Agriculture has always been the backbone of human civilization. But in recent decades, farmers across the globe have faced mounting challenges—climate change, soil degradation, water scarcity, and a rapidly growing population with shifting dietary preferences. These factors are pushing the agricultural industry to adapt faster than ever before. Amid this transformation, one innovative solution has quietly emerged as a game-changer: agro-textiles market.

Agro-textiles market are specially engineered fabrics designed for agricultural applications. From protecting crops against harsh sunlight to conserving water and shielding plants from pests, these textiles are redefining the way we grow food. Beyond being a farming aid, they represent a sustainable, technologically advanced path toward a more resilient future in agriculture.

The Growing Agro-Textiles Market

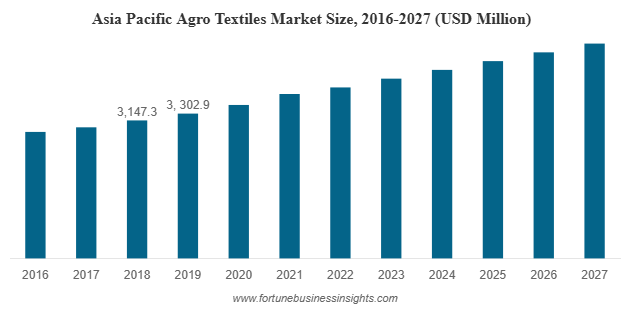

The global agro-textiles market was valued at USD 9,612.8 million in 2019 and is expected to reach USD 13,458.7 million by 2027, growing at a CAGR of 5.2% during the forecast period. Asia Pacific led the market in 2019, accounting for 34.36% of the share, while the U.S. market is anticipated to hit USD 1,766.4 million by 2027, driven by innovations in crop protection and the growing shift toward sustainable agriculture.

One of the key reasons for this growth is the rising global demand for food. With the world population expected to surpass 9 billion by 2050, farmers are under immense pressure to increase yield while maintaining environmental balance. Agro-textiles provide a practical answer—protecting crops, saving resources, and boosting production efficiency.

List of Top Agro Textiles Companies:

- SRF Limited (India)

- B&V Agro Irrigation Co. (India)

- (Japan)

- Beaulieu Technical Textiles. (Belgium)

- Meyabond Industry & Trading (Beijing) Co., Ltd. (China)

- Belton Industries. (U.S.)

- Neo Corp International Limited. (India)

- Hy-Tex (UK) Limited (U.K.)

Why Agro-Textiles Are on the Rise

Several interconnected factors are fueling the demand for agro-textiles market:

- Climate Challenges

Unpredictable rainfall, intense heatwaves, and frequent storms pose severe threats to farming. Agro-textiles like shade nets, crop covers, and windbreak fabrics help mitigate these risks by creating controlled microclimates. - Shift in Diets

As incomes rise globally, diets are shifting toward high-value foods like fruits, vegetables, and proteins. These crops often require greater care and protection, which agro-textiles readily provide. - Urbanization & Limited Farmland

With shrinking arable land, farmers must do more with less. Techniques like greenhouse cultivation and vertical farming rely heavily on agro-textile applications to maximize efficiency. - Sustainability Goals

Governments and organizations worldwide are pushing for eco-friendly farming solutions. Many agro-textiles today are developed using biodegradable or recyclable materials, aligning with sustainability targets.

Read More : https://www.fortunebusinessinsights.com/agro-textiles-market-102963

Key Applications Driving Growth

Agro-textiles have diverse uses across different agricultural segments. Let’s look at the most impactful applications:

- Shade Nets and Crop Covers

These are widely used to protect plants from excessive sunlight, wind, and frost. By regulating temperature and light, they improve crop quality and extend the growing season. - Fishing Nets and Aquaculture

Fishing nets remain one of the largest segments in the agro-textile industry. As global demand for fish and seafood rises, aquaculture relies heavily on durable and advanced textile solutions. - Ground Covers and Mulching Mats

Designed to suppress weeds, conserve soil moisture, and improve soil structure, these textiles reduce the need for chemical herbicides while promoting healthier soil. - Irrigation Solutions

Innovative fabrics like hydrating tubes with micropores allow water to reach plant roots directly, drastically improving water efficiency in drought-prone regions.

Regional Insights

While the agro-textiles market is global, certain regions are leading the way:

- Asia-Pacific holds the largest share, fueled by massive demand from China and India. Both countries use agro-textiles extensively in agriculture, aquaculture, and horticulture, driven by their large populations and food security goals.

- North America, especially the United States, is witnessing rapid adoption of advanced agro-textiles. The U.S. market alone is projected to exceed USD 1,766.4 million by 2027, supported by sustainability-driven farming innovations.

- Europe remains an important player, with a strong focus on eco-friendly materials and regulatory support for sustainable agricultural practices.

Key Industry Developments:

- January 2020– Diatex presented in the world’s leading trade fair IPM ESSEN 2020 for horticulture that took place in Germany. The company will present a tailor-made plant protection system and other crop field protection products at the IPM ESSEN 2020.

Innovation at the Core

The agro-textiles industry thrives on innovation. Some of the most exciting advancements include:

- UV-resistant and weatherproof fabrics that last longer and reduce maintenance costs.

- Biodegradable agro-textiles that prevent long-term soil and plastic pollution.

- Antibacterial coatings that keep plants healthier and extend shelf life post-harvest.

- Knitted shade fabrics tailored for specific crops, allowing farmers to fine-tune the growing environment.

These innovations not only improve performance but also make agro-textiles more environmentally responsible.

Challenges Along the Way

Despite its promising growth, the agro-textiles market faces some hurdles:

- Volatile raw material prices, particularly petroleum-based fibers like PET.

- High upfront costs for infrastructure and setup, which can discourage small-scale farmers.

- Lack of awareness in many regions, where traditional farming practices still dominate.

- Regulatory pressures on plastic-based materials, pushing companies to invest in sustainable alternatives.

Overcoming these challenges requires collaboration between governments, manufacturers, and farming communities.

Future Outlook

The future of agro-textiles market is bright. With growing awareness, rapid innovation, and stronger global emphasis on food security, these fabrics are set to become an integral part of modern agriculture. From small-scale farmers to large agribusinesses, agro-textiles offer a toolkit for tackling today’s farming challenges while preparing for tomorrow’s.

Thermal Paper Market Opportunities, Trends & Industry Analysis, Forecast 2032

By Sharvari, 2025-09-09

Thermal paper market is a specialized type of paper designed to change color when exposed to heat, eliminating the need for traditional inks. This effect is achieved by applying a coating of heat-sensitive dyes and color developers during the manufacturing process. The coating typically contains leuco dyes, organic acid developers, and sensitizers. Leuco dye, a colorless crystalline powder, melts when heated and reacts with an organic acid (the developer) to produce a visible color. Commonly, the developers used are Bisphenol-A (BPA) or Bisphenol-S (BPS).

