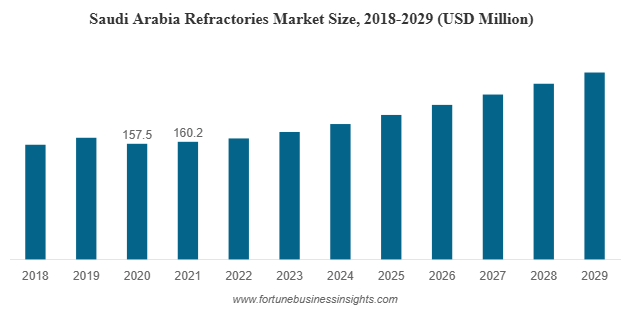

The Saudi Arabia refractories market was valued at USD 160.2 million in 2021 and is expected to grow steadily, reaching USD 254.6 million by 2029. This represents a compound annual growth rate (CAGR) of 6.4% over the forecast period from 2022 to 2029. Like many industries, the market faced significant challenges during the global COVID-19 pandemic, which led to a sharper decline in demand than anticipated. In fact, the market contracted by 4.9% in 2020 compared to 2019, reflecting the broader impact of pandemic-related disruptions across the country.

In recent years, Saudi Arabia refractories market has been rapidly transforming its economy, pushing beyond oil dependency and embracing large-scale industrial development. Amid this wave of progress, one crucial but often overlooked sector is making quiet but steady gains the refractories market.

Saudi Arabia refractories market are materials that can withstand extremely high temperatures, corrosion, and physical wear. They’re essential for lining furnaces, kilns, incinerators, and reactors used in heavy industries like steel, cement, glass, and non-ferrous metals. As these industries grow in Saudi Arabia, so does the demand for reliable refractory solutions.

List Of Key Companies Profiled:

- Saudi Refractory Industries (Dammam)

- AOSCO Refractory (Dammam)

- FSN Company (Dammam)

- Arabian Refractories Factory Company (Dammam)

- Q & E Company Ltd. (Al Jubail)

- Alfran (Amman)

- Thermal Insulation UAE (Sharjah)

Vision 2030: Fueling the Fire

At the heart of Saudi Arabia’s industrial surge is Vision 2030 — the Kingdom’s strategic roadmap for diversifying its economy. This ambitious plan is bringing massive infrastructure projects to life, including NEOM City, the Red Sea Project, and a host of new industrial zones and transportation networks.

All of these projects require raw materials like steel, glass, and cement — industries that heavily rely on high-performance refractories. Every furnace that melts steel or kiln that produces cement must be lined with refractory materials to handle the extreme heat and wear. As industrial output increases, so does the need for these specialized materials.

Steel and Glass: Two Refractory Giants

The steel sector in Saudi Arabia refractories market is already a major consumer of refractories. With more than 40 steel producers operating within the Kingdom and production capacity exceeding 18 million tons annually, it’s no surprise that this segment dominates refractory demand.

Glass manufacturing is another rising star. As urban development expands, the need for construction glass, automotive glass, and solar panel components is growing. Refractories are vital in glass furnaces that operate continuously at high temperatures — making them indispensable to the entire production process.

Refractory Types: Shaped vs. Unshaped, Clay vs. Non-Clay

The market can be divided based on the form and material of refractories.

By form:

- Bricks & shaped refractories are leading the market. These traditional, pre-formed blocks are used for lining fixed structures like furnaces and kilns.

- Monolithic & unshaped refractories are gaining popularity in applications requiring on-site installation and complex shapes, such as in oil refineries or custom furnace designs.

By material:

- Clay-based refractories are currently more common. They’re cost-effective, easy to source, and suitable for many standard applications.

- Non-clay refractories, which include high-alumina, magnesia, and silicon carbide materials, offer superior performance in terms of heat resistance and chemical durability. These are becoming more sought-after in high-tech or highly corrosive environments.

Read More : https://www.fortunebusinessinsights.com/saudi-arabia-refractories-market-106924

Opportunities to Watch

While challenges exist, the opportunities in this sector are substantial:

- Localization of raw materials: If Saudi Arabia can explore and utilize local sources of refractory raw materials like bauxite, alumina, or fire clay, it could significantly reduce import reliance and create new jobs.

- Technological innovation: Companies investing in automated production, waste recycling, or eco-friendly formulations are likely to gain a competitive edge, especially as green certifications become more important.

- Specialized applications: As industries like aerospace, energy, and advanced manufacturing grow in the region, there will be a need for niche refractory solutions with extreme heat and corrosion resistance.

- Government support: Incentives for domestic manufacturing and technology upgrades could stimulate more growth, particularly for small and mid-sized companies.

Challenges on the Horizon

Despite its strong growth potential, the refractories market in Saudi Arabia faces several challenges:

- Import dependency

Much of the refractory raw materials and even finished products are still imported. This creates vulnerabilities in the supply chain, especially in times of global disruption. Local manufacturers are pushing to reduce this dependency, but developing a robust domestic supply chain will take time and investment. - Environmental regulations

Refractory production and usage can contribute to environmental issues such as CO₂ emissions and waste generation. As Saudi Arabia strengthens its environmental regulations, manufacturers must adapt with cleaner technologies, emissions controls, and more sustainable practices — all of which can increase costs. - High operating costs

Producing refractories — especially high-performance types — requires significant energy and specialized equipment. This can be a barrier for new entrants and a profitability concern for smaller players in the market.

Outlook

The Saudi Arabia refractories market in Saudi Arabia is entering a phase of exciting growth, closely tied to the country’s broader industrial and infrastructure development goals. With strong demand from steel, glass, cement, and other sectors — and backing from Vision 2030 — the market is well-positioned for expansion.

Still, to unlock its full potential, the industry must navigate challenges related to imports, sustainability, and cost-efficiency. Those who invest early in innovation, local sourcing, and regulatory compliance will likely emerge as the long-term winners in this high-heat, high-stakes industry.

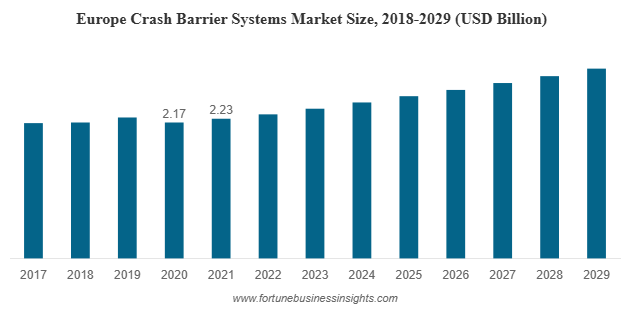

The global crash barrier systems market was valued at USD 6.79 billion in 2021 and is expected to expand from USD 7.01 billion in 2022 to USD 9.35 billion by 2029, reflecting a CAGR of 4.2% during the forecast period. Asia Pacific led the market in 2021 with a share of 32.84%, supported by large-scale infrastructure development. In the United States, the crash barrier systems market is projected to witness substantial growth, reaching USD 2.23 billion by 2032, fueled by advancements in technology and evolving construction practices.

