Building Thermal Insulation Market Compound Annual Growth Rate, Size & Outlook 2032

By Sharvari, 2025-09-02

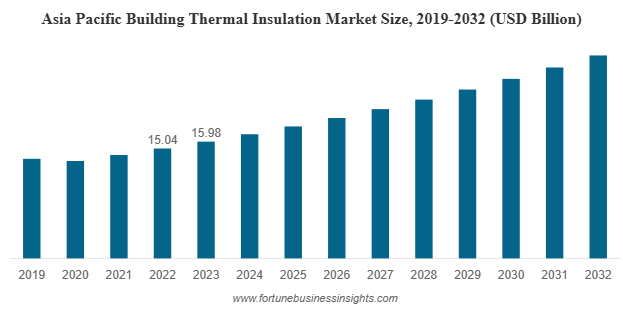

The global building thermal insulation market size was valued at USD 32.53 billion in 2023 and is expected to increase from USD 33.98 billion in 2024 to USD 48.60 billion by 2032, growing at a CAGR of 4.5% during the forecast period of 2024–2032. In 2023, Asia Pacific led the market with a 49.12% share. In the U.S., the market is projected to reach USD 7.60 billion by 2032, fueled by strong government support for energy-efficient technologies in the building and construction sector.

The global building thermal insulation market is experiencing steady growth as the world increasingly focuses on energy efficiency, environmental sustainability, and reducing greenhouse gas emissions in the construction industry. Thermal insulation plays a pivotal role in regulating indoor temperatures, lowering energy consumption, and improving the overall efficiency of buildings. With rapid urbanization, rising construction activities, and stringent government regulations promoting energy conservation, the demand for effective thermal insulation solutions has surged across residential, commercial, and industrial sectors.

Market Overview

The building thermal insulation market has grown significantly over the past decade, with market value reaching billions of dollars worldwide. The market is projected to continue its upward trajectory due to the increasing emphasis on energy-efficient building designs, government policies, and growing awareness of the environmental benefits of insulation materials. Insulation helps in reducing heating and cooling costs, minimizes the carbon footprint of buildings, and enhances occupant comfort, making it an essential component in modern construction practices.

List Of Top Building Thermal Insulation Companies:

- BASF (Germany)

- Atlas Roofing Company (U.S.)

- Cellofoam North America Inc. (U.S.)

- DuPont (U.S.)

- Knauf Insulation (U.S.)

- Owens Corning (U.S.)

- Armacell S.A. (Luxembourg)

- Beijing New Building Material (Group) Co., Ltd. (China)

- Evonik (Germany)

- Bondor Indonesia (Indonesia)

- BYUCKSAN (South Korea)

- Huamei Energy-saving Technology Group Co., Ltd. (China)

- Johns Manville (U.S.)

Key Material Segments

The market is broadly segmented based on the types of insulation materials, each offering unique properties and applications:

- Mineral Wool: Comprising glass wool and stone wool, mineral wool is one of the most widely used insulation materials. It provides excellent thermal and acoustic insulation and is highly fire-resistant, making it suitable for both residential and commercial buildings.

- Foamed Plastics: This category includes expanded polystyrene (EPS), extruded polystyrene (XPS), polyurethane (PU), and polyisocyanurate (PIR). Foamed plastics are lightweight, moisture-resistant, and highly durable, offering efficient thermal insulation in walls, roofs, and floors.

- Cellulose: Made from recycled paper or plant fibers, cellulose is an eco-friendly insulation material. It offers good thermal performance and is often preferred in sustainable and green building projects.

- Aerogels and Others: Advanced materials like aerogels provide superior insulation performance with very low thermal conductivity. Although relatively expensive, they are increasingly being adopted in high-performance and specialized applications.

Read More : https://www.fortunebusinessinsights.com/building-thermal-insulation-market-102708

Application Areas

Building thermal insulation market finds applications across various components of a building, including:

- Roofs: Insulating roofs helps reduce heat loss in winter and heat gain in summer, significantly lowering energy consumption for heating and cooling.

- Walls: Thermal insulation in walls ensures that indoor temperatures remain stable, enhancing comfort and reducing energy bills.

- Floors and Basements: Floor and basement insulation prevents heat transfer through the ground, contributing to energy savings and improved living conditions.

- Other Applications: Insulation is also used in pipes, ducts, and other structural elements to minimize energy loss and improve overall efficiency.

Market Drivers

Several factors are driving the growth of the building thermal insulation market:

- Stringent Energy Efficiency Regulations: Governments worldwide are introducing strict building codes and regulations that mandate energy-efficient designs. Compliance with these regulations is encouraging builders to adopt high-performance insulation materials.

- Rising Awareness of Environmental Sustainability: With growing concerns about climate change and environmental impact, building owners and developers are increasingly opting for insulation materials that reduce energy consumption and carbon emissions.

- Technological Advancements: Innovations in insulation materials are resulting in better thermal performance, durability, and cost-efficiency. Lightweight and easy-to-install materials are gaining popularity in both new constructions and retrofitting projects.

- Increasing Construction Activities: Rapid urbanization and infrastructure development in emerging economies are creating significant opportunities for the thermal insulation market. Rising residential and commercial construction projects directly contribute to market growth.

Regional Insights

- Asia Pacific: The region dominates the building thermal insulation market due to rapid urbanization, extensive construction activities, and supportive government policies promoting energy-efficient buildings. Countries like China and India are witnessing a surge in demand, particularly in residential and commercial projects.

- North America: The United States and Canada are significant contributors to the market in this region. A strong focus on energy conservation, coupled with government incentives for green buildings, has boosted the adoption of thermal insulation solutions.

- Europe: European countries continue to maintain a steady demand due to strict energy efficiency standards, sustainability initiatives, and the widespread adoption of green building practices.

Key Industry Developments:

- April 2021 – Atlas Roofing Company introduced SureSlope prefabricated tapered products. The new product family of polyiso roof insulation components is ideal for roofing applications, reducing job site waste and decreasing installation time.

- March 2021 - Owens Corning acquired vliepa GmbH, a company specializing in coating, printing, and finishing nonwovens, film, and paper for the construction industry. The acquisition widens the company’s nonwovens portfolio for European customers working in the regional construction industry.

Future Outlook

The future of the building thermal insulation market looks promising, with sustained growth expected over the coming years. Increasing environmental awareness, advancements in insulation materials, and government support for energy-efficient buildings will continue to drive the market. Additionally, the trend toward retrofitting existing buildings with better insulation to reduce energy costs and emissions presents significant opportunities.

As the construction industry increasingly prioritizes sustainability, building thermal insulation market will remain a crucial element in designing energy-efficient and environmentally friendly structures. The combination of technological innovation, regulatory support, and rising consumer awareness ensures that the market will continue to expand globally, contributing to energy conservation and a greener built environment.

