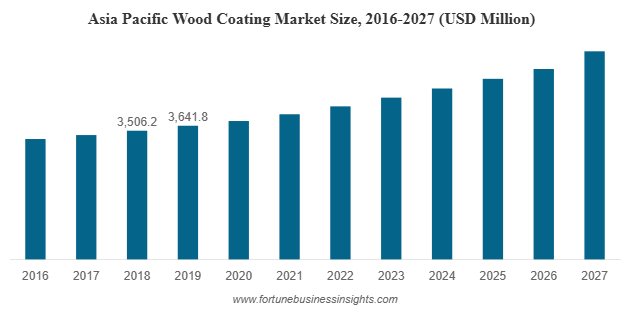

The global wood coating market was valued at USD 8,656.6 million in 2019 and is expected to grow to USD 12,323.2 million by 2027, registering a compound annual growth rate (CAGR) of 4.8% during the forecast period. In 2019, the Asia Pacific region led the market, accounting for 42.07% of the total market share.

List of Top Wood Coating Companies:

- Evonik (Essen, Germany)

- DSM (Heerlen, Netherlands)

- Dow (Michigan, U.S.)

- Akzo Nobel N.V. (Amsterdam, Netherlands)

- Asian Paints (Mumbai, India)

- BASF SE (Ludwigshafen, Germany)

- Kansai Nerolac Paints Limited (Osaka, Japan)

- PPG Industries, Inc. (Pennsylvania, U.S.)

- RPM International Inc. (Ohio, U.S.)

- The Sherwin-Williams Company (Ohio, U.S.)

- Teknos Group (Helsinki, Finland)

The Growing Demand for Wood Coatings

The growth of the wood coating market is closely linked to the expansion of the construction, furniture, and interior design sectors. Urbanization, rising disposable incomes, and increased homeownership have driven up demand for wooden furniture, cabinetry, flooring, and paneling—each requiring protective and decorative coatings.

In regions such as Asia-Pacific, especially countries like China and India, the demand for both affordable and luxury wooden furnishings has surged. This has led to higher consumption of wood coatings to enhance the aesthetic appeal and durability of furniture and wooden structures.

Evolving Technologies and Coating Types

Over the years, wood coating technologies have advanced significantly. Traditional solvent-borne coatings, although widely used, are now gradually being replaced by more environmentally friendly alternatives such as water-borne and UV-cured coatings. These new technologies offer a combination of lower environmental impact, improved performance, and faster drying times.

Water-borne coatings, in particular, have gained popularity due to their low volatile organic compound (VOC) content and reduced odor. They are widely used in both residential and industrial settings, especially in regions with stringent environmental regulations. UV-cured coatings are also gaining momentum in industrial applications, offering high durability, chemical resistance, and reduced processing times.

Another emerging segment is powder coatings for wood, which, although still in its early stages, shows potential due to its zero VOC content and high resistance properties. However, the technology requires specialized equipment and processes, which may limit its adoption in certain markets.

Market Segmentation by Resin and Application

The wood coating market is segmented based on resin type, coating technology, and end-use applications. Among resin types, polyurethane-based coatings lead the market. These coatings offer superior resistance to abrasion, chemicals, and moisture, making them ideal for high-performance applications such as kitchen cabinets, tabletops, and flooring.

Nitrocellulose and polyester resins are also used for specific aesthetic finishes, especially in decorative furniture and interior wooden components. Acrylic and alkyd resins are commonly used for general-purpose applications due to their ease of application and cost-effectiveness.

In terms of application, the furniture segment dominates the market, accounting for the largest share. Coatings in this category are used to protect and enhance the appearance of chairs, tables, wardrobes, and other home or office furniture. The cabinetry segment follows closely, with high demand from residential kitchens and commercial office interiors. Other significant application areas include wooden doors, flooring, and wall paneling.

Read More : https://www.fortunebusinessinsights.com/wood-coating-market-104605

Regional Outlook

Geographically, Asia-Pacific holds the largest share of the global wood coating market. The region's rapid industrialization, expanding middle class, and rising urban population have fueled growth in housing and furniture manufacturing. Countries such as China, India, Vietnam, and Indonesia have become major hubs for wood furniture production and exports, driving significant demand for coatings.

North America and Europe also represent mature markets with strong demand from both residential and commercial sectors. In these regions, environmental regulations regarding VOC emissions have accelerated the shift toward water-based and eco-friendly coatings. Additionally, the trend of home renovation and remodeling continues to boost sales of wood coatings in markets such as the United States, Germany, and the United Kingdom.

Latin America and the Middle East & Africa regions are expected to show moderate growth, supported by urban development, tourism-related construction, and increasing investments in housing infrastructure.

Key Market Challenges

Despite its growth prospects, the wood coating market faces several challenges. One of the primary concerns is the volatility in raw material prices. Many wood coating formulations rely on petrochemical derivatives, the prices of which are subject to fluctuations in the global oil market. This affects production costs and profit margins for manufacturers.

Another major challenge is compliance with environmental and health regulations. Coating manufacturers are under pressure to reduce VOC emissions, eliminate hazardous ingredients, and create sustainable products. This has led to increased investment in research and development, which can be resource-intensive.

Supply chain disruptions, such as those experienced during the COVID-19 pandemic, have also impacted production timelines and the availability of key materials, further complicating operations for manufacturers and suppliers.

Key Industry Developments:

- In February 2021, Axalta, a major global provider of liquid and powder coatings, has released a new Wood Coatings Pro mobile app for iOS and Android smartphones. For the wood coatings market, the new app provides easy and quick access to product information, industry color trends, and best practices.

- In February 2021, Dunn-Edwards introduced DECOPRIME, a new water-based wood primer. This new range is designed for inside wood cabinets, doors, and trim in kitchens and bathrooms. The DECOGLO paint, which will be available this fall, is part of a two-product solution for interior cabinets, doors, and trim.

Opportunities and Future Outlook

Looking ahead, the wood coating market is expected to benefit from increasing consumer awareness of sustainability, the ongoing shift toward green buildings, and technological advancements in coatings. The demand for low-VOC, bio-based, and high-performance coatings is likely to shape the future landscape of the industry.

Digital tools and automation in the application of coatings—especially in furniture manufacturing—will also enhance efficiency and reduce waste. Manufacturers that invest in innovative product development, sustainable materials, and customer-focused solutions will be best positioned to capitalize on emerging trends.

Furthermore, as the global economy stabilizes and construction activities regain momentum, the demand for aesthetically pleasing, durable, and environmentally responsible wood coatings will continue to rise.