- 2019 market size: USD 3.45 billion

- Forecast by 2027: USD 5.85 billion

- CAGR: 6.9%

- Leader: Europe

- Fastest growing region: Asia-Pacific

- Top application: Point-of-Sale systems

- Trend to watch: Sustainable, BPA-free alternatives

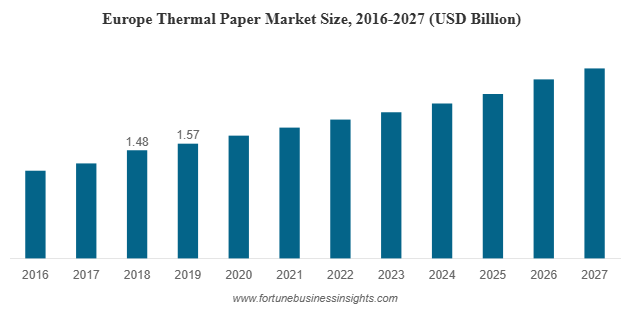

A Market on the Rise

The global thermal paper market was valued at USD 3.45 billion in 2019 and is expected to climb to USD 5.85 billion by 2027, growing at a CAGR of 6.9% during the forecast period. Europe led the market in 2019, accounting for 42.03% of the share, supported by strong retail and POS adoption. Meanwhile, the U.S. market is projected to reach USD 1.01 billion by 2027, fueled by increasing use across POS terminals, ATMs, and ticketing systems, along with the rising need for affordable and efficient printing solutions.

List Of Key Companies Profiled:

- Lecta (Spain)

- Hansol Paper (Korea)

- Appvion Operations, Inc. (USA)

- Domtar Corporation (USA)

- Ricoh Industrie France SAS (France)

- Mitsubishi Hi-Tech Paper (Germany)

- Koehler Paper Group (Germany)

- Kanzaki Specialty Papers, Inc. (USA)

- Jujo Thermal Ltd. (Finland)

- Oji Paper Co., Ltd. (Japan)

Segments That Matter

One interesting aspect of this market is its segmentation.

- By Width: The 3.125” (80 mm) rolls are the most widely used, especially in retail POS machines and lottery systems. If you’ve swiped your card at a store and received a wide receipt, chances are it came from this size category.

- By Technology: Direct thermal printing holds the lion’s share. It’s cost-effective, portable, and efficient—qualities that make it a favorite in retail and logistics industries.

- By Application: The POS segment dominates the market, as every retail counter, restaurant, and shopping center needs quick, reliable printing. At the same time, the tags and labels segment is gaining traction, accounting for nearly a quarter of the market in 2019, thanks to the logistics and e-commerce boom.

The BPA Dilemma

It’s not all smooth sailing for the thermal paper industry. A key challenge lies in the use of BPA (Bisphenol-A), a chemical developer traditionally used in thermal coatings. BPA has been under scrutiny for potential health risks, including endocrine disruption. Regulatory bodies in Europe and North America are tightening rules, urging manufacturers to find safer alternatives.

This shift is sparking innovation. Alternatives like BPS (Bisphenol-S) and Pergafast-201 are being developed and adopted, signaling a move toward sustainable and safer thermal paper solutions. While this transition comes with costs, it also presents opportunities for companies to differentiate themselves in an increasingly eco-conscious market.

Read More : https://www.fortunebusinessinsights.com/thermal-paper-market-102811

Why Thermal Paper Isn’t Going Anywhere

Some might wonder if thermal paper will survive in an increasingly digital world. After all, don’t digital wallets, e-receipts, and paperless billing threaten its existence? The answer is nuanced. While digital options are growing, the need for physical receipts, labels, and documentation remains strong across many industries.

Think about logistics—shipping labels and barcodes aren’t going away anytime soon. Retail and foodservice sectors still rely heavily on printed receipts. Healthcare and pharmaceuticals demand reliable printed labels for medications, diagnostics, and patient tracking. In short, while the format may evolve, the core demand for thermal paper is here to stay.

The Regional Leaders

When it comes to regional dominance, Europe leads the thermal paper market. Back in 2019, it accounted for about 42.03% of the global share, thanks to its strong retail infrastructure, widespread adoption of POS technology, and growing need for reliable labels in healthcare and logistics.

The United States also plays a big role, with its market projected to cross USD 1.01 billion by 2027. Here, the massive volume of ATM withdrawals, paired with a culture of digital billing and retail receipts, keeps the demand for thermal paper high.

But the story doesn’t end there. Asia-Pacific is fast becoming a powerhouse in this sector. Countries like China and India are seeing explosive growth in online shopping, cashless transactions, and logistics services. As e-commerce giants expand, the need for shipping labels, order receipts, and retail billing systems is skyrocketing. Meanwhile, Latin America, the Middle East, and Africa are gradually expanding as well, driven by rising trade, transport networks, and retail activity.

Key Industry Developments:

- July 2019 – Lecta announced that all the thermal paper it supplies in the European Union will be BPA-free, to comply with the prohibition announced by the EU from January 2020.

- February 2020 – Domtar Corporation announced the acquisition of the POS paper business of Appvion Operations, Inc. The transaction includes acquirement of the coater and related equipment located at Appvion’s Ohio based facility. Domtar seeks to make a globally competitive POS paper business and open new avenues for the growth of the company via this acquisition.

Looking Ahead

The thermal paper market may not be flashy, but it’s resilient, innovative, and quietly expanding. Its growth is anchored in daily essentials—receipts, labels, and tickets—that keep businesses and consumers connected. As industries expand and commerce continues to evolve, thermal paper will remain a key enabler of smooth transactions and efficient logistics. The next time you collect a receipt, tag, or label, remember—it’s not just a slip of paper. It’s part of a global market that’s growing faster than most of us realize.

Aluminum Composite Panels Market Demand, Drivers & Global Growth, Forecast 2032

By Sharvari, 2025-09-09

The face of modern architecture is changing rapidly, and one material at the heart of this transformation is the aluminum composite panels (ACP) market. These sleek, durable, and versatile panels are no longer just decorative finishes on skyscrapers; they’ve become essential to construction, automotive design, advertising, and even infrastructure projects. With global demand rising, the ACP market is on track to reach new heights over the next decade.

