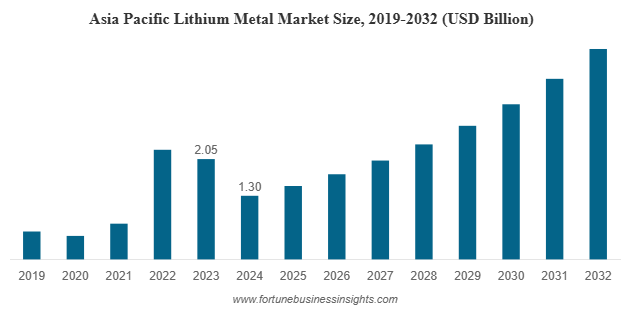

The global lithium metal market was valued at USD 2.21 billion in 2024 and is anticipated to rise from USD 2.55 billion in 2025 to reach USD 7.25 billion by 2032, registering a strong CAGR of 16.0% during the forecast period. Asia Pacific emerged as the leading region, accounting for 58.82% of the market share in 2024.

List Of Key Lithium Metal Companies Profiled

- Ganfeng Lithium Group Co. Ltd. (China)

- Techtone Inorganic Co., Ltd. (China)

- Chengxin Lithium Group Co., Ltd. (China)

- Rio Tinto (U.K.)

- CNNC Jianzhong Nuclear Fuel Co., Ltd. (China)

- Albemarle Corporation (U.S.)

- Li-Metal Corp. (Canada)

- Tianqi Lithium Inc. (China)

- ATT Advanced Elemental Materials Co., Ltd. (U.S.)

- Merck KGaA (Germany)

Market Overview

Lithium metal market is an essential component in next-generation battery technologies, particularly solid-state and lithium-sulfur batteries. These advanced systems offer higher energy density, faster charging, and improved safety compared to traditional lithium-ion batteries. The growing need for efficient energy storage across multiple sectors — from electric mobility to renewable energy integration — has positioned lithium metal as one of the most strategic materials of the decade.

The Asia Pacific region dominated the global market in 2024, accounting for over 58.82% share. Countries like China, Japan, and South Korea continue to lead due to strong investments in EV manufacturing, battery innovation, and local production capacities. Europe and North America are also emerging as significant players, supported by growing clean energy initiatives and strategic collaborations among automakers and battery suppliers.

Market Segmentation

By Form

- Ingot: This segment dominates the market, as lithium ingots are widely used in battery production and alloy manufacturing due to their high purity and uniformity.

- Powder: Lithium powder is gaining popularity in niche applications, including additive manufacturing, chemical synthesis, and compact battery designs.

- Others: Various customized forms of lithium metal cater to research and specialized industrial applications.

By Application

- Batteries: The battery segment leads the global market, driven by rising adoption of solid-state and lithium-sulfur batteries that rely heavily on lithium metal anodes. These batteries promise longer life cycles and higher efficiency for EVs and portable devices.

- Alloys: Lithium metal is also used in aluminum-lithium and magnesium-lithium alloys, offering lightweight strength for aerospace, defense, and automotive sectors.

- Others: Additional uses include electronics, pharmaceutical synthesis, and specialty chemicals.

Key Growth Drivers

- Electric Vehicle Expansion

The surge in global EV production remains the strongest growth catalyst. Lithium metal’s ability to store more energy per unit weight makes it ideal for high-performance batteries that extend vehicle range and reduce charging times. As governments worldwide push for zero-emission mobility, the demand for lithium metal is expected to grow rapidly.

- Rising Renewable Energy Integration

As solar and wind power adoption increases, so does the need for reliable energy storage systems. Lithium metal batteries provide the stability and energy density required for grid-level storage, supporting renewable energy continuity even during fluctuations in generation.

- Advances in Battery Technology

Ongoing research in solid-state batteries and lithium-sulfur batteries is reshaping the energy storage landscape. Lithium metal anodes are central to these innovations, offering up to twice the energy density of conventional lithium-ion systems. These technological breakthroughs are expected to open new growth avenues in both mobility and stationary storage sectors.

- Supportive Policies and Investments

Governments across regions are implementing favorable policies and subsidies for domestic battery manufacturing and raw material sourcing. Major automakers and energy firms are forming joint ventures with lithium producers to secure long-term supply chains, strengthening overall market growth.

Read More : https://www.fortunebusinessinsights.com/lithium-metal-market-113413

Challenges and Restraints

Despite its potential, the lithium metal market faces several obstacles. The high cost and volatility of raw materials continue to impact profitability for producers. Moreover, lithium extraction and purification are resource-intensive, involving significant water consumption and environmental considerations.

Limited global production capacity and supply chain constraints add another layer of challenge, particularly as demand outpaces current output. Furthermore, emerging alternative technologies such as sodium-ion and advanced solid-state chemistries could pose competition in certain applications if they achieve commercial scalability at lower costs.

Emerging Opportunities

The next wave of growth is likely to come from technological advancements in extraction and processing. Innovations such as direct lithium extraction (DLE) and recycling from used batteries could significantly reduce production costs and environmental impact.

Vertical integration is another major trend reshaping the industry. Leading producers are expanding across the value chain — from mining to refining and battery production — to secure raw material availability and enhance supply reliability.

Additionally, aerospace and defense sectors are increasingly adopting lithium-based alloys for lightweight structural components, offering steady niche demand outside the energy domain.

Competitive Landscape

The companies are investing heavily in R&D and capacity expansion to strengthen their foothold. Strategic acquisitions and partnerships are shaping the competitive environment. For example, large corporations are acquiring smaller lithium metal producers to expand production capabilities and secure access to patented technologies.

Key Industry Developments

- March 2025: Rio Tinto completed its USD 6.7 billion acquisition of Arcadium Lithium, positioning itself as a global leader in the supply of energy transition materials and significantly expanding its lithium portfolio to support the growing demand for clean energy solutions.

- August 2024: Arcadium Lithium acquired Li-Metal Corp.’s lithium metal business for USD 11 million in an all-cash deal. This acquisition included intellectual property, patents, and a pilot production facility in Ontario, Canada. This acquisition aimed to enhance Arcadium’s capabilities in producing lithium metal from various grades of lithium carbonate feedstock.

Future Outlook

Looking ahead, the lithium metal market is expected to continue its strong upward trajectory through 2032. The convergence of sustainability goals, EV adoption, and advancements in energy storage technology will create an ecosystem where lithium metal becomes a cornerstone material for the global energy transition.

As the world shifts toward a greener future, lithium metal’s high energy efficiency, lightweight nature, and adaptability across applications will ensure its critical role in shaping tomorrow’s clean energy economy. With ongoing technological progress and increasing investments, the market is set to enter an era of rapid expansion, positioning lithium metal as a key enabler of the next generation of batteries and energy systems.

