2023: Holcim Mexico commenced manufacturing its Fuerte Más reduced-CO2 cement at its cement plants in Tabasco and Macuspana at a combined rate of 60,000 t/yr.

- July 2021: Holcim has launched ECOPlanet, a range of green cement delivering at least 30% lower carbon footprints with superior performance. Initially, it was sold in Romania, Germany, Switzerland, Canada, France, Spain, and Italy. Further, the distribution was expanded across 15 more countries in order to enhance the geographic presence.

Challenges to Overcome

- Despite the promising outlook, the green cement industry faces some challenges.

- High Initial Costs

Producing green cement can be more expensive due to sourcing and processing recycled materials, adapting manufacturing processes, and investing in new technologies. Although the long-term environmental and operational savings can offset these costs, the initial investment remains a barrier for some manufacturers. - Lack of Awareness and Adoption

Many contractors and builders are still unfamiliar with the benefits of green cement. Misconceptions around its strength, availability, and compatibility with traditional construction methods can slow adoption. More industry-wide education and standardization are needed to close this gap. - Supply Chain Limitations

The availability of raw materials like fly ash or slag can be region-specific, making it challenging to maintain consistent supply across the country. Regional variations in industrial activity (e.g., power plants, steel production) affect the availability of these key inputs for green cement.

The Road Ahead

The future of U.S. green cement market in the U.S. looks promising. As demand grows for sustainable construction materials, and as technology reduces the cost and increases the efficiency of green cement production, broader adoption is expected. Furthermore, the integration of carbon capture and utilization technologies could dramatically reduce emissions from cement manufacturing in the coming years.

In a world grappling with climate change, the green cement industry represents not just a market opportunity but also a crucial step toward building a more sustainable future. Whether it's constructing eco-friendly homes, roads, or public infrastructure, green cement will play a central role in shaping America’s next-generation built environment.

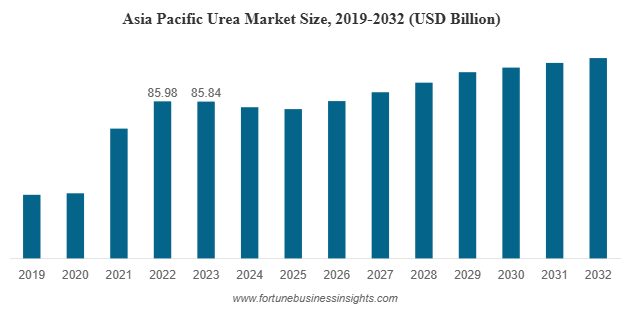

The global urea market was valued at USD 128.92 billion in 2023 and is expected to grow from USD 123.95 billion in 2024 to approximately USD 160.67 billion by 2032, registering a compound annual growth rate (CAGR) of 2.2% during the forecast period. In 2023, Asia Pacific emerged as the leading region, accounting for 66.58% of the total market share. Meanwhile, the urea market in the United States is projected to experience notable growth, with its value anticipated to reach USD 14.40 billion by 2032, primarily driven by the rising demand for nitrogen-based fertilizers aimed at enhancing crop yields.

Market Size and Growth Outlook

The global urea market continues to show steady growth driven by rising demand from both agricultural and industrial sectors. Urea, a nitrogen-rich compound, plays a vital role in modern agriculture as a key fertilizer, and its industrial applications continue to expand across chemical manufacturing, automotive emission controls, and animal feed.

List of Top Urea Companies:

- Sabic (Saudi Arabia)

- Qatar Fertilizer Company (Qatar)

- Eurochem (Switzerland)

- Yara International Asa (Norway)

- Nutrien Ag (Canada)

- Oci N.V. (Netherlands)

- Acron Group (Russia)

- Cf Industries Holdings (U.S.)

Market Segmentation and Applications

The urea market can be segmented by grade into fertilizer grade, feed grade, and technical grade. Fertilizer-grade urea holds the largest share, driven by its widespread use in the agricultural sector. As a high-nitrogen content fertilizer, urea is vital for supporting intensive farming practices that are necessary to meet the food demands of a growing global population.

Feed-grade urea is also seeing increased adoption, particularly in regions where pasture land is scarce and protein-rich feed alternatives are expensive. Urea serves as an affordable nitrogen supplement in animal diets, especially for ruminants such as cattle and sheep.

Technical-grade urea, though currently representing a smaller portion of the market, is expected to grow at a faster pace. This grade is used in various industrial applications such as the production of adhesives, resins, plastics, and coatings. Moreover, the increasing use of urea in the automotive sector, especially in Selective Catalytic Reduction (SCR) systems for emission control, is boosting demand for high-purity technical urea.

Key Market Drivers

One of the primary drivers of the global urea market is the growing demand for food, which necessitates enhanced agricultural productivity. Fertilizers like urea are essential for replenishing soil nutrients and achieving higher crop yields. With arable land per capita declining and the world population continuing to rise, fertilizer use is becoming increasingly critical.

In addition, industrial applications are contributing to market growth. The rise of chemical industries in emerging economies, along with stricter emissions regulations in the automotive sector, is encouraging the use of urea for industrial and environmental purposes.

Governments around the world are also playing a significant role in supporting the urea market. In many developing countries, urea is subsidized to make it affordable for farmers. Meanwhile, in developed economies, regulatory frameworks aimed at reducing greenhouse gas emissions are driving the demand for urea-based emission control systems.

Read More : https://www.fortunebusinessinsights.com/urea-market-106850

Regional Market Insights

Asia-Pacific is the dominant region in the global urea market, accounting for over 66.58% of total market share in 2023. Countries like China and India are at the forefront of this growth, with China being the largest producer and consumer of urea globally. This dominance is largely due to government-backed agricultural subsidies, population-driven food demand, and the presence of robust domestic fertilizer manufacturing facilities.

India, in particular, continues to increase its urea consumption to ensure food security and support farmers. Additionally, countries in Southeast Asia, including Vietnam, Indonesia, and Thailand, are also contributing significantly to regional demand due to increased focus on improving crop yields.

Outside of Asia, other regions such as North America and Europe are experiencing a slower but steady increase in demand. In these regions, the use of urea is more diversified, with significant industrial and automotive applications. For instance, in Europe and North America, urea is widely used in diesel exhaust fluid (DEF) systems to reduce nitrogen oxide emissions from vehicles.

Key Industry Developments

- March 2023: SABIC announced that it is collaborating with two U.S.-based companies, BiOWiSH Technologies and ADM, to supply Bio-Enhanced Urea to farmers for 2023’s growing season to support sustainable agriculture.

- June 2022: Nutrien Ag announced that it is increasing its fertilizer production capability. This move is expected to enable the company to respond to changes in global energy, agriculture, and fertilizer markets.

Competitive Landscape

The global urea market is characterized by the presence of several major players operating at both regional and international levels. Key companies include SABIC, Yara International, Nutrien Ltd., CF Industries Holdings, EuroChem Group, OCI N.V., and others. These players are actively engaged in strategies such as capacity expansion, mergers and acquisitions, and product innovation to strengthen their market positions.

Innovation is also being seen in the development of sustainable urea production processes. Technologies that reduce carbon emissions or use renewable energy sources are gaining attention as manufacturers aim to meet environmental targets while maintaining profitability.

Challenges and Restraints

Despite its widespread use, the urea market faces several challenges. One of the main issues is the environmental impact of overusing nitrogen fertilizers, which can lead to soil degradation, water pollution, and greenhouse gas emissions. This has prompted growing interest in sustainable farming practices and organic alternatives, which may limit long-term reliance on synthetic fertilizers.

In addition, fluctuations in the prices of raw materials such as natural gas — a primary feedstock for urea production — can impact the profitability of manufacturers. Geopolitical tensions, trade restrictions, and energy supply disruptions further add to the uncertainty in the market.