A Market on the Rise

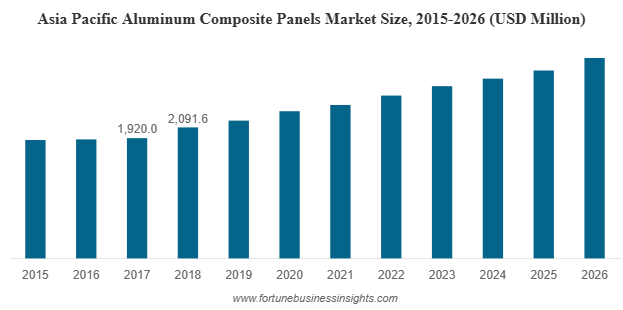

The global aluminum composite panels market was valued at USD 5.33 billion in 2018 and is expected to reach USD 8.71 billion by 2026, registering a CAGR of 6.1% during the forecast period. Asia Pacific led the market in 2018 with a 39.23% share, driven by rapid urbanization and large-scale infrastructure projects. In the U.S., the aluminum composite panels market is anticipated to witness strong growth, projected to reach USD 2.41 billion by 2032, supported by favorable policies and initiatives aimed at enhancing infrastructure across North America.

List Of Key Companies Profiled In Aluminum Composite Panels Market:

- 3A Composites GmbH

- Arconic

- Mitsubishi Chemical Corporation

- Hyundai Alcomax Co.,Ltd.

- Fairfield Metal LLC

- Jyi Shyang Industrial Co., Ltd.

- ALUMAX INDUSTRIAL CO., LTD.

- Yatai Industrial Group Co., Ltd.

- Shanghai Huayuan New Composite Materials Co., Ltd.

- Guangzhou Xinghe Aluminum Composite Panel Co., Ltd.

Segments That Shape the Market

The ACP market is diverse, catering to multiple applications and product types:

- By Product Type: Polyvinylidene fluoride (PVDF)-coated panels dominate due to their resistance to UV rays and long-lasting performance. Other types include polyester coatings, oxide films, and laminating coatings. Each comes with specific benefits suited to different industries.

- By Application: Building and construction remains the largest segment, followed by automotive and advertising. ACPs are also used in railways and other industrial applications, showing their versatility across sectors.

Why ACPs Are in Demand

- Boom in Construction: The construction industry is the backbone of ACP demand. Modern buildings require materials that are not only durable but also aesthetically pleasing. ACPs fit the bill perfectly with their smooth finishes, range of textures, and ability to mimic natural materials like wood, stone, or steel. They’re lightweight, easy to install, and offer insulation benefits—making them a favorite for facades, cladding, and interior applications.

- Outdoor Advertising: Billboards, signage, and digital displays increasingly use ACPs because of their ability to withstand harsh weather, resist corrosion, and deliver a sleek, professional finish. From highways to airports, ACPs have become the go-to medium for durable advertising structures.

- Automotive Industry: ACPs are also making their mark in mobility. From buses to luxury vehicles, they provide thermal insulation, reduce noise, and add to the visual appeal. Lightweight yet strong, they help improve efficiency without compromising on safety or design.

- Rapid Urbanization in Asia-Pacific: The Asia-Pacific region leads global ACP consumption, thanks to massive infrastructure development in countries like China and India. Affordable housing projects, metro rail systems, airports, and commercial complexes all rely heavily on ACPs.

- Sustainable and Energy-Efficient Construction: As sustainability becomes a priority, ACPs are favored for their recyclability and ability to improve building insulation, reducing energy consumption in both residential and commercial structures.

Read More : https://www.fortunebusinessinsights.com/aluminum-composite-panels-market-102304

Regional Highlights

- Asia-Pacific: The largest and fastest-growing region, driven by rapid urban development, infrastructure expansion, and government-backed housing projects.

- North America: Growth fueled by infrastructure modernization and an increasing preference for energy-efficient building materials.

- Europe: Known for stringent building regulations, Europe favors fire-safe and sustainable ACP variants, especially in retrofitting projects.

- Latin America and Middle East: Emerging markets with rising urban infrastructure needs and increasing adoption in commercial complexes and transport hubs.

Challenges Along the Way

While the growth story is impressive, ACPs are not without challenges. One of the biggest concerns is repair and maintenance costs. Once damaged, panels are often difficult to fix without replacing the entire sheet, which can be expensive. Additionally, raw material price fluctuations, especially in aluminum, pose a challenge for manufacturers trying to balance costs. Fire safety regulations are another hurdle. Certain types of ACP cores, such as those made from polyethylene, face restrictions in many regions due to fire hazards, pushing manufacturers to innovate with safer alternatives.

Key Industry Developments:

- July 2017 – Fairview Architectural acquired the Stryum business, an intelligent non-combustible aluminum cladding system, from Vitekk Industries. The company includes a variety of high-quality aluminum plate façade panels designed to provide durability and sustainability, complimenting Fairview's current portfolio of cladding solutions, including high-density cement fibre, natural stone, terracotta tiles and the leading non-combustible composite aluminum frame.

Future Outlook

The aluminum composite panels market is poised for sustained growth, with innovation at its core. In the coming years, expect to see:

- Fire-safe and eco-friendly cores that comply with strict regulations.

- Smart coatings with self-cleaning, anti-bacterial, and anti-static properties.

- Customization trends catering to both high-end architecture and budget-friendly housing.

With its ability to combine function, form, and affordability, ACP is no longer just a panel—it’s the face of modern infrastructure. From the sleek facades of skyscrapers to the billboards along highways, aluminum composite panels market are everywhere. They represent the perfect blend of design and durability, making them indispensable to modern construction and beyond. As the market grows from billions to tens of billions in value, one thing is clear: ACPs are not just building materials; they are the future of architectural expression and industrial design.

Automotive Composites Market Opportunities, Companies, Global Analysis & Forecast 2032

By Sharvari, 2025-09-08

The automotive composites market is expanding rapidly as automakers worldwide push for lighter, more efficient, and sustainable vehicles. Composite materials are revolutionizing the automotive industry by replacing conventional metals with lighter, stronger, and more durable alternatives. With growing emphasis on fuel efficiency, electric vehicle performance, and environmental regulations, the demand for composites in automotive applications is expected to accelerate significantly over the next decade.

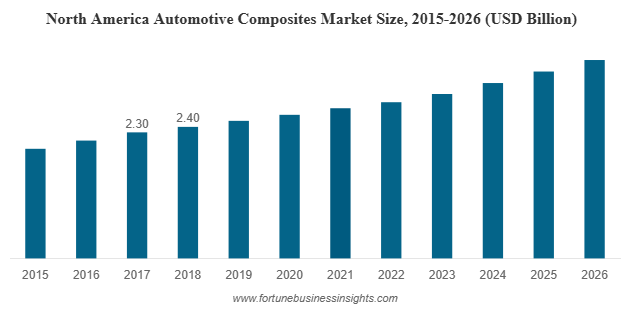

Market Size and Forecast

The global automotive composites market size was valued at USD 7.67 billion in 2018 and is anticipated to reach USD 13.5 billion by 2026, growing at a CAGR of 7.56% during the forecast period. North America held the leading position in 2018 with a 31.29% market share, while the U.S. market alone is expected to hit USD 3.22 billion by 2026, fueled by rising light weighting initiatives and the growing demand for improved fuel efficiency.

