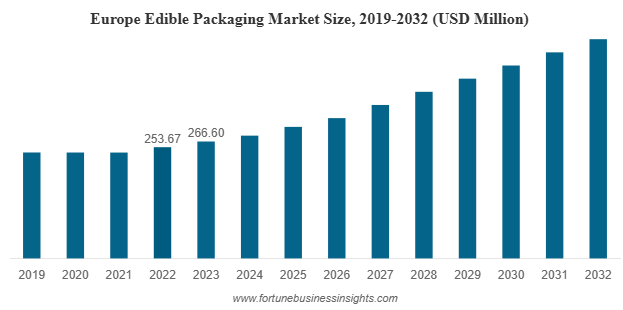

The global edible packaging market was valued at USD 711.09 million in 2023 and is expected to grow from USD 748.06 million in 2024 to approximately USD 1,193.98 million by 2032, reflecting a compound annual growth rate (CAGR) of 6.02% during the forecast period. In 2023, Europe led the market, accounting for 37.49% of the global share. Meanwhile, the U.S. edible packaging market is anticipated to witness substantial growth, reaching an estimated value of USD 282.59 million by 2032. This surge is largely driven by rising awareness around plastic pollution and a growing shift among consumers and businesses toward environmentally sustainable packaging solutions.

The global packaging industry is undergoing a transformative shift as sustainability takes center stage. With increasing awareness about environmental degradation, particularly the harmful impact of plastic waste, industries across the globe are exploring innovative, eco-friendly alternatives. One such emerging trend is edible packaging market a solution that not only reduces environmental footprint but also introduces a new layer of convenience and innovation in packaging technology.

List of Top Edible Packaging Companies:

- XAMPLA (U.K.)

- Notpla Ltd. (U.K.)

- JRF Technology (U.S.)

- MonoSol, LLC (U.S.)

- Evoware (Indonesia)

- Biome Bioplastics (U.K.)

- Decomer Technology OÜ (Estonia)

- Lactips (France)

- FlexSea (U.K.)

- Nagase America (U.S.)

Market Overview and Growth Forecast

Edible packaging market, as the name suggests, refers to packaging materials that can be safely consumed along with the product they contain. Typically made from natural ingredients like proteins, polysaccharides, or lipids, these materials are biodegradable, non-toxic, and often derived from renewable resources. This innovation is gaining traction in food and beverage sectors, as well as pharmaceuticals and personal care industries.

Drivers Fueling Market Expansion

Several factors are driving the growing adoption of edible packaging across industries:

- Environmental Concerns and Regulatory Pressure

Governments and environmental organizations are pushing for a drastic reduction in plastic waste, which accounts for a significant portion of global pollution. Edible packaging presents a viable, sustainable alternative that aligns with these regulatory goals. Bans and restrictions on single-use plastics in many regions have further accelerated the demand for biodegradable and edible solutions. - Consumer Awareness and Preference for Sustainable Products

Today's consumers are increasingly conscious of the environmental impact of their purchases. The rising popularity of zero-waste lifestyles, eco-conscious consumption, and plant-based living has created a favorable environment for edible packaging. Brands that adopt these solutions are often seen as more ethical and forward-thinking, which adds to their market appeal. - Innovation in Materials and Technology

Continuous research and development are leading to advanced edible packaging materials that offer improved shelf-life, moisture resistance, and barrier properties. Innovations such as antimicrobial films, flavored coatings, and functional packaging with added nutrients are enhancing both the utility and appeal of edible packaging. - Convenience and Portion Control

Edible packaging is ideal for single-serve and portion-controlled products. Whether it's an edible coffee cup, a protein bar wrapper, or a soup pod that dissolves in hot water, this type of packaging adds value by reducing waste and simplifying consumption.

Read More : https://www.fortunebusinessinsights.com/edible-packaging-market-107722

Key Market Segments

The edible packaging market is broadly segmented based on material type, product type, and end-use industry.

- By Material Type:

Protein-based materials currently dominate the market. Derived from sources such as soy, whey, casein, and collagen, these materials offer excellent film-forming properties and are rich in nutrients. Polysaccharide-based materials like starch, cellulose, and pectin are also gaining popularity due to their abundance and biodegradability. Lipid-based films, though less common, are used in applications where moisture barriers are critical. - By Product Type:

Films lead the edible packaging segment due to their flexibility, transparency, and widespread use in food products. Edible coatings are used to preserve fresh produce, meat, and bakery items by creating a protective layer. Edible utensils — such as spoons, straws, and cups — are gaining popularity, especially in the food service industry. - By End-Use Industry:

The food and beverage sector is the largest consumer of edible packaging, driven by demand for on-the-go snacks, sustainable packaging for confectionery, and functional beverages. The pharmaceutical industry is also exploring edible packaging, particularly in the form of capsules and coatings that deliver active ingredients safely and effectively.

Regional Insights

Europe currently holds the largest share of the edible packaging market, thanks to stringent environmental regulations and strong consumer demand for sustainable products. North America, particularly the U.S., is witnessing rapid adoption driven by innovation and favorable policies. Meanwhile, the Asia-Pacific region is emerging as the fastest-growing market due to rising urbanization, environmental awareness, and supportive government initiatives.

Challenges and Restraints

Despite its promise, the edible packaging market faces several hurdles:

- High Production Costs:

Compared to traditional plastic packaging, edible materials are more expensive to produce, limiting their use in cost-sensitive markets. - Durability and Storage Limitations:

Edible packaging materials are generally less robust than plastic and may require additional protection during transportation and storage. They are also more susceptible to moisture, heat, and microbial contamination. - Regulatory and Safety Issues:

Since edible packaging is consumed, it must meet stringent food safety standards. This requires thorough testing and certification, which can be time-consuming and costly for manufacturers.

Key Industry Developments:

- September 2023 – Xampla announced the launch of a remarkable consumer brand, Morro, to develop bio-based and edible packaging solutions that can compete with plastics. The launch of this brand will enable food brands to make an easy switch from single-use plastics and use the company’s breakthrough material.

- August 2022 – Nippon Paint China, the premier coatings company, partnered with BASF to introduce new eco-friendly edible packaging embraced by the Nippon Paint dry-mixed mortar series products.

Future Outlook

Despite these challenges, the edible packaging market holds immense potential. Advances in material science, growing investments in sustainable solutions, and strong consumer support are expected to overcome the current limitations. As economies move toward circular and green models, edible packaging could become a mainstream solution.

Businesses that embrace this shift early stand to benefit from regulatory incentives, brand differentiation, and access to a rapidly expanding consumer base that prioritizes sustainability. With growing awareness and continuous innovation, edible packaging is not just a trend — it's a transformative movement reshaping the future of packaging.

