The global potassium formate market was valued at USD 730.53 million in 2023 and is expected to grow from USD 756.54 million in 2024 to USD 1,073.08 million by 2032, registering a CAGR of 4.5% during the 2024–2032 forecast period. In 2023, North America held the largest market share at 32.5%.

Key Growth Drivers

- Environmentally Friendly De-Icing Agent

Potassium formate is widely recognized for its environmentally friendly characteristics, making it a preferred alternative to traditional chloride-based de-icing agents. Unlike sodium chloride or calcium chloride, potassium formate has a lower corrosive effect on infrastructure, vehicles, and the environment. Its biodegradability and minimal impact on soil and water systems make it a suitable choice for use in airports, bridges, highways, and runways. As environmental regulations become stricter across the globe, municipalities and airport authorities are increasingly shifting toward using potassium formate for winter maintenance.

- Demand in the Oil and Gas Industry

One of the most significant applications of potassium formate is in the oil and gas sector. It is commonly used as a high-density, low-solids brine in well-drilling operations. Its unique properties make it ideal for use in high-pressure, high-temperature (HPHT) wells, especially in environmentally sensitive areas such as offshore drilling sites. Potassium formate brines improve drilling efficiency by enhancing wellbore stability, minimizing formation damage, and reducing environmental risks. As exploration and production activities increase globally, particularly in deepwater and shale regions, the demand for potassium formate in this segment is expected to rise.

- Use in Heat Transfer Fluids

Potassium formate also finds extensive use in heat transfer applications, especially in refrigeration systems and industrial cooling processes. It is favored for its high thermal conductivity, non-toxic nature, and compatibility with various materials. In addition, it performs well at low temperatures, making it ideal for secondary refrigerant systems in food storage and processing facilities, data centers, and sports complexes. With industries seeking more energy-efficient and environmentally safe cooling solutions, the use of potassium formate-based heat transfer fluids is growing steadily.

- Agricultural and Chemical Applications

In agriculture, potassium formate is used as a feed preservative and growth promoter due to its antibacterial properties. It helps improve animal digestion and feed efficiency, particularly in pig and poultry farming. Furthermore, it serves as a key raw material or intermediate in the manufacture of various chemicals, especially in specialty chemical and pharmaceutical industries. These additional applications expand its utility across diverse industrial domains.

List Of Key Market Players Profiled In The Report

- Hawkins (U.S.)

- Geocon Products (India)

- Weifang Tainuo Chemical Co., Ltd. (China)

- Shandong Xinhua Pharma. (China)

- Dongying Shuntong Chemical (Group) Co., Ltd. (China)

- Sidley Chemical Co., Ltd. (China)

- Perstorp AB (Sweden)

- Honeywell International Inc. (U.S.)

- ADDCON GmbH (Germany)

- Dynalene, Inc. (U.S.)

Market Segmentation

By Form:

- Liquid: Liquid or brine form dominates the market due to ease of handling and direct use in drilling and de-icing applications. It is preferred in industries requiring bulk storage and transport.

- Solid: The solid form is gaining traction for use in regions with specific transportation or storage limitations. It offers longer shelf life and easier dosing in certain applications.

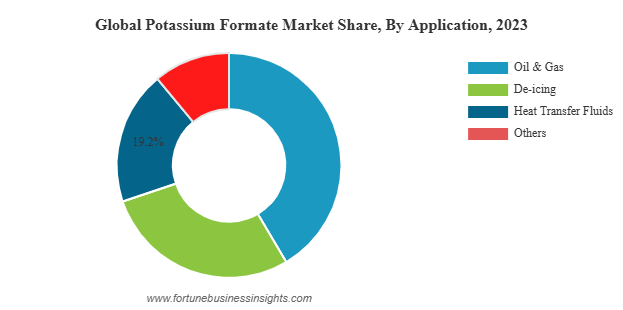

By Application:

- Oil & Gas: This segment accounts for the largest market share due to potassium formate’s widespread use as a drilling and completion fluid.

- De-icing: A rapidly growing application area, especially in colder regions that prioritize eco-friendly alternatives for road and runway maintenance.

- Heat Transfer Fluids: Increasing demand in industrial and commercial refrigeration systems drives this segment forward.

- Others: Includes agriculture, chemical manufacturing, and food processing, which contribute to consistent demand across smaller but stable end-use industries.

Read More : https://www.fortunebusinessinsights.com/potassium-formate-market-109687

Regional Insights

- North America

North America leads the global potassium formate market, primarily due to advanced oilfield operations in the United States and Canada. The region’s well-developed infrastructure for de-icing and strong awareness of environmental sustainability further supports high consumption levels. Additionally, the presence of major industry players contributes to market consolidation.

- Europe

Europe follows closely, driven by high environmental standards and significant adoption of potassium formate for both de-icing and industrial heat transfer applications. The region’s cold climate and focus on green alternatives make it a major consumer, particularly in countries like Germany, the UK, and Scandinavia.

- Asia Pacific

Asia Pacific is emerging as the fastest-growing regional market. The region’s increasing energy exploration activities, combined with growing industrialization in countries like China, India, and Southeast Asian nations, are boosting demand. Moreover, infrastructure expansion and modernization in cold-climate regions such as Northern China contribute to higher usage in de-icing applications.

- Rest of the World

Latin America and the Middle East & Africa regions are witnessing steady adoption due to the rise in oil exploration projects and improved infrastructure development.

Key Industry Developments

- October 2021 – BASF SE introduced a new line of potassium formate-based fluids specifically designed for aviation de-icing and anti-icing applications.

- August 2021 – Perstorp Potassium Formate (PoFO) was registered as a fertilizer under EC 2002/2003, simplifying the process for farmers using PoFO-based fertilizers like Amicult K 42. This registration eliminated the need for local raw material registration, thereby enhancing crop quality and yields.

Challenges Facing the Market

- Despite its many advantages, the potassium formate market faces some challenges. One of the primary concerns is its higher cost compared to traditional alternatives like sodium chloride. This price differential can limit its widespread adoption in price-sensitive markets. Additionally, volatility in the prices of raw materials such as formic acid can impact overall production costs and profitability for manufacturers.