Asia Pacific currently leads the market, supported by strong automotive production bases in China, India, Japan, and South Korea. Europe follows closely, driven by sustainability regulations and advanced R&D, while North America continues to grow with rising electric vehicle demand and strict fuel-efficiency standards.

List of Top Automotive Composites Market Companies:

- Teijin Ltd.

- Mitsubishi Chemical Corporation

- Toray Industries, Inc.

- SGL Carbon

- RTP Company

- Plasan Carbon Composites

- Owens Corning

- Solvay S.A.

- UFP Technologies, Inc.

- BASF SE

- Other Players

Key Growth Drivers

- Light weighting and Fuel Efficiency

Vehicle manufacturers are under pressure to reduce vehicle weight in order to improve fuel economy and reduce emissions. Composites such as carbon fiber and glass fiber provide high strength-to-weight ratios, enabling automakers to design vehicles that are both lighter and more efficient without compromising performance.

- Growing Electric Vehicle Adoption

Electric vehicles (EVs) demand lightweight materials to extend battery range and improve efficiency. Automotive composites are playing a crucial role in EV design, helping manufacturers reduce overall vehicle weight while maintaining structural integrity and crash safety standards.

- Advanced Material Properties

Automotive composites offer several advantages over traditional materials. They provide dimensional stability, corrosion resistance, low thermal expansion, and design flexibility. These properties make composites suitable for a wide range of applications including body panels, bumpers, interior components, and under-the-hood parts.

- Sustainability and Recycling Potential

Environmental regulations and consumer preferences are pushing the automotive industry toward sustainable solutions. Thermoplastic composites, which are recyclable and energy-efficient to process, are gaining popularity as the industry seeks greener alternatives to traditional thermoset composites.

Market Segmentation

By Fiber Type

- Glass Fiber Composites: Cost-effective, widely used in body panels, bumpers, and structural parts.

- Carbon Fiber Composites: High-performance materials increasingly used in luxury vehicles, sports cars, and electric vehicles.

- Natural Fiber Composites: Emerging as sustainable alternatives, particularly in interior applications.

By Resin Type

- Thermoset Composites: Currently dominate the market due to high durability and cost efficiency.

- Thermoplastic Composites: Gaining momentum due to recyclability and potential for large-scale mass production.

By Application

- Exterior Components: The largest application segment, including bumpers, doors, and body panels, accounting for nearly half of composite use in vehicles.

- Interior Components: Growing adoption in dashboards, seat structures, and trim parts.

- Powertrain and Under-the-Hood Parts: Increasing integration in engine covers, intake manifolds, and other high-performance areas.

Read More : https://www.fortunebusinessinsights.com/automotive-composites-market-102711

Regional Insights

- Asia Pacific: The leading region due to large-scale automotive production, government initiatives, and rising EV manufacturing hubs.

- Europe: Driven by stringent emission regulations, sustainability trends, and strong research and development activities.

- North America: Growth supported by light weighting initiatives, EV adoption, and government policies focused on fuel efficiency.

Competitive Landscape

The automotive composites market is highly competitive with global leaders and regional players investing in innovation and capacity expansion. Prominent companies include Toray Industries, SGL Carbon, Teijin Limited, Mitsubishi Chemical, Hexcel Corporation, Gurit Holding, and Owens Corning. These players focus on developing advanced materials, expanding production facilities, and collaborating with automakers to deliver customized solutions.

Mergers, acquisitions, and partnerships remain key strategies to gain a competitive edge. Companies are also investing in R&D to reduce the cost of carbon fiber composites, making them more accessible for mass-market vehicles.

Key Industry Developments:

- February 2021 – Teijin Ltd. announced installation of glass fiber sheet molding compound line at the company’s automotive composites business named ‘Benet Automotive s.r.o’. The investment was done to meet growing demand for Teijin’s composite parts from European automotive manufacturers.

- January 2021 – SGL Carbon announced investment of USD 4.5 million at its Arkansas site to expand the production of carbon composites for electric vehicles. The company is engaged in the manufacturing of carbon and glass fiber reinforced products for automotive applications. The new capacity addition will be used to meet growing demand for composite battery enclosures of modern e-car chassis.

Future Outlook

The next decade promises strong growth for the automotive composites market. Key trends shaping the industry include:

- Rising Demand for Carbon Fiber: As prices fall and manufacturing processes improve, carbon fiber composites are expected to see greater adoption across mainstream vehicles, not just luxury and sports models.

- Shift Toward Thermoplastic Composites: Their recyclability and lower production costs align with global sustainability goals.

- Integration in Electric Vehicles: As EV adoption surges, composites will become essential in achieving the weight reduction needed to optimize battery range.

- Innovation in Manufacturing: 3D printing and automated processes are likely to accelerate composite adoption in mass production.

The automotive composites market is on a transformative path, fueled by global trends in light weighting, electric mobility, and sustainability. With robust growth forecasts, increasing investment, and technological innovations, composites are set to play a central role in shaping the future of the automotive industry. As automakers continue to prioritize efficiency and performance, the demand for advanced composite materials will only accelerate, making this sector one of the most promising opportunities in the global automotive supply chain.

3D Printing Materials Market Insights, Challenges, Key Players & Forecast 2032

By Sharvari, 2025-09-08

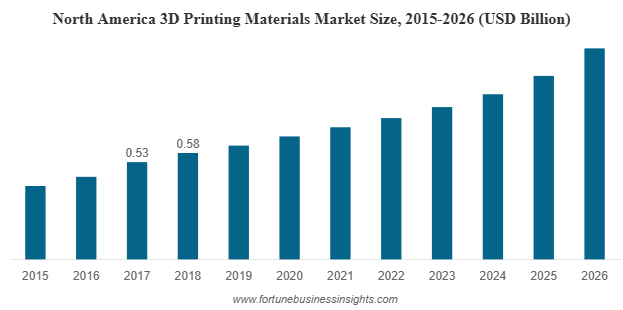

The global 3D printing materials market size was valued at USD 1.53 billion in 2018 and is expected to reach USD 3.78 billion by 2026, registering a CAGR of 12.1% over the forecast period. North America led the market with a 37.91% share in 2018, while the U.S. market alone is projected to hit USD 1.28 billion by 2026, fueled by the rapid adoption of additive manufacturing across diverse industries.

The 3D printing materials market is experiencing rapid expansion as industries across the globe embrace additive manufacturing for prototyping, production, and customization. From plastics and metals to advanced composites and biocompatible materials, the demand for innovative and efficient 3D printing solutions continues to reshape industries such as aerospace, automotive, healthcare, and consumer goods. This article explores the market size, growth drivers, material segments, regional dynamics, and future outlook of this fast-growing industry.