When we think of infrastructure, our minds often go to the wide stretches of highways, towering bridges, or the speed of vehicles that move across them. Yet, one of the most critical elements that keeps these systems safe often goes unnoticed—the crash barrier system. These barriers, whether fixed or portable, are silent guardians that protect lives, vehicles, and properties by reducing the impact of collisions. With the rapid pace of road construction and urbanization worldwide, the demand for reliable crash barrier systems is set to climb steadily in the coming years.

List of Top Crash Barrier Systems Companies:

- Tata Steel (India)

- Lindsay Corporation. (U.S.)

- Transpo Industries Inc. (U.S.)

- Hill and Smith (UK)

- RoadSafe Traffic Systems, Inc. (U.S.)

- Trinity Highway Products, LLC. (U.S.)

- Valmont Industries (U.S.)

- Pinax Steel Industries (India)

- Volkmann & Rossbach GmbH & Co. KG (Germany)

Rising Demand

- Infrastructure Boom

Developing nations like India, China, and Brazil are investing heavily in roads, bridges, and flyovers. The more miles of road we build, the greater the need for safety barriers to reduce risks in areas with high traffic density or difficult terrain. Every highway expansion project now accounts for crash barriers as a fundamental requirement, not just an add-on.

- Stricter Road Safety Regulations

Governments around the globe are tightening safety norms to reduce accidents and fatalities. Many new projects cannot even proceed without integrating roadside, bridge, or median barriers into their designs. As policies grow stricter, manufacturers and contractors are compelled to prioritize safety solutions.

- Rising Vehicle Ownership

The surge in urbanization has led to more vehicles on the road, which unfortunately increases the likelihood of accidents. Crash barrier systems act as preventive tools, keeping vehicles from veering off the road, falling into ditches, or colliding with oncoming traffic.

- Preference for Fixed Barriers

Among product types, fixed crash barriers dominate the market. These include steel guardrails and rigid concrete barriers designed for permanent protection. Fixed barriers are particularly crucial in accident-prone areas such as mountainous roads, highways, and bridges where the margin for error is minimal.

Key Market Segments

By Type: Fixed vs. Portable

Fixed barriers remain the most widely adopted due to their durability and effectiveness in high-risk zones. However, portable crash barriers are gaining traction, especially for temporary construction sites or work zones. They provide flexibility, ease of installation, and cost advantages for short-term projects.

By Technology: Rigid, Semi-Rigid, Flexible

- Rigid barriers hold the largest share as they provide the strongest form of restraint, preventing vehicles from breaking through.

- Semi-rigid barriers such as W-beam steel guardrails balance impact absorption with containment, making them suitable for highways.

- Flexible barriers, like wire rope systems, absorb impact energy and reduce vehicle damage, though they are used in more specific applications.

By Application

Roadside barriers lead the way, especially on highways, mountain passes, and bridge edges. Median barriers prevent head-on collisions, while bridge barriers safeguard vehicles from plunging into rivers or valleys. Work zone barriers, often portable, are vital in protecting both construction workers and drivers in temporary high-risk areas.

By Region

Asia Pacific is the clear leader, accounting for nearly one-third of the global market. The massive investments in road infrastructure in India and China drive this dominance. Europe also holds a strong position due to its stringent safety standards and modernization efforts, while North America continues to expand steadily, supported by investments in upgrading highways and bridges.

Read More : https://www.fortunebusinessinsights.com/crash-barrier-system-market-106084

Opportunities

The future of crash barrier systems market is bright, with innovation and safety driving momentum. Several key trends are expected to shape the coming years:

- Portable Innovation: Lighter, modular, and more durable portable barriers will become common in construction zones, offering flexibility without compromising safety.

- Smart Barriers: Integration of sensors and reflective materials could lead to intelligent barrier systems that monitor impacts, alert authorities, and enhance visibility at night.

- Eco-Friendly Materials: With sustainability gaining importance, manufacturers may increasingly use recyclable or low-carbon materials to create greener barrier systems.

- Government Investments: Large-scale road projects across Asia, Africa, and Latin America will continue to push demand for roadside and bridge safety solutions.

Key Industry Developments:

- June 2021: Trinity Highway Products, LLC signed an agreement with Highway Care Ltd. to produce, sell, and rent the MASH-tested HighwayGuard Barrier in North America. With this partnership, Trinity Highway broadened its commitment to offer innovative roadway solutions of HighwayGuard to Mexico, the U.S., and Canada.

- August 2019: Lindsay Corporation launched ABSORB-M, a new, non-redirective, water-filled crash cushion system. The product is suited for unanchored and anchored barriers. With this launch, the company would expand its product line.

Why It Matters

Crash barrier systems market may seem like simple roadside structures, but they save countless lives every year. For governments, they represent compliance with global safety standards. For contractors and builders, they are critical to meeting project requirements. For manufacturers, they provide opportunities to innovate and grow. And for everyday drivers, they mean safer journeys, fewer fatal accidents, and greater peace of mind.

Challenges Facing the Market

While growth prospects are promising, the market is not without hurdles:

- Raw Material Costs: Steel, aluminum, and rubber prices fluctuate regularly, creating challenges for manufacturers in maintaining stable pricing.

- Impact Concerns: Although barriers reduce the severity of accidents, rigid systems may sometimes cause secondary damage to vehicles, leading to debates about design and application.

- High Installation Costs: Quality crash barrier systems require significant investment in both materials and skilled labor. Maintenance adds further to lifecycle costs.

Future Outlook

The global crash barrier systems market is steadily expanding, projected to grow from just over USD 7.01 billion in 2022 to more than USD 9.35 billion by 2029. This growth is driven by infrastructure development, regulatory enforcement, and increasing vehicle traffic worldwide. Although challenges such as cost and material volatility remain, the opportunities for innovation, sustainability, and smarter safety systems point to a promising future.

In the end, crash barriers are more than just physical structures—they are critical lifelines that protect drivers, passengers, and communities, making them indispensable to the modern world of infrastructure.

Acrylonitrile Butadiene Styrene Market Opportunities, Companies, Global Analysis & Forecast 2032

By Sharvari, 2025-09-11

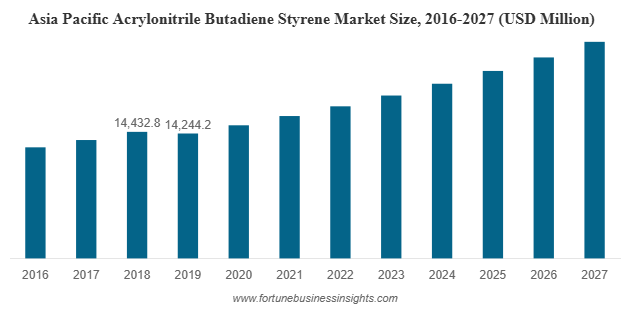

In 2019, the global acrylonitrile butadiene styrene (ABS) market was valued at USD 25,135.0 million and is expected to reach USD 42,809.5 million by 2027, growing at a compound annual growth rate (CAGR) of 6.9% during the forecast period. The Asia Pacific region led the market, accounting for 56.67% of the global share that year. Additionally, the ABS market in the United States is projected to reach USD 4,254.1 million by 2028, driven by increasing demand for durable and lightweight plastics, particularly in the automotive and consumer goods sectors.