Moreover, regulatory pressures, particularly in Europe and North America, are encouraging the reduction of chemical fertilizer use and promoting alternatives that are more environmentally friendly. This shift, although gradual, may influence future demand patterns.

Opportunities and Future Outlook

Looking ahead, the urea market is expected to continue growing steadily, with several opportunities on the horizon. Countries with strong agricultural sectors but limited domestic fertilizer production are likely to invest in local manufacturing or increase imports. Similarly, the expansion of industrial applications, including in the pharmaceutical, textile, and automotive sectors, will open new growth avenues.

There is also significant potential for innovation in sustainable urea market products, such as enhanced-efficiency fertilizers that minimize nitrogen losses and environmental impact. As climate change and sustainability remain top global concerns, such products may shape the future of the industry.

In conclusion, while the urea market faces certain challenges, its critical role in agriculture and expanding industrial use cases ensure it remains a key component in the global economy. With ongoing investment, technological advancement, and regulatory support, the urea market is well-positioned for stable long-term growth.

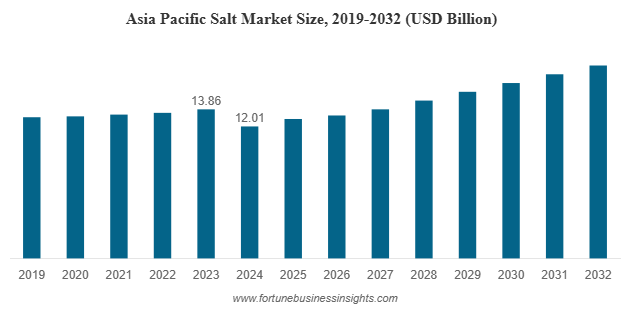

The global salt market was valued at USD 25.98 billion in 2024 and is expected to expand from USD 26.92 billion in 2025 to USD 36.12 billion by 2032, reflecting a CAGR of 4.29% over the forecast period. Asia Pacific led the market in 2024 with a 46.23% share, driven by robust industrial demand and rising consumption in the food sector. In the United States, the salt market is projected to reach USD 4.91 billion by 2032, supported by increasing demand for food-grade salt as well as extensive use in industrial processes and de-icing applications. Key players in the industry include Cargill Salt, Compass Minerals International, Inc., INEOS Enterprises, and American Rock Salt.

Salt market is one of the world’s oldest and most widely used commodities, and it continues to play a vital role in both daily life and industrial applications. Far beyond its use as a kitchen essential, salt market has become indispensable in chemical manufacturing, water treatment, de-icing, oil and gas, and agriculture. The global salt market is experiencing steady growth as industries expand, populations rise, and specialty salts gain consumer appeal.

List Of Key Salt Companies Profiled

- American Rock Salt (U.S.)

- Cargill Salt (U.S.)

- Compass Minerals International, Inc. (U.S.)

- INEOS Enterprises Salt (U.K.)

- K+S Aktiengesellchaft (Germany)

- China National Salt Industry (China)

- Chemetica (Poland)

- US Salt LLC (U.S.)

- Ahir Salt Industries (India)

- GHCL Limited (India)

Key Growth Drivers

- Industrial and Chemical Applications

The largest portion of global salt demand comes from industrial uses, particularly in chemical processing. Salt is essential in the production of chlorine, caustic soda, and soda ash, which serve as building blocks for industries ranging from plastics and paper to glass and textiles. The expansion of chemical manufacturing in emerging economies is a major driver of salt consumption, especially in Asia Pacific.

- De-icing in Cold Regions

In countries with harsh winters, salt is vital for public safety. Rock salt is widely used to melt snow and ice on roads, highways, and airport runways. This consistent demand makes North America and Europe strong regional markets, as municipalities and governments allocate significant budgets to maintain road safety during winter.

- Expanding Role in Water Treatment, Oil & Gas, and Agriculture

Beyond chemicals and de-icing, salt is a key material in water softening and treatment processes, which are critical for both municipal and industrial systems. In the oil and gas sector, salt is used in drilling operations and enhanced oil recovery. Agriculture also depends on salt for soil treatment and livestock feed supplements, ensuring stable demand from rural economies.

- Rising Popularity of Gourmet and Specialty Salts

Consumer preferences are evolving, and specialty salts are capturing growing attention. Solar salt, vacuum pan salt, and artisanal salts such as pink Himalayan or sea salt are being marketed as healthier or more natural alternatives. These products are increasingly popular in gourmet cooking, wellness markets, and premium retail outlets, creating opportunities for higher-margin sales.

Market Segmentation

The salt market can be categorized by type, source, and application.

- By Type: Rock salt dominates the market thanks to its large-scale use in de-icing and industrial processes. Other types include solar salt, vacuum pan salt, and salt in brine, each serving specific applications.

- By Source: Salt is primarily obtained either from brine or through mining. Mines hold the larger market share due to their ability to provide consistent quality and volume. Brine-based production, however, is still widely practiced in coastal areas.

- By Application: Chemical processing remains the largest application segment, followed by de-icing. Other key uses include water treatment, oil and gas, agriculture, and food flavoring.

Read More : https://www.fortunebusinessinsights.com/salt-market-103011

Regional Insights

- Asia Pacific

Asia Pacific leads the global market with a share exceeding 46% in 2024. Countries such as China, India, and Australia are major producers and consumers of salt. Industrial growth, population expansion, and rising demand for processed foods all contribute to this region’s dominance.

- North America

North America is a key market, driven by strong demand for both industrial salt and de-icing salt. The United States alone is expected to reach nearly USD 5 billion in salt market value by 2032. Harsh winters and a robust chemical sector fuel consistent demand.

- Europe

Europe also holds a significant share, particularly due to its chemical industry and extensive use of de-icing salts. However, environmental regulations are more stringent here, requiring companies to adopt sustainable mining and production practices.

- Rest of the World

Latin America and the Middle East & Africa are smaller but growing markets. Rising industrial activity and urbanization are expected to fuel gradual demand increases in these regions over the next decade.

Opportunities for Businesses

The salt market is evolving, and businesses that innovate will be best positioned to capture growth. Producers can focus on:

- Sustainable Production Methods: Eco-friendly mining and brine management will not only meet regulatory requirements but also attract environmentally conscious customers.

- Specialty Salt Branding: Premium salts marketed for their purity, origin, or unique mineral content can help companies differentiate and achieve higher margins.

- Diversification into Industrial Uses: Serving fast-growing industries such as chemicals, oil and gas, and water treatment ensures long-term stability.

- Regional Expansion: Asia Pacific continues to offer strong opportunities due to industrialization and population growth, making it a priority region for expansion.

Key Industry Developments

- December 2024: GHCL, a key salt manufacturer and part of the Dalmia Group, invested USD 40.44 million to create a salt field in Kutch. The Zara Zumara Salt Field will be developed in the Jara area of Kutch.

- May 2023: Cargill’s salt business signed an agreement with CIECH Group, a leading supplier of evaporated salt products. Through this agreement, Cargill extended its range of specialty and evaporated food salt solutions for European food manufacturers.

Opportunities

While growth opportunities are significant, the salt industry also faces notable challenges.

- Environmental Impact: Salt production, especially through large-scale evaporation or mining, can damage ecosystems. The disposal of brine and saline wastewater affects aquatic life and soil quality, raising sustainability concerns.

- Regulatory Hurdles: Stricter environmental and safety regulations are affecting salt producers, particularly those operating underground mines or near coastal ecosystems. Compliance costs can be high and may limit smaller producers.

- Climate and Supply Variability: Weather conditions influence production. For example, solar salt production depends on long dry seasons, making it vulnerable to climate change. Unpredictable weather can affect output and supply chains.