Market Size and Growth Projections

The global 3D printing materials market has grown from being a niche sector to a multi-billion-dollar industry. In recent years, the market size has increased significantly due to the rising adoption of 3D printing technologies in both prototyping and large-scale production. Forecasts suggest that the market will maintain strong momentum, with double-digit compound annual growth rates (CAGR) projected over the next decade.

Plastics remain the most widely used material type, primarily due to their affordability and versatility. However, metals and specialty materials are quickly catching up, especially in high-performance sectors like aerospace and medical implants. The combination of increasing industrial adoption, technological innovations, and declining costs is positioning the market for exponential growth.

List of Top 3D Printing Materials Market Companies:

- Stratasys Ltd.

- 3D Systems, Inc.

- Materialise NV

- Markforged, Inc.

- EOS GmbH

- Höganäs AB

- Arkema

- Royal DSM N.V.

- ExOne

- GE Additive

- Evonik Industries AG

Key Market Drivers

- Rapid Prototyping and Customization

One of the primary drivers of the 3D printing materials market is the ability to produce prototypes quickly and at a lower cost. Unlike traditional manufacturing methods, 3D printing allows designers and engineers to test and refine products in days rather than weeks. Customization is another strong advantage, enabling industries to create tailored products, from medical implants to consumer electronics casings.

- Increasing Demand Across Industries

Sectors such as aerospace, automotive, and healthcare are leading adopters of 3D printing. Aerospace companies use lightweight yet strong 3D printed parts to enhance fuel efficiency. Automakers are deploying 3D printing for prototyping, spare parts, and even functional components. In healthcare, biocompatible 3D printing materials are revolutionizing prosthetics, implants, and surgical tools.

- Waste Reduction and Sustainability

3D printing materials support sustainability goals by reducing material waste compared to subtractive manufacturing processes. Companies are also investing in recyclable and eco-friendly materials to align with global sustainability initiatives.

- Advancements in Material Science

The continuous development of new materials—ranging from high-performance metals to flexible polymers and composite blends—is fueling innovation. These materials expand the scope of 3D printing applications and improve performance across industries.

Market Restraints

Despite strong growth prospects, the market faces certain challenges. The cost of 3D printing materials is considerably higher compared to traditional raw materials, often 10 to 15 times more expensive. This cost factor restricts adoption in small and medium-sized enterprises. Additionally, technical barriers such as material limitations, slower production speed compared to conventional methods, and lack of skilled professionals can hinder widespread adoption.

Material Segment Analysis

- Plastics: The most dominant material segment, offering cost-effective and versatile options for prototyping and functional parts.

- Metals: Gaining momentum with applications in aerospace, automotive, and healthcare. Titanium, aluminum, and steel are widely used for their strength and durability.

- Photopolymers: Known for their precision and surface finish, these materials are increasingly popular in dental and medical applications.

- Composites and Others: High-performance composites are emerging as game-changers, providing enhanced strength-to-weight ratios and durability for demanding industries.

Read More : https://www.fortunebusinessinsights.com/3d-printing-material-market-102296

Future Trends

The future of the 3D printing materials market is defined by innovation and expansion. Key trends include:

- Sustainable Materials: Increased focus on recyclable and biodegradable 3D printing materials.

- Multi-Material Printing: The ability to combine multiple materials in a single print to create advanced, multifunctional products.

- AI Integration: Artificial intelligence will optimize material use, improve quality control, and enhance design capabilities.

- Healthcare Innovations: Growth in bio-printing and customized medical devices will continue to transform the healthcare industry.

Regional Insights

- North America: Currently the largest regional market, supported by strong aerospace and defense industries, along with significant investments in healthcare innovation.

- Europe: A major hub for automotive and industrial applications, with countries like Germany, France, and the UK adopting advanced 3D printing technologies.

- Asia Pacific: Expected to grow at the fastest pace due to expanding manufacturing industries in China, Japan, and South Korea. Rising investments and government initiatives are fueling adoption across the region.

- Rest of the World: Countries in Latin America and the Middle East are gradually adopting 3D printing technologies, especially in industrial and healthcare applications.

Industry Applications

- Aerospace and Defense: Lightweight, high-strength materials are widely used for structural and functional parts, reducing fuel costs and improving efficiency.

- Automotive: Automakers leverage 3D printing for design validation, custom components, and spare parts production.

- Healthcare: Biocompatible materials enable the production of prosthetics, implants, surgical instruments, and even experimental bio-printing.

- Consumer Goods and Electronics: Customization, rapid design, and aesthetic flexibility drive demand for 3D printed materials in fashion, electronics, and household products.

Key Industry Developments:

- September 2019 – 3D Systems launched new materials for 3D printing namely PRO-BLK 10, and HI-TEMP 300-AMB. The new products will diversify the company’s product portfolio and expand the range of applications for customers.

- November 2018 – Royal DSM N.V. launched “Arnitel ID2060 HT”, a high-performance thermoplastic copolyester for 3D printing by using fused filament fabrication. The filament offers a balance of properties such as chemical resistance, flexibility, and high-temperature resistance.

Future Outlook

The global 3D printing materials market is on an impressive growth trajectory, driven by rapid prototyping, industrial adoption, sustainability goals, and breakthroughs in material science. While high costs remain a challenge, continuous research, innovation, and scaling will reduce barriers over time. With industries from aerospace to healthcare embracing additive manufacturing, the demand for advanced 3D printing materials will only accelerate. The future of this market is not just about replacing traditional manufacturing but about reshaping how products are designed, developed, and delivered worldwide.

Liquid Waste Management Market Global Reports, Opportunities, Trends & Forecast 2032

By Sharvari, 2025-09-08

The global liquid waste management market has become one of the fastest-growing sectors in the environmental and utility industries. Rising urbanization, population growth, water scarcity, and strict government regulations are driving the adoption of efficient wastewater treatment and recycling systems. As the demand for clean water continues to surge, the market for managing, treating, and recycling liquid waste is expected to expand steadily over the forecast period.

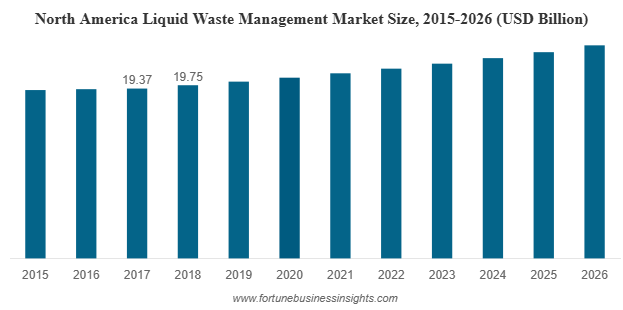

Market Size and Growth Outlook

The global liquid waste management market size was valued at USD 65.93 billion in 2018 and is expected to grow to USD 85.02 billion by 2026, registering a steady CAGR of 3.3% over the forecast period. North America led the market in 2018 with a 29.96% share, supported by advanced infrastructure and strict environmental standards. Within the region, the U.S. market is forecast to reach USD 22.29 billion by 2026, driven by rising industrial waste disposal requirements and the enforcement of stringent environmental regulations.