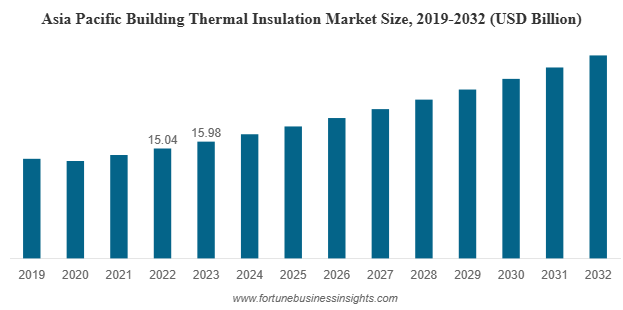

The global building thermal insulation market was valued at USD 32.53 billion in 2023 and is expected to expand from USD 33.98 billion in 2024 to USD 48.60 billion by 2032, registering a CAGR of 4.5% during the forecast period. Asia Pacific led the market in 2023 with a dominant 49.12% share, driven by rapid urbanization and construction growth. In the United States, the market is projected to reach USD 7.60 billion by 2032, supported by strong government initiatives promoting energy-efficient technologies in the building and construction sector.

List Of Top Building Thermal Insulation Companies:

- BASF (Germany)

- Atlas Roofing Company (U.S.)

- Cellofoam North America Inc. (U.S.)

- DuPont (U.S.)

- Knauf Insulation (U.S.)

- Owens Corning (U.S.)

- Armacell S.A. (Luxembourg)

- Beijing New Building Material (Group) Co., Ltd. (China)

- Evonik (Germany)

- Bondor Indonesia (Indonesia)

- BYUCKSAN (South Korea)

Key Growth Drivers

- Infrastructure Expansion and Urbanization in Asia-Pacific

Asia-Pacific continues to be the leading region in the global building thermal insulation market, accounting for nearly half of the global share in 2023. Rapid urbanization in countries such as China, India, and those in Southeast Asia is creating a surge in demand for new residential and commercial buildings. Governments in these regions are also prioritizing energy-efficient building codes, further fueling the adoption of insulation materials.

- Energy Efficiency and Regulatory Frameworks

One of the most significant growth drivers is the increasing focus on reducing energy consumption in buildings. Heating and cooling account for a large portion of energy use, and effective thermal insulation plays a crucial role in minimizing losses. Governments across Europe, North America, and Asia are implementing stricter building codes and energy performance standards. These regulations are compelling builders and property owners to incorporate insulation materials to meet compliance requirements and reduce energy costs.

- Rise of DIY-Friendly Products

With rising labor costs and increasing consumer interest in cost-saving solutions, there is growing demand for insulation materials that can be installed without professional assistance. Manufacturers are responding by introducing user-friendly products such as spray foams, lightweight panels, and easy-to-apply insulating sheets. This trend is particularly strong in developed markets, where homeowners are keen on undertaking small renovation projects themselves.

Market Segmentation Insights

- By Material

Foamed plastics, which include expanded polystyrene (EPS), extruded polystyrene (XPS), polyurethane (PU), and polyisocyanurate (PIR), dominated the market in 2023. These materials are preferred for their lightweight properties, cost-effectiveness, and versatility in different climatic conditions. Mineral wool, comprising glass wool and stone wool, is also widely used due to its excellent fire resistance and acoustic insulation qualities. Other advanced materials, such as aerogels and cellulose, are gaining attention for their superior performance, though their high cost limits mass adoption.

- By Application

Roof and ceiling insulation accounted for the largest market share in 2023. Roofs are often the most exposed part of a building, and effective insulation in this area significantly reduces heat transfer. Wall insulation is another major segment, particularly important in both hot and cold climates. Floors and basements also represent a growing application area, especially in regions with extreme weather conditions where comprehensive building insulation is necessary.

- By End-Use Sector

The residential sector continues to dominate the market, driven by urban growth, government incentives, and consumer awareness. Rising middle-class populations in emerging economies are also contributing to residential construction growth. Meanwhile, non-residential buildings such as offices, retail spaces, hospitals, and educational institutions are adopting insulation solutions to comply with green building standards and to cut operational costs.

Challenges and Restraints

Despite strong growth prospects, the industry faces several challenges. Certain insulation materials, such as glass wool, can cause respiratory irritation during installation, raising concerns about worker safety. Similarly, foamed plastics like polystyrene have faced regulatory scrutiny due to emissions of potentially harmful compounds. These health and environmental concerns could restrain adoption unless manufacturers develop safer alternatives.

Another major restraint is the high cost of advanced materials. While products like aerogels deliver exceptional thermal performance, their elevated price makes them less accessible in cost-sensitive markets. This limits their usage primarily to specialized applications where performance outweighs cost considerations.

Read More : https://www.fortunebusinessinsights.com/building-thermal-insulation-market-102708

Regional Outlook

- Asia-Pacific: The region remains the largest and fastest-growing market, driven by massive construction activities, urban population growth, and government-led initiatives for sustainable infrastructure.

- North America: Growth is fueled by incentives for energy-efficient construction, heightened awareness of sustainable building practices, and infrastructure investments. The United States and Canada are leading in the adoption of innovative insulation products.

- Europe: The region is focusing heavily on retrofitting older buildings to improve energy efficiency. Strict building regulations, combined with consumer awareness of sustainability, are spurring demand for mineral wool and eco-friendly materials.

Key Industry Developments:

- April 2021 – Atlas Roofing Company introduced SureSlope prefabricated tapered products. The new product family of polyiso roof insulation components is ideal for roofing applications, reducing job site waste and decreasing installation time.

- March 2021 - Owens Corning acquired vliepa GmbH, a company specializing in coating, printing, and finishing nonwovens, film, and paper for the construction industry. The acquisition widens the company’s nonwovens portfolio for European customers working in the regional construction industry.

Future Opportunities

The future of the building thermal insulation market looks promising, with several opportunities shaping the landscape:

- Green Building and Net-Zero Energy Goals: With global momentum around green certifications and net-zero energy buildings, demand for high-performance insulation materials is expected to soar.

- Retrofitting Projects: Developed regions are witnessing a growing need to insulate existing structures, offering significant opportunities for insulation providers.

- Innovation in Materials: Companies investing in sustainable, non-toxic, and biodegradable insulation solutions are likely to gain a competitive edge.

- Expansion of DIY Market: Products designed for easy installation are set to become a mainstream growth driver, catering to homeowners and small-scale projects.

Outlook

The global building thermal insulation market is on a strong growth trajectory, expanding from USD 32.53 billion in 2023 to an anticipated USD 48.60 billion by 2032. While challenges such as material health concerns and cost barriers persist, opportunities in green building, retrofitting, and material innovation are expected to outweigh these restraints. Asia-Pacific will continue to lead the market, while Europe and North America will remain key hubs for regulatory-driven adoption. As the world moves towards energy efficiency and sustainability, building thermal insulation will play a pivotal role in shaping the future of construction.