Global Market Overview and Forecast

In a world where innovation and durability go hand in hand, the role of plastics in modern manufacturing continues to expand. One such versatile material is Acrylonitrile Butadiene Styrene (ABS) Market – a thermoplastic polymer that has quietly become a cornerstone in various industries including automotive, consumer electronics, construction, and healthcare. Known for its toughness, high impact resistance, and glossy finish, acrylonitrile butadiene styrene market is a preferred material for manufacturers who seek a balance between performance and cost-effectiveness.

The acrylonitrile butadiene styrene market has been witnessing steady growth over the past decade, with a promising future ahead. With increasing demand across key sectors, advancements in polymer technology, and the rising need for lightweight yet durable materials, ABS is expected to continue playing a vital role in global manufacturing.

This growth is being driven largely by increased demand in emerging economies, especially in Asia-Pacific, where industrialization, urbanization, and rising consumer income are pushing the consumption of electronics, vehicles, and home appliances. Asia-Pacific currently holds the largest share of the global ABS market and is expected to retain this lead well into the future.

List of Top Acrylonitrile Butadiene Styrene Companies:

- BASF (Ludwigshafen, Germany)

- 3M (Minnesota, United States)

- Covestro AG (Leverkusen, Germany)

- INEOS (London, UK)

- SABIC (Riyadh, Saudi Arabia)

- LG Chemicals (Seoul, South Korea)

- Chi Mei Corporation (Tainan City, Taiwan)

- Asahi Kasei Corp. (Tokyo, Japan)

What is Acrylonitrile Butadiene Styrene Market and Why is it Important?

Acrylonitrile butadiene styrene market is a terpolymer made by polymerizing three different monomers: acrylonitrile, butadiene, and styrene. Each of these components contributes distinct properties to the final product. Acrylonitrile provides chemical resistance and thermal stability, butadiene adds toughness and impact resistance, while styrene offers rigidity and a shiny finish.

This combination makes acrylonitrile butadiene styrene market extremely versatile. It can be easily molded into complex shapes, painted, and even plated with metals, making it ideal for applications where aesthetics meet functionality.

From the casing of your TV remote to the interior panels of your car, acrylonitrile butadiene styrene market is everywhere. Its wide range of applications and favorable properties have helped the material maintain a strong foothold in the global market.

Key Drivers Fueling Acrylonitrile Butadiene Styrene Market Growth

- Automotive Industry and Lightweighting Trends

The automotive sector is one of the most significant consumers of acrylonitrile butadiene styrene market. As car manufacturers around the world move toward lightweighting to improve fuel efficiency and reduce emissions, ABS has emerged as a go-to material. Its high impact resistance and strength-to-weight ratio make it ideal for use in interior trims, dashboards, consoles, and exterior body panels.

- Surge in Consumer Electronics and Appliances

The booming electronics and home appliance industries are also major contributors to acrylonitrile butadiene styrene market demand. acrylonitrile butadiene styrene market is widely used in the manufacturing of computer monitors, TVs, vacuum cleaners, and kitchen appliances due to its excellent finish and mechanical properties. As technology advances and consumers seek more stylish, durable products, the need for materials like acrylonitrile butadiene styrene market only grows stronger.

- Growth in the Construction Sector

ABS is also gaining traction in the construction industry, particularly in plumbing and fitting applications. It is used in pipes, wall panels, and various fixtures due to its resistance to corrosion, ease of installation, and long service life. Rapid urbanization and infrastructure development in developing countries further support this trend.

- Healthcare and Medical Devices

The global pandemic brought to light the critical importance of reliable medical equipment. acrylonitrile butadiene styrene market is frequently used in medical devices like nebulizers, syringe components, and diagnostic tools because it can withstand sterilization and has good mechanical properties. Even beyond the pandemic, the healthcare sector is expected to remain a strong growth driver.

Read More : https://www.fortunebusinessinsights.com/acrylonitrile-butadiene-styrene-abs-market-104538

Innovation and Sustainability: The Road Ahead

In response to environmental and regulatory pressure, companies are increasingly investing in recycling technologies and sustainable practices. Recycled acrylonitrile butadiene styrene market is gaining popularity, particularly in industries like automotive and electronics, where manufacturers aim to meet their sustainability goals without compromising product quality.

Innovations in acrylonitrile butadiene styrene market production, including bio-based formulations and enhanced grades with better heat and impact resistance, are also gaining traction. These advancements not only widen the application scope of ABS but also help address some of the material’s traditional limitations.

Additionally, acrylonitrile butadiene styrene market is making inroads into 3D printing, offering designers and engineers a durable and easy-to-print material for prototyping and even small-scale production.

Key Industry Developments:

- In June 2021 – Nexeo Plastics and Covestro launched the new Polycarbonate/ABS 3D printing filament Addigy FPB 2684 3D. This filament is available from now on via Nexeo Plastics’ distribution platform. With this launch, the company will continue to invest and expand their 3D printing product portfolio and support services.

- In January 2021 – INEOS Styrolution builds a demonstration plant at its Antwerp, Belgium, site to test production of ABS plastic from recycled feedstock. The project, called “LIFE ABSolutely Circular” aims at demonstrating the environmental and economic benefits of using advanced recycling technologies to close the loop of plastic recycling.

Challenges Facing the Acrylonitrile Butadiene Styrene Market

Despite its many advantages, the acrylonitrile butadiene styrene market is not without challenges. Growing environmental concerns about plastic waste are leading to stricter regulations and shifting consumer preferences. As sustainability becomes a major focus, industries are being pushed to explore recyclable or bio-based alternatives to traditional polymers like ABS.

Moreover, the volatility of raw material prices and supply chain disruptions can affect acrylonitrile butadiene styrene market production. Since acrylonitrile butadiene styrene market is derived from petrochemicals, fluctuations in oil prices and geopolitical tensions can have a direct impact on manufacturing costs.

Another emerging challenge is competition from other advanced polymers. In certain high-performance applications, materials like polycarbonate (PC), polypropylene (PP), and thermoplastic elastomers (TPEs) can replace ABS, depending on the required specifications.

Final Thoughts

The future of the acrylonitrile butadiene styrene market looks bright, driven by rising industrial demand, technological advancements, and evolving consumer lifestyles. As long as industries continue to seek reliable, versatile, and cost-effective materials, ABS will remain a valuable player.

However, sustainability will be key. Manufacturers that invest in eco-friendly solutions, recycling capabilities, and innovative product design will be better positioned to thrive in a market that’s becoming more conscious of environmental impacts.

For businesses, investors, and engineers alike, staying updated on ABS market trends isn’t just smart—it’s essential in navigating the next generation of manufacturing and product development.