The market outlook indicates that the need for innovative, affordable, and eco-friendly wastewater treatment solutions will only rise as global populations expand and freshwater resources decline.

List of Top Liquid Waste Management Market Companies:

- Veolia Environmental Services

- SUEZ Environment SA

- Xylem

- Evoqua Water Technologies Corporation

- Covanta Holding Corporation

- Clean Harbors, Inc.

- GFL Environmental Inc.

- Cleanaway

- Aqua America Inc.

- Hulsey Environmental Services

Key Drivers of the Market

- Rapid Urbanization and Population Boom

Global urban populations are increasing rapidly, with more than two-thirds of the world’s people projected to live in cities by 2050. This rapid urbanization leads to a significant rise in domestic and industrial wastewater generation. The growing need to treat and recycle this wastewater is a major driver for the liquid waste management industry.

- Growing Water Scarcity and Recycling Needs

Freshwater demand is expected to grow by nearly 50% by 2030. Many countries are already facing acute water stress, which makes recycling and reuse of wastewater essential. Liquid waste management systems not only help meet water demand but also ensure environmental sustainability.

- Stringent Environmental Regulations

Governments around the world have enforced strict environmental laws to control water pollution. Regulations require industries to meet effluent discharge standards, compelling investment in wastewater treatment facilities. Compliance with these rules is a strong factor driving market growth.

- Technological Advancements

Emerging technologies are reshaping the wastewater sector. Solar-powered degradation methods, advanced membrane filtration, reverse osmosis, sludge digestion, and chemical treatment techniques are enabling cost-efficient and sustainable management of liquid waste. These innovations reduce operational costs and improve overall treatment efficiency.

Market Segmentation

By Source

- Residential: The largest contributor to wastewater, accounting for 70–80% of domestic water usage that is converted into liquid waste.

- Commercial and Industrial: Includes wastewater generated from industries such as pulp and paper, textiles, chemicals, petrochemicals, and food & beverage.

By Technology

- Membrane Filtration

- Reverse Osmosis

- Biological Treatment

- Chemical Precipitation

- Sludge Digestion

Each of these technologies plays a vital role in ensuring cost-effective and efficient treatment of liquid waste across different sectors.

Read More : https://www.fortunebusinessinsights.com/liquid-waste-management-market-102643

Key Trends Shaping the Market

- Shift Toward Circular Economy: Increasing focus on recycling and reusing wastewater to create a closed-loop system.

- Green and Sustainable Technologies: Adoption of renewable energy-powered treatment methods such as solar degradation.

- Smart Water Management: Use of IoT and AI technologies to monitor, predict, and optimize wastewater treatment operations.

- Public-Private Partnerships: Collaboration between governments and private firms to invest in infrastructure development..

Regional Insights

- North America

North America leads the global liquid waste management market, accounting for nearly 30% of the total share. The region benefits from advanced infrastructure, strong government policies, and high investment in modern wastewater plants. The U.S. in particular treats more than 95% of its wastewater, with mega treatment plants in cities like Chicago and Boston.

- Asia-Pacific

Asia-Pacific is the fastest-growing regional market. Industrialization, rapid urban growth, and rising freshwater demand are driving investment in liquid waste management. India, for example, is projected to face a massive water demand of more than 1.5 trillion cubic meters by 2030, pushing the need for large-scale treatment and recycling systems.

- Europe

Europe has one of the highest levels of wastewater treatment compliance. Countries like Germany treat over 90% of their wastewater, supported by strong regulatory frameworks and high technological adoption.

- Latin America, Middle East & Africa

Latin America shows varying levels of adoption, with Chile treating over 90% of wastewater while some countries treat less than 10%. In the Middle East and Africa, treated wastewater is increasingly used in agriculture and landscaping, helping to conserve freshwater resources.

Key Industry Developments:

- February 2020: SUEZ NWS, Shanghai Chemical Industry Park (SCIP) and SAIC Motor entered into a partnership to recover hazardous liquid waste in an Industrial park. The new joint venture has been established by SUEZ to provide high-quality waste treatment services to SCIP & SAIC and to expand into the Chinese Market.

- June 2019: AngloGold Ashanti, the world’s third-largest gold producer from South Africa entered into a contract with Veolia Ghana Limited for all water treatment plants in Ghana. Veolia will manage four wastewater treatment plants for three years.

Market Challenges

Despite strong growth, the liquid waste management market faces certain challenges:

- High Costs of Treatment: Establishing advanced wastewater treatment plants requires heavy investment, particularly in low-income countries where adoption remains limited.

- Infrastructure Limitations: In many regions, old and poorly maintained piping systems reduce efficiency and increase the cost of treatment.

Low Awareness in Developing Countries: Many industries and communities in underdeveloped regions still lack awareness and resources to adopt modern wastewater solutions

Future Outlook

The global liquid waste management market is on track for steady growth through 2032 and beyond. Growing awareness of environmental issues, rising water scarcity, and advancements in treatment technologies are expected to create significant opportunities. Governments, industries, and households alike will continue to invest in efficient systems that ensure sustainability, compliance, and long-term resource security.

The liquid waste management market is entering a new phase of growth, supported by rising demand for clean water, rapid industrialization, and regulatory pressure. While challenges remain, particularly in developing regions, ongoing innovations and global investments in infrastructure will ensure that wastewater treatment becomes a central pillar of sustainable development.

With steady growth projected in the coming years, companies operating in this market have a unique opportunity to contribute to global water security while driving long-term profitability.

Personal Protective Equipment Market Size, Share, Companies & Future Outlook 2032

By Sharvari, 2025-09-05

In an increasingly safety-conscious world, Personal Protective Equipment (PPE) market has emerged as a cornerstone of workplace safety across industries. From healthcare and construction to oil and gas, PPE is not just a regulatory requirement—it's a crucial tool for protecting workers and ensuring operational continuity. As global industries evolve, so does the demand for effective and innovative safety equipment.