- Another restraint is the lack of widespread awareness about the benefits of potassium formate, particularly in developing nations. Education and awareness campaigns by manufacturers and regulatory support may help overcome these limitations.

Future Outlook

The potassium formate market is poised for consistent growth, supported by increasing industrial applications, rising environmental awareness, and regulatory encouragement for eco-friendly chemical usage. Its ability to serve as a high-performance, low-impact solution in diverse industries such as oil and gas, de-icing, and thermal management ensures strong long-term potential. Manufacturers investing in cost reduction, product innovation, and expanding application scope are likely to lead the next phase of market expansion.

The global adhesives and sealants market has been experiencing steady growth, driven by rising demand across packaging, automotive, construction, and electronics industries. Adhesives are used for bonding similar or dissimilar materials, while sealants are applied to block the passage of fluids through surfaces or joints. Together, they play a crucial role in product assembly, structural integrity, insulation, and packaging.

Market Size and Growth Forecast

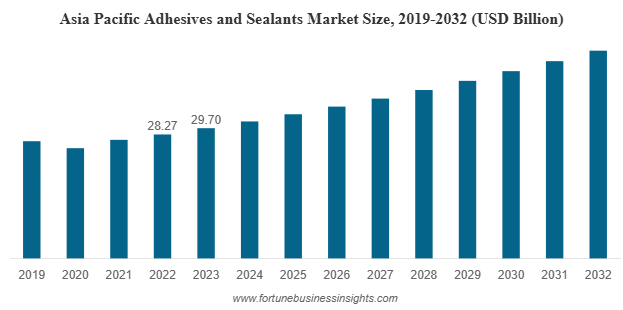

The global adhesives and sealants market was valued at USD 79.38 billion in 2023 and is expected to rise from USD 82.88 billion in 2024 to USD 118.83 billion by 2032, reflecting a CAGR of 4.6% during the forecast period. In 2023, Asia Pacific led the market, holding the largest share. The adhesives and sealants market in the United States is anticipated to grow substantially, with its value projected to reach USD 22.36 billion by 2032, driven by growing demand in both residential and non-residential construction sectors.

List Of Key Companies Profiled:

- 3M (U.S.)

- Arkema S.A. (France)

- Henkel Corporation (Germany)

- Ashland Inc. (U.S.)

- Avery Dennison (U.S.)

- BASF SE (Germany)

- Evonik Industries (Germany)

- H.B. Fuller Company (U.S.)

- PPG Industries (U.S.)

Key Market Drivers

- Expansion in Packaging and E-Commerce

The packaging industry continues to be a major driver of adhesives consumption. Increased demand for flexible, eco-friendly, and secure packaging—especially due to the surge in e-commerce—has significantly boosted market growth. Adhesives are widely used in labeling, carton sealing, flexible packaging laminates, and other bonding applications that require precision and reliability. - Infrastructure and Construction Growth

The building and construction sector is a vital consumer of sealants and structural adhesives. Urbanization, increasing residential and commercial development, and renovation projects are contributing to rising usage in tiling, flooring, glazing, weatherproofing, and insulation systems. Sealants help improve energy efficiency and protect buildings from water damage, while adhesives are used in modular and prefabricated construction. - Automotive Industry Demand

In the automotive industry, the push toward lightweighting and electric vehicle (EV) production is encouraging the use of high-performance adhesives and sealants. These materials allow the joining of different substrates such as metals, plastics, and composites, replacing traditional welding or mechanical fastening. They also contribute to noise reduction, corrosion protection, and better vehicle aerodynamics. - Sustainable and Low-VOC Formulations

Environmental regulations are influencing product development, with a strong push toward low-VOC (volatile organic compound) and eco-friendly formulations. Water-based, hot-melt, and reactive systems are gaining popularity as they offer reduced environmental impact while maintaining high performance. The demand for green building certifications and sustainable packaging is further accelerating this trend. - Electronics and Appliances

With growing demand for consumer electronics and smart devices, adhesives and sealants are being increasingly used for circuit boards, displays, camera modules, and batteries. These materials provide insulation, shock resistance, and protection against dust and moisture, supporting durability and miniaturization in electronics manufacturing.

Market Segmentation Highlights

By Resin Type:

- Acrylic adhesives dominate due to their excellent bonding strength and weather resistance.

- Silicone sealants are preferred in construction and electronics for their flexibility and resistance to extreme temperatures.

- Polyurethane adhesives are widely used in automotive, construction, and footwear for their toughness and impact resistance.

- Epoxy adhesives offer high strength and are primarily used in structural and industrial applications.

By Technology:

- Water-based adhesives hold the largest share, thanks to low toxicity and widespread use in paper, packaging, and consumer goods.

- Hot-melt adhesives are gaining traction in packaging and automotive interiors due to fast setting time and efficiency.

- Solvent-based adhesives are used where high resistance is required, though their use is declining due to environmental regulations.

- Reactive adhesives like polyurethane and epoxy are favored for high-performance bonding applications.

By Application:

- Packaging remains the leading application segment for adhesives, driven by growing consumption in food and consumer goods.

- Building and construction is the largest end-use segment for sealants, especially in glazing, expansion joints, and insulation.

- Automotive, electronics, healthcare, and footwear are also important industries contributing to market expansion.

Read More : https://www.fortunebusinessinsights.com/industry-reports/adhesives-and-sealants-market-101715

Regional Insights

- Asia Pacific accounted for the largest market share of 37.4% in 2023, driven by rapid industrialization, a booming construction sector, and strong automotive manufacturing in countries like China, India, and Japan. The region’s dominance is also supported by low labor costs, abundant raw materials, and large-scale infrastructure development.

- North America and Europe are also significant contributors, with growing demand for sustainable construction solutions and increasing use of electric vehicles. These regions are characterized by stringent environmental regulations, prompting manufacturers to invest in cleaner, compliant formulations.

- Latin America, Middle East, and Africa are emerging markets with strong potential, as governments focus on infrastructure projects and industrial diversification.

Key Industry Developments

- July 2023: Sika announced the acquisition of a family-owned business named “Chema” based in Peru. Chema is a well-established brand in the Peruvian mortar market and provides a range of tile grouts, tile adhesives, and other high-quality products. The acquisition strengthens its presence in the distribution channel in Peru and the development of Sika’s Building Finishing portfolio.