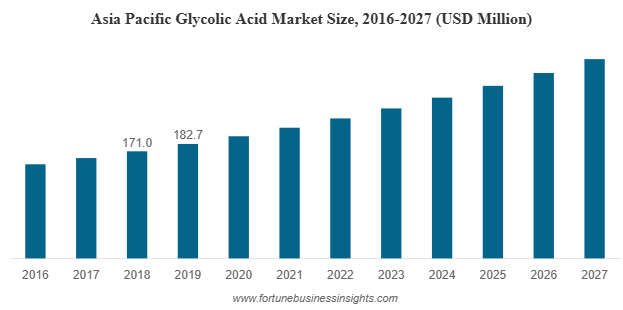

The global glycolic acid market was valued at USD 468.2 million in 2019 and is expected to reach approximately USD 820.3 million by 2027, growing at a CAGR of 7.3% over the forecast period. In 2019, Asia Pacific emerged as the leading region, accounting for 39.02% of the global market share. Meanwhile, the U.S. glycolic acid market is anticipated to hit USD 140.96 million by 2027, driven by strong demand across cosmetics, skincare, and industrial cleaning applications.

In recent years, glycolic acid market has moved from a niche skincare ingredient to a globally sought-after compound with wide-reaching applications. Whether you're browsing the label of your favorite facial cleanser or researching innovative industrial solutions, chances are glycolic acid is playing a silent but powerful role. What started as a cosmetic staple has now evolved into a multi-industry asset, gaining momentum across the globe.

The Beauty Industry : Glycolic Acid Market

No discussion of glycolic acid market is complete without highlighting its prominence in cosmetics and personal care. As the smallest alpha hydroxy acid (AHA), glycolic acid has the unique ability to penetrate the skin deeply and effectively. It promotes exfoliation, boosts collagen production, and improves skin texture—making it a favorite among dermatologists and beauty brands alike.

In the age of social media-driven beauty standards, consumers are constantly seeking products that deliver visible results. Glycolic acid fits perfectly into this narrative. Its role in anti-aging serums, exfoliating toners, acne treatments, and chemical peels continues to expand, especially in rapidly growing markets like Asia-Pacific, where the demand for premium skincare products is rising.

Furthermore, a growing awareness around skincare routines, especially among millennials and Gen Z, is pushing demand for effective and science-backed ingredients. As a result, beauty companies are launching new product lines centered around glycolic acid, helping to maintain its popularity in this highly competitive sector.

List Of Key Companies Profiled In Glycolic Acid Market:

- China Petrochemical Corporation (Sinopec Corp.), (China)

- The Chemours Company (U.S.)

- CABB Group (Germany)

- Saanvi Corp (India)

- Parchem Fine & Specialty Chemicals (U.S.)

- Water Chemical Co., Ltd (China)

- Shandong Xinhua Pharmaceutical Co., Ltd. (China)

- Mehul Dye Chem Industries (India)

- Avid Organics (India)

- Zhonglan Industry Co., Ltd. (China)

- Eastman Chemical Company (U.S.)

Beyond Beauty: Industrial and Pharmaceutical Applications

While the cosmetics industry remains a major consumer, glycolic acid is far from being a one-trick pony. It is a versatile chemical used across multiple industries. Its properties—being biodegradable, non-toxic, and water-soluble—make it an ideal component for various formulations beyond skincare.

In the pharmaceutical industry, glycolic acid is used in the manufacture of bio-absorbable sutures and controlled drug-release systems. Its effectiveness in creating biodegradable polymers is also gaining attention, particularly in the field of medical devices.

The textile and leather industries leverage glycolic acid during dyeing and tanning processes due to its efficient pH adjustment capabilities. Similarly, in food processing, it acts as a preservative and flavor enhancer.

Additionally, glycolic acid serves as an effective agent in cleaning and industrial solutions, especially for removing hard water deposits, rust, and mineral scale without damaging metal surfaces. Its increasing usage in household cleaning products and electronic component manufacturing is a testament to its adaptability.

Read More : https://www.fortunebusinessinsights.com/industry-reports/glycolic-acid-market-101922

Key Market Segments: Purity Levels and Their Uses

The glycolic acid market is segmented by purity level—primarily 99%, 70%, 30%, and others. Among these, the 99% purity segment holds the largest share, largely because it is used across high-demand sectors like pharmaceuticals, cosmetics, textiles, and food processing.

The 70% purity level is particularly used in medical applications, while 30% glycolic acid is popular in chemical peels and skincare treatments. These variations in concentration allow for customized applications across industries, ensuring that glycolic acid remains relevant across a broad spectrum of use cases.

Asia-Pacific: The Market Leader

When it comes to geographical dominance, the Asia-Pacific region leads the glycolic acid market, accounting for nearly 39% of the global share in 2019. Countries like China and India are experiencing rapid industrialization, urbanization, and economic growth, which in turn is boosting demand in both cosmetics and industrial applications.

Furthermore, the booming e-commerce landscape in these regions has made skincare products more accessible to consumers. Coupled with a growing middle-class population and increased disposable income, Asia-Pacific continues to be the most dynamic and lucrative market for glycolic acid.

Key Industry Developments:

- October 2018: CABB Group GmbH invested millions of Euros to increase the storage and production volume of monochloroacetic (MCA) acid & its derivatives at the Knapsack and Gersthofen facility. The expansion will be boosting the company’s production of glycolic acid at Gersthofen facility.

- January 2019 - Skinceuticals launched a new glycolic acid cream, Glycolic 10 Renew Overnight that improves skin glow by 36% while also maintaining tolerability. The cream effectively targets dullness, fine lines, and uneven texture of the skin. It stimulates cell regeneration for enriched tone, texture, and brighter complexion.

Market Challenges: Health, Safety, and Environmental Concerns

Despite its widespread use and benefits, glycolic acid does come with certain challenges. Overuse in cosmetics can lead to skin irritation, inflammation, and heightened sensitivity to sunlight. As a result, product developers and consumers alike must pay attention to recommended usage levels and combine glycolic acid with sun protection measures.

On the manufacturing side, the production of glycolic acid can involve hazardous byproducts such as phosgene—a compound that requires stringent regulatory control. Environmental regulations are becoming tighter, particularly in North America and Europe, which may pose challenges for manufacturers and increase compliance costs.

Additionally, the emergence of natural and plant-based alternatives such as lactic acid and salicylic acid is shifting some consumer preferences away from synthetic options, particularly in the clean beauty segment.

Competitive Landscape and Key Players

The glycolic acid market is moderately fragmented, with both global giants and regional players competing for market share. Some of the major players include:

- The Chemours Company

- CABB Group GmbH

- Water Chemical Co. Ltd.

- Parchem Fine & Specialty Chemicals

- Mehul Dye Chem Industries

- Avid Organics Pvt. Ltd.

- Zhonglan Industry Co. Ltd.

These companies are investing heavily in research and development, capacity expansion, and strategic collaborations to maintain a competitive edge.