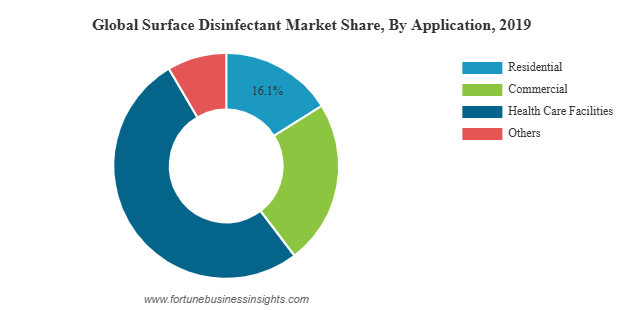

The global surface disinfectant market size was valued at USD 770.6 million in 2019 and is expected to reach USD 1,547.7 million by 2027, growing at a CAGR of 9.1% between 2020 and 2027. North America led the market in 2019, accounting for a 38.92% share. In the U.S., the market is projected to experience substantial growth, reaching USD 524.4 million by 2027, driven by increased awareness of sanitation and hygiene across healthcare, residential, and commercial sectors, particularly in the post-pandemic era.

Key Market Drivers

One of the primary drivers of the surface disinfectant market is the increasing emphasis on sanitation and hygiene across various sectors. The outbreak of global pandemics and rising incidences of hospital-acquired infections have heightened awareness about the importance of disinfecting surfaces to prevent the spread of pathogens. Healthcare facilities, in particular, are adopting rigorous cleaning protocols to ensure the safety of patients and staff, which has created substantial demand for surface disinfectant products.

In addition to healthcare, commercial establishments such as offices, restaurants, and retail outlets are increasingly implementing disinfectant routines to maintain hygiene standards for employees and customers. Residential consumers are also contributing to market growth by using disinfectants as part of daily cleaning practices, driven by heightened awareness of microbial contamination in households.

List of Top Surface Disinfectant Companies:

- 3M (U.S.)

- The Proctor & Gamble Company (U.S.)

- Kimberley-Clark Corporation (U.S.)

- SC Johnson Professional (U.S.)

- The Clorox Company (U.S.)

- Ecolab (U.S.)

- Metrex Research LLC(U.S.)

- Reckitt Benckiser Group Plc (U.K.)

- Diversey Inc.(U.S.)

- STERIS plc (Ireland)

- Whiteley Corporation (Australia)

- Other Key Players

Product Segmentation

The surface disinfectant market is categorized into different product types, including liquids, aerosols, gels, and wipes. Among these, liquid disinfectants hold the largest market share due to their ease of use, broad-spectrum efficacy, and suitability for multiple surfaces. Liquid formulations are highly favored in healthcare settings for disinfecting medical equipment, patient rooms, and operating theaters. Wipes and aerosols are gaining traction in commercial and household applications due to their convenience and portability.

In terms of composition, alcohol-based disinfectants dominate the market, appreciated for their rapid antimicrobial activity and broad-spectrum effectiveness against bacteria, viruses, and fungi. Other compositions, such as quaternary ammonium compounds, peracetic acid, and hydrogen peroxide formulations, are also gaining popularity due to their effectiveness against resistant pathogens and versatility in different applications.

Application Insights

Healthcare facilities are the largest consumers of surface disinfectants, accounting for a significant portion of global demand. The need to prevent healthcare-associated infections, coupled with stringent hygiene regulations, has driven hospitals, clinics, and diagnostic centers to adopt surface disinfectants extensively.

Commercial spaces, including offices, hotels, and restaurants, form another major application segment. The growing focus on cleanliness and hygiene, particularly in the post-pandemic era, has led these sectors to invest in high-quality disinfectant products. Residential use is also on the rise, with consumers increasingly incorporating disinfectants into their daily cleaning routines to safeguard against germs and pathogens.

Read More : https://www.fortunebusinessinsights.com/surface-disinfectant-market-103062

Regional Analysis

North America is the leading region in the surface disinfectant market, accounting for a substantial share of the global revenue. The U.S. market, in particular, is experiencing strong growth due to heightened awareness of hygiene practices, the presence of advanced healthcare infrastructure, and strict regulatory standards. The growing adoption of innovative disinfectant formulations further strengthens market growth in the region.

Europe follows closely, with countries such as Germany, France, and the U.K. showing robust demand. The market growth in this region is fueled by rising health consciousness, increasing disposable incomes, and stringent public health regulations mandating hygiene standards in public and private spaces.

Asia Pacific is an emerging market for surface disinfectants, driven by rising healthcare investments, increasing awareness about sanitation, and the expansion of urban populations. Countries such as China, India, and Japan are witnessing rapid adoption of disinfectant products across hospitals, schools, and commercial establishments. The growing availability of affordable disinfectant solutions further supports market penetration in this region.

Key Industry Developments:

- January 2019 – Reckitt Benckiser formed a strategic alliance with Diversey to increase its presence in North America. This strategic alliance will help Reckitt Benckiser to expand its reach to educational institutes, food establishments, and hospitals.

- February 2020 – The Procter and Gamble Company launched a new line of antibacterial cleaners named Microban 24. The new product line is said to protect the applied surface for a complete 24 hours, even when the surface has been contacted multiple times.

Industry Trends and Innovations

The surface disinfectant market is witnessing several trends that are reshaping the industry. One notable trend is the growing focus on eco-friendly and sustainable products. Manufacturers are increasingly developing formulations that are biodegradable, non-toxic, and safe for human use, addressing the rising demand for environmentally responsible cleaning solutions.

Another trend is innovation in disinfectant formulations. The increasing prevalence of antimicrobial resistance has led manufacturers to explore alternative compositions such as hydrogen peroxide and peracetic acid, which offer enhanced efficacy against resistant pathogens. Additionally, the development of ready-to-use wipes, aerosol sprays, and multi-surface cleaners is making disinfectant usage more convenient for both commercial and residential consumers.

Regulatory support also plays a crucial role in shaping the market. Government agencies and health authorities across the world enforce strict guidelines and standards for surface disinfectants, ensuring product safety, efficacy, and compliance. These regulations encourage the adoption of high-quality disinfectants while promoting research and development in advanced formulations.

Market Outlook

The future of the surface disinfectant market looks promising, with consistent growth expected across healthcare, commercial, and residential applications. Rising awareness of hygiene, regulatory support, and continuous product innovation are key factors driving this growth. As consumers and businesses increasingly prioritize cleanliness and infection control, the demand for effective and versatile disinfectant solutions is likely to surge.

In conclusion, the global surface disinfectant market presents significant opportunities for manufacturers, distributors, and investors. With expanding applications, innovative product developments, and increasing consumer awareness, the market is poised for substantial growth over the coming years, contributing to enhanced hygiene standards and public health protection worldwide.