Aerospace and Defense Materials Market Demand, Drivers & Global Growth, Forecast 2032

By Sharvari, 2025-09-22

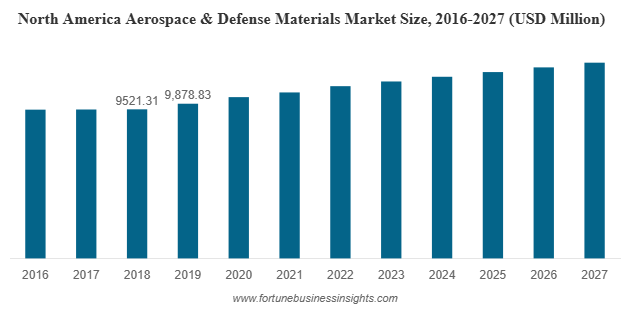

The global aerospace and defense materials market was valued at USD 18,411.83 million in 2019 and is expected to reach USD 23,825.45 million by 2027, registering a compound annual growth rate (CAGR) of 4.21% over the forecast period. In 2019, North America led the market, accounting for 53.65% of the total share. The U.S. market, in particular, is projected to hit USD 12,019.42 million by 2027, driven by ongoing advancements in lightweight and high-performance material technologies.

The aerospace and defense materials market is undergoing a significant transformation as technological innovations, global geopolitical shifts, and sustainability pressures reshape the industry landscape. With the aviation and defense sectors demanding higher performance, fuel efficiency, and durability, material science is playing a central role in meeting these evolving expectations.

List Of Key Companies Profiled In Aerospace And Defense Materials Market:

- Arconic Inc. (US)

- Toray Composite Materials America, Inc. (US)

- Huntsman (US)

- Evonik Industries (Germany)

- Hexcel Corporation (US)

- Materion Corp. (US)

- AMI Metals Inc. (US)

- TATA Advanced Materials Limited. (India)

- Koninklijke Ten Cate BV (Netherlands)

- Sofitec (Spain)

- Teijin Ltd. (Renegade Materials Corp.) (Japan)

- Others

The Need for Advanced Materials in Aerospace and Defense

Aerospace and defense applications operate under some of the most demanding conditions imaginable—extreme temperatures, high pressure, friction, and exposure to corrosive environments. To ensure performance, safety, and longevity, materials used in these applications must meet stringent mechanical, chemical, and thermal requirements.

Traditionally, materials like aluminum alloys and steel have dominated aerospace manufacturing. However, the growing focus on fuel efficiency and emission reduction has shifted the spotlight towards newer, lightweight, and more durable alternatives such as composites and titanium alloys. These materials are not only lighter but also offer superior resistance to fatigue, corrosion, and heat—making them ideal for critical aircraft components, from fuselage sections to jet engine parts.

Market Segmentation: Materials Driving Innovation

The aerospace and defense materials market can be segmented based on material type, application, aircraft type, and geographic region. In terms of material type, the key segments include:

- Aluminum Alloys: Known for their excellent strength-to-weight ratio, aluminum alloys remain widely used in commercial aircraft structures and military applications.

- Titanium Alloys: With high corrosion resistance and exceptional mechanical properties, titanium alloys are extensively used in jet engines, fasteners, and landing gear components.

- Composites: Representing the fastest-growing segment, composite materials such as carbon fiber-reinforced polymers are revolutionizing the industry by offering extreme lightweighting potential without compromising strength.

- Steel Alloys and Super Alloys: Though heavier, these materials are essential in areas that demand superior hardness and thermal resistance, such as turbine blades and structural reinforcements.

Each of these materials plays a pivotal role across different aircraft platforms, ranging from commercial and military aircraft to business jets and unmanned aerial vehicles.

Read More : https://www.fortunebusinessinsights.com/aerospace-defense-materials-market-102980

Aircraft Fleet Expansion and Rising Demand

One of the key growth drivers for the market is the increasing global demand for aircraft, both in commercial aviation and defense sectors. Commercial airlines, especially in Asia-Pacific and the Middle East, are expanding their fleets to meet growing passenger traffic and route coverage. This leads to a surge in demand for materials required in new aircraft production, retrofitting, and maintenance.

On the defense side, heightened geopolitical tensions and modernization programs are prompting governments to invest heavily in next-generation fighter jets, helicopters, drones, and military transport aircraft. These defense platforms require high-performance materials to achieve stealth, speed, and survivability—further contributing to the growth of the aerospace and defense materials market.

Technological Innovation: A Catalyst for Growth

Innovation is at the heart of the evolving materials market. The industry is witnessing the emergence of advanced composites, 3D-printed metal parts, and hybrid materials that combine the best properties of multiple elements.

Manufacturers are leveraging nanotechnology, material simulations, and digital twin technologies to engineer materials at the molecular level. These advancements are leading to improved thermal resistance, enhanced durability, and better recyclability—aligning well with sustainability goals across the aerospace value chain.

Furthermore, the increasing adoption of additive manufacturing is enabling on-demand production of complex parts using materials like titanium and nickel-based super alloys. This not only reduces material waste but also shortens production cycles and lowers costs.

Regional Landscape: North America Leads, Asia-Pacific Surges

North America holds the dominant share in the global aerospace and defense materials market, thanks to the presence of key aircraft manufacturers, defense contractors, and raw material suppliers. The United States, in particular, is a hub for aerospace innovation and has one of the largest defense budgets globally.

Meanwhile, the Asia-Pacific region is emerging as the fastest-growing market, driven by robust economic growth, increasing air passenger traffic, and rising defense expenditures in countries such as China, India, and Japan. Governments in the region are investing in indigenous aircraft development programs, which is accelerating local demand for high-performance aerospace materials.

Key Industry Developments:

- April 2020 – Hexcel Corporation, an advanced composites manufacturer headquartered in the US, and Woodward, Inc., a key player providing designing, manufacturing and other services in the aerospace industry headquartered in the US, announced mutual termination of merger agreement, which was previously announced in January 2020. The disruption caused by the COVID-19 outbreak has forced the companies to announce the termination of the agreement.

- August 2019 – Teijin Ltd, a Japan-based manufacturer of advanced materials and chemicals, announced the successful acquisition of Renegade Materials Corporation, a key supplier of highly heat-resistant thermoset prepreg for the aerospace industry in North America. This has strengthened Tenjin’s position in the aerospace business and also increased its manufacturing capabilities.

Challenges Hindering Market Potential

Despite its promising outlook, the aerospace and defense materials market faces several challenges. One major obstacle is the stringent certification and testing requirements imposed by aviation regulatory bodies. Any new material introduced must undergo years of testing to prove its reliability and safety under extreme conditions. This slows the rate of innovation and commercial adoption.