Outlook

The growth of the glycolic acid market is not just a reflection of changing consumer habits but also a sign of how versatile and valuable this compound has become across industries. As awareness of its benefits continues to rise and innovation drives new formulations, glycolic acid is poised to remain a key ingredient in both personal care and industrial applications. For businesses looking to tap into a high-growth, high-impact market, glycolic acid market offers opportunities that extend well beyond the skincare aisle.

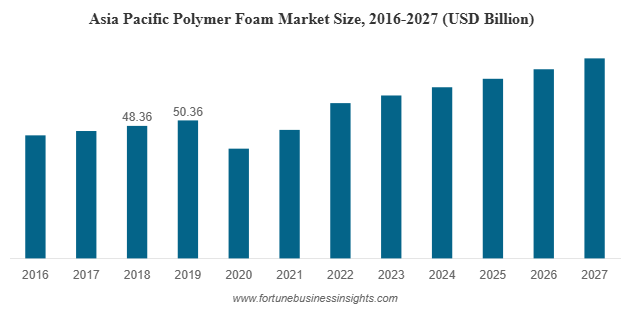

The global polymer foam market was valued at USD 114.88 billion in 2019 and is expected to grow to USD 157.63 billion by 2027, registering a CAGR of 7.73% during the forecast period. Asia Pacific led the market in 2019 with a 43.84% share, while the U.S. market is anticipated to reach USD 23.49 million by 2027, driven by rising applications in furniture, automotive, and construction insulation.

Market Snapshot: Growth at a Strong Pace

Polymer foam market might not be the first thing you think of when it comes to everyday life, but chances are you’re surrounded by them right now. From the cushion on your chair to the insulation in your walls, polymer foams play a role in comfort, safety, and energy efficiency. Their lightweight, bubble-filled structure makes them unique—offering durability, flexibility, and cushioning all in one material. In recent years, these versatile materials have become an essential part of industries like construction, automotive, packaging, and furniture. With growing demand across these sectors, the global polymer foam market is on a steady upward trajectory.

List Of Key Companies Covered:

- Sealed Air (U.S.)

- Arkema (France)

- Armacell International S.A. (Germany)

- Borealis AG (Austria)

- Polymer Technologies, Inc. (U.S.)

- Zotefoams plc (UK)

- Synthos (Poland)

- Sekisui Alveo (Switzerland)

- BASF SE (Germany)

Key Growth Drivers

- Comfort Meets Versatility

One of the strongest growth drivers of polymer foam demand is its use in furniture, bedding, and seating applications. Sofas, mattresses, office chairs, and even footwear rely on foams for comfort and support. In addition, automotive interiors like seats, armrests, and headrests have increasingly incorporated foams to enhance passenger comfort while reducing weight. This balance of strength and softness is hard to achieve with other materials. - Expanding Use in Construction

In the construction industry, polymer foams are invaluable for insulation, soundproofing, waterproofing, and flooring. With the global push toward energy-efficient buildings, foams are helping reduce energy consumption by improving thermal insulation. Their ability to act as sealants and fillers also makes them vital in creating durable, sustainable building structures. - Rising Popularity of Memory Foam

Memory foam, a form of polyurethane foam, has been one of the most significant contributors to market growth. Known for its ability to contour to body shape, memory foam has become a favorite in mattresses, pillows, and footwear. As consumers increasingly seek ergonomic solutions that improve comfort and reduce stress, the popularity of memory foam is expected to keep climbing. - Packaging and Transportation Needs

The packaging industry also leans heavily on polymer foams. Lightweight yet durable, foams are widely used to protect goods during transport. Their role in food packaging and medical product protection has become especially important, ensuring safety and extended shelf life.

Challenges in the Market

Despite the promising growth, the polymer foam industry faces challenges. One of the biggest hurdles is environmental sustainability. Most commonly used foams, such as polyurethane, polystyrene, and polyethylene, are not biodegradable. Concerns over plastic waste and stricter regulations in major economies are pushing the industry to rethink its practices. Recycling remains a challenge, although innovations in eco-friendly foams are gradually emerging.

Another challenge was seen during the COVID-19 pandemic. With lockdowns affecting construction and automotive industries, foam demand dropped temporarily. However, demand in packaging—particularly for food and healthcare products—helped offset some of the decline.

Regional Highlights

- Asia-Pacific dominates the market, holding nearly 43.84% of the global share as of 2019. Rapid industrialization, a growing middle-class population, and strong demand from construction and packaging industries in countries like China, India, and Japan are driving this dominance.

- North America also plays a significant role, with demand largely supported by the automotive, furniture, and insulation industries. The U.S. market in particular has shown resilience with its focus on comfort-based applications.

- Europe remains steady, driven by automotive interiors, home applications, and growing emphasis on sustainability in construction.

- Latin America and the Middle East & Africa are relatively smaller markets, facing slower growth due to import dependence and limited local foam production.

Read More : https://www.fortunebusinessinsights.com/industry-reports/polymer-foam-market-101698

Market Segmentation

By Type:

- Polyurethane (PU) leads the segment, widely used in construction, furniture, and bedding.

- Polystyrene (PS) is cost-effective and popular for packaging due to its insulation qualities.

- PVC foams are important in furniture manufacturing and construction boards.

- Others, such as PET and polyamide foams, serve specialized sectors including wind energy, transportation, and niche packaging.

By Application:

- Building & Construction stands as the largest segment, driven by insulation, fillers, and energy-saving requirements.

- Automotive applications continue to rise as lightweight foams help improve fuel efficiency.

- Packaging demand grows steadily, particularly in food safety and protective shipping.

- Furniture & Appliances remain strong consumers of foam materials.

- Apparel & Others cover areas such as footwear, toys, agriculture, and military products.

Key Industry Developments

- August 2019: Sheela Foam Limited, largest manufacturer of mattresses and foam based in India, acquired Interplasp SL, a Spanish Company, which has an annual production of 11,000 tons (total capacity 22,000 tons) of polyurethane foam for bedding and furniture applications.

- March 2019: Sika AG, a specialty chemical manufacturer of bonding, damping, sealing, reinforcing solutions for automotive and construction industries, acquired Belineco LLC, a Belarus-based producer of polyurethane foam systems. With this acquisition, Sika is further expected to develop its technology to manufacture polyurethane foams.

Industry Players and Developments

Global leaders in the polymer foam industry include companies like BASF, SABIC, Sealed Air, Arkema, Armacell, Zotefoams, Toray, and Celanese. These players are focusing on mergers, acquisitions, and new product launches to strengthen their foothold.

For example, Sheela Foam of India expanded its polyurethane business by acquiring Interplasp in Spain, while Sika AG of Switzerland strengthened its polyurethane systems through the purchase of Belineco in Belarus. Such strategic moves highlight how companies are striving to expand geographically and technologically.

The Road Ahead

Looking forward, the polymer foam market shows no signs of slowing down. Growth will continue to be driven by booming construction in emerging economies, rising demand for comfort-based products, and ongoing innovations in memory foam and other specialty foams. However, sustainability will be the key theme for the future. Companies that invest in eco-friendly materials, recycling technologies, and compliance with green regulations are likely to set themselves apart.

