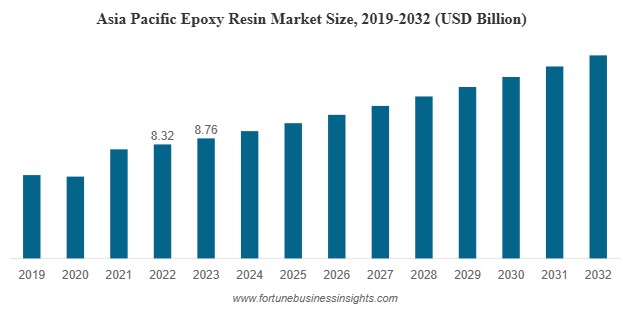

The global epoxy resin market was valued at USD 12.74 billion in 2023 and is expected to reach USD 21.37 billion by 2032, registering a CAGR of 5.9% during the forecast period. In 2023, Asia Pacific led the market, accounting for 68.76% of the global share.

List Of Key Companies Profiled

- Kukdo Chemical Co., Ltd. (South Korea)

- Huntsman Corporation (U.S.)

- Olin Corporation (U.S.)

- Nan Ya Plastics Corporation (Taiwan)

- Hexion Inc. (Westlake Chemicals) (U.S.)

- Chang Chun Group (Taiwan)

- Aditya Birla Chemicals (India)

- Sika Group (Switzerland)

- DIC Corporation (Japan)

- China Petrochemical & Chemical Corporation (China)

Market Overview

Epoxy resins market are thermosetting polymers that cure when mixed with a hardener, forming durable materials that offer high performance even under extreme conditions. They are extensively used in paints and coatings, adhesives, composites, electrical insulation, and structural applications. The growing focus on infrastructure development, energy efficiency, and lightweight materials is significantly propelling the adoption of epoxy-based systems across industries.

In 2023, Asia Pacific dominated the global epoxy resin market with an impressive share of nearly 68.76%. The region’s dominance is attributed to robust industrialization, large-scale manufacturing activities, and increasing construction projects in China, India, Japan, and South Korea. Furthermore, rising investments in wind energy, electric vehicles, and smart electronics are creating new growth opportunities for resin manufacturers in the region.

Key Growth Drivers

- Expanding Construction and Infrastructure Activities

Epoxy resins market are increasingly used in flooring, coatings, adhesives, and structural composites within the construction sector. Their resistance to chemicals, abrasion, and moisture makes them ideal for industrial floors, bridges, and marine structures. With global infrastructure spending on the rise, especially in developing economies, the construction segment continues to be a major growth driver. - Increasing Demand from the Electronics Sector

Epoxy resins are widely used in the production of printed circuit boards, semiconductors, and encapsulating materials for electrical components. Their superior electrical insulation and thermal stability help protect delicate components from moisture and corrosion. The expanding consumer electronics industry, coupled with the growth of electric vehicles and 5G technology, is further strengthening demand in this segment. - Growing Use in Wind Energy and Composites

As the renewable energy sector accelerates, epoxy resins are finding growing use in the fabrication of wind turbine blades and lightweight composites. Their ability to enhance strength while maintaining lightness makes them vital for improving turbine efficiency. The push toward clean energy generation is expected to fuel steady growth for epoxy resins in the coming decade. - Rising Adoption of Bio-based and Sustainable Resins

With increasing emphasis on sustainability, several manufacturers are investing in the development of bio-based epoxy resins derived from natural feedstocks such as lignin, vegetable oils, and tannins. These eco-friendly alternatives reduce dependence on petrochemical raw materials and help lower carbon footprints. The shift toward green chemistry and stricter environmental regulations are encouraging companies to innovate in this direction.

Challenges Facing the Market

Despite promising growth prospects, the epoxy resin market faces certain challenges. Fluctuations in raw material prices—particularly bisphenol A (BPA) and epichlorohydrin—often affect profit margins and pricing stability. Additionally, the growing regulatory scrutiny on BPA usage and volatile organic compound (VOC) emissions is pushing manufacturers to adopt safer and more sustainable production technologies.

Another challenge lies in market fragmentation. The presence of multiple regional players, especially in Asia Pacific, results in intense price competition. To overcome these challenges, major manufacturers are focusing on capacity expansion, strategic collaborations, and vertical integration to ensure consistent raw material supply and improved economies of scale.

Read More : https://www.fortunebusinessinsights.com/epoxy-resin-market-106597

Competitive Landscape

The global epoxy resin industry is moderately consolidated, with key players focusing on innovation, capacity expansion, and product differentiation. Prominent companies operating in the market include Kukdo Chemical, Hexion, Aditya Birla Chemicals, Olin Corporation, Huntsman Corporation, Nan Ya Plastics Corporation, Chang Chun Plastics, Sika AG, and DIC Corporation.

Several companies are expanding their manufacturing capabilities to cater to rising demand. Grasim Industries, a part of the Aditya Birla Group, recently expanded its epoxy production capacity in Gujarat, India. Kukdo Chemical established a new 40,000-ton-per-year plant in Gujarat to strengthen its presence in the Indian market. DCM Shriram also announced investments to enhance domestic epoxy capacity, reflecting the industry’s strong growth trajectory.

Regional Insights

- Asia Pacific remains the largest and fastest-growing regional market, driven by construction, electronics, and renewable energy sectors.

- Europe benefits from strong demand in automotive and wind energy applications, particularly in Germany and Spain.

- North America continues to see consistent growth due to infrastructure investments and increasing use of advanced materials in aerospace and defense.

- Latin America and the Middle East & Africa are gradually emerging as potential markets due to industrial development and expanding chemical manufacturing capacities.

Key Industry Developments

- March 2024 – Grasim Industries Limited, in its Chemical business, inaugurated the capacity expansion project of Epoxy resins and formulation capacity at Vilayat, Gujarat. Grasim Industries Limited is a subsidiary of Aditya Birla Group. With this capacity expansion, the company’s overall capacity for its advanced materials will increase to 246,000 tons per annum.

- February 2024 – India’s DCM Shriram announced the expansion of its epoxy manufacturing plant with an investment plan of USD 120.6 million over the next years.

Future Outlook

The epoxy resin market is poised for steady and diversified growth over the next decade. Companies that invest in sustainable technologies, bio-based formulations, and efficient manufacturing practices are likely to capture emerging opportunities. Increasing collaborations between resin producers and end-use industries, particularly in wind energy and advanced composites, will help accelerate innovation and strengthen market position.

In the coming years, the focus will also shift toward high-performance and specialty epoxy systems designed for niche applications such as 3D printing, aerospace components, and electronics encapsulation. With continuous advancements in material science, epoxy resins will remain essential to innovation in coatings, adhesives, and composite technologies worldwide.

The epoxy resin market’s outlook is promising, supported by solid demand across diverse end-use industries and increasing investments in sustainability. While challenges such as raw material volatility and regulatory compliance persist, the shift toward bio-based materials and advanced composites offers significant opportunities for manufacturers. As global economies move toward cleaner technologies and lightweight solutions, epoxy resins will continue to play a crucial role in shaping the materials landscape of the future.