Future Outlook

Salt market may seem like a simple commodity, but its applications stretch across countless industries, making it a cornerstone of global trade and development. With the global market set to grow from USD 25.98 billion in 2024 to USD 36.12 billion by 2032, the industry is poised for steady expansion. Opportunities in specialty salts, sustainable production, and industrial demand highlight salt’s enduring relevance in the modern economy. Companies that align with these trends will be well-positioned to thrive in this growing market.

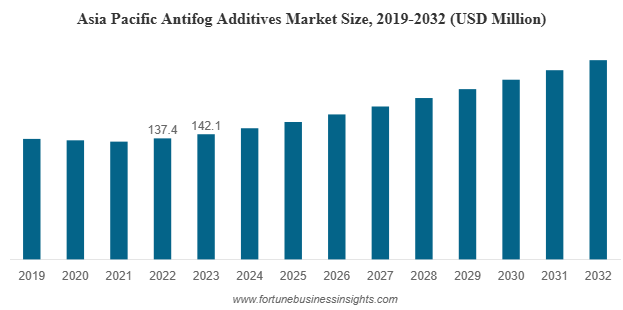

The global antifog additives market was valued at USD 370.0 million in 2023 and is projected to increase from USD 385.9 million in 2024 to USD 564.7 million by 2032, reflecting a compound annual growth rate (CAGR) of 4.8% over the forecast period. In 2023, Asia Pacific led the market, accounting for 38.41% of the global share.

In an age where consumer expectations for freshness, hygiene, and visual appeal are higher than ever, the smallest innovations can make a big impact. One such unsung hero of modern packaging and agriculture is the antifog additive market a chemical compound that prevents the formation of fog on plastic films. While often overlooked, these additives are essential in maintaining product visibility, ensuring food safety, and improving crop yields in controlled agricultural environments.

Types of Antifog Additives Market

Several types of antifog additives market are used based on the application, regulatory requirements, and the nature of the film. The most common types include:

- Glycerol esters

- Polyglycerol esters

- Sorbitan esters

- Ethoxylated sorbitan esters

- Polyoxyethylene esters

Each type has unique properties that influence how effectively it prevents fog, how long it lasts, and whether it’s safe for food contact. For instance, food-grade packaging requires additives that are non-toxic, FDA-approved, and do not migrate into the food over time.

List Of Key Companies Profiled:

- Croda International Plc (U.K.)

- Avient (U.S.)

- LyondellBasell Industries Holdings B.V. (U.S.)

- SABO S.p.A. (Italy)

- Emery Oleochemicals (U.S.)

- Corbion (Netherlands)

- Evonik Industries AG (Germany)

- Polyvel Inc. (U.S.)

- Primex Plastics Corporation (U.S.)

- Palsgaard (Denmark)

What Are Antifog Additives Market?

Antifog additives market are specialized chemicals integrated into plastic films used primarily in food packaging and agricultural applications. Their main function is to prevent water droplets (fog) from forming on the surface of these films. When moisture builds up due to temperature changes or humidity, it often condenses into small droplets that scatter light and obscure visibility. In food packaging, this fog can make the product look unappealing or even unsafe. In agriculture, fog on greenhouse films can reduce light transmission, affecting plant growth.

These additives work by reducing the surface tension of water on the film, causing moisture to spread out in a thin, transparent layer rather than forming droplets. This small chemical adjustment dramatically improves the clarity and usefulness of plastic films.

Why Is the Market Growing?

Several key factors are driving the steady rise in demand for antifog additives market:

- Rising Demand for Packaged Food

With rapid urbanization, growing middle-class populations, and busy lifestyles, the global appetite for packaged and ready-to-eat food continues to rise. Consumers want products that look fresh and clean on the shelf, and foggy packaging can diminish confidence in quality. Antifog additives market ensure the product remains visible, which is essential for maintaining consumer trust.

- Expansion of E-Commerce and Food Delivery

The growth of online grocery shopping and food delivery services has placed additional demands on packaging. Products often move through varying temperature zones during transport, increasing the risk of condensation. To ensure the food arrives looking its best, antifog films are being adopted more widely across cold-chain logistics.

- Growth in Protected Agriculture

Greenhouses and high-tunnel farming are becoming more common worldwide, especially in regions aiming to improve food security. These systems rely heavily on plastic films to control temperature and humidity. Antifog additives market help maintain optimal light transmission by preventing fog on these films, thus promoting better crop growth and yield.

- Changing Consumer Preferences

Today’s consumers are more conscious of hygiene, freshness, and presentation. Especially post-pandemic, clear and clean packaging plays a role in perceived food safety. The visual appeal of a product has a direct impact on purchasing decisions, further elevating the importance of antifog additives market technologies.

Read More : https://www.fortunebusinessinsights.com/antifog-additives-market-107642

Regional Insights

- Asia-Pacific

This region currently dominates the antifog additives market, holding the largest share as of 2023. Rapid industrialization, increasing packaged food consumption, and agricultural advancements in countries like China and India are major contributors. China, in particular, is projected to witness one of the highest growth rates in the coming years.

- North America and Europe

These mature markets are also witnessing healthy growth, driven by innovation in sustainable packaging and strict food safety regulations. The focus here is not just on performance but also on compliance with environmental and health standards.

Key Industry Developments:

- October 2022- Emery Oleochemicals announced a partnership with Sukano. The partnership aims to develop and launch the PET antifogging compound made from natural oils and fat.

- November 2022- SABO S.p.A. announced the acquisition of TAA derivative business of Evonik Industries. The acquisition aims to establish a presence in polymer additive manufacturing.

Challenges and Opportunities

Despite strong growth prospects, the market is not without challenges. Rising environmental concerns around plastic waste and chemical additives are pressuring manufacturers to innovate. There is growing demand for bio-based and biodegradable antifog additives market that offer the same performance without the environmental drawbacks.

Additionally, regulatory frameworks in Europe and North America are tightening around the use of certain chemicals, especially in food-contact materials. Manufacturers that can align with these regulations while maintaining effectiveness will be well-positioned for future success.

The industry also sees potential in developing long-lasting antifog solutions for reusable packaging and exploring antifog applications beyond food and agriculture, such as in automotive, optical films, and medical devices.

Future Outlook

As technology continues to evolve and the demand for smarter, safer packaging grows, antifog additives market will remain a crucial element in the packaging and agricultural industries. The future lies in sustainable innovation creating products that not only perform well but also align with global sustainability goals.

For companies operating in this space, the message is clear: invest in R&D, stay ahead of regulatory trends, and develop eco-friendly alternatives. The fog-free future of packaging and agriculture depends on it.

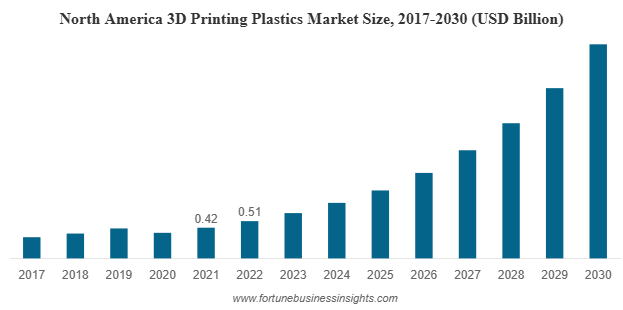

The global 3D printing plastics market was valued at USD 1.26 billion in 2022 and is expected to expand from USD 1.55 billion in 2023 to USD 7.46 billion by 2030, registering a strong CAGR of 25.1% over the forecast period. North America led the market in 2022 with a 40.48% share, while the U.S. market alone is anticipated to reach USD 2.71 billion by 2030, driven by rapid advancements in additive manufacturing and prototyping technologies.