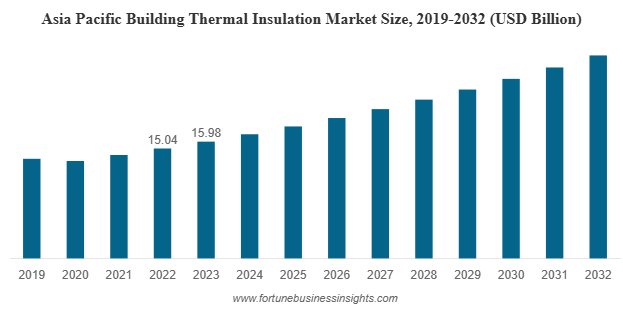

The global building thermal insulation market was valued at USD 32.53 billion in 2023 and is expected to increase from USD 33.98 billion in 2024 to USD 48.60 billion by 2032, registering a CAGR of 4.5% during 2024–2032. Asia Pacific led the market in 2023 with a dominant 49.12% share. In the U.S., the building thermal insulation market is poised for substantial growth, projected to reach around USD 7.60 billion by 2032, supported by strong government initiatives promoting energy-efficient technologies in the construction sector.

The global building thermal insulation market is witnessing steady growth, driven by the growing demand for energy-efficient construction materials and the increasing focus on sustainability across residential and commercial projects. Thermal insulation plays a critical role in reducing energy consumption, maintaining indoor comfort, and minimizing greenhouse gas emissions. The rising awareness about energy conservation, coupled with strict government regulations promoting green building standards, is fueling market expansion worldwide.

List Of Top Building Thermal Insulation Companies:

- BASF (Germany)

- Atlas Roofing Company (U.S.)

- Cellofoam North America Inc. (U.S.)

- DuPont (U.S.)

- Knauf Insulation (U.S.)

- Owens Corning (U.S.)

- Armacell S.A. (Luxembourg)

- Beijing New Building Material (Group) Co., Ltd. (China)

- Evonik (Germany)

- Bondor Indonesia (Indonesia)

- BYUCKSAN (South Korea)

Market Overview

The global building thermal insulation market is witnessing steady growth, driven by the growing demand for energy-efficient construction materials and the increasing focus on sustainability across residential and commercial projects. Thermal insulation plays a critical role in reducing energy consumption, maintaining indoor comfort, and minimizing greenhouse gas emissions. The rising awareness about energy conservation, coupled with strict government regulations promoting green building standards, is fueling market expansion worldwide.

The construction industry’s recovery following the pandemic, particularly in Asia Pacific, Europe, and North America, has further accelerated market demand. Modern building designs increasingly incorporate insulation solutions that improve thermal performance, lower energy bills, and comply with evolving energy efficiency regulations.

Regional Insights

Asia Pacific dominated the global building thermal insulation market in 2023, accounting for nearly 49.12% of the total share. The region’s growth is mainly fueled by rapid urban infrastructure development, booming residential construction, and supportive government policies encouraging sustainable building practices. China, India, and Southeast Asian countries are leading contributors, driven by their expanding construction sectors and rising awareness of energy conservation.

Europe also represents a significant market due to its stringent energy efficiency standards and widespread adoption of eco-friendly construction materials. The European Union’s initiatives toward achieving net-zero energy buildings have spurred the use of high-performance insulation materials. North America continues to show strong growth potential, supported by technological innovations, retrofitting of older buildings, and consumer preference for energy-saving homes.

Read More : https://www.fortunebusinessinsights.com/building-thermal-insulation-market-102708

Market Segmentation

The market can be segmented by material type, application, and end-use industry.

By material, foamed plastics dominate the market, including expanded polystyrene (EPS), extruded polystyrene (XPS), polyurethane (PU), and polyisocyanurate (PIR). These materials are widely used for their lightweight nature, excellent thermal resistance, and versatility across a range of building applications. Mineral wool and fiberglass are also key segments, particularly in regions emphasizing fire safety and acoustic performance.

By application, roof and ceiling insulation represent the largest segment, owing to their direct impact on reducing heat gain and loss in buildings. Wall and floor insulation are also witnessing rising demand as building designs become more complex and energy performance becomes a top priority for architects and engineers.

By end-use, the residential sector holds a significant share of the global market. Growing urban populations, rising disposable incomes, and government incentives promoting energy-efficient housing contribute to this trend. The non-residential segment—including office complexes, hospitals, educational institutions, and industrial buildings—is also expanding rapidly as organizations strive to lower operational costs and meet sustainability targets.

Market Drivers

The primary driver of the building thermal insulation market is the growing emphasis on energy efficiency and environmental sustainability. Rising electricity and fuel costs are pushing homeowners and commercial developers to adopt insulation materials that reduce heating and cooling needs. Additionally, governments worldwide are implementing policies and subsidies to encourage green building practices, which further boosts market growth.

Another key factor is the increasing pace of urbanization and industrialization. Rapid construction of residential and commercial infrastructure in emerging economies is generating strong demand for advanced insulation systems. Moreover, consumer awareness about the long-term benefits of insulation—such as lower energy bills and enhanced comfort—is expanding product adoption.

Technological innovations in insulation materials are also reshaping the market landscape. Manufacturers are focusing on developing products that offer superior performance, durability, and environmental friendliness. The emergence of bio-based foams, recycled insulation materials, and easy-to-install solutions is helping manufacturers meet modern construction needs while adhering to sustainability goals.

Key Industry Developments:

- April 2021 – Atlas Roofing Company introduced SureSlope prefabricated tapered products. The new product family of polyiso roof insulation components is ideal for roofing applications, reducing job site waste and decreasing installation time.

- March 2021 - Owens Corning acquired vliepa GmbH, a company specializing in coating, printing, and finishing nonwovens, film, and paper for the construction industry. The acquisition widens the company’s nonwovens portfolio for European customers working in the regional construction industry.

Challenges and Restraints

Despite strong growth prospects, the market faces certain challenges. Health and safety concerns associated with some insulation materials, such as fiberglass and foamed plastics, can limit adoption if not handled properly. Additionally, the volatile prices of raw materials like polymers and glass fibers can affect manufacturing costs and pricing stability. Stringent regulations related to emissions and chemical safety also compel manufacturers to continually invest in research and development to ensure compliance.

Future Outlook

The future of the building thermal insulation market looks promising, as environmental sustainability becomes a global priority. Governments, businesses, and consumers are increasingly aligned toward reducing carbon emissions and improving building performance. The integration of smart technologies, such as sensors for monitoring energy efficiency, will further enhance insulation systems’ value proposition.

By 2032, the market is expected to play an even more vital role in achieving global energy-saving goals, reducing dependency on fossil fuels, and supporting the transition toward green and energy-efficient buildings. With continuous innovation and growing awareness, the building thermal insulation industry is set to remain a cornerstone of sustainable construction across all regions.