Aluminum Composite Panels Market Size, SWOT Analysis, Trends & Forecast 2032

By Sharvari, 2025-09-01

The global construction and infrastructure industry has witnessed tremendous transformations over the last decade, driven by rapid urbanization, technological advancements, and a growing demand for sustainable materials. Among the many innovations shaping modern building practices, Aluminum Composite Panels (ACPs) Market have emerged as one of the most versatile and preferred solutions for architects, builders, and even the automotive sector. With increasing adoption across multiple industries, the ACP market is set for remarkable expansion in the coming years.

Market Overview

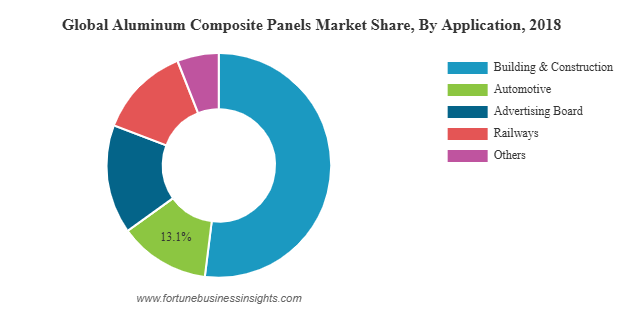

The global aluminum composite panels market size was valued at USD 5.33 billion in 2018 and is anticipated to reach USD 8.71 billion by 2026, registering a CAGR of 6.1% over the forecast period. Asia Pacific led the market in 2018 with a 39.23% share, supported by rapid urbanization and infrastructure growth. Meanwhile, the U.S. market is expected to witness strong expansion, projected to reach USD 2.41 billion by 2032, fueled by supportive government policies and initiatives to enhance infrastructure.

List of Key Companies Profiled In Aluminum Composite Panels Market:

- 3A Composites GmbH

- Arconic

- Mitsubishi Chemical Corporation

- Hyundai Alcomax Co.,Ltd.

- Fairfield Metal LLC

- Jyi Shyang Industrial Co., Ltd.

- ALUMAX INDUSTRIAL CO., LTD.

- Yatai Industrial Group Co., Ltd.

What Makes ACPs Unique?

Aluminum Composite Panels market are composed of two aluminum sheets bonded to a non-aluminum core, usually polyethylene or mineral-filled material. This design gives ACPs several advantages, including:

- Lightweight strength: Despite being lightweight, they provide excellent durability and rigidity.

- Weather resistance: Their ability to withstand extreme weather conditions makes them ideal for exterior applications.

- Thermal insulation: ACPs help improve the energy efficiency of buildings.

- Design flexibility: Available in various colors, finishes, and textures, they are widely used to enhance aesthetic appeal.

- Cost-effectiveness: Compared to pure aluminum sheets or other façade materials, ACPs are relatively affordable.

These unique properties make ACPs indispensable in industries ranging from construction to advertising and automotive manufacturing.

Key Market Drivers

- Building and Construction Boom

The construction sector remains the largest consumer of ACPs. Their use in cladding, facades, roofing, and insulation has grown substantially due to their durability and modern appearance. Rapid urbanization in countries such as China, India, and those in Southeast Asia is driving demand. Governments investing heavily in smart cities and infrastructure upgrades are further accelerating market growth.

- Expanding Outdoor Advertising Industry

ACPs are widely used in signage and billboards, particularly in outdoor advertising. Their smooth surface ensures superior print quality, while their resistance to harsh weather conditions ensures longevity. With digital and programmatic advertising gaining momentum, ACPs are becoming the material of choice for durable and high-quality display structures.

- Automotive Applications

The automotive sector accounted for over 13% of the ACP market in 2018. Lightweight materials are increasingly preferred to improve fuel efficiency and reduce emissions. ACPs also contribute to noise insulation, heat retention, and design flexibility in vehicles, making them valuable in next-generation automotive engineering.

Read More : https://www.fortunebusinessinsights.com/aluminum-composite-panels-market-102304

Regional Insights

- Asia Pacific

Asia Pacific dominated the global market with more than 39% share in 2018, valued at approximately USD 2.09 billion. This dominance is expected to continue, thanks to booming construction projects, expanding urban populations, and rising investments in housing and infrastructure. Countries such as China and India are leading contributors due to their large-scale real estate developments.

- North America

The United States is projected to be one of the fastest-growing ACP markets, supported by government infrastructure spending and the adoption of advanced building materials. Growing interest in sustainable construction and modern façade designs is also boosting demand.

- Europe

In Europe, environmental consciousness and regulatory pressure for energy-efficient buildings are shaping the ACP market. ACPs with fire-retardant and eco-friendly cores are becoming increasingly popular, particularly in renovation projects across Western and Northern Europe.

- Latin America and Middle East & Africa

Regions such as Brazil, Chile, and the Gulf countries are witnessing strong growth, fueled by urban modernization projects, commercial construction, and government-led initiatives to improve infrastructure.

Key Industry Developments:

- July 2017 – Fairview Architectural acquired the Stryum business, an intelligent non-combustible aluminum cladding system, from Vitekk Industries. The company includes a variety of high-quality aluminum plate façade panels designed to provide durability and sustainability, complimenting Fairview's current portfolio of cladding solutions, including high-density cement fibre, natural stone, terracotta tiles and the leading non-combustible composite aluminum frame.

Market Challenges

While ACPs offer numerous advantages, the market faces certain challenges:

- Maintenance complexity: Damaged ACPs are difficult and expensive to repair, which can discourage adoption in cost-sensitive markets.

- High production costs: Advanced coating and lamination technologies increase manufacturing expenses, raising the price of premium ACPs.

- Fire safety concerns: Although modern ACPs use fire-retardant cores, earlier controversies over flammable cores have created caution among some buyers.

Emerging Trends and Innovations

The future of the ACP market lies in continuous innovation. Manufacturers are focusing on developing eco-friendly, recyclable, and fire-safe panels to meet strict regulatory standards and consumer expectations. Nanocoating technologies are being introduced to create self-cleaning surfaces that reduce maintenance costs. Customization is another trend, with digital printing and advanced finishes allowing architects and designers to bring unique concepts to life.

Additionally, sustainability is becoming a key focus. Panels with non-toxic, mineral-filled cores are gaining popularity as green building certifications encourage environmentally responsible materials.

Future Outlook

With the construction industry embracing modernization, ACPs market are expected to play a central role in shaping urban skylines. Their versatility ensures continued demand in advertising and automotive industries as well. Rising investments in research and development will unlock new opportunities, particularly in high-performance coatings and sustainable alternatives.

The Aluminum Composite Panels market is not just growing—it is evolving. As cities expand, vehicles advance, and advertising becomes more sophisticated, ACPs will remain at the forefront of innovation. By blending durability, aesthetics, and functionality, these panels are redefining the way industries approach design and construction.