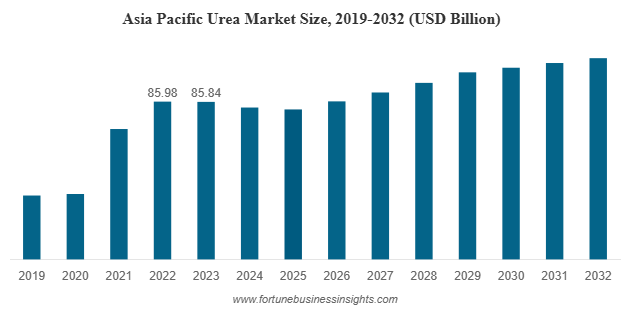

The global urea market was valued at USD 128.92 billion in 2023 and is expected to grow from USD 123.95 billion in 2024 to approximately USD 160.67 billion by 2032, reflecting a compound annual growth rate (CAGR) of 2.2% over the forecast period. Asia Pacific led the market in 2023, accounting for 66.58% of the global share. In the United States, the urea market is also set for significant growth, with projections indicating it could reach around USD 14.40 billion by 2032, primarily driven by the rising demand for nitrogen-based fertilizers to support increased crop yields.

Market Overview

The global urea market is witnessing steady growth, fueled by increasing demand across agriculture, animal feed, and industrial sectors. As one of the most widely used nitrogenous fertilizers, urea plays a critical role in global food security and industrial processes. From rising crop demand to innovations in green urea production, several forces are reshaping the future of this essential commodity.

List of Top Urea Companies:

- SABIC (Saudi Arabia)

- Qatar Fertilizer Company (Qatar)

- EuroChem (Switzerland)

- Yara International ASA (Norway)

- Nutrien AG (Canada)

- OCI N.V. (Netherlands)

- Acron Group (Russia)

- CF Industries Holdings (U.S.)

Key Market Drivers

- Rising Global Food Demand

The increasing global population has led to rising demand for food crops, driving up the need for fertilizers that can enhance agricultural productivity. Urea, with its high nitrogen content (about 46%), is one of the most effective fertilizers for improving crop yields. With limited arable land available, farmers are turning to urea-based fertilizers to maximize output per hectare, especially in countries like India, China, Brazil, and parts of Africa.

- Declining Soil Fertility

Depleting soil quality due to over-cultivation and insufficient replenishment of nutrients has become a major issue in many parts of the world. Urea is being used extensively to compensate for the nitrogen deficiency in soils, which is crucial for plant growth and photosynthesis. The trend is particularly strong in developing nations where modern farming techniques are still being adopted.

- Growth in Livestock Farming

Urea is also gaining prominence in animal husbandry. In ruminants like cattle and sheep, feed-grade urea is used as a non-protein nitrogen source to enhance microbial protein synthesis in the rumen. With the global rise in meat and dairy consumption, livestock farming has become more intensive, increasing the need for efficient feed additives like urea.

- Industrial and Chemical Applications

Beyond agriculture, urea finds application in the chemical industry for the production of resins, adhesives, and plastics. It is also used in the automotive sector as a component of diesel exhaust fluid (DEF) in Selective Catalytic Reduction (SCR) systems, which help reduce nitrogen oxide emissions. As governments enforce stricter environmental regulations, demand for technical-grade urea in emission control systems is expected to rise.

Market Segmentation Highlights

By Grade

- Fertilizer Grade: This segment holds the largest market share, supported by its extensive use in crop cultivation worldwide.

- Feed Grade: Used in animal nutrition, particularly in ruminants, where it serves as a low-cost protein supplement.

- Technical Grade: The fastest-growing segment, driven by applications in resin production, chemicals, and pollution control technologies.

By Application

- Agriculture: Dominates the market due to the essential role of nitrogen in plant growth.

- Animal Feed: Gaining popularity for enhancing livestock productivity.

- Chemical Synthesis and Other Uses: Includes manufacturing of adhesives, de-icers, and even cosmetics in some formulations.

Read More : https://www.fortunebusinessinsights.com/urea-market-106850

Regional Insights

Asia-Pacific dominates the global urea market, accounting for over 66.58% of the total market share in 2023. Countries such as China and India are major consumers, driven by large-scale agricultural activities and high population densities. The region also benefits from favorable government policies promoting fertilizer usage and food security.

North America and Europe, while having lower agricultural dependency than Asia, are emerging as significant markets for technical-grade urea, particularly in the industrial and automotive sectors. The United States is experiencing steady growth due to demand from corn and wheat farming, while European countries are focusing on eco-friendly applications of urea in emission control.

The Middle East and Africa are notable for their production capabilities. Many Middle Eastern countries possess natural gas reserves, which serve as key feedstocks for urea production, making them major exporters.

Challenges Facing the Urea Market

Despite its growth potential, the urea market faces several challenges:

- Environmental Concerns: Excessive use of urea can lead to nitrogen runoff, groundwater contamination, and greenhouse gas emissions. Regulatory bodies are increasingly focusing on more sustainable farming practices.

- Volatility in Raw Material Prices: Urea is derived from ammonia, which in turn is produced from natural gas. Fluctuating gas prices can significantly affect urea production costs.

- Shift Toward Organic Farming: The global trend toward organic and eco-friendly farming is reducing the reliance on synthetic fertilizers, including urea. Some governments are even offering incentives for organic cultivation.

Innovations and Sustainability Trends

One of the most promising trends in the urea market is the development of sustainable and low-emission production technologies. The concept of "Green Urea," produced using renewable energy sources and eco-friendly catalysts, is gaining traction. Portable or decentralized urea production units are also being piloted in remote farming regions to reduce logistical challenges and lower the carbon footprint.

Companies are increasingly investing in R&D to improve urea's environmental profile and reduce its negative impact on ecosystems. Coated or slow-release urea formulations are being developed to enhance nitrogen use efficiency and minimize leaching.

Key Industry Developments

- March 2023: SABIC announced that it is collaborating with two U.S.-based companies, BiOWiSH Technologies and ADM, to supply Bio-Enhanced Urea to farmers for 2023’s growing season to support sustainable agriculture.

- June 2022: Nutrien Ag announced that it is increasing its fertilizer production capability. This move is expected to enable the company to respond to changes in global energy, agriculture, and fertilizer markets.

Competitive Landscape

Leading players in the global urea market include names like Yara International, Nutrien Ltd., SABIC, EuroChem Group, CF Industries, and OCI NV. These companies are focusing on expanding production capacities, forming strategic partnerships, and adopting sustainable practices to gain a competitive edge.

Recent years have also seen increased mergers and acquisitions aimed at consolidating market presence and diversifying product portfolios.

Outlook

The global urea market stands at the crossroads of agricultural productivity and environmental responsibility. While demand continues to rise across traditional and emerging applications, producers and policymakers alike must address the sustainability challenges associated with urea use. With innovation driving greener production methods and smart application techniques, the urea industry is well-positioned for a balanced and sustainable future.