- March 2023: Arkema acquired Polytec PT, specialized in adhesives for batteries and electronics. With this acquisition, Arkema would strengthen Bostik’s product offerings to serve the fast-growing batteries and electronics markets. This bolt-on acquisition is part of the Group’s strategy to become a full system provider and support its customers to develop sustainable solutions for the batteries and electronics markets.

Challenges and Restraints

Despite positive growth trends, the industry faces several challenges:

- Volatility in Raw Material Prices: Fluctuations in prices of petrochemical-based inputs such as resins and solvents affect manufacturing costs and pricing strategies.

- Stringent Environmental Regulations: Compliance with safety and environmental standards adds complexity and cost to product development.

- Availability of Substitutes: In certain applications, traditional mechanical fastening, welding, or other joining methods still compete with adhesive solutions.

- Technical Barriers: In advanced structural applications, adhesives must meet stringent performance and durability standards, posing technical hurdles in formulation and testing.

Outlook

The global adhesives and sealants market is poised for steady and sustained growth over the coming years. The shift toward eco-conscious products, technological advancements in adhesive chemistry, and demand from key end-use industries are expected to continue driving market expansion. Companies that focus on innovation, sustainability, and meeting evolving customer needs will be best positioned to capitalize on emerging opportunities.

As industries increasingly prioritize performance, cost-efficiency, and environmental responsibility, adhesives and sealants will play a central role in shaping the future of manufacturing, packaging, and construction.

The global organic cotton market is gaining significant traction, driven by the rising awareness of sustainable practices, health consciousness, and environmental concerns. Organic cotton, unlike its conventional counterpart, is cultivated using eco-friendly agricultural methods without the use of synthetic chemicals, pesticides, or genetically modified seeds. This natural and environmentally responsible approach is fueling widespread adoption across various industries—from apparel and personal care to medical and packaging applications.

Market Size and Forecast

The global organic cotton market was valued at USD 1,113.5 million in 2023 and is expected to grow from USD 1,585.5 million in 2024 to USD 25,890.2 million by 2032, registering a strong CAGR of 40.0% during the forecast period 2024–2032. In 2023, Asia Pacific held the largest share of the market at 65.7%. Additionally, the organic cotton market in the United States is projected to witness significant growth, with its value anticipated to reach approximately USD 504.56 million by 2032, fueled by rising consumer demand for eco-friendly and sustainable textiles.

The surge in market demand is largely attributed to increasing consumer preference for eco-friendly and ethically sourced products, especially among younger demographics who are highly concerned about the environmental and social impact of the products they purchase.

List Of Key Companies Profiled

- Cargill Incorporated (U.S.)

- Plexus Cotton Ltd. (U.K.)

- Staple Cotton Cooperative Association (U.S.)

- Calcot Ltd. (U.S.)

- The Rajlakshmi Cotton Mills (P) Limited (India)

- Remei AG (Switzerland)

- Arvind Limited(India)

- Noble Ecotech (India)

Environmental and Health Benefits

Organic cotton farming promotes soil fertility, biodiversity, and water conservation. By eliminating harmful chemicals and synthetic fertilizers, it significantly reduces the risk of water contamination and adverse effects on both ecosystems and human health. In addition, organic cotton farming supports farmers’ health by reducing their exposure to toxic substances and encouraging safer agricultural practices.

These environmental and social benefits are key motivators for the rapid growth of this segment, as global consumers and brands alike are becoming more conscious of the sustainability embedded in their supply chains.

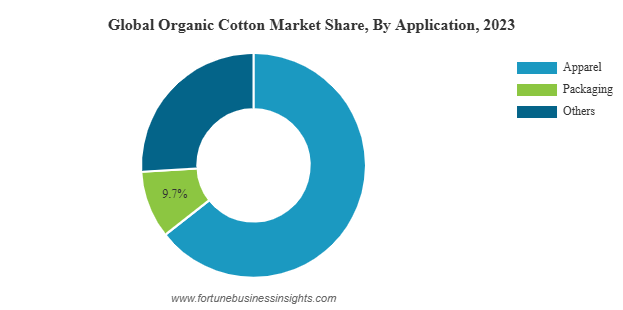

Key Market Segments

- By Fiber Type:

Middle-staple fiber, which includes the widely cultivated American upland variety, holds the dominant position in the market. This variety is favored for its balanced cost-effectiveness, good strength, and versatility in clothing and home textiles. - By Application:

The apparel segment continues to lead the market, supported by a growing demand for organic t-shirts, dresses, sportswear, baby clothing, and innerwear. Organic cotton is also making inroads in packaging—especially among cosmetic and e-commerce brands—due to its traceability, biodegradability, and reduced chemical content. - In addition to apparel and packaging, the medical and personal care segments are showing steady growth, where organic cotton is being used in wound care, hygiene products, and reusable medical textiles due to its hypoallergenic and chemical-free nature.

Read More : https://www.fortunebusinessinsights.com/organic-cotton-market-106612

Regional Insights

- Asia Pacific emerged as the largest market in 2023, accounting for over 65% of the global market share. This dominance is primarily due to the strong presence of organic cotton-producing countries such as India, China, and Turkey. The region benefits from abundant arable land, skilled labor, favorable climate conditions, and supportive policies promoting organic farming.

- North America, particularly the United States, is experiencing steady growth, fueled by rising consumer demand for sustainable lifestyle products and increased usage of organic cotton in premium and healthcare-related textiles. The U.S. market is expected to reach around USD 504 million by 2032.

- Europe is also witnessing significant progress, driven by stringent sustainability regulations, eco-conscious consumers, and a strong inclination toward ethically sourced fashion and textiles.

- Latin America, the Middle East, and Africa are emerging markets with high potential. These regions are gradually expanding their organic cotton farming capacity and improving traceability through farmer cooperatives and export partnerships.

Market Drivers and Trends

- Growing Consumer Awareness: As global consumers become increasingly aware of the environmental and health impact of conventional cotton production, the demand for sustainable alternatives like organic cotton is rapidly accelerating.

- Regulatory Push: Governments and international organizations are encouraging sustainable farming and textile production practices, which is further fueling demand for certified organic cotton.