Future Outlook

The global polymer foam market is much more than a materials industry—it’s an innovation-driven sector that touches our daily lives in countless ways. From energy-efficient homes and safer packaging to more comfortable furniture and advanced automotive interiors, polymer foams have established themselves as essential. While challenges around sustainability remain, the industry’s strong growth prospects and adaptability ensure it will remain at the forefront of modern living and industrial progress.

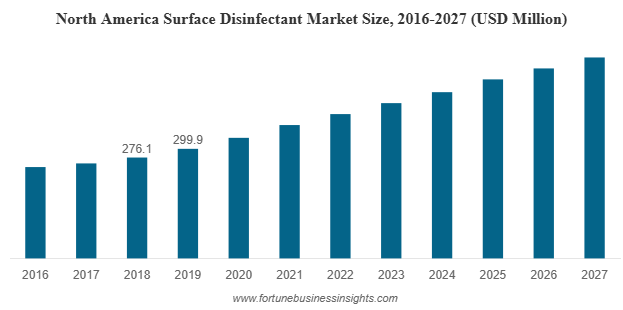

The global surface disinfectant market was valued at USD 770.6 million in 2019 and is expected to grow significantly, reaching USD 1,547.7 million by 2027. This reflects a robust compound annual growth rate (CAGR) of 9.1% during the forecast period from 2020 to 2027. In 2019, North America led the market, accounting for 38.92% of the global share. The United States, in particular, is projected to experience substantial growth, with the market expected to reach USD 524.4 million by 2027. This upward trend is largely fueled by increased awareness around hygiene and sanitation in the wake of the pandemic, especially across the healthcare, residential, and commercial sectors.

Market Snapshot: From Billions to Bigger Billions

Over the last few years, the global mindset around hygiene has undergone a massive shift. What was once considered a routine task has now become a top priority across homes, hospitals, public spaces, and workplaces. At the heart of this change lies one key product category: surface disinfectants market.

From kitchen countertops to operating room tables, surface disinfectants market have become an essential line of defense against harmful pathogens. But beyond their daily use, these products are also at the center of a booming global market—one that’s poised for remarkable growth in the coming years.

List of Top Surface Disinfectant Companies:

- 3M (U.S.)

- The Proctor & Gamble Company (U.S.)

- Kimberley-Clark Corporation (U.S.)

- SC Johnson Professional (U.S.)

- The Clorox Company (U.S.)

- Ecolab (U.S.)

- Metrex Research LLC(U.S.)

- Reckitt Benckiser Group Plc (U.K.)

- Diversey Inc.(U.S.)

The Role of Healthcare and HAIs

One of the largest consumers of surface disinfectants continues to be the healthcare sector. Hospitals, clinics, and diagnostic centers rely on disinfectants to minimize the risk of hospital-acquired infections (HAIs)—a serious concern that affects millions of patients globally every year. HAIs such as bloodstream infections, urinary tract infections, and ventilator-associated pneumonia are preventable to a large extent with strict disinfection protocols.

As healthcare systems become more advanced and patient safety takes center stage, the demand for high-performance disinfectants that can neutralize a broad range of pathogens is only expected to rise.

Breaking Down the Market: What’s in Demand?

Surface disinfectants are not a one-size-fits-all category. The market can be broadly segmented by type, composition, and application, each playing a unique role in how and where these products are used.

- By Type: Liquids Lead the Way

Liquid disinfectants currently dominate the market due to their widespread use in both residential and commercial settings. They offer versatility, cost-effectiveness, and ease of application across a variety of surfaces. However, wipes are quickly gaining popularity, especially in consumer and office environments. Their convenience, portability, and reduced cross-contamination risk make them an increasingly preferred choice.

- By Composition: Alcohol-Based Rules, But Alternatives Rise

Alcohol-based disinfectants remain the most widely used, especially in healthcare and public spaces, due to their proven effectiveness against bacteria and viruses. These products are fast-acting, evaporate quickly, and are generally approved by regulatory authorities worldwide.

That said, peracetic acid and hydrogen peroxide-based solutions are seeing significant growth, especially in industrial and food processing sectors. These alternatives offer high-level disinfection with less toxicity and are more environmentally friendly—an important consideration for the future of the market.

- By Application: Beyond Hospitals

While healthcare remains the largest segment, applications in commercial spaces, transportation, and homes are contributing heavily to the market’s growth. Offices, gyms, schools, and public transit systems are all embracing strict disinfection protocols. On the residential side, consumers have become more proactive in maintaining hygiene, stocking their homes with disinfectant sprays, wipes, and multi-surface cleaners as part of daily routines.

Regional Growth: Asia-Pacific on the Rise

While North America currently holds the largest market share, driven by strong healthcare infrastructure and high awareness levels, it’s the Asia-Pacific region that’s showing the fastest growth. Countries like India and China are witnessing a surge in demand due to increased healthcare spending, growing urban populations, and improved access to hygiene products.

Government campaigns focused on sanitation, coupled with rising consumer awareness, are accelerating the adoption of surface disinfectants across both urban and rural areas. Moreover, local manufacturing and distribution are expanding rapidly, making products more accessible and affordable.

Read More : https://www.fortunebusinessinsights.com/surface-disinfectant-market-103062

Innovation and Sustainability: The Future Focus

As the surface disinfectant market matures, innovation is becoming a key differentiator. Brands are focusing on developing eco-friendly, non-toxic, and biodegradable formulas that are safer for both people and the environment. Alcohol-free disinfectants, enzyme-based cleaners, and sustainable packaging are emerging trends to watch.

Additionally, smart disinfection technologies—such as automated dispensers, UV sanitizing devices, and antimicrobial coatings—are being integrated into larger sanitation ecosystems in healthcare and commercial buildings.

Key Industry Developments:

- January 2019 – Reckitt Benckiser formed a strategic alliance with Diversey to increase its presence in North America. This strategic alliance will help Reckitt Benckiser to expand its reach to educational institutes, food establishments, and hospitals.

- February 2020 – The Procter and Gamble Company launched a new line of antibacterial cleaners named Microban 24. The new product line is said to protect the applied surface for a complete 24 hours, even when the surface has been contacted multiple times.

Challenges to Consider

Despite the optimistic outlook, the market does face some challenges. The hazardous nature of certain chemicals used in disinfectants requires careful handling, storage, and disposal. Regulatory scrutiny is tightening, and companies must ensure compliance with safety standards while continuing to innovate.

Also, consumer misinformation about effectiveness, overuse of certain chemicals, and environmental concerns are pushing manufacturers to strike a balance between performance and sustainability.

Future Outlook

The surface disinfectant market is no longer a niche segment—it’s a central player in the global effort to maintain hygiene and prevent the spread of disease. As demand grows across healthcare, residential, and industrial sectors, this market offers significant opportunities for innovation, sustainability, and improved public health outcomes.

In a world where cleanliness is no longer optional, surface disinfectants market have earned their place as everyday essentials. The future belongs to brands that can deliver powerful protection—without compromising safety or sustainability.