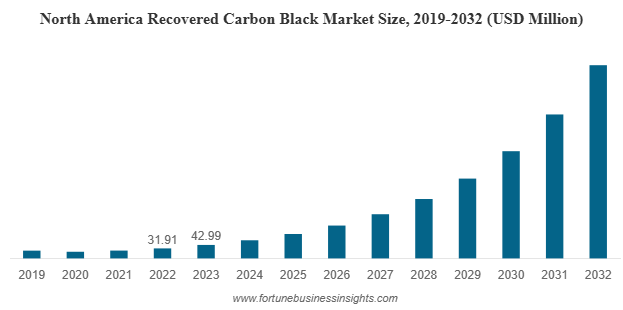

The global recovered carbon black market was valued at USD 118.7 million in 2023 and is expected to expand from USD 161.1 million in 2024 to USD 1,910.4 million by 2032, registering an impressive CAGR of 36.2% during the forecast period. North America led the market in 2023, accounting for a 36.22% share, driven by strong recycling initiatives and growing demand from the tire and automotive industries.

The recovered carbon black (RCB) market is gaining significant traction worldwide as industries and governments push for sustainability, circular economy models, and reduced carbon footprints. Recovered carbon black, a sustainable alternative to virgin carbon black, is derived from pyrolysis of end-of-life tires (ELTs) and other rubber waste materials. It offers comparable properties to traditional carbon black but with a significantly lower environmental impact, making it an ideal choice for tire manufacturing, non-tire rubber applications, plastics, and coatings.

List Of Key Companies Profiled:

- Delta Energy LLC (U.S.)

- Black Bear Carbon B.V. (Netherlands)

- Scandinavian Enviro Systems AB (Sweden)

- Klean Industries Inc. (U.S.)

- Radhe Group of Energy (India)

- Bolder Industries (U.S.)

- Enrestec (Taiwan)

- SR2O Holdings, LLC (U.S.)

- Contec (Poland)

- Hosokawa Micron B.V. (Netherlands)

Market Overview and Growth Outlook

The rapid shift toward sustainability and resource efficiency has positioned recovered carbon black as a crucial component of the green materials landscape. Traditional carbon black production depends heavily on fossil fuels, particularly oil, which contributes to high greenhouse gas emissions. Recovered carbon black, however, is manufactured by extracting carbon residue from end-of-life tires using thermal decomposition or pyrolysis, resulting in reduced CO₂ emissions and better waste utilization.

In 2023, North America dominated the recovered carbon black market with a 36.22% share, supported by strong regulatory frameworks, rising recycling activities, and growing adoption in the tire and automotive industries. Europe closely follows, driven by stringent environmental regulations and efforts to achieve circular economy goals. Meanwhile, Asia Pacific is expected to witness the fastest growth rate over the forecast period, attributed to increasing industrialization, rising automotive production, and the availability of abundant waste tires in countries such as China and India.

Key Market Drivers

- Growing Focus on Sustainability and Circular Economy

The global emphasis on sustainability has made recovered carbon black a preferred choice across multiple sectors. Governments and corporations are focusing on reducing waste and promoting circular resource flows. rCB plays a central role in this transformation by converting discarded tires into valuable raw materials, significantly minimizing the environmental footprint of rubber products. - Abundant Availability of End-of-Life Tires (ELTs)

The increasing number of vehicles globally has led to a massive accumulation of waste tires. Instead of disposing of these tires in landfills, industries are utilizing them as feedstock for rCB production. The reuse of tire-derived carbon black not only mitigates waste disposal challenges but also supports the production of cost-effective and eco-friendly materials. - Expanding Applications Across Industries

Recovered carbon black is not limited to tire manufacturing. It is increasingly being adopted in plastics, coatings, inks, and non-tire rubber goods such as hoses, conveyor belts, and gaskets. The wide range of applications, coupled with improved product performance, is contributing to the market’s expansion across different end-use sectors. - Advancements in Pyrolysis and Recycling Technologies

Ongoing innovations in pyrolysis technology have improved the yield, purity, and performance of recovered carbon black. Advanced processing techniques help achieve finer particle size distribution and better surface activity, making rCB a reliable substitute for virgin carbon black in high-performance applications.

Read More : https://www.fortunebusinessinsights.com/recovered-carbon-black-market-109550

Market Challenges

Despite its strong growth potential, the recovered carbon black market faces several challenges that could impact large-scale adoption.

- Quality Consistency Issues: Ensuring uniform quality across different batches remains a major concern for manufacturers. Tire producers, in particular, require stringent quality standards that rCB suppliers must meet consistently.

- Infrastructure Gaps: Developing nations lack sufficient recycling infrastructure and pyrolysis plants, limiting large-scale production.

- Regulatory Barriers: The absence of harmonized international standards for rCB usage and certification can hinder its acceptance in certain applications.

- Limited Awareness: Many end-users are still unaware of rCB’s potential benefits and performance capabilities, which slows down market penetration.

Segmentation Insights

By application, the tire segment dominates the market and is expected to maintain its lead throughout the forecast period. The increasing adoption of rCB in tire production is driven by the material’s comparable reinforcement properties and cost efficiency. The non-tire rubber segment, including industrial belts, gaskets, and molded goods, also represents a substantial share, supported by the push for sustainable manufacturing. Additionally, the plastics and inks & coatings segments are emerging as high-growth areas as manufacturers seek eco-friendly pigments and fillers.

By region, North America continues to lead due to strong policy support and investment in recycling facilities. Europe benefits from regulatory initiatives promoting waste tire recovery and emission reduction. Meanwhile, Asia Pacific is poised to register the highest CAGR, backed by rising industrial demand, low production costs, and government programs supporting waste-to-resource projects.

Key Industry Developments:

- February 2024 – Michelin has partnered with Antin and Enviro to construct the first end-of-life tire-recycling plant. The partnership is based on supplying end-of-life-cycle tires and recovered carbon black and pyrolysis oil.

- February 2023 – Klean Industries Inc. is expanding its strategic partnership with Niersberger Group. The partnership involves executing tire pyrolysis projects to recover carbon black & renewable fuels.

Industry Developments

Recent strategic developments highlight the industry’s growth momentum. In February 2024, Michelin announced a partnership to establish a large-scale tire recycling and rCB production facility. Similarly, Black Bear Carbon entered a long-term cooperation agreement with HELM AG to strengthen its supply chain in sustainable carbon materials. Companies such as Klean Industries and Bolder Industries are expanding their global presence by constructing new pyrolysis plants to meet increasing demand.

Future Outlook

The recovered carbon black market is on a path of exponential growth, driven by sustainability mandates, circular economy initiatives, and technological progress. The transition toward eco-friendly materials across automotive, construction, and manufacturing sectors is expected to create vast opportunities for rCB producers.