- Innovation in Farming and Sourcing: Regenerative agricultural practices and agroforestry are being adopted in various regions, enhancing soil health and carbon sequestration. These initiatives are improving the long-term viability and appeal of organic cotton farming.

- Traceability and Transparency: Brands are now emphasizing end-to-end transparency in their supply chains. This includes adopting certification standards, digital tracking systems, and ethical sourcing frameworks that ensure integrity and accountability in organic cotton production.

Challenges to Consider

Despite its promising growth, the organic cotton market faces certain challenges:

- High Production Costs: Organic cotton often involves higher input costs and lower yields compared to conventional cotton, which can affect its competitiveness.

- Certification Complexity: Meeting organic certification standards can be difficult, especially for small-scale farmers who lack the resources or knowledge to navigate complex compliance processes.

- Fragmented Supply Chain: In many parts of the world, the organic cotton value chain remains unorganized and scattered, making it difficult to maintain consistent quality and traceability at scale.

Future Outlook

The organic cotton market is set to transform the global textile landscape by aligning economic opportunity with environmental and social responsibility. As awareness continues to grow and innovations in sustainable agriculture and ethical sourcing mature, organic cotton is poised to become the foundation of future-ready textile systems.

Governments, brands, and producers who prioritize regenerative farming, certification compliance, and traceable sourcing models will not only enhance their environmental footprint but also tap into the rising demand from conscious consumers worldwide.

The global thermoplastic elastomer market was valued at USD 26,856.8 million in 2019 and is expected to grow to USD 39,424.6 million by 2027, registering a CAGR of 5.7% during the forecast period. In 2019, Asia Pacific held the largest share of the market at 52.97%. Additionally, the thermoplastic elastomer market in the U.S. is anticipated to reach USD 6,045 million by 2027, driven by the increasing demand for lightweight and durable materials in the automotive and consumer goods sectors.

The global thermoplastic elastomer (TPE) market is experiencing steady growth as industries increasingly seek materials that offer a combination of flexibility, strength, durability, and environmental friendliness. These materials exhibit characteristics of both thermoplastics and elastomers, making them ideal for various end-use industries including automotive, medical, construction, consumer goods, and electronics.

Key Growth Drivers

A major factor driving market growth is the increased use of TPEs in the automotive industry. These materials are used extensively in automotive parts such as bumpers, weather seals, gaskets, under-the-hood components, and interior trims. Their lightweight properties contribute to improved fuel efficiency, while their strength and resistance to wear enhance durability. Additionally, manufacturers are adopting TPEs to replace heavier metal and rubber parts, contributing to overall vehicle weight reduction and improved sustainability.

Another strong driver is the medical and healthcare sector, where demand for biocompatible and latex-free materials is rising. TPEs are ideal for medical tubing, syringe tips, seals, and other medical components due to their flexibility, chemical resistance, and ability to withstand sterilization. The increasing need for disposable medical products and safe packaging solutions is also contributing to market growth.

In the consumer goods industry, TPEs are used in items requiring a soft-touch feel, flexibility, and durability. These include personal care items, toothbrush grips, kitchen utensils, sporting goods, and toys. The material’s ability to be molded into complex shapes and its recyclability make it an economical and sustainable option for manufacturers.

The construction sector is also contributing to TPE demand, particularly in waterproofing systems, window seals, and roofing membranes. TPEs offer excellent weather resistance, UV stability, and long service life, making them suitable for harsh outdoor conditions.

List Of Key Companies Profiled In Thermoplastic Elastomer Market

- Arkema SA (Colombes, France)

- Covestro AG (Leverkusen, Germany)

- Evonik Industries AG (Essen, Germany)

- Teknor APEX Company (Rhode Island, U.S.)

- BASF SE (Ludwigshafen, Germany)

- Huntsman Corporation (Texas, U.S.)

- Sinopec Group (Beijing, China)

- Lubrizol Corporation (Ohio, U.S.)

- Kraton Corporation (Texas, U.S.)

- Tosoh Corporation (Tokyo, Japan)

Material Type and Applications

- The TPE market is categorized into several types based on material composition: Styrenic Block Copolymers (SBCs), Thermoplastic Polyurethanes (TPUs), Thermoplastic Vulcanizates (TPVs), Thermoplastic Polyolefins (TPOs), and Copolyester Elastomers (COPEs).

- Among these, SBCs hold a significant market share due to their low cost, ease of processing, and use in adhesives, footwear, and general-purpose applications. TPUs are valued for their high elasticity, transparency, and resistance to abrasion, making them ideal for use in electronics, sports gear, and medical devices.

- TPVs are increasingly used in automotive and industrial applications, especially for components that must withstand high temperatures, oils, and chemicals. TPOs and COPEs are gaining traction in applications requiring thermal stability and durability, such as automotive exteriors and electrical components.

- These materials are processed using conventional thermoplastic methods like injection molding and extrusion, which lowers production costs and allows for rapid manufacturing.

Read More : https://www.fortunebusinessinsights.com/thermoplastic-elastomer-tpe-market-104515

Regional Market Insights

-

In 2023, Asia Pacific led the global TPE market, driven by rapid industrialization, urbanization, and growing automotive production in countries like China, India, and Japan. The region’s expanding construction sector and rising consumer demand for electronics and personal care products are further fueling the demand for thermoplastic elastomers.

-

North America holds a substantial share of the global market, backed by robust manufacturing infrastructure, high automotive output, and rising healthcare expenditure. The U.S. in particular is witnessing increasing adoption of TPEs in medical devices, automotive interiors, and consumer goods due to stringent safety standards and environmental regulations.

- Europe is also a key market, with growing applications in automotive, electronics, and construction. The push toward sustainability, supported by government regulations and recycling targets, is encouraging the use of recyclable TPE grades in the region.

- Latin America and the Middle East & Africa are emerging markets for TPEs. These regions are seeing growth due to infrastructure development, increased industrial activity, and rising demand for consumer goods and automotive parts.

Key Industry Developments:

- August 2020: Lubrizol invested in the thermoplastic polyurethane business globally. The investments include the increased production capabilities of surface paint protection film (PPF) and protection. At the same time, it would provide additional benefits to PPF manufacturers and supply chains.

- November 2020: Evonik announced the cooperation with HP for developing a new co-branded1 elastomer, a flexible high-performance specialty powder based on a thermoplastic amide grade (TPA) for 3D printing.