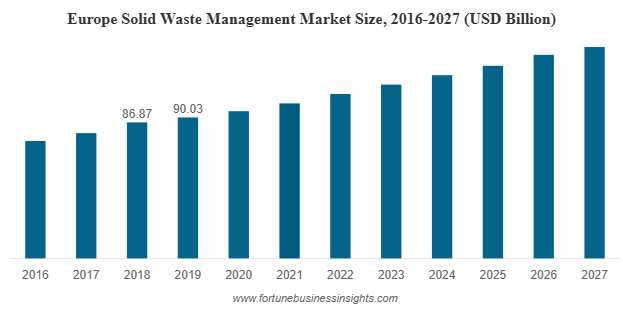

The global solid waste management market was valued at USD 285.16 billion in 2019 and is expected to reach approximately USD 366.52 billion by 2027, growing at a compound annual growth rate (CAGR) of 3.3% during the forecast period. In 2019, Europe led the market, accounting for 31.57% of the global share, driven by its advanced infrastructure and stringent environmental regulations. Meanwhile, the United States market is projected to experience significant growth, with its value expected to reach around USD 93.46 billion by 2032. This growth is largely attributed to the country’s robust collection, processing, and disposal systems, as well as the strong presence of major industry players such as Waste Management Inc., Covanta Holding Corporation, Clean Harbors Inc., and others.

The Market at a Glance

In a world that thrives on consumption, one unavoidable byproduct of modern life is waste. From overflowing landfills to plastic-laden oceans, improper waste disposal has become one of the most pressing environmental issues of our time. But the story doesn’t end there. A silent revolution is underway solid waste management market is transforming from a reactive necessity into a proactive industry driving innovation, sustainability, and economic growth.

List Of Key Players Profiled:

- Waste Management Inc. (USA)

- SUEZ Group (France)

- Veolia Environment S.A. (France)

- Biffa PLC (U.K.)

- Clean Harbors Inc. (USA)

- Covanta Holdings Corporation (USA)

- Hitachi Zosen Corporation (Japan)

- Remondis AG & Co. Kg (Germany)

- Republic Services Inc. (USA)

- Stericycle Inc. (USA)

Why the Industry is Booming

- Urbanization and Population Growth

With more people moving into urban areas, the volume of municipal and industrial waste is escalating rapidly. Cities generate enormous amounts of garbage daily—from household refuse and commercial waste to construction debris and hazardous materials. Managing this rising tide of waste requires robust systems and infrastructure, fueling demand for waste collection, recycling, and disposal services.

- Government Regulations and Environmental Policies

Governments worldwide are tightening environmental regulations and implementing new waste management policies. These include landfill bans on recyclable and compostable materials, mandatory recycling programs, and incentives for using clean technologies. Such regulations are pushing industries and municipalities to invest more in effective waste treatment and recycling facilities.

- The Shift Towards a Circular Economy

The traditional linear model of "take, make, dispose" is being replaced by the circular economy—an approach where resources are kept in use for as long as possible. Waste is no longer seen solely as a problem but as a resource that can be reused, recycled, or converted into energy. This shift is not just environmentally beneficial but also economically attractive, spurring innovation in waste processing technologies.

Market Segmentation: What’s Driving Growth?

By Waste Type

Among the different categories, industrial waste leads the global market. With the rise of manufacturing and heavy industries, especially in developing economies, the need for proper disposal of non-hazardous and hazardous industrial waste has become critical. These industries are under increasing pressure to manage waste in compliance with environmental standards.

Municipal solid waste, which includes everyday items discarded by the public, is also a major contributor. This includes organic waste, paper, plastics, glass, and metals. As urban populations grow, the volume of municipal waste is expected to rise steadily, further fueling the need for comprehensive waste management systems.

By Service

The market is also segmented by services such as collection, processing, disposal, and recycling. Waste collection dominates the segment, accounting for more than half of the market share. This service is critical, especially in densely populated urban centers where effective collection systems prevent public health hazards.

However, there is growing investment in waste processing and recycling. Technologies like composting, anaerobic digestion, incineration, and waste-to-energy conversion are gaining ground. These not only reduce the volume of waste sent to landfills but also generate electricity, heat, or fuel—making waste management more sustainable and profitable.

Read More : https://www.fortunebusinessinsights.com/solid-waste-management-market-103045

Geographic Landscape: Who’s Leading?

- Europe

Europe is a global leader in solid waste management market, with a highly developed infrastructure and strong government support. Many European countries have advanced waste-to-energy facilities, and recycling rates are among the highest in the world. Strict regulations and public awareness campaigns have contributed to Europe’s success in minimizing landfill use and promoting circular economy principles.

- North America

The United States is also a major player in the solidwaste management industry, with a highly organized collection system and a growing focus on sustainability. Public and private sector collaboration, along with technological innovation, is driving growth. Key players in the region are expanding their operations and investing in smart waste tracking, segregation technologies, and energy recovery systems.

- Asia-Pacific

Asia-Pacific represents the fastest-growing market, driven by rapid urbanization in countries like China, India, and Southeast Asian nations. However, the region also faces challenges such as underdeveloped infrastructure, limited public awareness, and lack of regulatory enforcement. Despite these hurdles, rising investments and government initiatives aimed at improving waste management are setting the stage for substantial growth in the coming years.

Key Industry Developments:

-

July 2019 – The consortium BCE led by SUEZ Group signed a 25 years contract with municipal company Beogradske Elektrane to sell heat produced from waste-to-energy in Belgrade, Serbia. By signing this contact, the municipal company is aiming to introduce renewable energy by reducing its energy dependency on natural gas. The plant operation will be handled by SUEZ Group and the plant will process 500 Kilo Tons of Municipal waste and 200 Kilo Tons of construction & demolition waste per year.

- December 2019 – Covanta Holdings Corporation agreed with Zhao County, China to build & operate a new Energy-from-waste facility. The project will offer sustainable waste management solutions to the county. With this agreement, the company is aiming to expand its geographical footprints into Chinese market.

Challenges Ahead

While the solid waste management market shows promise, several obstacles remain:

- High operational costs: Advanced equipment, labor, and technology require significant investment.

- Inadequate infrastructure: In many developing regions, basic collection and disposal systems are still lacking.

- Low public participation: Recycling and segregation rely heavily on citizen involvement, which is inconsistent across regions.

- Illegal dumping and informal sectors: In some areas, informal waste pickers dominate the industry, leading to unsafe and inefficient practices.

Addressing these challenges will require a combination of technological innovation, policy reform, and public education.

Looking Forward: The Future of Solid Waste Management Market

The future of solid waste management market lies in smart solutions, public-private partnerships, and green technologies. From AI-driven sorting systems to decentralized composting and real-time monitoring of collection routes, the industry is evolving at a rapid pace. As climate change continues to dominate global conversations, effective waste management will be key to achieving environmental sustainability.

Solid waste management market is no longer just about getting rid of garbage—it’s about rethinking our relationship with waste. The industry is shifting toward a more sustainable, circular, and tech-driven model. For investors, policymakers, entrepreneurs, and communities alike, this market presents not just an environmental imperative but also a growing economic opportunity.