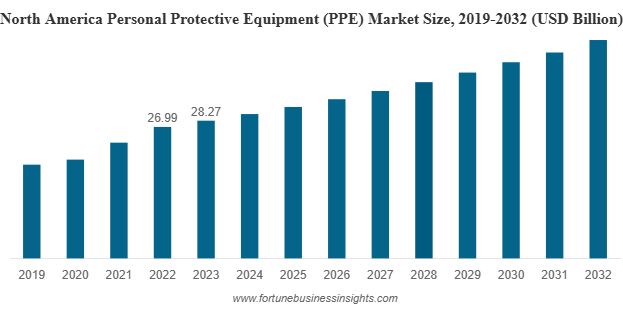

The global personal protective equipment (PPE) market was valued at USD 83.91 billion in 2023 and is expected to grow from USD 87.69 billion in 2024 to USD 128.57 billion by 2032, reflecting a compound annual growth rate (CAGR) of 4.9% during the forecast period. North America led the market in 2023, accounting for a 33.69% share of the global revenue. In particular, the U.S. PPE market is poised for substantial growth, projected to reach approximately USD 37.98 billion by 2032, fueled by expanding infrastructure development and rising construction activity across the country.

Key Market Segments Driving Growth

The personal protective equipment (PPE) market spans a wide range of products, but some categories are leading the way. Hand protection remains the most dominant segment, with gloves used extensively across manufacturing, healthcare, and chemical industries. Other major product segments include protective clothing, safety footwear, eye and face protection, and hearing protection. As industries become more complex and the work environment more hazardous, companies are investing in comprehensive PPE solutions that address multiple risk factors.

List Of Top Ppe Companies:

- 3M (U.S.)

- Ansell Ltd. (Australia)

- Alpha ProTech (Canada)

- DuPont (U.S.)

- Avon Rubber p.l.c. (U.K.)

- Mallcom (India) Limited (India)

- Bullard (U.S.)

- Delta Plus Group (France)

Market Drivers: From Regulations to Innovation

Several powerful forces are propelling the PPE market forward.

- Stricter Safety Regulations

Governments worldwide are tightening workplace safety laws, making personal protective equipment (PPE) market compliance non-negotiable. Regulatory bodies across regions are mandating the use of protective equipment and conducting regular inspections. These regulations are particularly strict in high-risk industries, forcing organizations to invest more heavily in compliant PPE solutions.

- Post-Pandemic Awareness

The COVID-19 pandemic fundamentally shifted global awareness about personal protection. While demand for personal protective equipment (PPE) market surged during the crisis, many of the habits and safety protocols developed during the pandemic have remained in place. Organizations are now more proactive about maintaining a stockpile of essential gear and training employees on proper usage.

- Innovation and Smart PPE

Technology is transforming traditional safety gear into connected, data-driven solutions. Smart PPE—such as intelligent safety gloves, sensor-equipped helmets, and wearable monitoring systems—is growing rapidly. These products can track worker movement, detect harmful gases, monitor fatigue levels, and provide real-time alerts, improving both safety and efficiency. The smart PPE market is growing at an even faster pace, with double-digit CAGR projections over the next decade.

- Sustainable Materials and Green Manufacturing

Sustainability is emerging as a key theme in personal protective equipment (PPE) market development. Manufacturers are increasingly using bio-based, recyclable, and environmentally friendly materials to reduce the ecological footprint of their products. For example, biodegradable gloves and hard hats made from sugarcane-derived polymers are gaining traction. These innovations help companies align their safety policies with broader ESG (Environmental, Social, and Governance) goals.

Industries Leading PPE Adoption

While personal protective equipment (PPE) market is used across almost every sector, certain industries are driving its adoption at a faster pace. Manufacturing leads the charge, followed closely by construction, healthcare, oil and gas, and automotive. In these high-risk sectors, the need for protective equipment is embedded not just in regulatory requirements but also in operational protocols.

For instance, the construction industry requires helmets, gloves, high-visibility clothing, and harnesses as standard, while the healthcare sector prioritizes surgical masks, gowns, and gloves. In oil and gas, flame-resistant clothing, respiratory masks, and chemical-resistant gloves are essential.

Read More : https://www.fortunebusinessinsights.com/personal-protective-equipment-ppe-market-102015

Regional Insights: North America Leads, Asia-Pacific Rising

North America remains the largest market for PPE, accounting for over 33% of global revenue in 2023. The region's strong industrial base, strict safety regulations, and high compliance rates have contributed to this dominance. The U.S. Occupational Safety and Health Administration (OSHA), the National Institute for Occupational Safety and Health (NIOSH), and other regulatory bodies play a key role in setting and enforcing standards that drive PPE adoption.

However, Asia-Pacific is expected to see the fastest growth over the next decade. Rapid industrialization, a growing labor force, and increasing awareness of workplace safety are all fueling demand in countries like China, India, and Southeast Asian nations. Governments in these regions are also stepping up safety regulations, further supporting market growth.

Key Industry Developments:

- March 2023: Ansell opened its Greenfield Manufacturing Plant in India, investing USD 80 million in the plant. The new facility aims at providing the most innovative and highest quality surgical gloves to healthcare professionals across the country.

- April 2022: Honeywell acquired Norcross Safety Products L.L.C., a manufacturer of PPE, for USD 1.2 billion. This acquisition would provide the company with a platform in the fragmented global business projected to provide significant growth opportunities. This investment in Norcross allows the company to enter into a highly regulated industrial safety market completely.

Challenges Facing the PPE Market

Despite robust growth, the personal protective equipment (PPE) market is not without its challenges. Counterfeit and substandard products are a major concern, especially in developing regions where regulatory oversight may be weaker. Poorly made PPE not only fails to protect workers but also undermines trust in legitimate suppliers.

Another key challenge is the rising cost of high-quality and smart personal protective equipment (PPE) market. Small and medium-sized enterprises (SMEs) often struggle to afford advanced gear, even when it offers long-term value. Additionally, issues like discomfort, lack of proper sizing—particularly for women—and resistance to technology adoption can slow the uptake of new personal protective equipment (PPE) market solutions.

Supply chain disruptions, such as those experienced during the pandemic, also remain a risk. Many countries are now focusing on building local personal protective equipment personal protective equipment (PPE) market manufacturing capabilities to ensure supply security.

Future Outlook

As the global workplace evolves, so too does the importance of personal protective equipment (PPE) market. Companies are no longer viewing it as just another cost of doing business, but as a strategic investment in worker safety, productivity, and brand reputation. With regulations tightening, technologies advancing, and sustainability rising in importance, the PPE industry is poised for a strong and transformative decade. Whether through smart innovations, better materials, or broader access to safety gear across developing regions, the future of personal protective equipment (PPE) market is not just bigger but smarter and more responsible.