Market Challenges and Opportunities

- Despite promising growth, the TPE market faces challenges such as fluctuating raw material prices, limited temperature resistance of certain TPE types, and competition from traditional rubber and thermoset materials in some applications. However, rising innovation in material formulations and processing technologies is expected to overcome these hurdles.

- The development of bio-based and recyclable TPEs presents significant growth opportunities. As environmental concerns rise, industries are increasingly shifting toward sustainable materials. Bio-based TPEs, derived from renewable sources, are being developed to meet the growing demand for eco-friendly alternatives.

- Moreover, the expanding use of electric vehicles (EVs), the miniaturization of electronic components, and advancements in medical technology are expected to create new application areas for TPEs.

The global thermoplastic elastomer (TPE) market is positioned for steady and long-term growth, driven by the material’s unique combination of flexibility, strength, and recyclability. With increasing use across automotive, medical, consumer, construction, and electronics sectors, TPEs are becoming a material of choice for both performance and sustainability. As industries continue to innovate and prioritize efficiency and environmental impact, the demand for advanced TPE solutions is expected to rise significantly through 2032 and beyond.

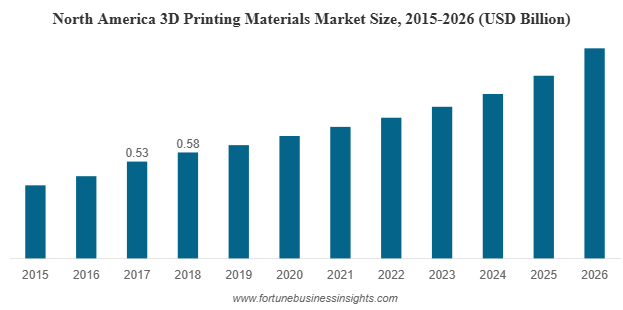

The global 3D printing materials market was valued at USD 1.53 billion in 2018 and is expected to grow to USD 3.78 billion by 2026, registering a CAGR of 12.1% during the forecast period. In 2018, North America led the market with a share of 37.91%. The 3D printing materials market in the U.S. is anticipated to reach USD 1.28 billion by 2026, driven by the increasing adoption of additive manufacturing across various industries.

3D printing materials are essential inputs used in additive manufacturing processes to create three-dimensional objects layer by layer. These materials enable customization, prototyping, and end-use production, making them invaluable in a range of industries including aerospace, automotive, healthcare, consumer goods, and construction.

Key Market Drivers

A major factor propelling the growth of the 3D printing material market is the increasing demand for rapid prototyping and custom manufacturing. Traditional manufacturing processes are often time-consuming and cost-intensive, especially for low-volume or complex parts. 3D printing allows for faster development cycles, reduced waste, and greater design freedom, making it an ideal choice for a variety of industries.

In aerospace and automotive sectors, the need for lightweight and durable components is contributing significantly to the rising use of 3D printing materials. These materials help reduce the overall weight of parts without compromising performance, improving fuel efficiency and contributing to lower carbon emissions.

The healthcare sector is also a major contributor to market growth. Customized implants, dental prosthetics, surgical instruments, and anatomical models can be produced with high precision using 3D printing. Biocompatible materials that are safe for use inside the human body are in high demand for such applications.

List of Top 3D Printing Materials Companies:

- Stratasys Ltd.

- 3D Systems, Inc.

- Materialise NV

- Markforged, Inc.

- EOS GmbH

- Höganäs AB

- Arkema

- Royal DSM N.V.

- ExOne

- GE Additive

Material Type Insights

The 3D printing material market includes a wide variety of materials such as plastics, metals, ceramics, and composites.

- Plastics represent the largest segment due to their affordability, ease of use, and versatility. Common types of plastic materials used in 3D printing include polylactic acid (PLA), acrylonitrile butadiene styrene (ABS), polyethylene terephthalate glycol (PETG), and nylon. These are widely used in consumer products, educational models, and industrial prototyping.

- Metals are gaining traction in industries that require high-strength, high-temperature, and corrosion-resistant components. Materials such as titanium, stainless steel, aluminum, and cobalt-chrome are used to manufacture functional parts in aerospace, automotive, and medical applications.

- Ceramics and composites are being increasingly adopted in specialized applications, especially where high heat resistance and structural integrity are critical. These materials are used in fields such as electronics, dental, and defense manufacturing.

Read More : https://www.fortunebusinessinsights.com/3d-printing-material-market-102296

Technology Advancements and Applications

The evolution of 3D printing technologies such as fused deposition modeling (FDM), selective laser sintering (SLS), stereolithography (SLA), and direct metal laser sintering (DMLS) has expanded the compatibility and performance of materials. These technologies allow manufacturers to produce highly detailed, durable, and complex parts at scale.

With the integration of automation, artificial intelligence, and simulation software, the additive manufacturing process has become more efficient and cost-effective. This, in turn, is accelerating the adoption of 3D printing materials across sectors. In construction, large-scale printers are being used to build architectural components and even entire structures, while the fashion industry is exploring 3D-printed textiles and accessories.

Regional Insights

- In 2023, North America held the largest share of the 3D printing material market, driven by strong research and development activity, the presence of leading manufacturers, and the growing adoption of advanced manufacturing technologies across industries.

- Asia Pacific is anticipated to witness the highest growth rate during the forecast period. Countries such as China, Japan, South Korea, and India are investing heavily in digital manufacturing infrastructure. Expanding automotive, electronics, and consumer goods industries are contributing significantly to regional demand. Supportive government initiatives and increasing awareness about sustainable manufacturing are also driving market growth in this region.

- Europe also holds a significant share of the global market, with countries like Germany, the UK, and France focusing on integrating 3D printing into industrial processes, education, and healthcare systems.

Key Industry Developments:

- September 2019 – 3D Systems launched new materials for 3D printing namely PRO-BLK 10, and HI-TEMP 300-AMB. The new products will diversify the company’s product portfolio and expand the range of applications for customers.

- November 2018 – Royal DSM N.V. launched “Arnitel ID2060 HT”, a high-performance thermoplastic copolyester for 3D printing by using fused filament fabrication. The filament offers a balance of properties such as chemical resistance, flexibility, and high-temperature resistance.