Additive manufacturing, better known as 3D printing plastics market, has moved beyond its early days as a niche prototyping tool. Today, it is shaping how industries design, test, and manufacture products on demand. Among the wide range of materials used in this technology, plastics hold a crucial position. From aerospace to healthcare, 3D printing plastics market are transforming the way companies innovate and deliver solutions.

In recent years, the 3D printing plastics market has been experiencing remarkable growth. What was once valued at just over a billion dollars in 2022 is forecasted to multiply several times over by the end of this decade. With a compound annual growth rate exceeding 25.1%, the industry is expected to cross seven billion dollars by 2030. Such rapid expansion is being driven by material innovation, advances in printing technologies, and rising adoption across diverse sectors.

List Of Key Companies Profiled In 3d Printing Plastics Market:

- HP Development Company, L.P (U.S.)

- Evonik Industries AG. (Germany)

- Stratasys (U.S.)

- 3D Systems, Inc. (U.S.)

- Arkema S.A.(France)

- Henkel Corporation (Germany)

- EOS GmbH Electro Optical Systems (Germany)

- Solvay S.A.(Belgium)

- Huntsman Corporation (U.S.)

- SABIC (Saudi Arabia)

Why the Market Is Growing So Fast

- Innovation in Materials

One of the biggest factors pushing growth is the introduction of new plastic formulations designed specifically for 3D printing plastics market. Polylactic Acid (PLA), a biodegradable polymer derived from renewable resources such as corn starch, is gaining strong traction. It is not only eco-friendly but also easy to print, making it a preferred choice for beginners and professionals alike. Alongside PLA, other plastics such as ABS, polyamide, and polycarbonate are finding increasing demand due to their strength, flexibility, and durability.

- Technological Advancements

3D printing itself has seen major improvements in speed, resolution, and the ability to handle multiple materials and colors simultaneously. These advancements allow for the creation of complex geometries and high-performance components that were once impossible or too costly to manufacture using traditional methods. Better printers also mean faster turnaround times, which adds to the appeal of using plastics for both prototyping and end-use applications.

- Expanding End-User Applications

Industries are embracing 3D printing plastics market for very different reasons.

- Aerospace and defense companies are drawn to lightweight plastic components that reduce fuel consumption and overall costs.

- Healthcare is adopting these materials for customized implants, dental models, and patient-specific medical devices.

- Automotive manufacturers benefit from the ability to produce rapid prototypes and lightweight parts.

- Electronics and consumer goods industries use plastics for everything from functional components to creative product designs.

This diversity of applications ensures that demand is not concentrated in one sector but spread across multiple industries.

- Regional Expansion

North America currently leads the global market thanks to early adoption, technological expertise, and strong demand from aerospace and healthcare industries. However, Asia Pacific is emerging as the fastest-growing region. Countries such as China, India, Japan, and South Korea are investing heavily in additive manufacturing, supported by strong automotive, electronics, and consumer goods industries. Europe, too, continues to play a key role, driven by exports and advanced manufacturing systems.

Breaking Down the Market

The 3D printing plastics market can be segmented in several ways:

- By Material Type: PLA is the leading segment due to its eco-friendly nature and ease of use. ABS, polyamide, and polycarbonate also hold significant shares.

- By End-Use Industry: Aerospace and defense currently dominate the market, but healthcare is catching up quickly. Automotive, electronics, and consumer goods contribute steadily to overall demand.

- By Region: North America is the largest market, Asia Pacific is the fastest growing, and Europe continues to maintain a strong presence. Emerging markets in Latin America and the Middle East are also expected to expand gradually.

Read More : https://www.fortunebusinessinsights.com/3d-printing-plastics-market-108834

Opportunities for Businesses

For companies operating in this space, the growth trajectory offers immense opportunities. A few strategies stand out:

- Invest in R&D: There is room for breakthrough developments in material science. Plastics that combine multiple strengths—durability, lightness, sustainability, and affordability—will redefine the market.

- Focus on Compliance: Firms targeting aerospace or healthcare must be prepared for rigorous testing and certification processes. Building strong quality assurance systems will be key to long-term success.

- Strengthen Supply Chains: With global supply chains facing instability, localizing production and building partnerships for raw materials can provide resilience and cost advantages.

- Leverage Customization: 3D printing allows companies to offer tailor-made products with shorter lead times. Businesses that can capitalize on this demand for customization will stay ahead of the competition.

Key Industry Developments:

- March 2022: Evonik developed VESTAKEEP iC4800 3DF, a new osteoconductive PEEK filament that improves fusion between bone and implants. By developing this new filament, the company will further expand its portfolio of 3D-printable biomaterials for medical technology.

- March 2022: Evonik and Asiga, an Australian 3D printer manufacturer collaborated in photopolymer-based 3D printing. The companies aim to elevate the 3D printing industrial manufacturing at large-scale by increasing their competence in photo-curing technologies.

Challenges the Industry Faces

While the growth story is strong, the industry is not without its hurdles.

- Material Limitations: Developing plastics that meet all requirements—strength, heat resistance, flexibility, and biocompatibility—remains a challenge. Aerospace and medical industries, in particular, demand materials that can perform under extreme conditions.

- Certification and Regulation: Getting approval for 3D printed parts, especially in sensitive sectors such as healthcare and aerospace, involves stringent safety and quality checks. These add to costs and time before new materials or products can hit the market.

- Supply Chain Risks: Global disruptions in recent years have highlighted the vulnerability of raw material supply chains. Ensuring a steady and cost-effective supply of 3D printing plastics remains a critical concern.

Outlook

The future of the 3D printing plastics market looks bright. With projections crossing seven billion dollars by 2030 and applications expanding across industries, the sector is set for a dynamic decade. Growth in Asia Pacific, steady leadership in North America, and innovations across Europe will shape the global landscape.

Healthcare and aerospace are expected to deliver some of the most groundbreaking use-cases, especially as material limitations are overcome and regulatory hurdles are navigated. At the same time, eco-friendly materials such as PLA will become increasingly important as industries prioritize sustainability.

In short, 3D printing plastics market are not just materials for tomorrow they are already redefining how we create, customize, and consume products today.

U.S. Antimicrobial Plastics Market Global Trend, Size, Share, Growth & Forecast 2030

By Sharvari, 2025-09-16

The U.S. antimicrobial plastics market size was valued at USD 6.68 billion in 2022 and is projected to grow at a CAGR of 7.5% during the forecast period.

In today’s fast-paced, hygiene-conscious world, industries are evolving to prioritize cleanliness, safety, and sustainability like never before. One standout example of this evolution is the rapid growth of the U.S. antimicrobial plastics market. As concerns over infection control, food safety, and environmental impact continue to rise, antimicrobial plastics have carved out a vital space across industries ranging from healthcare to consumer goods.

List Of Key Companies Profiled:

- BASF SE (Germany)

- LyondellBasell Industries Holdings B.V. (Netherlands)

- DuPont de Nemours, Inc (U.S.)

- INEOS Group Limited (U.K.)

- Avient Corporation (U.S.)

- SABIC (Saudi Arabia)

- Palram Industries Ltd. (Israel)

- RTP Company (U.S.)

- Microban International, Ltd. (U.S.)

- King Plastic Corporation (U.S.)

Market Size and Growth Trends

The U.S. antimicrobial plastics market is experiencing robust growth and shows no signs of slowing down. Fueled by increasing demand in healthcare, packaging, and automotive industries, the market has seen a steady upward trajectory in both volume and value.

Over the next few years, industry experts forecast a strong compound annual growth rate (CAGR), supported by ongoing innovations, rising public health awareness, and stringent hygiene regulations. With the global spotlight on health post-pandemic, antimicrobial materials are no longer a luxury—they are a necessity.

What Are Antimicrobial Plastics?