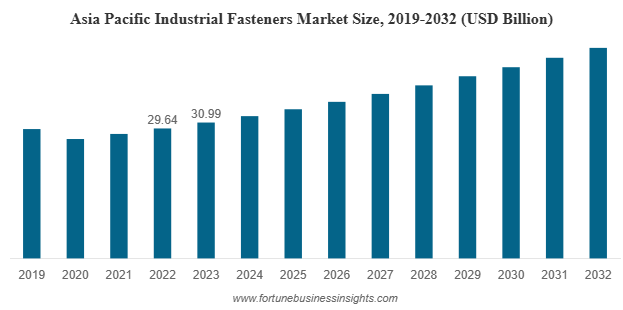

The global industrial fasteners market was valued at USD 85.83 billion in 2023 and is expected to grow to USD 89.34 billion in 2024, reaching approximately USD 125.87 billion by 2032. This growth represents a compound annual growth rate (CAGR) of 4.3% over the forecast period. In 2023, Asia Pacific led the market, accounting for 36.11% of the global share. Meanwhile, the U.S. industrial fasteners market is projected to see significant expansion, with its value expected to reach around USD 21.13 billion by 2032, largely driven by the increasing production of electric vehicles in the country.

The global industrial fasteners market is undergoing a period of steady growth, driven by rising demand from key sectors such as automotive, aerospace, construction, and industrial machinery. As industries evolve to meet sustainability targets, technological advancements, and increasing infrastructure needs, the role of fasteners—essential components used to hold two or more objects together—has become more critical than ever.

List Of Key Companies Profiled:

- Howmet Aerospace Inc. (U.S.)

- ATF Inc. (U.S.)

- Nifco Inc. (Japan)

- MW Industries, Inc. (MWI) (U.S.)

- LISI Group - Link Solutions for Industry (France)

- Sesco Industries, Inc. (U.S.)

- Birmingham Fastener and Supply Inc. (U.S.)

- BPF (India)

- Elgin Fastener Group (U.S.)

- Eastwood Manufacturing (U.S.)

Market Overview and Size Projections

From complex aerospace systems to consumer electronics, fasteners play an indispensable role in ensuring mechanical reliability, safety, and durability. Recent market research highlights strong growth potential through the end of this decade, with key regions and materials emerging as leaders in innovation and revenue generation.

While this is a moderate growth trajectory, it is sustained by long-term industry trends such as electrification, infrastructure expansion, lightweight material innovations, and global trade recovery.

Key Market Segments

The industrial fasteners market is segmented primarily by material, product type, and application.

- By Material

Metal fasteners continue to dominate the market owing to their superior strength, load-bearing capacity, and reliability. Steel, stainless steel, aluminum, and brass are among the most commonly used metals. However, the demand for plastic fasteners is rising steadily, particularly in industries where weight reduction, corrosion resistance, and insulation are critical—such as electronics, automotive interiors, and lightweight machinery.

Plastic fasteners are also gaining traction as industries move toward sustainability and recyclable materials. Despite being less durable than metal counterparts, their ease of installation and lower cost make them attractive in specific applications.

- By Product Type

Externally threaded fasteners (like bolts and screws) hold the largest market share due to their extensive use in automotive and construction. Internally threaded fasteners, non-threaded fasteners (such as rivets and pins), and specialty fasteners designed for aerospace and electronics industries also contribute significantly to the market.

The push for fasteners that meet both performance and environmental requirements is leading to innovations in design, coating, and material science.

- By Application

The automotive industry is the largest end-user of industrial fasteners and is expected to maintain its lead during the forecast period. Automotive manufacturers increasingly demand lightweight, durable, and cost-efficient fasteners that align with fuel efficiency and emissions standards. As electric vehicles (EVs) gain global momentum, this sector will see even more demand for advanced fastening solutions that can handle high-voltage systems, battery modules, and compact mechanical assemblies.

Other major application sectors include building and construction, aerospace and defense, machinery manufacturing, electronics, and marine. In the construction sector, the rise in commercial real estate, infrastructure modernization, and residential development—especially in developing economies—are pushing up demand for high-strength fasteners.

Read More : https://www.fortunebusinessinsights.com/industrial-fasteners-market-102732

Market Drivers

Several factors are driving sustained demand in the global industrial fasteners market:

- Infrastructure Development: With massive infrastructure projects underway in emerging economies, demand for heavy-duty fasteners used in bridges, buildings, and transportation networks is rising.

- Automotive Electrification: The global shift toward EVs necessitates a rethinking of fastening systems, prompting growth in demand for lightweight and high-strength materials.

- Aerospace Industry Expansion: High-performance fasteners are crucial in aircraft manufacturing. With increased air travel and defense investments, this segment is expected to grow rapidly.

- Technological Advancements: Smart fasteners with sensors and integrated features are being developed to enhance efficiency, particularly in complex industrial machinery and robotics.

Regional Market Insights

- The Asia-Pacific region led the global industrial fasteners market in 2023, accounting for over one-third of the total market share. Countries like China, India, Japan, and South Korea are key contributors, thanks to their robust manufacturing capabilities, infrastructure investments, and rapidly expanding automotive sectors.

- China, in particular, is a manufacturing powerhouse for fasteners, supplying both domestic and international markets. India's "Make in India" initiative is also stimulating local production and attracting foreign investment in manufacturing and infrastructure, thereby boosting fastener consumption.

- North America, especially the United States, is seeing growth due to rising electric vehicle production and demand for lightweight, high-performance components. Europe remains a mature yet innovative market, with countries like Germany and France investing in aerospace and precision manufacturing.

Challenges and Restraints

Despite the positive outlook, the market faces several challenges. One of the primary restraints is the emergence of alternative joining technologies, such as adhesives, welding, and clinching, which can replace traditional fasteners in certain applications. These methods offer weight savings and aesthetic advantages, particularly in automotive design.

Additionally, raw material price fluctuations, stringent regulatory standards, and rising labor and manufacturing costs can create hurdles, especially for small and medium-sized fastener manufacturers.

Key Industry Developments:

- June 2022- Belenus acquired the Tellep Brand, a renowned fastener brand owned by Metalac SPS Ind. e Com. Ltda. (Sorocaba, SP), a Precision Castparts Corp member group. The brand is a line of screw hexagon sockets with several head kinds (cylindrical, flat, bulging, and others) and items made for application in fastening systems with high resistance demand.

- April 2022- Birmingham Fastener announced the acquisition of Champion Sales and Manufacturing, Inc. This acquisition strengthens Birmingham Fastener’s waterworks product offering and manufacturing diversity.

Competitive Landscape

The industrial fasteners market is moderately fragmented, with key players competing on quality, innovation, and supply chain efficiency. Leading companies include manufacturers specializing in aerospace-grade fasteners, automotive OEM fasteners, and custom-engineered fastening systems.

Strategic collaborations, mergers and acquisitions, and expansion into emerging markets are commonly employed to strengthen market position. Companies are also investing in R&D to develop corrosion-resistant, tamper-proof, and environmentally sustainable products.

Outlook

The industrial fasteners market is poised for steady growth over the next decade, driven by global industrialization, urban infrastructure development, and the ongoing transformation of the automotive and aerospace industries. To capitalize on this momentum, manufacturers must innovate in materials, enhance production efficiency, and adapt to shifting customer needs across industries and geographies.

Businesses that prioritize sustainability, compliance, and technology integration in their fastening solutions will be well-positioned to lead in this evolving market.