As regulatory standards evolve and quality control technologies advance, recovered carbon black is likely to become a mainstream material in tire and rubber manufacturing. With strong government support and growing consumer preference for sustainable products, the industry is set to play a pivotal role in shaping the future of green manufacturing and waste management worldwide.

The global industrial packaging market was valued at USD 74.94 billion in 2024 and is projected to grow to USD 78.5 billion in 2025 , reaching USD 114.54 billion by 2032 at a CAGR of 5.45% during the forecast period. Asia Pacific led the market in 2023, accounting for 41.79% of the global share , driven by rapid industrialization and expanding manufacturing sectors. In the U.S. , the market is expected to reach USD 25.33 billion by 2032 , supported by strong demand for durable and protective packaging solutions across heavy-duty industries such as chemicals, construction, and automotive .

The global industrial packaging market is witnessing significant growth, propelled by rising industrial activities, expansion in manufacturing and logistics, and the increasing focus on sustainability and efficiency in packaging operations. Industrial packaging plays a vital role in protecting goods during storage, handling, and transportation. It is essential for heavy-duty, hazardous, and bulk materials across sectors such as chemicals, pharmaceuticals, food and beverages, and construction.

List of Key Companies Profiled in the Report:

- Mondi Group (U.K.)

- WestRock (U.S.)

- Smurfit Kappa (Ireland)

- Sonoco (U.S.)

- DS Smith (U.K.)

- Amcor Limited (Australia)

- Greif Inc. (U.S.)

- Mauser Packaging Solutions (U.S.)

- Ball Corporation (U.S.)

Market Overview and Growth Factors

Industrial packaging encompasses large-scale packaging products such as drums, intermediate bulk containers (IBCs), corrugated boxes, pallets, and pails used for storage and transport of materials. The market is primarily driven by the growth of global manufacturing sectors, including chemicals, agriculture, automotive, and construction.

Another major growth driver is the increasing requirement for durable and recyclable packaging materials. Companies across industries are focusing on sustainable packaging options to meet environmental regulations and reduce their carbon footprint. The growing demand for supply chain efficiency , coupled with technological innovations such as smart tracking and IoT-based packaging, is also reshaping the industry.

Rising globalization of trade and the expansion of e-commerce logistics have further increased the need for safe and efficient packaging that can withstand long-distance transportation and complex handling conditions.

Market Segmentation

By Material:

Plastic remains the most widely used material in industrial packaging due to its high strength, versatility, and cost-effectiveness. Products such as drums, containers, and IBCs made from high-density polyethylene (HDPE) and polypropylene are extensively used in the chemical and food industries. However, rising environmental concerns are pushing manufacturers to adopt recycled plastics and biodegradable alternatives.

Paper and paperboard packaging are gaining momentum as eco-friendly substitutes, especially for boxes and cartons. Metal packaging, though less common, is used in applications that require superior protection from corrosion or contamination.

By Product Type:

Boxes and cartons account for a major share of the market, given their adaptability to various product sizes and ease of recycling. Drums and IBCs are essential for transporting liquids and chemicals, ensuring leak-proof and safe handling. Pallets, trays, sacks, and pails are also integral to material handling and logistics across multiple industries.

By End-use Industry:

The food and beverage segment leads the market, representing around one-fourth of total demand. The need for secure, hygienic, and durable packaging to maintain product integrity has fueled this segment’s growth. The pharmaceutical sector follows closely, driven by strict safety regulations and the expansion of global medicine distribution networks. The chemical industry also remains a key contributor, as industrial packaging ensures compliance with hazardous material transport standards. Other significant end users include construction, consumer goods, and agriculture.

Read More : https://www.fortunebusinessinsights.com/industrial-packaging-market-107306

Key Market Drivers and Opportunities

- Industrial Expansion and Global Trade:

The rising output of manufacturing and construction industries is fueling the need for large-scale packaging solutions capable of protecting goods in transit and storage. - Sustainability Focus:

Growing environmental awareness and government policies have accelerated the shift toward recyclable, reusable, and biodegradable packaging materials. This trend has opened new opportunities for innovation in eco-friendly packaging designs. - Technological Advancements:

The integration of smart technologies such as RFID tags, sensors, and IoT devices is transforming industrial packaging into an intelligent system that can monitor temperature, humidity, and product safety throughout the supply chain. - Reusable Packaging Systems:

Increasing adoption of reusable containers, drums, and IBCs is helping companies reduce operational costs and waste generation while maintaining efficiency in bulk material handling. - Emerging Market Growth:

Rapid industrialization in emerging economies, including India, Brazil, Indonesia, and Vietnam, presents lucrative opportunities for packaging manufacturers to expand their production and distribution networks.

Regional Insights

Asia Pacific dominated the global industrial packaging market in 2024, holding approximately 41.79% share of the total revenue. The region’s leadership is attributed to rapid industrialization, expanding manufacturing bases in China, India, and Japan, and strong demand from the food processing and pharmaceutical sectors. Government initiatives promoting local manufacturing and infrastructure development have also contributed to market expansion.

North America is the second-largest market, driven by the presence of well-established industrial sectors, advanced supply chain systems, and an increasing emphasis on sustainable materials. The U.S. market benefits from high investments in automation and innovative packaging solutions to optimize logistics and reduce waste.

Europe also holds a substantial share, supported by strict environmental regulations that encourage the use of recyclable and biodegradable materials. However, the region faces challenges related to raw material price volatility and stringent compliance standards.

Key Industry Developments:

- December 2023 – Novvia Group, a worldwide provider of life sciences packaging, announced the acquisition of JWJ Packaging, a U.S.-based supplier of drum pails and other rigid container products. Based in Millstone Township, New Jersey, JWJ Packaging has been serving customers across the tri-state area with a diverse range of products and services.

- July 2023 – Berry Global launched a new version of its high-performance, patented NorDiVent form-fill-seal (FFS) film for powdered products, incorporating up to 50% recycled plastic content, helping its customers achieve sustainability goals.

Challenges and Restraints

Despite strong growth prospects, the market faces challenges such as fluctuating raw material costs, particularly for plastic resins and metals. Compliance with environmental regulations and waste management laws also adds to manufacturing costs. Additionally, maintaining the balance between product durability and sustainability remains a key concern for producers seeking to minimize environmental impact without compromising functionality.

Outlook

The global industrial packaging market is poised for consistent growth through 2032 as sustainability, automation, and digitalization continue to shape the industry. With increasing demand from sectors such as food, pharmaceuticals, and chemicals, the market is expected to maintain a steady expansion trajectory. The shift toward green and smart packaging will be crucial for long-term success, positioning manufacturers that prioritize innovation and environmental responsibility at the forefront of this evolving industry.