U.S. antimicrobial plastics market are plastic materials that have been infused with active agents that inhibit the growth of microorganisms such as bacteria, mold, mildew, and even some viruses. These agents can be either inorganic, like silver or copper, or organic, and they help keep surfaces cleaner for longer periods, reducing the risk of contamination and the spread of infections.

These plastics are particularly important in environments where hygiene is non-negotiable—such as hospitals, food processing facilities, and high-touch consumer products.

Why the Market Is Growing So Fast

There are several key factors contributing to the rising demand for antimicrobial plastics in the United States:

- Healthcare Sector Demand

The medical and healthcare industry remains the largest consumer of antimicrobial plastics. With a growing number of hospitals, clinics, and diagnostic labs, the demand for sterile and contamination-resistant materials has never been higher. From surgical instruments to IV components and bed rails, antimicrobial plastics are critical in maintaining a sterile environment and minimizing hospital-acquired infections.

- Packaging and Food Safety

The food industry is under constant pressure to ensure safety and longevity of its products. Antimicrobial plastics are now widely used in food packaging to extend shelf life and reduce spoilage. Consumers are increasingly seeking packaging that not only protects their food but also ensures hygienic handling from production to table.

- Rise in Consumer Awareness

Post-pandemic, awareness about germ transmission through surfaces has skyrocketed. Consumers are now actively seeking products that offer antimicrobial properties—from smartphone cases and kitchen countertops to gym equipment and children’s toys. This behavioral shift is directly influencing manufacturers to integrate antimicrobial technology into everyday items.

- Automotive and Building Applications

Car interiors, door handles, seat belts, and HVAC systems are all high-touch points that can benefit from antimicrobial treatment. Similarly, the construction industry is adopting antimicrobial plastics in areas like wall panels, handrails, and bathroom fittings to meet hygiene standards, especially in commercial buildings and public facilities.

Dominance of Inorganic Additives

Inorganic antimicrobial agents, particularly silver-based compounds, currently dominate the market due to their long-lasting effectiveness and stability under various conditions. These additives are known to be highly effective against a broad spectrum of microorganisms and can be integrated into a wide range of polymer types.

Read More : https://www.fortunebusinessinsights.com/u-s-antimicrobial-plastics-market-108257

Market Segmentation Insights

The U.S. antimicrobial plastics market is segmented by:

- Type of Plastic: Commodity plastics like polyethylene and polypropylene are widely used due to their cost-effectiveness and versatility.

- Additives Used: Inorganic agents like silver and copper dominate, while research continues on safer, more eco-friendly organic alternatives.

- End-Use Industries: The major consumers include medical & healthcare, packaging, automotive, consumer goods, and building & construction.

Each segment has its own unique demands and regulatory frameworks, making innovation and adaptability key to long-term success.

What’s Next for the U.S. Antimicrobial Plastics Market?

Looking ahead, the market is poised for continued expansion driven by:

- Biodegradable and Sustainable Options: There’s rising demand for antimicrobial plastics that are also biodegradable or made from recycled materials.

- Smart Antimicrobial Surfaces: Innovations may soon bring self-cleaning, UV-reactive, or even sensor-embedded antimicrobial plastics into the mainstream.

- Consumer-Led Design: As awareness grows, consumers will increasingly push for safer, germ-resistant materials in everything from home appliances to school supplies.

- Government Regulations: Policy changes and stricter hygiene protocols will further stimulate adoption in critical sectors like transportation, healthcare, and food processing.

Key Industry Developments:

- November 2021 – Sunbeam Products, Inc. and Microban International have announced a strategic partnership to develop a premium-quality product portfolio under the Calphalon brand to produce knife handles by innovating the Microban silver shield platform, which features product protection against microbes.

- May 2021 – Avient Corporation has launched a new antimicrobial technology by enlarging its product portfolio to protect against bacterial microbes. The new technology GLS TPE is expected to extend the organization's market presence into more extensive applications for gadgets, cars, and air conditioning seals.

Challenges Facing the Market

Despite the promising growth, the U.S. antimicrobial plastics market does face a few challenges:

- Cost of Raw Materials: Antimicrobial additives can significantly increase production costs, especially for low-margin industries like food packaging.

- Environmental Concerns: With growing awareness around plastic pollution, companies must balance antimicrobial performance with recyclability and sustainability.

- Regulatory Compliance: Manufacturers need to navigate complex regulations regarding the use of biocidal agents, labeling, and safety certifications.

- Performance Durability: Ensuring that antimicrobial properties last for the full product lifecycle is crucial. Degradation over time can result in reduced effectiveness and consumer dissatisfaction.

Outlook

The U.S. antimicrobial plastics market is not just a trend—it’s a pivotal part of the future of materials science. As industries and consumers alike place more value on cleanliness, safety, and sustainability, antimicrobial plastics will play a central role in shaping safer environments.

For businesses, now is the time to invest in antimicrobial innovation, adapt to changing consumer expectations, and build products that deliver not just performance, but peace of mind.

Whether you’re a manufacturer, distributor, or simply an informed consumer, understanding this market opens up a world of opportunity—and it’s only just beginning.

Saudi Arabia Refractories Market Size, Share, Companies & Future Outlook 2029

By Sharvari, 2025-09-16

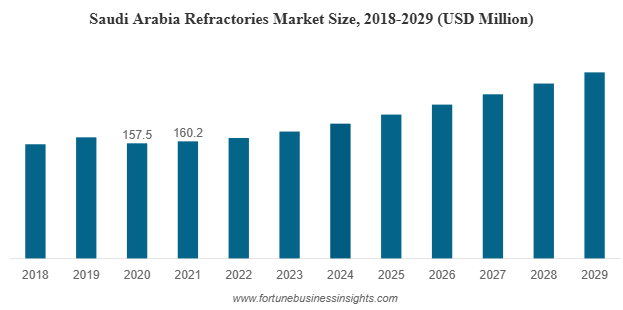

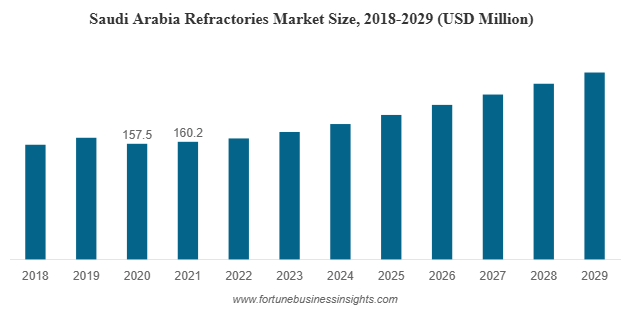

The Saudi Arabia refractories market was valued at USD 160.2 million in 2021 and is expected to expand from USD 164.8 million in 2022 to USD 254.6 million by 2029, registering a CAGR of 6.4% during the forecast period. The COVID-19 pandemic had a significant impact on the industry, with demand falling short of expectations across the country. In fact, the market recorded a 4.9% decline in 2020 compared to 2019, highlighting the challenges faced during the crisis.

Market Size and Forecast

The Saudi Arabia Refractories Market is undergoing rapid transformation, driven by industrial expansion, government initiatives, and rising demand from core industries such as steel, cement, glass, and non-ferrous metals. As the Kingdom works toward its Vision 2030 objectives, refractories are emerging as a crucial component in supporting industrial infrastructure, manufacturing, and construction.

This article explores the size of the market, major growth drivers, challenges, and the future outlook, offering insights for businesses, investors, and stakeholders aiming to understand this fast-growing industry.