Protective Packaging Market Insights, Challenges, Key Players & Forecast 2030

By Sharvari, 2025-09-24

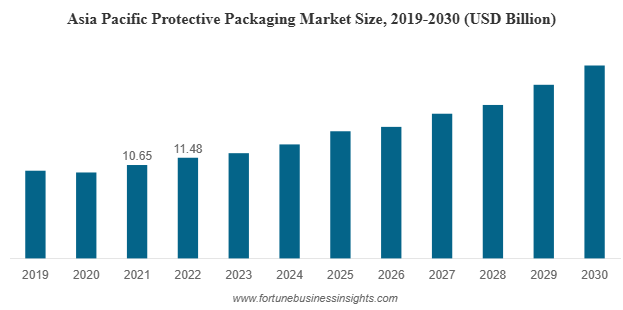

The global protective packaging market was valued at USD 36.31 billion in 2022 and is expected to rise from USD 38.52 billion in 2023 to USD 61.44 billion by 2030, reflecting a CAGR of 6.90% during the forecast period. Asia Pacific led the market in 2022 with a 31.62% share, while the U.S. market is set for strong growth, projected to reach USD 14.80 billion by 2032, fueled by rising demand for protective packaging in international trade.

This steady growth reflects how packaging has transformed from being a functional necessity to a strategic driver of customer satisfaction, sustainability, and supply chain efficiency.

List Of Key Companies Profiled In Protective Packaging Market:

- Smurfit Kappa (Ireland)

- Westrock Company (U.S.)

- Sealed Air Corporation (U.S.)

- Sonoco Product Company (U.S.)

- Huhtamaki (Finland)

- DS Smith PLC (U.K.)

- Pregis LLC (U.S.)

- Pro-Pac Packaging Limited (Australia)

- Storopack (Germany)

- Intertape Polymer Group (U.S.)

Key Drivers of Market Growth

- Expansion of E-Commerce

One of the strongest growth catalysts is the booming e-commerce industry. The rising number of online shoppers has created a pressing need for reliable packaging solutions that protect products from damage during handling, storage, and transportation. Protective packaging ensures a positive customer experience, which is vital for brand loyalty in a highly competitive online retail space.

- Rising Food & Beverage Demand

The food and beverage sector remains the largest end-user of protective packaging. From dairy and bakery products to frozen meals, packaging plays a critical role in maintaining freshness, extending shelf life, and preventing contamination. As global consumption of convenience and packaged foods increases, the reliance on advanced protective packaging solutions continues to grow.

- Growth in Consumer Electronics and Pharmaceuticals

The consumer electronics industry, marked by fragile goods such as smartphones, wearables, and home appliances, requires robust packaging materials that provide cushioning and insulation. Similarly, the pharmaceutical sector depends heavily on protective packaging for the safe transport of sensitive drugs, vaccines, and medical equipment, especially under strict temperature and handling conditions.

Market Segmentation Insights

By Material

Plastic continues to dominate the market due to its lightweight, shock-resistant, and cost-effective properties. However, paper and paperboard materials are gaining traction as industries seek eco-friendly alternatives. The shift toward biodegradable and recyclable materials highlights the industry’s effort to balance durability with sustainability.

By Product Type

Flexible protective packaging, such as wraps, pouches, and cushioning films, holds the largest market share. These solutions are widely favored for their versatility, cost efficiency, and lighter environmental impact compared to rigid packaging.

By Function

Wrapping emerged as the dominant function segment, largely due to its versatility. Whether in food, electronics, or industrial applications, wrapping ensures safety against dust, moisture, and physical impacts during transportation.

By End-Use Industry

- Food & Beverage: Leading application area with rising packaged food consumption.

- Consumer Electronics: Strong growth driven by rising smartphone penetration and online electronics sales.

- Pharmaceuticals: Critical for maintaining the safety and efficacy of medical products.

- Industrial Goods & Personal Care: Increasing adoption due to global shipping needs and consumer awareness.

Read More : https://www.fortunebusinessinsights.com/protective-packaging-market-107319

Regional Market Highlights

- Asia Pacific

Asia Pacific leads the global protective packaging market, accounting for more than 31.62% share in 2022. Countries such as China and India, with their rapidly expanding e-commerce industries, strong manufacturing bases, and rising disposable incomes, are fueling this dominance.

- North America

The region’s growth is supported by advanced supply chain systems and the strong presence of e-commerce giants. Consumer preference for fast and damage-free deliveries makes protective packaging indispensable.

- Europe

Sustainability plays a critical role in shaping Europe’s protective packaging landscape. With stringent regulations against single-use plastics and strong consumer awareness, companies are rapidly adopting paper-based and biodegradable materials.

- Latin America, Middle East, and Africa

These regions are seeing rising demand in online food delivery, cosmetics, and personal care industries. As logistics infrastructure improves, adoption of protective packaging is set to accelerate.

Challenges Facing the Industry

Despite rapid growth, the protective packaging market faces several challenges:

- Regulatory pressure on plastics: Governments across the globe are imposing bans and restrictions on single-use plastics, pushing companies to explore costlier but eco-friendly alternatives.

- Rising raw material costs: Volatility in the prices of paper, polymers, and aluminum is straining profit margins.

- Supply chain disruptions: Geopolitical tensions, trade restrictions, and global shipping delays can negatively impact the availability of packaging materials.

Key Industry Developments:

- August 2023 – Ranpack launched Wrap’n Go converter for protective honeycomb paper. The company brought its Geami Wrap’n Go converter, which turns kraft paper into protective, pack-in-store packaging for fragile items, to the North American market, providing an alternate option to the plastic solution.

- February 2023 – The circular materials company Cruz Foam announced the launch of a revolutionary new product family of environmentally protective packaging, introducing highly efficient solutions that meet the specific needs of customers in transporting sensitive and temperature-sensitive goods to consumers and businesses.

Emerging Trends and Innovations

The industry is experiencing rapid innovation to meet the twin goals of protection and sustainability. Some notable trends include:

- Paper-based bundling solutions replacing traditional plastic shrink wraps for beverages and multipacks.

- Biodegradable foams and cushioning materials made from renewable resources that reduce environmental impact.

- Advanced moisture-resistant coatings applied to paper packaging to improve durability and expand its use in diverse industries.

- Smart packaging technologies that incorporate tracking features to improve logistics efficiency and ensure product authenticity.

Future Outlook

The protective packaging market is on track for strong expansion through 2030, driven by global commerce, digital retail, and consumer demand for convenience. However, the path forward will be shaped by how the industry addresses sustainability challenges. Companies that embrace innovation in eco-friendly materials, invest in recycling systems, and adopt circular economy models are expected to lead the market.

As packaging continues to be a bridge between businesses and consumers, its role goes beyond protection—serving as a tool for brand reputation, compliance, and environmental responsibility.

U.S. Antimicrobial Plastics Market Insights, Challenges, Key Players & Forecast 2030

By Sharvari, 2025-09-23

The U.S. antimicrobial plastics market size was valued at USD 6.68 billion in 2022 and is projected to grow at a CAGR of 7.5% during the forecast period.