The protective clothing market has become an essential component across multiple industries, serving as a vital shield against workplace hazards and ensuring employee safety. From the chemical industry to healthcare, energy, construction, and defense, the demand for reliable and durable protective garments continues to rise. Growing awareness of workplace safety, stringent regulations, and the integration of smart and eco-friendly materials are reshaping the industry. The protective clothing market, once considered a niche segment, is now at the forefront of industrial innovation and is projected to witness significant growth in the coming years.

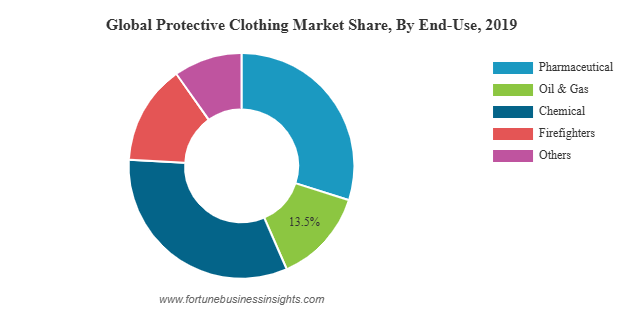

Market Size and Growth Prospects

The global protective clothing market size was valued at USD 12.48 billion in 2019 and is expected to expand to USD 34.31 billion by 2027, registering a strong CAGR of 14% during the forecast period. In 2018, North America’s market size stood at USD 4.34 billion, and the region went on to lead the global market with a 37.4% share in 2019. The U.S. market, in particular, is anticipated to reach USD 10.45 billion by 2027, driven by stringent workplace safety regulations and rising demand from healthcare applications.

List of Top Protective Clothing Companies:

- Honeywell International Inc. (U.S.)

- Lakeland Inc. (U.S.)

- L. Gore & Associates, Inc. (U.S.)

- PBI Performance Products, Inc. (U.S.)

- TenCate Protective Fabrics (U.S.)

- Kimberly-Clark Corporation (U.S.)

- Ansell Microgard Ltd. (U.K.)

- DuPont (U.S.)

- Bennett Safetywear Ltd. (U.K.)

- TEIJIN LIMITED (Japan)

- Udyogi (India)

Market Segmentation

The protective clothing market can be segmented based on product type, application, and end-use industry.

- By Product: Durable protective clothing dominates the market due to its long lifespan and ability to withstand harsh conditions. Disposable protective garments also hold a growing share, particularly in healthcare and laboratories where contamination control is critical.

- By Application: Chemical-defending garments lead the market, reflecting the high demand from chemical processing and healthcare sectors where protection from hazardous substances is crucial. Fire and heat-resistant clothing is another vital segment, widely used in construction, firefighting, and oil & gas.

- By End-Use Industry: The chemical industry continues to be the largest consumer of protective clothing, with oil & gas, construction, and healthcare sectors also contributing significantly. Notably, the oil & gas sector alone accounted for around 13.5% of the market share in 2019.

Key Growth Drivers

- Stringent Regulations: Governments and international organizations are enforcing strict safety guidelines, making protective clothing mandatory in hazardous work environments.

- Industrial Growth: Expanding industries in emerging economies are boosting demand for reliable protective equipment.

- Healthcare Sector Expansion: The rise of global health crises has further highlighted the importance of protective apparel in hospitals and laboratories.

- Technological Advancements: Smart textiles, lightweight fabrics, and ergonomic designs are driving innovation in protective gear, making it both safe and comfortable.

Read More : https://www.fortunebusinessinsights.com/protective-clothing-market-102707

Emerging Trends

One of the most significant trends shaping the protective clothing market is the push for sustainable solutions. Companies are increasingly investing in eco-friendly apparel made from natural and biodegradable fibers. These not only meet environmental standards but also offer cost-effectiveness and durability.

Another notable trend is the rise of smart protective clothing market. Integration of wearable technology, such as sensors that monitor body temperature, detect toxic gases, or track worker movement, is revolutionizing the way industries approach safety. These innovations allow for real-time hazard detection and ensure that workers are better protected against unforeseen risks.

Additionally, manufacturers are focusing on developing multi-functional protective clothing market that provides resistance against multiple hazards simultaneously, such as chemical exposure, fire, and extreme temperatures. This reduces the need for multiple layers of clothing, thereby improving worker comfort and efficiency.

Regional Insights

North America dominated the protective clothing market in 2019, accounting for over one-third of the global share. The region’s leadership is largely attributed to strict regulatory frameworks imposed by agencies such as OSHA and ANSI, which enforce uncompromising safety standards across industries. In particular, the U.S. market is projected to reach more than USD 10.45 billion by 2027, fueled by strong demand in healthcare, chemical, and energy sectors.

Meanwhile, Asia Pacific is emerging as the fastest-growing region. Countries like China, India, and South Korea are experiencing rapid industrialization, accompanied by growing safety awareness and rising investment in protective gear. This surge is driven by expanding manufacturing activities, an increasing number of occupational hazards, and government initiatives aimed at strengthening workplace safety standards. Europe also remains a significant market, supported by its highly regulated industrial environment and focus on sustainable protective solutions.

Key Industry Developments:

- In March 2020 - Protective Industrial Products (PIP) announced the expansion of salesforce in Latin America for industrial protective products. This will help the company in expanding the supply chain and support the growing demand of customers through better distribution network to the local market.

- In February 2019 - Protective Industrial Products Inc. acquired West Chester Protective Gear. The company specializes in the manufacturing of protective apparel for industrial purposes. This acquisition will help in strengthening product portfolio and complement the customer base.

Challenges in the Market

While the growth trajectory of the protective clothing market is strong, several challenges need to be addressed. High costs associated with advanced protective gear can limit adoption, especially in small and medium-sized enterprises. Moreover, balancing protection with comfort remains a challenge, as bulky or restrictive clothing can hinder productivity. The industry also faces the ongoing challenge of ensuring proper disposal of protective apparel, particularly disposable variants, to minimize environmental impact.

Future Outlook

The future of the protective clothing market lies in innovation, sustainability, and compliance. Companies that invest in research and development of lightweight, breathable, and eco-friendly protective garments are expected to gain a competitive edge. As industries increasingly adopt smart textiles and connected worker solutions, the market is set to transform into a hub of technological integration.

By 2027, protective clothing market will not only serve as a safety requirement but also as a performance-enhancing tool, providing workers with comfort, mobility, and real-time safety data. The growing convergence of safety regulations, sustainability goals, and technological innovation ensures that the market will continue to thrive, with Asia Pacific emerging as a hotspot of opportunity.

The protective clothing market is witnessing unprecedented growth, driven by regulatory enforcement, technological advancement, and heightened safety awareness across industries. With the global market expected to triple in less than a decade, stakeholders have significant opportunities to innovate and expand. By embracing sustainability, smart technology, and multifunctional solutions, the industry is poised to redefine workplace safety while meeting the demands of a rapidly changing world.