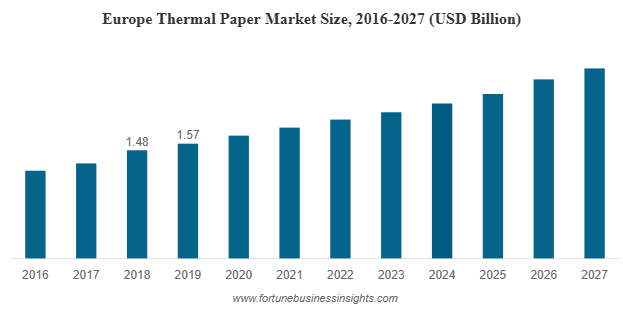

The global thermal paper market was valued at USD 3.45 billion in 2019 and is expected to grow to USD 5.85 billion by 2027, registering a CAGR of 6.9% during the forecast period. Europe led the market with a 42.03% share in 2019, supported by extensive retail infrastructure and high adoption of POS systems. In the United States, the market is projected to reach USD 1.01 billion by 2027, driven by increasing demand for cost-efficient printing solutions across point-of-sale terminals, ATMs, and ticketing applications.

Thermal paper market plays an indispensable role in modern business operations, serving as a key substrate for receipts, labels, tickets, and tags. It is widely used in point-of-sale (POS) systems, ATMs, logistics, and healthcare applications, making it an essential component of everyday transactions across multiple industries. As the global economy continues to digitize, the demand for high-performance, durable, and environmentally friendly printing solutions is evolving rapidly, shaping the dynamics of the thermal paper market.

List Of Key Companies Profiled:

- Lecta (Spain)

- Hansol Paper (Korea)

- Appvion Operations, Inc. (USA)

- Domtar Corporation (USA)

- Ricoh Industrie France SAS (France)

- Mitsubishi Hi-Tech Paper (Germany)

- Koehler Paper Group (Germany)

- Kanzaki Specialty Papers, Inc. (USA)

- Jujo Thermal Ltd. (Finland)

- Oji Paper Co., Ltd. (Japan)

Market Overview and Regional Insights

The thermal paper market is segmented based on width, printing technology, and application. By width, the 3.125-inch (80 mm) segment dominates due to its extensive use in POS systems, ticketing, and gaming applications. When it comes to printing technology, direct thermal printing holds the largest share, primarily because of its simplicity, cost-effectiveness, and reduced maintenance requirements. However, thermal transfer printing is gaining popularity due to its superior print quality and long-lasting image stability, especially in industrial and logistics applications.

From a regional standpoint, Europe held the leading share in 2019, accounting for more than 40% of the global market. The region’s dominance can be attributed to a well-established retail infrastructure, widespread POS adoption, and stringent regulatory policies encouraging the use of BPA-free thermal paper. North America follows closely, supported by a mature retail industry and strong demand for receipts and labels in various commercial settings.

Asia Pacific, however, is expected to exhibit the fastest growth over the forecast period. Rapid urbanization, a surge in cashless transactions, and the expansion of e-commerce and logistics sectors in countries such as China and India are propelling the market forward. Furthermore, growing investments in transportation, ticketing systems, and healthcare facilities are expanding the use of thermal paper in this region.

Key Market Drivers

- Growth of POS and Retail Systems

The rapid digitalization of payment systems has resulted in an increase in POS terminals worldwide. Despite the rise of paperless receipts, a large portion of retail and small businesses continue to rely on printed receipts for proof of purchase, audits, and compliance purposes. This continued reliance is fueling demand for thermal paper rolls in supermarkets, convenience stores, and hospitality sectors.

- Expansion of E-commerce and Logistics

Thermal paper is widely used for printing barcodes, shipping labels, and tracking tags—core elements in supply chain management. With global parcel volumes expected to grow significantly over the coming years, logistics companies are increasingly adopting durable and high-contrast thermal paper for labeling and tracking shipments. This trend directly supports market expansion, particularly in the Asia Pacific and North American regions.

- Shift Toward BPA-Free and Sustainable Products

Traditional thermal papers often used Bisphenol-A (BPA) as a developer, which raised health and environmental concerns. Regulatory authorities have restricted BPA usage in many regions, pushing manufacturers to develop BPA-free alternatives using safer chemicals such as BPS, Pergafast-201, and TGSA. The transition toward eco-friendly and non-toxic coatings has become a defining trend in the thermal paper market. Companies investing in green chemistry and recyclable substrates are expected to gain a competitive edge in the coming years.

Read More : https://www.fortunebusinessinsights.com/thermal-paper-market-102811

Challenges Impacting Market Growth

While the thermal paper market continues to expand, it faces several challenges. The growing adoption of digital and e-receipt solutions in developed economies is reducing the need for physical receipts in some segments. Additionally, fluctuating raw material costs, particularly for paper and chemicals, can impact profit margins for manufacturers.

Another challenge stems from environmental concerns. Despite efforts to replace BPA, the industry faces scrutiny over the recyclability and disposal of thermal paper, as many coated varieties cannot be easily processed through standard recycling systems. Furthermore, as mobile payment systems and digital receipts become more popular, especially in urban markets, thermal paper suppliers will need to diversify applications and explore new growth avenues such as industrial labeling and healthcare diagnostics.

Competitive Landscape

The global thermal paper market is moderately consolidated, with several major players dominating production and distribution. Leading manufacturers include Lecta, Hansol Paper, Appvion Operations, Domtar Corporation, Ricoh Industrie France, Mitsubishi Hi-Tech Paper, Koehler Paper Group, Jujo Thermal, and Oji Paper Co. These companies are focusing on research and development to enhance product durability, print quality, and environmental sustainability.

Strategic initiatives such as mergers, acquisitions, and capacity expansions are also reshaping the competitive landscape. For instance, several companies have increased investments in BPA-free coatings and advanced thermal transfer technologies to meet global regulatory standards and consumer preferences. Additionally, firms are expanding their presence in fast-growing markets like Asia Pacific to leverage rising consumption from retail, logistics, and public transportation sectors.

Key Industry Developments:

- July 2019 – Lecta announced that all the thermal paper it supplies in the European Union will be BPA-free, to comply with the prohibition announced by the EU from January 2020.

- February 2020 – Domtar Corporation announced the acquisition of the POS paper business of Appvion Operations, Inc. The transaction includes acquirement of the coater and related equipment located at Appvion’s Ohio based facility. Domtar seeks to make a globally competitive POS paper business and open new avenues for the growth of the company via this acquisition.

Future Outlook

The thermal paper market outlook remains positive, driven by ongoing demand from POS, ticketing, and labeling applications. Despite the growing shift toward digital receipts, thermal paper will continue to play a crucial role in industries where physical documentation is required for compliance, verification, or operational convenience. The development of sustainable, BPA-free thermal coatings will remain a central theme, influencing product innovation and consumer choice.

Manufacturers focusing on product diversification, eco-friendly materials, and value-added printing solutions are likely to strengthen their position in the evolving market. As emerging economies continue to expand their retail and transportation infrastructure, the global thermal paper market is poised to achieve steady and resilient growth through the end of the decade.