Security Printing Market Global Reports, Opportunities, Trends & Forecast 2032

By Sharvari, 2025-10-08

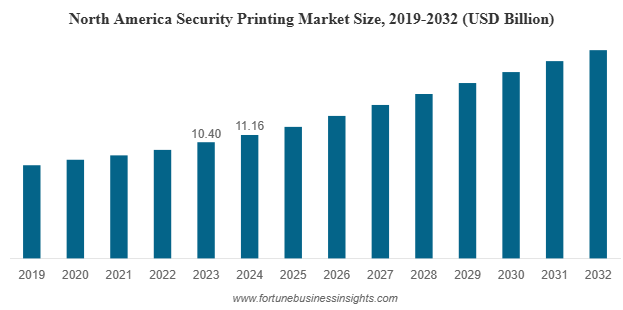

The global security printing market was valued at USD 35.47 billion in 2024 and is expected to grow to USD 37.93 billion in 2025, reaching USD 62.56 billion by 2032. The market is anticipated to expand at a CAGR of 7.41% during the forecast period, with North America leading the market in 2024, accounting for a 31.46% share.

In today’s fast-evolving digital and physical economies, the importance of security printing has never been greater. From currency and government documents to product authentication and packaging, security printing plays a crucial role in protecting organizations, consumers, and governments from the rising tide of counterfeiting and identity fraud.

Some of the Key Companies Profiled in the Report:

- Arrow System Inc. (U.S.)

- Orion Security Print (U.K.)

- Eltronis UK (U.K.)

- A1 Security Print (U.K.)

- ECO3 (Belgium)

- JUI Group (India)

- CETIS d.d (Slovenia)

- The Flesh Company (U.S.)

- TROY Group, Inc. (U.S.)

Growing Concerns Over Counterfeiting and Fraud

One of the primary forces fueling market expansion is the rapid increase in counterfeiting activities across industries such as banking, government, pharmaceuticals, and consumer goods. The proliferation of counterfeit currencies, fake IDs, fraudulent certificates, and imitation products has created an urgent demand for advanced printing solutions that incorporate multiple layers of security.

Governments worldwide are investing in the modernization of official documents such as passports, driver’s licenses, and national identity cards, integrating security features such as holograms, microtext, watermarks, and color-shifting inks. In the private sector, companies are deploying these technologies to safeguard brand integrity, reduce losses, and enhance consumer trust.

Regulatory and Government Initiatives

Regulations and mandates from global authorities are also shaping the security printing landscape. Governments are increasingly enforcing stricter compliance requirements for financial instruments, pharmaceutical labeling, and legal documentation. These initiatives are compelling organizations to adopt secure printing solutions that not only prevent tampering and forgery but also ensure end-to-end traceability throughout the supply chain.

In the healthcare and pharmaceutical sectors, the implementation of serialization and traceability laws to combat counterfeit drugs has driven demand for secure packaging and printed authentication labels. Similarly, the introduction of e-passports and biometric ID systems has opened new opportunities for specialized security printing providers.

Technological Advancements Reshaping the Market

The evolution of printing technologies has revolutionized how security elements are designed and applied. Advanced printing methods such as holographic imaging, micro printing, UV-visible inks, optically variable devices, and embedded RFID or NFC chips are increasingly used to achieve superior protection.

A major trend transforming the market is the integration of digital security features alongside traditional printing techniques. This hybrid approach provides a two-layer defense—physical authenticity through printed features and digital verification through data encryption or scanning technologies. With the rise of connected ecosystems, this synergy ensures real-time authentication and tracking across multiple industries.

Moreover, innovations in software-based anti-counterfeiting measures, such as digital watermarks and blockchain-enabled traceability, are gaining attention. These technologies allow manufacturers to verify products instantly and prevent tampering throughout the distribution network.

Market Segmentation Insights

The global security printing market can be segmented based on printing type, application, and region.

By printing type, offset lithographic printing holds the largest share due to its ability to produce high-quality, complex designs with precision and scalability. Flexographic printing is also gaining traction owing to its versatility and cost-effectiveness, particularly in packaging and label production.

By application, government documents dominate the market, driven by rising demand for secure identification systems, passports, and certificates. Financial instruments such as banknotes, bonds, and checks remain another key segment, supported by the ongoing need for fraud-resistant printing. Additionally, brand protection and product labeling applications are rapidly expanding as manufacturers seek to combat counterfeit goods in industries like electronics, apparel, and cosmetics.

Read More : https://www.fortunebusinessinsights.com/security-printing-market-110211

Regional Overview

North America led the market in 2024, supported by robust government regulations, high awareness levels, and advanced technological infrastructure. The United States, in particular, continues to invest in secure ID and currency printing, making it a major revenue contributor.

Europe follows closely, with countries like Germany, the U.K., and France focusing on upgrading official documentation and adopting environmentally sustainable printing materials.

Asia Pacific, however, is expected to witness the fastest growth during the forecast period. The region’s strong industrial base, growing population, and digitalization initiatives are driving the need for secure documentation and packaging. India, China, and Japan are at the forefront of this expansion, with governments investing heavily in anti-counterfeiting measures and national identity programs.

Challenges and Emerging Opportunities

Despite its strong growth prospects, the market faces challenges such as high implementation costs, complex material requirements, and environmental concerns associated with certain inks and films. However, these challenges are paving the way for innovation in eco-friendly security printing, where manufacturers are focusing on biodegradable materials, recyclable substrates, and sustainable production processes.

Another emerging opportunity lies in the rise of smart packaging and authentication solutions. The integration of QR codes, RFID, and NFC technologies allows instant product verification, offering new levels of transparency to consumers and regulators alike. As global supply chains continue to digitize, security printing is expected to evolve into a cornerstone of trust and traceability.

Key Industry Developments

- September 2024: HP Indigo and Agfa Offset Solutions (now ECO3) launched variable design solutions for brand protection and security printing. The designs provide security and safeguard against counterfeiting and diversion while effortlessly integrating with the original design, maintaining the appearance and essence of the original document or product.

- June 2024: Hitech Print Systems strengthened its dedication to excellence and innovation by acquiring a second nine-color pre-owned Rotatek RK 250 Plus press. This notable enhancement to its production capabilities is set to increase the company's output and further raise its quality and efficiency standards. Hitech focuses on the security printing of crucial documents such as question papers, answer sheets, OMR forms, university diplomas, certificates, and cheques, among others.

Outlook

The global security printing market is entering an era of dynamic transformation, fueled by technology convergence, sustainability initiatives, and growing security threats. Governments, manufacturers, and service providers must collaborate to develop multi-layered security systems that protect not only documents and currency but also digital data and brand value.

As counterfeiting becomes more sophisticated, the future of security printing will depend on continuous innovation, hybrid physical-digital integration, and commitment to sustainability. The companies that embrace these trends today will define the standards of trust and authenticity in tomorrow’s connected world.