The global smart coatings market is experiencing rapid expansion, driven by technological innovations, increasing adoption across industries, and rising awareness about the benefits of advanced protective solutions. Unlike traditional coatings, smart coatings market provide multifunctional capabilities such as self-healing, anti-corrosion, anti-fouling, anti-icing, antimicrobial, and color-shifting properties. These features enable improved performance, enhanced safety, and extended durability, making them a preferred choice in industries ranging from automotive to construction and aerospace.

Market Size and Growth

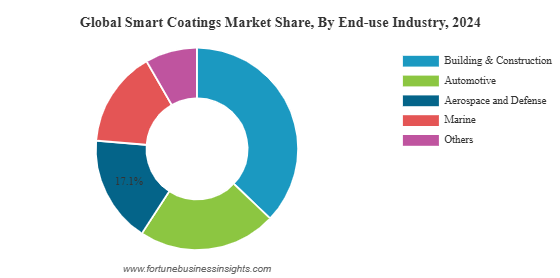

The global smart coatings market size was valued at USD 7.17 billion in 2024 and is projected to expand from USD 8.34 billion in 2025 to USD 26.15 billion by 2032, registering a CAGR of 17.7% during 2025–2032. In 2024, Asia Pacific led the market, accounting for 45.33% share.

List Of Key Smart Coating Companies Profiled

- 3M (U.S.)

- AkzoNobel N.V. (Netherlands)

- Axalta Coating Systems LLC (U.S.)

- DuPont (U.S.)

- Hempel AS (Denmark)

- Jotun Group (Norway)

- NEI Corporation (U.S.)

- PPG Industries, Inc. (U.S.)

- RPM International Inc. (U.S.)

- The Sherwin-Williams Company (U.S.)

Key Market Drivers

Several factors are fueling the growth of the smart coatings market:

- Rising Industrial Demand

Industries such as automotive, aerospace, marine, healthcare, and construction are adopting smart coatings market to address challenges like corrosion, biofouling, microbial growth, and weathering. Their ability to provide multi-layered protection makes them essential in critical applications. - Technological Advancements

Innovations in nanotechnology, materials science, and chemical engineering are enabling the development of next-generation smart coatings market. These advanced solutions are not only more effective but also more environmentally sustainable. - Focus on Sustainability

Growing awareness of eco-friendly and energy-efficient solutions is pushing industries to replace traditional coatings with smart coatings market that reduce energy consumption, extend product lifecycles, and lower environmental impact. - Rising Infrastructure Development

Rapid urbanization and large-scale infrastructure projects, particularly in Asia Pacific, are creating demand for high-performance coatings that offer self-cleaning, weather resistance, and long-term durability. - Healthcare Applications

Antimicrobial smart coatings market are gaining traction in healthcare facilities, medical devices, and public infrastructure, where hygiene and infection control are critical.

Application Landscape

Smart coatings market are finding applications across multiple sectors:

- Automotive: Used for anti-scratch, self-healing, and corrosion resistance, ensuring longer vehicle life and reduced maintenance.

- Aerospace and Defense: Essential for anti-icing, anti-corrosion, and stealth applications, ensuring safety and performance in extreme environments.

- Construction: Self-cleaning and weather-resistant coatings are widely used for buildings, bridges, and infrastructure projects.

- Marine: Anti-fouling coatings help reduce drag on ships, improving fuel efficiency and reducing maintenance costs.

- Healthcare: Antimicrobial coatings enhance hygiene in hospitals, clinics, and medical devices, contributing to infection control.

Key Market Trends

- Shift Toward Multifunctional Coatings

There is growing demand for coatings that combine multiple properties, such as self-cleaning and anti-corrosion, offering greater value to end users. - Integration of Nanotechnology

Nanostructured smart coatings market are revolutionizing the industry by delivering improved strength, resistance, and functionality at lower material costs. - Eco-Friendly Innovations

Companies are developing water-based, low-VOC, and recyclable smart coatings market to comply with environmental standards and meet consumer preferences. - Smart Infrastructure Growth

The rise of smart cities and connected infrastructure is creating opportunities for coatings with self-diagnostic and responsive functionalities. - Increasing R&D Investments

Leading companies are investing heavily in research and partnerships to create advanced smart coatings market that cater to diverse industrial needs.

Read More : https://www.fortunebusinessinsights.com/smart-coatings-market-113374

Key Industry Developments

- July 2024 – AkzoNobel expanded its portfolio with Resicoat EV powder coatings, designed for electric vehicle components to enhance insulation, corrosion resistance, and thermal management.

- November 2023 – Covestro AG launched Impranil CQ DLU, a bio-based polyurethane dispersion with 34% plant-derived carbon, targeting sports, automotive, and technical textiles. This replaces petroleum-based alternatives while maintaining durability.

- October 2022 – Apex Auto Care (2022) unveiled self-healing ceramic coatings (Self Heal Plus and Heal Light) that repair scratches at 60°C, offering a durable alternative to traditional films.

- February 2022 – Sherwin-Williams acquired AquaSurTech, a Canadian company specializing in eco-friendly coatings for building products, to strengthen its sustainable solutions portfolio.

- September 2021 – PPG Industries introduced Sigma Sailadvance NX, an antifouling smart coating for marine applications, leveraging nanotechnology to reduce drag and improve fuel efficiency.

Regional Insights

- Asia Pacific led the smart coatings market in 2024, holding a dominant share of 45.33%. This leadership is attributed to the region’s rapid industrialization, strong construction activity, and booming automotive sector. Countries such as China, India, and Japan are at the forefront of adoption, making Asia Pacific the fastest-growing market for smart coatings market.

- North America is witnessing strong growth due to technological advancements, high R&D investment, and increasing demand for advanced protective materials in aerospace and defense.

- Europe continues to be a significant market, driven by stringent environmental regulations and a focus on sustainable construction and energy efficiency.

- Emerging economies in Latin America and the Middle East & Africa are expected to create new opportunities, particularly in oil & gas, marine, and infrastructure projects.

Future Outlook

The future of the smart coatings market looks highly promising. With continuous innovation, broader adoption across industries, and rising demand for sustainable and high-performance materials, the market is set to achieve exponential growth. Asia Pacific will remain the global leader, while North America and Europe will continue to play pivotal roles through technological advancements and regulatory support.

By 2032, smart coatings market are expected to become integral to industries ranging from automotive and aerospace to healthcare and construction, transforming the way surfaces are protected and maintained. Companies that focus on innovation, eco-friendly solutions, and expanding their presence in high-growth regions will be best positioned to capitalize on this dynamic market.

The global smart coatings market is entering a period of unprecedented growth, driven by innovation, industrial demand, and sustainability initiatives. With a projected market value of USD 26.15 billion by 2032, this sector represents a significant opportunity for businesses and investors alike. As industries continue to prioritize performance, safety, and environmental responsibility, smart coatings market will remain at the forefront of technological advancement and industrial transformation.