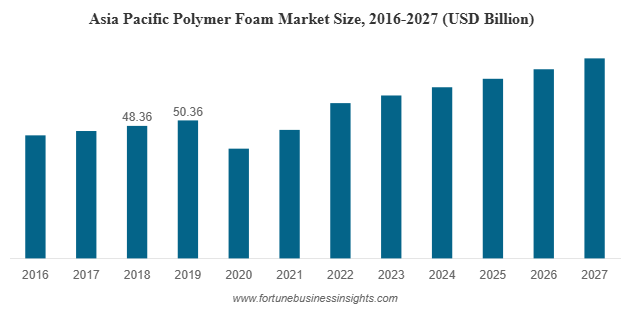

The global polymer foam market size was USD 114.88 billion in 2019 and it is projected to reach USD 157.63 billion by 2027, exhibiting a CAGR of 7.73% during the forecast period. Asia Pacific dominated the polymer foam market with a market share of 43.84% in 2019. Moreover, the U.S. polymer foam market is projected to reach USD 23.49 million by 2027, supported by its use in furniture, automotive, and construction insulation.

List Of Key Companies Covered:

- Sealed Air (U.S.)

- Arkema (France)

- Armacell International S.A. (Germany)

- Borealis AG (Austria)

- Polymer Technologies, Inc. (U.S.)

- Zotefoams plc (UK)

- Synthos (Poland)

- Sekisui Alveo (Switzerland)

- BASF SE (Germany)

Expanding Applications Across Industries

Polymer foam market have established their presence in a wide range of applications, including building and construction, automotive, packaging, furniture, appliances, and footwear. Each of these industries benefits from the material’s versatility and adaptability.

In the building and construction industry, polymer foams are widely used for insulation, roofing, sealing, and soundproofing. They contribute significantly to energy efficiency by maintaining temperature stability, reducing heating and cooling costs, and enhancing overall building performance. The rising focus on green construction and sustainable materials is expected to further drive demand for polymer foam-based insulation solutions.

In the automotive sector, polymer foam market play a vital role in improving comfort, noise reduction, and vehicle light weighting. They are extensively used in seats, headrests, armrests, and sound-damping components. The ongoing shift toward fuel efficiency and electric vehicles is creating new opportunities for foam manufacturers to innovate in lightweight and recyclable materials.

The packaging industry remains one of the largest consumers of polymer foam market, particularly for protecting delicate and temperature-sensitive goods. Foam packaging offers superior cushioning, impact resistance, and thermal insulation, making it ideal for food, electronics, and pharmaceutical products. With the growth of e-commerce and logistics, demand for efficient packaging materials is expected to remain strong.

In the furniture and bedding industry, polymer foam market such as polyurethane and memory foam are widely used in mattresses, pillows, and cushions due to their softness, resilience, and ergonomic support. The growing preference for comfort-based and orthopedically supportive products is pushing manufacturers to develop advanced foam formulations.

Rising Popularity of Memory Foam

Memory foam has emerged as one of the most dynamic sub-segments of the polymer foam market. Initially developed for aerospace applications, it has gained widespread popularity in consumer products such as mattresses, footwear, and seating. The material’s viscoelastic nature allows it to adapt to body contours, offering superior comfort and pressure relief. Growing consumer awareness about sleep quality and ergonomic design continues to boost the adoption of memory foam-based products globally.

Regional Insights: Asia Pacific Dominates the Market

The Asia Pacific region holds a dominant position in the global polymer foam market, accounting for over 43.84% of the total share in 2019. The region’s growth is fueled by rapid urbanization, infrastructure development, and rising disposable incomes in countries such as China, India, and Indonesia. Increased construction activities, coupled with strong demand from packaging and automotive sectors, have created a thriving market for polymer foam manufacturers in the region.

Europe remains a key market driven by the automotive and construction industries, where stringent energy efficiency regulations are encouraging the use of insulating materials. The North American market also shows steady growth, supported by demand for high-performance foams in industrial and consumer applications. Meanwhile, Latin America and the Middle East & Africa are emerging markets, expected to grow gradually as industrialization and infrastructure development gain momentum.

Challenges and Environmental Concerns

Despite its promising growth trajectory, the polymer foam market faces several challenges. Environmental concerns associated with non-biodegradable foam waste remain a major issue. Most polymer foams are derived from petrochemical sources, raising questions about recyclability and end-of-life disposal. Governments and organizations are now pushing for stricter environmental standards and promoting the use of recyclable or bio-based alternatives.

Recycling polymer foam market is technically possible but often economically unviable due to its low density and bulky nature. This makes transportation and processing costly. To overcome these issues, manufacturers are increasingly investing in advanced recycling technologies and developing biodegradable formulations to minimize environmental impact.

Volatility in raw material prices is another significant restraint. The dependence on crude oil-derived feedstocks makes polymer foam prices sensitive to global energy market fluctuations. Moreover, disruptions in supply chains, such as those caused by the COVID-19 pandemic, have highlighted the need for greater resilience and local sourcing strategies within the industry.

Read More : https://www.fortunebusinessinsights.com/industry-reports/polymer-foam-market-101698

Market Segmentation Overview

By type, the market is segmented into polyurethane (PU), polystyrene (PS), polyvinyl chloride (PVC), and others. Polyurethane foam dominates the market due to its extensive use in insulation, furniture, and packaging. Polystyrene foam remains a popular choice for packaging and construction due to its cost-effectiveness and excellent insulation properties. PVC foam is gaining attention in furniture, panels, and decorative applications because of its durability and lightweight nature.

By application, building and construction remains the largest segment, followed by automotive and packaging. The construction sector’s demand for efficient insulation materials is expected to accelerate further with the increasing emphasis on sustainable and energy-efficient infrastructure.

Key Industry Developments

-

August 2019: Sheela Foam Limited, largest manufacturer of mattresses and foam based in India, acquired Interplasp SL, a Spanish Company, which has an annual production of 11,000 tons (total capacity 22,000 tons) of polyurethane foam for bedding and furniture applications.

- March 2019: Sika AG, a specialty chemical manufacturer of bonding, damping, sealing, reinforcing solutions for automotive and construction industries, acquired Belineco LLC, a Belarus-based producer of polyurethane foam systems. With this acquisition, Sika is further expected to develop its technology to manufacture polyurethane foams.

Competitive Landscape and Strategic Developments

Strategic initiatives such as mergers, acquisitions, and new product launches are helping companies strengthen their market positions. For instance, Sheela Foam’s acquisition of Interplasp SL expanded its polyurethane foam footprint in Europe. Similarly, Sika AG’s acquisition of Belineco LLC enhanced its polyurethane foam systems portfolio. These developments reflect a clear industry trend toward diversification and global expansion.

Future Outlook

The future of the polymer foam market looks promising, with continuous innovation in product design and sustainability. As industries shift toward lightweight, energy-efficient, and eco-friendly materials, polymer foams are expected to play an increasingly vital role. The growing emphasis on recyclable and bio-based foams will open new avenues for manufacturers while meeting environmental objectives.