The U.S. is witnessing a notable surge in demand for antimicrobial plastics, driven by advancements in modern healthcare infrastructure and expanding applications across multiple industries. As the need for hygienic and durable materials grows, especially in medical devices, food packaging, and automotive interiors, antimicrobial plastics are increasingly becoming a material of choice. This rising demand is further supported by increased investments in research and development, enabling manufacturers to expand their product offerings and cater to a broader range of end-use sectors. These factors collectively position the U.S. antimicrobial plastics market for substantial growth in the coming years.

List Of Key Companies Profiled:

- BASF SE (Germany)

- LyondellBasell Industries Holdings B.V. (Netherlands)

- DuPont de Nemours, Inc (U.S.)

- INEOS Group Limited (U.K.)

- Avient Corporation (U.S.)

- SABIC (Saudi Arabia)

- Palram Industries Ltd. (Israel)

- RTP Company (U.S.)

- Microban International, Ltd. (U.S.)

- King Plastic Corporation (U.S.)

Understanding the Market Landscape

The steady expansion is driven by a combination of technological innovation, industry demand, and consumer expectations. From antimicrobial packaging materials that extend the shelf life of food products to touch-safe automotive interiors, the applications are widespread and growing.

As hygiene awareness continues to grow across industries, antimicrobial plastics are playing an increasingly vital role in ensuring safety, durability, and performance. These specialized materials, designed to inhibit the growth of bacteria, fungi, and other harmful microorganisms, are seeing significant demand in sectors like healthcare, packaging, consumer goods, automotive, and construction. In the U.S., the antimicrobial plastics market has evolved rapidly in recent years and is expected to continue its strong growth trajectory through 2030.

Key Growth Drivers

- Healthcare and Medical Applications

Healthcare remains the leading end-use sector for antimicrobial plastics. The need for sterile and infection-resistant materials in hospitals, clinics, and diagnostic centers is at an all-time high. Plastics with antimicrobial properties are used in a wide array of medical devices, surgical instruments, beddings, curtains, tubing, and more. These materials reduce the risk of hospital-acquired infections and improve overall safety standards.

Silver-based additives, for instance, have long been favored in the medical industry for their broad-spectrum antimicrobial activity. With increasing investments in healthcare infrastructure and aging populations, the demand for such plastics is set to grow consistently.

- Food Packaging and Consumer Goods

The food packaging industry is another key growth area for antimicrobial plastics. These materials are used to reduce the growth of microbes that cause food spoilage, extending shelf life and improving food safety. This not only benefits manufacturers and retailers but also aligns with consumer expectations for freshness and quality.

In the consumer goods sector, antimicrobial plastic is increasingly viewed as a value-added feature. Products such as cutting boards, water bottles, toothbrushes, and mobile cases are now being marketed with antimicrobial protection. The rise in demand for hygienic and easy-to-clean consumer items is a direct response to changing lifestyle habits.

- Automotive and Transport Industry

As vehicle interiors become more advanced and multifunctional, manufacturers are seeking materials that offer both performance and cleanliness. Steering wheels, dashboard components, air vents, and seat fabrics are frequently touched surfaces that can harbor bacteria and viruses. Antimicrobial plastics are now being used in these parts to enhance hygiene, especially in shared or commercial vehicles such as taxis, buses, and rental cars.

The use of antimicrobial materials in HVAC systems and filtration units is also growing, further pushing demand from the transportation sector.

- Rising Public Health Awareness

The global COVID-19 pandemic drastically shifted perceptions about surface hygiene and infection control. Consumers and industries alike are now far more conscious of cleanliness. This has led to an increased preference for products with antimicrobial features, not just in medical settings but also in everyday environments. Schools, offices, gyms, restaurants, and public transit systems are incorporating more antimicrobial surfaces and materials than ever before.

Read More : https://www.fortunebusinessinsights.com/u-s-antimicrobial-plastics-market-108257

Material Segmentation: Additives and Plastics

In terms of additives, inorganic compounds — especially silver, copper, and zinc oxide — dominate the market. These materials have proven long-term efficacy against a broad spectrum of pathogens and are generally stable under various conditions. While organic additives are used as well, they are often more prone to degradation and have a shorter antimicrobial lifespan.

When it comes to plastic types, commodity plastics such as polyethylene, polypropylene, polyvinyl chloride (PVC), and polystyrene account for the largest share. Their widespread usage, relatively low cost, and compatibility with antimicrobial additives make them ideal for mass-market applications. Engineering plastics and high-performance materials are used in more specialized applications where higher thermal or mechanical performance is needed.

Key Industry Developments:

- November 2021 – Sunbeam Products, Inc. and Microban International have announced a strategic partnership to develop a premium-quality product portfolio under the Calphalon brand to produce knife handles by innovating the Microban silver shield platform, which features product protection against microbes.

- May 2021 – Avient Corporation has launched a new antimicrobial technology by enlarging its product portfolio to protect against bacterial microbes. The new technology GLS TPE is expected to extend the organization's market presence into more extensive applications for gadgets, cars, and air conditioning seals.

Challenges and Constraints

Despite its promising outlook, the antimicrobial plastics market faces some challenges:

- Environmental Concerns: Growing scrutiny around plastic waste and pollution poses a threat to market expansion. The use of additives, especially inorganic compounds, can complicate recycling processes. Moreover, the environmental impact of leaching metals like silver or copper is being evaluated by regulatory bodies.

- Regulatory Compliance: U.S. manufacturers must navigate strict FDA and EPA regulations when developing antimicrobial products. These regulatory requirements can slow down time-to-market and add complexity to production.

- Cost Implications: The inclusion of antimicrobial additives increases the overall cost of plastic production. In price-sensitive markets, this can be a deterrent unless the benefits — such as extended lifespan or improved safety — are clearly communicated.

Future Outlook and Strategic Considerations

Looking ahead, the U.S. antimicrobial plastics market presents significant opportunities for innovation and expansion. Research and development efforts are increasingly focused on sustainable antimicrobial materials that balance performance with environmental responsibility. Biodegradable plastics with built-in antimicrobial properties are an emerging area of interest.

Collaboration across the value chain — from raw material suppliers to end-use manufacturers — will be crucial in developing customized solutions for specific applications. Moreover, educating consumers about the benefits of antimicrobial products, and ensuring transparency about safety and environmental impact, will help build long-term trust.

In conclusion, the demand for antimicrobial plastics in the U.S. is not just a trend but a reflection of evolving consumer priorities and industrial needs. As health, hygiene, and sustainability take center stage, antimicrobial materials are positioned to play a pivotal role across multiple sectors in the coming years.