Personal Protective Equipment Market Demand, Drivers & Global Growth, Forecast 2032

By Sharvari, 2025-08-25

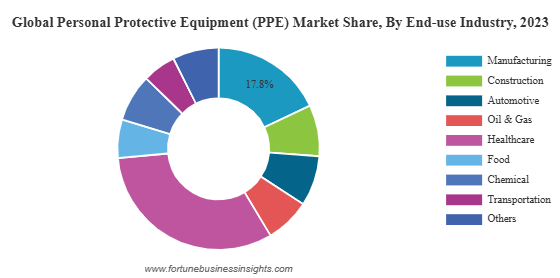

The global personal protective equipment (PPE) market was valued at USD 83.91 billion in 2023 and is expected to increase from USD 87.69 billion in 2024 to USD 128.57 billion by 2032, registering a CAGR of 4.9% during the forecast period. North America led the market in 2023 with a 33.69% share, while the U.S. market is projected to expand notably, reaching USD 37.98 billion by 2032, supported by rising infrastructure development and construction activities across the country.

The market is being shaped not only by regulatory frameworks but also by the growing emphasis on sustainability, advanced technologies like smart wearables, and the expansion of industries in emerging economies.

Market Size and Forecast

The Personal Protective Equipment (PPE) market has become one of the most critical industries in the modern world. From healthcare and manufacturing to oil & gas, construction, and automotive, PPE ensures worker safety and regulatory compliance. The COVID-19 pandemic significantly accelerated the adoption of PPE, and today, the industry continues to expand due to strict workplace safety regulations, technological innovation, and growing awareness of occupational hazards.

List Of Top PPE Companies:

- 3M (U.S.)

- Ansell Ltd. (Australia)

- Alpha ProTech (Canada)

- DuPont (U.S.)

- Avon Rubber p.l.c. (U.K.)

- Mallcom (India) Limited (India)

- Bullard (U.S.)

- Delta Plus Group (France)

- Supermax Corporation Berhad (Malaysia)

- MSA Safety (U.S.)

Market Segmentation and Key Products

The PPE industry covers a broad range of products, each serving a specific safety function. Key categories include:

- Hand Protection: Gloves remain one of the largest product segments, driven by demand from healthcare, food processing, and chemical industries.

- Respiratory Protection: Face masks and respirators gained unprecedented attention during the pandemic and continue to be crucial across healthcare and industrial settings.

- Protective Clothing: Widely used in manufacturing, laboratories, and chemical industries, protective suits shield workers from biological and chemical hazards.

- Foot and Eye Protection: Boots, helmets, face shields, and goggles remain essential across construction, oil & gas, and mining sectors.

The manufacturing industry dominates demand due to rising industrialization, while the healthcare sector continues to see strong adoption, particularly in Europe and North America.

Regional Insights

- North America leads the global PPE market, accounting for more than one-third of the global share in 2023. The region benefits from strict workplace safety standards, rapid industrial growth, and rising adoption of smart protective equipment. The market is projected to grow from USD 26.99 billion in 2022 to USD 28.27 billion in 2023.

- Europe follows closely, with a strong demand for hand protection and healthcare-related products. Stringent safety regulations across the European Union have ensured steady adoption of PPE across multiple industries.

- Asia Pacific is witnessing the fastest growth, fueled by rapid urbanization, expansion of the construction sector, and rising investments in manufacturing. Countries like China and India are becoming significant hubs for PPE production as well as consumption.

Read More : https://www.fortunebusinessinsights.com/personal-protective-equipment-ppe-market-102015

Rise of Smart PPE

One of the most exciting developments in the PPE sector is the emergence of smart PPE equipment embedded with sensors, IoT connectivity, and real-time monitoring capabilities. Products such as sensor-equipped safety gloves, helmets with augmented reality features, and smart respiratory masks are transforming workplace safety by providing instant alerts, fatigue monitoring, and improved hazard detection. While smart PPE adoption is rising quickly in North America and Europe, challenges such as high costs, privacy concerns, and lack of proper fitting especially for women still limit widespread adoption.

Key Market Drivers

Several factors are fueling the expansion of the PPE market:

- Stringent Safety Regulations: Governments worldwide are enforcing occupational safety standards, compelling industries to invest in quality protective gear.

- Healthcare Expansion: Growing demand from hospitals, laboratories, and pharmaceutical industries keeps healthcare as one of the leading sectors for PPE usage.

- Industrialization in Emerging Economies: Rapid growth in Asia Pacific’s manufacturing and construction industries continues to generate high PPE demand.

- Technological Advancements: Innovations in smart PPE are reshaping the industry, offering better safety outcomes and worker productivity.

- Sustainability Focus: Manufacturers are increasingly adopting eco-friendly materials and recyclable products, responding to rising environmental awareness.

Key Industry Developments:

- March 2023: Ansell opened its Greenfield Manufacturing Plant in India, investing USD 80 million in the plant. The new facility aims at providing the most innovative and highest quality surgical gloves to healthcare professionals across the country.

- April 2022: Honeywell acquired Norcross Safety Products L.L.C., a manufacturer of PPE, for USD 1.2 billion. This acquisition would provide the company with a platform in the fragmented global business projected to provide significant growth opportunities. This investment in Norcross allows the company to enter into a highly regulated industrial safety market completely.

- March 2022: 3M, MSA Safety and Dentec Safety Specialists redesigned reusable industrial face masks to protect healthcare workers better and help prevent mask shortages. These elastomeric respirators have gained NIOSH approval, as they are redesigned by either removing the exhalation valve or fitting it with a new filter and valve to trap the virus inside.

- January 2022: MSA Safety Incorporated acquired England-based Bristol Uniforms for USD 60 million. This acquisition would strengthen MSA Safety’s hold in fire service and PPE, expanding the business in the U.K. and key European markets.

Challenges in the Market

Despite its growth, the PPE market faces certain hurdles. The high cost of advanced protective equipment, particularly smart PPE, can discourage smaller organizations from adoption. Issues of comfort, durability, and proper fit remain, with studies showing that women often struggle with poorly fitting PPE designed primarily for male workers. Additionally, counterfeit and low-quality products in some markets pose a significant threat to both safety and brand credibility.

Competitive Landscape

The PPE market is highly competitive, with leading companies focusing on innovation, partnerships, and acquisitions. Major players include 3M, Honeywell, DuPont, MSA Safety, Ansell, Lakeland Industries, and Alpha Pro Tech. These companies are investing heavily in R&D to create lightweight, comfortable, and technologically advanced protective gear. Many are also exploring sustainable solutions to align with global environmental goals.

Future Outlook

Looking ahead, the PPE market is expected to witness continued expansion, particularly with the growing integration of smart technologies and the demand for sustainable solutions. North America will maintain its dominance, but Asia Pacific will emerge as the fastest-growing region, offering significant opportunities for manufacturers and investors.

The PPE industry is no longer just about compliance—it’s about innovation, worker well-being, and the creation of safer, smarter workplaces. As industries evolve and risks become more complex, personal protective equipment will continue to serve as the frontline defense for millions of workers worldwide.