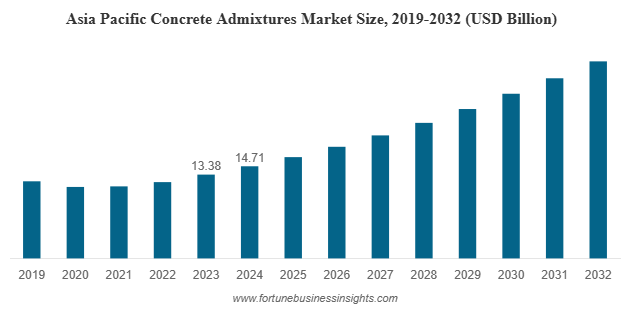

The global concrete admixtures market was valued at USD 22.78 billion in 2024 and is expected to increase from USD 24.90 billion in 2025 to USD 42.90 billion by 2032, registering a CAGR of 8.9% during the forecast period. Asia Pacific led the market in 2024, accounting for a 64.57% share, driven by rapid urbanization and large-scale infrastructure projects. In the United States, the market is anticipated to witness substantial growth, reaching approximately USD 3.08 billion by 2032, fueled by the rising adoption of high-performance concrete solutions.

The surge in concrete admixtures market value reflects how admixtures have become indispensable in achieving superior concrete properties. From improving strength and durability to enhancing workability and reducing environmental impact, admixtures are central to modern construction chemistry.

List of Top Concrete Admixtures Companies:

- Buildtech Products (India)

- Sika AG (Switzerland)

- RAZON ENGINEERING COMPANY PRIVATE LIMITED (India)

- Flowcrete Group Ltd. (U.K.)

- CEMEX S.A.B. de C.V. (Mexico)

- BASF SE (Germany)

- GCP Applied Technologies (U.S.)

- RPM International Inc. (U.S.)

Growing Role of Admixtures in High-Performance Concrete

Concrete admixtures market are chemical or mineral additives that modify specific properties of concrete during mixing, curing, or service life. Their inclusion can make concrete stronger, more durable, or better suited to extreme environments. Common types include water-reducing admixtures, accelerators, retarders, air-entraining agents, and waterproofing compounds.

Among these, water-reducing admixtures currently dominate the market. They enable significant reductions in water content without compromising strength, leading to better compaction, higher durability, and improved sustainability. As construction projects demand faster schedules and longer-lasting structures, the use of these admixtures continues to rise across both developed and emerging economies.

Regional Dominance: Asia Pacific Leads the Market

The Asia Pacific region holds the largest share of the global market, accounting for approximately 64.57% in 2024. Rapid urbanization, infrastructure expansion, and industrial growth across China, India, and Southeast Asia are driving this dominance.

Countries such as India and Indonesia are witnessing record investments in road networks, commercial buildings, and residential housing. Meanwhile, China’s ongoing focus on urban redevelopment and smart city projects continues to fuel demand for high-quality concrete with enhanced performance.

Government initiatives promoting sustainable and green construction practices have further accelerated adoption. The region’s booming population and industrial base are also expanding the need for large-scale, durable infrastructure, making concrete admixtures essential to the construction process.

Market Segmentation: Types and Applications

By type, the market is broadly segmented into water-reducing, retarding, accelerating, air-entraining, and waterproofing admixtures. Water-reducing admixtures lead the segment, supported by their ability to enhance compressive strength and reduce porosity in concrete. Meanwhile, air-entraining agents are gaining traction in colder regions where freeze-thaw durability is critical.

By application, residential construction currently represents the largest segment, as global housing demand continues to rise. However, the infrastructure sector is the fastest-growing segment, propelled by major transportation, energy, and public utility projects. Infrastructure projects, particularly in developing economies, require high-performance concrete that can withstand environmental and load stresses—further strengthening demand for advanced admixtures.

Read More : https://www.fortunebusinessinsights.com/concrete-admixtures-market-102832

Market Drivers: Sustainability, Innovation, and Urbanization

The global construction industry is increasingly focused on sustainability and efficiency, creating favorable conditions for admixture adoption. One of the major drivers is the push for eco-friendly concrete solutions. Admixtures help reduce cement consumption by improving workability and strength, which lowers carbon dioxide emissions associated with cement production.

Moreover, the demand for high-performance concrete in infrastructure, high-rise buildings, and bridges has created opportunities for admixture manufacturers to innovate. Modern admixtures can enhance strength while maintaining flow, allowing architects and engineers to design more complex structures with thinner sections and longer spans.

Rapid urbanization and growing infrastructure investments are additional growth catalysts. Developing countries are allocating substantial budgets for highways, airports, metros, and smart cities—projects that require superior construction materials. Admixtures play a vital role in meeting performance specifications and quality standards in these mega-projects.

Challenges and Restraints

Despite promising growth, the market faces a few challenges. Rising raw material costs and strict environmental regulations related to chemical manufacturing may affect profit margins. Some admixtures rely on petrochemical-based compounds, which are subject to fluctuating prices and environmental concerns.

Additionally, the construction industry’s traditional nature and low awareness in certain regions can limit the adoption of advanced admixtures. Contractors in smaller markets may still prioritize cost over performance, slowing the transition to sustainable, high-quality concrete solutions.

KEY INDUSTRY DEVELOPMENTS:

- November 2023: Sika AG announced that the group had expanded its concrete admixture capacity in the U.S. The company continues to invest in its polymer production at its Sealy site in the U.S. state of Texas. Sika’s latest move marks its second polymer investment in the state of Texas in just five years. The company requires polymers for chemical building blocks that are needed to produce Sika ViscoCrete, a high-performance, resource-saving concrete admixture. The company initiated this expansion to meet the growing demand for its products in the U.S. and Canada.

- June 2023: Fosroc India launched a state-of-the-art Concrete Lab in Chennai that will provide advanced building material testing facilities to developers, contractors, and other construction professionals.

Competitive Landscape

Companies are investing heavily in research and development to create low-carbon, high-performance admixtures. For example, firms are introducing new formulations that minimize water use and enhance concrete durability while complying with stringent environmental norms. Expansions of manufacturing plants and collaborations with construction companies are also common strategies to strengthen market presence and meet regional demand surges.

Future Outlook

The concrete admixtures market is set for strong, sustained growth over the next decade. As cities expand and governments push for sustainable infrastructure, the need for performance-optimized concrete will only increase. The market’s future lies in balancing innovation with sustainability—creating admixtures that not only enhance strength and longevity but also reduce environmental impact.

Manufacturers focusing on green chemistry, performance enhancement, and cost-effective formulations are likely to lead the next phase of market evolution. With global construction expected to surge in the coming years, the concrete admixtures industry stands at the forefront of transforming how the world builds—stronger, smarter, and more sustainably than ever before.