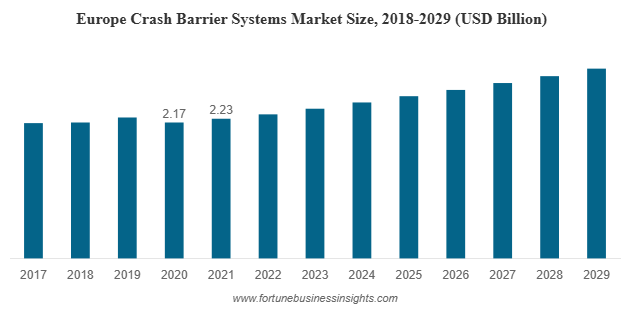

Crash Barrier System Market Global Opportunities, Insights, Size, Growth & Forecast 2029

By Sharvari, 2025-09-23

The global crash barrier systems market was valued at USD 6.79 billion in 2021 and is expected to grow from USD 7.01 billion in 2022 to USD 9.35 billion by 2029, registering a compound annual growth rate (CAGR) of 4.2% over the forecast period. In 2021, Asia Pacific led the market, accounting for 32.84% of the global share, driven by rapid infrastructure development across the region. Meanwhile, the U.S. market is projected to see substantial growth, with its crash barrier systems market expected to reach approximately USD 2.23 billion by 2032, fueled by advancements in technology and evolving construction techniques.

In an era where infrastructure development and road safety are critical priorities for governments across the globe, the demand for crash barrier systems is witnessing significant growth. These systems play a vital role in minimizing road accident fatalities by providing structural safety and preventing vehicles from straying into dangerous zones. As the volume of vehicular traffic increases and urban landscapes expand, the global crash barrier systems market is set to experience sustained growth through the next decade.

List of Top Crash Barrier Systems Companies:

- Tata Steel (India)

- Lindsay Corporation. (U.S.)

- Transpo Industries Inc. (U.S.)

- Hill and Smith (UK)

- RoadSafe Traffic Systems, Inc. (U.S.)

- Trinity Highway Products, LLC. (U.S.)

- Valmont Industries (U.S.)

- Pinax Steel Industries (India)

- Volkmann & Rossbach GmbH & Co. KG (Germany)

Key Market Drivers

- Urbanization and Road Expansion Projects

The rapid expansion of urban areas in countries like China, India, Indonesia, and Brazil has created the need for massive road network development. As cities become denser and populations grow, governments are investing heavily in building new highways, overpasses, bridges, and urban expressways—creating a continuous demand for crash barrier systems to ensure public safety. - Government Regulations and Safety Standards

The implementation of stricter safety norms and regulations across both developed and developing nations has been a major factor driving demand. Regulatory bodies are mandating the installation of crash barriers, especially in accident-prone areas and high-speed corridors. This not only includes highways but also infrastructure projects such as airports, metros, and industrial complexes. - Increased Vehicle Ownership

With the rising middle-class population and increasing disposable incomes, global vehicle ownership is on the rise. This has led to heavier traffic on roads, increasing the likelihood of accidents. As a preventive measure, public authorities are incorporating advanced crash protection systems into road designs. - Growing Awareness of Road Safety

There is a rising public awareness of road safety issues, particularly in countries that previously lacked rigorous enforcement. This shift in public sentiment has prompted policymakers and civic bodies to improve road conditions and invest in safety infrastructure, including the installation of barriers in hazardous zones.

What Are Crash Barrier Systems?

Crash barrier systems market are designed to protect vehicles and passengers in the event of a collision by absorbing impact energy and reducing the severity of crashes. These systems are installed along roadsides, medians, bridges, and sharp curves, as well as in work zones and parking areas. Depending on the requirement, crash barriers can be fixed (permanent) or portable (temporary), and are typically made from materials such as steel, concrete, or polymer composites.

There are also variations in barrier technology—rigid, semi-rigid, and flexible—each serving different functional and structural needs. While rigid barriers offer strong containment and are commonly used in highways and bridges, semi-rigid and flexible barriers allow more deflection and are useful in less hazardous conditions or temporary setups.

Market Segmentation Insights

- By Type:

The market is dominated by fixed (permanent) crash barriers due to their durability and long-term effectiveness in high-risk areas. These are often constructed using reinforced concrete or heavy-duty steel. Portable barriers, on the other hand, are gaining popularity for temporary use, especially in construction zones, event venues, and during maintenance work on roadways.

- By Technology:

Rigid barriers are the most widely used due to their ability to completely stop vehicles from breaching restricted zones.

Semi-rigid systems such as W-beam guardrails offer controlled deflection, making them suitable for urban roads and medium-speed areas.

Flexible barriers use tensioned cables and are designed to absorb energy more gradually, often used in rural or low-speed roadways.

- By Application:

The roadside barrier segment accounts for the largest market share, as these are essential along highways and freeways to prevent vehicles from veering off the road. Median barriers, bridge barriers, and work-zone barriers are also integral to the market, each serving unique safety functions in different settings.

Read More : https://www.fortunebusinessinsights.com/crash-barrier-system-market-106084

Regional Insights

Asia-Pacific holds the largest share of the global crash barrier systems market, thanks to rapid infrastructure growth, increasing vehicle sales, and heightened road safety awareness. Governments in the region are implementing aggressive plans to upgrade road infrastructure, especially in India and China.

Europe follows closely, backed by stringent road safety standards and mature infrastructure. North America also shows steady growth, driven by technological innovation and federal investments in transportation safety initiatives.

Emerging markets in the Middle East, Africa, and Latin America are witnessing growing opportunities as governments push for modernization of roads and public infrastructure.

Key Industry Developments:

- June 2021: Trinity Highway Products, LLC signed an agreement with Highway Care Ltd. to produce, sell, and rent the MASH-tested HighwayGuard Barrier in North America. With this partnership, Trinity Highway broadened its commitment to offer innovative roadway solutions of HighwayGuard to Mexico, the U.S., and Canada.

- August 2019: Lindsay Corporation launched ABSORB-M, a new, non-redirective, water-filled crash cushion system. The product is suited for unanchored and anchored barriers. With this launch, the company would expand its product line.

Challenges in the Market

While the growth outlook is promising, the crash barrier systems market faces certain challenges:

- Volatile Raw Material Prices: Steel, aluminum, and other materials used in manufacturing barriers are subject to global price fluctuations, which can impact project costs and profitability.

- Environmental and Aesthetic Concerns: In urban areas, there is a rising preference for barriers that blend with the environment or offer aesthetic value, requiring manufacturers to innovate with design and materials.

- Impact Safety: Rigid barriers, while effective in containment, can cause severe damage or fatalities in certain crash scenarios. This raises the demand for smarter, more adaptive technologies.

Future Outlook

The future of crash barrier systems market lies in innovation and smart infrastructure. Technologies such as energy-absorbing barriers, integrated sensors, and data-driven maintenance solutions are poised to transform this market. As cities become smarter and transportation systems evolve, crash barriers will not just be physical safeguards, but intelligent components of an integrated safety network.

With rising investments in infrastructure and a growing emphasis on public safety, the global crash barrier systems market is expected to remain on a strong growth trajectory in the years ahead.