Overall, the polymer foam market is on track for sustained growth, driven by urbanization, industrial development, and consumer preference for comfort and performance-based materials. Companies that invest in sustainable production technologies and strategic collaborations are likely to lead this evolving global market.

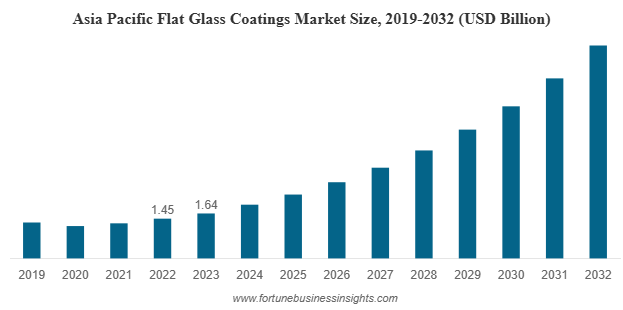

The global flat glass coatings market was valued at USD 2.50 billion in 2023 and is projected to expand from USD 2.98 billion in 2024 to USD 11.50 billion by 2032, registering an impressive CAGR of 18.0% during the forecast period. Asia Pacific emerged as the leading region, accounting for 65.6% of the global market share in 2023.

List Of Key Companies Profiled:

- Arkema S.A. (France)

- The Sherwin-Williams Company (U.S.)

- Nippon Sheet Glass Co., Ltd (Japan)

- Guardian Glass (U.S.)

- Ferro Corporation (U.S.)

- Fenzi Group (Italy)

- Corning Inc. (U.S.)

- Vitro Architectural Glass (Mexico)

- Hesse GmbH & Co. KG (Germany)

- Viracon (U.S.)

Market Overview

Flat glass coatings market have evolved from being just a protective layer to a core enabler of performance, energy efficiency, and sustainability across industries. From architectural façades to solar panels and automotive glazing, coated glass is redefining how modern infrastructure interacts with light, heat, and the environment. As technology advances and green building initiatives expand, the global flat glass coatings market is witnessing remarkable growth and innovation.

The market’s transformation is also linked to technological advancements in nanocoatings, water-based solutions, and multifunctional protective layers that enhance glass performance in various environmental conditions.

Key Growth Drivers

Rising Demand for Solar Energy Applications

One of the strongest forces driving the flat glass coatings market is the rapid growth of the solar energy industry. Solar panels rely on coated glass to improve energy absorption and minimize light reflection. Anti-reflective and hydrophobic coatings play a crucial role in increasing efficiency and reducing maintenance costs for photovoltaic systems. As renewable energy adoption accelerates worldwide, the need for high-performance coatings in solar panels is expected to multiply.

Sustainable Construction and Energy Efficiency Trends

The construction industry is undergoing a major sustainability transformation. Governments and private developers are investing in green buildings that reduce energy consumption and improve occupant comfort. Coated flat glass helps achieve these goals by controlling heat transfer, blocking harmful UV rays, and allowing optimal daylight transmission. Low-emissivity (Low-E) coatings, for instance, have become essential in modern architecture for maintaining thermal balance and reducing energy costs.

Technological Advancements in Coating Materials

Innovation is another cornerstone of this market’s expansion. The industry is moving toward water-based coatings and nano-coatings that deliver better performance while complying with environmental regulations. Water-based coatings produce lower volatile organic compound (VOC) emissions, aligning with sustainability standards. Meanwhile, nano-coatings provide additional benefits such as self-cleaning, anti-bacterial, anti-fog, and scratch-resistant properties. These advancements not only improve durability but also open up new applications in automotive, electronics, and decorative sectors.

Market Challenges

While the outlook is highly positive, certain challenges persist.

- Environmental Regulations: Traditional solvent-based coatings often contain high levels of VOCs, which can be harmful to both the environment and human health. Stringent environmental rules across Europe and North America have limited their usage, pushing manufacturers to invest in cleaner alternatives.

- Raw Material Volatility: Price fluctuations in raw materials, including resins and solvents, can affect production costs and profit margins.

- Supply Chain Disruptions: The pandemic underscored vulnerabilities in global supply chains, highlighting the importance of local sourcing and diversification strategies.

Market Segmentation Insights

- By Resin Type

Acrylic resins dominate the flat glass coatings market, valued for their exceptional weather resistance, clarity, and cost-effectiveness. Polyurethane and epoxy resins follow closely, providing enhanced durability and chemical resistance for demanding environments.

- By Technology

Water-based coatings hold the largest market share due to their eco-friendly characteristics and regulatory compliance. However, nano-coating technology is emerging as the fastest-growing segment, driven by its superior optical clarity, resistance, and multifunctionality.

- By Application

The mirror application segment currently leads the market, particularly in interior design and automotive sectors. Architectural applications are growing rapidly as smart cities and energy-efficient infrastructure projects increase worldwide. Solar, decorative, and automotive applications are also witnessing robust growth, supported by aesthetic preferences and functional requirements.

Read More : https://www.fortunebusinessinsights.com/flat-glass-coatings-market-102910

Regional Analysis

- Asia Pacific

Asia Pacific remains the dominant regional market, accounting for approximately 65.6% of the global share in 2023. The growth is largely attributed to massive infrastructure development, rapid urbanization, and expanding solar energy capacity in countries such as China, India, and Japan. The region’s booming construction and automotive industries further amplify demand for advanced glass coatings.

- North America and Europe

Both North America and Europe are expected to post steady growth through 2032. Stringent energy-efficiency regulations, coupled with strong adoption of solar technologies and green building standards, are major contributing factors. Europe, in particular, is witnessing significant demand for low-E and anti-reflective coatings in both residential and commercial buildings.

- Rest of the World

Regions such as the Middle East, Africa, and Latin America are gradually embracing flat glass coatings, driven by the expansion of construction and renewable energy projects. Increasing awareness about sustainable materials and technological modernization is expected to create new growth avenues across these markets.

Key Industry Developments:

- September 2021: Guardian Glass started to produce 130” x 240” or superjumbo, SunGuard coatings on clear or Guardian UltraClear float glass at its Carleton, Michigan facility. The flat glass manufacturer has responded to the demand from architects who have pushed design boundaries with buildings that maximize views and natural light for occupants in forward-thinking facades while also reaching energy performance codes and standards.

- April 2021: Ferro Corporation, a leading global supplier of technology-based functional coatings and color solutions, announced that Prince International Corporation (Prince) has completed the previously announced acquisition of Ferro.

Competitive Landscape

The flat glass coatings industry is characterized by intense competition and continuous innovation. Leading companies are focusing on R&D initiatives, strategic partnerships, and geographic expansion to strengthen their global presence. Manufacturers are also investing in advanced coating technologies that enhance energy efficiency, optical quality, and longevity while minimizing environmental impact.

Future Outlook

Looking ahead, the flat glass coatings market is poised for transformative growth. The integration of nanotechnology, eco-friendly water-based solutions, and smart coatings will redefine performance standards in the glass industry. Moreover, the growing emphasis on sustainability and energy conservation will continue to boost adoption across multiple sectors.