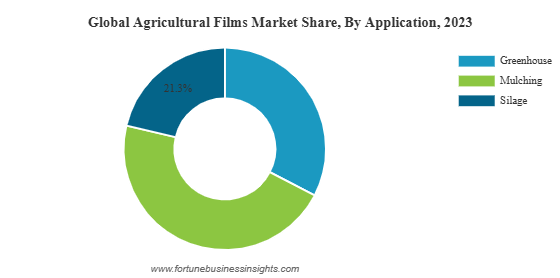

The global agricultural films market was valued at USD 11.28 billion in 2023 and is expected to expand from USD 11.96 billion in 2024 to USD 19.66 billion by 2032, registering a CAGR of 6.3% during the forecast period. Asia Pacific led the market in 2023 with a 53.81% share. In the United States, the market is poised for substantial growth, projected to reach USD 2.57 billion by 2032, fueled by rising adoption of plasticulture applications in agriculture.

This positive trajectory is driven by the increasing use of mulching films, silage films, and greenhouse covers in both developed and developing economies. The rising adoption of biodegradable alternatives is further boosting the market’s attractiveness, especially in regions with strict regulations on plastic use.

Market Size and Forecast

The global agricultural films sector is witnessing a major transformation driven by rising food demand, technological advancements, and the urgent need for sustainable farming practices. Among the many innovations shaping modern agriculture, agricultural films have emerged as a critical solution for improving crop productivity, protecting resources, and promoting sustainable farming. These films are thin plastic or biodegradable layers used in mulching, silage, and greenhouse applications, offering farmers multiple benefits such as moisture retention, temperature regulation, and weed control.

As the global population continues to grow, the demand for efficient food production is rising. Agricultural films are proving to be indispensable in ensuring higher yields, reducing resource wastage, and supporting eco-friendly farming methods. Their adoption is expected to accelerate in the coming years, particularly in emerging economies where food security and agricultural modernization remain high priorities.

List Of Key Companies Profiled:

- Rani Plast (Finland)

- Armando Alvarez (Spain)

- BASF SE (Germany)

- Berry Global Inc. (U.S.)

- Kuraray Co., Ltd. (Japan)

- Coveris (U.K.)

- rkw Group (Germany)

- Trioworld Industrier AB (Sweden)

- Exxon Mobil Corporation (U.S.)

- Groupe Barbier (France)

- Novamont S.p.A (Italy)

Key Segments in the Market

By Material

Among the different materials used, Linear Low-Density Polyethylene (LLDPE) dominates the global market. LLDPE films are highly favored due to their cost-effectiveness, durability, flexibility, and strong resistance to chemicals. These features make them suitable for diverse farming conditions and long-term use.

At the same time, biodegradable films made from plant-based polymers are gaining momentum. They are designed to break down naturally in soil, reducing environmental concerns associated with conventional plastic films.

By Application

- Mulching Films: The largest application segment, mulching films are widely used for conserving soil moisture, preventing weed growth, and regulating temperature. They enhance soil quality and contribute significantly to improved crop yields.

- Silage Films: Accounting for more than one-fifth of the market share, silage films are essential in preserving animal fodder by ensuring airtight storage, reducing spoilage, and maintaining nutritional value.

- Greenhouse Films: These films allow farmers to extend the growing season, protect crops from harsh weather, and enhance productivity in controlled environments.

Read More : https://www.fortunebusinessinsights.com/agricultural-films-market-102701

Regional Insights

- Asia Pacific: The clear leader in the global agricultural films market, accounting for more than half of the global share in 2023. The region’s dominance is largely driven by extensive use in China and India, where growing populations and rising food demand are pushing farmers to adopt modern farming techniques.

- North America: The United States is projected to witness strong demand, with the market expected to reach over USD 2.57 billion by 2032. Advanced agricultural practices and emphasis on sustainable farming are key growth drivers.

- Europe: Growth in this region is influenced by stringent regulations on plastic usage and increasing adoption of biodegradable agricultural films. European farmers are leading in the transition toward eco-friendly solutions.

- Latin America and the Middle East & Africa: These regions are expected to witness steady growth supported by improvements in agricultural infrastructure and adoption of modern farming methods.

Market Drivers and Trends

- Growing Food Demand

The ever-increasing global population is putting immense pressure on food systems. Agricultural films play a crucial role in enhancing crop yields and ensuring that resources like water and fertilizers are used more efficiently.

- Shift Toward Eco-Friendly Solutions

One of the most significant trends in the market is the adoption of biodegradable agricultural films. These films not only help in maintaining soil fertility but also reduce the need for herbicides and minimize plastic waste. This eco-friendly shift is strongly supported by governments and international bodies pushing for sustainable agriculture.

- Regulatory Support

Governments worldwide are introducing strict regulations to limit the use of non-degradable plastics in agriculture. These policies are encouraging manufacturers to invest in research and develop biodegradable and recyclable film options, further driving innovation.

- Technological Advancements

Advancements in film manufacturing technology have led to improved durability, UV resistance, and efficiency. Multi-layer films with enhanced properties are gaining popularity, offering better protection and longer-lasting performance in diverse farming conditions.

KEY INDUSTRY DEVELOPMENTS:

- March 2023– Rani Plast and eight other progressive companies announced collaboration on a novel nation-wide recycling collection system. The move is expected to help reduce difficulties in the disposal of used agricultural plastic.

- May 2022 – Berry Global announced a collaboration with CleanFarms and Poly-Ag Recycling on a close-loop method for Canada’s Circular economy.

- August 2021 - RKW Group launched the next generation e7 silage film - Polydress FarmGuard with improved oxygen barrier properties. This 7-layer silage film was strategically launched to reduce farm waste, save farmers time and cost, and attain sustainability.

- April 2022 - ExxonMobil introduced its novel Exceed S performance polyethylene (PE) resins. This product provides an excellent combination of stiffness and toughness and easy processability.

Opportunities for Growth

The agricultural films market offers promising opportunities for manufacturers, investors, and policymakers alike. Companies focusing on developing eco-friendly, cost-effective, and high-performance films are likely to gain a competitive edge. In addition, emerging markets in Asia, Africa, and Latin America present significant growth potential due to increasing agricultural modernization and government support for sustainable farming practices.

Farmers adopting these films benefit from higher productivity, reduced input costs, and better-quality produce. For policymakers, promoting biodegradable films can contribute to achieving environmental sustainability goals while ensuring food security.

Outlook

The agricultural films market is on a strong growth path, supported by global demand for sustainable farming solutions. With a projected market size nearing USD 20 billion by 2032, the sector is set to play a vital role in shaping the future of agriculture. From mulching and silage to greenhouse applications, agricultural films offer unmatched benefits in improving yields, conserving resources, and reducing environmental impact.