Exterior Automotive Plastics Market Report, Size & Restraints, Forecast 2029

By Sharvari, 2025-09-23

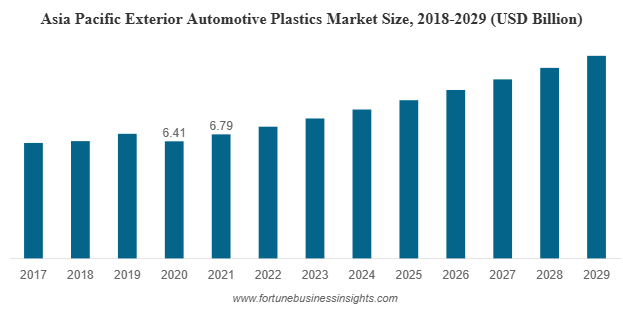

The global exterior automotive plastics market was valued at USD 11.53 billion in 2021 and is expected to increase from USD 12.18 billion in 2022 to USD 17.94 billion by 2029, registering a CAGR of 5.7% during the forecast period. Asia Pacific led the market in 2021 with a 58.89% share.

The exterior automotive plastics industry is undergoing rapid transformation, driven by electrification, sustainability goals, and rising consumer demand for stylish yet efficient vehicles. One material group that has become increasingly important in this shift is exterior automotive plastics market. Once considered supplementary to metals, plastics are now essential for reducing vehicle weight, enhancing design flexibility, and supporting regulatory compliance.

List of Top Exterior Automotive Plastics Companies:

- Arkema (France)

- BASF SE (Germany)

- Borealis AG (Austria)

- Dupont (U.S.)

- DSM (Netherlands)

- Evonik Industries (Germany)

- Exxonmobil (Texas)

- Lanxess (Germany)

- LyondellBasell (Netherlands)

- Covestro AG (Germany)

Key Growth Drivers

- Lightweighting Imperative

The global push for improved fuel efficiency and reduced emissions has made vehicle lightweighting a priority. Plastics offer significant weight savings compared to traditional metals, helping automakers design vehicles that meet stringent emission standards while enhancing overall performance. For electric vehicles (EVs), lighter weight translates directly into extended driving range, making plastics a natural fit for modern automotive engineering.

- Rising Adoption of Electric Vehicles

With EV sales accelerating worldwide, demand for exterior plastics has gained momentum. Every kilogram saved in an EV helps improve battery efficiency, which makes lightweight polymers a strategic material for body parts such as bumpers, grills, liftgates, and fenders. Manufacturers are increasingly incorporating plastics into EV designs to optimize energy use and ensure cost-effective production.

- Design Flexibility and Aesthetic Appeal

Exterior automotive plastics market provide unmatched design versatility. Automakers can mold plastics into complex shapes, incorporate unique textures, and add premium finishes that improve both aerodynamics and consumer appeal. Features such as adaptive headlights, stylish bumpers, and panoramic roofs often rely heavily on engineered plastic components.

- Regulatory and Sustainability Pressures

Governments around the world are enforcing strict emission standards and encouraging recyclability. Plastics enable compliance by lowering vehicle weight and offering the potential for sustainable alternatives, such as bio-based polymers. These factors are driving automotive manufacturers to adopt innovative plastic solutions across their product portfolios.

Market Segmentation Insights

- By Material

The exterior automotive plastics market is segmented by materials such as polypropylene, ABS, PBT, polyurethane, and others. In 2021, the “Others” category, which includes ABS and polyester, held a major share due to superior durability, weather resistance, and surface finish. Polypropylene also plays a crucial role because of its impact resistance, cost efficiency, and ease of molding.

- By Application

Among applications, bumpers and grills dominate the exterior automotive plastics market as they account for both safety and aesthetic value in vehicles. These components are increasingly designed with high-strength plastics to balance durability with lightweight advantages. Other important applications include roofs, lighting, liftgates, and fenders, where plastics are enabling new levels of styling and aerodynamic performance.

Read More : https://www.fortunebusinessinsights.com/exterior-automotive-plastics-market-106720

Regional Dynamics

- Asia-Pacific

Asia-Pacific leads the exterior automotive plastics market, capturing nearly 58.89% share in 2021. The region benefits from the presence of leading OEMs, cost-effective manufacturing capabilities, and strong raw material availability. China, in particular, plays a pivotal role, supported by its robust automotive production base and rapid EV adoption.

- Europe

Europe is another critical market, with growth supported by strict environmental regulations and a strong focus on sustainability. Automakers in Germany, France, and the U.K. are integrating recyclable plastics and bio-based materials into their designs to meet regulatory expectations and consumer demand for eco-friendly vehicles.

- North America

North America shows strong potential, driven by innovation in premium vehicles and pickup trucks, as well as investments in electric mobility. U.S. automakers are adopting advanced plastics for exterior applications to balance performance with the region’s increasing focus on environmental impact reduction.

Challenges and Restraints

Despite their advantages, plastics face certain challenges:

- Performance Concerns: Metals still outperform plastics in some aspects of strength and crash resistance. Addressing safety concerns remains critical.

- Recycling Limitations: Many engineered plastics are difficult to recycle, creating environmental concerns. Developing cost-effective recycling methods is a top priority.

- Consumer Perceptions: Some customers view plastics as less durable or “cheap,” requiring automakers to emphasize quality and premium finishes.

Key Industry Developments:

- May 2022: Lanxess and Advent International signed an agreement to acquire DSM Engineering Materials from Royal DSM for around USD 3.9 billion. The DSM Engineering Materials will become part of a joint venture established by Lanxess and Advent International, which hold 40% and 60% of the joint venture, respectively.

- January 2020: BASF SE closed the acquisition of Solvay’s polyamide business. The acquisition broadened the company’s polyamide capabilities with innovative products such as Technyl. This allowed the company to support its customers with better engineering plastics solutions for e-mobility and autonomous driving. Moreover, the transaction enhanced the company’s access to growth markets in Asia as well as in South and North America.

Emerging Trends

The exterior automotive plastics market is undergoing exciting changes with the rise of bioplastics and bio-based polymers such as PLA, bio-nylon, and bio-polypropylene. These materials promise lower environmental impact and better recyclability.

Additionally, premium automotive features—including panoramic roofs, convertible systems, and adaptive lighting—are increasingly reliant on high-performance plastics. The industry is also investing in closed-loop recycling systems to recover and reuse materials more efficiently.

Opportunities for Stakeholders

- Material Suppliers: Opportunity to develop sustainable, recyclable, and lightweight polymers tailored for automotive exterior use.

- OEMs and Automakers: Ability to differentiate products through innovative designs that balance performance, sustainability, and cost.

- Policy Makers: Potential to shape standards that encourage eco-friendly materials while supporting recycling infrastructure.

Future Outlook

The exterior automotive plastics market is poised for sustained growth as the industry moves toward electrification and greener production models. Innovations in material science, coupled with government regulations, will further accelerate adoption.

By 2029, the exterior automotive plastics market is expected to surpass USD 17.94 billion, driven by strong demand in Asia-Pacific, growing adoption in North America, and stringent environmental standards in Europe. For stakeholders across the value chain, the message is clear: investing in exterior automotive plastics—especially sustainable and recyclable alternatives—offers a strategic pathway to growth in the evolving automotive landscape.