In the next decade, the industry’s trajectory will be shaped by innovations that merge functionality with environmental responsibility. Companies that prioritize R&D investment, align with evolving regulations, and cater to high-growth applications—particularly in solar energy and green construction—will be best positioned to lead this dynamic market.

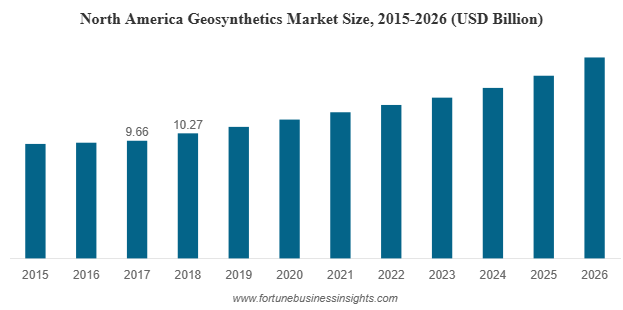

The global geosynthetics market was valued at USD 27.16 billion in 2018 and is expected to reach USD 45.25 billion by 2026, registering a CAGR of 6.6% during the forecast period. North America led the market in 2018 with a 37.81% share, driven by robust infrastructure investments. In the United States, the market is anticipated to witness substantial growth, projected to reach USD 4.56 billion by 2032, fueled by rising government expenditure on large-scale construction and infrastructure development projects.

As the world continues to urbanize at an unprecedented pace, sustainable construction materials are playing a vital role in reshaping modern infrastructure. Among these materials, geosynthetics market have emerged as indispensable components in civil, environmental, and geotechnical engineering projects. These synthetic materials, used to stabilize terrain and improve soil performance, are witnessing growing demand across diverse applications such as road construction, drainage, waste management, and mining.

List of Key Companies Profiled in Geosynthetics Market:

- Koninklijke Ten Cate bv

- GSE Environmental

- TENAX SPA

- Fibertex Nonwovens A/S

- Tensar International Corporation

- HUESKER

- Strata Systems, Inc.

- AGRU AMERICA, INC

- Global Synthetics

- Terram Geosynthetics Pvt. Ltd. (TGPL)

- CTM Geosynthetics

- Garware Technical Fibres Ltd.

Growing Adoption Across Infrastructure and Environmental Projects

One of the key factors driving the geosynthetics market is the surge in global infrastructure development. Governments and private sectors are investing heavily in transportation, roadways, railways, and water management systems. Geosynthetics market such as geotextiles, geomembranes, and geogrids enhance structural stability, control erosion, improve drainage, and extend the lifespan of these infrastructures.

In road construction, for example, geosynthetics market are used for reinforcement and separation, reducing the amount of aggregate material required while increasing pavement durability. This not only reduces project costs but also supports sustainable building practices by lowering resource consumption.

In the mining and waste management industries, geosynthetics market serve critical environmental functions. They act as liners and barriers to prevent groundwater contamination and ensure effective containment of hazardous materials. With rising concerns about waste management and stricter environmental regulations, demand for geosynthetic market liners in landfills and industrial waste facilities continues to expand.

Sustainability and Environmental Benefits

One of the most compelling advantages of geosynthetics market lies in their environmental impact. They help reduce the use of natural resources like sand and gravel, which are often extracted through environmentally harmful mining activities. By replacing traditional materials with geosynthetics market, construction projects achieve improved performance while minimizing their carbon footprint.

Geosynthetics market also play a key role in protecting natural landscapes. Their ability to control soil erosion, manage stormwater, and stabilize slopes makes them an essential solution in regions facing challenges like flooding, coastal erosion, and land degradation. Moreover, the development of new biodegradable and recycled geosynthetic products aligns well with global sustainability initiatives, giving the industry additional momentum toward a greener future.

Market Segmentation Insights

The geosynthetics market is segmented into several product categories, each catering to specific engineering needs. Geotextiles represent the largest product segment, accounting for more than 30% of total market share in recent years. Their versatility and widespread use in road construction, slope stabilization, drainage systems, and landfills make them the cornerstone of the industry.

Other key segments include geomembranes, widely used for containment applications; geogrids, which provide soil reinforcement; and geonets, which aid in drainage and filtration. Geosynthetic clay liners, geocells, and geocomposites are also witnessing increased adoption as engineers seek advanced materials that can perform multiple functions simultaneously.

From an application standpoint, the market covers infrastructure development, waste management, water management, mining, and erosion control. Among these, infrastructure development remains the leading segment, driven by expanding urbanization and the growing need for resilient public works.

Read More : https://www.fortunebusinessinsights.com/geosynthetics-market-102545

Regional Outlook

North America dominated the global geosynthetics market in 2018, accounting for nearly 38% of the total share. The region’s robust construction sector, strong regulatory frameworks, and high environmental awareness have all contributed to steady demand growth. The United States remains a key market, with significant applications in highway reinforcement, landfill containment, and stormwater management systems.

Asia Pacific is projected to experience the fastest growth during the forecast period. Rapid urbanization in countries such as India, China, and Indonesia, combined with government-led infrastructure initiatives, is creating substantial opportunities for geosynthetic manufacturers. The region’s growing focus on sustainable construction and environmental conservation is also boosting product demand.

Europe continues to be a mature yet dynamic market, with an emphasis on high-performance and eco-friendly materials. Meanwhile, regions such as the Middle East & Africa and Latin America are witnessing increasing adoption due to rising investments in transportation and mining projects.

Challenges and Constraints

Despite the promising outlook, the geosynthetics industry faces a few challenges. One key restraint is the potential for field damage during installation. Improper handling, exposure to ultraviolet light, or extreme temperature conditions can degrade the physical and mechanical properties of these materials. This highlights the importance of quality control, skilled installation, and regular inspection to ensure long-term performance.

Another concern lies in the initial cost of advanced geosynthetic market materials. While they deliver long-term cost savings through enhanced durability and reduced maintenance, the upfront investment can be higher than that of traditional alternatives, especially in developing economies. Additionally, limited awareness and lack of standardized regulations in some regions may slow down adoption rates.

Emerging Trends and Future Opportunities

Innovation is reshaping the geosynthetics market landscape. Manufacturers are increasingly focusing on developing products with improved mechanical strength, chemical resistance, and durability. The integration of smart materials, including sensor-embedded geosynthetics market for real-time monitoring of soil movement and drainage performance, is an exciting emerging trend.

Sustainability is also shaping product development. Companies are investing in recycled polymers, biodegradable materials, and production processes that reduce energy consumption and waste generation. The demand for green construction materials, coupled with stricter environmental regulations, is expected to further drive this shift.

Furthermore, new engineering techniques such as deep patch repair methods for road stabilization are expanding the range of applications for geosynthetics market. These advancements are expected to create lucrative opportunities for market players and encourage broader industry adoption.

Key Industry Developments:

- July 2019 - Ferguson Enterprises acquired Action Plumbing Supply and Innovative Soil Solutions to expand erosion control capabilities and geotextile business in the U.S.