As the world moves toward sustainable practices, the shift from conventional plastics to biodegradable films will define the next phase of market evolution. Stakeholders across the agricultural value chain—farmers, manufacturers, investors, and regulators—must collaborate to leverage this opportunity and build a resilient, eco-friendly future for global agriculture.

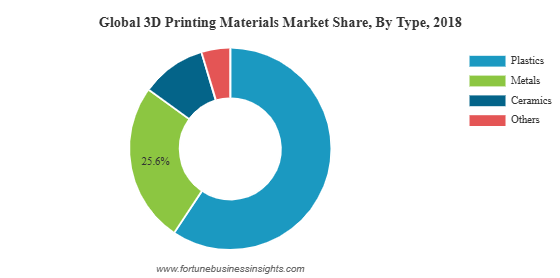

The global 3D printing materials market was valued at USD 1.53 billion in 2018 and is expected to expand to USD 3.78 billion by 2026, registering a CAGR of 12.1% during the forecast period. North America led the market in 2018 with a 37.91% share, while the U.S. market alone is projected to reach USD 1.28 billion by 2026, fueled by the rising adoption of additive manufacturing across diverse industries.

Market Dynamics

3D printing materials market are essential for producing prototypes, functional parts, and end-use products using additive manufacturing technologies. These materials include plastics, metals, ceramics, and composites, each serving unique applications. The growing preference for lightweight, durable, and cost-efficient materials is reshaping production in industries ranging from aerospace and automotive to healthcare and consumer electronics.

One of the key factors propelling the market is the increased demand for rapid prototyping and mass customization. Companies are increasingly using 3D printing to shorten product development cycles, reduce costs, and achieve greater design flexibility. Another major driver is the reduced material waste associated with additive manufacturing compared to conventional production, aligning with the global push towards sustainability.

However, challenges remain. The cost of 3D printing materials market is significantly higher than traditional manufacturing inputs, often 10–15 times more expensive. Additionally, the market is fragmented with only a limited number of dominant vendors, leading to intense competition and price pressures. These challenges, while notable, are expected to be mitigated by ongoing research, innovation, and the entry of new suppliers.

List of Top 3D Printing Materials Companies:

- Stratasys Ltd.

- 3D Systems, Inc.

- Materialise NV

- Markforged, Inc.

- EOS GmbH

- Höganäs AB

- Arkema

- Royal DSM N.V.

- ExOne

- GE Additive

- Evonik Industries AG

- Höganäs AB

- BASF SE

- Covestro AG

Growth Drivers

Several key trends are fueling the expansion of the 3D printing materials market:

- Rising adoption in aerospace and defense: Demand for lightweight, durable, and fuel-efficient components is accelerating material usage.

- Healthcare applications: The production of implants, prosthetics, and dental devices is boosting demand for biocompatible and specialty materials.

- Sustainability focus: Additive manufacturing reduces material waste, aligning with environmental goals and sustainable production.

- Advancements in material science: Ongoing R&D is leading to the development of stronger, more versatile, and cost-efficient 3D printing materials.

Material Insights

Among the different material types, plastics hold the largest market share. Their affordability, versatility, and widespread use in prototyping make them the preferred choice for industries such as consumer goods and electronics. Thermoplastics like PLA, ABS, and nylon dominate the segment due to their ease of processing and compatibility with multiple 3D printing technologies.

On the other hand, the metal segment is registering the fastest growth. Industries such as aerospace, automotive, and healthcare are increasingly turning to metal-based 3D printing for high-performance applications. The ability to produce complex, lightweight, and durable components has made metals like titanium, aluminum, and stainless steel critical in these sectors.

Ceramics and composites also play a niche but growing role. Ceramics are being explored for high-temperature and biomedical applications, while composites enhance mechanical properties by combining polymers with reinforcing materials like carbon fibers. Photopolymers are another important category, particularly in dental and medical applications, due to their precision and biocompatibility.

Read More : https://www.fortunebusinessinsights.com/3d-printing-material-market-102296

Application Landscape

The application of 3D printing materials market spans multiple industries. The aerospace and defense sector is one of the largest consumers, leveraging additive manufacturing to create lightweight parts, reduce fuel consumption, and enhance performance. The automotive industry uses 3D printing for prototyping, tool manufacturing, and increasingly for producing functional components.

In the healthcare sector, demand is surging for biocompatible materials that enable the production of implants, prosthetics, and surgical models. Customized solutions and patient-specific products are becoming mainstream, offering significant improvements in medical care. The industrial manufacturing sector also benefits from 3D printing, particularly in producing tools, jigs, fixtures, and replacement parts on demand.

Regional Highlights

North America dominated the market in 2018, capturing nearly 37.91% of the global share. The region’s strong growth is attributed to technological advancements, widespread adoption of 3D printing, and investments from major aerospace and automotive players. The United States remains a leader in the market, with projections estimating a value of over USD 1.2 billion by 2026.

Meanwhile, Asia-Pacific is emerging as the fastest-growing region. The surge is driven by rapid industrialization, the growth of consumer electronics, and government initiatives promoting advanced manufacturing. Countries like China, Japan, South Korea, and India are witnessing increasing adoption of 3D printing across automotive, healthcare, and industrial sectors. Europe also maintains a strong position, particularly in Germany, which has become a hub for additive manufacturing innovation.

Key Industry Developments:

- September 2019 – 3D Systems launched new materials for 3D printing namely PRO-BLK 10, and HI-TEMP 300-AMB. The new products will diversify the company’s product portfolio and expand the range of applications for customers.

- November 2018 – Royal DSM N.V. launched “Arnitel ID2060 HT”, a high-performance thermoplastic copolyester for 3D printing by using fused filament fabrication. The filament offers a balance of properties such as chemical resistance, flexibility, and high-temperature resistance.

Challenges

Despite its immense potential, the market faces hurdles. High material costs remain a significant barrier to widespread adoption, particularly for small and medium-sized enterprises. Additionally, the lack of standardized processes and certifications in some industries slows down broader application. Supply chain limitations and the need for advanced technical expertise also pose challenges.

Future Outlook

The outlook for the 3D printing materials market remains highly promising. With an expected CAGR of over 12% through 2026, opportunities abound for manufacturers, suppliers, and end-users. The continuous development of innovative materials, coupled with expanding applications across industries, will play a central role in driving growth.

As companies increasingly prioritize sustainability, customization, and efficiency, the demand for advanced 3D printing materials will continue to rise. The aerospace, automotive, and healthcare industries will remain the largest contributors, while emerging sectors like construction and consumer goods add new growth avenues.

The 3D printing materials market is on the cusp of significant transformation. From plastics to metals and beyond, these materials are reshaping the way industries design, prototype, and manufacture products. While challenges like high costs and market fragmentation persist, the overall growth trajectory is strong, fueled by innovation and the expanding adoption of additive manufacturing worldwide. By 2026, the market is set to nearly double in size, reflecting the profound impact of 3D printing on global manufacturing.