Aerospace and Defense Materials Market Size, SWOT Analysis, Trends & Forecast 2032

By Sharvari, 2025-09-10

The aerospace and defense materials industry is one of the most technologically advanced and strategically critical sectors in the world. Behind every aircraft, spacecraft, and defense system lies a foundation of highly engineered materials that provide strength, resilience, and performance. From composites to super alloys, these materials are not just structural components—they are enablers of efficiency, innovation, and security. The aerospace and defense materials market has witnessed consistent growth over the past decade, and its trajectory looks promising as the demand for lighter, stronger, and more durable materials continues to rise.

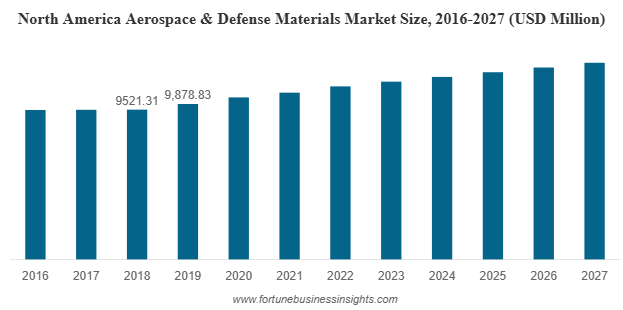

Market Growth and Forecast

The global aerospace and defense materials market was valued at USD 18,411.83 million in 2019 and is anticipated to reach USD 23,825.45 million by 2027, registering a CAGR of 4.21% over the forecast period. North America led the market in 2019 with a 53.65% share, while the U.S. market alone is expected to generate USD 12,019.42 million by 2027, driven by advancements in lightweight and high-performance materials.

List Of Key Companies Profiled In Aerospace And Defense Materials Market:

- Arconic Inc. (US)

- Toray Composite Materials America, Inc. (US)

- Huntsman (US)

- Evonik Industries (Germany)

- Hexcel Corporation (US)

- Materion Corp. (US)

- AMI Metals Inc. (US)

- TATA Advanced Materials Limited. (India)

- Koninklijke Ten Cate BV (Netherlands)

Key Drivers of Market Growth

- Rising Aircraft Demand

The rapid growth of the global middle class and increasing disposable income have boosted the demand for air travel. Airlines are under pressure to expand their fleets with modern, fuel-efficient aircraft. This surge directly drives the demand for advanced materials such as composites, titanium alloys, and aluminum.

- Focus on Light weighting

Reducing aircraft weight has become a top priority for manufacturers, as lighter planes consume less fuel and emit fewer carbon emissions. Composites and titanium alloys are now widely used in aircraft structures and engines, replacing heavier traditional metals.

- Defense Spending

Geopolitical tensions and modernization programs are fueling growth in the military segment. Countries are investing in advanced fighter jets, drones, and helicopters—all of which require specialized high-performance materials.

- Technological Innovations

New generations of materials, from carbon-fiber composites to heat-resistant super alloys, are pushing the boundaries of aerospace engineering. More than 80% of titanium alloys used in aerospace are dedicated to engines alone, showcasing the importance of high-performance materials in critical components.

Material Segmentation: What’s Leading the Market?

- Composites: Currently the most valuable segment, composites dominate due to their exceptional strength-to-weight ratio. They are expected to grow the fastest in both value and volume, especially as next-generation aircraft integrate higher composite content.

- Aluminum: While newer materials are gaining traction, aluminum remains the most widely used by volume, especially in structural and interior components.

- Titanium Alloys: With superior corrosion resistance and high strength, titanium alloys are the second-fastest growing category, particularly in jet engines and defense applications.

- Super alloys: Accounting for over 16.6% of the market in 2019, super alloys are vital in engine components due to their ability to withstand extreme conditions.

End-User Insights: Commercial vs. Military

- Commercial Aircraft: This segment dominates the aerospace and defense materials market. With global airlines expanding fleets and replacing aging aircraft, commercial aviation accounts for the majority of material demand.

- Military Aircraft: Though smaller in volume, the military segment is growing at a faster pace. Rising defense budgets, territorial disputes, and the development of stealth and unmanned aircraft are driving demand for specialized, durable materials.

Read More : https://www.fortunebusinessinsights.com/aerospace-defense-materials-market-102980

Regional Landscape

- North America: In 2019, North America held more than 53.65% of the global market share. The region benefits from the presence of major aerospace companies such as Boeing, Lockheed Martin, and General Electric, alongside significant defense spending. By 2027, the U.S. aerospace and defense materials market alone is expected to cross USD 12,019.42 million.

- Europe: Europe ranks second, driven by strong aerospace manufacturing in France, Germany, and the U.K. Airbus, Safran, and Rolls-Royce continue to play pivotal roles in boosting demand.

- Asia-Pacific: Expected to be the fastest-growing region, thanks to indigenous aircraft programs in China and India, alongside collaborations with international aerospace players. COMAC’s C919 in China and India’s defense projects are notable drivers.

- Emerging Markets: Latin America, the Middle East, and Africa are also gaining momentum. Brazil, Mexico, Turkey, and Israel are investing in aerospace manufacturing, while the Gulf states are expanding defense capabilities.

Challenges in the Market

While the outlook is promising, the aerospace and defense materials market faces several challenges:

- Stringent Regulations: New materials undergo years of rigorous testing before being approved for aerospace use. This slows the adoption of innovative technologies.

- High Costs: Advanced materials like carbon composites and titanium alloys are significantly more expensive than traditional metals, posing challenges for cost-sensitive airlines and defense programs.

- Supply Chain Disruptions: Events like the COVID-19 pandemic highlighted vulnerabilities in global supply chains, delaying production and project timelines.

Key Industry Developments:

- April 2020 – Hexcel Corporation, an advanced composites manufacturer headquartered in the US, and Woodward, Inc., a key player providing designing, manufacturing and other services in the aerospace industry headquartered in the US, announced mutual termination of merger agreement, which was previously announced in January 2020. The disruption caused by the COVID-19 outbreak has forced the companies to announce the termination of the agreement.

- August 2019 – Teijin Ltd, a Japan-based manufacturer of advanced materials and chemicals, announced the successful acquisition of Renegade Materials Corporation, a key supplier of highly heat-resistant thermoset prepreg for the aerospace industry in North America. This has strengthened Tenjin’s position in the aerospace business and also increased its manufacturing capabilities.

Outlook

The aerospace and defense materials market is set to expand steadily as the aviation sector rebounds, military modernization accelerates, and new technologies enter the mainstream. With light weighting, efficiency, and performance at the core of material innovation, composites, titanium alloys, and super alloys will remain central to industry growth. At the same time, regulatory barriers and high costs may continue to test the pace of adoption.

The aerospace and defense materials market is more than just numbers and forecasts—it is the foundation of innovation in the skies and in defense systems. As manufacturers, suppliers, and governments invest in cutting-edge technologies, the demand for advanced materials will only intensify. By 2027, the market’s steady climb will reflect not just the growth of aviation and defense but also the evolving role of materials as the true backbone of aerospace engineering.