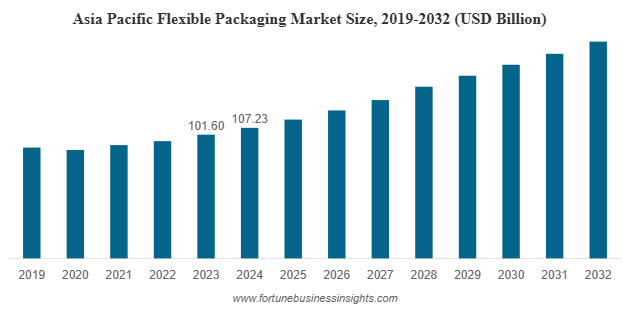

The global flexible packaging market was valued at USD 258.74 billion in 2024 and is projected to rise from USD 270.83 billion in 2025 to USD 406.14 billion by 2032, reflecting a robust CAGR of 5.96% during the forecast period. Asia Pacific led the market in 2024, accounting for a significant 41.44% share of the global revenue.

List of Top Flexible Packaging Companies:

- Amcor Plc (Switzerland)

- Constantia Flexibles (Austria)

- Sonoco Product company (U.S.)

- Mondi (U.K.)

- Huhtamaki Oyj (Finland)

- Berry Global (U.S.)

- Sealed Air (U.S.)

- Graphic Packaging International (U.S.)

- Transcontinental Inc. (U.S.)

- UFlex Limited (India)

Market Overview

Flexible packaging market refers to materials such as plastic films, paper, and foil that can easily bend or form various shapes, allowing for versatile designs and efficient storage. Compared to rigid packaging, flexible formats consume less material, reduce transportation costs, and lower carbon emissions. These advantages are making flexible packaging the preferred choice for manufacturers looking to optimize supply chains and enhance sustainability credentials.

The global market’s expansion is also fueled by changing consumer lifestyles, increased urbanization, and the rapid growth of e-commerce. Consumers are increasingly prioritizing on-the-go products and easy-to-open packaging options, pushing companies to innovate with pouches, wraps, and resealable bags that maintain product freshness while improving convenience.

Regional Insights

The Asia Pacific region dominated the global flexible packaging market in 2024 with a market share of 41.44%. Countries like China, India, Japan, and Indonesia are witnessing significant industrialization and retail expansion, fueling the need for efficient and sustainable packaging solutions. Rising disposable incomes and a growing middle class are increasing consumption of packaged food, beverages, and personal care products—key applications for flexible packaging.

North America and Europe are also major contributors to market growth, driven by technological advancements and strong sustainability initiatives. In Europe, stringent packaging waste regulations have encouraged the use of recyclable and biodegradable materials. Meanwhile, North America continues to innovate in terms of barrier films and advanced laminates that extend shelf life and improve product safety.

Key Market Drivers

- Growing Demand from the Food & Beverage Industry

Food and beverages remain the largest end-use segment for flexible packaging market. The ability of pouches, sachets, and wraps to provide superior barrier protection against moisture, oxygen, and light makes them ideal for extending product shelf life. From snacks and frozen foods to dairy and beverages, manufacturers are embracing flexible packaging for its efficiency and design versatility. - Sustainability and the Circular Economy

One of the strongest trends shaping the market is the push for sustainable materials. Manufacturers are increasingly adopting recyclable, compostable, and bio-based films to meet environmental regulations and consumer expectations. Efforts toward establishing a circular economy—where packaging waste is minimized and reused—are gaining momentum globally. Brands are investing in mono-material packaging and bio-plastics that can be more easily recycled without compromising performance. - Technological Advancements in Materials and Printing

Innovation in materials, adhesives, and barrier coatings has significantly improved the durability and functionality of flexible packaging. Advanced digital printing technologies allow for better customization, reduced waste, and faster turnaround times. These improvements help brands enhance visual appeal and strengthen product differentiation in competitive retail environments. - Expansion of E-commerce and Home Delivery Models

The explosive growth of e-commerce and food delivery services has amplified the demand for packaging that is lightweight yet durable enough to protect goods during transit. Flexible packaging, due to its adaptability and lower material usage, has emerged as a key solution for online retail and shipping applications.

Read More : https://www.fortunebusinessinsights.com/flexible-packaging-market-104897

Challenges and Restraints

Despite its advantages, the flexible packaging market faces challenges related to recyclability and waste management. Many products are made from multi-layer laminates that combine plastic, metalized films, and adhesives, making them difficult to recycle using conventional systems. Governments across regions are tightening regulations to encourage recyclability and reduce plastic waste, which may pressure manufacturers to redesign packaging materials and invest in advanced recycling technologies.

Additionally, the high cost of sustainable alternatives remains a hurdle for some small and medium-sized producers. While eco-friendly materials are in demand, they often come with higher production and procurement costs compared to conventional plastics, limiting adoption in price-sensitive markets.

Key Industry Developments:

- April 2024 – Klöckner Pentaplast (kp), a significant food packaging industry company, declared the launch of the first food packaging trays comprising 100% recycled PET (rPET) deriving from trays. The newly launched kp tray is the first to be composed entirely of recycled tray material. This innovation is the major result of KP's Tray2Tray initiative, intending to rewrite the PET recycling rules. The president of food packaging at KP also stated that this achievement is a breakthrough in the packaging industry.

- April 2024 – Parkside announced the launch of Recoflex Paper for sustainable, flexible packaging solutions. The new range of versatile Recoflex Papers is accessible as a single-ply or laminate in numerous specifications. It offers durability, barrier performance, and excellent heat sealability, changing the game for paper-based flexible packaging in a number of market applications. With the launch, the company is stepping up its efforts to help solve the global packaging problem.

Emerging Trends and Opportunities

The future of flexible packaging market lies in innovation and sustainability. The adoption of mono-material packaging, which simplifies recycling, is expected to grow rapidly. Similarly, the use of recycled plastics and bio-based polymers is gaining momentum as brands seek to reduce their carbon footprint. Companies are also exploring smart packaging solutions, integrating QR codes and sensors to enhance traceability and consumer engagement.

Moreover, as global consumers become more health-conscious and environmentally aware, demand for clean-label and transparent packaging is expected to increase. Flexible packaging offers excellent opportunities for creative design, allowing brands to communicate authenticity and sustainability through aesthetics and materials.

Conclusion

The flexible packaging market is on a transformative path, balancing consumer convenience with sustainability goals. With its superior performance, cost-effectiveness, and eco-friendly potential, flexible packaging is reshaping how products are stored, transported, and consumed worldwide. While challenges related to waste management and regulation persist, innovation and collaboration across the value chain are expected to drive long-term growth.

By 2032, flexible packaging market will not only dominate key sectors such as food, beverages, and pharmaceuticals but also play a pivotal role in advancing global sustainability objectives. As industries embrace new materials, circular economy practices, and design innovation, flexible packaging stands out as a defining force in the future of global packaging.