Challenges and Opportunities

- While the 3D printing material market shows immense promise, it is not without challenges. High costs of advanced materials, limited standardization, and concerns around material performance in certain critical applications can hinder adoption. Additionally, the lack of skilled labor in some regions may impact implementation.

- However, these challenges present opportunities for innovation. As demand rises, material manufacturers are investing in research and development to create cost-effective, high-performance materials. The development of recyclable, eco-friendly materials is also gaining traction, aligning with global sustainability goals.

- The increasing availability of open-source designs and the rise of decentralized manufacturing are expected to further enhance the accessibility and utility of 3D printing. Education and training initiatives are also helping bridge the skills gap, enabling broader market adoption.

The global 3D printing material market is poised for significant growth over the coming years. Rapid advancements in technology, expanding industrial applications, and increasing focus on customization and sustainability are driving the demand for diverse and innovative materials. With strong support from both the public and private sectors, the 3D printing material industry is set to play a pivotal role in shaping the future of global manufacturing.

The global building thermal insulation market was valued at USD 32.53 billion in 2023 and is expected to increase from USD 33.98 billion in 2024 to USD 48.60 billion by 2032, registering a CAGR of 4.5% during the forecast period from 2024 to 2032. In 2023, Asia Pacific held the largest share of the market, accounting for 49.12%. The market in the U.S. is anticipated to grow substantially, reaching approximately USD 7.60 billion by 2032, driven by strong government support for energy-efficient technologies in the building and construction sector.

Importance of Building Thermal Insulation

Thermal insulation in buildings plays a crucial role in minimizing heat transfer between indoor and outdoor environments. This leads to lower energy consumption, better indoor temperature control, and reduced dependency on heating and cooling systems. As global energy demands grow, governments and building owners alike are prioritizing thermal insulation to reduce operational costs and carbon footprints.

Thermal insulation is no longer just an add-on but a necessity in both residential and commercial buildings. It contributes significantly to improved energy performance ratings and supports global sustainability goals. With increasing emphasis on green buildings and zero-energy standards, the use of insulation materials in construction is expected to rise further.

List of Top Building Thermal Insulation Companies:

- BASF (Germany)

- Atlas Roofing Company (U.S.)

- Cellofoam North America Inc. (U.S.)

- DuPont (U.S.)

- Knauf Insulation (U.S.)

- Owens Corning (U.S.)

- Armacell S.A. (Luxembourg)

- Beijing New Building Material (Group) Co., Ltd. (China)

- Evonik (Germany)

- PT. Bondor Indonesia (Indonesia)

- BYUCKSAN (South Korea)

Key Growth Drivers

One of the major drivers of the market is the increasing number of energy efficiency policies and building codes that encourage or mandate the use of insulation materials. Several countries have introduced energy efficiency standards for both new and existing structures, leading to a surge in demand for high-performance thermal insulation products.

Rapid urbanization and industrialization, especially in emerging economies, are also supporting market growth. The rising construction of commercial complexes, residential apartments, and public infrastructure projects has amplified the need for insulation materials that ensure optimal thermal performance and occupant comfort.

In colder regions, building insulation is essential to retain heat, while in warmer climates, it helps keep interiors cool, reducing air conditioning needs. This global adaptability has made thermal insulation a fundamental component of climate-responsive architecture.

Read More : https://www.fortunebusinessinsights.com/building-thermal-insulation-market-102708

Material Insights

The building thermal insulation market includes a wide range of materials such as glass wool, stone wool, expanded polystyrene (EPS), extruded polystyrene (XPS), polyurethane foam, and more. Among these, EPS and XPS are widely used due to their excellent thermal resistance, lightweight nature, and moisture resistance. Glass wool is another leading material, favored for its cost-efficiency and widespread availability in residential applications.

Foam-based insulation materials like polyurethane and polyisocyanurate are gaining popularity in high-performance buildings and industrial settings where enhanced insulation is required. Increasing innovation in insulation materials is also leading to the emergence of eco-friendly alternatives, such as cellulose, hemp, and sheep wool, which are being adopted as part of sustainable building initiatives.

Application and Installation Trends

Thermal insulation is commonly installed in building components such as walls, roofs, floors, basements, and ceilings. Wall insulation accounts for the largest market share due to the surface area it covers and its critical role in maintaining thermal comfort. Roof insulation also holds a significant portion of the market, especially in areas with extreme weather conditions.

Both new construction and renovation projects are contributing to market growth. However, retrofitting existing buildings with insulation materials is becoming increasingly important, particularly in developed nations where older structures require energy performance upgrades. Government-backed initiatives and rebate programs are encouraging homeowners and building managers to invest in thermal insulation retrofits.

Regional Market Insights

Europe held the largest share of the global building thermal insulation market in 2023. The region benefits from strict energy efficiency regulations, high energy costs, and widespread awareness regarding environmental sustainability. Countries like Germany, France, and the UK are leading the way with robust green building programs and mandatory energy standards.

North America follows closely, with the U.S. being a major contributor. The presence of a mature construction industry, strong regulatory backing, and increasing demand for energy conservation are key factors driving regional growth.

Asia Pacific is projected to witness the highest growth rate during the forecast period. Rapid infrastructure development, a rising middle-class population, and favorable government initiatives aimed at promoting energy-efficient construction are fueling demand in countries like China, India, and Japan.

Latin America and the Middle East & Africa are also emerging markets for thermal insulation. Increased construction activities, coupled with growing awareness about energy savings and indoor comfort, are creating new opportunities in these regions.

Key Industry Developments:

- April 2021 – Atlas Roofing Company introduced SureSlope prefabricated tapered products. The new product family of polyiso roof insulation components is ideal for roofing applications, reducing job site waste and decreasing installation time.

- March 2021 - Owens Corning acquired vliepa GmbH, a company specializing in coating, printing, and finishing nonwovens, film, and paper for the construction industry. The acquisition widens the company’s nonwovens portfolio for European customers working in the regional construction industry.

Challenges and Opportunities

Despite the positive outlook, the building thermal insulation market faces challenges such as fluctuating raw material prices and limited awareness in some regions. Installation costs and lack of skilled labor may also hinder market expansion, particularly in developing nations.