Supply chain disruptions, such as those experienced during the COVID-19 pandemic, have also exposed vulnerabilities in raw material sourcing and logistics. Additionally, the high cost of advanced materials, such as carbon fiber and titanium, can limit their usage, particularly in cost-sensitive applications.

Looking Ahead: A Market of Opportunity

The future of the aerospace and defense materials market is undeniably bright. As aircraft manufacturers pursue lightweighting strategies, adopt sustainable materials, and embrace digital transformation, material suppliers have a critical role to play in shaping the next generation of aerospace solutions.

Opportunities abound for players who can deliver materials that balance performance, cost-efficiency, and environmental responsibility. With continuous R&D, strong collaboration between OEMs and material scientists, and a growing emphasis on circular manufacturing, the market is well-positioned for long-term success.

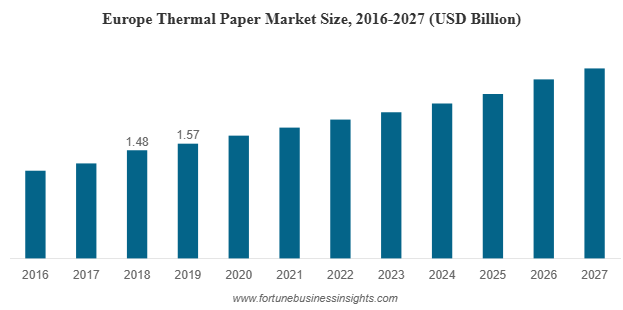

The global thermal paper market was valued at USD 3.45 billion in 2019 and is expected to expand to USD 5.85 billion by 2027, reflecting a 6.9% CAGR over the forecast period. Europe led the market in 2019, accounting for 42.03% of the share. Meanwhile, the U.S. market is poised for notable growth, projected to hit USD 1.01 billion by 2027, fueled by rising adoption across point-of-sale systems, ATMs, and ticketing applications, as well as the increasing demand for cost-efficient printing solutions.

Thermal paper market is an indispensable part of modern transactions and record-keeping. From cash registers and ATMs to shipping labels and medical wristbands, this special paper has become the silent backbone of global commerce. Unlike ordinary paper, thermal paper contains a chemical coating that reacts to heat, allowing images and text to be printed without ink. As industries seek faster, cheaper, and more efficient printing solutions, the thermal paper market is expanding steadily, supported by digitalization, retail growth, and e-commerce boom.

List Of Key Companies Profiled:

- Lecta (Spain)

- Hansol Paper (Korea)

- Appvion Operations, Inc. (USA)

- Domtar Corporation (USA)

- Ricoh Industrie France SAS (France)

- Mitsubishi Hi-Tech Paper (Germany)

- Koehler Paper Group (Germany)

- Kanzaki Specialty Papers, Inc. (USA)

- Jujo Thermal Ltd. (Finland)

- Oji Paper Co., Ltd. (Japan)

- Kanzan Spezialpapiere GmbH (Germany)

- Iconex LLC (UK)

Market Segmentation

- By Width

Thermal paper market is commonly classified by its width. The 3.125-inch (80 mm) size holds the largest share, widely used in point-of-sale terminals, gaming, and lottery systems. Narrower widths, such as 2.25-inch rolls, are gaining traction in ticketing, labeling, and portable receipt printers.

- By Printing Technology

The market is largely split between direct thermal and thermal transfer printing. Direct thermal dominates due to its low cost and simplicity, requiring no ribbons or ink. This makes it ideal for high-volume printing like receipts. Thermal transfer, on the other hand, is favored where durability is critical—such as shipping labels, medical records, and product tags—because the prints last longer and resist fading.

- By Application

Point-of-sale (POS) applications lead the market. Millions of transactions each day generate printed receipts, keeping demand strong. Logistics and transportation are also important segments, as thermal labels are essential for shipping and tracking packages. Other applications include lottery and gaming, medical wristbands, event tickets, and parking systems.

Read More : https://www.fortunebusinessinsights.com/thermal-paper-market-102811

Growth Drivers

- Retail and Banking Expansion

Retail stores, restaurants, and supermarkets rely heavily on POS systems, each transaction producing a thermal receipt. Similarly, banking transactions at ATMs continue to contribute significantly. Despite digital alternatives, many consumers and businesses still prefer or require physical proof of purchase.

- E-Commerce and Logistics

The rapid rise of online shopping has fueled demand for thermal labels used in warehousing, shipping, and order tracking. Thermal paper’s reliability and cost-effectiveness make it the preferred choice for labeling millions of parcels worldwide.

- Regulatory Shifts and Safer Materials

One of the most notable trends in the thermal paper market is the transition away from BPA-based coatings due to health concerns. Manufacturers are developing alternatives such as Bisphenol-S (BPS) or other safer developers. This shift not only addresses regulatory compliance but also opens opportunities for companies that can innovate in eco-friendly and safe thermal products.

Regional Insights

Europe has traditionally dominated the thermal paper market, accounting for over 42.03% of the global share in 2019. The region’s strong retail and banking infrastructure, combined with widespread use of point-of-sale systems, has fueled consumption. Strict regulations on Bisphenol-A (BPA) in thermal papers are also driving European manufacturers to innovate with safer alternatives, ensuring continued demand.

Asia Pacific is emerging as the fastest-growing region. Countries such as China and India are witnessing massive growth in organized retail, logistics, e-commerce, and financial services. The expansion of supermarkets, online shopping, and payment digitization has created a surge in receipts, labels, and tickets printed on thermal paper. North America continues to be a steady contributor, supported by high transaction volumes across ATMs, restaurants, and retail chains.

Challenges

Despite its growth, the thermal paper market faces certain restraints. The biggest challenge is the rise of digital receipts. Many retailers, especially in developed markets, are offering e-receipts through email or mobile apps. While this reduces paper usage, it could impact long-term demand for thermal paper in some segments.

Another challenge comes from regulatory pressure. Restrictions on chemicals like BPA increase costs for manufacturers as they adapt production processes. In addition, price volatility in raw materials such as pulp and chemicals may impact profit margins.

Key Industry Developments:

- July 2019 – Lecta announced that all the thermal paper it supplies in the European Union will be BPA-free, to comply with the prohibition announced by the EU from January 2020.

- February 2020 – Domtar Corporation announced the acquisition of the POS paper business of Appvion Operations, Inc. The transaction includes acquirement of the coater and related equipment located at Appvion’s Ohio based facility. Domtar seeks to make a globally competitive POS paper business and open new avenues for the growth of the company via this acquisition.

Future Outlook

The outlook for the thermal paper market remains positive. While paperless technologies are growing, the reality is that billions of consumers and businesses worldwide continue to rely on printed receipts, labels, and tickets. In many regions, especially emerging economies, thermal paper usage is expected to increase further as retail, banking, and logistics infrastructures expand.