List Of Key Companies Profiled:

- Saudi Refractory Industries (Dammam)

- AOSCO Refractory (Dammam)

- FSN Company (Dammam)

- Arabian Refractories Factory Company (Dammam)

- Q & E Company Ltd. (Al Jubail)

- Alfran (Amman)

- Thermal Insulation UAE (Sharjah)

Importance of Saudi Arabia Refractories Market

Saudi Arabia Refractories Market are specialized, heat-resistant materials used to line furnaces, kilns, reactors, and other equipment that must endure extreme heat, chemical corrosion, and mechanical wear. They are indispensable in industries such as iron and steel, cement, glass, and petrochemicals. Without quality refractory linings, these industries cannot achieve efficiency, safety, or cost-effectiveness in their operations.

In Saudi Arabia, where large-scale industrialization is central to economic diversification, the demand for high-performance refractories is expanding at a steady pace.

Key Segments of the Market

By Form

- Bricks and shaped refractories dominate the market, thanks to their extensive use in furnaces, kilns, and metal processing units.

- Monolithic and unshaped refractories are gaining popularity due to their versatility in lining irregular shapes and complex industrial equipment.

By Product Type

- Clay refractories, including fireclay and other affordable compositions, lead in terms of volume because of their cost-effectiveness and wide availability.

- Non-clay refractories, such as high alumina, silica, magnesia, and specialty compositions, are increasingly in demand for high-temperature and high-stress applications.

By End-Use Industry

- Iron and steel remains the largest consumer segment, as steelmaking processes rely heavily on refractory linings for converters, blast furnaces, and ladles.

- Cement and glass industries also contribute significantly, with glass furnaces requiring advanced materials to withstand continuous high-temperature melting operations.

- Non-ferrous metals and petrochemicals represent growing opportunities, especially as Saudi Arabia strengthens its energy and industrial base.

Read More : https://www.fortunebusinessinsights.com/saudi-arabia-refractories-market-106924

Growth Drivers

- Vision 2030 and Industrial Diversification

Saudi Arabia’s Vision 2030 blueprint focuses on diversifying the economy beyond oil. The plan emphasizes boosting steel production, automotive manufacturing, construction, and renewable energy—all sectors that rely heavily on refractory applications. - Megaprojects and Infrastructure Development

Projects like NEOM City, the Red Sea Project, and new industrial hubs are fueling demand for steel, cement, and glass. This directly translates into higher consumption of refractories for production units and industrial infrastructure. - Rising Steel Production

Saudi Arabia is investing heavily in steel plants to meet domestic and export demand. Since steelmaking is one of the most refractory-intensive processes, this sector will remain the backbone of market growth. - Technological Advancements

Innovations in refractory materials—such as non-clay compositions with superior thermal, mechanical, and chemical resistance—are gaining traction. These advanced materials improve efficiency, reduce downtime, and comply with stricter environmental standards.

Challenges Facing the Market

- Raw Material Dependence: Saudi Arabia imports a significant portion of refractory raw materials, making the market vulnerable to global supply chain disruptions and fluctuating costs.

- High Energy and Production Costs: Refractory manufacturing is energy-intensive, and rising energy prices can impact margins for producers.

- Environmental Regulations: As the Kingdom advances its sustainability agenda, manufacturers must adopt eco-friendly production processes, which require additional investment.

- Skilled Workforce Needs: Operating advanced refractory technologies and installations requires technical expertise, which remains a challenge in certain regions.

Future Outlook

The future of the Saudi Arabia refractories market looks highly promising. Between 2022 and 2029, steady growth is expected across all major end-use industries. Steel will continue to dominate demand, while the glass and cement industries are set to expand further due to construction megaprojects.

Advanced non-clay refractories are anticipated to capture greater market share, supported by industries that require superior performance under corrosive and high-temperature conditions. Moreover, local manufacturing capabilities are likely to expand as the Kingdom reduces dependency on imports and promotes domestic production facilities.

The Saudi Arabia Refractories Market is on a growth trajectory, fueled by industrialization, megaprojects, and rising steel and cement production. While challenges such as raw material dependency and environmental regulations persist, the outlook remains highly positive through 2029.

For businesses, this market presents opportunities to innovate, localize production, and align with Vision 2030’s goals. For investors and stakeholders, refractories are not just heat-resistant materials they are the backbone of Saudi Arabia’s industrial transformation.

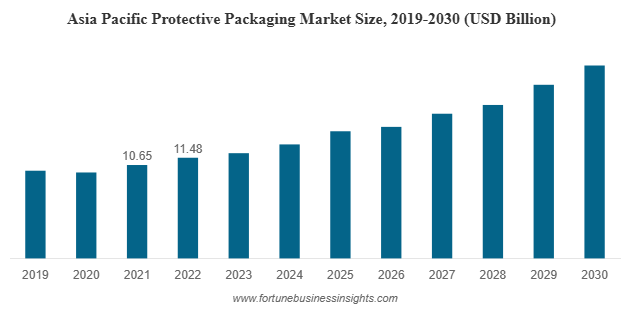

The global protective packaging market was valued at USD 36.31 billion in 2022 and is expected to expand from USD 38.52 billion in 2023 to USD 61.44 billion by 2030, reflecting a compound annual growth rate (CAGR) of 6.90% during the forecast period. In 2022, the Asia Pacific region led the market, accounting for 31.62% of the global share. Meanwhile, the U.S. protective packaging market is also anticipated to witness strong growth, with projections estimating it will reach USD 14.80 billion by 2032. This growth is largely driven by the rising demand for protective packaging in international trade activities.

In an era dominated by online shopping, global logistics, and heightened consumer expectations, protective packaging has emerged as one of the most critical components in product delivery. From fragile electronics to perishable foods, protective packaging ensures that goods reach customers safely and in top condition.

List Of Key Companies Profiled In Protective Packaging Market:

- Smurfit Kappa (Ireland)

- Westrock Company (U.S.)

- Sealed Air Corporation (U.S.)

- Sonoco Product Company (U.S.)

- Huhtamaki (Finland)

- DS Smith PLC (U.K.)

- Pregis LLC (U.S.)

- Pro-Pac Packaging Limited (Australia)

- Storopack (Germany)

- Intertape Polymer Group (U.S.)

Growth Drivers

- The E-Commerce Explosion

E-commerce has reshaped the way we shop. With products shipped directly to doorsteps, the demand for protective packaging has surged. Customers now expect their orders to arrive in pristine condition—whether it's a smartphone, skincare product, or a frozen meal. Packaging that fails to protect leads to returns, dissatisfaction, and brand damage. As online shopping becomes the default, businesses are investing heavily in durable, lightweight, and cost-effective packaging solutions.

- Expanding Applications Across Industries

Protective packaging market is no longer confined to just electronics or fragile goods. It’s now an essential requirement in industries such as:

- Food and Beverage: Ensures freshness and prevents contamination during transport.

- Pharmaceuticals: Maintains the integrity and safety of sensitive medical products.

- Automotive and Electronics: Shields against mechanical damage, moisture, and dust.

- Cosmetics and Personal Care: Protects aesthetic packaging and preserves shelf appeal.

The more industries that rely on long-distance shipping, the more critical packaging becomes to business operations.

- Rising Demand in Developing Regions

Asia-Pacific currently holds the largest market share and continues to be the fastest-growing region. Countries like China and India are experiencing massive e-commerce growth, expanding manufacturing bases, and urbanization—all of which contribute to increased demand for protective packaging. Additionally, Latin America and the Middle East & Africa are witnessing steady growth as global trade increases and consumer purchasing power rises.

Trends Shaping the Market

- Sustainable Packaging Solutions

Plastic continues to dominate the market due to its low cost, durability, and efficiency. However, growing environmental concerns are pushing both companies and consumers toward greener alternatives. There is a strong trend toward the use of recyclable materials, biodegradable films, and molded pulp packaging. Businesses are under pressure to strike a balance between functionality and sustainability—without sacrificing protection.