However, increasing investments in sustainable construction, innovation in product development, and supportive government policies offer strong growth prospects. Manufacturers are focusing on developing recyclable, non-toxic, and high-performance insulation products to align with global environmental goals.

The building thermal insulation market is poised for sustained growth as energy efficiency becomes a global priority. With rising construction activity, regulatory support, and a strong push for sustainable building practices, the demand for thermal insulation materials is expected to remain robust over the coming years. As the construction industry evolves, thermal insulation will continue to play a critical role in achieving energy conservation and environmental sustainability across residential, commercial, and industrial spaces.

The global surface disinfectant market was valued at USD 770.6 million in 2019 and is expected to grow to USD 1,547.7 million by 2027, registering a CAGR of 9.1% from 2020 to 2027. North America held the largest share of the market in 2019, accounting for 38.92%. In the U.S., the market is projected to see substantial growth, reaching USD 524.4 million by 2027, driven by increased awareness of hygiene and sanitation across healthcare, residential, and commercial sectors, particularly in the post-pandemic period.

Growing Demand Due to Infection Awareness

The demand for surface disinfectants has surged due to heightened awareness about hygiene and the need to prevent the spread of infections. Hospitals, clinics, and laboratories are adopting stringent sanitation practices, making disinfectants essential in day-to-day operations. The global pandemic has further highlighted the importance of regular and effective surface disinfection, leading to increased use in residential, commercial, and industrial spaces.

The fear of cross-contamination and rising cases of healthcare-associated infections (HAIs) have compelled healthcare professionals to adopt safer and more efficient disinfection methods. This has led to the increased usage of disinfectants that not only clean but also eliminate pathogens from surfaces. In turn, this supports the overall growth of the market.

List of Top Surface Disinfectant Companies:

- 3M (U.S.)

- The Proctor & Gamble Company (U.S.)

- Kimberley-Clark Corporation (U.S.)

- SC Johnson Professional (U.S.)

- The Clorox Company (U.S.)

- Ecolab (U.S.)

- Metrex Research LLC(U.S.)

- Reckitt Benckiser Group Plc (U.K.)

- Diversey Inc.(U.S.)

- STERIS plc (Ireland)

- Whiteley Corporation (Australia)

- Other Key Players

Key Market Drivers

One of the major drivers of the surface disinfectant market is the increasing demand from healthcare institutions. Hospitals and medical centers require daily surface disinfection to maintain a sterile environment and reduce the chances of infection spread. Surface disinfectants play a critical role in maintaining cleanliness in operation theaters, ICUs, patient wards, and other critical areas.

Another important growth driver is the expansion of the commercial sector, including hotels, schools, restaurants, offices, and airports. These facilities are placing greater emphasis on maintaining hygiene standards to ensure safety for employees, customers, and visitors. As a result, the demand for ready-to-use surface disinfectants in spray and wipe forms is rising.

Additionally, increasing awareness of hygiene among consumers has led to the use of disinfectants in homes, especially on kitchen counters, bathroom surfaces, and high-touch areas such as door handles and switches.

Read More : https://www.fortunebusinessinsights.com/surface-disinfectant-market-103062

Product Innovations and Technological Advancements

Companies are focusing on innovations in formulation and packaging to meet the evolving needs of users. There is a rising demand for eco-friendly, non-toxic, and biodegradable disinfectant solutions. Manufacturers are launching products with shorter contact times, broad-spectrum efficacy, and less chemical odor to improve user experience and safety.

Alcohol-based disinfectants continue to dominate the market due to their rapid action and effectiveness against a wide range of pathogens. Quaternary ammonium compounds and hydrogen peroxide-based products are also widely used in healthcare and industrial applications. Moreover, pre-saturated disinfectant wipes are gaining popularity because of their convenience, especially in situations requiring frequent surface cleaning.

Challenges in the Market

Despite strong growth prospects, the surface disinfectant market faces certain challenges. Prolonged use of chemical-based disinfectants such as bleach and alcohol can cause skin irritation, respiratory issues, and other health concerns. Moreover, improper handling or overuse can lead to environmental harm.

Compliance with regulatory standards is another challenge. Regulatory authorities across regions have strict guidelines regarding the efficacy, safety, and labeling of disinfectant products. Manufacturers must ensure that their products meet these requirements, which can increase operational complexity and cost.

Regional Market Insights

In 2023, North America held the largest share in the global surface disinfectant market, driven by a well-established healthcare infrastructure, strong awareness, and stringent government regulations. The United States remains a leading contributor due to widespread product adoption in both healthcare and household settings.

Europe also accounts for a significant market share, supported by high standards of hygiene and a proactive approach to infection control. Countries such as Germany, the UK, and France continue to show strong demand across medical and commercial sectors.

The Asia Pacific region is expected to witness the fastest growth during the forecast period. Emerging economies like India and China are investing heavily in healthcare infrastructure and public sanitation. Growing population density, frequent disease outbreaks, and increasing urbanization are factors that further support market growth in the region.

Key Industry Developments:

- January 2019 – Reckitt Benckiser formed a strategic alliance with Diversey to increase its presence in North America. This strategic alliance will help Reckitt Benckiser to expand its reach to educational institutes, food establishments, and hospitals.

- February 2020 – The Procter and Gamble Company launched a new line of antibacterial cleaners named Microban 24. The new product line is said to protect the applied surface for a complete 24 hours, even when the surface has been contacted multiple times.

Segmentation Overview

The surface disinfectant market is segmented based on product type, composition, application, and end-user. Among product types, liquids dominate the market due to their ease of application and widespread availability. Wipes and sprays are also gaining momentum because of their user-friendly nature.

From a composition standpoint, alcohols and quaternary ammonium compounds hold significant shares due to their effectiveness. In terms of application, in-house surfaces such as countertops, furniture, and floors account for the largest usage. By end-user, the healthcare segment remains the largest consumer of surface disinfectants, followed by commercial and residential users.

Outlook

The global surface disinfectant market is positioned for sustainable growth over the next decade. The combination of growing public awareness, infection control protocols, and technological innovation will continue to fuel market expansion. As consumers increasingly seek safer and more environmentally friendly options, companies are expected to focus on product development and strategic partnerships to strengthen their market presence.