- December 2017 – A Canadian-based company, Groupe Solmax, a provider of high-quality polyethylene (PE) geomembranes mainly for environmental and industrial applications, acquired manufacturer of geosynthetics lining, GSE Environmental. Both the companies will operate globally in the geosynthetics products business, delivering large manufacturing players with high-quality containment systems for industrial, domestic, or hazardous retention ponds, waste burial sites, heap leaching pads, and fracking.

Outlook

The geosynthetics market stands at the intersection of sustainability, innovation, and infrastructure development. As global construction activities surge and environmental awareness deepens, these materials are becoming integral to the future of modern engineering. Their ability to enhance durability, reduce environmental impact, and optimize project costs makes them a critical solution for building resilient and sustainable infrastructure worldwide.

With continued advancements in material science and increasing governmental support for sustainable practices, the geosynthetics market is poised for steady and transformative growth in the years ahead.

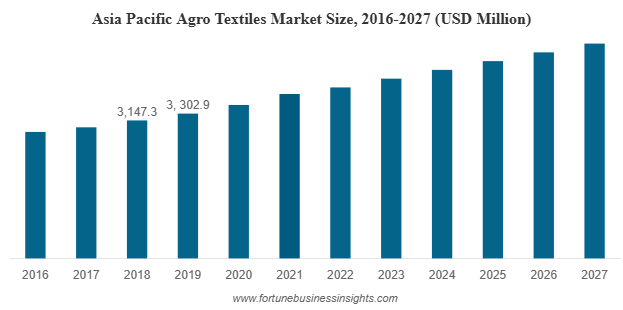

In 2019, the global agro-textiles market was valued at USD 9,612.8 million and is expected to grow to USD 13,458.7 million by 2027, reflecting a compound annual growth rate (CAGR) of 5.2% over the forecast period. The Asia-Pacific region led the market, accounting for 34.36% of the global share in 2019. In the United States, the agro-textiles market is projected to reach USD 1,766.4 million by 2027, driven by advancements in crop protection technologies and a growing emphasis on sustainable agricultural practices.

The global agriculture industry is undergoing a significant transformation. Driven by increasing population, climate change, and the need for sustainable farming practices, farmers are seeking innovative ways to boost productivity and safeguard crops. One of the most effective solutions gaining traction in recent years is the use of agro-textiles market specialized textiles designed specifically for agricultural and horticultural applications.

Agro-textiles market are playing a vital role in modern farming by offering protection, enhancing yield, and supporting environmental sustainability. From crop covers to shade nets, these fabrics are revolutionizing how we cultivate food, manage resources, and respond to climate challenges.

List of Top Agro Textiles Companies:

- SRF Limited (India)

- B&V Agro Irrigation Co. (India)

- (Japan)

- Beaulieu Technical Textiles. (Belgium)

- Meyabond Industry & Trading (Beijing) Co., Ltd. (China)

- Belton Industries. (U.S.)

- Neo Corp International Limited. (India)

- Hy-Tex (UK) Limited (U.K.)

- Diatex (France)

- Zhongshan Hongjun Nonwovens Co., Ltd. (China)

- Other Key Players

Agro-Textiles Market Overview

Agro-textiles market refer to woven, non-woven, or knitted textile materials used in agriculture, aquaculture, floriculture, and horticulture. They are made using synthetic polymers such as polyethylene (PE), polypropylene (PP), and polyester (PET), and are treated to withstand harsh environmental conditions.

Key applications of agro-textiles include:

- Shade nets to protect plants from excessive sunlight

- Mulch mats to control weed growth and retain soil moisture

- Crop covers to provide insulation and guard against pests

- Fishing nets for aquaculture and inland fisheries

- Anti-hail and bird protection nets to reduce crop damage

These materials help in reducing the need for chemical pesticides, improving crop health, and extending growing seasons.

Market Growth and Outlook

The agro-textiles market has witnessed steady growth over the past decade and is expected to continue expanding in the years ahead. One of the main factors contributing to this growth is the rising global demand for food. With agricultural land becoming increasingly limited, farmers are turning to agro-textiles to improve productivity per acre.

In recent years, the market size has grown significantly and is projected to maintain a strong compound annual growth rate (CAGR) through the coming decade. Innovations in textile materials, growing awareness of sustainable farming techniques, and supportive government policies are contributing to the upward trend.

Key Market Drivers

- Population Growth and Food Security

The global population continues to rise, putting pressure on the agriculture sector to increase food production. Agro-textiles support this goal by protecting crops from environmental damage and helping to increase yields. With better crop protection and efficient resource usage, farmers can meet higher demand without expanding farmland.

- Climate Change and Extreme Weather

Unpredictable weather patterns, extreme heat, hailstorms, and pest infestations are threatening crop health. Agro-textiles act as a shield against these challenges. Shade nets reduce heat stress, anti-hail nets protect delicate crops, and insect-proof covers help minimize the need for harmful pesticides.

- Sustainability and Reduced Chemical Usage

With growing concerns about soil health, pollution, and the environmental impact of chemical use, agro-textiles offer a viable alternative. Many of these products help control weeds and pests without chemicals, leading to safer, more eco-friendly farming. Some agro-textiles are even made using biodegradable materials, supporting long-term sustainability.

- Expansion of Aquaculture

Agro-textiles are not limited to land-based farming. They play a crucial role in aquaculture, particularly in fishing nets, feeding bags, and water filtration systems. As global demand for fish and seafood increases, the aquaculture sector is adopting more textile-based solutions to improve yields and reduce losses.

Read More : https://www.fortunebusinessinsights.com/agro-textiles-market-102963

Regional Insights

- Asia-Pacific

The Asia-Pacific region, led by countries like India and China, represents the largest market share for agro-textiles. The growing agricultural sector, increasing government support, and demand for protected cultivation methods are key drivers in this region.

- North America and Europe

In North America and Europe, the focus is shifting toward sustainable agriculture and organic farming. Governments are promoting eco-friendly agricultural practices, leading to greater adoption of high-quality agro-textiles. European countries are particularly keen on using biodegradable and recyclable materials.

- Latin America, Middle East & Africa

Emerging markets in Latin America and Africa are showing promising growth potential. While the adoption rate is currently lower compared to developed regions, awareness is rising, and investment in modern agriculture is growing steadily.

Challenges in the Agro-Textile Market

Despite strong growth prospects, the agro-textiles industry faces a few challenges:

- High Initial Costs: While long-term benefits are significant, the upfront investment can deter small-scale farmers.

- Lack of Awareness: In many regions, farmers are not fully aware of the benefits and applications of agro-textiles.

- Raw Material Volatility: The cost of polymers and synthetic materials used in production can fluctuate, affecting product pricing.

- Environmental Regulations: Increasing regulations on plastic-based products may require manufacturers to innovate sustainable alternatives.

Future Trends and Innovations

The agro-textiles industry is evolving rapidly. Key future trends include:

- Use of Biodegradable Materials: There is growing interest in natural fibers and biodegradable polymers to align with environmental goals.

- Smart Agro-Textiles: Innovations such as temperature-sensitive fabrics or moisture-responsive covers could help further optimize growing conditions.

- Customized Solutions: Manufacturers are offering product variants tailored to specific crops, climates, and geographies.