Key opportunities lie in innovation. Companies that develop BPA-free, eco-friendly thermal papers with enhanced durability will be well-positioned to capture market share. In addition, the demand for specialized applications—such as wristbands in healthcare, tamper-proof tickets, and smudge-resistant shipping labels—will create new growth avenues.

The global thermal paper market is at an interesting crossroads. On one hand, digital transformation and paperless receipts pose long-term challenges. On the other, surging demand in retail, e-commerce, logistics, and healthcare continues to ensure robust growth. Regional markets like Asia Pacific are expected to drive the next wave of expansion, while European manufacturers focus on sustainable innovations.

For businesses, the message is clear: thermal paper remains highly relevant, and the companies that embrace safety, sustainability, and innovation will thrive in the evolving market.

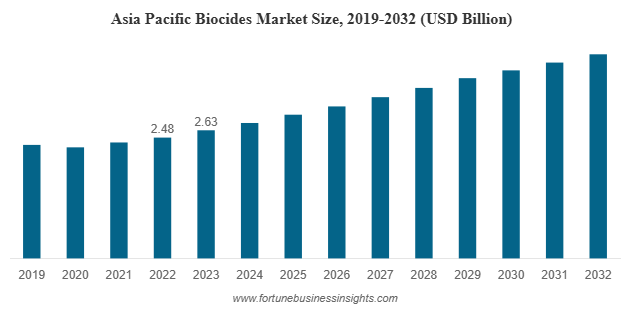

In 2023, the global biocides market was valued at USD 7.99 billion and is expected to increase to USD 8.34 billion in 2024, eventually reaching USD 11.70 billion by 2032. This represents a compound annual growth rate (CAGR) of 4.2% over the forecast period. Asia Pacific led the market in 2023, accounting for the largest share at 32.92%. In the United States, the biocides market is also set to grow substantially, with projections estimating it will reach USD 2.56 billion by 2032. This growth is largely driven by the increasing preference for water-based paints over oil-based alternatives, which is boosting product demand across various applications.

Biocides market are chemical substances or microorganisms used to control harmful organisms through chemical or biological means. These substances play a crucial role in numerous industries including water treatment, paints and coatings, personal care, food and beverage, healthcare, and textiles. With increasing concerns around hygiene, contamination, and microbial control, the global biocides market is witnessing steady and sustained growth.

List Of Key Companies Profiled

- Vink Chemicals GmbH & Co. KG (Germany)

- Clariant (Switzerland)

- Kemira Oyj (Finland)

- Troy Corporation (U.S.)

- Thor Group Limited (UK)

- Lanxess AG (Germany)

- Solvay SA (Belgium)

- Neogen Corporation (UK)

- Finoric LLC (U.S.)

Key Drivers of Market Growth

- Rising Demand in Paints and Coatings

One of the most significant drivers of the biocides market is the growing demand from the paints and coatings sector. Biocides are added to coatings to prevent the growth of fungi, algae, and bacteria that can degrade the quality and lifespan of painted surfaces. With an expanding construction industry, especially in Asia Pacific and the Middle East, the demand for biocidal additives in paints is on the rise.

The shift from solvent-based to water-based paints has also contributed to increased biocide use. Water-based paints, while environmentally friendly, are more susceptible to microbial growth and thus require preservatives to maintain shelf life and performance.

- Water Treatment Applications

Water treatment is another major segment where biocides find extensive use. They are crucial for controlling microbial growth in drinking water systems, industrial water treatment, cooling towers, and wastewater management. The growing need for clean and safe water across industrial, municipal, and residential sectors is pushing up the demand for effective biocidal solutions.

Halogen-based biocides like chlorine remain dominant in water treatment, but there is increasing interest in more sustainable and less toxic alternatives due to environmental and health concerns.

- Increased Hygiene Awareness Post-Pandemic

The COVID-19 pandemic brought hygiene and cleanliness into sharp focus globally. From homes to healthcare facilities, there is heightened awareness about the need to eliminate pathogens and maintain sanitized environments. Biocides are now widely used in disinfectants, sanitizers, hand washes, and surface cleaners to ensure microbial control.

This increased use in cleaning products is not just limited to households. The healthcare, food processing, and hospitality industries are all increasingly using biocides to comply with stricter hygiene standards.

- Growth in Emerging Markets

Developing economies in Asia Pacific, Latin America, and the Middle East are witnessing rapid industrialization and urbanization. These trends are translating into greater demand for infrastructure, water treatment facilities, and consumer products all of which drive demand for biocides.

In 2023, Asia Pacific held the largest market share, driven by rapid industrial expansion in China, India, and Southeast Asian countries. The region's construction boom, growing population, and supportive government policies are expected to fuel future growth.

Read More : https://www.fortunebusinessinsights.com/biocides-market-105452

Market Segmentation

The biocides market can be segmented by type and application.

By Type

- Halogen Compounds: These include chlorine and iodine-based biocides, widely used for their broad-spectrum antimicrobial activity.

- Quaternary Ammonium Compounds (Quats): Known for their effectiveness in cleaning and disinfecting products.

- Metallic Compounds: Such as silver and copper-based biocides, used especially in healthcare and textile applications.

- Organic Acids and Phenolic Biocides: Used in personal care and food processing industries.

By Application

- Paints and Coatings: Leading application segment due to growing demand in construction and automotive industries.

- Water Treatment: Including municipal water, industrial process water, and wastewater.

- Cleaning Products: Disinfectants, sanitizers, and surface cleaners.

- Food and Personal Care: Used as preservatives and antimicrobial agents.

- Textiles and Furniture: To prevent mold and microbial growth in fabrics and furnishings.

Opportunities Ahead

The market is ripe with opportunities for innovation and product development. Manufacturers are investing in R&D to create biocides that are effective, sustainable, and safe for both humans and the environment. Natural and bio-based biocides are gaining traction, especially in food and personal care applications.

Additionally, the healthcare industry offers immense potential for biocide usage. From hospital disinfectants to surgical equipment sterilizers, the role of biocides in preventing healthcare-associated infections is critical and growing.

Key Industry Developments

- December 2019 – LANXESS acquired a Brazilian biocide manufacturer, Itibanyl Produtos Especiais Ltda. (IPEL). The acquisition is helping the company in the material protection products business unit and reinforcing global presence while also serving South American consumers from a domestic production facility.

Competitive Landscape

The biocides market is moderately fragmented, with several key players actively innovating and expanding their market presence. Leading companies include manufacturers of specialty chemicals, life sciences firms, and companies focusing on industrial cleaning and hygiene solutions. Strategies such as mergers, acquisitions, product launches, and regional expansions are commonly employed to stay competitive.