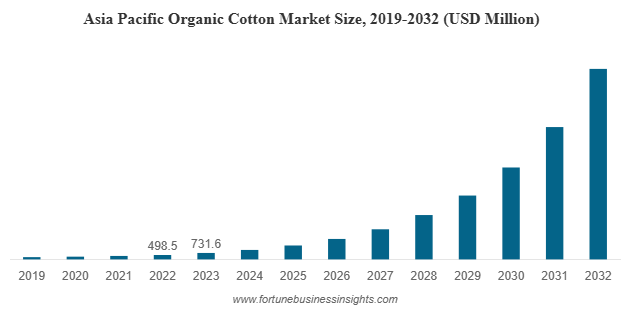

The global organic cotton market was valued at USD 1,113.5 million in 2023 and is expected to expand from USD 1,585.5 million in 2024 to USD 25,890.2 million by 2032, registering an impressive CAGR of 40.0% during the forecast period (2024–2032). Asia Pacific led the market in 2023 with a dominant 65.7% share, supported by strong production in India and China. Meanwhile, the U.S. organic cotton market is projected to witness robust growth, reaching approximately USD 504.56 million by 2032, fueled by rising consumer preference for sustainable and eco-friendly textile products.

List Of Key Companies Profiled

- Cargill Incorporated (U.S.)

- Plexus Cotton Ltd. (U.K.)

- Staple Cotton Cooperative Association (U.S.)

- Calcot Ltd. (U.S.)

- The Rajlakshmi Cotton Mills (P) Limited (India)

- Remei AG (Switzerland)

- Arvind Limited(India)

- Noble Ecotech (India)

- Louis Dreyfus Company (Netherlands)

- Texas Organic Cotton Marketing Cooperative (U.S.)

Growing Demand for Sustainable Textiles

The transition from conventional to organic cotton market is being driven by growing environmental awareness, consumer demand for transparency, and stricter global regulations on sustainability. Conventional cotton farming is resource-intensive, often requiring significant water and chemical inputs that harm soil health and biodiversity. Organic cotton, in contrast, is cultivated without synthetic pesticides or fertilizers, preserving ecosystems while promoting healthier soil and water management.

As consumers become more aware of the environmental and ethical impact of their purchases, brands are increasingly incorporating organic cotton into their product lines. Leading fashion, apparel, and home textile brands are committing to sourcing 100% sustainable cotton within the next decade, reflecting the growing emphasis on responsible supply chains.

Market Segmentation and Key Insights

The organic cotton market can be segmented by staple length, quality type, and application. Among staple lengths, middle staple cotton dominates the market due to its widespread use in everyday apparel, home textiles, and accessories. Long-staple and extra-long-staple cotton varieties, known for their softness and strength, are gaining traction in the luxury and premium clothing sectors. Meanwhile, short-staple organic cotton finds application in packaging, medical textiles, and nonwoven materials.

By quality type, upland cotton accounts for the largest share, being highly suitable for mass-market applications. Supima and Giza cotton varieties, with superior fiber length and texture, are used in high-end fashion and home furnishings where durability and feel are key differentiators.

In terms of application, apparel leads the global organic cotton market. Everyday clothing, sportswear, undergarments, and children’s wear make up a significant portion of demand. Beyond fashion, the packaging segment is rapidly expanding, driven by the replacement of plastic with biodegradable and recyclable materials in retail, cosmetics, and e-commerce sectors. The medical and hygiene sectors are also adopting organic cotton for masks, gowns, bandages, and wipes, as consumers increasingly prioritize non-toxic and skin-friendly materials.

Read More : https://www.fortunebusinessinsights.com/organic-cotton-market-106612

Regional Overview

Asia Pacific dominated the global organic cotton market in 2023, accounting for a 65.7% share. The region’s leadership is fueled by strong production bases in India and China, where favorable climatic conditions, government initiatives, and the availability of skilled labor support large-scale organic cotton cultivation. India, in particular, remains a leading producer and exporter of organic cotton, supplying major global apparel brands.

North America represents another fast-growing market, projected to reach USD 504.56 million by 2032. The region’s growth is driven by increasing awareness of sustainable fashion, along with the expansion of organic product lines by leading U.S. retailers and fashion brands. Europe, on the other hand, continues to be a hub for sustainable textile innovation, with strict environmental regulations, eco-label certifications, and high consumer preference for sustainable apparel. Emerging markets in Latin America, the Middle East, and Africa are also showing significant potential, supported by growing agricultural capacity and investments in organic farming.

Key Growth Drivers

Several factors are contributing to the strong outlook of the organic cotton market:

- Environmental Benefits: Organic cotton farming improves soil fertility, reduces water consumption, and eliminates harmful chemical inputs, aligning with global sustainability goals.

- Consumer Awareness: Growing consumer consciousness regarding the environmental and ethical impact of textile production is driving demand for certified organic products.

- Brand Commitments: Global brands are pledging to transition to sustainable raw materials, integrating organic cotton across apparel, home furnishings, and packaging.

- Technological Advancements: Innovations in cotton processing, seed quality, and supply chain traceability are improving productivity and reducing costs.

- Diverse Applications: The versatility of organic cotton is enabling its use beyond fashion—into packaging, home décor, and medical textiles.

Market Challenges

Despite its rapid growth, the organic cotton industry faces several challenges. Higher production costs, lower yields, and limited access to organic-certified seeds remain significant hurdles for farmers. Supply constraints are another concern, as the demand for organic cotton currently outpaces available supply, especially from certified sources. Additionally, price sensitivity among consumers and the premium associated with organic cotton products can limit adoption in cost-driven markets. Ensuring traceability and authenticity across complex supply chains also remains a priority for the industry.

Competitive Landscape

The global market is moderately consolidated, with key players such as Cargill Incorporated, Plexus Cotton Ltd., Staple Cotton Cooperative Association, Calcot Ltd., Rajlakshmi Cotton Mills (India), Remei AG, Arvind Limited, and Noble Ecotech leading the space. These companies are focusing on strategic partnerships, capacity expansion, and certification programs to strengthen supply chain transparency and increase their global reach. Collaborations between cotton cooperatives and major fashion brands are helping stabilize supply and ensure fair trade practices across the value chain.

Future Outlook

Looking ahead, the organic cotton market is set to play a defining role in shaping the future of sustainable textiles. Rising environmental regulations, government incentives, and growing consumer loyalty toward eco-friendly products are expected to accelerate market adoption. With continuous innovations in farming, processing, and traceability technologies, organic cotton is poised to become a mainstream material across industries ranging from apparel to packaging and healthcare.

As sustainability transitions from a niche trend to a global standard, the organic cotton industry stands as a symbol of responsible growth, paving the way for a greener and more ethical textile future.