- Government Support: Subsidies and awareness campaigns are increasing in various countries to promote protected cultivation using agro-textiles.

Key Industry Developments:

- January 2020– Diatex presented in the world’s leading trade fair IPM ESSEN 2020 for horticulture that took place in Germany. The company will present a tailor-made plant protection system and other crop field protection products at the IPM ESSEN 2020.

Outlook

Agro-textiles market are proving to be a game-changer in modern agriculture and aquaculture. They enhance productivity, reduce environmental impact, and help farmers adapt to changing climate conditions. As the industry continues to innovate, agro-textiles will become an essential component of sustainable food production systems worldwide.

For businesses, investors, and policymakers, the agro-textiles market offers a compelling opportunity to contribute to both economic growth and environmental stewardship.

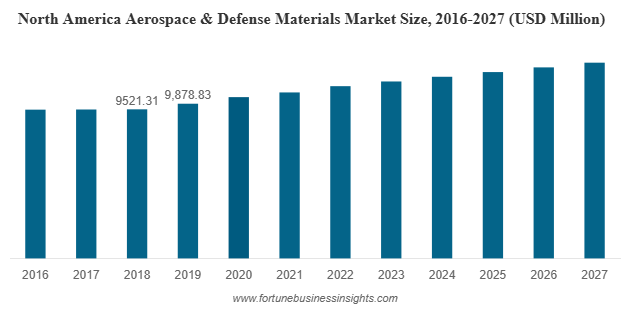

In 2019, the global aerospace and defense materials market was valued at USD 18,411.83 million and is expected to grow to USD 23,825.45 million by 2027, registering a compound annual growth rate (CAGR) of 4.21% over the forecast period. North America held the largest share of the market that year, accounting for 53.65% of the global total. The U.S., in particular, is anticipated to see its aerospace and defense materials market reach USD 12,019.42 million by 2027, driven by ongoing advancements in lightweight and high-performance material technologies.

List Of Key Companies Profiled In Aerospace And Defense Materials Market:

- Arconic Inc. (US)

- Toray Composite Materials America, Inc. (US)

- Huntsman (US)

- Evonik Industries (Germany)

- Hexcel Corporation (US)

- Materion Corp. (US)

- AMI Metals Inc. (US)

- TATA Advanced Materials Limited. (India)

- Koninklijke Ten Cate BV (Netherlands)

- Sofitec (Spain)

Market Overview

The global aerospace and defense materials sector is evolving rapidly, with materials innovation playing a central role in shaping its future. From lightweight composites to high-performance alloys, the demand for advanced materials is surging in response to growing commercial aviation needs, rising defense budgets, and the ongoing pursuit of fuel efficiency and sustainability.

This growth reflects both the rising demand for new aircraft and the modernization of existing fleets across key markets. Additionally, heightened geopolitical tensions and military modernization programs worldwide have created a favorable environment for defense material innovation and procurement.

Key Materials Driving the Aerospace & Defense Materials Market

Several types of materials are at the core of the aerospace and defense industry, each selected for its unique properties such as strength-to-weight ratio, corrosion resistance, fatigue durability, and thermal performance.

- Composites

Advanced composites—primarily carbon fiber-reinforced polymers—are increasingly being adopted in commercial and military aircraft due to their lightweight yet highly durable nature. They significantly reduce aircraft weight, leading to fuel savings and lower emissions. Composites are now commonly used in aircraft fuselages, wings, and interiors. Their ability to be molded into complex shapes also supports aerodynamic designs and structural innovations. - Aluminum Alloys

Long the material of choice for aircraft structures, aluminum alloys continue to dominate in terms of volume. Their affordability, workability, and corrosion resistance make them ideal for components like airframes, panels, and interior fittings. While being gradually supplemented by composites, aluminum remains essential in modern aircraft manufacturing. - Titanium Alloys

Titanium is prized for its exceptional strength, lightweight properties, and resistance to extreme temperatures and corrosion. It is used extensively in jet engines, landing gear, and high-stress structural components. Though more expensive than aluminum, its performance in critical applications justifies its use, especially in military and high-performance commercial aircraft. - Superalloys

These high-performance alloys—often based on nickel, cobalt, or iron—are used primarily in engine components where materials must withstand high thermal and mechanical stress. Superalloys are essential in maintaining the performance and reliability of jet propulsion systems, especially under extreme operating conditions.

Major Growth Drivers

Several interconnected factors are fueling the demand for advanced aerospace and defense materials market.

- Rising Global Air Traffic

Increasing urbanization and economic growth in developing countries have led to a surge in global air travel. This has spurred demand for new aircraft, particularly in the Asia-Pacific region, where expanding middle-class populations are driving airline growth. As aircraft production ramps up, so does the demand for high-quality structural materials. - Military Modernization and Spending

Governments around the world are investing heavily in defense modernization programs. These include the procurement of advanced fighter jets, drones, helicopters, and surveillance systems—all of which rely on high-performance materials to meet stringent durability and stealth requirements. National security concerns and geopolitical instability have further accelerated defense budgets globally. - Focus on Fuel Efficiency and Emissions Reduction

The aerospace industry is under pressure to meet environmental regulations and reduce its carbon footprint. This has led to a greater emphasis on lightweight materials that help improve fuel efficiency. The integration of composites and titanium is helping manufacturers design aircraft that consume less fuel without compromising safety or performance. - Aging Aircraft Fleets

Many commercial airlines are replacing older aircraft with newer, more efficient models. This replacement cycle presents a significant opportunity for material suppliers, as next-generation aircraft increasingly depend on innovative materials to achieve performance goals.

Read More : https://www.fortunebusinessinsights.com/aerospace-defense-materials-market-102980

Regional Trends

- North America remains the dominant region in the aerospace and defense materials market, thanks to its well-established aircraft manufacturing ecosystem and large-scale defense projects.

- Europe continues to be a major player, with leading aerospace companies investing in advanced material research and development.

- Asia-Pacific is emerging as the fastest-growing region, driven by rising air travel, the expansion of domestic aviation manufacturing, and increasing defense budgets in countries like China and India.

Challenges Ahead

Despite the positive outlook, the aerospace and defense materials market faces several challenges:

- High Cost of Advanced Materials: Composites and superalloys are significantly more expensive than traditional materials, posing affordability challenges—especially for smaller aircraft manufacturers.

- Complex Certification Processes: New materials must undergo rigorous testing and certification before being adopted, which can delay innovation and market entry.

- Supply Chain Vulnerabilities: Global supply chains remain vulnerable to geopolitical disruptions, raw material shortages, and trade restrictions, which can affect the availability of critical aerospace materials.

Key Industry Developments:

- April 2020 – Hexcel Corporation, an advanced composites manufacturer headquartered in the US, and Woodward, Inc., a key player providing designing, manufacturing and other services in the aerospace industry headquartered in the US, announced mutual termination of merger agreement, which was previously announced in January 2020. The disruption caused by the COVID-19 outbreak has forced the companies to announce the termination of the agreement.