Aluminum Foil Packaging Market Global Trend, Size, Share, Growth & Forecast 2032

By Sharvari, 2025-09-05

The global aluminum foil packaging market was valued at USD 13.86 billion in 2023 and is expected to grow to USD 14.54 billion in 2024, reaching approximately USD 22.24 billion by 2032. This represents a steady compound annual growth rate (CAGR) of 5.45% over the forecast period. In the United States, the market is also poised for substantial growth, projected to hit USD 2.85 billion by 2032, driven by rising demand for flexible, lightweight, and sustainable packaging—particularly across the food, pharmaceutical, and consumer goods sectors. Asia Pacific led the global market in 2023, accounting for a dominant 49.28% share, supported by rapid industrialization and a surge in packaged product consumption across the region.

Market Overview

The global aluminum foil packaging market is witnessing a steady and promising upward trend, backed by increasing demand for convenient, sustainable, and efficient packaging solutions across industries. With growing awareness of environmental sustainability and the need for longer shelf life of consumables, aluminum foil packaging has become a preferred material in sectors such as food and beverage, pharmaceuticals, personal care, and more.

List of Top Aluminum Foil Packaging Companies:

- Amcor plc (U.S.)

- Constantia Flexibles (Austria)

- Qingdao Kingchuan Packaging (China)

- Henan Tendeli Metallurgical Materials Co., Ltd (China)

- Henan Huawei Aluminium Co., Ltd (China)

- Hindalco Industries Ltd. (India)

- Novelis (U.S.)

- Zhejiang Zhongjin Aluminum Industry Co., Ltd. (China)

- KM Packaging (U.K.)

- ProAmpac (U.S.)

Aluminum Foil: A Packaging Powerhouse

Aluminum foil packaging market has long been valued for its versatility and protective qualities. It is lightweight, flexible, non-toxic, and highly effective at blocking moisture, light, oxygen, and bacteria. These properties make it especially suitable for packaging sensitive items such as food, medicine, and cosmetic products. The foil acts as a complete barrier, preserving the product's freshness, aroma, and integrity.

In the food and beverage sector, aluminum foil packaging market is widely used for wrapping, container linings, lids, and pouches. Ready-to-eat meals, dairy products, snacks, and confectionery items often rely on foil packaging to ensure product safety and long shelf life. The rising popularity of on-the-go food consumption and the increasing demand for packaged and frozen meals are significantly contributing to the growing usage of aluminum foil in this industry.

In the pharmaceutical sector, aluminum foil packaging market is considered essential due to its ability to provide high-level protection from external contaminants. Aluminum blister packs, strip packs, and cold-form foil are commonly used for packaging tablets, capsules, and injectables. With an aging global population and the expansion of healthcare access in developing countries, demand for pharmaceutical packaging continues to rise, directly fueling the aluminum foil packaging market.

Sustainability: A Key Growth Driver

One of the most critical factors propelling the aluminum foil packaging market is its alignment with sustainability goals. Aluminum is 100% recyclable without any loss in quality. Unlike plastic, which often ends up in landfills or the ocean, aluminum can be reused indefinitely, making it a preferred material in the age of circular economies and environmentally conscious production.

Consumers are increasingly favoring eco-friendly packaging, and manufacturers are responding by incorporating more recycled content in their aluminum products. Furthermore, governments around the world are implementing stricter regulations and incentives to encourage sustainable packaging, including bans on single-use plastics and support for recyclable materials. These policy changes create a favorable landscape for the continued adoption of aluminum foil in packaging solutions.

Regional Insights and Market Dominance

Geographically, the Asia Pacific region dominates the global aluminum foil packaging market and accounted for nearly half of the global market share in 2023. This dominance is driven by rising urbanization, growing disposable incomes, and the rapid expansion of food delivery and e-commerce sectors in countries like China, India, and Southeast Asia. In addition, the strong presence of manufacturing facilities and favorable government initiatives are boosting regional production and consumption of aluminum foil products.

North America also represents a significant market, with the United States expected to reach USD 2.85 billion in aluminum foil packaging sales by 2032. The region is benefiting from a high demand for sustainable packaging, technological advancements in foil processing, and a strong presence of major players focused on innovation and environmental responsibility.

Europe, too, is a strong contributor to market growth, with stringent regulations around plastic usage and a mature consumer base that values high-quality, recyclable packaging. Germany, France, and the UK are key markets driving this trend forward.

Read More : https://www.fortunebusinessinsights.com/aluminum-foil-packaging-market-108056

Industry Players and Strategic Moves

Several major companies are actively investing in the aluminum foil packaging sector to strengthen their market positions and address growing demand. For instance, prominent industry player Novelis Inc. has invested significantly in aluminum recycling and production capacity, including a USD 2.5 billion facility in the United States focused on sustainable aluminum rolling and recycling. Such investments reflect the industry’s focus on reducing environmental impact and increasing supply chain efficiency.

Meanwhile, companies like RUSAL are committing billions toward enhancing production infrastructure and alumina refining capabilities. Pactiv Evergreen Inc., through acquisitions and expansions, is increasing its footprint in food service packaging and leveraging aluminum foil’s benefits for high-performance applications.

These strategic moves highlight a competitive landscape where innovation, sustainability, and scalability are key differentiators.

Challenges to Watch

Despite its many advantages, the aluminum foil packaging market does face a few challenges. Fluctuating raw material prices, especially the volatility of aluminum prices in global markets, can impact profit margins and supply chain stability. Additionally, the energy-intensive nature of aluminum production raises concerns about carbon emissions, although this is being offset to some extent by the growing use of recycled aluminum.

Another potential hurdle is competition from alternative packaging materials, such as bioplastics and paper-based solutions. However, aluminum foil’s superior barrier properties and recyclability still give it a significant edge, particularly in applications where product preservation is critical.

Key Industry Developments:

- April 2024 - Shyam Metalics & Energy offered its latest innovation, SEL Tiger Foil. This innovation presents an opportunity for household food safety, crafted with incredible care and a profound commitment to excellence. From 9-meter rolls for occasional usage to generous 72-meter rolls for everyday culinary pursuits, SEL Tiger Foil offers an array of options, ensuring an ideal fit for every need.

- March 2024 - Capri Sun launched recyclable pouches made from aluminum, PE, and PET, which it claims has a lower carbon footprint than any other common beverage packaging. According to the company its current pouch, which weighs only a fifth of any comparable PET bottle and would reduce CO2 emissions by a further 25%.

Future Outlook

The aluminum foil packaging market is set to continue its upward trajectory through 2032 and beyond, driven by rising demand for safe, sustainable, and efficient packaging solutions. With increasing awareness of environmental issues, evolving consumer preferences, and supportive policy environments, aluminum foil stands out as a strong contender in the future of global packaging.

Aluminum foil packaging market players that focus on innovation, recycling infrastructure, and strategic expansion are likely to lead the way in shaping this dynamic and essential market segment. As sustainability becomes a non-negotiable aspect of modern business, aluminum foil packaging is well-positioned to meet the demands of both consumers and industries around the world.