Challenges and Restraints

Despite its growth, the biocides market faces several challenges:

- Raw Material Price Volatility: Prices of key raw materials, such as halogens and metal compounds, are subject to market fluctuations, impacting production costs.

- Stringent Regulations: Regulatory frameworks like REACH in Europe and EPA guidelines in the U.S. impose restrictions on the use of certain biocidal ingredients, driving up compliance costs.

- Environmental Concerns: Certain traditional biocides can be toxic to aquatic life and the environment. As a result, there's increasing pressure to adopt eco-friendly formulations.

Outlook

The global biocides market is on a steady upward trajectory, powered by growing industrial demand, rising hygiene awareness, and a push for clean water and safer products. While regulatory and environmental challenges persist, the ongoing shift towards sustainable and innovative solutions positions the market for robust growth over the coming decade. Companies that can adapt to these evolving demands and invest in next-generation biocidal products are likely to lead the charge in this essential and expanding sector.

Flat Glass Coatings Market Global Opportunities, Insights, Size, Growth & Forecast 2032

By Sharvari, 2025-09-19

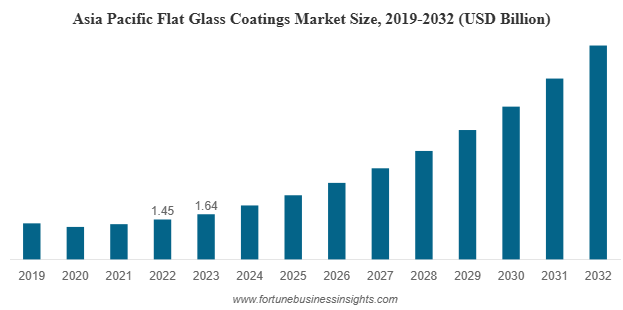

The global flat glass coatings market was valued at USD 2.50 billion in 2023 and is expected to rise to USD 2.98 billion in 2024, ultimately reaching USD 11.5 billion by 2032. This growth reflects a robust compound annual growth rate (CAGR) of 18.0% over the forecast period. Asia Pacific led the global market in 2023, accounting for a dominant 65.6% share, driven by rapid urbanization, construction activity, and solar energy investments. Meanwhile, the U.S. flat glass coatings market is poised for substantial growth, projected to reach approximately USD 802.46 million by 2032, primarily fueled by the rising demand for advanced coatings in architectural applications.

The flat glass coatings market is undergoing a dynamic transformation, driven by rising sustainability initiatives, technological advancements, and the increasing demand for energy-efficient materials. As industries continue to evolve toward eco-conscious infrastructure and renewable energy integration, flat glass coatings are emerging as essential components in architectural, automotive, and solar applications.

List Of Key Companies Profiled:

- Arkema S.A. (France)

- The Sherwin-Williams Company (U.S.)

- Nippon Sheet Glass Co., Ltd (Japan)

- Guardian Glass (U.S.)

- Ferro Corporation (U.S.)

- Fenzi Group (Italy)

- Corning Inc. (U.S.)

- Vitro Architectural Glass (Mexico)

- Hesse GmbH & Co. KG (Germany)

- Viracon (U.S.)

Growth Drivers: Sustainability and Solar Power

One of the primary factors fueling the market's growth is the global shift toward sustainable construction and green building practices. As governments and regulatory bodies enforce stricter energy efficiency standards, demand for coated glass in residential, commercial, and industrial buildings is surging. Coated flat glass helps reduce solar heat gain, enhances insulation, and improves natural lighting all of which contribute to lower energy consumption and improved occupant comfort.

Additionally, the rise of solar energy is playing a crucial role. As countries invest heavily in renewable energy infrastructure, especially solar photovoltaics (PV), the need for specialized coatings that improve the efficiency and durability of solar panels is growing rapidly. Coatings such as anti-reflective, self-cleaning, and hydrophobic layers are widely used to boost solar panel output and minimize maintenance.

Market Segmentation: A Closer Look

- By Resin Type

The market is segmented by resin type into acrylic, epoxy, polyurethane, and others. Among these, acrylic coatings hold the dominant share, expected to account for over 41.0% by 2025. Acrylics are favored due to their excellent transparency, UV resistance, and weatherability, making them ideal for architectural and decorative glass applications.

Epoxy coatings, holding a significant market share as well, are valued for their strong adhesion, chemical resistance, and durability. These are widely used in industrial and automotive glass where performance under extreme conditions is crucial.

- By Technology

Technologically, the market is categorized into water-based, solvent-based, and nano coatings. Water-based coatings currently lead the market due to their lower volatile organic compound (VOC) emissions and greater compliance with environmental regulations. These coatings are gaining widespread acceptance in both developed and developing markets.

Nano coatings, while currently occupying a smaller market share, are expected to experience the fastest growth rate. Their multifunctional properties including anti-reflection, self-cleaning, anti-bacterial, and thermal insulation make them highly desirable for high-performance architectural glazing, solar panels, and automotive glass.

Solvent-based coatings, though effective in certain applications, are gradually losing ground due to increasing environmental concerns and the availability of more sustainable alternatives.

- By Application

In terms of application, the market is divided into mirror coatings, architectural glass, solar power, automotive, and others. Mirror coatings currently lead due to widespread usage in interior design, hospitality, and commercial settings.

However, the architectural segment is fast catching up, driven by rising construction activity and the global push for energy-efficient building materials. Coated glass is now a standard feature in modern buildings, offering enhanced thermal insulation, glare control, and aesthetic value.

The solar power segment is expected to witness exponential growth, as flat glass coatings are essential in improving light transmission, reducing reflection losses, and ensuring panel longevity in harsh environmental conditions.

Read More : https://www.fortunebusinessinsights.com/flat-glass-coatings-market-102910

Regional Insights: Asia-Pacific Dominates

- Regionally, Asia-Pacific dominates the global flat glass coatings market, accounting for over 65.6% of the market share in 2023. This dominance is attributed to rapid urbanization, infrastructure development, and government support for renewable energy projects in countries such as China, India, and Southeast Asian nations.

- India, in particular, is emerging as a key growth market with an anticipated CAGR of over 18.10%. The nation’s ambitious solar energy goals, growing real estate sector, and demand for sustainable building materials are major contributors to this trend.

- In North America, the market is driven by increasing green building certifications, high per capita energy consumption, and strong automotive demand. The United States is expected to reach over USD 802.46 million in flat glass coating revenues by 2032.

- Europe is also a significant market, growing at a steady pace. With stringent EU regulations on energy efficiency and building emissions, demand for advanced glass coatings continues to rise across Germany, France, and the Nordic countries.