- Growth in Flexible and Wrapping Packaging

Among the various product types, flexible packaging solutions are seeing the fastest growth. These include bubble wrap, paper wraps, and foam-in-place solutions, which offer excellent cushioning while being adaptable to various product sizes and shapes. Wrapping packaging is especially popular for its lightweight nature, ease of customization, and cost efficiency. These solutions are essential for reducing shipping weight and protecting irregularly shaped items.

- Advanced Protective Functions

Today’s protective packaging does more than just prevent breakage. Key functions include:

- Void Fill: Prevents products from moving during transit.

- Cushioning: Absorbs shock and vibration.

- Insulation: Maintains product temperature (especially in food and pharma sectors).

- Blocking and Bracing: Secures products in place inside the container.

These multifunctional aspects of protective packaging are becoming essential for meeting increasingly complex logistical requirements.

Read More : https://www.fortunebusinessinsights.com/protective-packaging-market-107319

What Businesses Should Focus On

For companies that manufacture, ship, or sell physical products, the rise of the protective packaging market presents both a challenge and an opportunity. Here are a few key takeaways:

- Invest in R&D: Stay ahead by developing or using sustainable and advanced packaging materials.

- Optimize Packaging Design: Go beyond protection—design for space efficiency, brand identity, and user experience.

- Partner Strategically: Work with reliable suppliers who offer innovative, compliant, and cost-effective packaging solutions.

- Educate Consumers: Highlight your sustainable packaging efforts as part of your brand story. Today’s consumers care.

Key Industry Developments:

- August 2023 – Ranpack launched Wrap’n Go converter for protective honeycomb paper. The company brought its Geami Wrap’n Go converter, which turns kraft paper into protective, pack-in-store packaging for fragile items, to the North American market, providing an alternate option to the plastic solution.

- February 2023 – The circular materials company Cruz Foam announced the launch of a revolutionary new product family of environmentally protective packaging, introducing highly efficient solutions that meet the specific needs of customers in transporting sensitive and temperature-sensitive goods to consumers and businesses.

Challenges and Opportunities

- Regulation and Compliance

Governments worldwide are enacting stricter regulations on single-use plastics and non-recyclable materials. As sustainability becomes non-negotiable, packaging manufacturers are investing in R&D to develop eco-friendly solutions that comply with international standards. This opens doors for innovation and differentiation in the market.

- Supply Chain Resilience

The COVID-19 pandemic exposed the fragility of global supply chains. Delays in raw materials and disruptions in manufacturing highlighted the need for more robust and localized packaging solutions. Companies are now diversifying their supplier base and investing in supply chain resilience to avoid future setbacks.

- Technological Innovation

Technological advancements such as smart packaging (which can monitor temperature and tampering), automation in packaging lines, and the integration of AI for packaging design are becoming game-changers. These innovations not only improve efficiency but also reduce waste and costs in the long run.

Outlook

Protective packaging market is no longer just a backend logistics concern—it’s a strategic asset. With the market set to nearly double over the next decade, businesses that prioritize innovation, sustainability, and adaptability in their packaging strategies will be better positioned to thrive in an increasingly competitive landscape.

From cushioning to compliance, the future of protective packaging is dynamic, and it’s reshaping how products are shipped, received, and experienced around the world.

The Saudi Arabia refractories market was valued at USD 160.2 million in 2021 and is expected to grow steadily, reaching USD 254.6 million by 2029. This represents a compound annual growth rate (CAGR) of 6.4% over the forecast period from 2022 to 2029. Like many industries, the market faced significant challenges during the global COVID-19 pandemic, which led to a sharper decline in demand than anticipated. In fact, the market contracted by 4.9% in 2020 compared to 2019, reflecting the broader impact of pandemic-related disruptions across the country.

In recent years, Saudi Arabia refractories market has been rapidly transforming its economy, pushing beyond oil dependency and embracing large-scale industrial development. Amid this wave of progress, one crucial but often overlooked sector is making quiet but steady gains the refractories market.

Saudi Arabia refractories market are materials that can withstand extremely high temperatures, corrosion, and physical wear. They’re essential for lining furnaces, kilns, incinerators, and reactors used in heavy industries like steel, cement, glass, and non-ferrous metals. As these industries grow in Saudi Arabia, so does the demand for reliable refractory solutions.

List Of Key Companies Profiled:

- Saudi Refractory Industries (Dammam)

- AOSCO Refractory (Dammam)

- FSN Company (Dammam)

- Arabian Refractories Factory Company (Dammam)

- Q & E Company Ltd. (Al Jubail)

- Alfran (Amman)

- Thermal Insulation UAE (Sharjah)

Vision 2030: Fueling the Fire

At the heart of Saudi Arabia’s industrial surge is Vision 2030 — the Kingdom’s strategic roadmap for diversifying its economy. This ambitious plan is bringing massive infrastructure projects to life, including NEOM City, the Red Sea Project, and a host of new industrial zones and transportation networks.

All of these projects require raw materials like steel, glass, and cement — industries that heavily rely on high-performance refractories. Every furnace that melts steel or kiln that produces cement must be lined with refractory materials to handle the extreme heat and wear. As industrial output increases, so does the need for these specialized materials.

Steel and Glass: Two Refractory Giants

The steel sector in Saudi Arabia refractories market is already a major consumer of refractories. With more than 40 steel producers operating within the Kingdom and production capacity exceeding 18 million tons annually, it’s no surprise that this segment dominates refractory demand.

Glass manufacturing is another rising star. As urban development expands, the need for construction glass, automotive glass, and solar panel components is growing. Refractories are vital in glass furnaces that operate continuously at high temperatures — making them indispensable to the entire production process.

Refractory Types: Shaped vs. Unshaped, Clay vs. Non-Clay

The market can be divided based on the form and material of refractories.

By form:

- Bricks & shaped refractories are leading the market. These traditional, pre-formed blocks are used for lining fixed structures like furnaces and kilns.

- Monolithic & unshaped refractories are gaining popularity in applications requiring on-site installation and complex shapes, such as in oil refineries or custom furnace designs.

By material:

- Clay-based refractories are currently more common. They’re cost-effective, easy to source, and suitable for many standard applications.

- Non-clay refractories, which include high-alumina, magnesia, and silicon carbide materials, offer superior performance in terms of heat resistance and chemical durability. These are becoming more sought-after in high-tech or highly corrosive environments.

Read More : https://www.fortunebusinessinsights.com/saudi-arabia-refractories-market-106924

Opportunities to Watch

While challenges exist, the opportunities in this sector are substantial:

- Localization of raw materials: If Saudi Arabia can explore and utilize local sources of refractory raw materials like bauxite, alumina, or fire clay, it could significantly reduce import reliance and create new jobs.

- Technological innovation: Companies investing in automated production, waste recycling, or eco-friendly formulations are likely to gain a competitive edge, especially as green certifications become more important.

- Specialized applications: As industries like aerospace, energy, and advanced manufacturing grow in the region, there will be a need for niche refractory solutions with extreme heat and corrosion resistance.

- Government support: Incentives for domestic manufacturing and technology upgrades could stimulate more growth, particularly for small and mid-sized companies.

Challenges on the Horizon

Despite its strong growth potential, the refractories market in Saudi Arabia faces several challenges:

- Import dependency

Much of the refractory raw materials and even finished products are still imported. This creates vulnerabilities in the supply chain, especially in times of global disruption. Local manufacturers are pushing to reduce this dependency, but developing a robust domestic supply chain will take time and investment. - Environmental regulations

Refractory production and usage can contribute to environmental issues such as CO₂ emissions and waste generation. As Saudi Arabia strengthens its environmental regulations, manufacturers must adapt with cleaner technologies, emissions controls, and more sustainable practices — all of which can increase costs. - High operating costs

Producing refractories — especially high-performance types — requires significant energy and specialized equipment. This can be a barrier for new entrants and a profitability concern for smaller players in the market.