With ongoing investments in hygiene infrastructure and rising demand across both developed and emerging economies, the surface disinfectant market is set to play a vital role in global health and safety in the years to come.

The global solid waste management market was valued at USD 285.16 billion in 2019 and is expected to reach USD 366.52 billion by 2027, growing at a CAGR of 3.3% during the forecast period. In 2019, Europe led the market with a share of 31.57%. Additionally, the solid waste management market in the U.S. is anticipated to experience significant growth, projected to reach USD 93.46 billion by 2032. This growth is driven by the country’s well-developed collection, processing, and disposal systems, along with the presence of major waste management companies.

Solid waste management involves the systematic control of generation, collection, transportation, processing, recycling, and disposal of various types of waste. The primary objective is to reduce the harmful effects of waste on human health, the environment, and natural resources. As the world faces increasing pressure to adopt sustainable practices, efficient waste management has become more critical than ever.

Key Drivers of Market Growth

- Urban Expansion and Infrastructure Development

The sharp increase in urban population is directly contributing to higher volumes of waste. Cities worldwide are witnessing a surge in domestic, commercial, and construction-related waste. Rapid infrastructure development, particularly in developing countries, is creating an urgent need for robust waste management systems.

- Government Initiatives and Regulatory Frameworks

Governments across various regions are implementing stricter waste management laws and policies. These include mandates for waste segregation, recycling targets, landfill restrictions, and eco-friendly disposal methods. Such regulatory backing is pushing municipalities and private operators to invest in more advanced and efficient waste handling solutions.

- Increased Environmental Awareness

Public concern over pollution, landfill overflows, and greenhouse gas emissions has intensified. With heightened environmental awareness, both individuals and organizations are seeking sustainable waste disposal methods. This shift is encouraging greater participation in recycling and composting programs, which, in turn, supports the solid waste management industry.

- Technological Advancements in Waste Treatment

Modern waste processing technologies such as sensor-based collection systems, smart bins, automated material sorting, and waste-to-energy conversion are improving operational efficiency and minimizing landfill use. These innovations are being adopted at a rapid pace, particularly in smart city projects and industrial zones.

List Of Key Players Profiled:

- Waste Management Inc. (USA)

- SUEZ Group (France)

- Veolia Environment S.A. (France)

- Biffa PLC (U.K.)

- Clean Harbors Inc. (USA)

- Covanta Holdings Corporation (USA)

- Hitachi Zosen Corporation (Japan)

- Remondis AG & Co. Kg (Germany)

- Republic Services Inc. (USA)

Read More : https://www.fortunebusinessinsights.com/solid-waste-management-market-103045

Market Restraints

- High Operational Costs : Advanced waste treatment facilities and technologies often require substantial investment, making them inaccessible for low-income regions.

- Lack of Infrastructure in Developing Countries : Inadequate collection and disposal systems in rural and underserved urban areas hinder the effectiveness of waste management.

- Limited Public Participation : Poor awareness and participation in waste segregation at the source affect the efficiency of recycling and composting initiatives.

Regional Insights

- Asia Pacific

This region holds the largest share in the global solid waste management market. Rapid industrialization, urbanization, and increasing consumer waste are primary contributors. Governments in countries like China, India, and Indonesia are undertaking significant projects to modernize waste collection and disposal systems. The region is also seeing increased investments in recycling facilities and waste-to-energy plants.

- North America

North America continues to show significant growth, supported by mature infrastructure and strong environmental policies. The U.S. solid waste management market, in particular, is expected to grow steadily due to ongoing efforts to reduce landfill dependence and enhance recycling and composting practices. Initiatives encouraging circular economy models are further contributing to market expansion.

- Europe

European countries have long emphasized sustainable waste practices. With strict regulations on waste disposal and ambitious recycling targets, the region is at the forefront of implementing circular economy principles. The adoption of producer responsibility policies and green packaging initiatives supports the region’s dominance in sustainable waste management.

- Latin America, Middle East & Africa

These regions are emerging as potential markets, driven by urban growth and increasing governmental and international support for infrastructure development. While challenges such as limited funding and awareness exist, ongoing reforms and investments in waste collection and sanitation systems are laying the groundwork for long-term growth.

Market Segmentation

The solid waste management market can be segmented based on:

- Waste Type : Municipal solid waste (MSW), industrial waste, hazardous waste, and electronic waste (e-waste).

- Service : Collection, transportation, recycling, treatment, landfilling, and incineration.

- End-User : Residential, commercial, industrial, and construction sectors.

Among these, municipal solid waste dominates the segment, primarily due to the volume generated by urban residential areas and commercial institutions. However, the demand for proper hazardous and electronic waste handling is also rising as consumption patterns evolve.

Competitive Landscape

The global market comprises a mix of public and private players offering a range of waste management services. Companies are actively focusing on expanding their capabilities through technology adoption, joint ventures, and geographic diversification. The emphasis is increasingly on eco-friendly solutions, cost optimization, and resource recovery through recycling and energy conversion.

Public-private partnerships (PPPs) are playing a significant role in improving municipal waste services, particularly in developing regions. Many service providers are also exploring data-driven approaches and digital platforms to streamline operations and track waste generation patterns more effectively.

Key Industry Developments:

- July 2019 – The consortium BCE led by SUEZ Group signed a 25 years contract with municipal company Beogradske Elektrane to sell heat produced from waste-to-energy in Belgrade, Serbia. By signing this contact, the municipal company is aiming to introduce renewable energy by reducing its energy dependency on natural gas . The plant operation will be handled by SUEZ Group and the plant will process 500 Kilo Tons of Municipal waste and 200 Kilo Tons of construction & demolition waste per year.

- December 2019 – Covanta Holdings Corporation agreed with Zhao County, China to build & operate a new Energy-from-waste facility. The project will offer sustainable waste management solutions to the county. With this agreement, the company is aiming to expand its geographical footprints into Chinese market.

Outlook

The future of the solid waste management market lies in sustainability, innovation, and inclusive participation. As global waste generation continues to rise, governments, businesses, and communities must collaborate to create circular systems that reduce waste at the source, increase recycling rates, and promote responsible consumption.

With continued investment in infrastructure, supportive policies, and technological integration, the solid waste management industry is well-positioned to address the growing environmental challenges and contribute meaningfully to global sustainability goals.