Key Industry Developments:

- September 2021: Guardian Glass started to produce 130” x 240” or superjumbo, SunGuard coatings on clear or Guardian UltraClear float glass at its Carleton, Michigan facility. The flat glass manufacturer has responded to the demand from architects who have pushed design boundaries with buildings that maximize views and natural light for occupants in forward-thinking facades while also reaching energy performance codes and standards.

- April 2021: Ferro Corporation, a leading global supplier of technology-based functional coatings and color solutions, announced that Prince International Corporation (Prince) has completed the previously announced acquisition of Ferro.

Challenges and Restraints

Despite strong growth prospects, the flat glass coatings market faces several challenges. Environmental regulations targeting VOC emissions are tightening, particularly in the European Union and North America. This puts pressure on manufacturers to transition from solvent-based coatings to more eco-friendly solutions.

Moreover, supply chain disruptions, raw material price volatility, and skilled labor shortages have created obstacles for consistent manufacturing and product delivery. The market also demands continuous R&D investment to innovate coatings that are multifunctional, durable, and environmentally compliant.

Key Players and Innovation

Leading companies in the flat glass coatings market space include multinational giants and specialized coating manufacturers. Major players are focusing on expanding their product portfolios, entering strategic partnerships, and investing in research to develop next-generation coatings. Innovation is centered on self-cleaning surfaces, anti-bacterial features, and improved solar transmission features that are becoming increasingly sought-after in construction, healthcare, and renewable energy sectors.

Future Outlook

The flat glass coatings market is at a pivotal point, fueled by global demand for clean energy, sustainable buildings, and high-performance materials. With robust growth projected through 2032, companies that focus on innovation, environmental compliance, and customer-centric solutions will be best positioned to lead in this rapidly expanding sector.

As the world leans into a low-carbon future, the humble pane of glass enhanced with intelligent coatings will play a far greater role than ever imagined.

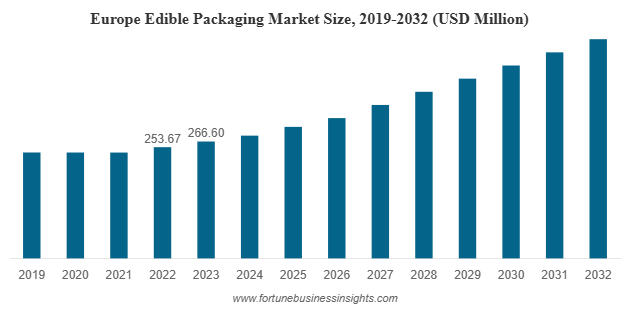

The global edible packaging market was valued at USD 711.09 million in 2023 and is expected to increase from USD 748.06 million in 2024 to USD 1,193.98 million by 2032, registering a CAGR of 6.02% during the forecast period. In 2023, Europe led the market with a 37.49% share, while the U.S. market is anticipated to expand significantly, projected to reach USD 282.59 million by 2032. This growth is fueled by rising awareness of plastic pollution and the growing shift of consumers and businesses toward eco-friendly, sustainable packaging solutions.

Market Size and Forecast

The global edible packaging industry is undergoing a remarkable transformation as sustainability and environmental responsibility become critical priorities. Among the most innovative solutions emerging in this landscape is edible packaging market a packaging material designed to be both biodegradable and safe for consumption. Unlike conventional plastics that take centuries to decompose, edible packaging is made from natural polymers such as proteins, polysaccharides, and lipids, offering a safe, eco-friendly, and waste-free alternative. With consumers, businesses, and regulators pushing for greener choices, the edible packaging market is gaining strong momentum.

List of Top Edible Packaging Companies:

- XAMPLA (U.K.)

- Notpla Ltd. (U.K.)

- JRF Technology (U.S.)

- MonoSol, LLC (U.S.)

- Evoware (Indonesia)

- Biome Bioplastics (U.K.)

- Decomer Technology OÜ (Estonia)

- Lactips (France)

- FlexSea (U.K.)

- Nagase America (U.S.)

Key Growth Drivers

- Rising Environmental Awareness

Plastic waste has become one of the most pressing global environmental issues. Governments, NGOs, and environmental advocates are pushing for alternatives that reduce waste and pollution. Edible packaging directly addresses these concerns by offering a zero-waste solution.

- Consumer Demand for Sustainable Options

Today’s consumers are more informed and conscious about their purchasing decisions. They prefer brands that demonstrate environmental responsibility. Edible packaging aligns perfectly with this trend by offering safe, innovative, and eco-friendly product experiences.

- Innovation and Technological Advancements

The industry has seen advancements such as nanotechnology integration, active coatings, and the inclusion of antioxidants or antimicrobial agents in edible films. These innovations extend shelf life, improve functionality, and enhance food safety.

- Growth in Food & Beverage Sector

The food and beverage industry has become the largest consumer of edible packaging, particularly in bakery, confectionery, dairy, and ready-to-eat products. Growing urbanization and changing lifestyles further support this trend.

Read More : https://www.fortunebusinessinsights.com/edible-packaging-market-107722

Market Segmentation

By Material

- Proteins dominate the market due to their superior gas barrier properties, transparency, and flexibility. Proteins such as casein, whey, soy, and gluten are widely used.

- Polysaccharides represent another important segment, valued for their biodegradability and functional properties.

By Product Type

- Edible films hold the largest share, accounting for nearly 45% of the market in 2023. They are especially popular for wrapping bakery and confectionery products.

- Edible coatings and utensils are also gaining popularity as sustainable alternatives to plastic cutlery and packaging layers.

By End Use

- Food and Beverages remain the leading end-use industry, with applications ranging from fresh produce to dairy and confectionery.

- Pharmaceuticals are also adopting edible packaging for safer, controlled dosage delivery.

Regional Insights

- Europe leads the global market, accounting for nearly 37.49% of the share in 2023. Strict regulations on plastic usage and strong consumer awareness have driven adoption across the region.

- Asia Pacific is the fastest-growing market, supported by rapid urbanization, rising disposable incomes, and government initiatives promoting eco-friendly packaging.

- North America is also a significant market, with the United States playing a key role in driving demand for sustainable packaging.

Key Industry Developments:

- September 2023 – Xampla announced the launch of a remarkable consumer brand, Morro, to develop bio-based and edible packaging solutions that can compete with plastics. The launch of this brand will enable food brands to make an easy switch from single-use plastics and use the company’s breakthrough material.

- August 2022 – Nippon Paint China, the premier coatings company, partnered with BASF to introduce new eco-friendly edible packaging embraced by the Nippon Paint dry-mixed mortar series products.