Outlook

The Saudi Arabia refractories market in Saudi Arabia is entering a phase of exciting growth, closely tied to the country’s broader industrial and infrastructure development goals. With strong demand from steel, glass, cement, and other sectors — and backing from Vision 2030 — the market is well-positioned for expansion.

Still, to unlock its full potential, the industry must navigate challenges related to imports, sustainability, and cost-efficiency. Those who invest early in innovation, local sourcing, and regulatory compliance will likely emerge as the long-term winners in this high-heat, high-stakes industry.

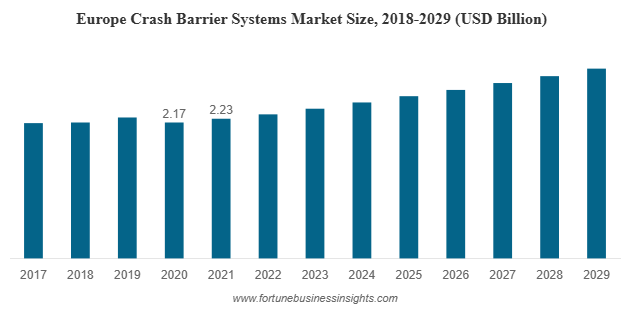

The global crash barrier systems market was valued at USD 6.79 billion in 2021 and is expected to expand from USD 7.01 billion in 2022 to USD 9.35 billion by 2029, reflecting a CAGR of 4.2% during the forecast period. Asia Pacific led the market in 2021 with a share of 32.84%, supported by large-scale infrastructure development. In the United States, the crash barrier systems market is projected to witness substantial growth, reaching USD 2.23 billion by 2032, fueled by advancements in technology and evolving construction practices.

When we think of infrastructure, our minds often go to the wide stretches of highways, towering bridges, or the speed of vehicles that move across them. Yet, one of the most critical elements that keeps these systems safe often goes unnoticed—the crash barrier system. These barriers, whether fixed or portable, are silent guardians that protect lives, vehicles, and properties by reducing the impact of collisions. With the rapid pace of road construction and urbanization worldwide, the demand for reliable crash barrier systems is set to climb steadily in the coming years.

List of Top Crash Barrier Systems Companies:

- Tata Steel (India)

- Lindsay Corporation. (U.S.)

- Transpo Industries Inc. (U.S.)

- Hill and Smith (UK)

- RoadSafe Traffic Systems, Inc. (U.S.)

- Trinity Highway Products, LLC. (U.S.)

- Valmont Industries (U.S.)

- Pinax Steel Industries (India)

- Volkmann & Rossbach GmbH & Co. KG (Germany)

Rising Demand

- Infrastructure Boom

Developing nations like India, China, and Brazil are investing heavily in roads, bridges, and flyovers. The more miles of road we build, the greater the need for safety barriers to reduce risks in areas with high traffic density or difficult terrain. Every highway expansion project now accounts for crash barriers as a fundamental requirement, not just an add-on.

- Stricter Road Safety Regulations

Governments around the globe are tightening safety norms to reduce accidents and fatalities. Many new projects cannot even proceed without integrating roadside, bridge, or median barriers into their designs. As policies grow stricter, manufacturers and contractors are compelled to prioritize safety solutions.

- Rising Vehicle Ownership

The surge in urbanization has led to more vehicles on the road, which unfortunately increases the likelihood of accidents. Crash barrier systems act as preventive tools, keeping vehicles from veering off the road, falling into ditches, or colliding with oncoming traffic.

- Preference for Fixed Barriers

Among product types, fixed crash barriers dominate the market. These include steel guardrails and rigid concrete barriers designed for permanent protection. Fixed barriers are particularly crucial in accident-prone areas such as mountainous roads, highways, and bridges where the margin for error is minimal.

Key Market Segments

By Type: Fixed vs. Portable

Fixed barriers remain the most widely adopted due to their durability and effectiveness in high-risk zones. However, portable crash barriers are gaining traction, especially for temporary construction sites or work zones. They provide flexibility, ease of installation, and cost advantages for short-term projects.

By Technology: Rigid, Semi-Rigid, Flexible

- Rigid barriers hold the largest share as they provide the strongest form of restraint, preventing vehicles from breaking through.

- Semi-rigid barriers such as W-beam steel guardrails balance impact absorption with containment, making them suitable for highways.

- Flexible barriers, like wire rope systems, absorb impact energy and reduce vehicle damage, though they are used in more specific applications.

By Application

Roadside barriers lead the way, especially on highways, mountain passes, and bridge edges. Median barriers prevent head-on collisions, while bridge barriers safeguard vehicles from plunging into rivers or valleys. Work zone barriers, often portable, are vital in protecting both construction workers and drivers in temporary high-risk areas.

By Region

Asia Pacific is the clear leader, accounting for nearly one-third of the global market. The massive investments in road infrastructure in India and China drive this dominance. Europe also holds a strong position due to its stringent safety standards and modernization efforts, while North America continues to expand steadily, supported by investments in upgrading highways and bridges.

Read More : https://www.fortunebusinessinsights.com/crash-barrier-system-market-106084

Opportunities

The future of crash barrier systems market is bright, with innovation and safety driving momentum. Several key trends are expected to shape the coming years:

- Portable Innovation: Lighter, modular, and more durable portable barriers will become common in construction zones, offering flexibility without compromising safety.

- Smart Barriers: Integration of sensors and reflective materials could lead to intelligent barrier systems that monitor impacts, alert authorities, and enhance visibility at night.

- Eco-Friendly Materials: With sustainability gaining importance, manufacturers may increasingly use recyclable or low-carbon materials to create greener barrier systems.

- Government Investments: Large-scale road projects across Asia, Africa, and Latin America will continue to push demand for roadside and bridge safety solutions.

Key Industry Developments:

- June 2021: Trinity Highway Products, LLC signed an agreement with Highway Care Ltd. to produce, sell, and rent the MASH-tested HighwayGuard Barrier in North America. With this partnership, Trinity Highway broadened its commitment to offer innovative roadway solutions of HighwayGuard to Mexico, the U.S., and Canada.

- August 2019: Lindsay Corporation launched ABSORB-M, a new, non-redirective, water-filled crash cushion system. The product is suited for unanchored and anchored barriers. With this launch, the company would expand its product line.

Why It Matters

Crash barrier systems market may seem like simple roadside structures, but they save countless lives every year. For governments, they represent compliance with global safety standards. For contractors and builders, they are critical to meeting project requirements. For manufacturers, they provide opportunities to innovate and grow. And for everyday drivers, they mean safer journeys, fewer fatal accidents, and greater peace of mind.

Challenges Facing the Market

While growth prospects are promising, the market is not without hurdles:

- Raw Material Costs: Steel, aluminum, and rubber prices fluctuate regularly, creating challenges for manufacturers in maintaining stable pricing.

- Impact Concerns: Although barriers reduce the severity of accidents, rigid systems may sometimes cause secondary damage to vehicles, leading to debates about design and application.

- High Installation Costs: Quality crash barrier systems require significant investment in both materials and skilled labor. Maintenance adds further to lifecycle costs.

Future Outlook

The global crash barrier systems market is steadily expanding, projected to grow from just over USD 7.01 billion in 2022 to more than USD 9.35 billion by 2029. This growth is driven by infrastructure development, regulatory enforcement, and increasing vehicle traffic worldwide. Although challenges such as cost and material volatility remain, the opportunities for innovation, sustainability, and smarter safety systems point to a promising future.

In the end, crash barriers are more than just physical structures—they are critical lifelines that protect drivers, passengers, and communities, making them indispensable to the modern world of infrastructure.