- August 2019 – Teijin Ltd, a Japan-based manufacturer of advanced materials and chemicals, announced the successful acquisition of Renegade Materials Corporation, a key supplier of highly heat-resistant thermoset prepreg for the aerospace industry in North America. This has strengthened Tenjin’s position in the aerospace business and also increased its manufacturing capabilities.

Future Outlook

The future of the aerospace and defense materials market is closely tied to technological innovation and sustainability. Advancements in additive manufacturing (3D printing), hybrid materials, and recyclable composites are expected to redefine material performance benchmarks. As aircraft manufacturers seek to balance cost, performance, and environmental impact, materials science will continue to be at the forefront of aerospace innovation.

Companies that invest in R&D, foster partnerships with aircraft manufacturers, and navigate regulatory complexities effectively will be well-positioned to lead in this growing and competitive market.

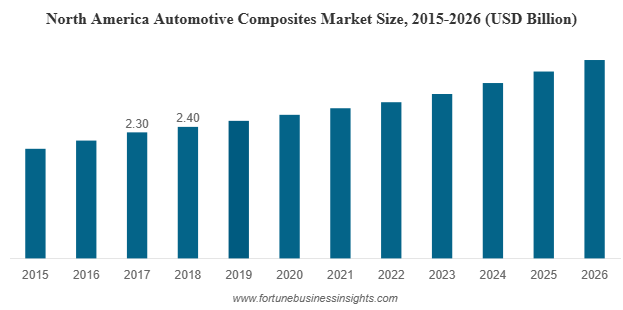

The global automotive composites market was valued at USD 7.67 billion in 2018 and is expected to expand to USD 13.5 billion by 2026, registering a CAGR of 7.56% during the forecast period. In 2018, North America held the leading share at 31.29%, while the U.S. market is projected to reach USD 3.22 billion by 2026, supported by the growing focus on lightweight vehicles and enhanced fuel efficiency.

The global automotive composites industry is experiencing a material revolution. As governments tighten emission standards and consumers demand more efficient vehicles, manufacturers are turning to innovative materials to strike the balance between performance, sustainability, and affordability. Among these, automotive composites are emerging as a game-changer. Lightweight, durable, and versatile, composites are reshaping how vehicles are designed and produced.

List of Top Automotive Composites Market Companies:

- Teijin Ltd.

- Mitsubishi Chemical Corporation

- Toray Industries, Inc.

- SGL Carbon

- RTP Company

- Plasan Carbon Composites

- Owens Corning

- Solvay S.A.

- UFP Technologies, Inc.

- BASF SE

- Other Players

Automotive Composites Market Importance in Automotive Design

One of the greatest challenges for automakers today is reducing vehicle weight without compromising safety, performance, or cost. Composites provide an effective solution. Glass fiber, carbon fiber, and natural fiber composites can significantly reduce vehicle mass when compared to traditional steel and even aluminum.

- Glass fiber composites: Offer a weight reduction of around 15–20% and are widely used due to their cost-effectiveness and durability.

- Carbon fiber composites: Deliver up to 40% weight savings, making them ideal for performance vehicles, though higher costs remain a challenge.

- Natural fiber composites: Increasingly popular in interior applications, offering sustainability benefits and compliance with eco-friendly regulations.

For electric vehicles (EVs), lightweight materials are even more critical. Every kilogram saved translates into a longer driving range or the possibility of reducing battery size, improving cost efficiency. This has driven strong interest in composites for EV body panels, battery enclosures, and structural components.

Resin Trends Driving Market Growth

Automotive composites market are typically classified by the resin system used.

- Thermoset resins currently dominate due to their high strength, dimensional stability, and excellent resistance to heat and stress. They are widely used in exterior body components and structural applications.

- Thermoplastic resins are gaining momentum because of their recyclability, faster production cycles, and potential for mass production. However, challenges such as high melt viscosity and impregnation issues during processing still limit widespread adoption.

As automakers move toward circular economy practices, thermoplastic composites are expected to capture a larger share of future demand.

Key Applications of Automotive Composites Market

Automotive composites market are finding their way into multiple parts of the vehicle.

- Exterior Applications – Body panels, hoods, headlamps, and bumpers dominate composite demand. These components not only reduce weight but also improve corrosion resistance and design flexibility.

- Interior Applications – Natural fiber composites are increasingly replacing plastics in door panels, dashboards, and trim components, offering both weight reduction and eco-friendliness.

- Structural and Powertrain Parts – Although still emerging, composites are being explored for use in chassis components, suspension systems, and under-the-hood applications where high strength and thermal resistance are critical.

Read More : https://www.fortunebusinessinsights.com/automotive-composites-market-102711

Growth Drivers

Several factors are fueling the rise of automotive composites market:

- Light-weighting for Efficiency: Regulatory pressure for reduced CO₂ emissions has made weight reduction a top priority for automakers. Composites provide the most effective path to achieving this.

- Electrification: EV adoption worldwide is accelerating composite demand due to the dual need for lightweighting and structural safety.

- Sustainability Push: Growing consumer and regulatory demand for sustainable products is boosting the use of natural fiber composites and bio-based resins.

- Design Flexibility: Composites allow for more innovative vehicle designs, enabling manufacturers to balance aesthetics with function.

Challenges and Restraints

Despite their benefits, composites face hurdles:

- Recycling Issues: Separating fibers and resins at the end of life is complex and expensive. Current recycling processes are limited, making composites less attractive for circular economy initiatives.

- High Costs: Carbon fiber composites remain expensive compared to metals. Thermoplastic composites, while recyclable, involve higher processing costs.

- Scalability: Manufacturing composites at the scale and speed required by the automotive industry remains a challenge.

These barriers have slowed widespread adoption, particularly in mass-market vehicles.

Regional Insights

- North America continues to dominate due to the presence of leading composite manufacturers, strong R&D capabilities, and adoption in performance and luxury vehicles.

- Europe is driving sustainability efforts, leading to the growing use of natural fiber composites and stricter recycling mandates.

- Asia Pacific is the fastest-growing region, with rising automotive production in China, India, and Thailand, and increasing consumer preference for lightweight vehicles.

Key Industry Developments:

- February 2021 – Teijin Ltd. announced installation of glass fiber sheet molding compound line at the company’s automotive composites business named ‘Benet Automotive s.r.o’. The investment was done to meet growing demand for Teijin’s composite parts from European automotive manufacturers.

- January 2021 – SGL Carbon announced investment of USD 4.5 million at its Arkansas site to expand the production of carbon composites for electric vehicles. The company is engaged in the manufacturing of carbon and glass fiber reinforced products for automotive applications. The new capacity addition will be used to meet growing demand for composite battery enclosures of modern e-car chassis.

Outlook for the Future

The future of the automotive composites market looks promising. With the shift toward electrification, stricter emission norms, and consumer demand for sustainable vehicles, composites are moving from niche applications to mainstream use. As recycling technologies improve and production costs decline, adoption is expected to accelerate further.

Automotive composites are no longer limited to luxury sports cars. They are becoming a necessity for mass-market vehicles aiming to meet the demands of the next generation of drivers. Companies that innovate in sustainable composite materials and scalable production technologies will shape the future of mobility.