Challenges and Restraints

Despite its potential, the edible packaging market faces several hurdles:

- High Production Costs: Manufacturing edible packaging materials requires advanced processes and natural raw materials, making them more expensive compared to plastics.

- Shelf Life Concerns: Edible packaging is sensitive to moisture, contamination, and handling conditions, often requiring secondary packaging.

- Regulatory Compliance: Strict food safety standards mean manufacturers must meet rigorous hygiene and quality requirements, which can slow adoption.

These challenges highlight the need for continuous research and technological innovation to make edible packaging market more affordable and practical.

Future Outlook

The edible packaging market presents a significant opportunity for innovation, sustainability, and growth. While high costs and regulatory barriers remain, advancements in material science and increased investment in eco-friendly solutions are expected to overcome these challenges.

For businesses, edible packaging market offers a chance to differentiate products, meet sustainability goals, and appeal to eco-conscious consumers. For policymakers, it provides an effective tool to reduce plastic waste and promote circular economies. And for consumers, edible packaging promises a cleaner, greener, and more responsible future.

With strong momentum and growing awareness, the edible packaging market is set to play a vital role in redefining the future of sustainable packaging worldwide.

The U.S. green cement market size was worth USD 11.08 billion in 2022 and is projected to grow at a CAGR of 10.1% during the forecast period.

The growing awareness of climate change, coupled with stringent environmental regulations, is a key driver behind this surge. The Biden administration’s push for net-zero emissions by 2050 and various green building initiatives across states have provided the perfect backdrop for the adoption of eco-friendly materials, including green cement.

Market Overview and Growth Forecast

As the U.S. green cement market marches toward ambitious climate targets and embraces sustainable infrastructure, one sector quietly undergoing a transformation is the cement industry. Traditional cement is responsible for a significant share of global carbon emissions — nearly 8% of total CO₂ emissions worldwide. In response, green cement is emerging as a game-changer, offering a more environmentally responsible alternative without compromising strength or durability.

U.S. green cement market refers to a range of cementitious products designed to reduce the carbon footprint of construction. Unlike traditional Portland cement, which is energy-intensive and highly polluting, green cement incorporates recycled materials like fly ash, blast furnace slag, and other industrial by-products. The manufacturing process also consumes less energy and emits fewer greenhouse gases.

List Of Key Companies Profiled:

- Green Cement Inc. (U.S.)

- Holcim Ltd (Switzerland)

- CEMEX S.A.B. de C.V. (Mexico)

- CRH plc (Ireland)

- Heidelberg Cement (Germany)

- Eco Material Technologies (U.S.)

Driving Factors Behind Market Expansion

Several factors are contributing to the rise of green cement usage in the U.S.

- Environmental Regulations and Climate Goals

Stricter environmental norms and national commitments to lower carbon emissions are pushing industries to rethink their processes. Cement producers are under pressure to reduce emissions and embrace sustainable practices. Green cement offers a viable route to meet these expectations without drastically overhauling existing supply chains. - Demand for Sustainable Construction

Sustainability is no longer a buzzword — it’s a fundamental requirement in today’s construction industry. Developers, architects, and civil engineers are increasingly integrating green materials into their projects to meet environmental certifications such as LEED (Leadership in Energy and Environmental Design). Green cement helps improve a project’s overall sustainability score, which is a growing priority for both public and private sector projects. - Urbanization and Infrastructure Development

Rapid urbanization in the U.S. has led to increased demand for residential and non-residential infrastructure. With cities expanding and federal investments pouring into public infrastructure, the demand for durable and sustainable construction materials is also rising. Green cement, with its lower environmental impact and high performance, fits this demand perfectly. - Innovation in Material Science

The cement industry has seen remarkable innovations in recent years. Advanced manufacturing techniques, along with research into alternative raw materials, have led to significant improvements in green cement’s performance. Fly ash-based and slag-based green cements now offer comparable — and sometimes superior — properties to traditional cement, including better thermal insulation and longer lifecycle.

Read More : https://www.fortunebusinessinsights.com/u-s-green-cement-market-109205

Market Segmentation Insights

The green cement market is broadly segmented by type and application.

By Type, fly ash-based green cement holds the largest market share. Fly ash, a by-product of coal combustion, is widely available in the U.S. and offers excellent binding properties. Slag-based and recycled aggregate cement are also gaining attention as viable alternatives.

By Application, the residential segment dominates the market. The push for sustainable housing developments, energy-efficient homes, and green building certifications is contributing to this trend. The non-residential and infrastructure segments are also expanding steadily, supported by government-backed construction projects emphasizing sustainability.

Key Industry Developments:

- March 2023: Holcim Mexico commenced manufacturing its Fuerte Más reduced-CO2 cement at its cement plants in Tabasco and Macuspana at a combined rate of 60,000 t/yr.

- July 2021: Holcim has launched ECOPlanet, a range of green cement delivering at least 30% lower carbon footprints with superior performance. Initially, it was sold in Romania, Germany, Switzerland, Canada, France, Spain, and Italy. Further, the distribution was expanded across 15 more countries in order to enhance the geographic presence.

Challenges to Overcome

- Despite the promising outlook, the green cement industry faces some challenges.

- High Initial Costs

Producing green cement can be more expensive due to sourcing and processing recycled materials, adapting manufacturing processes, and investing in new technologies. Although the long-term environmental and operational savings can offset these costs, the initial investment remains a barrier for some manufacturers. - Lack of Awareness and Adoption

Many contractors and builders are still unfamiliar with the benefits of green cement. Misconceptions around its strength, availability, and compatibility with traditional construction methods can slow adoption. More industry-wide education and standardization are needed to close this gap. - Supply Chain Limitations

The availability of raw materials like fly ash or slag can be region-specific, making it challenging to maintain consistent supply across the country. Regional variations in industrial activity (e.g., power plants, steel production) affect the availability of these key inputs for green cement.

The Road Ahead

The future of U.S. green cement market in the U.S. looks promising. As demand grows for sustainable construction materials, and as technology reduces the cost and increases the efficiency of green cement production, broader adoption is expected. Furthermore, the integration of carbon capture and utilization technologies could dramatically reduce emissions from cement manufacturing in the coming years.

In a world grappling with climate change, the green cement industry represents not just a market opportunity but also a crucial step toward building a more sustainable future. Whether it's constructing eco-friendly homes, roads, or public infrastructure, green cement will play a central role in shaping America’s next-generation built environment.

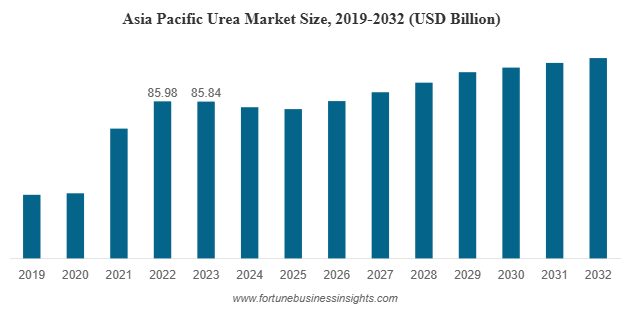

The global urea market was valued at USD 128.92 billion in 2023 and is expected to grow from USD 123.95 billion in 2024 to approximately USD 160.67 billion by 2032, registering a compound annual growth rate (CAGR) of 2.2% during the forecast period. In 2023, Asia Pacific emerged as the leading region, accounting for 66.58% of the total market share. Meanwhile, the urea market in the United States is projected to experience notable growth, with its value anticipated to reach USD 14.40 billion by 2032, primarily driven by the rising demand for nitrogen-based fertilizers aimed at enhancing crop yields.

Market Size and Growth Outlook

The global urea market continues to show steady growth driven by rising demand from both agricultural and industrial sectors. Urea, a nitrogen-rich compound, plays a vital role in modern agriculture as a key fertilizer, and its industrial applications continue to expand across chemical manufacturing, automotive emission controls, and animal feed.

List of Top Urea Companies:

- Sabic (Saudi Arabia)

- Qatar Fertilizer Company (Qatar)

- Eurochem (Switzerland)

- Yara International Asa (Norway)

- Nutrien Ag (Canada)

- Oci N.V. (Netherlands)

- Acron Group (Russia)

- Cf Industries Holdings (U.S.)

Market Segmentation and Applications

The urea market can be segmented by grade into fertilizer grade, feed grade, and technical grade. Fertilizer-grade urea holds the largest share, driven by its widespread use in the agricultural sector. As a high-nitrogen content fertilizer, urea is vital for supporting intensive farming practices that are necessary to meet the food demands of a growing global population.

Feed-grade urea is also seeing increased adoption, particularly in regions where pasture land is scarce and protein-rich feed alternatives are expensive. Urea serves as an affordable nitrogen supplement in animal diets, especially for ruminants such as cattle and sheep.

Technical-grade urea, though currently representing a smaller portion of the market, is expected to grow at a faster pace. This grade is used in various industrial applications such as the production of adhesives, resins, plastics, and coatings. Moreover, the increasing use of urea in the automotive sector, especially in Selective Catalytic Reduction (SCR) systems for emission control, is boosting demand for high-purity technical urea.

Key Market Drivers

One of the primary drivers of the global urea market is the growing demand for food, which necessitates enhanced agricultural productivity. Fertilizers like urea are essential for replenishing soil nutrients and achieving higher crop yields. With arable land per capita declining and the world population continuing to rise, fertilizer use is becoming increasingly critical.

In addition, industrial applications are contributing to market growth. The rise of chemical industries in emerging economies, along with stricter emissions regulations in the automotive sector, is encouraging the use of urea for industrial and environmental purposes.

Governments around the world are also playing a significant role in supporting the urea market. In many developing countries, urea is subsidized to make it affordable for farmers. Meanwhile, in developed economies, regulatory frameworks aimed at reducing greenhouse gas emissions are driving the demand for urea-based emission control systems.

Read More : https://www.fortunebusinessinsights.com/urea-market-106850

Regional Market Insights

Asia-Pacific is the dominant region in the global urea market, accounting for over 66.58% of total market share in 2023. Countries like China and India are at the forefront of this growth, with China being the largest producer and consumer of urea globally. This dominance is largely due to government-backed agricultural subsidies, population-driven food demand, and the presence of robust domestic fertilizer manufacturing facilities.

India, in particular, continues to increase its urea consumption to ensure food security and support farmers. Additionally, countries in Southeast Asia, including Vietnam, Indonesia, and Thailand, are also contributing significantly to regional demand due to increased focus on improving crop yields.

Outside of Asia, other regions such as North America and Europe are experiencing a slower but steady increase in demand. In these regions, the use of urea is more diversified, with significant industrial and automotive applications. For instance, in Europe and North America, urea is widely used in diesel exhaust fluid (DEF) systems to reduce nitrogen oxide emissions from vehicles.

Key Industry Developments

- March 2023: SABIC announced that it is collaborating with two U.S.-based companies, BiOWiSH Technologies and ADM, to supply Bio-Enhanced Urea to farmers for 2023’s growing season to support sustainable agriculture.

- June 2022: Nutrien Ag announced that it is increasing its fertilizer production capability. This move is expected to enable the company to respond to changes in global energy, agriculture, and fertilizer markets.

Competitive Landscape

The global urea market is characterized by the presence of several major players operating at both regional and international levels. Key companies include SABIC, Yara International, Nutrien Ltd., CF Industries Holdings, EuroChem Group, OCI N.V., and others. These players are actively engaged in strategies such as capacity expansion, mergers and acquisitions, and product innovation to strengthen their market positions.

Innovation is also being seen in the development of sustainable urea production processes. Technologies that reduce carbon emissions or use renewable energy sources are gaining attention as manufacturers aim to meet environmental targets while maintaining profitability.

Challenges and Restraints

Despite its widespread use, the urea market faces several challenges. One of the main issues is the environmental impact of overusing nitrogen fertilizers, which can lead to soil degradation, water pollution, and greenhouse gas emissions. This has prompted growing interest in sustainable farming practices and organic alternatives, which may limit long-term reliance on synthetic fertilizers.

In addition, fluctuations in the prices of raw materials such as natural gas — a primary feedstock for urea production — can impact the profitability of manufacturers. Geopolitical tensions, trade restrictions, and energy supply disruptions further add to the uncertainty in the market.

Moreover, regulatory pressures, particularly in Europe and North America, are encouraging the reduction of chemical fertilizer use and promoting alternatives that are more environmentally friendly. This shift, although gradual, may influence future demand patterns.

Opportunities and Future Outlook

Looking ahead, the urea market is expected to continue growing steadily, with several opportunities on the horizon. Countries with strong agricultural sectors but limited domestic fertilizer production are likely to invest in local manufacturing or increase imports. Similarly, the expansion of industrial applications, including in the pharmaceutical, textile, and automotive sectors, will open new growth avenues.

There is also significant potential for innovation in sustainable urea market products, such as enhanced-efficiency fertilizers that minimize nitrogen losses and environmental impact. As climate change and sustainability remain top global concerns, such products may shape the future of the industry.

In conclusion, while the urea market faces certain challenges, its critical role in agriculture and expanding industrial use cases ensure it remains a key component in the global economy. With ongoing investment, technological advancement, and regulatory support, the urea market is well-positioned for stable long-term growth.